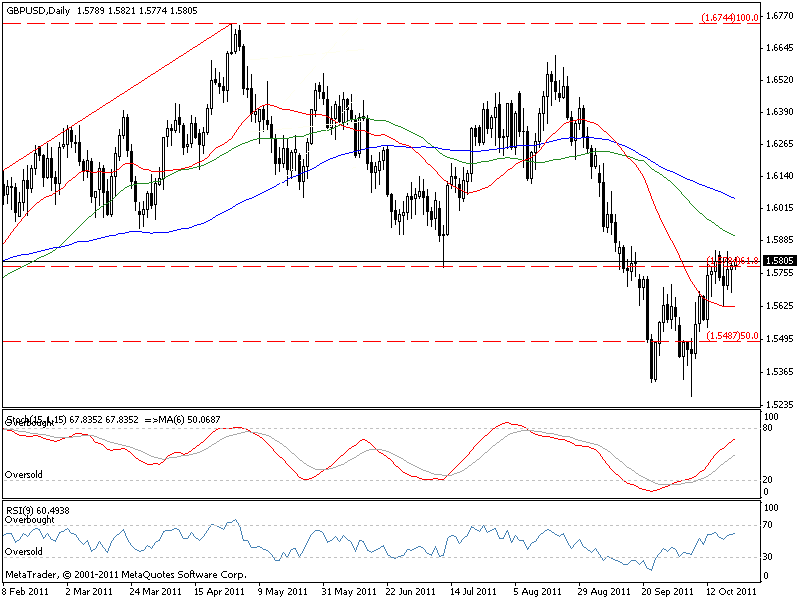

The currency pair founded support at key level at 1.5350. If the following upside swing remains in tact first important resistance is expected at 1.5784 (61.8% Fibo correction), followed by 1.6545 and the top from 02.05 at 1.6720. In the opposite direction first support would be the 50% Fibonacci level at 1.5487 followed by 1.5350.

| Support | 1.5415 | 1.5325 | 1.5190 |

| Resistance | 1.6545 | 1.6720 | 1.7030 |

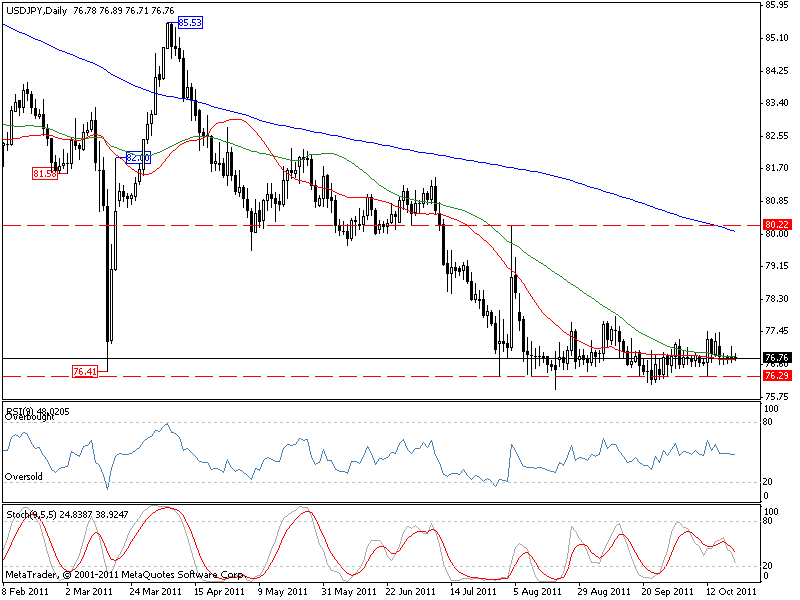

Movement in the general area of consolidation continues. Correction after falling from 85.52 to 79.57 reached 38.2 percent, followed by a break in the downward direction, as the price moves in the range 76.29 - 80.22, repelling from 76.29. Currently, the appreciation of the Japan currency reached 76.58 yen, below the levels of 78,50 ¥, which was the start of the last intervention by the BoJ. While the upper level is near historic lows. Important levels are 82.00 (50-DMA and intervention after the G-7) 83.30-level before the earthquake and 85.80 peak in April.

| Support | 76.9 | 76.29 | 75.95 |

| Resistance | 80.22 | 82.11 | 85.53 |

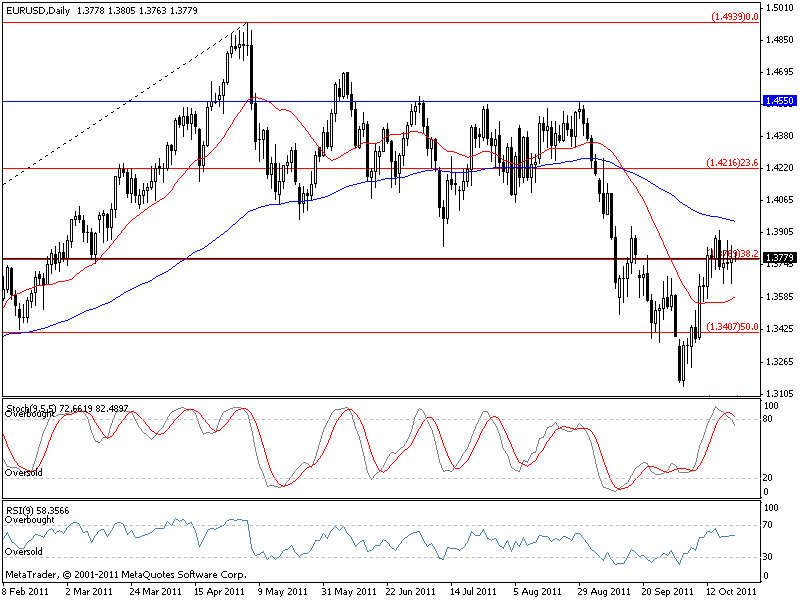

The Euro broke the support at 1.4150 (32.8% Fibonacci level) and 1.3664 (61.8% Fibo correction). Next support level is attended at 1.3047. In the opposite direction, the price will face resistance at the level of 1.4150 followed by 1.4550 and a break in the upward direction next resistance price will meet at about 1.4700.

| Support | 1.3047 | 1.2870 | 1.2200 |

| Resistance | 1.4150 | 1.4550 | 1.4700 |