Investing.com’s stocks of the week

The last three weeks covered a longer-term outlook, beyond 2015, in 13 major markets. Today, sticking with the longer-term charts we check in on the sleepy municipal bond market. Along with US Treasuries, Muni’s have also been on a tear higher. Weathering not just the concerns for higher interest rates that treasuries have scoffed at, but also the bankruptcy concerns for places like Puerto Rico. And today it still looks higher.

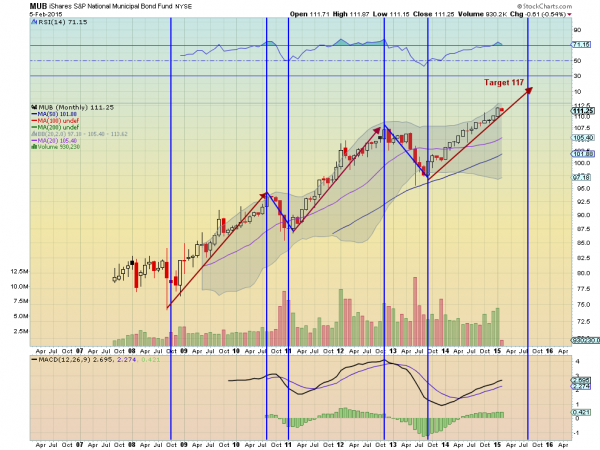

The monthly chart above shows the price action of the iShares S&P Municipal Bond Fund (NYSE:MUB) since its inception in 2007.. There are 3 distinct moves higher followed by 2 smaller pullbacks. This is known as a '3 Drives pattern' and it targets a continued move higher to 117 before any reversal. What is interesting about this pattern is that you can also see that the first two legs higher took a similar amount of time. Specifically, they each took 22 months. Applying that timing to the current leg gives a target for the move to 117 of August this year.

That is another 5% in Municipals in 6 months. Not too shabby.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.