Platinum Falls

The platinum price is noticeably behind in growth against other precious metals. Since the beginning of this year, its prices have risen by 3.5%. Will the platinum price grow?

Since early 2017, silver has increased by 5.3%, gold - by 9.8% and palladium - by 30%. The main reason for such weak dynamics could be the general decline in demand for diesel cars after the scandal with the German automaker Volkswagen (DE:VOWG_p) due to the non-compliance with environmental standards. Platinum is used as a catalyst in diesel and gasoline engines. Meanwhile, in 2016, there was a worldwide deficit of this metal in the amount of 0.19 mln ounces. According to forecasts, the global production of diesel cars may grow by 1.4% in 2017 and will further increase by 1.1% annually. The main factor for the increase in platinum demand may be its price equalization with palladium. In early 2016 the difference between an ounce of platinum and palladium was about $340, and now it has been reduced to about $50. As palladium becomes more expensive and prices equalize, it becomes more profitable to use platinum as a catalyst in gasoline engines.

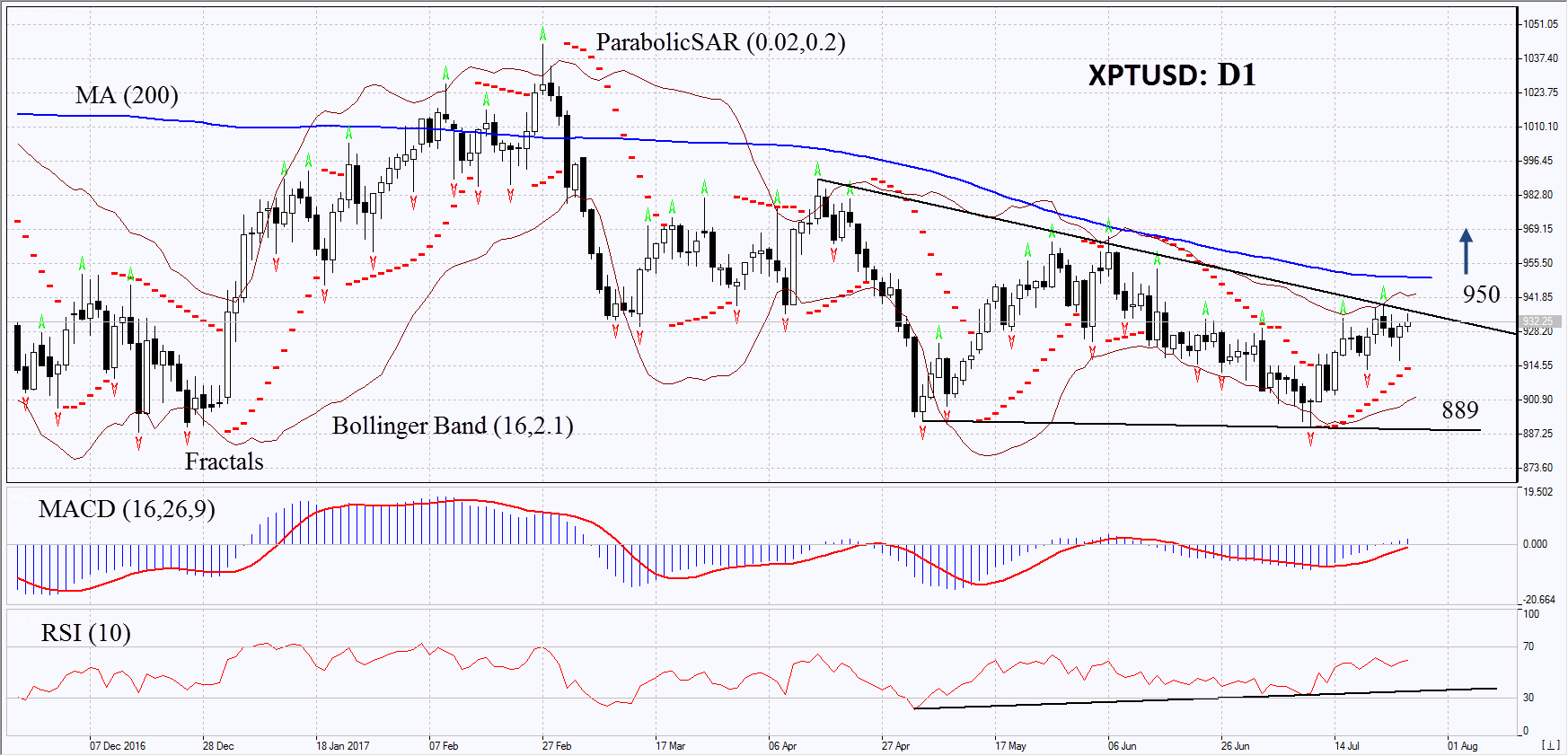

On the daily timeframe, XPT/USD: D1 has approached the upper boundary of the triangle trend. To open a Buy position, it needs to be overcome. The further price increase is possible in case of an increased world demand for platinum.

- The Parabolic indicator gives a bullish signal.

- The Bollinger® bands have narrowed, which means lower volatility. They are tilted upwards.

- The RSI indicator is above 50. It has formed a positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case XPTUSD exceeds the 200-day moving average line, the upper Bollinger band and the last fractal high at 950. This level may serve as an entry point. The initial stop loss may be placed below the two last fractal lows, the Bollinger band and the 8-month low signal at 889. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 950 without reaching the order at 889 we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

Position - Buy

Buy stop - above 950

Stop loss - below 889