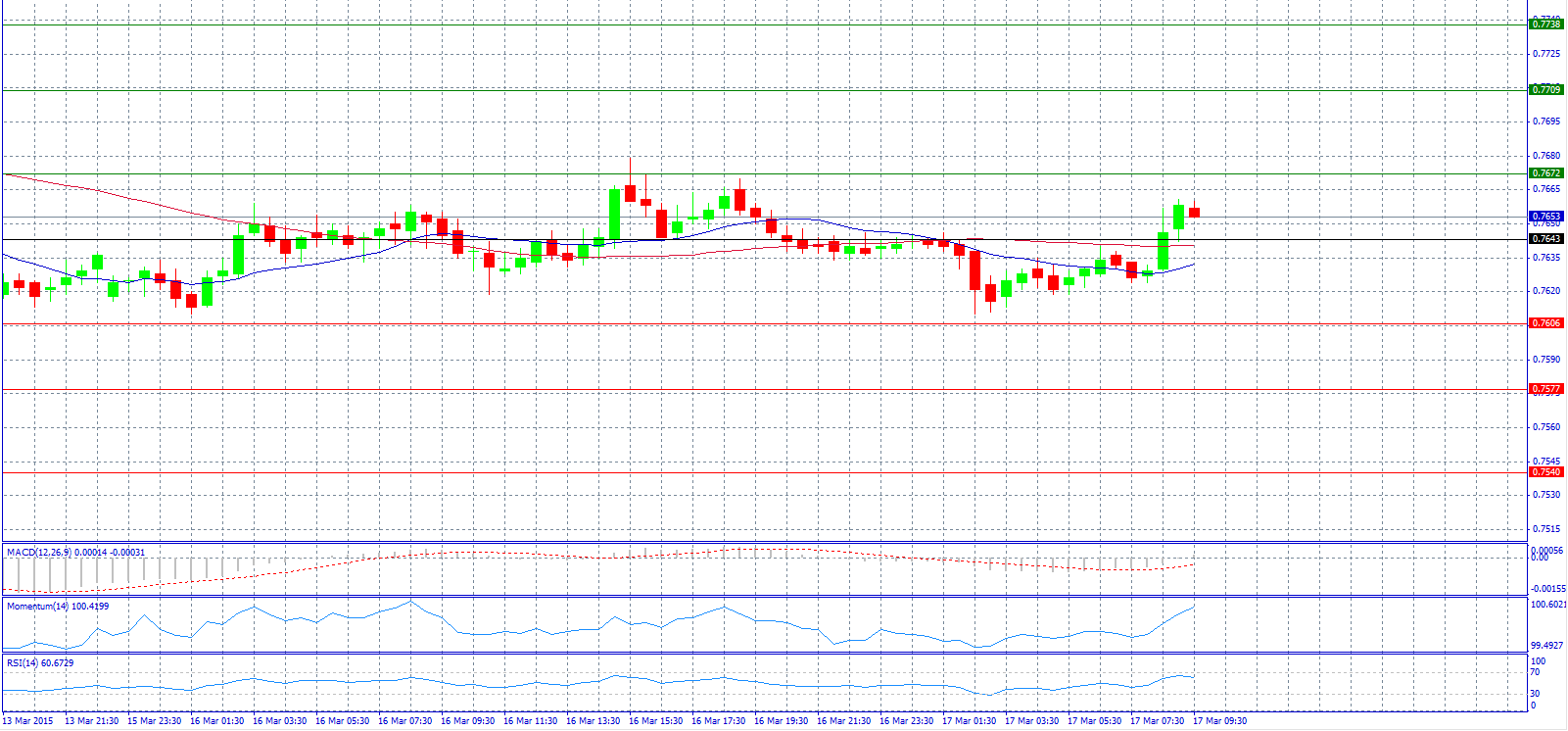

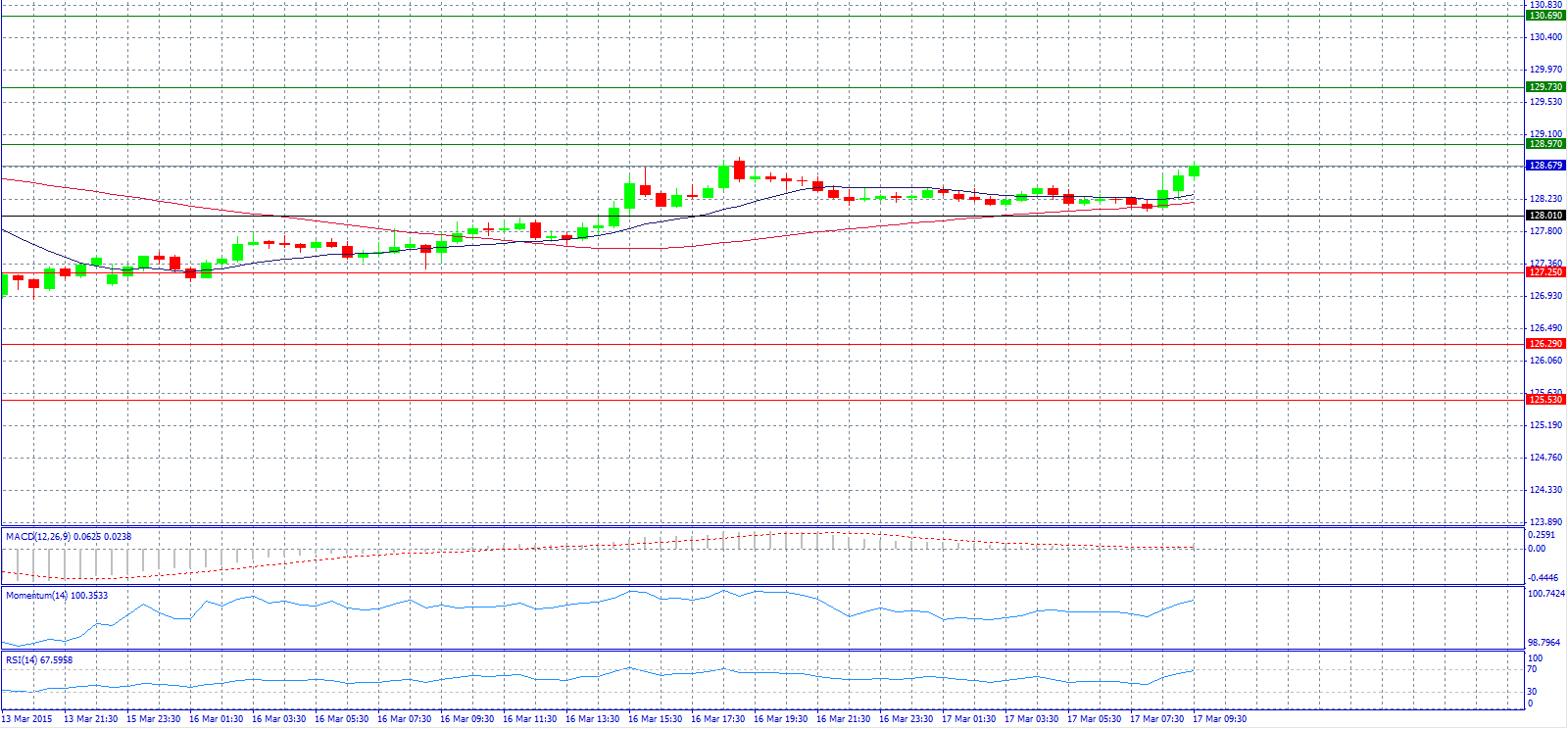

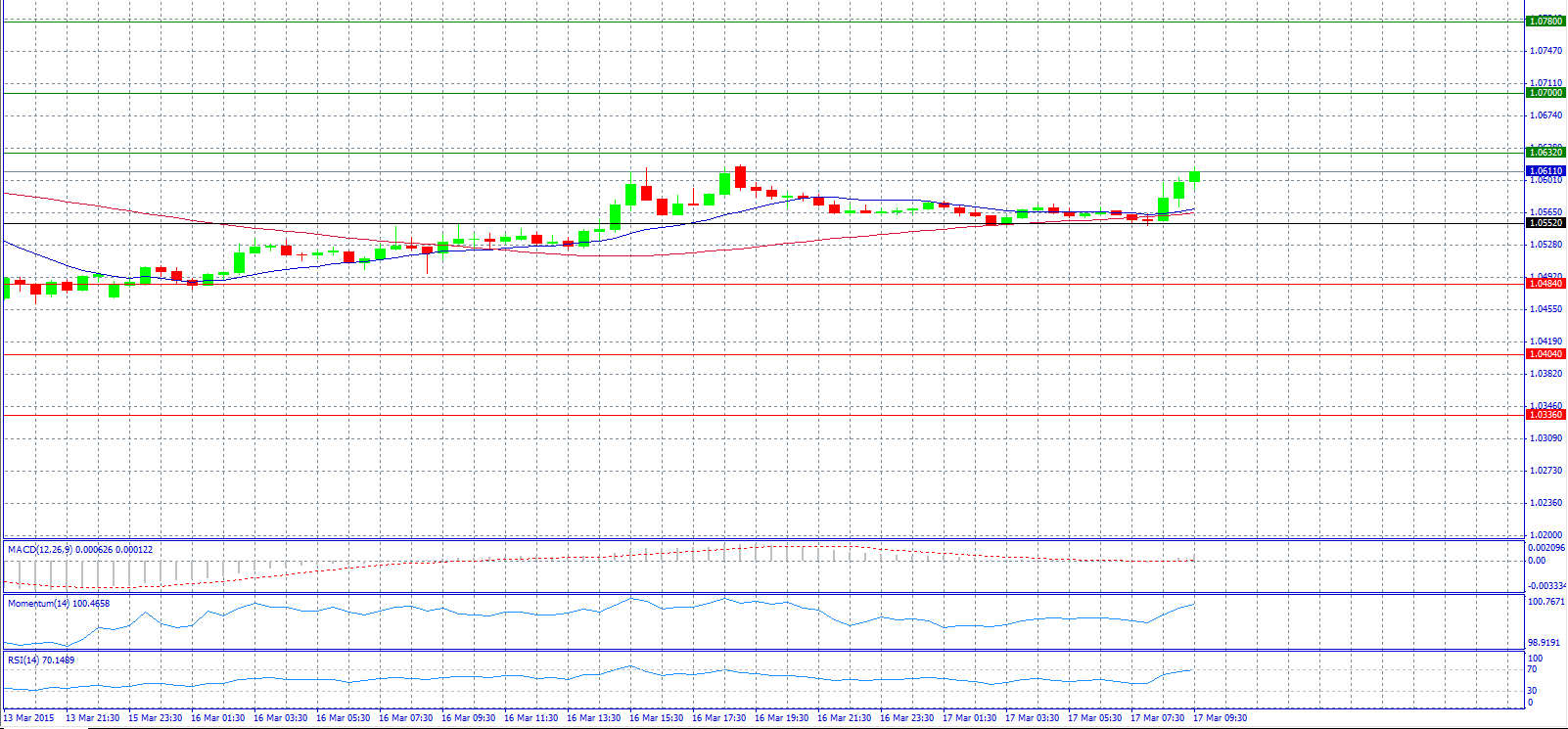

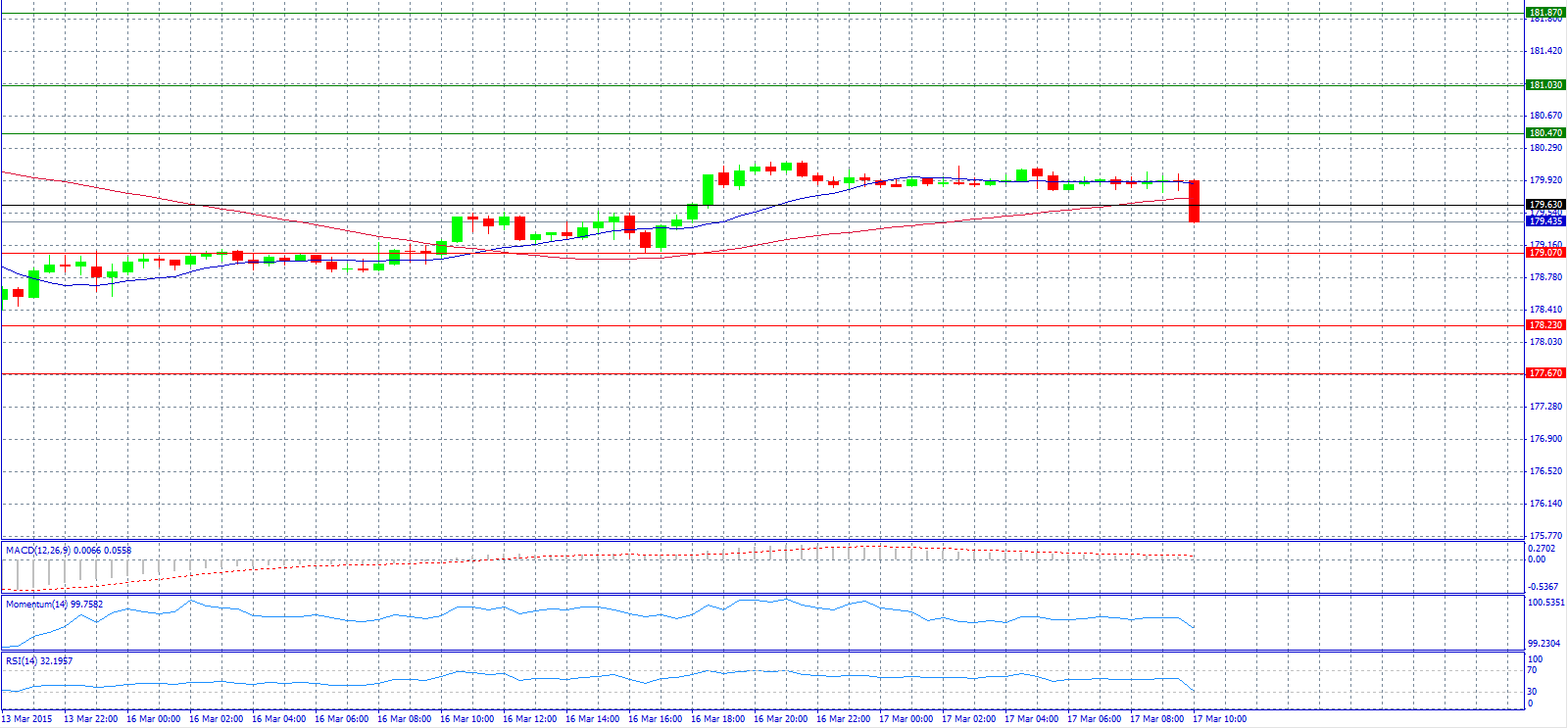

*All charts are 30-M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7643 with target @ 0.7709.

Market Scenario 2: Short positions below 0.7643 with target @ 0.7606.

Comment: The pair after it showed weakness in the early European morning and had losses, now it’s advancing again above 0.7650 level.

Supports and Resistances:

R3 0.7738

R2 0.7709

R1 0.7672

PP 0.7643

S1 0.7606

S2 0.7577

S3 0.7540

Market Scenario 1: Long positions above 128.01 with target @ 129.73.

Market Scenario 2: Short positions below 128.01 with target @ 127.25.

Comment: The pair traded almost steady in mid-Asia and now it’s advancing 128.60 level.

Supports and Resistances:

R3 130.69

R2 129.73

R1 128.97

PP 128.01

S1 127.25

S2 126.29

S3 125.53

Market Scenario 1: Long positions above 1.0552 with target @ 1.0700.

Market Scenario 2: Short positions below 1.0552 with target @ 1.0484.

Comment: The pair advances higher with German data ahead.

Supports and Resistances:

R3 1.0780

R2 1.0700

R1 1.0632

PP 1.0552

S1 1.0484

S2 1.0404

S3 1.0336

Market Scenario 1: Long positions above 179.63 with target @ 180.47.

Market Scenario 2: Short positions below 179.63 with target @ 179.07.

Comment: The pair is currently trading below pivot point 179.63.

Supports and Resistances:

