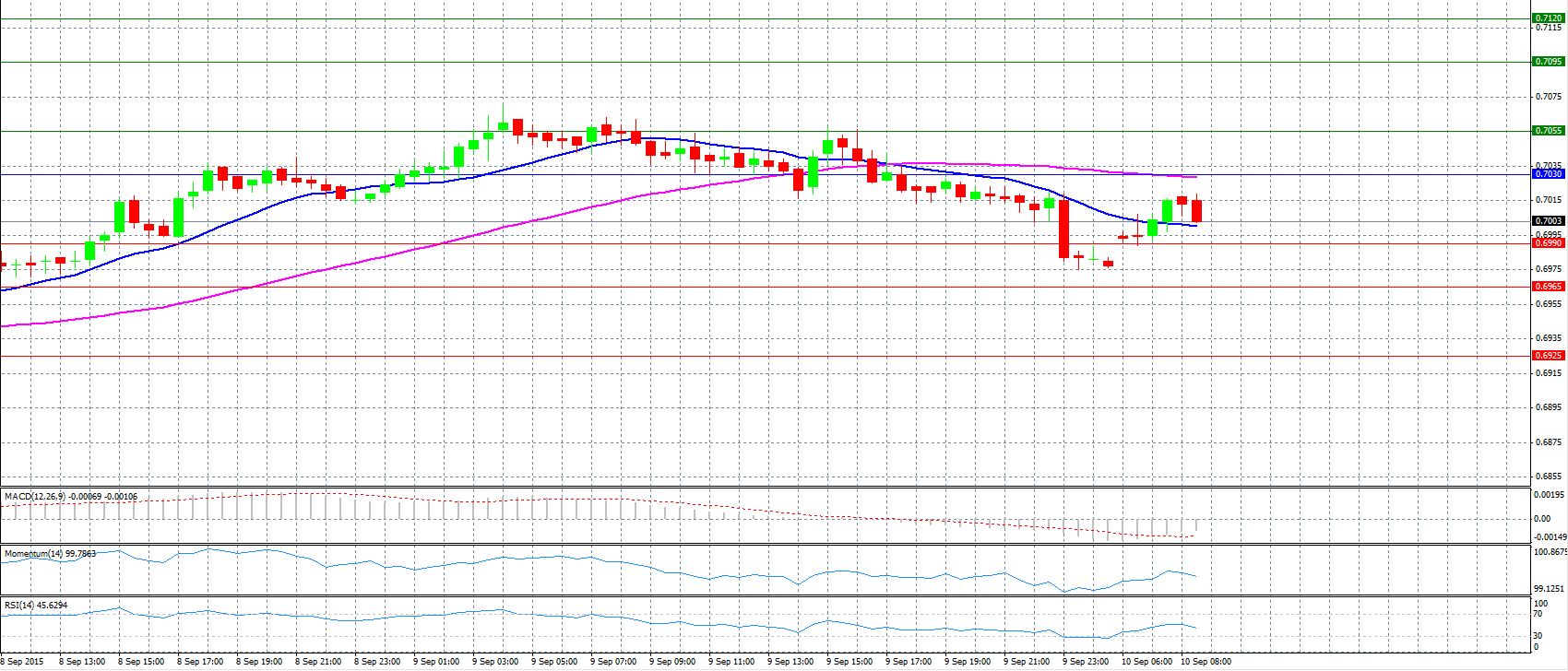

Market Scenario 1: Long positions above 0.7030 with targets at 0.7055 and 0.7095.

Market Scenario 2: Short positions below 0.7030 with targets at 0.6990 and 0.6965.

Comment: The pair weakened, but managed to rebound above 0.7000 level.

