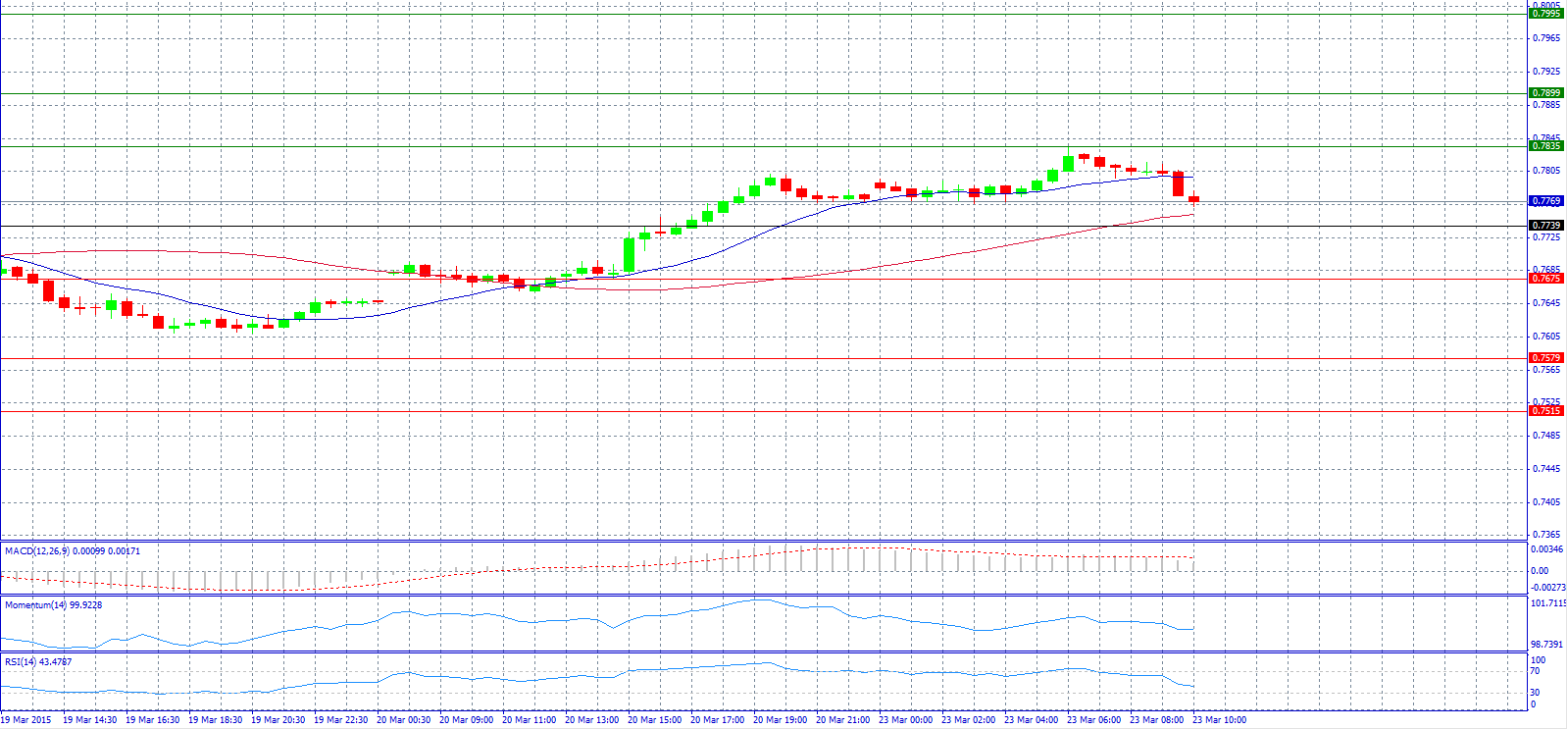

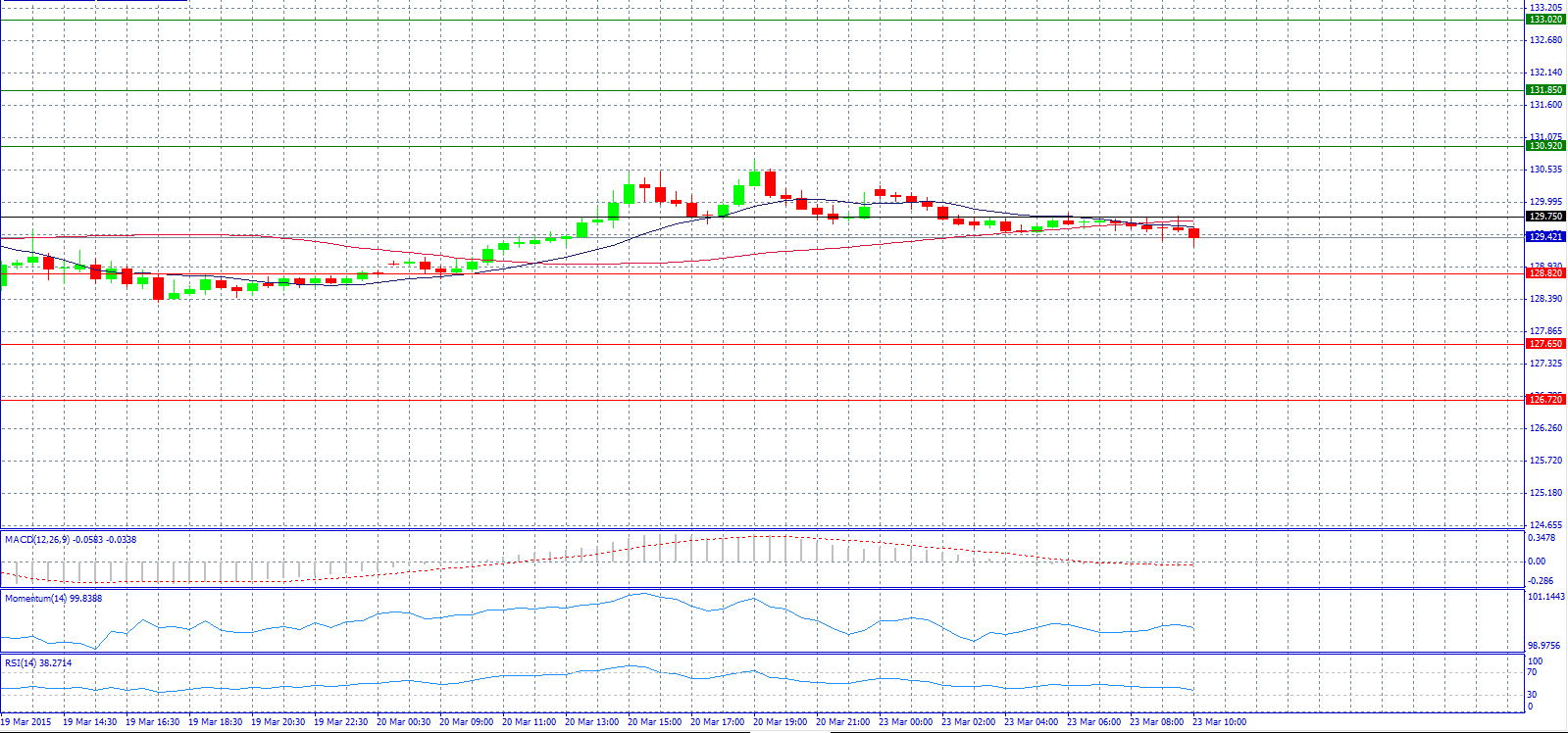

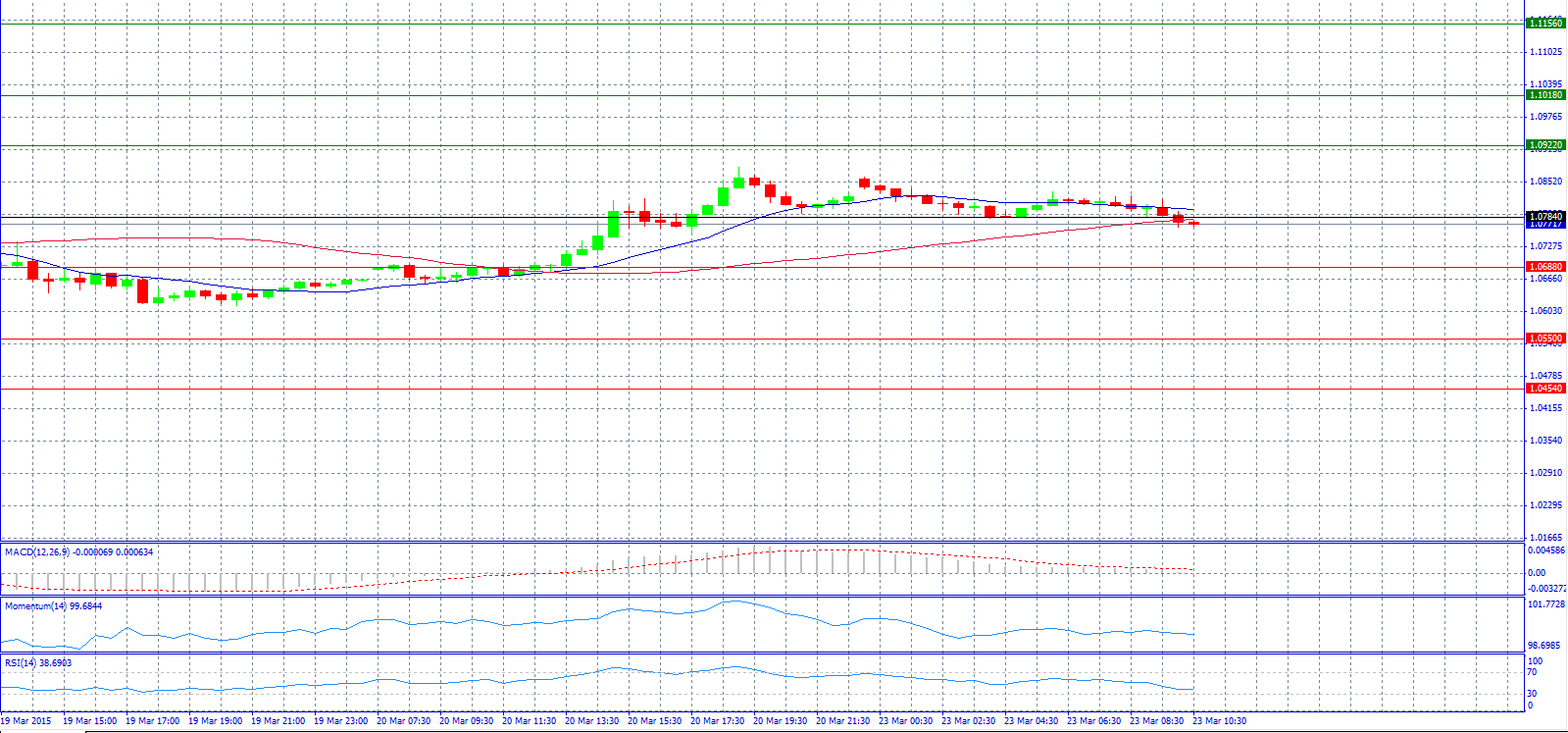

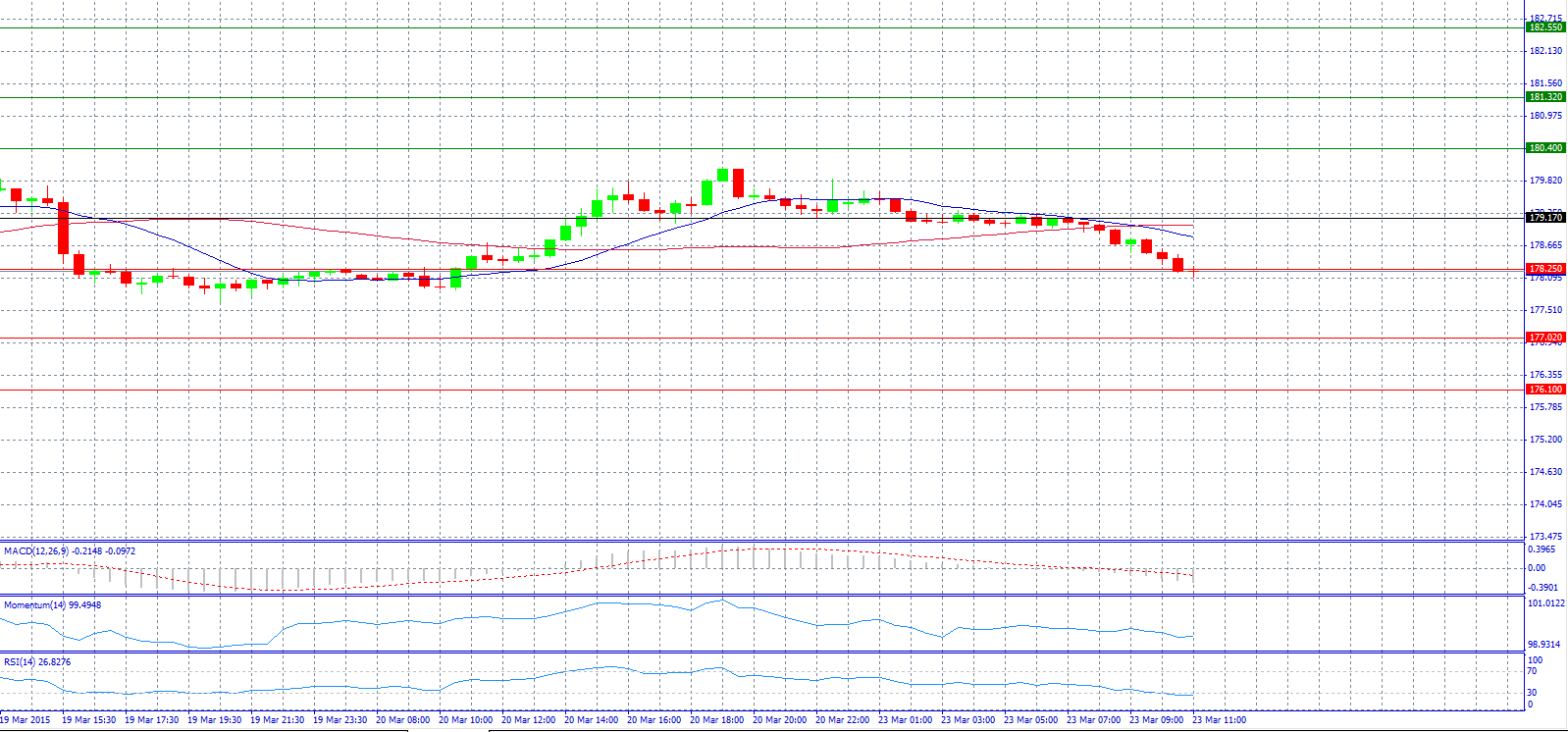

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7739 with target @ 0.7835.

Market Scenario 2: Short positions below 0.7739 with target @ 0.7675.

Comment: The pair advanced above 0.7800 early on in the Asia session on the back of widespread USD weakness, but the pair soon fell below this level.

Supports and Resistances:

R3 0.7995

R2 0.7899

R1 0.7835

PP 0.7739

S1 0.7675

S2 0.7579

S3 0.7515

Market Scenario 1: Long positions above 129.75 with target @ 130.92.

Market Scenario 2: Short positions below 129.75 with target @ 128.82.

Comment: The pair trades neutral below pivot point 129.75.

Supports and Resistances:

R3 133.02

R2 131.85

R1 130.92

PP 129.75

S1 128.82

S2 127.65

S3 126.72

Market Scenario 1: Long positions above 1.0784 with target @ 1.0922.

Market Scenario 2: Short positions below 1.0784 with target @ 1.0688.

Comment: The pair price action suggest downside pressure is easing for the pair.

Supports and Resistances:

R3 1.1156

R2 1.1018

R1 1.0922

PP 1.0784

S1 1.0688

S2 1.0550

S3 1.0454

Market Scenario 1: Long positions above 179.17 with target @ 180.40.

Market Scenario 2: Short positions below 179.17 with target @ 177.02.

Comment: The pair trades steady as consolidation from 177.13 level continues.

Supports and Resistances:

R3 182.55

R2 181.32

R1 180.40

PP 179.17

S1 178.25

S2 177.02

S3 176.10

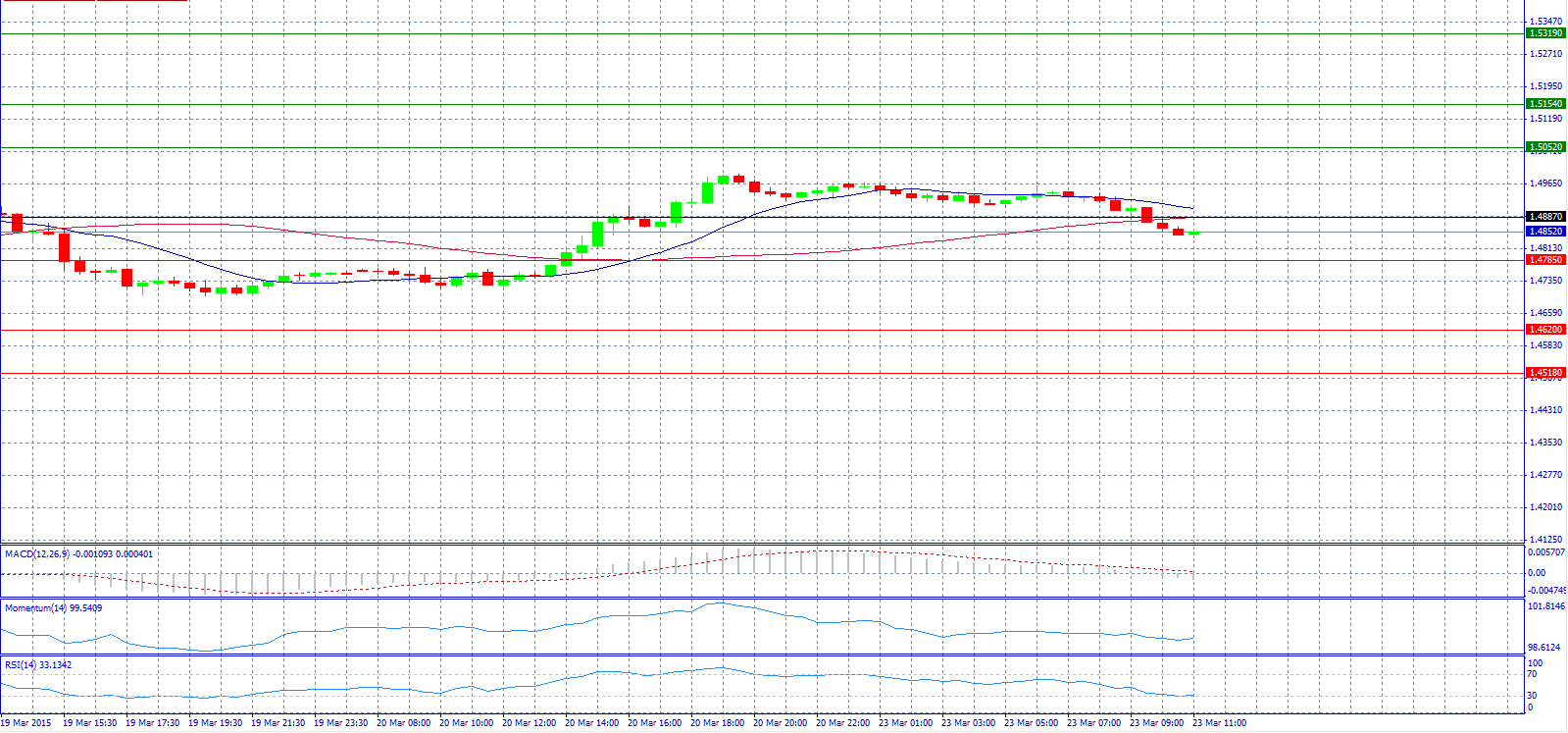

Market Scenario 1: Long positions above 1.4887 with target @ 1.5052.

Market Scenario 2: Short positions below 1.4887 with target @ 1.4785.

Comment: The pair weakened after the UK CBI warned the negative effects of the “power vacuum” post-election results.

Supports and Resistances:

R3 1.5319

R2 1.5154

R1 1.5052

PP 1.4887

S1 1.4785

S2 1.4620

S3 1.4518

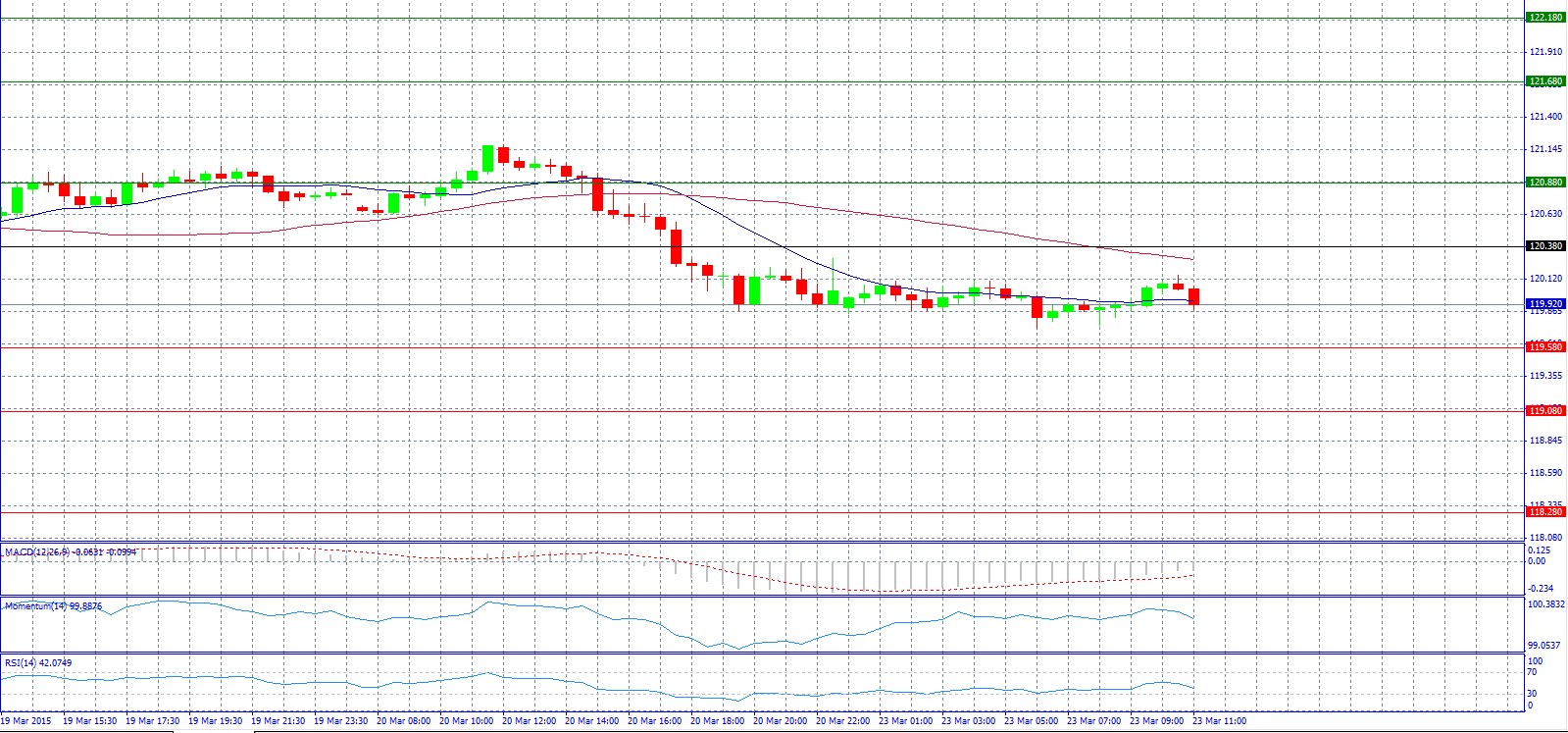

Market Scenario 1: Long positions above 120.38 with target @ 120.88.

Market Scenario 2: Short positions below 120.38 with target @ 119.08.

Comment: The pair trades near 119.90 after hitting fresh high above 120.15 in the European morning.

Supports and Resistances:

R3 122.18

R2 121.68

R1 120.88

PP 120.38

S1 119.58

S2 119.08

S3 118.28

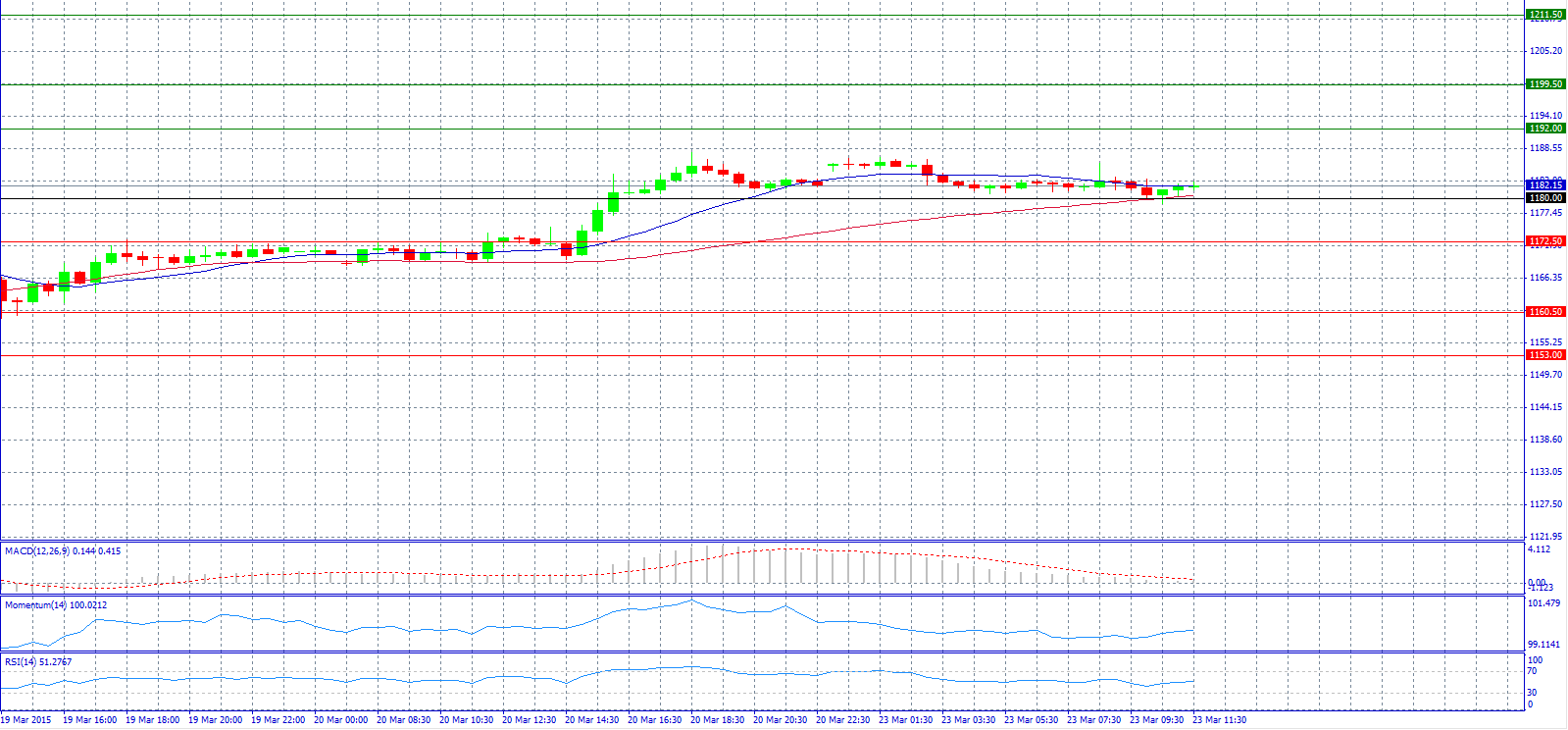

Market Scenario 1: Long positions above 1180.00 with target @ 1192.00.

Market Scenario 2: Short positions below 1180.00 with target @ 1172.50.