R3 181.87

R2 181.03

R1 180.47

PP 179.63

S1 179.07

S2 178.23

S3 177.67

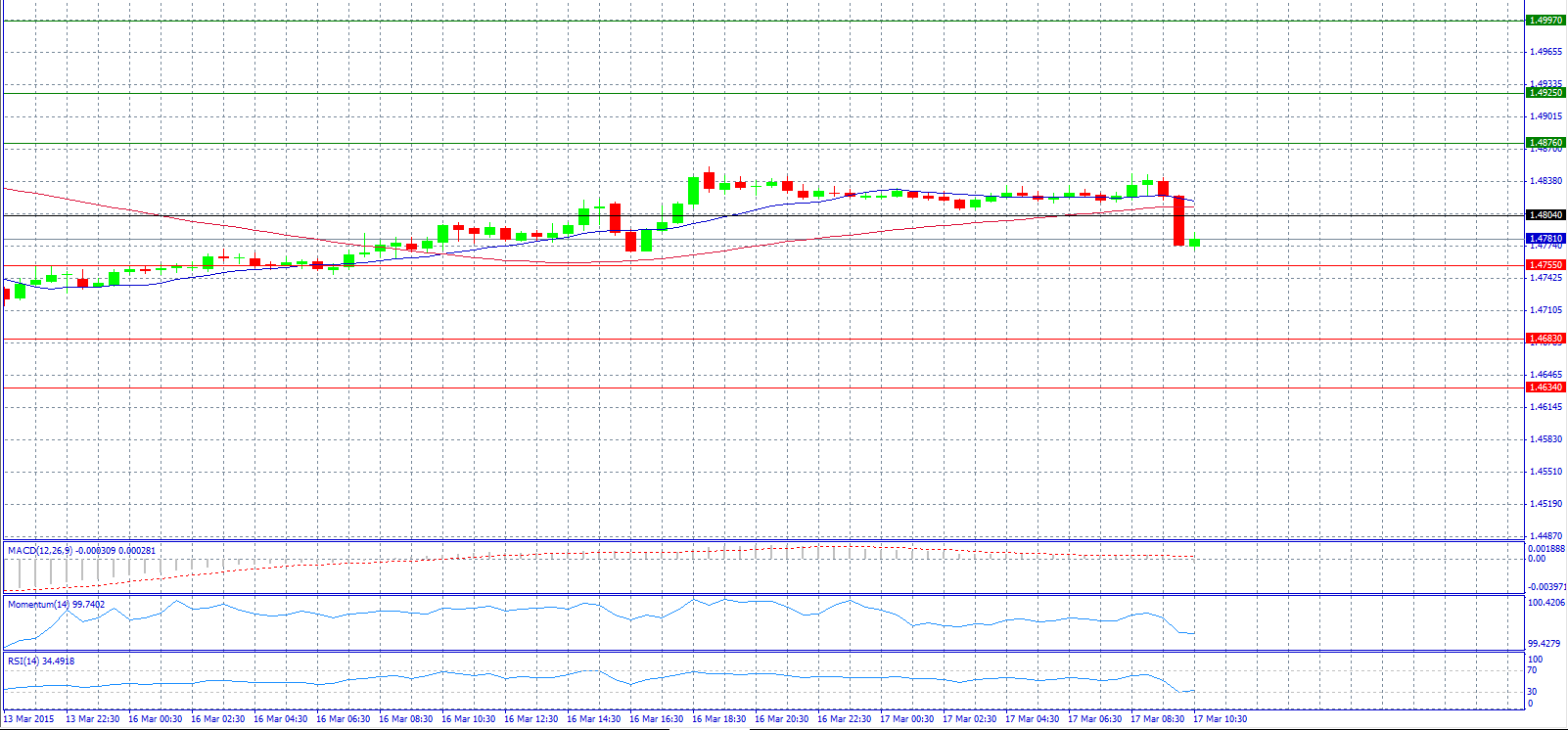

Market Scenario 1: Long positions above 1.4804 with target @ 1.4876.

Market Scenario 2: Short positions below 1.4804 with target @ 1.4755.

Comment: The pair rallied during the session on Monday, jumping back above the 1.48 level and now trading below it again.

Supports and Resistances:

R3 1.4997

R2 1.4925

R1 1.4876

PP 1.4804

S1 1.4755

S2 1.4683

S3 1.4634

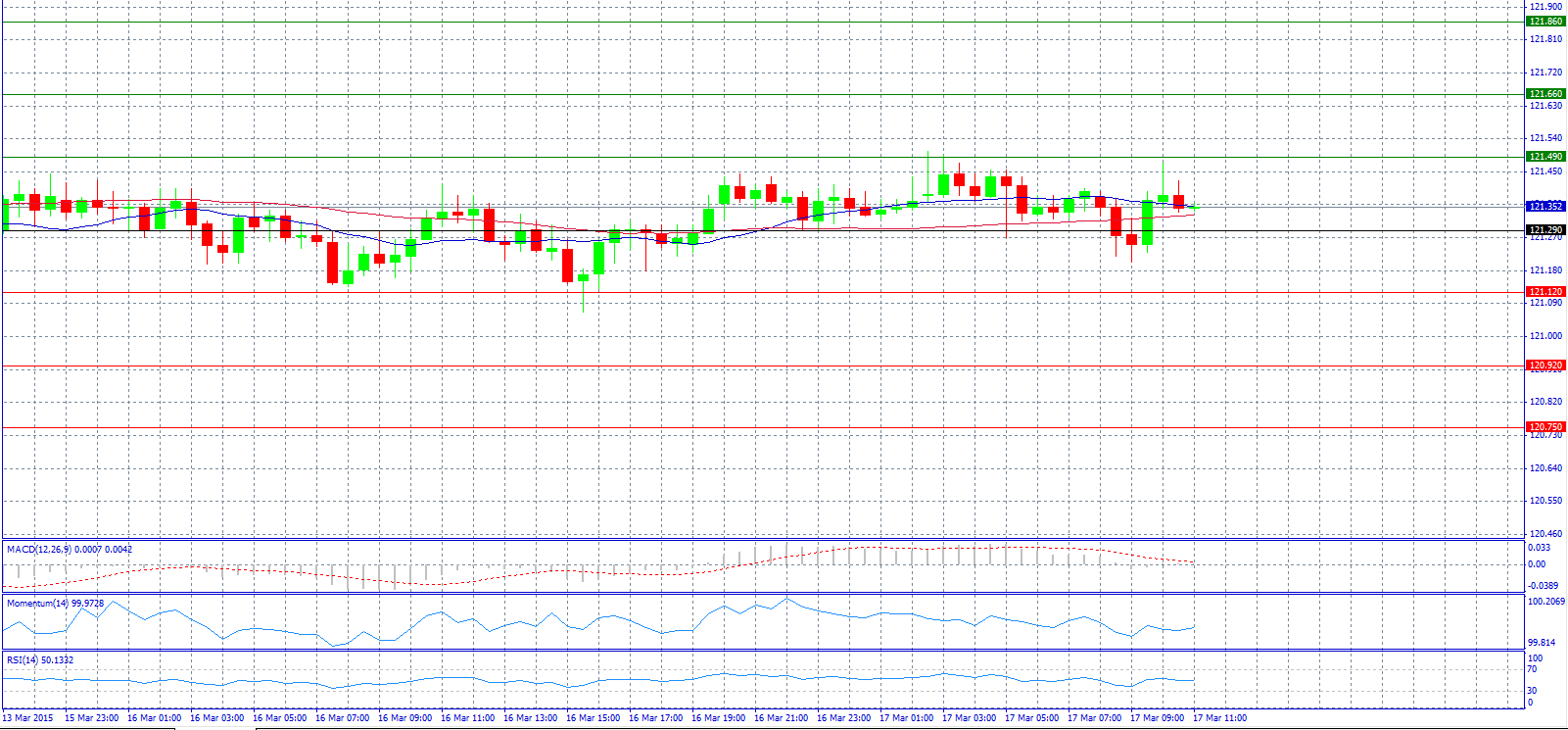

Market Scenario 1: Long positions above 121.29 with target @ 121.49.

Market Scenario 2: Short positions below 121.29 with target @ 121.12.