Supports and Resistances:

R3 0.7120

R2 0.7095

R1 0.7055

PP 0.7030

S1 0.6990

S2 0.6965

S3 0.6925

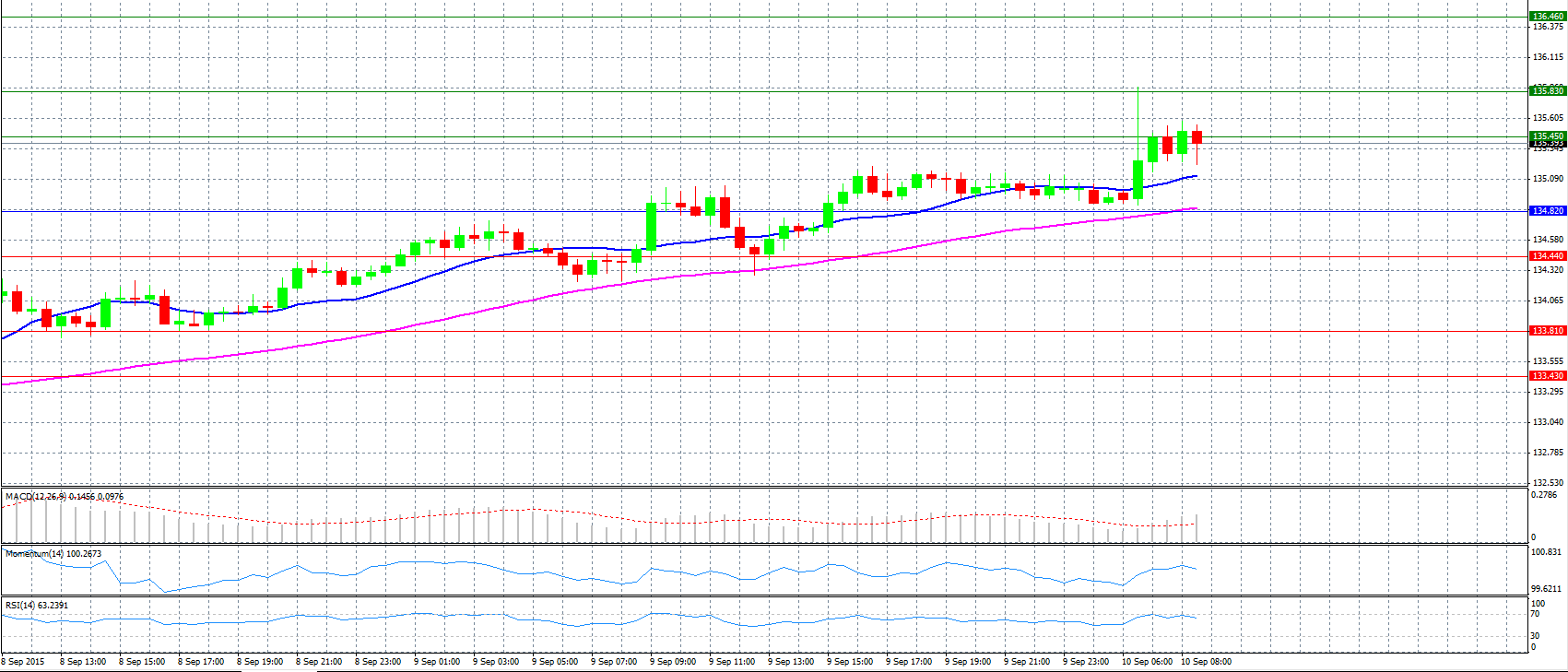

Market Scenario 1: Long positions above 134.82 with targets at 135.45 and 135.83.

Market Scenario 2: Short positions below 134.82 with targets at 134.44 and 133.81.

Comment: The pair rose but found resistance at 135.45 level.