Comment: Gold prices retain gains on weaker dollar.

Supports and Resistances:

R3 1211.50

R2 1199.50

R1 1192.00

PP 1180.00

S1 1172.50

S2 1160.50

S3 1153.00

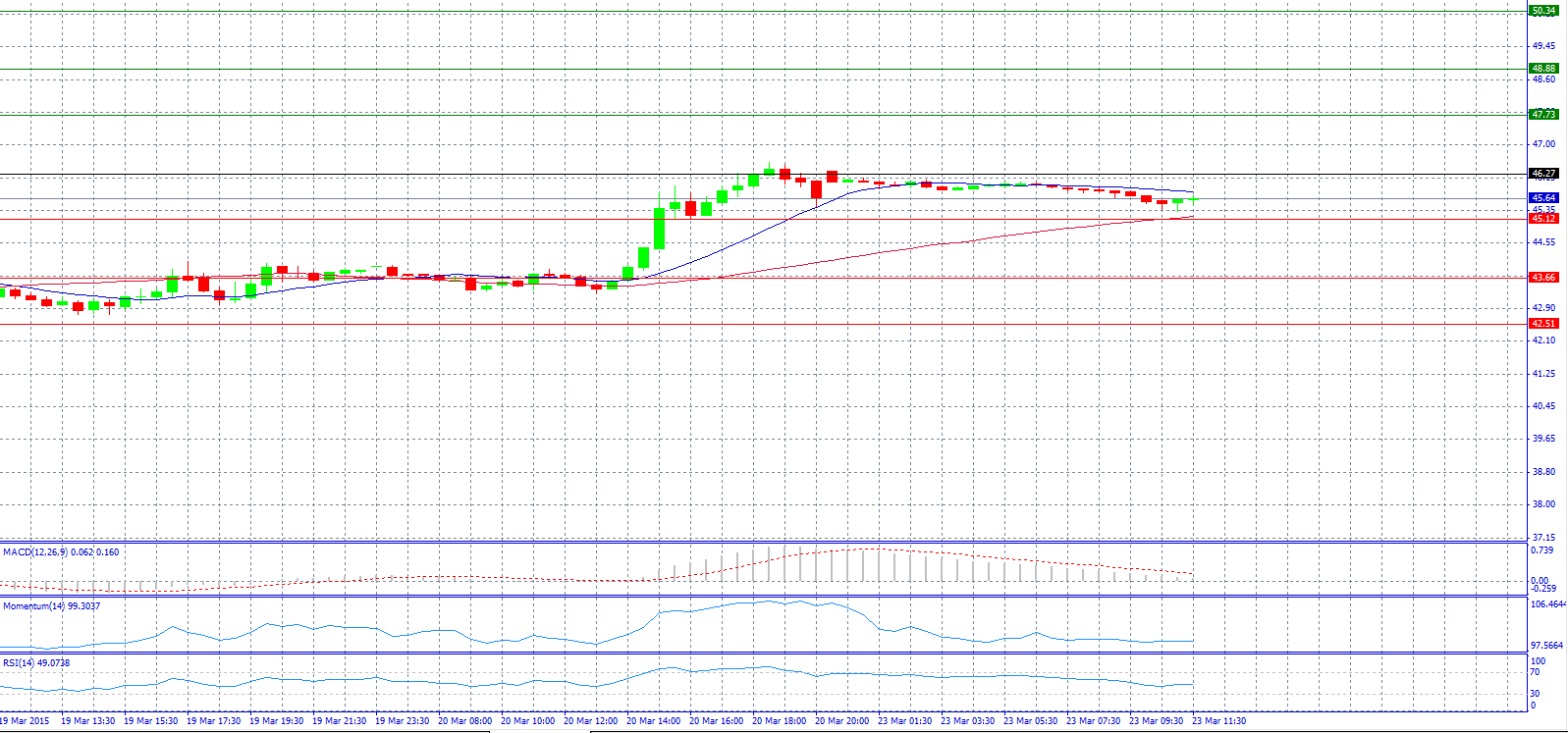

Market Scenario 1: Long positions above 46.27 with target @ 47.73.

