Technically Speaking For April 3

Summary

- Shutting down the Mexican border would have far-reaching negative consequences.

- The service sector's report was encouraging.

- It's still a large-cap rally, which is concerning.

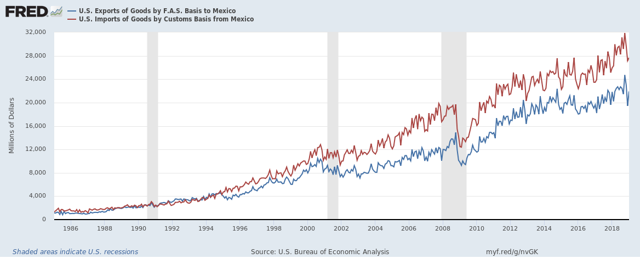

Why yes, Virginia, shutting down the U.S.-Mexico border is an incredibly unwise policy idea. Here are two graphs from the FRED database that show the amount of cross-border trade that occurs between the U.S. and Mexico:

The above figures are on a monthly basis. Yes, the U.S. imports more from Mexico than it exports. There are two reasons for this. First, we're a much larger economy. Second, the U.S. supply chain is now fully integrated with Mexico, largely as a result of NAFTA.

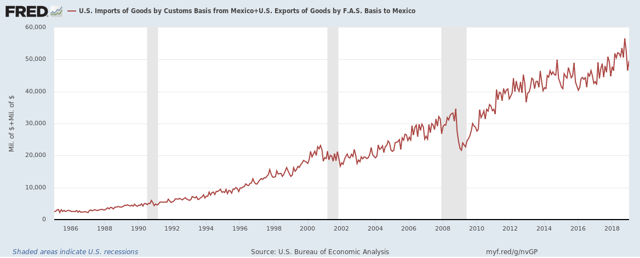

Here is a chart of exports and imports added together:

That's slightly more than $50 billion/month in the latter half of 2018. Bottom line - that's a lot of activity to threaten. Also, see this post from Menzie Chen at Econbrowser.com.

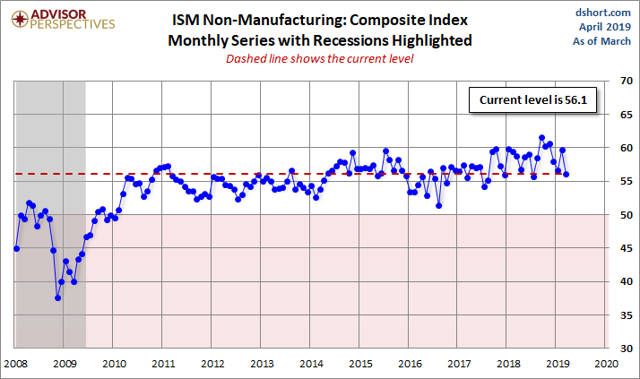

The latest non-manufacturing ISM report was good. Although it dropped 3.6 points, the headline number is 56.1. Here's a chart of the data from Adviser Perspectives:

Even though production and new orders declined sharply (-7.3 and -6.2, respectively), both were still in the upper-50s. The anecdotal comments were strong. The only potentially concerning development is the drop in export orders over the last four months, which have declined from 59.5 to 52.5. Although still positive, the decline is noticeable.

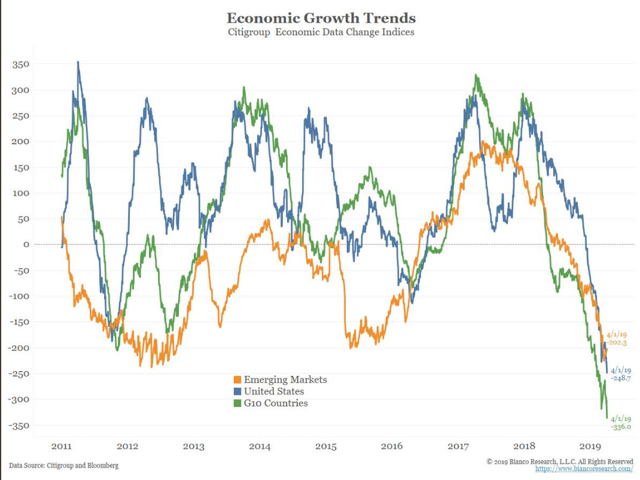

Global activity is slowing (from Bianco Research):

The Global Economy is Slowing! This chart shows the Citi Data Change Indices for emerging markets (orange), the U.S. (blue) and the G10 (green). These series, which measure economic data versus one-year averages, are currently at their lowest levels of the post-crisis period.

