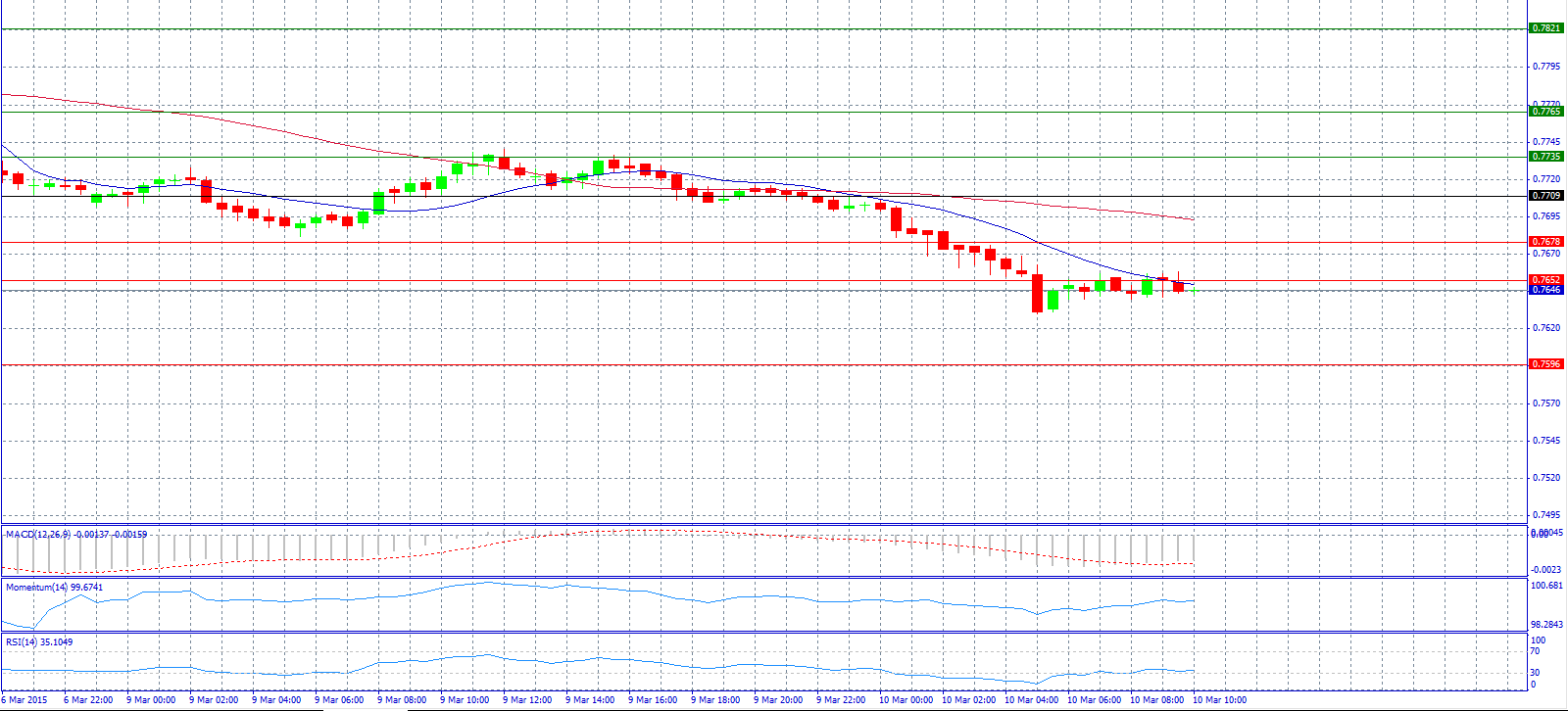

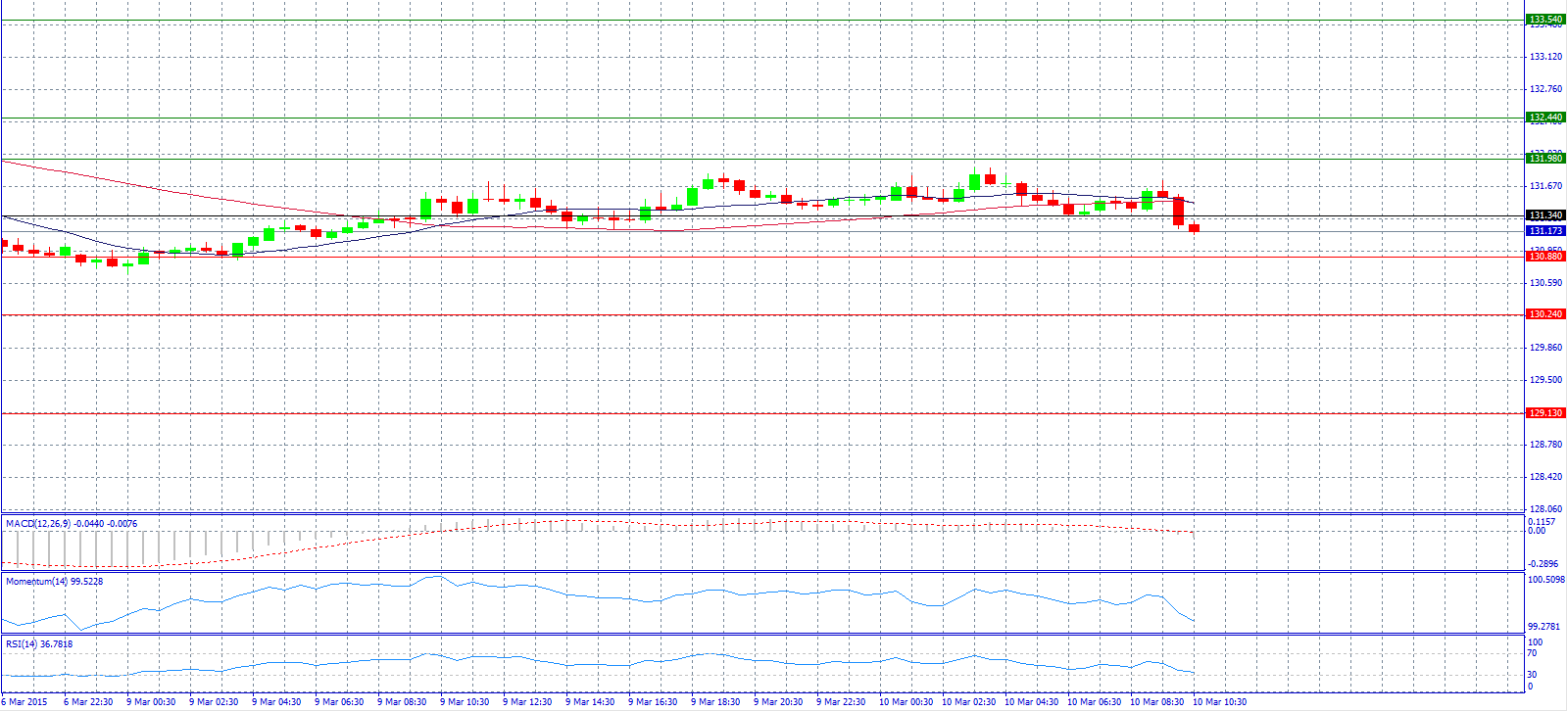

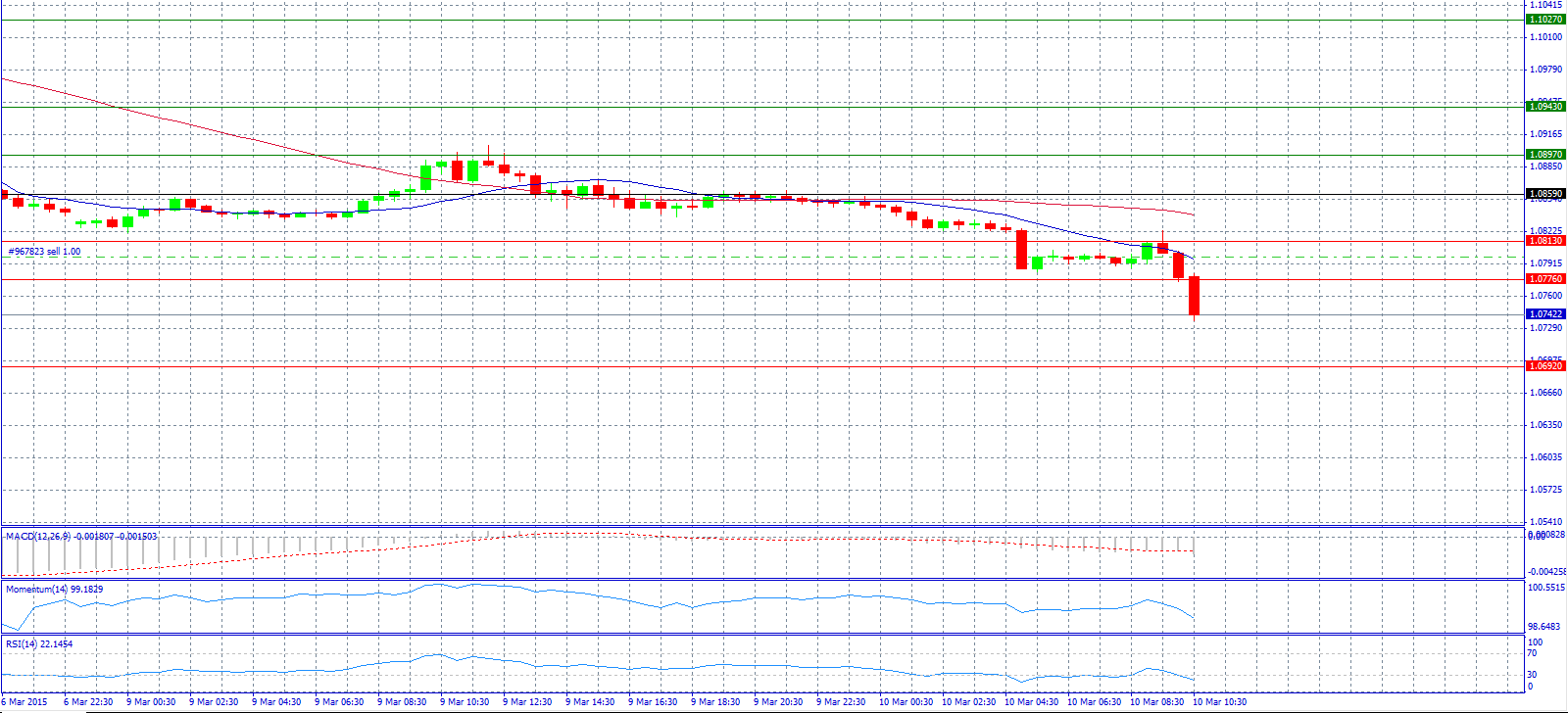

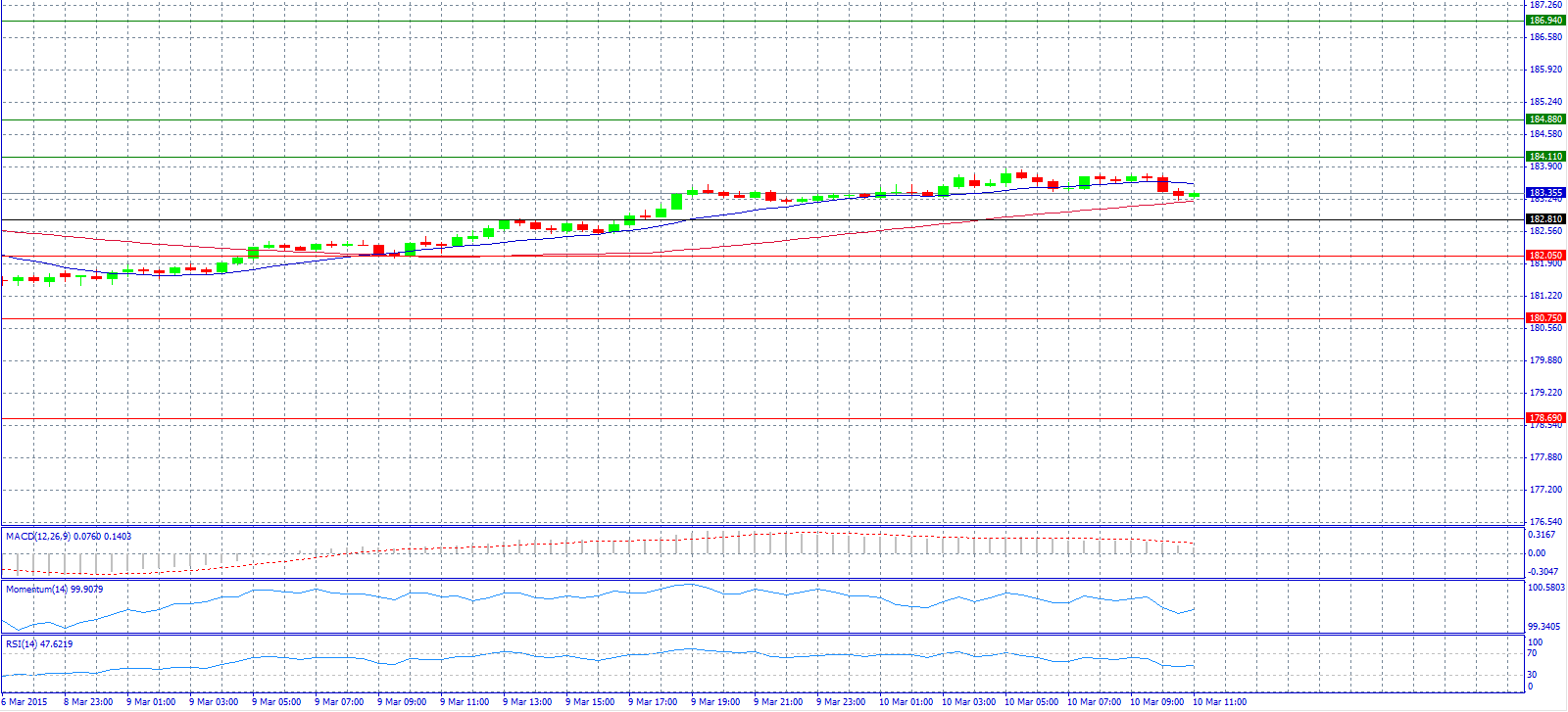

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7709 with target @ 0.7735.

Market Scenario 2: Short positions below 0.7709 with target @ 0.7596.

Comment: The gold market is not helping the pair which continues to be bearish.

Supports and Resistances:

R3 0.7821

R2 0.7765

R1 0.7735

PP 0.7709

S1 0.7678

S2 0.7652

S3 0.7596

Market Scenario 1: Long positions above 131.34 with target @ 131.98.

Market Scenario 2: Short positions below 131.34 with target @ 130.24.

Comment: The pair is becoming strongly bearish.

Supports and Resistances:

R3 133.54

R2 132.44

R1 131.98

PP 131.34

S1 130.88

S2 130.24

S3 129.13

Market Scenario 1: Long positions above 1.0859 with target @ 1.0897.

Market Scenario 2: Short positions below 1.0859 with target @ 1.0692.

Comment: The pair will probably fall to 1.0245 as per Goldman Sachs (NYSE:GS).

Supports and Resistances:

R3 1.1027

R2 1.0943

R1 1.0897

PP 1.0859

S1 1.0813

S2 1.0776

S3 1.0692

Market Scenario 1: Long positions above 182.81 with target @ 184.11.

Market Scenario 2: Short positions below 182.81 with target @ 182.05.

Comment: The pair rejected 184.00 level.

