Very little happened on the precious metals market yesterday and the related markets, but it seems that we might see something more interesting today.

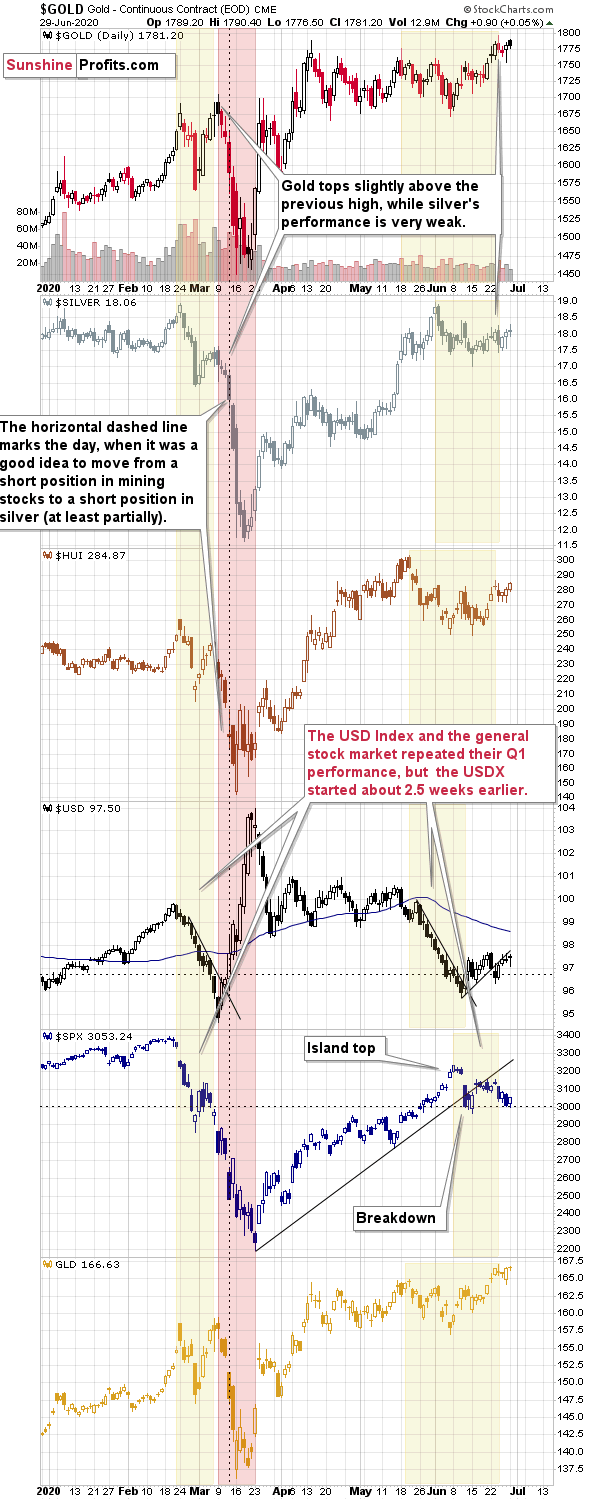

The USD Index (third from the bottom) reversed and at the moment of writing these words, it's testing the previous June highs. A clear breakout above these highs might prove to traders that what we've been seeing in the past few weeks is not just a zig-zag correction, but a beginning of a new major rally.

This could trigger - technically - the bigger moves in all markets, not only the USD Index. As the USDX soars, stocks would be likely to slide, and the same fate would be likely for PMs and miners.

There could be - and likely will be eventually - a fundamental trigger for these moves anyway, which is why we are forecasting gold at much higher levels in the following years but not in the following weeks.