Supports and Resistances:

R3 136.46

R2 135.83

R1 135.45

PP 134.82

S1 134.44

S2 133.81

S3 133.43

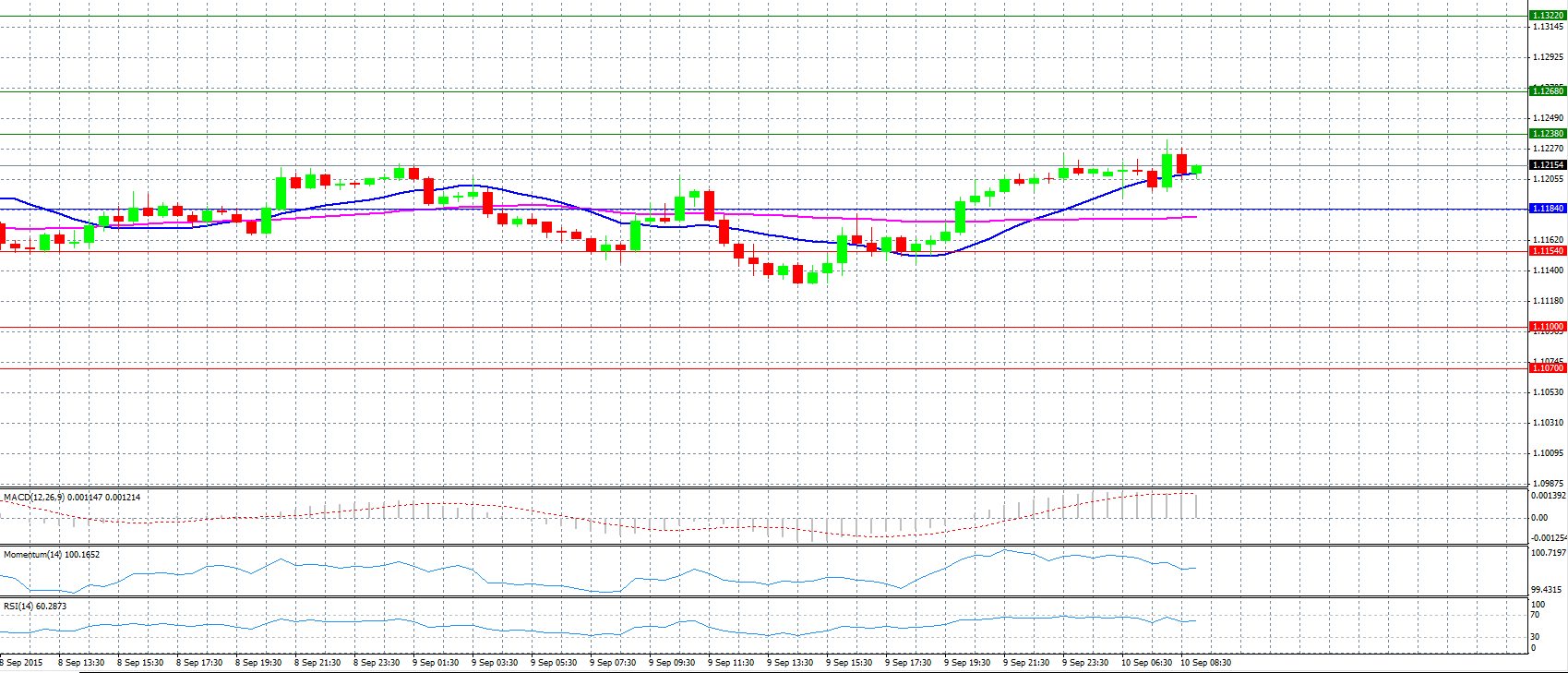

Market Scenario 1: Long positions above 1.1184 with targets at 1.1238 and 1.1268.

Market Scenario 2: Short positions below 1.1184 with targets at 1.1154 and 1.1100.

Comment: The pair remains intact above 1.1200 level even though the Euro Stoxx 50 futures turned positive ahead of the opening bell.

Supports and Resistances:

R3 1.1322

R2 1.1268

R1 1.1238

PP 1.1184

S1 1.1154

S2 1.1100

S3 1.1070

Market Scenario 1: Long positions above 185.35 with targets at 186.29 and 187.35.

Market Scenario 2: Short positions below 185.35 with targets at 184.29 and 183.35.

