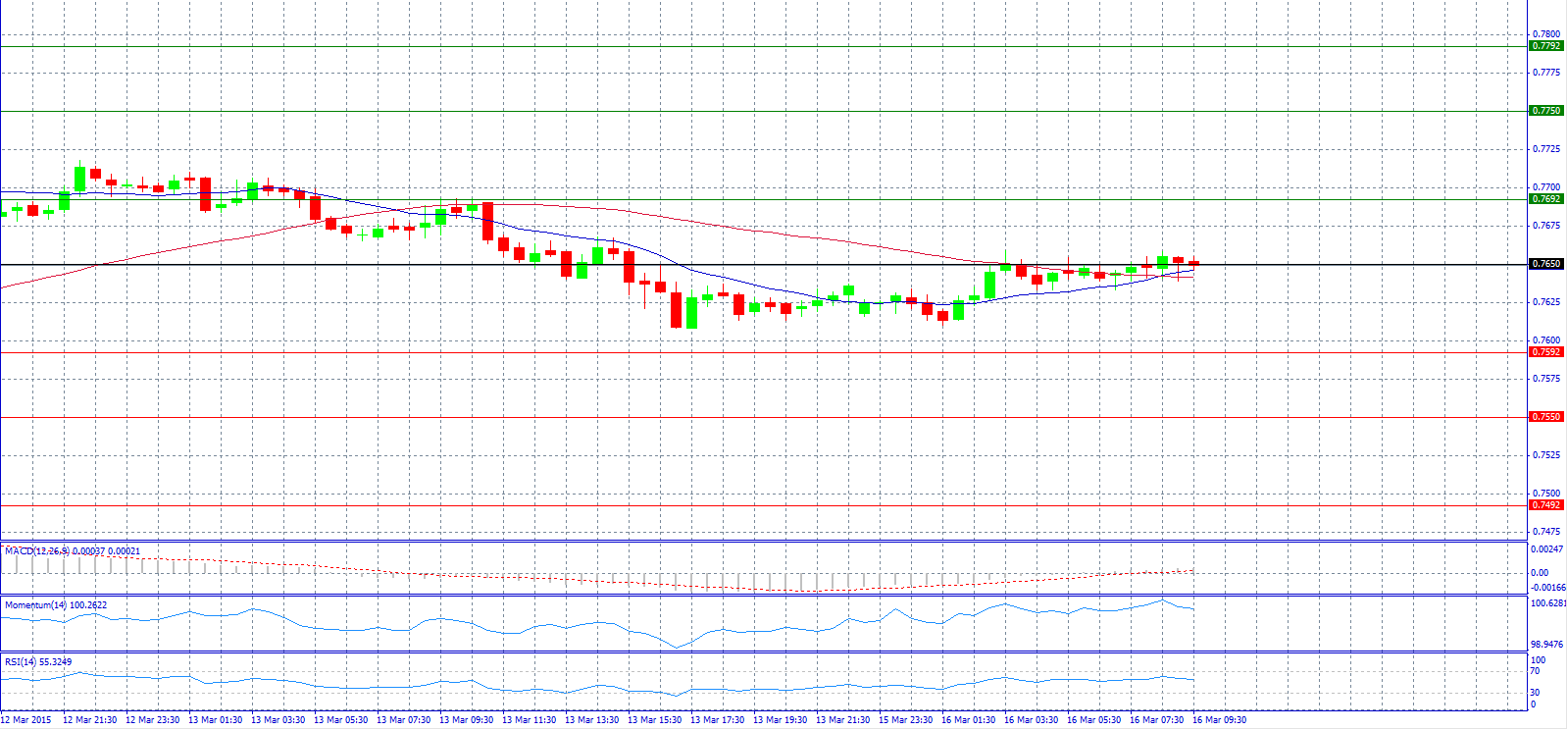

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7650 with target @ 0.7692.

Market Scenario 2: Short positions below 0.7650 with target @ 0.7592.

Comment: The pair trades near pivot point 0.7650.