Supports and Resistances:

R3 186.94

R2 184.88

R1 184.11

PP 182.81

S1 182.05

S2 180.75

S3 178.69

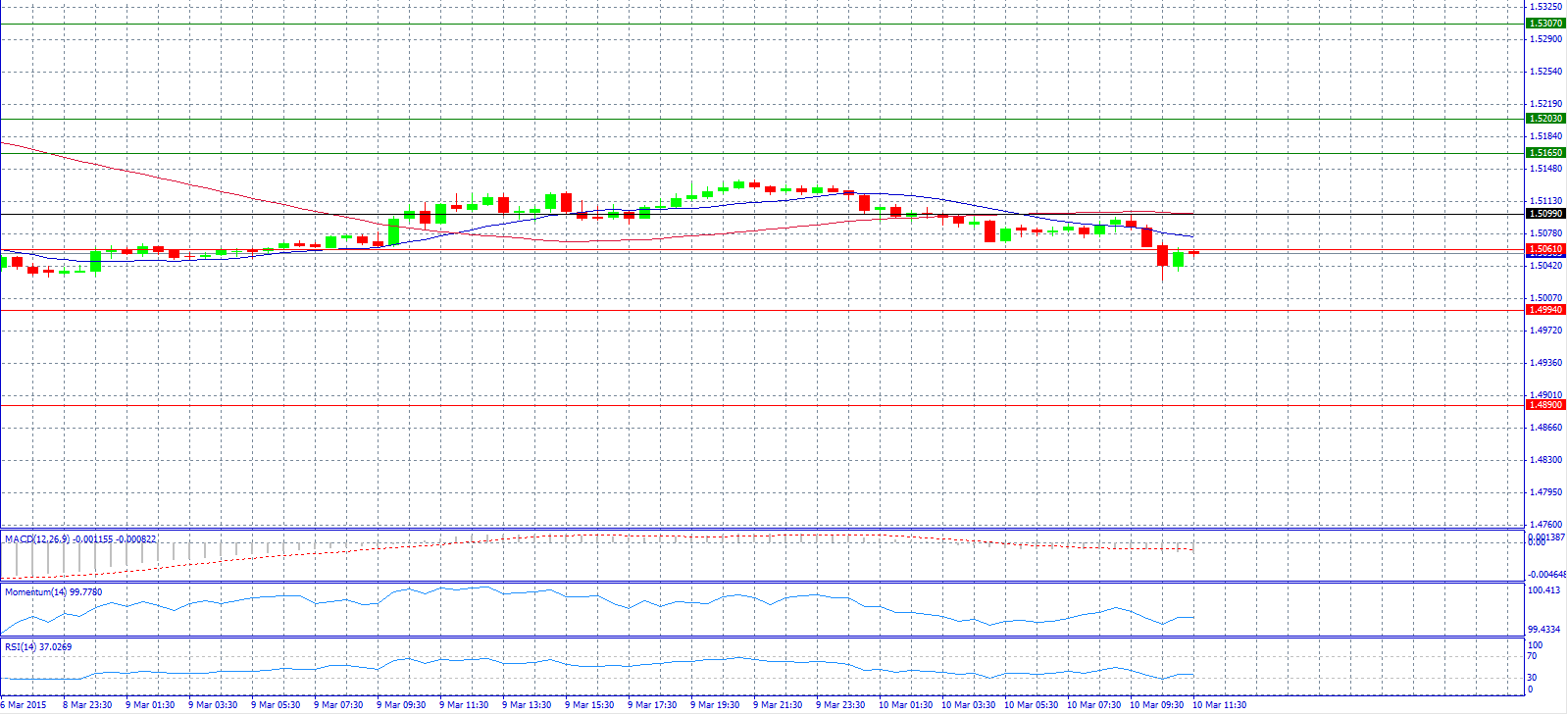

Market Scenario 1: Long positions above 1.5099 with target @ 1.5165.

Market Scenario 2: Short positions below 1.5099 with target @ 1.4994.

Comment: The pair will reach 1.4950 level according to analysts at UOB Group.