Comment: The pair fights to stay above pivot point 185.35.

Supports and Resistances:

R3 188.29

R2 187.35

R1 186.29

PP 185.35

S1 184.29

S2 183.35

S3 182.29

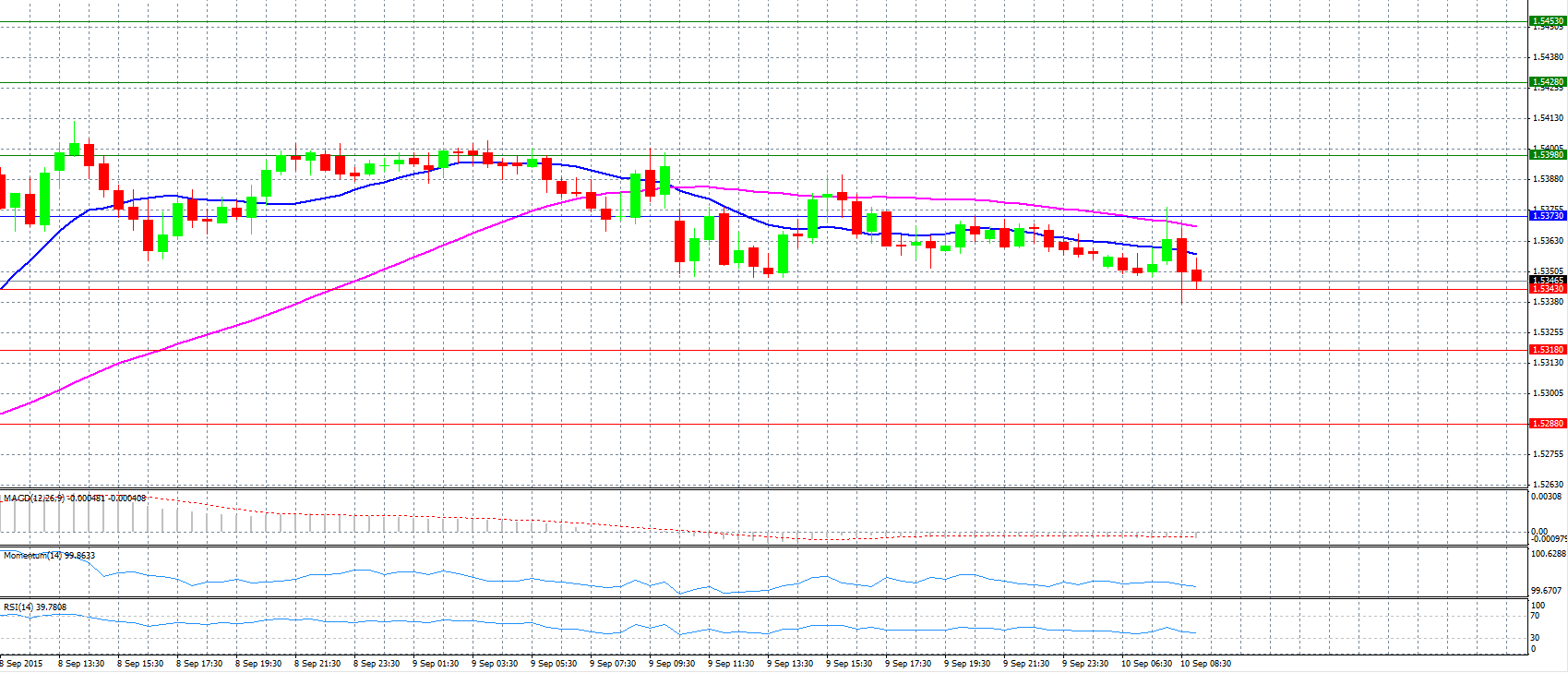

Market Scenario 1: Long positions above 1.5373 with targets at 1.5398 and 1.5428.

Market Scenario 2: Short positions below 1.5373 with targets at 1.5343 and 1.5318.