Supports and Resistances:

R3 0.7792

R2 0.7750

R1 0.7692

PP 0.7650

S1 0.7592

S2 0.7550

S3 0.7492

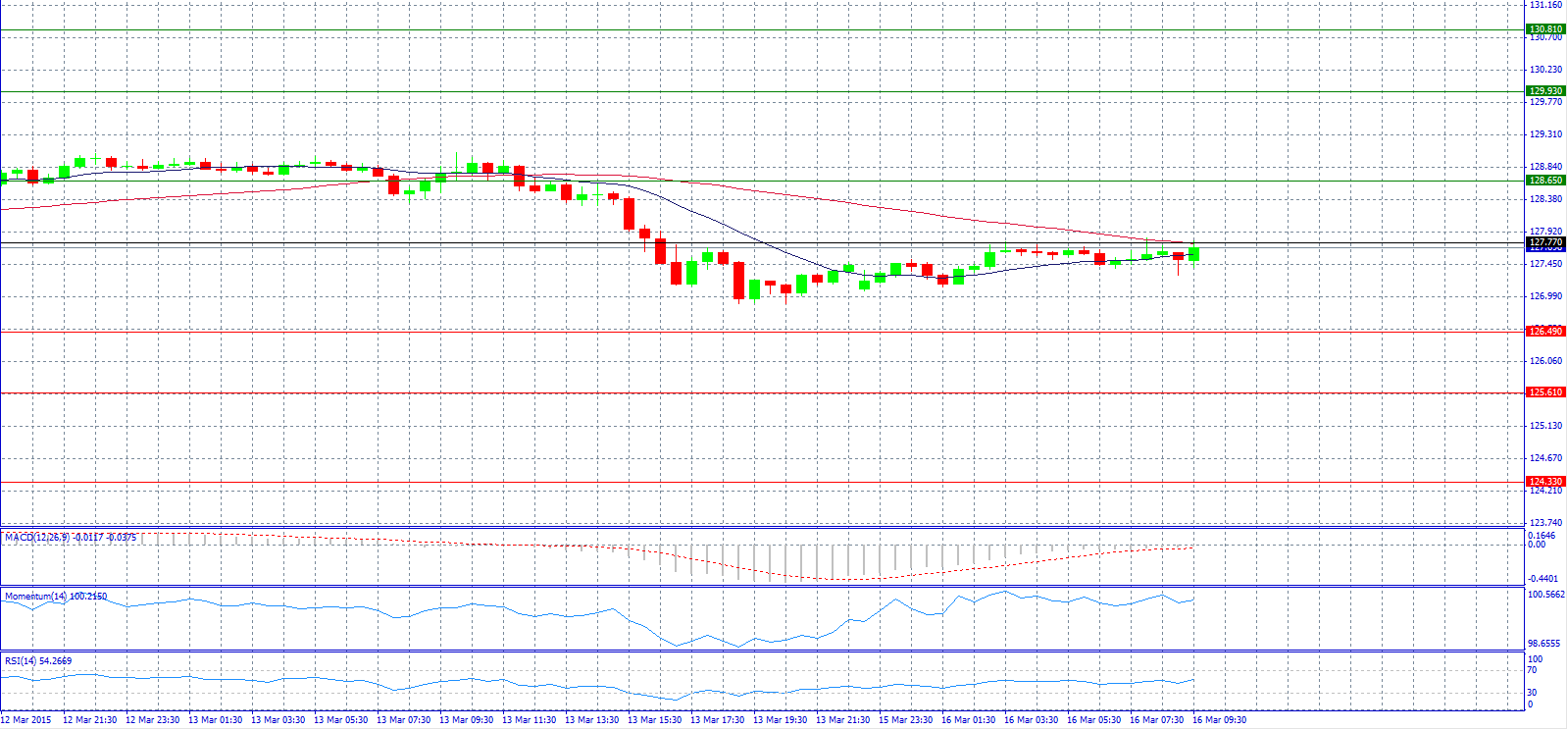

Market Scenario 1: Long positions above 127.77 with target @ 128.65.

Market Scenario 2: Short positions below 127.77 with target @ 126.49.

Comment: The pair remains below 128.00 level.

