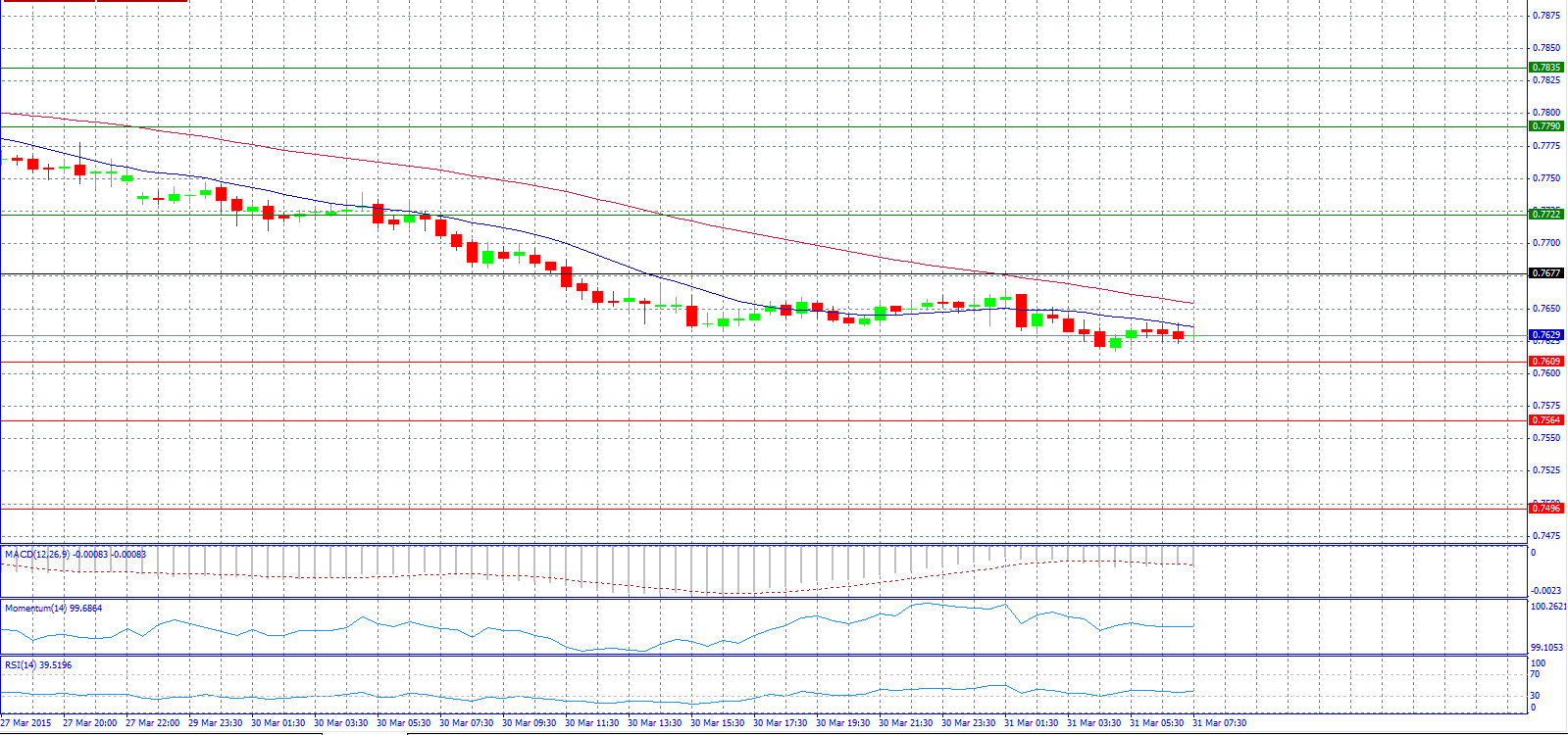

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7677 with target @ 0.7722.

Market Scenario 2: Short positions below 0.7677 with target @ 0.7564.

Comment: The pair suffers from a downward pressure but a break below 0.7560 is not expected according to analysts.