Comment: The pair is weaker ahead of UK events and eases to 1.5350 level.

Supports and Resistances:

R3 1.5453

R2 1.5428

R1 1.5398

PP 1.5373

S1 1.5343

S2 1.5318

S3 1.5288

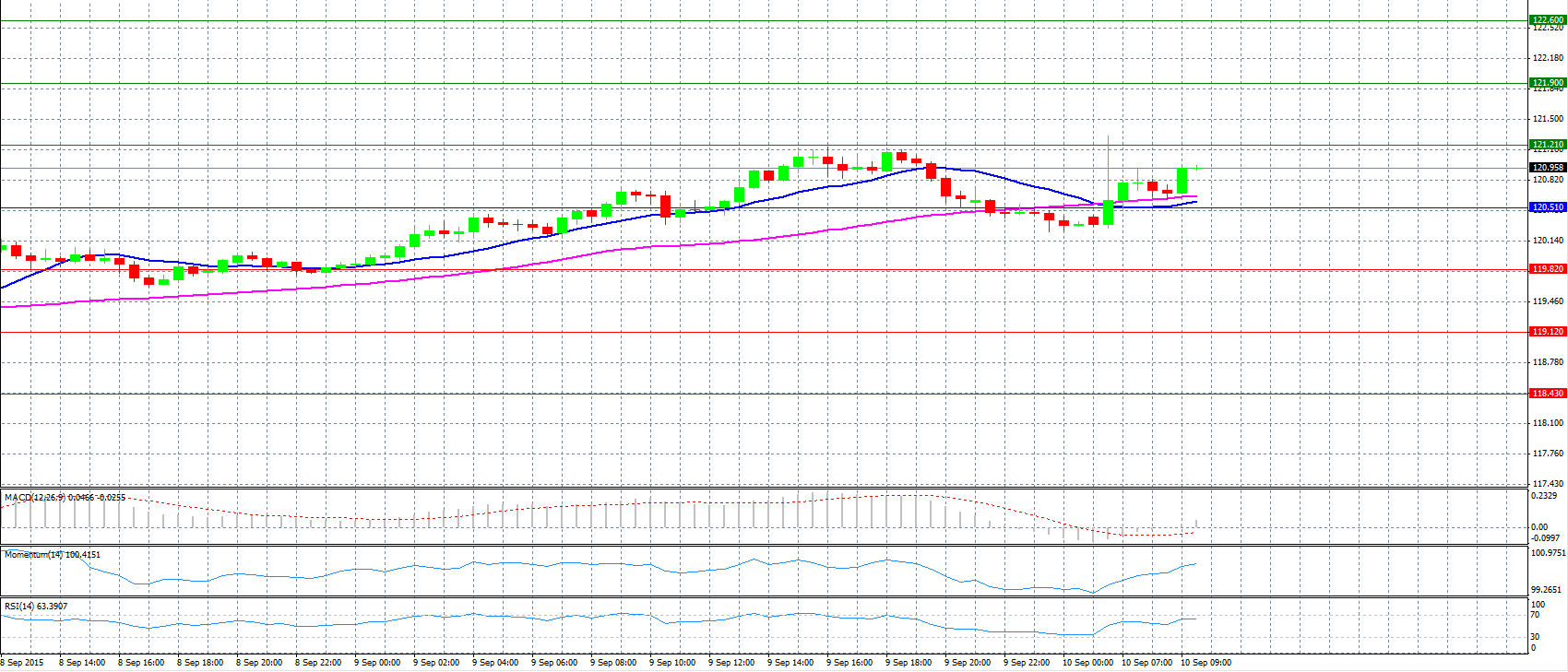

Market Scenario 1: Long positions above 120.51 with targets at 121.21 and 121.90.

Market Scenario 2: Short positions below 120.51 with targets at 119.82 and 119.12.

Comment: The pair is back below 121.00 level, as the Japanese yen has reclaimed part of the recent ground lost to the greenback.