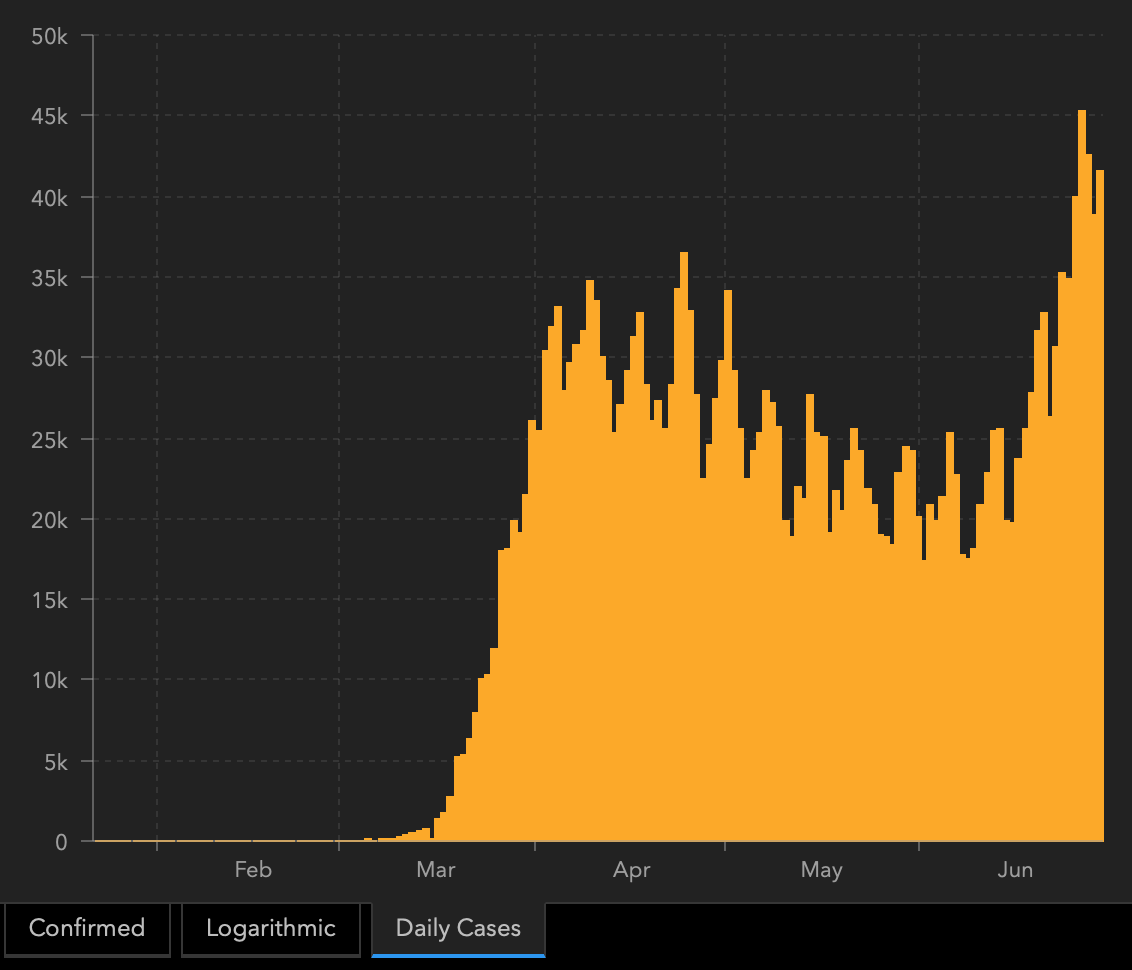

The new coronavirus cases are growing quickly and now only 16 states have the Rt number below 1. In other words, the number of new cases is declining in 16 states, and its growing in the remaining states. The snowball of new cases is growing, and the authorities will have to deal with it in one way or another. The social distancing procedures are being reintroduced only a little, and let's keep in mind that the longer the delay, the more severe the consequences will ultimately be. At some point more serious measures will have to be taken, and they will likely impact the economy to a degree that's much greater than what people are currently expecting. It was when people focused on the dire economic implications of the pandemic and lockdown that the markets really moved, and PMs plunged. We are still before this move.

There's not much more that we can add today as far as chart analysis is concerned, but we would like to reply to the questions that we received recently.

Q: First of all, in 2008, the Fed did not start an aggressive bond buying programs until after the PM and the stock markets tanked. The Fed is now all in and will prevent the market and PM to decline significantly as it did in March.

A: The Fed didn't start the bond buying programs until after the PMs and stock markets tanked in 2008, but it was supposed to be the new shocker back then. What the markets were used to previously were rate cuts, and the Fed had cut those previously - as the prices declined. The markets are now used to both: rate cuts and QEs. And each QE worked less effectively than the previous one.

