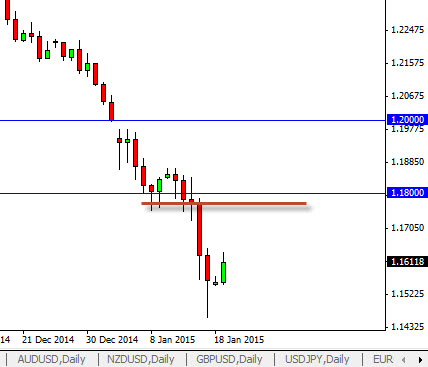

Looking at the Tuesday session, there is almost nothing on the economic calendar so we believe it will essentially be a technical day. With that being said, the EUR/USD pair has bounced a little bit during the Monday trading session as the German economic numbers were a bit stronger than anticipated. However, we see a significant barrier at the 1.18 level that should bring in plenty of put buying as the market continues to show real downward pressure overall. After all, that area was massively supportive, so it should now become just as resistive.

Ultimately, we believe that the US dollar will continue to strengthen overall, so we don’t really have any interest in going against it. Having said that though, we look at some of the other markets around the world such as the FTSE and recognize that the FTSE may breakout if we can get above the 6650 level. We like buying calls above there, and pullbacks it could show signs of support at lower levels as it should be a momentum building exercise to go much higher.

Silver markets formed a shooting star during the day on Monday, testing the $18 level but failing. With that being the case, the market looks as if it will probably pull back from here but we recognize that $17 should be massively supportive. Pullbacks at this point time should continue to offer call buying opportunities, just as a move above the top of the shooting star would be a call buying opportunity as it would show a significant break of resistance going forward. It is not until we break well below the $17 level that we would be comfortable buying puts again.