Supports and Resistances:

R3 130.81

R2 129.93

R1 128.65

PP 127.77

S1 126.49

S2 125.61

S3 124.33

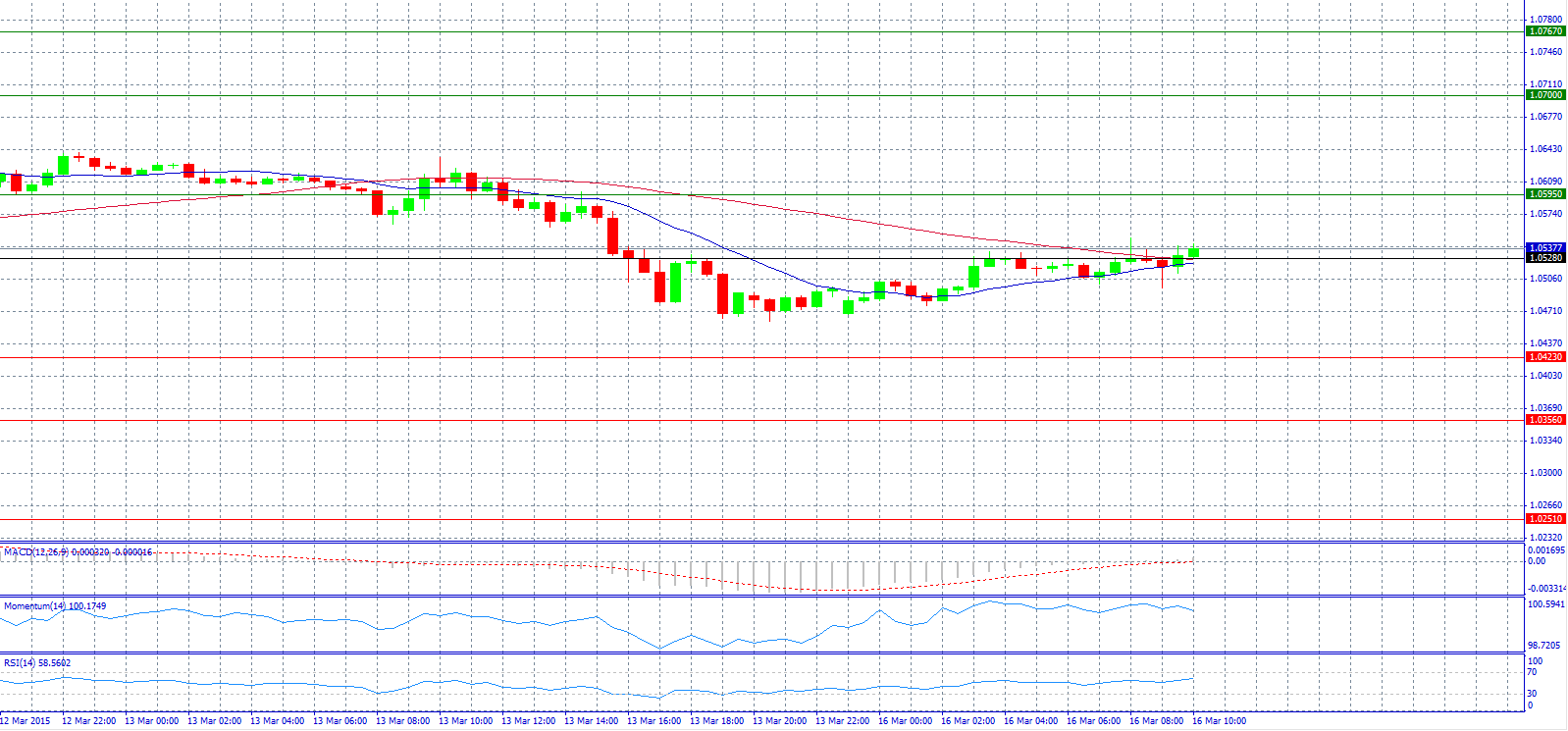

Market Scenario 1: Long positions above 1.0528 with target @ 1.0595.

Market Scenario 2: Short positions below 1.0528 with target @ 1.0423.

Comment: The pair slips to a fresh 12-year low of 1.0457 early, but then rebounds to a 1.0547 high.

