Technically Speaking For April 17Summary

- The latest Chinese economic data was positive.

- The latest industrial production report was a bit weak.

- The small-caps sold-off sharply today.

The Fed released the latest Beige Book, which contained the following description of the U.S. economy (emphasis added):

Economic activity expanded at a slight-to-moderate pace in March and early April. While most Districts reported that growth continued at a similar pace as the previous report, a few Districts reported some strengthening. There was little change in the outlook among contacts in reporting Districts, with those expecting slight-to-modest growth in the months ahead. Reports on consumer spending were mixed but suggested sluggish sales for both general retailers and auto dealers. Reports on tourism were generally more upbeat. Reports on loan demand were mixed, but indicated steady growth. Reports on manufacturing activity were favorable, although contacts in many Districts noted trade-related uncertainty. Most Districts reported stronger home sales, although some Districts noted low demand for higher-priced homes. Among reporting Districts, agricultural conditions remained weak, with contacts expressing concerns over the impact of current and future rainfall and flooding.

The Fed has used the words "moderate" and "modest" to excess during this economic expansion. This paragraph uses the word "slight-to-modest" implying a slower than moderate growth rate - not exactly a word you'd like to hear when describing the economic activity. The paragraph sends contrasting signals: consumer activity is "sluggish" while manufacturing activity was "favorable". Agricultural conditions are weak but home sales are up. Overall, it's a very mixed picture.

There was a flurry of Chinese economic releases today. Let's start with GDP growth of 6.4%, which was slightly faster than projections. Then there's the 8.5% Y/Y increase in industrial production, which grew 5.3% the previous month. This number seems especially strong when the latest Markit manufacturing reading was 50.8. Investment in fixed assets made far more sense; it was up 6.3% Y/Y - a 0.1% increase from the previous month's reading. Retail sales advanced 8.7%; this data series grew 8.1%-8.2% in the preceding four quarters. Overall, the data appears to indicate that the Chinese economy has stabilized, meaning the government's targeted stimulus program is working.

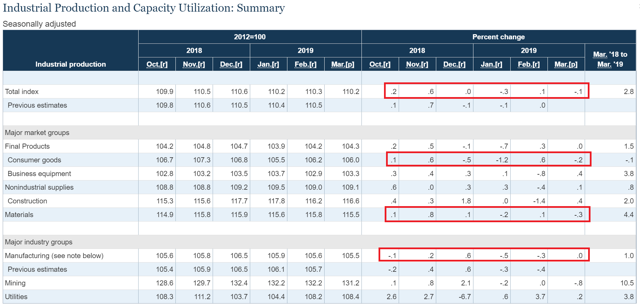

The Federal Reserve released the latest industrial production data, which is a bit concerning:

The topline number has been weak for the last six months; the strongest monthly increase was 0.6%; the next best reading was 0.2% with the remaining numbers just around 0%. Consumer goods number have also been weak; they've declined in three of the last four months and have only grown strongly in two of the last six readings. Materials and manufacturing output have also been disappointing.

My basic market thesis: The markets are "toppy"; the rally in the Treasury market and large-cap equity indexes and underperformance of the smaller-caps indicates traders are projecting weaker growth. For my thesis to change I need a Treasury market selloff and/or a stronger small-cap performance.

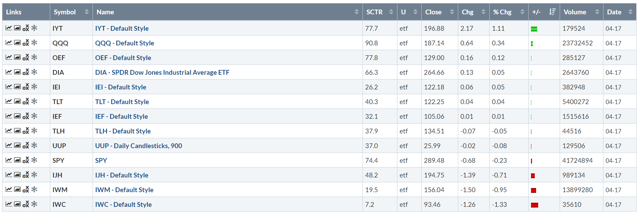

Let's turn to today's performance table.

With the exception of the IYT, the equity indexes performed poorly. Once again, the QQQ was the best performer, but it only rose 0.34%. And that's where the good news ends. The Treasuries bounced around 0% while the smaller-cap indexes all sold off. This continues their trend of performing poorly.