Notice that all three regions are declining and by pretty sharp margins.

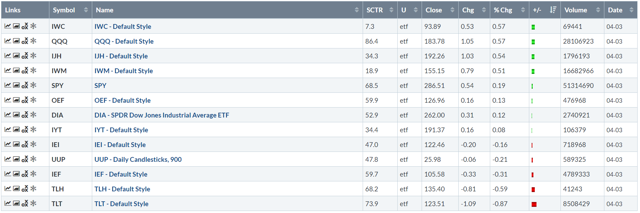

Let's turn to today's performance table:

There's some really good news in the above table: the smaller-cap indexes were some of the day's top performers. This indicates that today at least, the risk-on attitude won the day on Wall Street. Treasuries underperforming adds to that sentiment.

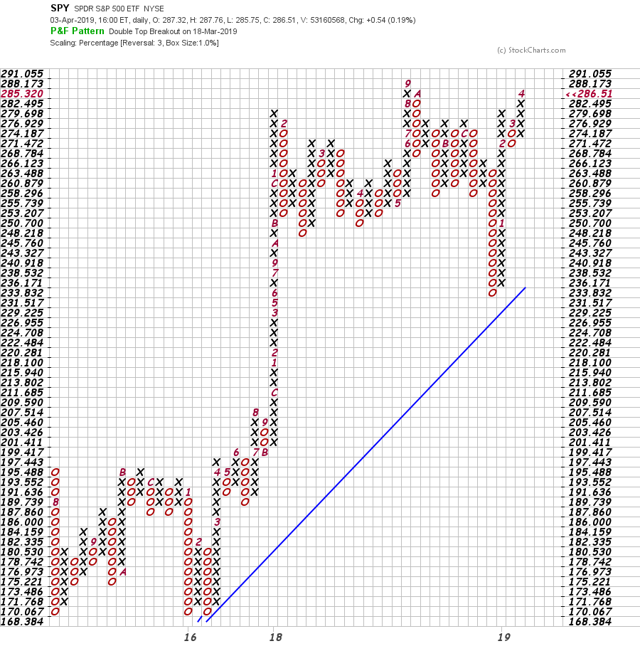

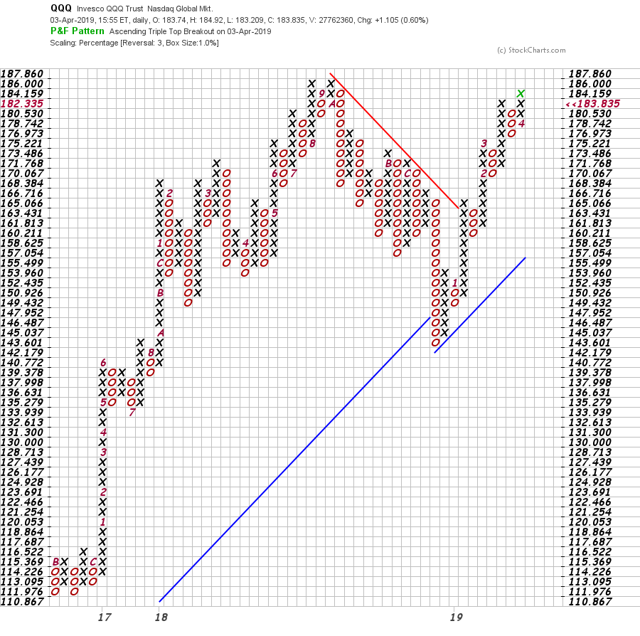

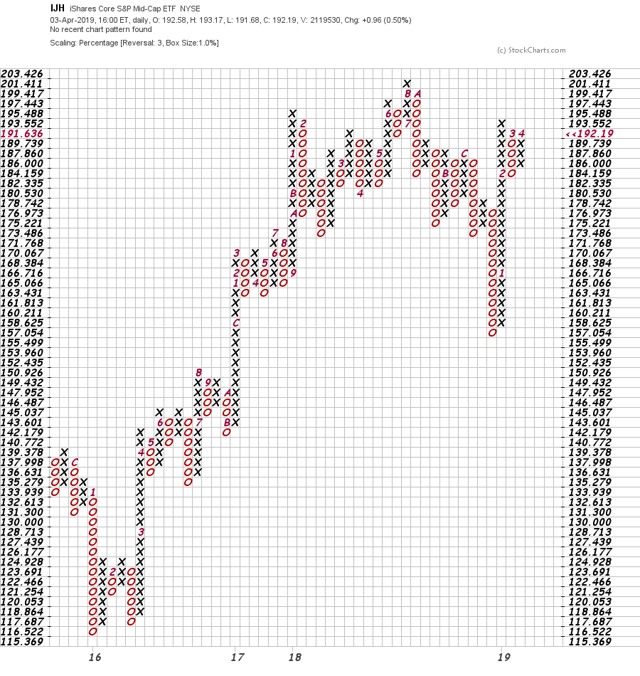

However, the main problem with this rally remains: smaller-caps are underperforming relative to their larger-cap brethren. Point and figure charts of the major index ETFs highlights this situation.

The SPYs chart shows a solid rally for most of this year as symbolized by the long column of X's third from the right. Prices are just shy of making new highs as well - another bullish development.