Supports and Resistances:

R3 1.0767

R2 1.0700

R1 1.0595

PP 1.0528

S1 1.0423

S2 1.0356

S3 1.0251

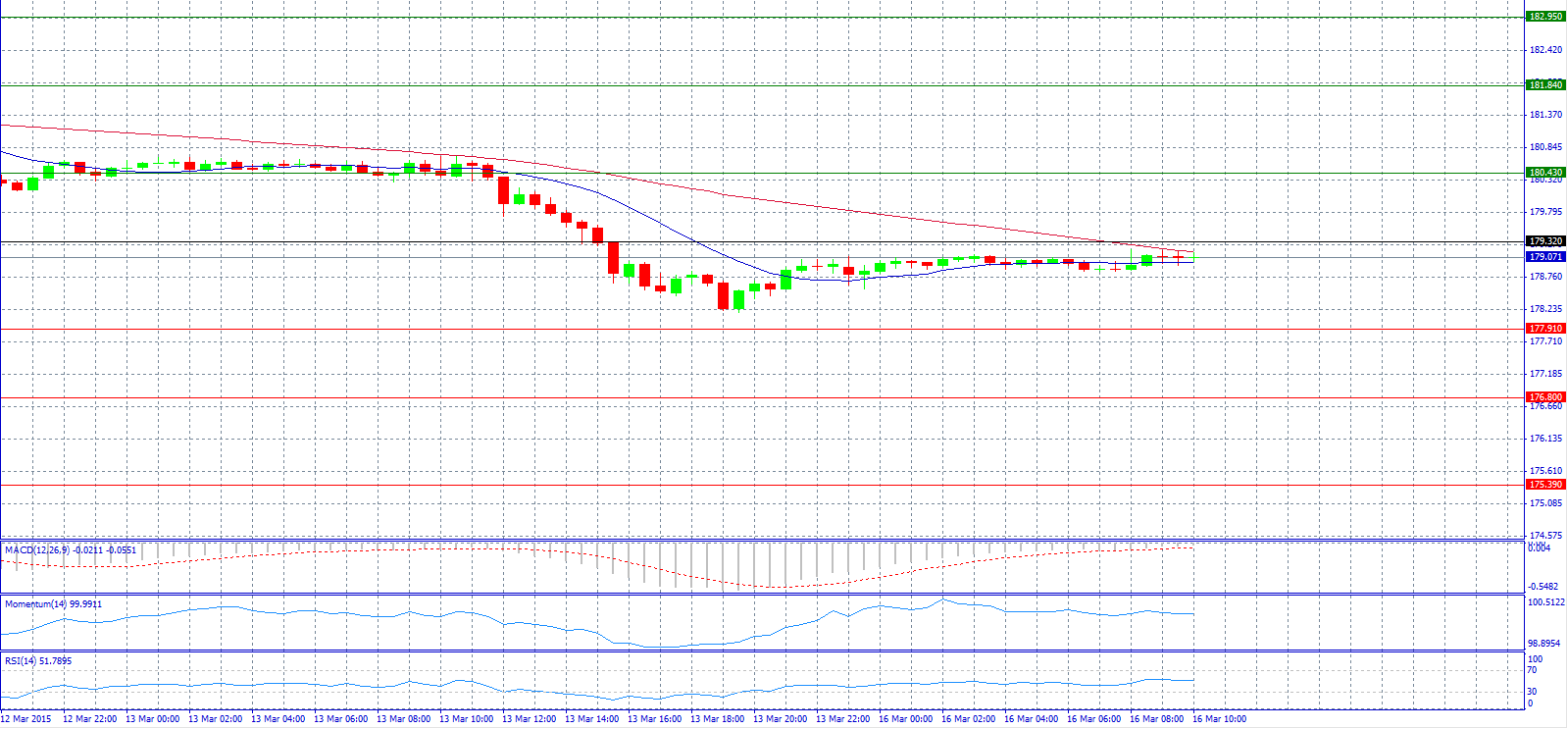

Market Scenario 1: Long positions above 179.32 with target @ 180.43.

Market Scenario 2: Short positions below 179.32 with target @ 177.91.

Comment: The pair seems to trade steady below pivot point 179.32.