Supports and Resistances:

R3 0.7835

R2 0.7790

R1 0.7722

PP 0.7677

S1 0.7609

S2 0.7564

S3 0.7496

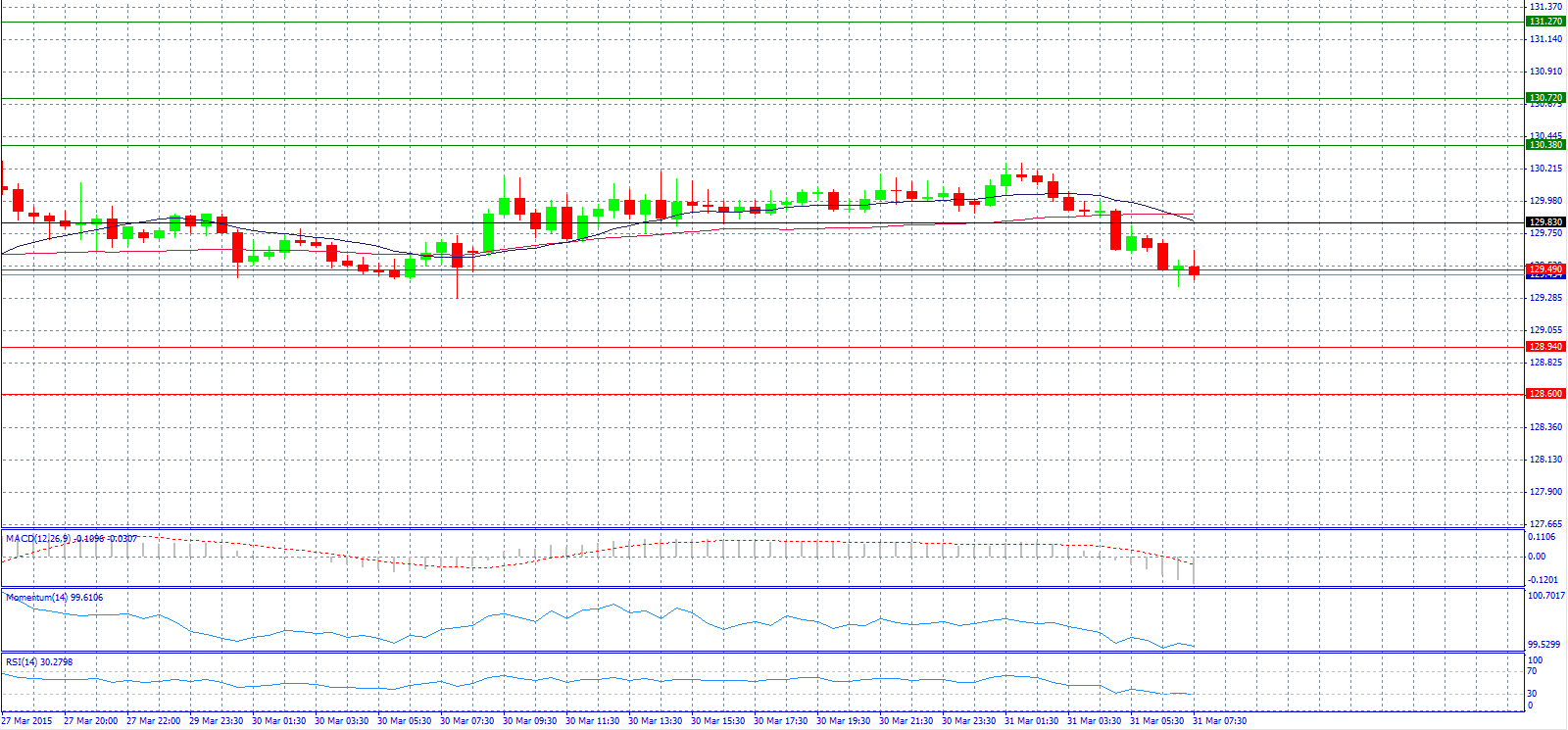

Market Scenario 1: Long positions above 129.83 with target @ 130.38.

Market Scenario 2: Short positions below 129.83 with target @ 128.94.

Comment: The pair fell to a session low of 129.37 after the German retail sales rose less than expected in February.

Supports and Resistances:

R3 131.27

R2 130.72

R1 130.38

PP 129.83

S1 129.49

S2 128.94

S3 128.60

Market Scenario 1: Long positions above 1.0845 with target @ 1.0881.

Market Scenario 2: Short positions below 1.0845 with target @ 1.0711.

Comment: The pair might drop to 1.0755 level today, and the upside would remain capped at 1.0825 as Greece concerns linger according to analysts.

