Summary

Why is women's labor force participation declining?

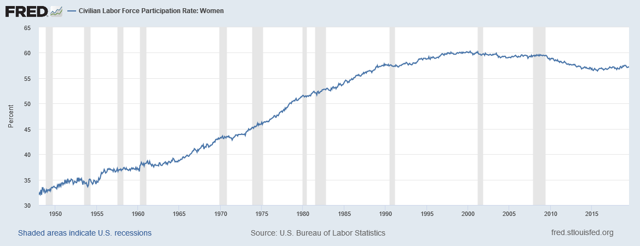

The percentage of women in the labor force increased to 60% by the end of the 1990s but has since trended modestly lower to 57%. According to today's NY Times, a key reason is they are taking care of family members (emphasis added):

The burden of care for aging relatives is reshaping the lives of millions of others. About 15 percent of women and 13 percent of men 25 to 54 years old spend time caring for an older relative, according to the Labor Department. Among those 55 to 64, the share rises to one in five Americans. And 20 percent of these caregivers also have children at home.

We can expect this trend to continue as the US continues to age:

What’s more, demand for care is growing. “The boomer generation is turning 70 at a rate of 10,000 per day and living years longer than when the safety net was originally built,” said Ai-jen Poo, a co-director of Caring Across Generations, a coalition of advocacy groups.

Two variables combine to create economic growth: one is population growth and the other is productivity growth. When you take people out of the labor force, you do two things: limit growth and increase the dependency ratio -- the relationship between those who are working and those who aren't.

Richmond Red President Barker isn't yet on board with a rate cut (emphasis added):

Barkin said he was not yet persuaded by the case that persistently weak inflation is a reason for cutting rates. But he said he was weighing a manufacturing slowdown, a fall in business investment and weakness in foreign economies.

"I am watching closely the growth part," Barkin told reporters in White Sulphur Springs, West Virginia.

Today's GDP report from the BEA shows that the US economy is still in fair shape. However, business investment is softer. And the latest durable goods report from the Census shows that new orders for capital equipment and raw materials are weak, implying continued softness in business investment.

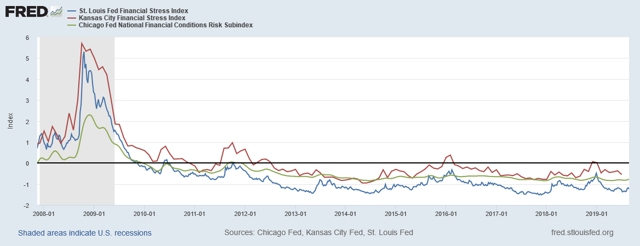

Financial stress is low:

Above are three measures from three regional Feds: the St. Louis Financial Stress Index, the Kansas City Fed Financial Stress Index, and the Chicago Fed Financial Conditions Risk Sub-index. The chart goes back to the recession to show what elevated stress levels look like. Low levels mean there is little stress in the system.

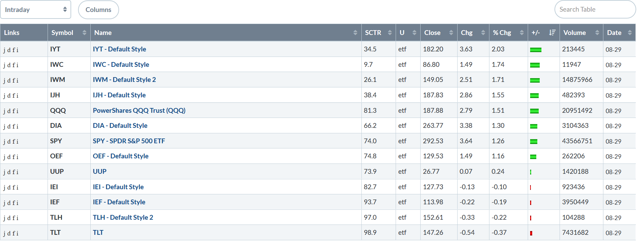

Let's turn to today's performance table:

This was a second consecutive day of solid gains led by the transports, micros, and small-caps. That was followed by mid-caps and the QQQs. This is what a strong rally looks like -- the risk-based averages leading the way for larger-cap indexes. The Treasury market sold off modestly.

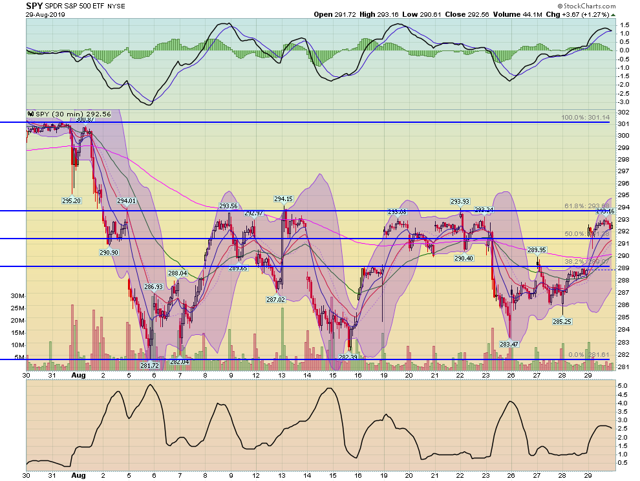

It's possible to argue that a positive trend is developing in the shorter time frames.