Supports and Resistances:

R3 1.5307

R2 1.5203

R1 1.5165

PP 1.5099

S1 1.5061

S2 1.4994

S3 1.4890

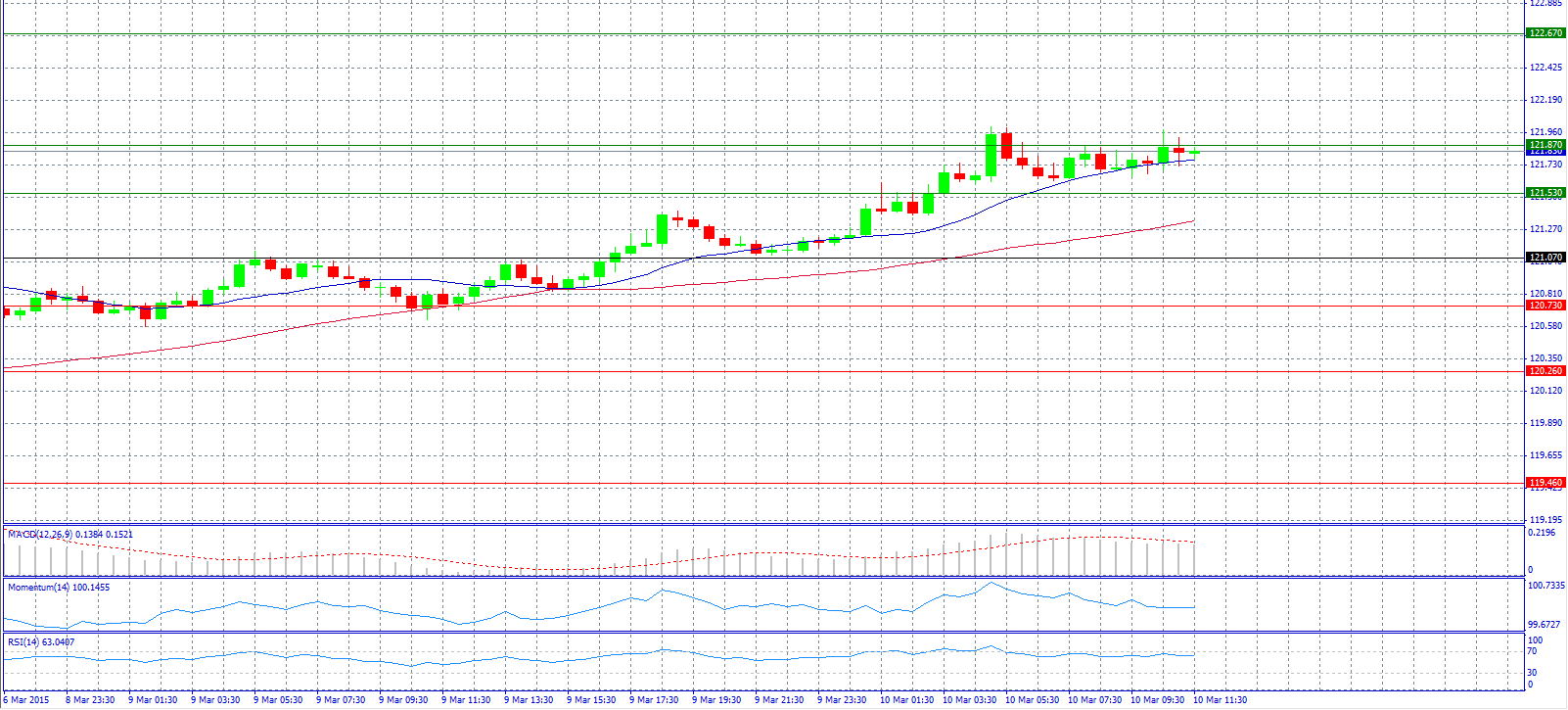

Market Scenario 1: Long positions above 121.07 with target @ 122.67.

Market Scenario 2: Short positions below 121.07 with target @ 120.73.

Comment: The pair was advancing higher during the Asian session, making fresh trend highs at 122.00.