Comment: The pair fall below 121.37 level.

Supports and Resistances:

R3 121.86

R2 121.66

R1 121.49

PP 121.29

S1 121.12

S2 120.92

S3 120.75

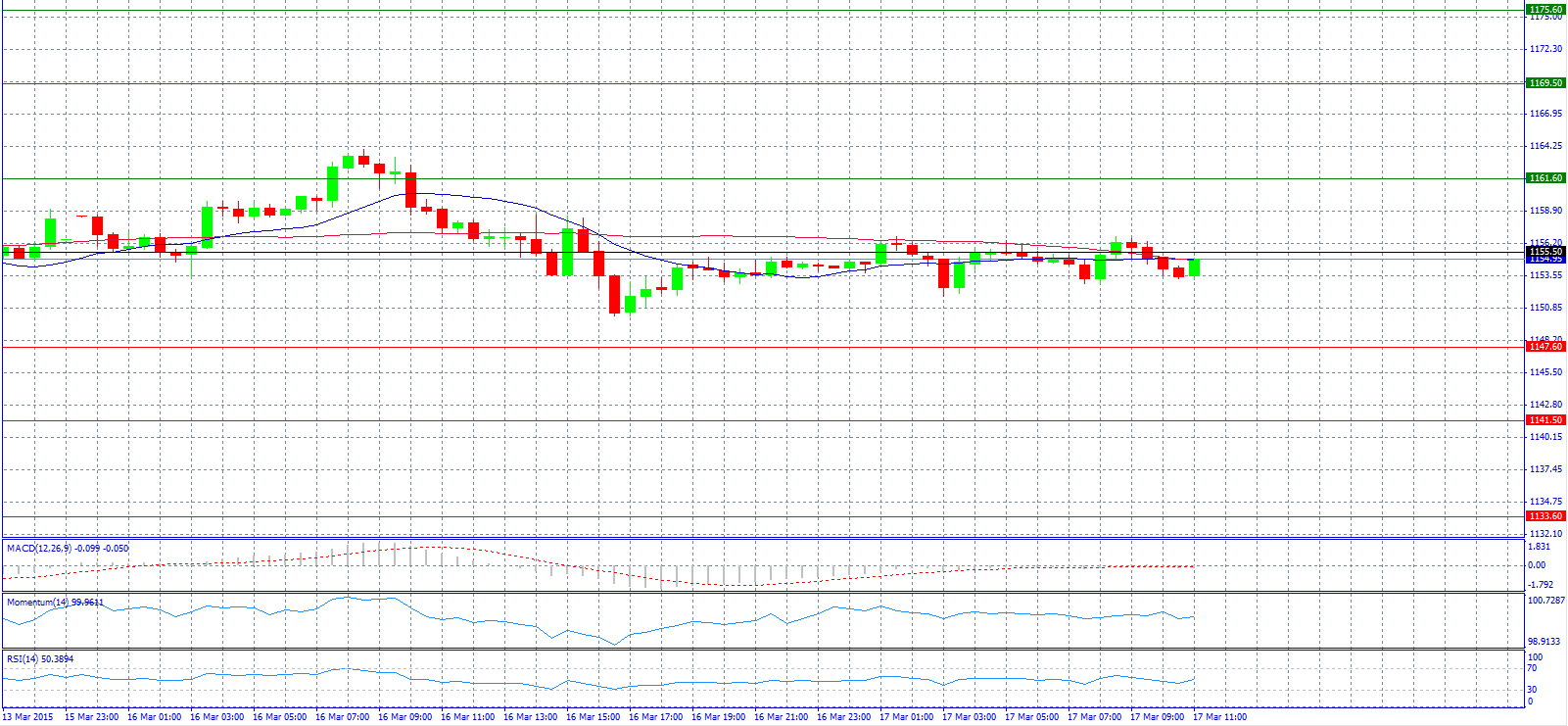

Market Scenario 1: Long positions above 1155.50 with target @ 1161.60.