Supports and Resistances:

R3 1.0966

R2 1.0930

R1 1.0881

PP 1.0845

S1 1.0796

S2 1.0760

S3 1.0711

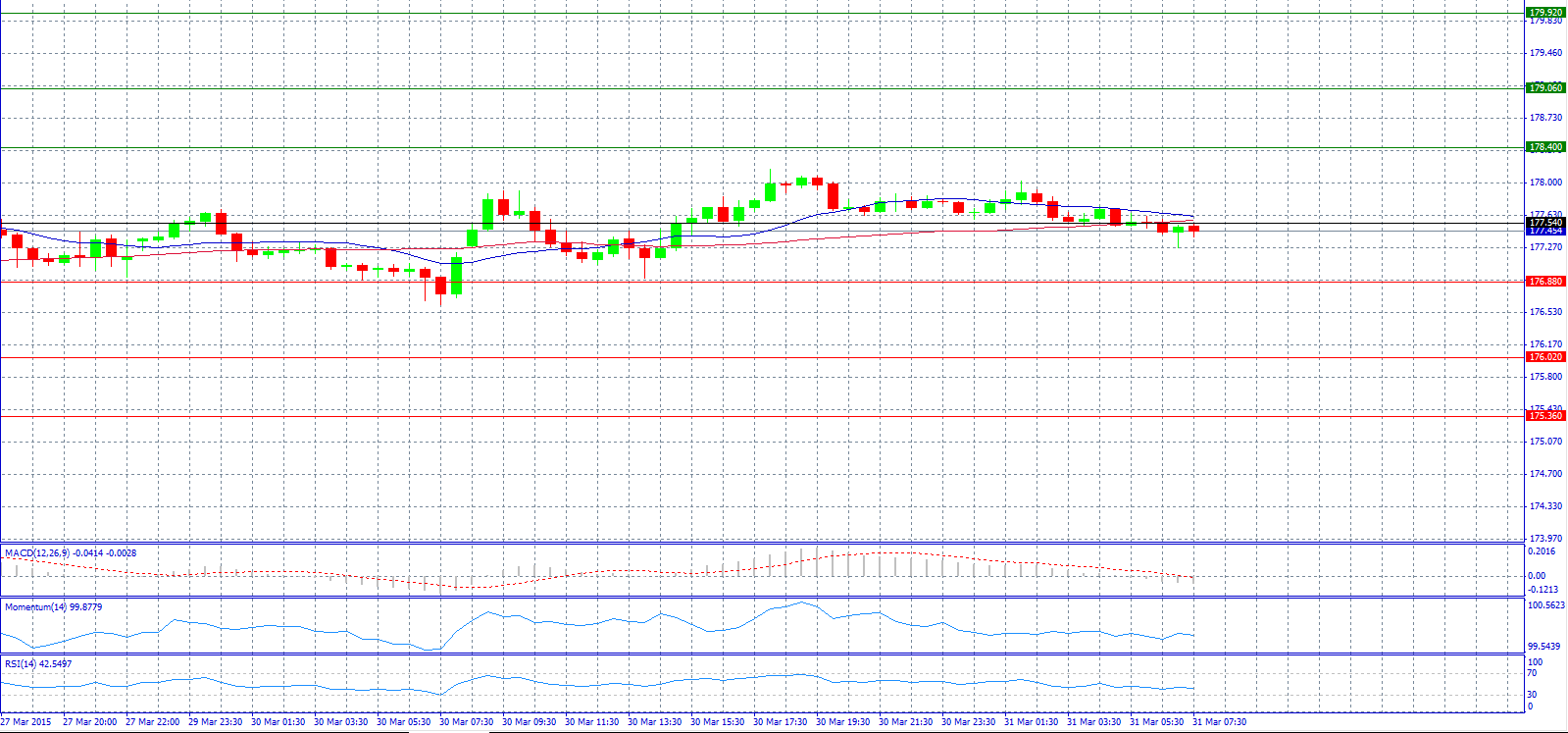

Market Scenario 1: Long positions above 177.54 with target @ 178.40.

Market Scenario 2: Short positions below 177.54 with target @ 176.88.

Comment: The pair trades below the pivot point at 177.45 level.

Supports and Resistances:

R3 179.92

R2 179.06

R1 178.40

PP 177.54

S1 176.88

S2 176.02

S3 175.36

Market Scenario 1: Long positions above 1.4820 with target @ 1.4889.

Market Scenario 2: Short positions below 1.4820 with target @ 1.4672.

Comment: The pair falls back on the 1.4700 handle due to stronger US dollar while the cable is expected to get further direction from UK GDP data.

