The current bull market for U.S. stocks is the fourth longest in history. Two others journeyed into a seventh year, while one other (1990s) enjoys the distinction of having traveled into an eighth year. Even if one subscribes to the idea that “bull markets never die of old age,” probability alone suggests that we are closer to the end than the beginning.

Many market-watchers enjoy finishing the thought on what eventually kills a powerful bull run. “Excessive valuations,” some argue. At the moment, the median U.S. stock price-to-earnings (P/E) and price-to-sales (P/S) ratios are the steepest on record, yet few fundamental analysts show concern. “Recessions,” market-based economists assert. However, the National Bureau of Economic Research (NBER) was not able to identify the last recession until 10/2008 – one full year after the 10/2007 bear began decimating investor portfolios.

What do I think terminates bullish rallies? An intensifying erosion of faith in what kicked off a remarkable rally in the first place.

In the seemingly unstoppable ’90s, Americans placed their never-say-die devotion in a “New Economy.” Gurus guided the herd towards corporations that had yet to show meaningful profits on the notion that the Internet changed the rules of investing altogether. Eventually, the collapse of the dot-coms not only demonstrated that profits still mattered, but an allegiance to a new paradigm resulted in account value meltdowns. Faith in the “New Economy” had been shattered.

In the 10/02-10/07 bull market uptrend, the investment community fell in love with the real estate boom. So strong was the belief that real estate riches are secure – so enamored were market-based investors in the conviction that ever-increasing real estate gains cemented commodity demand and natural resources growth – the masses ignored “sub-prime” and “interest-only” insanity. Even though real estate sales were waning by 2006, it wasn’t until 2008 that we witnessed an intensifying disintegration in structured finance. Before all was done and said, a total eclipse of the financial system destroyed stock-oriented capital, standards of living for retirees as well as faith in the foolish idea that property values only go up.

What will destroy the record-breaking run-up that perma-bulls are currently celebrating? When zero-percent rate policy and quantitative easing combined back in December of 2008, it did not take long before investors began to celebrate financial engineering by the Federal Reserve. It was a rocky ride at first. Severe corrective activity occurred in 2009, 2010 and 2011. Nevertheless, by 2012, investors began to cheer monetary policy as well as the unbelievably slow pace at which the central bank of the United States would raise rates. In fact, every time they’ve hinted at a shift, they’ve backtracked.

The most recent backtrack by the Fed? Remove the word “patient” from its statement on when it would raise overnight-lending rates off of zero, yet simultaneously downgrade its economic projections for 2015, 2016 and 2017. Even more dovish for those with boundless love for Yellen’s Fed? Committee members walked back the projected pace of rate hikes. The previously announced year-end expectation of 1.125% for overnight lending rates has been slashed to 0.625%. Hip, hip hooray for stocks! The Fed’s done it again!

If it is faith in monetary policy that will sustain the bull market, a spasmodic, across-the-board lack of faith in central bank manipulation will eventually poison it.

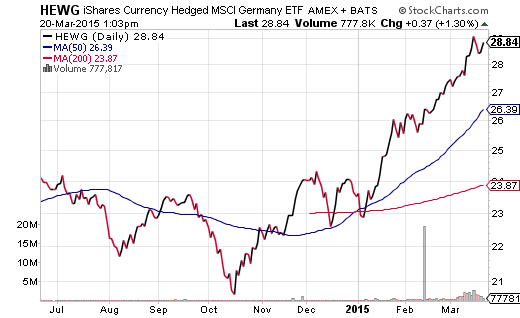

The extraordinary confidence in monetary policy is by no means limited to the United States. If your central bank is buying stocks and/or bonds to reflate your economy – if your central bank is lowering rates and/or electronically creating money – your market-based portfolios are surging in value. Perhaps ironically, since Europe entered the quantitative easing game at the star of this calendar year, foreign markets have been on fire. Indeed, many of my clients have been benefiting from allocations to funds like WisdomTree Europe Hedged Equity (NYSE:HEDJ) and iShares Currency Hedged Germany (NYSE:HEWG).

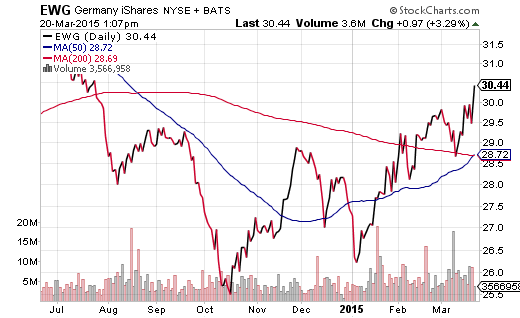

Equally worthy of note, there are technical breakouts in the traditional ETFs for developed market exposure as well. The 50-day moving average for iShares MSCI Germany (ARCA:EWG) is crossing above its 200-day – a technical chart phenomenon commonly referred to as a “golden cross.”

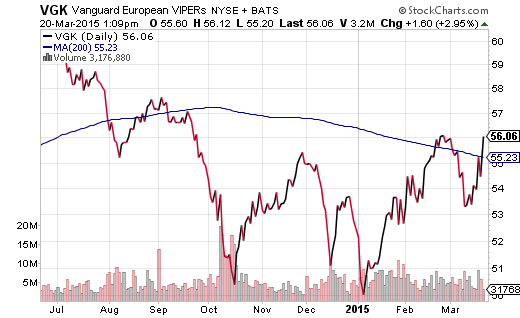

Similarly, the price of Vanguard Europe (ARCA:VGK) is above its long-term 200-day trendline.

Granted, the Fed may have fueled yet another run at all-time highs for U.S. stocks. In their recent statement, they acknowledged the economy is weakening and that removing “patience” from their wording did not imply impatience. They talked about the adverse impact of the pace of the U.S. dollar’s rise. They even mentioned slow wage growth and low inflation on their way to lowering rate hike expectations. In so doing, they cooled off the U.S. dollar’s march.

That said, an accommodating Fed can still change its outlook based on incoming data. In contrast, the rest of the world is aggressively easing and will continue to do so for the foreseeable future. In other words, six months out, the dollar will likely be in the same high spot or perhaps even stronger, whereas monetary policy devotees are likely to benefit from increasing their currency-hedged foreign exposure.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.