Supports and Resistances:

R3 182.95

R2 181.84

R1 180.43

PP 179.32

S1 177.91

S2 176.80

S3 175.39

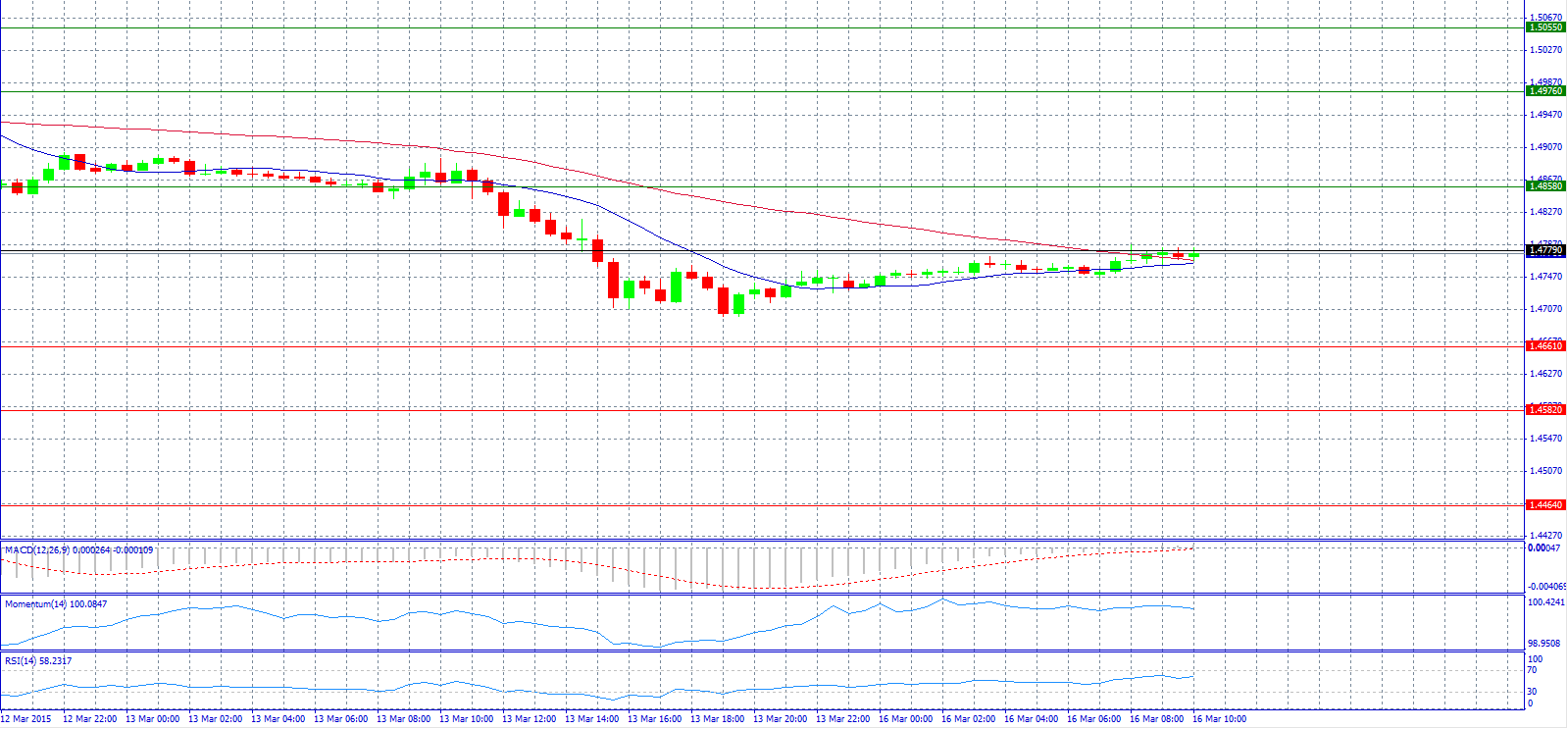

Market Scenario 1: Long positions above 1.4779 with target @ 1.4858.

Market Scenario 2: Short positions below 1.4779 with target @ 1.4661.

Comment: The pair trades near pivot point 1.4779.