Supports and Resistances:

R3 1.5037

R2 1.4968

R1 1.4889

PP 1.4820

S1 1.4741

S2 1.4672

S3 1.4593

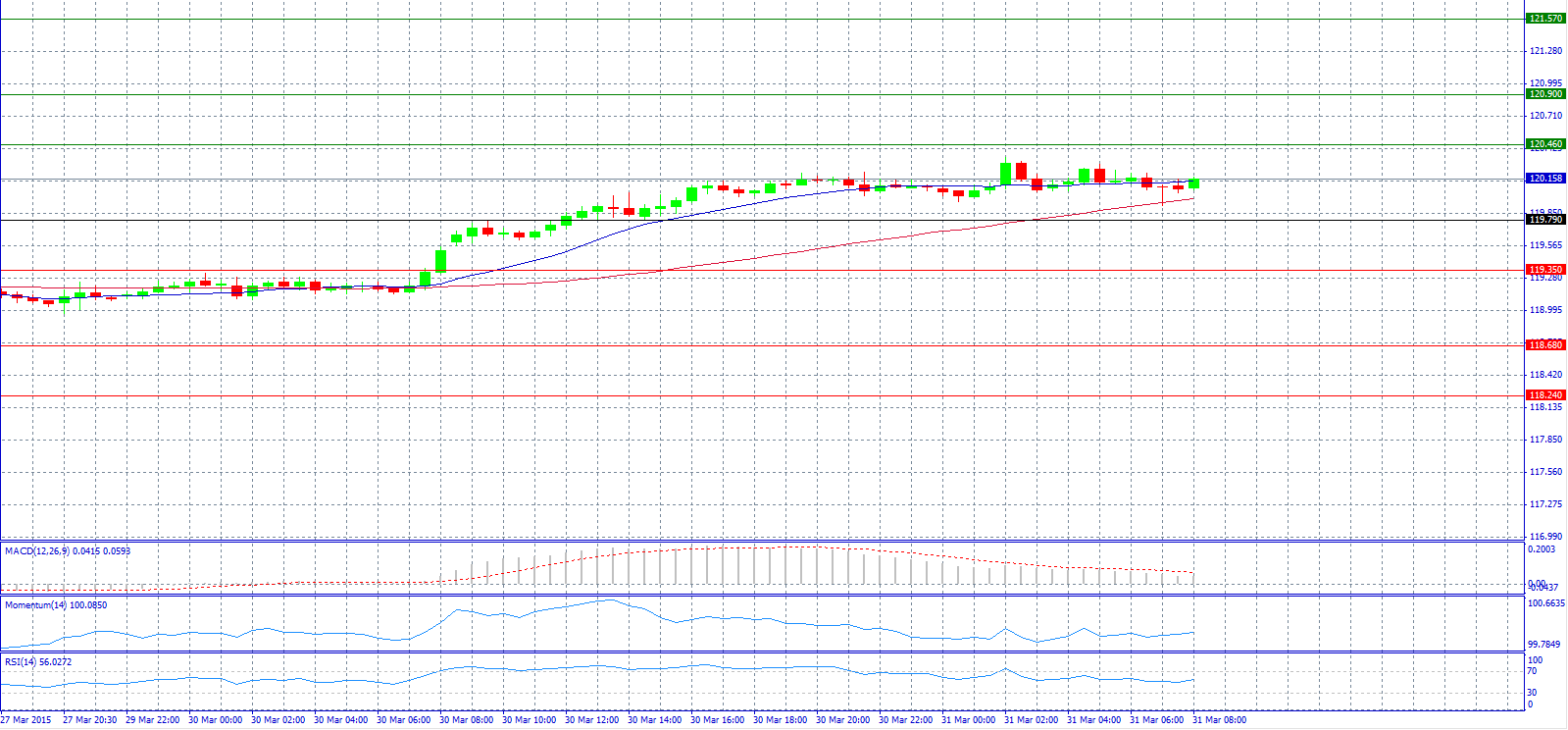

Market Scenario 1: Long positions above 119.79 with target @ 120.90.

Market Scenario 2: Short positions below 119.79 with target @ 119.35.

Comment: The pair surpassed 120.00 level and now there is a Bullish Confirmation Pattern in the market.

Supports and Resistances:

R3 121.57

R2 120.90

R1 120.46

PP 119.79

S1 119.35

S2 118.68

S3 118.24

Market Scenario 1: Long positions above 1189.10 with target @ 1196.00.

Market Scenario 2: Short positions below 1189.10 with target @ 1171.70.

Comment: Gold prices are under pressure from the dollar strength.

