Slower Growth Outlook Bearish For Swiss Franc

Swiss economic growth outlook was downgraded due to weak performance in the first half of the year. Will the USD/CHF continue rebounding?

The Swiss National Bank decided to keep the target range for the three-month Libor at between minus 1.25% and minus 0.25% at its 14 September meeting. The Q2 Swiss GDP grew 0.3% on quarter from downwardly revised 0.1% growth in first quarter. Economic growth in annual terms slowed though as second-quarter GDP dropped to 0.3% year-on-year from 0.6% in first three months of 2017. And the State Secretariat for Economic Affairs said on Thursday it now expects economic growth of 0.9% in 2017, below its June forecast of 1.4 %. The slower growth outlook is bearish for the Swiss franc.

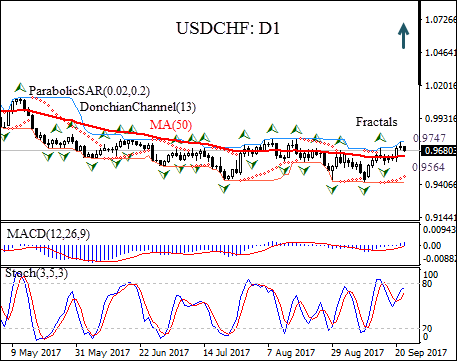

The USD/CHF is rising on the daily chart after hitting twelve months low two weeks ago.

- The Parabolic indicator gives a buy signal.

- The Donchian channel signals uptrend: it is tilted up.

- The MACD indicator is above the signal and the gap is widening, which is a bullish signal.

- The stochastic oscillator is rising but hasn’t reached the overbought zone.

We believe the bullish momentum will continue after the price breaches above the upper Donchian bound at 0.9747. This level can be used as an entry point for a pending order to buy. The stop loss can be placed below the fractal low at 0.9564. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technicals

- Position - Buy

- Buy stop - Above 0.9747

- Stop loss - Below 0.9564