Supports and Resistances:

R3 1.5055

R2 1.4976

R1 1.4858

PP 1.4779

S1 1.4661

S2 1.4582

S3 1.4464

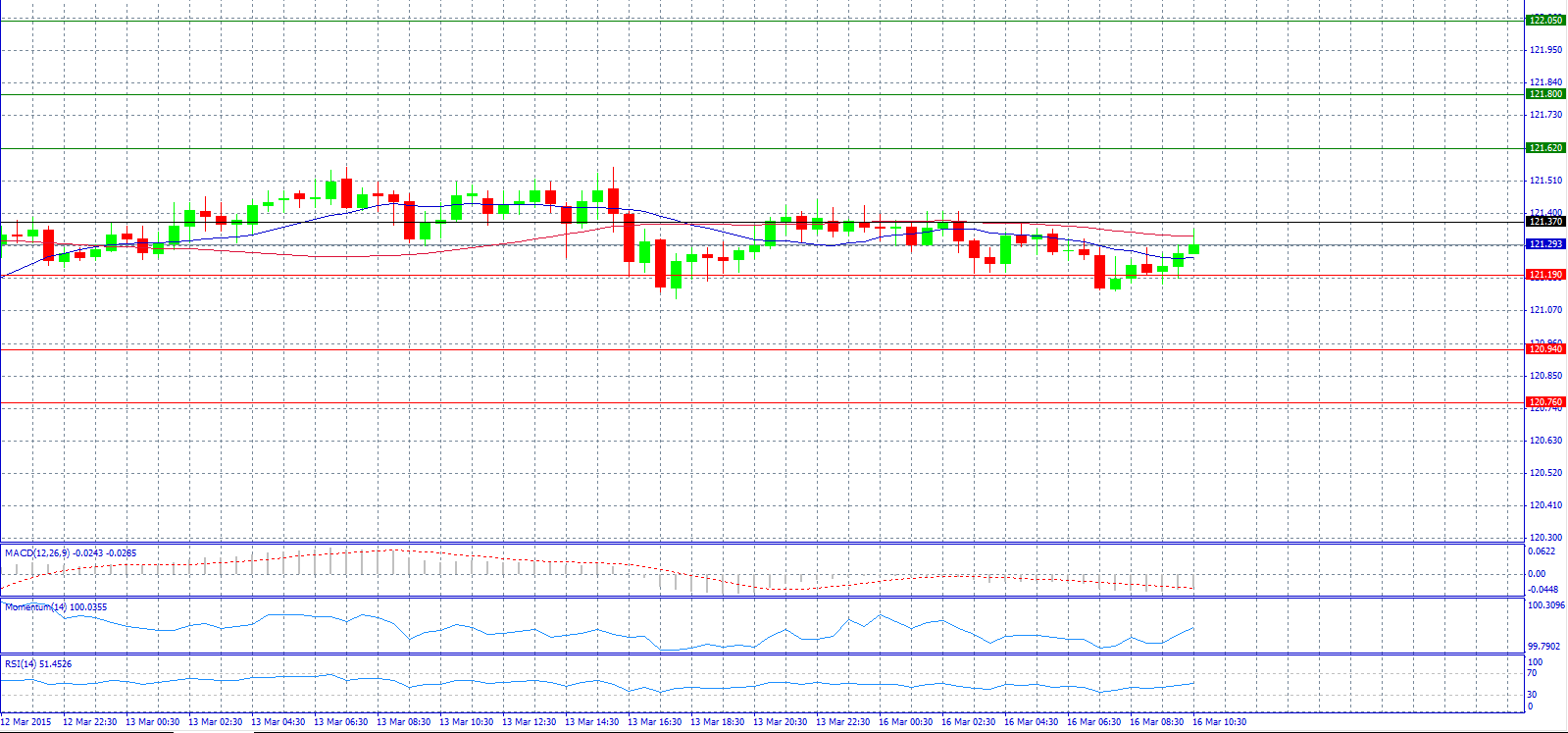

Market Scenario 1: Long positions above 121.37 with target @ 121.62.

Market Scenario 2: Short positions below 121.37 with target @ 120.94.

Comment: The pair found support at 121.19 level and now it’s advancing again.