Market Scenario 2: Short positions below 46.27 with target @ 43.66.

Comment: Crude oil prices could trade between $35 to $40 a barrel by the end of the second-quarter of 2015, according to analysts.

Supports and Resistances:

R3 50.34

R2 48.88

R1 47.73

PP 46.27

S1 45.12

S2 43.66

S3 42.51

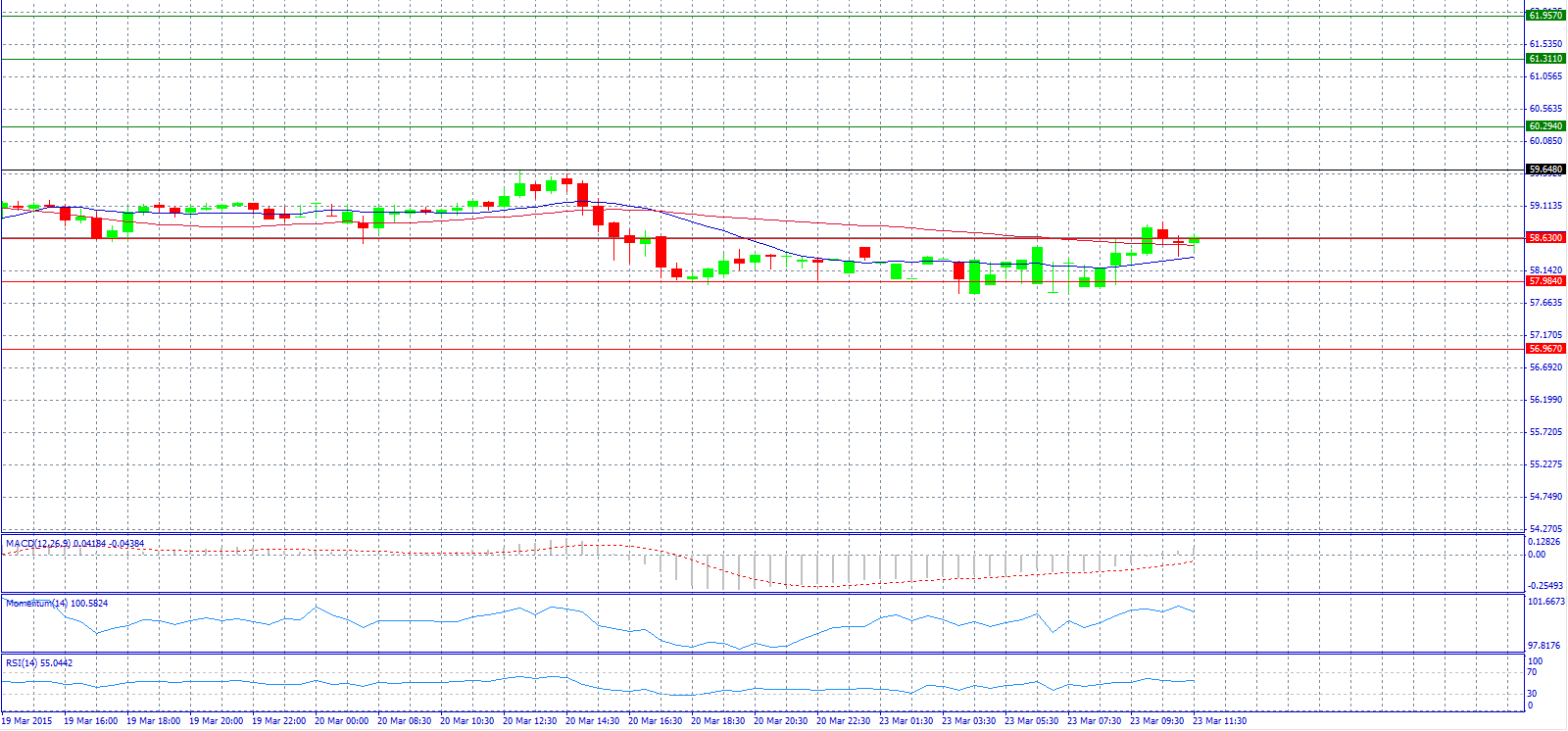

Market Scenario 1: Long positions above 59.648 with target @ 60.294.

Market Scenario 2: Short positions below 59.648 with target @ 57.984.

Comment: The pair is stabilizing despite oil's fade.

Supports and Resistances:

R3 61.957

R2 61.311

R1 60.294

PP 59.648

S1 58.630

S2 57.984

S3 56.967