Supports and Resistances:

R3 122.67

R2 121.87

R1 121.53

PP 121.07

S1 120.73

S2 120.26

S3 119.46

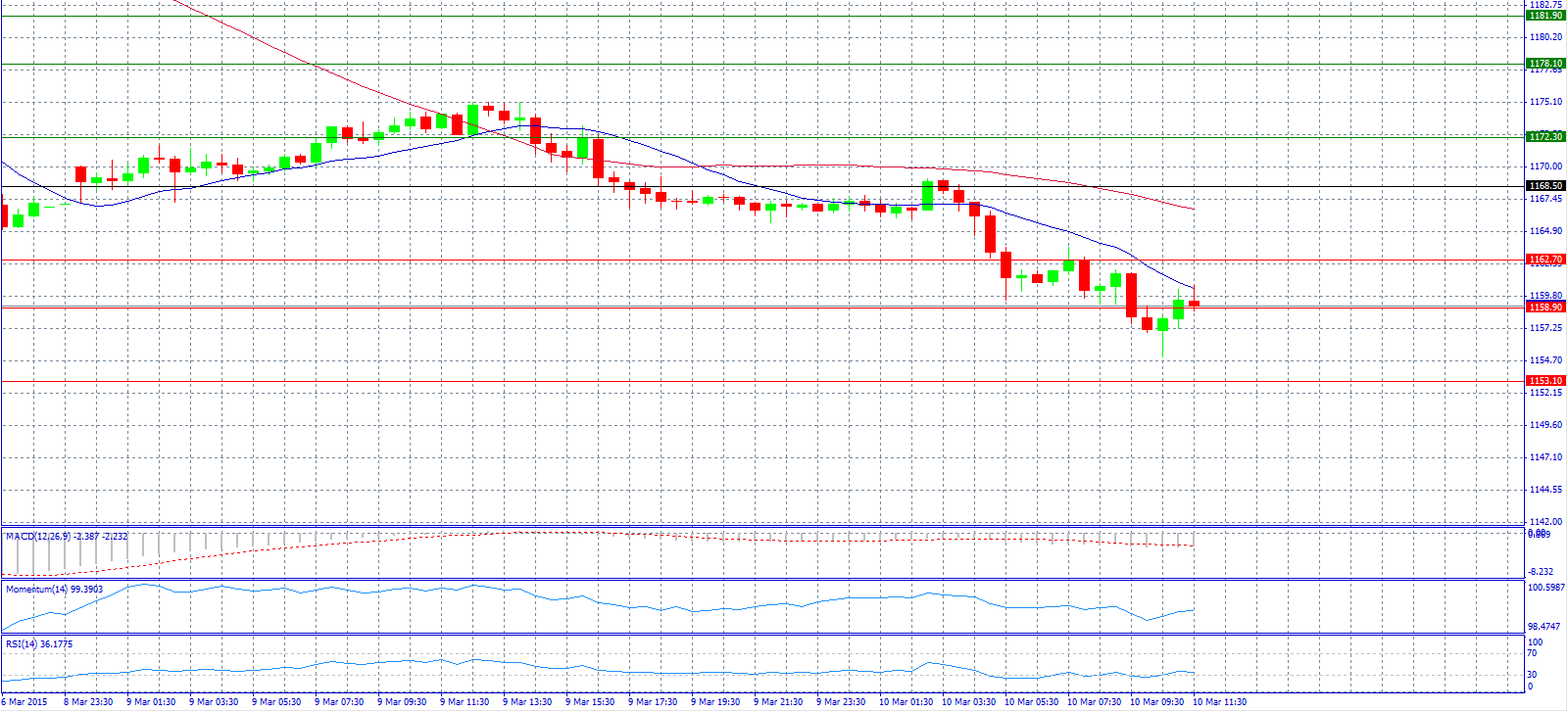

Market Scenario 1: Long positions above 1168.50 with target @ 1172.30.

Market Scenario 2: Short positions below 1168.50 with target @ 1153.10.

Comment: Gold prices fall from 1160.00 level.

