The main currency pair starts the week and the month by consolidating around the 1.0569 mark.

The US Federal Reserve's intention to potentially raise interest rates once again in 2023 is strengthening the position of the USD. The 10-year treasury bonds yield in the US remains at long-term highs regardless of a minor correction.

This week, statistics will be abundant in both the US and the eurozone. Employment sector reports for September in the US are expected to show stabilisation without any notable catalysts.

The eurozone will report on retail sales in August, the PPI, and business activity in the services sector. All these reports will provide insight into the state of the economic system. It is not certain whether there will be any catalyst among the European statistics to support the EUR, although this possibility exists.

EUR/USD Technicals

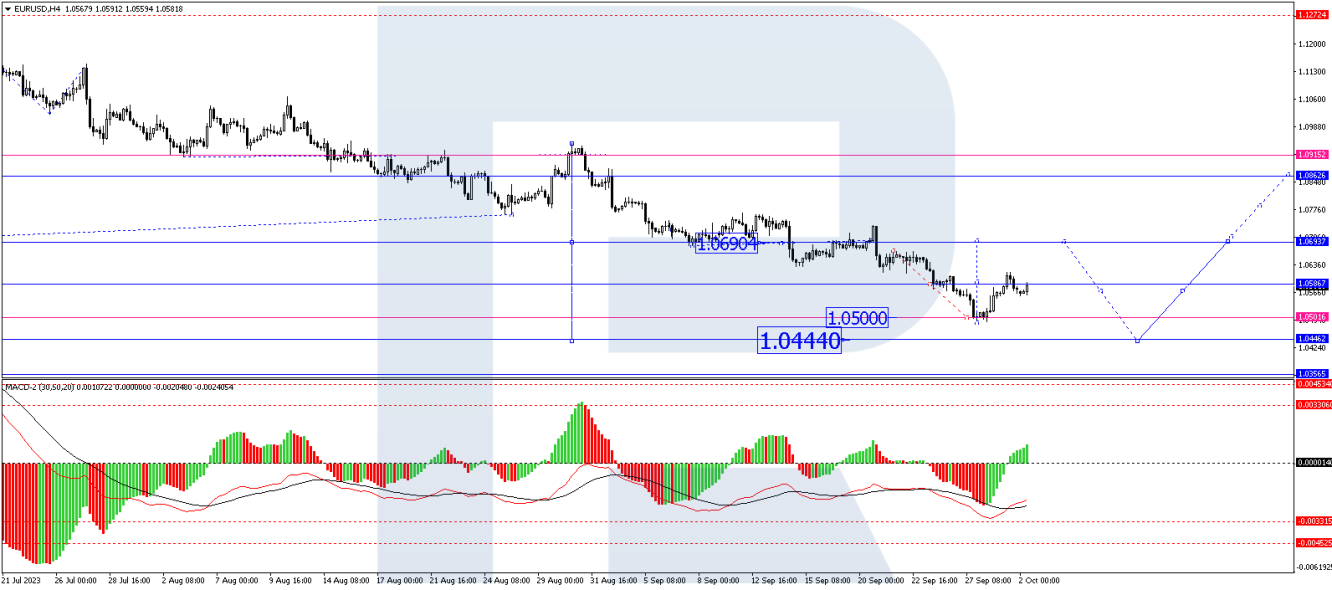

On the EUR/USD H4 chart, a consolidation range has formed around 1.0700, reaching the local target of a declining wave at 1.0500 upon escaping the range downwards. Today the market has corrected to 1.0615. A new link of correction to 1.0620 is not excluded, followed by a decline to 1.0440. After reaching this level, a correction to 1.0700 could follow (with a test from below). Next, a decline to 1.0140 is expected. Technically, this scenario is confirmed by the MACD, whose signal line is below zero. The indicator is expected to set new lows.

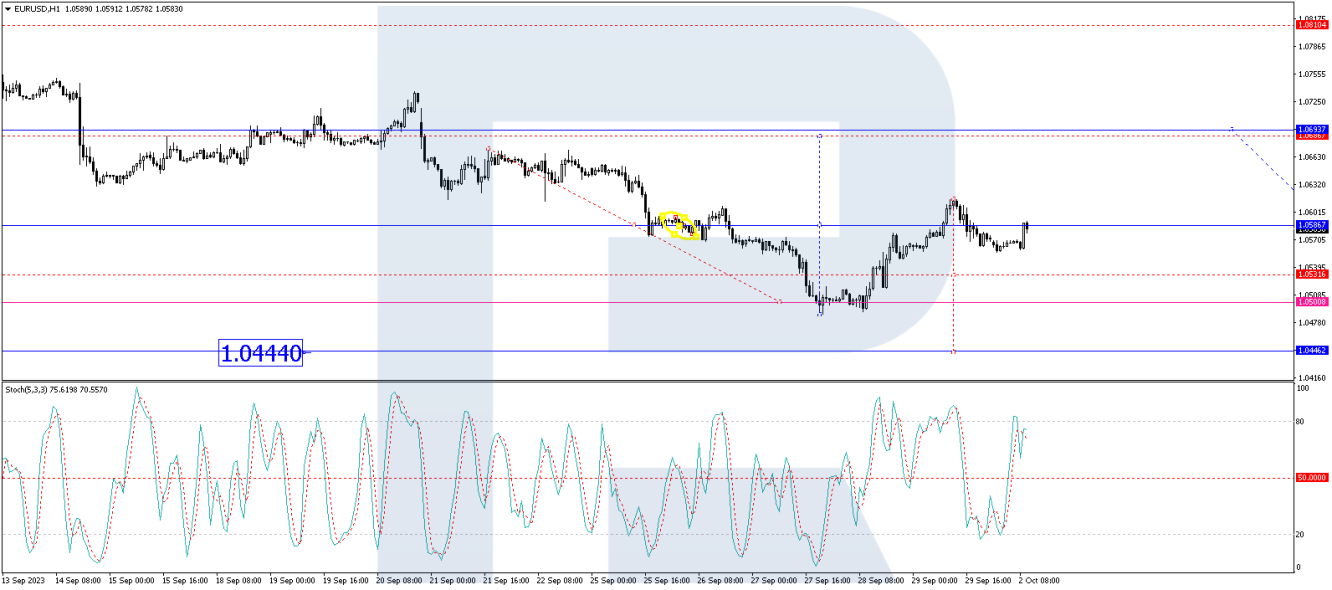

On the EURUSD H1 chart, a movement in a declining wave to 1.0440 is forming. By now, the market has completed a consolidation range of around 1.0586, reaching the local target of a declining wave at 1.0500 with an escape from the range downwards. A link of correction to 1.0615 has formed today. A new price hike to 1.0620 is not excluded. Next, a new declining movement to 1.0440 is expected, followed by a rise to 1.0700. Technically, this scenario is confirmed by the Stochastic oscillator, whose signal line has rebounded from the 80 mark and is currently pointing sharply downwards. The line might eventually fall to the 20 mark.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.