Supports and Resistances:

R3 122.05

R2 121.80

R1 121.62

PP 121.37

S1 121.19

S2 120.94

S3 120.76

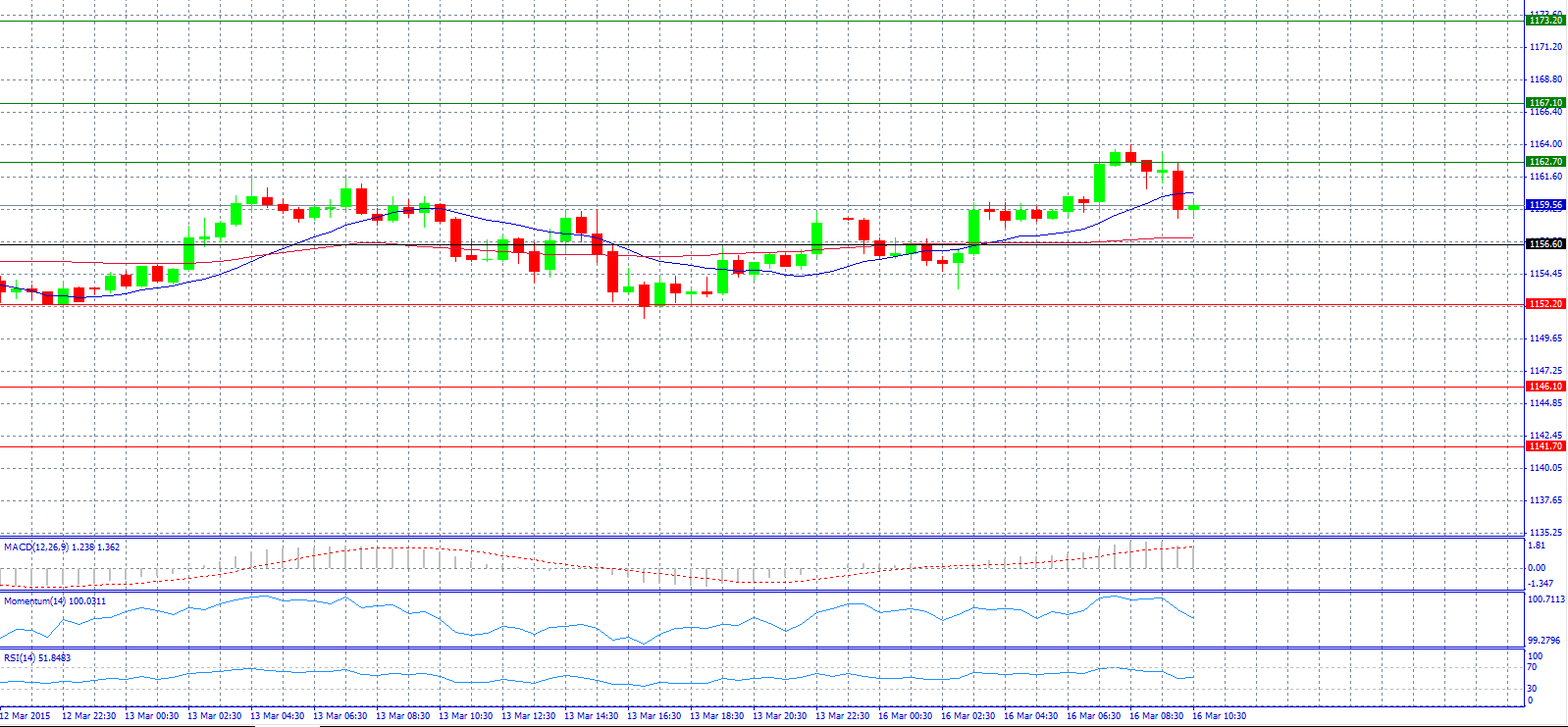

Market Scenario 1: Long positions above 1156.60 with target @ 1167.10.

Market Scenario 2: Short positions below 1156.60 with target @ 1152.20.

Comment: Gold prices are near lowest levels in over three months ahead of Fed meeting.

Supports and Resistances:

R3 1173.20

R2 1167.10

R1 1162.70

PP 1156.60

S1 1152.20

S2 1146.10

S3 1141.70

Market Scenario 1: Long positions above 45.68 with target @ 46.60.

Market Scenario 2: Short positions below 45.68 with target @ 44.07.

Comment: Crude oil prices fall by 2.1% on weak Asian cues.