Supports and Resistances:

R3 1181.90

R2 1178.10

R1 1172.30

PP 1168.50

S1 1162.70

S2 1158.90

S3 1153.10

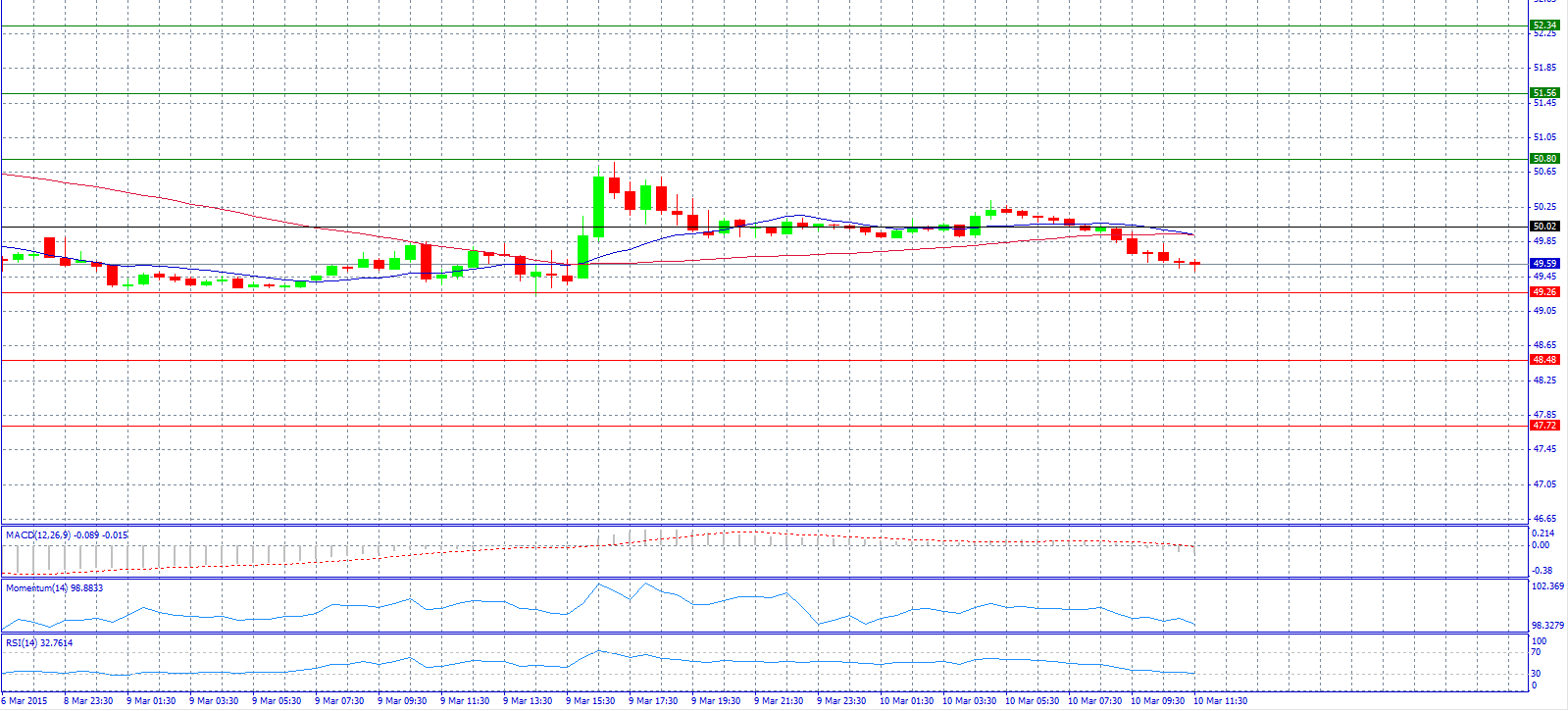

Market Scenario 1: Long positions above 49.96 with target @ 51.04.

Market Scenario 2: Short positions below 49.96 with target @ 48.70.

Comment: Crude oil prices await fresh incentives.

Supports and Resistances:

R3 53.38

R2 52.30

R1 51.04

PP 49.96

S1 48.70

S2 47.62

S3 46.36

Market Scenario 1: Long positions above 60.402 with target @ 61.056.

Market Scenario 2: Short positions below 60.402 with target @ 59.016.

Comment: Ruble weakened in early trade on Tuesday after a three-day holiday weekend, reacting to the broadly firmer U.S. currency and oil prices slipping to near two-week lows.

Supports and Resistances:

R3 62.441

R2 61.788

R1 61.056

PP 60.402

S1 59.670

S2 59.016

S3 58.284

Forexcorporate Markets Research Department