Supports and Resistances:

R3 122.60

R2 121.90

R1 121.21

PP 120.51

S1 119.82

S2 119.12

S3 118.43

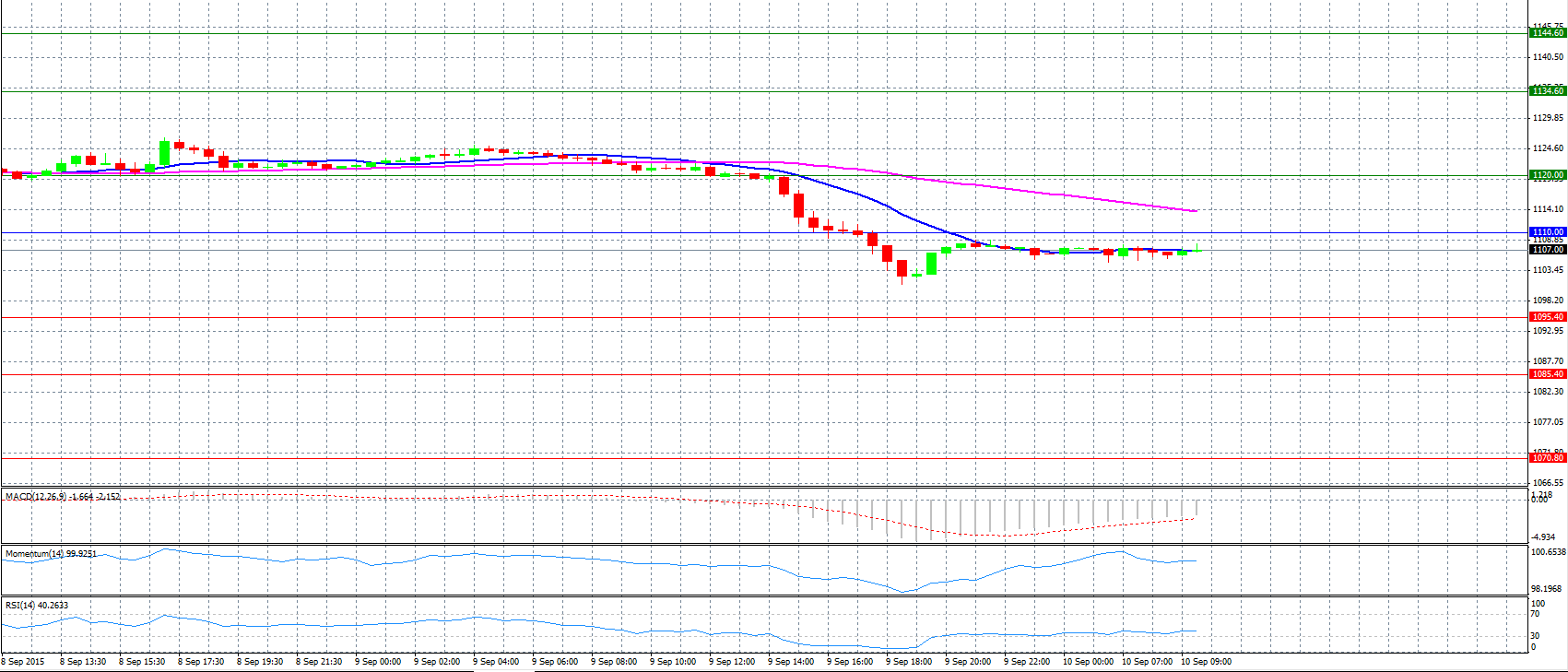

Market Scenario 1: Long positions above 1110.00 with targets at 1120.00 and 1134.60.

Market Scenario 2: Short positions below 1110.00 with targets at 1095.40 and 1085.40.

Comment: Gold prices languished near a four-week low on Thursday, retaining sharp overnight losses, as strong US economic data and outflows from bullion-backed exchange traded funds sapped investor interest.