Market Scenario 2: Short positions below 1155.50 with target @ 1147.60.

Comment: Gold prices trade steady at 1154.00 level and traders remain on the sidelines ahead of the start of the two-day Federal Reserve meeting later in the day.

Supports and Resistances:

R3 1175.60

R2 1169.50

R1 1161.60

PP 1155.50

S1 1147.60

S2 1141.50

S3 1133.60

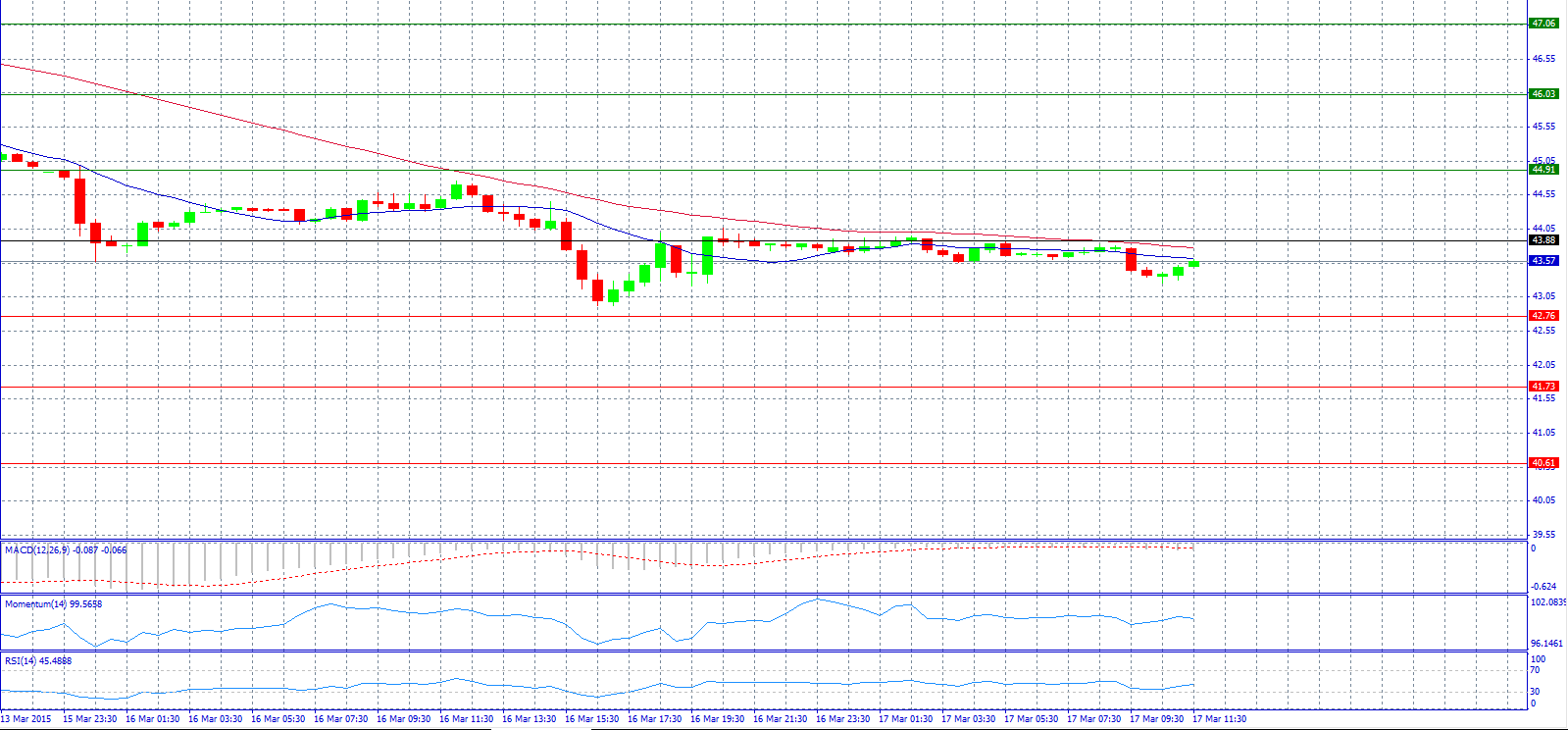

Market Scenario 1: Long positions above 43.88 with target @ 44.91.