The SPY (NYSE:SPY) has been in an uptrend for the last four days. Today, prices gapped higher, moving through the key 290 area. Prices also maintained their gains, which is very important after a gap higher.

And the IEF broke a short-term trend. As the Treasury market has been absorbing the bullishness in the market, this is a potentially positive development.

But we still need to see meaningful advances in the 30-day charts -- something we're not seeing.

The SPY (NYSE:SPY) remains in the lower half of its 30-day chart with the 293-294 level still providing technical resistance.

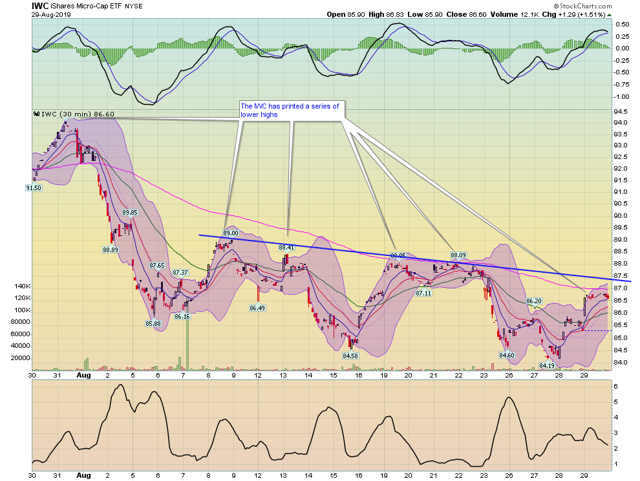

The IWC is still contained by a downward sloping trend line while printing a series of lower highs.

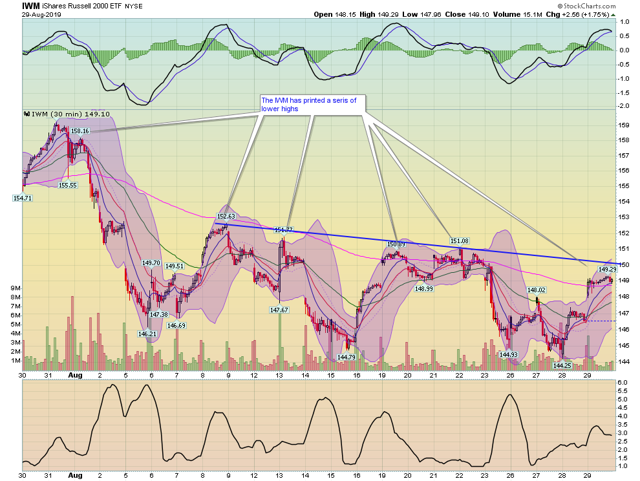

The IWM has the same pattern, as does the ...

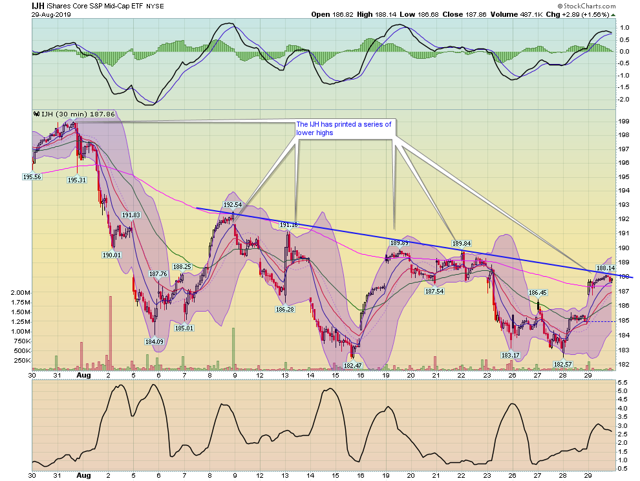

... the IJH.

At a minimum, the riskier indexes have to break though their respective resistance levels on the 30-day chart for the move higher to gain its legs.