Supports and Resistances:

R3 1144.60

R2 1134.60

R1 1120.00

PP 1110.00

S1 1095.40

S2 1085.40

S3 1070.80

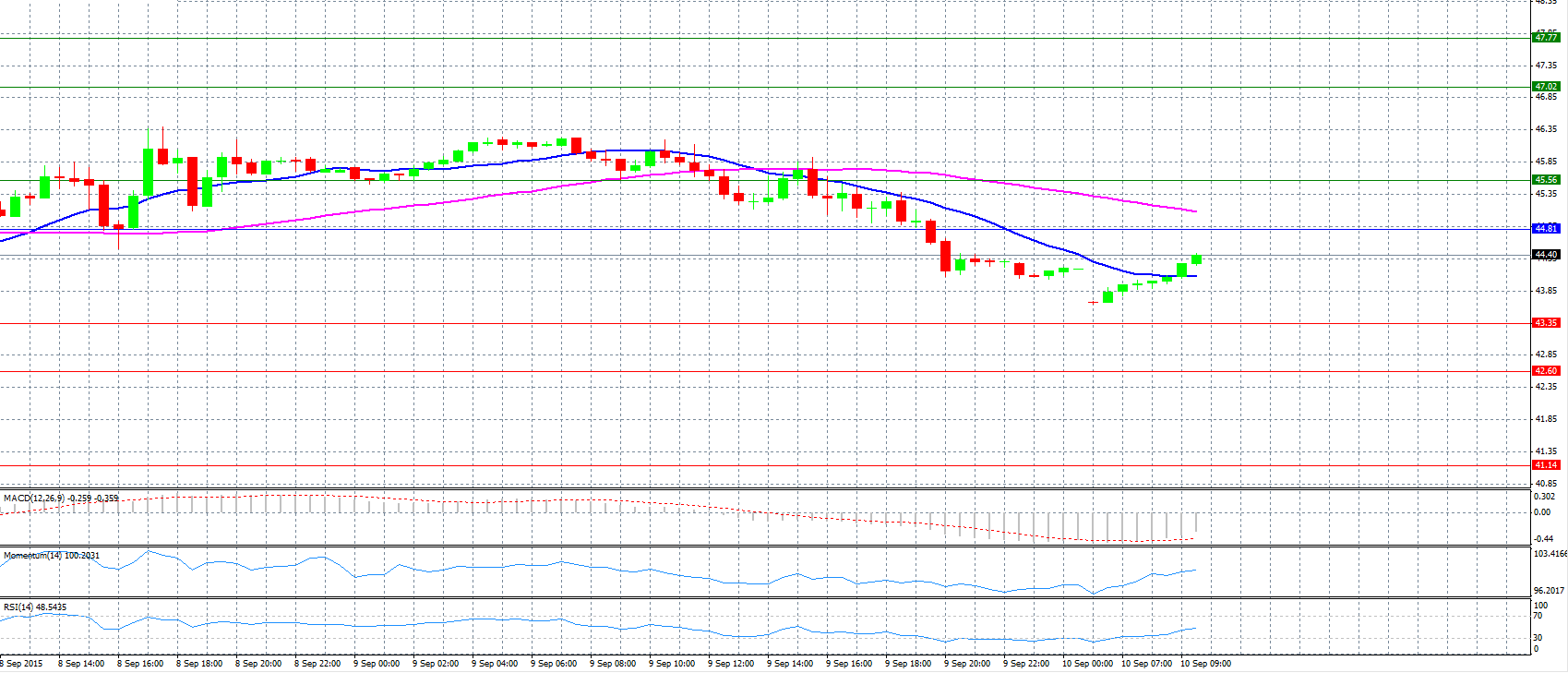

CRUDE OIL

Market Scenario 1: Long positions above 44.81 with targets at 45.56 and 47.02.

Market Scenario 2: Short positions below 44.81 with targets at 43.35 and 42.60.

Comment: Crude oil prices have a bearish tone as Asia’s biggest economies slow further.

