Twitter,(TWTR), began trading Thursday as a public company. The debut was deemed successful, apparently because:

1. It was not at the NASDAQ

2. It was at the NYSE

3. It did not crash any systems.

ISLAND may have helped by disconnecting itself at just before the first print.

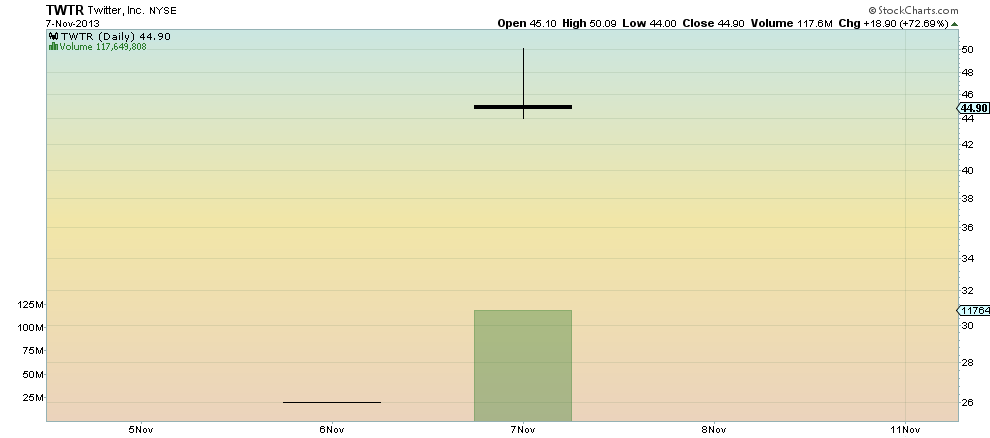

From a technical perspective it was an extremely important day. It put in a very important Japanese Candlestick. The chart below shows the price action on a daily basis since its debut. Notice the gap up and then a Gravestone Doji. A Doji itself signals indecision. After a gap up, many would look for a reversal lower, but indecision really means it could go either way. But this particular Gravestone Doji is a negative omen. It needs confirmation by a move lower on Friday, which would then signal a reversal back lower. It was also a Shooting Star. Another reversal pattern. The initial target would be a retracement of 38.2% of the move higher or to 40.89 and then 38.04 and 35.20. Look for your borrow early tomorrow to take advantage of this.

The above analysis is of course total BS. You cannot do technical analysis on one day's price action. If your advisor tries to sell you on a trade in the stock based on Thursday’s activity, hang up, or better yet move your money. It is the same for a trade based on fundamentals of this stock at this point. It has very limited data and only a guess at what is to come. Good luck.

I am not trying to tell you to stay away from the stock because of these things. Only to be realistic in your approach. Whether it is fundamental or technical you don’t know jack about this company. Trade it, invest in it, or not, with your eyes wide open.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post