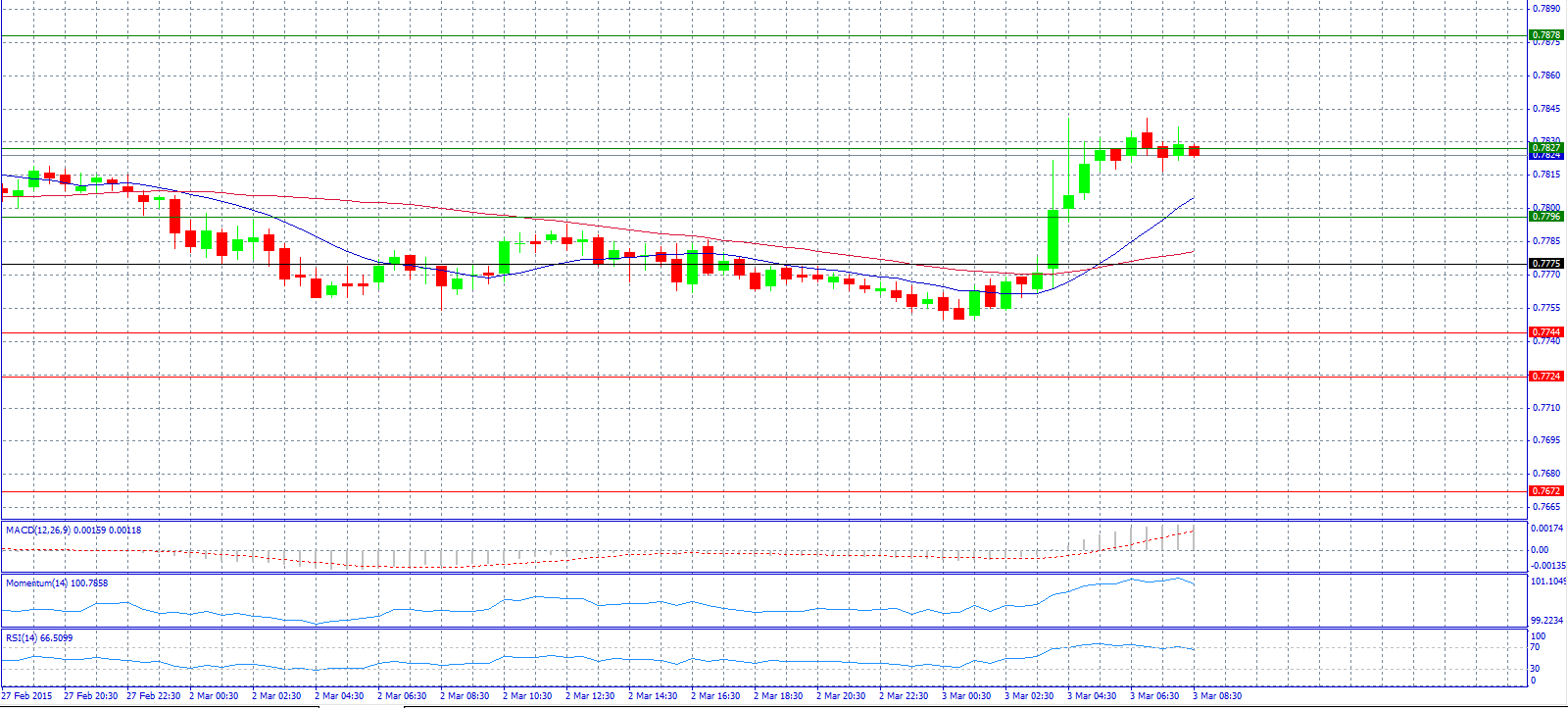

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7775 with target @ 0.7878.

Market Scenario 2: Short positions below 0.7775 with target @ 0.7744.

Comment: The pair advanced above 0.7800 level after RBA’s Status-Quo.