Supports and Resistances:

R3 1213.40

R2 1206.50

R1 1196.00

PP 1189.10

S1 1178.60

S2 1171.70

S3 1161.20

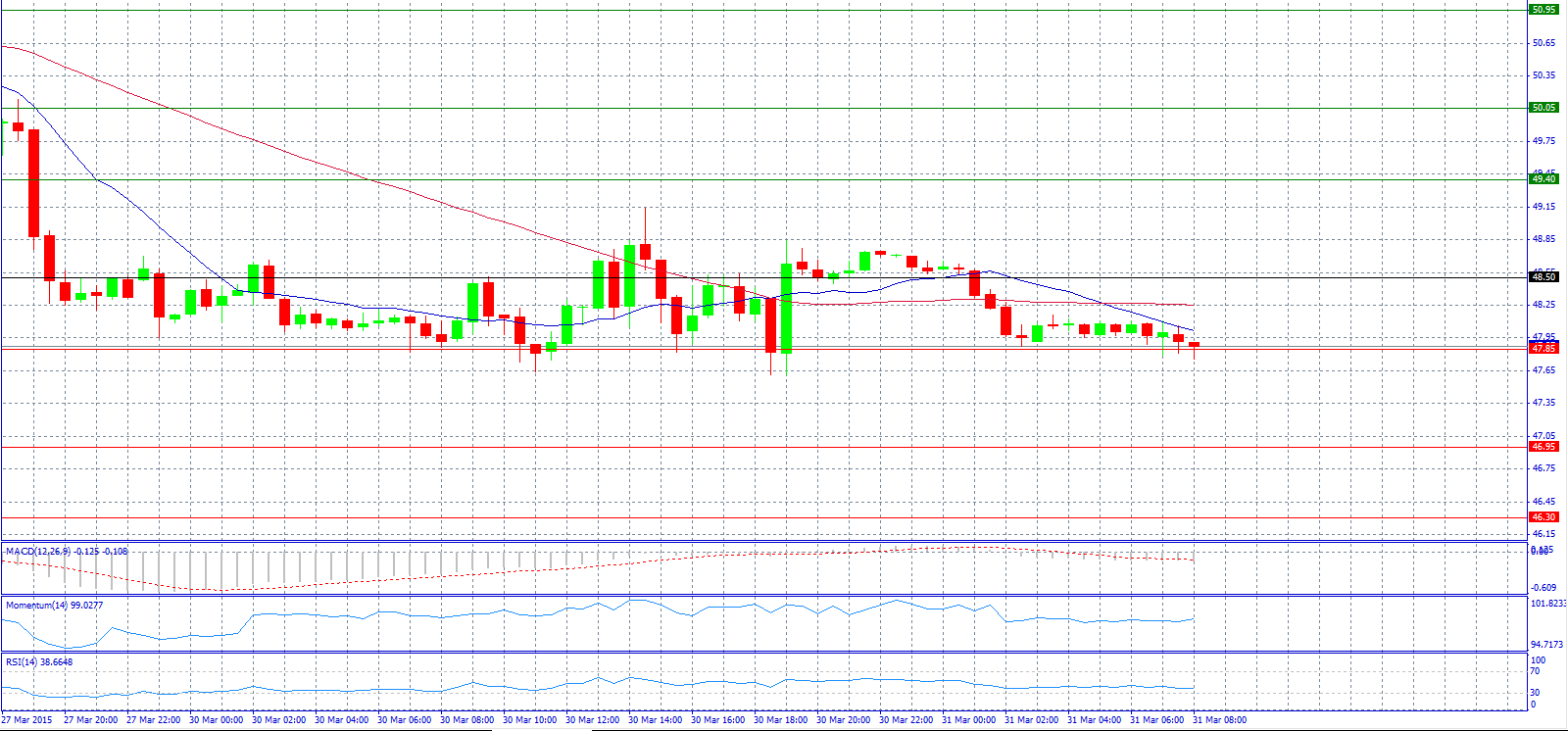

Market Scenario 1: Long positions above 48.50 with target @ 49.40.

Market Scenario 2: Short positions below 48.50 with target @ 46.95.

Comment: Crude oil prices could still remain subdued into the second quarter according to analysts.

Supports and Resistances:

R3 50.95

R2 50.05

R1 49.40

PP 48.50

S1 47.85

S2 46.95

S3 46.30

Market Scenario 1: Long positions above 57.760 with target @ 58.619.

Market Scenario 2: Short positions below 57.760 with target @ 55.936.

Comment: There could be further weakness in store for the Russian currency, pushing the pair higher according to analysts.

Supports and Resistances:

R3 60.443

R2 59.584

R1 58.619

PP 57.760

S1 56.795

S2 55.936

S3 54.971