Supports and Resistances:

R3 47.77

R2 47.02

R1 45.56

PP 44.81

S1 43.35

S2 42.60

S3 41.14

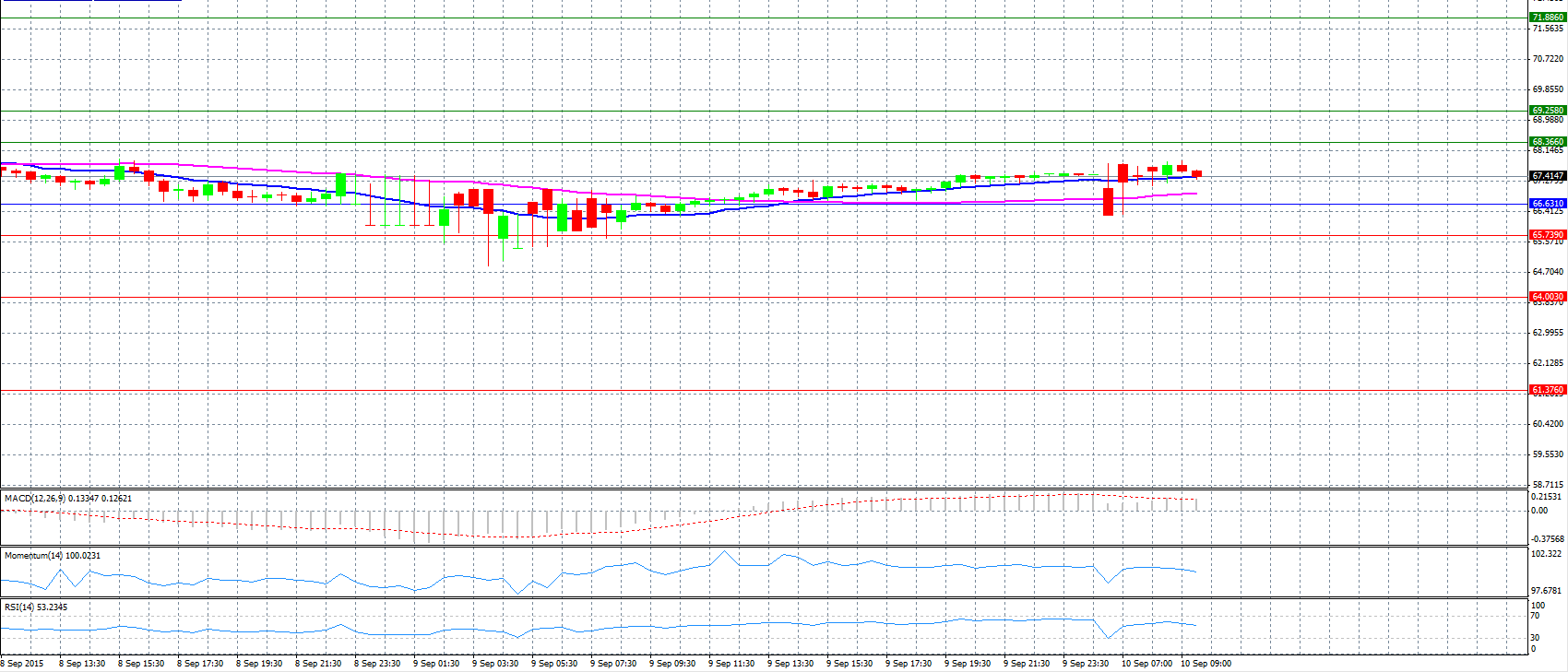

Market Scenario 1: Long positions above 66.631 with targets at 68.366 and 69.258.

Market Scenario 2: Short positions below 66.631 with targets at 65.739 and 64.003.

Comment: The pair trades neutral near 67.300 level.

Supports and Resistances:

R3 71.886

R2 69.258

R1 68.366

PP 66.631

S1 65.739

S2 64.003

S3 61.376