If the Fed is already all-in, then how will they prevent further shock the market to prevent declines? What new shocker would they provide? By definition, being all in, means that one can't add anything more.

And stocks are likely to slide anyway, because the Fed can't fix the broken supply chains, nor can it make people go out, conduct businesses in the regular way and convince people that "nothing is really going on, you don't have to save your cash for hard times". In 2008, we had liquidity crisis, and the Fed injected liquidity - it helped, but the economic damage was substantial anyway. Right now, we have a different type of crisis. It's not the lack of liquidity that's the problem, but rather the pandemic, which can't be treated with dollars only. The market seems to have assumed that what we saw in March was a one-time event and a bad dream and that all will now be good. And it will be - in a few years. In the meantime, there will be a severe economic slump - much worse than what had already hit the markets, and much worse than what we saw in 2008.

Yet, the stock market didn't decline as low as it did in 2008, while the USD Index didn't rally as high. And gold didn't plunge as low - initially.

The Fed is already all in, while we are not in the situation in which it can really help much, as the problem is not with liquidity. Even though the situation is now much worse than in 2008, the markets have not moved as much as they did back then. This suggests that the markets are still likely to move more (in the directions in which they moved in March), while the Fed won't be able to do much about it. This doesn't bode well for stocks in my opinion. It does bode well for gold, but not initially. During both: 2008 and March 2020 slides, gold showed that it's likely to initially decline along with stocks and along with rising USD Index, and rally only after the decline. The above is very positive for gold, but not initially.

Q: GS now upped its forecast to 2000 and BAC has a 3000 target. Why are you so aggressive in you down side targets? PMs might will touch their march lows, but even that seems impossible given the current circumstances. Why not include some possible interim target prices above your profit-take exit prices in GDXJ and GDX (NYSE:GDX). Will there not be stops along the way.

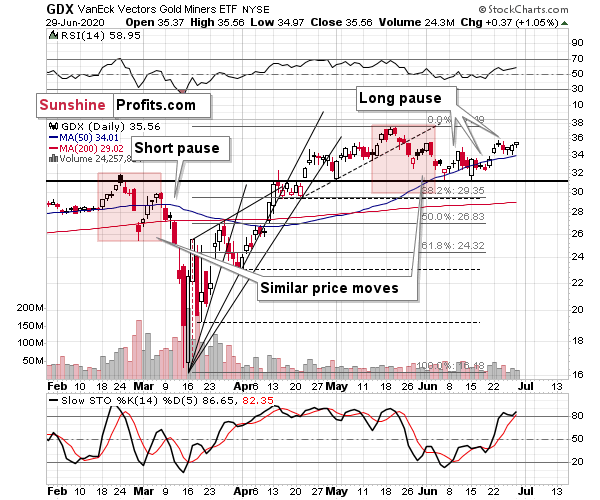

A: The profit-take exit prices are based on what is really likely to happen in the precious metals sector. It's taking more time than I had originally expected it to, but the stock market is likely to move much lower in my opinion and it's likely to take mining stocks along with them.

As far as interim price targets are concerned, each support level (based on the previous lows and the Fibonacci retracements) could trigger a quick rebound during the decline.

However, the two most important things details are not visible on the above chart.

The first is that we will likely get the opportunity to move from mining stocks to silver as the latter tends to outperform in the final part of a given move. We don't know at what prices it would take place, but we are monitoring the situation for the day (or days) when miners slide very profoundly while silver declines only somewhat. This would likely be the "switch" day. At that time - if we spot this occasion - we would close the position in miners and open one in silver. If it's too unclear, we would likely ride the decline in the miners.

The second thing is the day when gold reverses and moves back up while the USD Index continues to rally. This is what happened in 2008, and what happened in March 2020. It served as a major buy signal, and we expect it to mark the end of the decline also this time. This signal will be more important than the price that gold, silver, or mining stocks have at that time.

Summary

Summing up, the outlook for the precious metals market is extremely bearish for the next 1-3 weeks due to the huge number of bearish signs (and their strength) that we have right now, and how likely PMs are to repeat their March slide to a significant extent). The sharply rising new Covid-19 cases numbers, as well as gold's long-term cyclical turning point both, suggest that gold's one final slide is just around the corner.