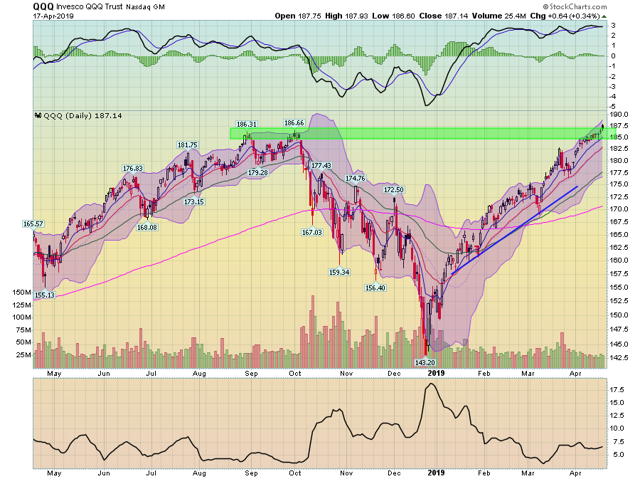

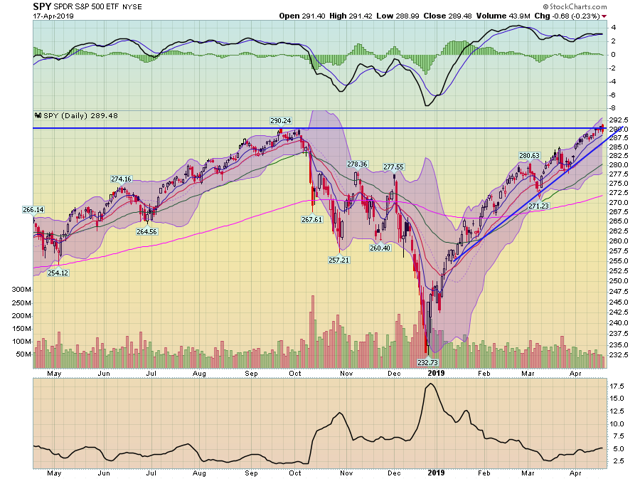

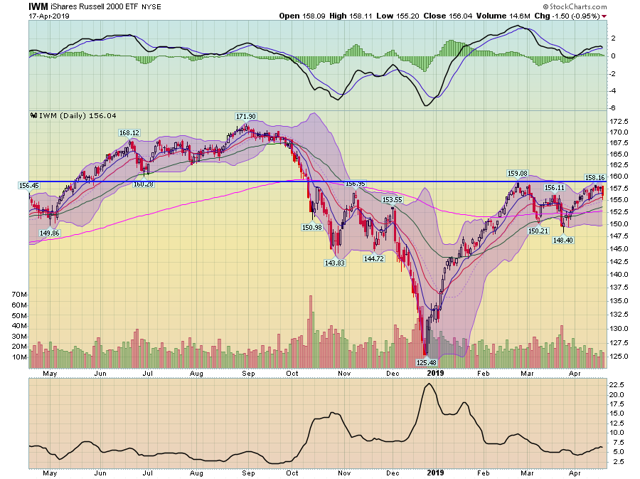

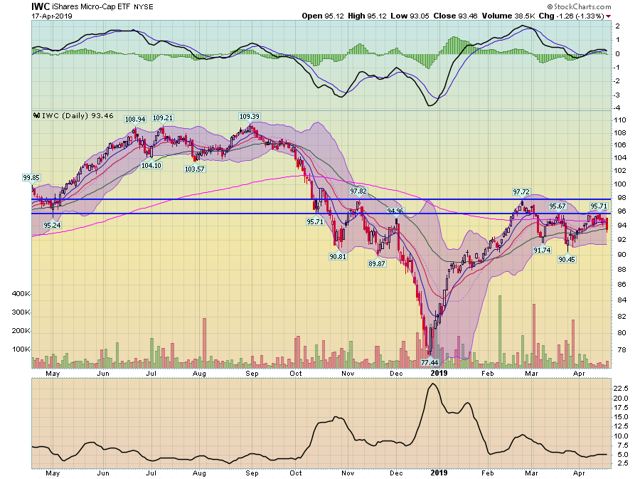

The daily charts continue to show the divergent price action between large and smaller-cap indexes.

The QQQ continues to perform exceedingly well. It remains in the uptrend it started in early January. It broke through resistance levels in the mid-180s. The main problem is that momentum is very stretched historically.

The SPY is also doing well; prices are still rallying, having broached all-time highs recently. The one problem is momentum is a bit weaker and clearly moving lower.

And then we have the small-cap indexes:

In comparison to the QQQ and SPY, which have been advancing all Spring, the IWM has been moving sideways. Prices have been unable to move through resistance at the 159 level. Momentum is weak.

The micro-caps are actually moving modestly lower relative to price levels in late February. Momentum is weaker.

Nothing today reversed my basic thesis about the markets. This is still a "we expect weak growth" market set-up.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.