Market Scenario 2: Short positions below 43.88 with target @ 42.76.

Comment: Crude oil prices continue to fall and currently trading at $43/barrel.

Supports and Resistances:

R3 47.06

R2 46.03

R1 44.91

PP 43.88

S1 42.76

S2 41.73

S3 40.61

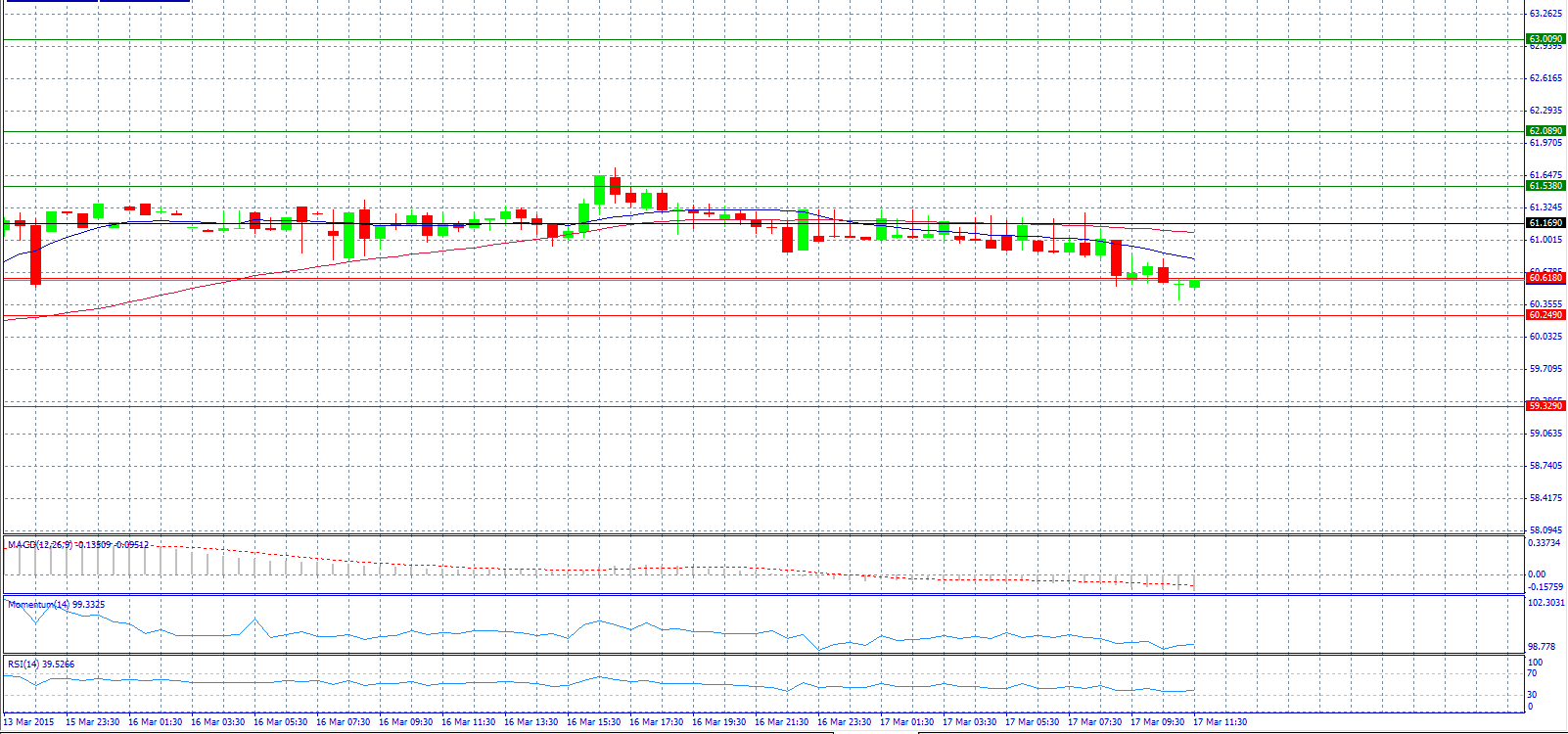

Market Scenario 1: Long positions above 61.169 with target @ 61.538.

Market Scenario 2: Short positions below 61.169 with target @ 60.249.

Comment: The ruble stabilized in recent weeks as the pace of inflation slowed, alongside steadying government benchmark rates.

Supports and Resistances:

R3 63.009

R2 62.089

R1 61.538

PP 61.169

S1 60.618

S2 60.249

S3 59.329