The QQQs are perhaps more impressive. Since the first of the year, they've printed a "two steps forward, one step back" progression that allows for a healthy round of profit-taking after a rally. They're also a few points shy of their recent highs.

The mid-caps are decent; they've had a solid run, although they're a bit farther below their recent highs.

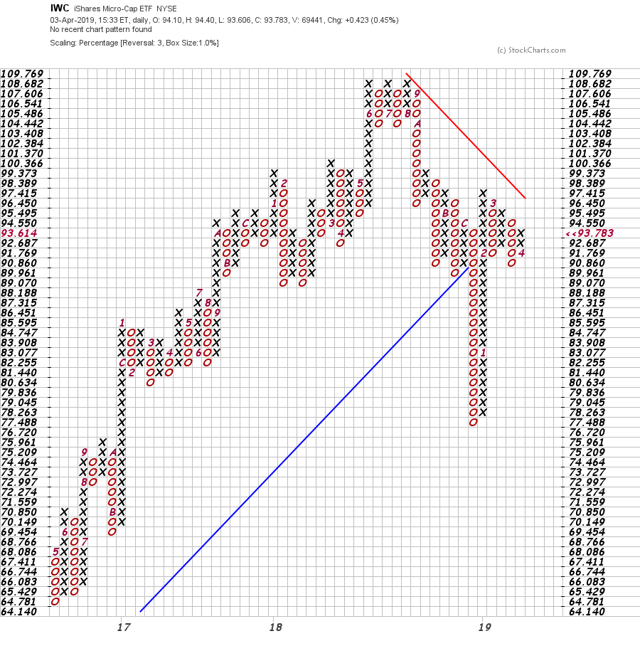

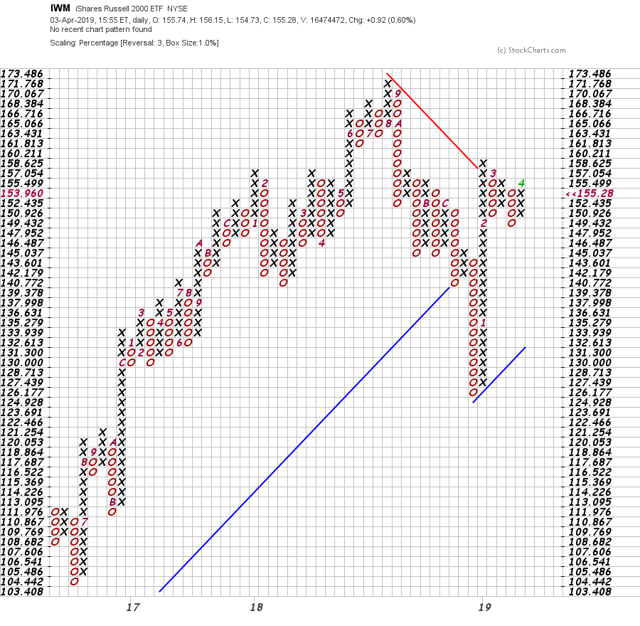

But then we have the smaller-cap indexes:

The micro-caps have printed a series of lower highs - a bearish development.

The IWMs have a similar problem of lower highs.

And so we return to this rally's basic problem: its all about large-caps. These are companies that will be able to better financially withstand a period of slower growth, which the bond market is saying is a distinct possibility. And that leaves out the small-cap companies, which need faster economic growth to grow their bottom line.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.