Supports and Resistances:

R3 49.13

R2 48.21

R1 46.60

PP 45.68

S1 44.07

S2 43.15

S3 41.54

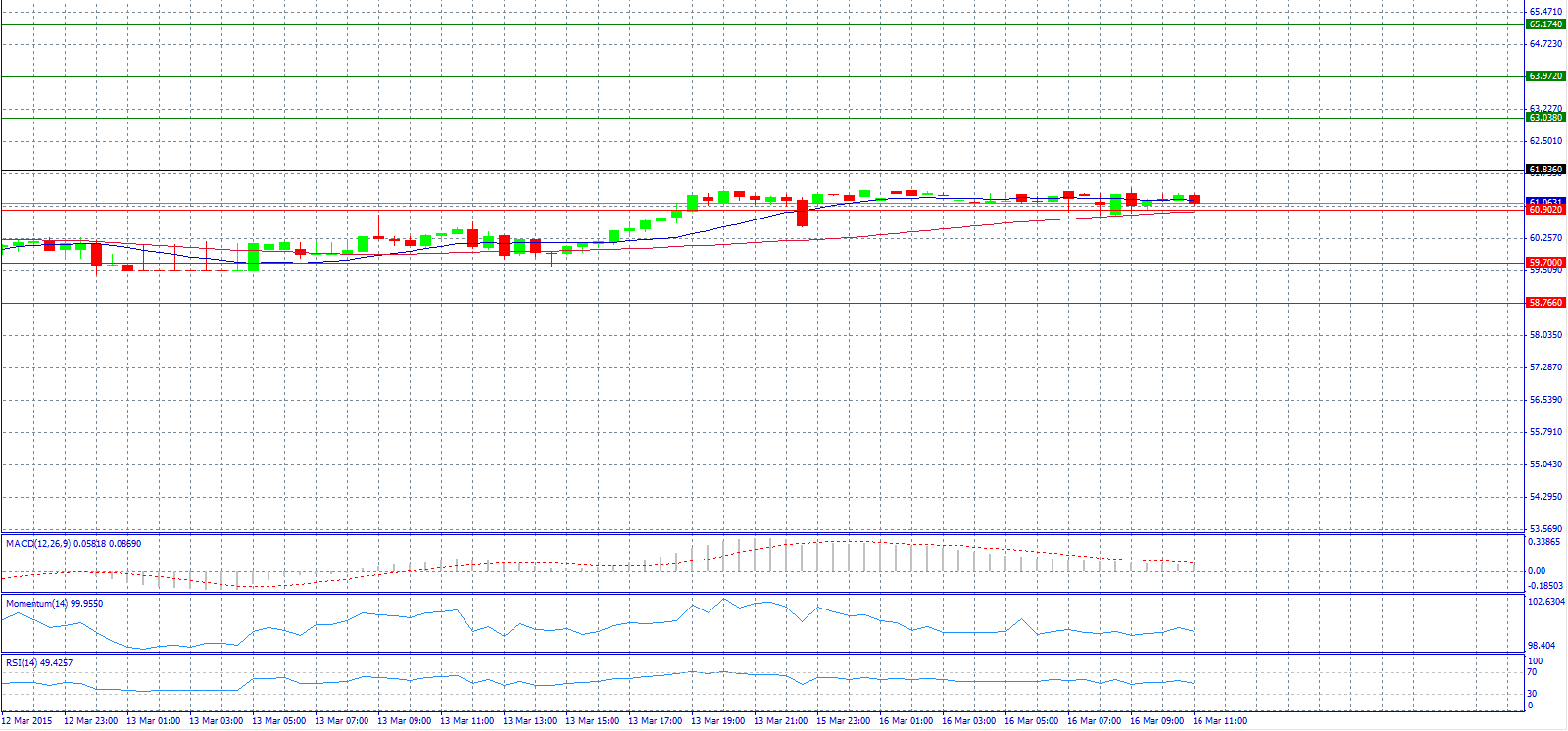

Market Scenario 1: Long positions above 61.836 with target @ 63.038.

Market Scenario 2: Short positions below 61.836 with target @ 59.700.

Comment: The confidence of the investors has returned for the ruble, and even a rate cut today left it unfazed.

Supports and Resistances:

R3 65.174

R2 63.972

R1 63.038

PP 61.836

S1 60.902

S2 59.700

S3 58.766