Supports and Resistances:

R3 0.7878

R2 0.7827

R1 0.7796

PP 0.7775

S1 0.7744

S2 0.7724

S3 0.7672

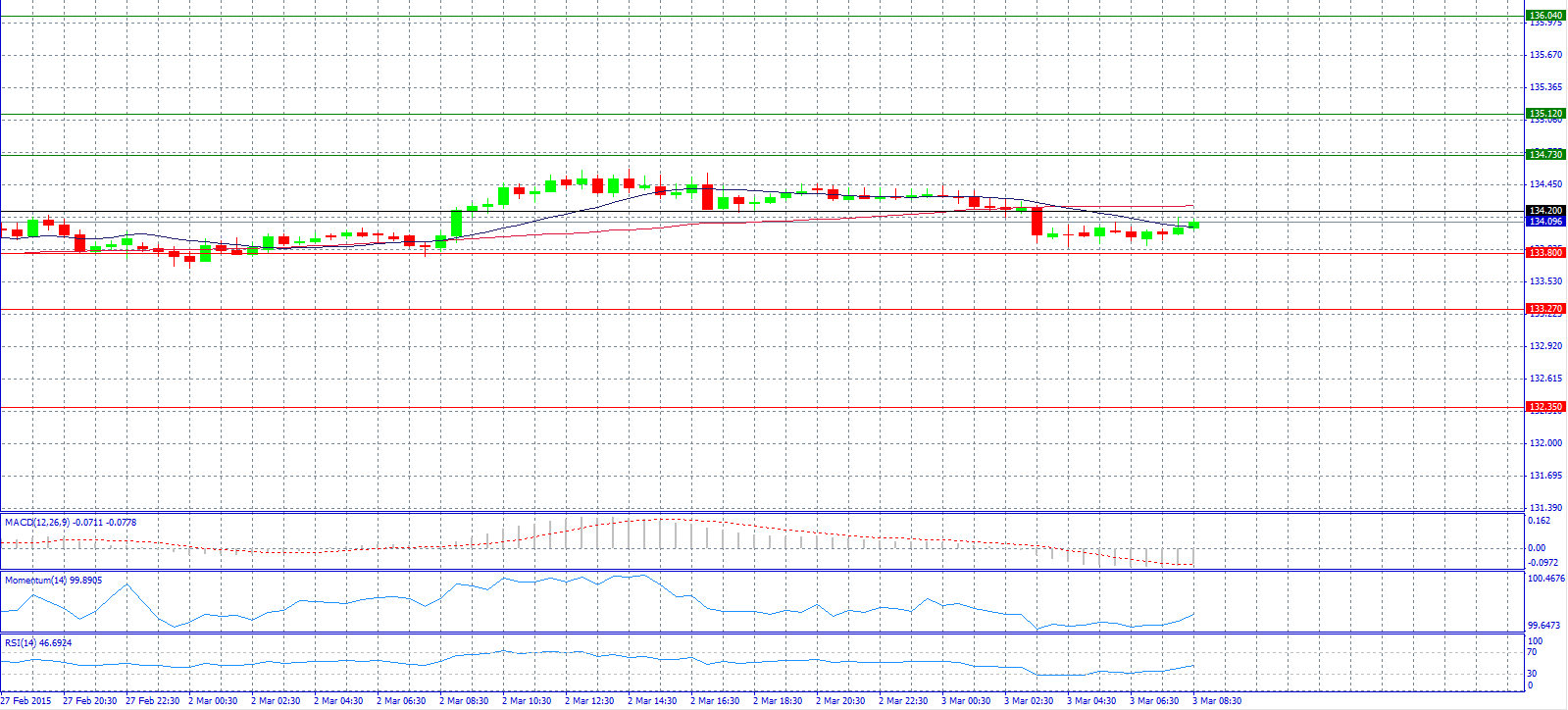

Market Scenario 1: Long positions above 134.20 with target @ 134.73.

Market Scenario 2: Short positions below 134.20 with target @ 133.27.

Comment: The pair advanced higher after the German Retail Sales release.

Supports and Resistances:

R3 136.04

R2 135.12

R1 134.73

PP 134.20

S1 133.80

S2 133.27

S3 132.35

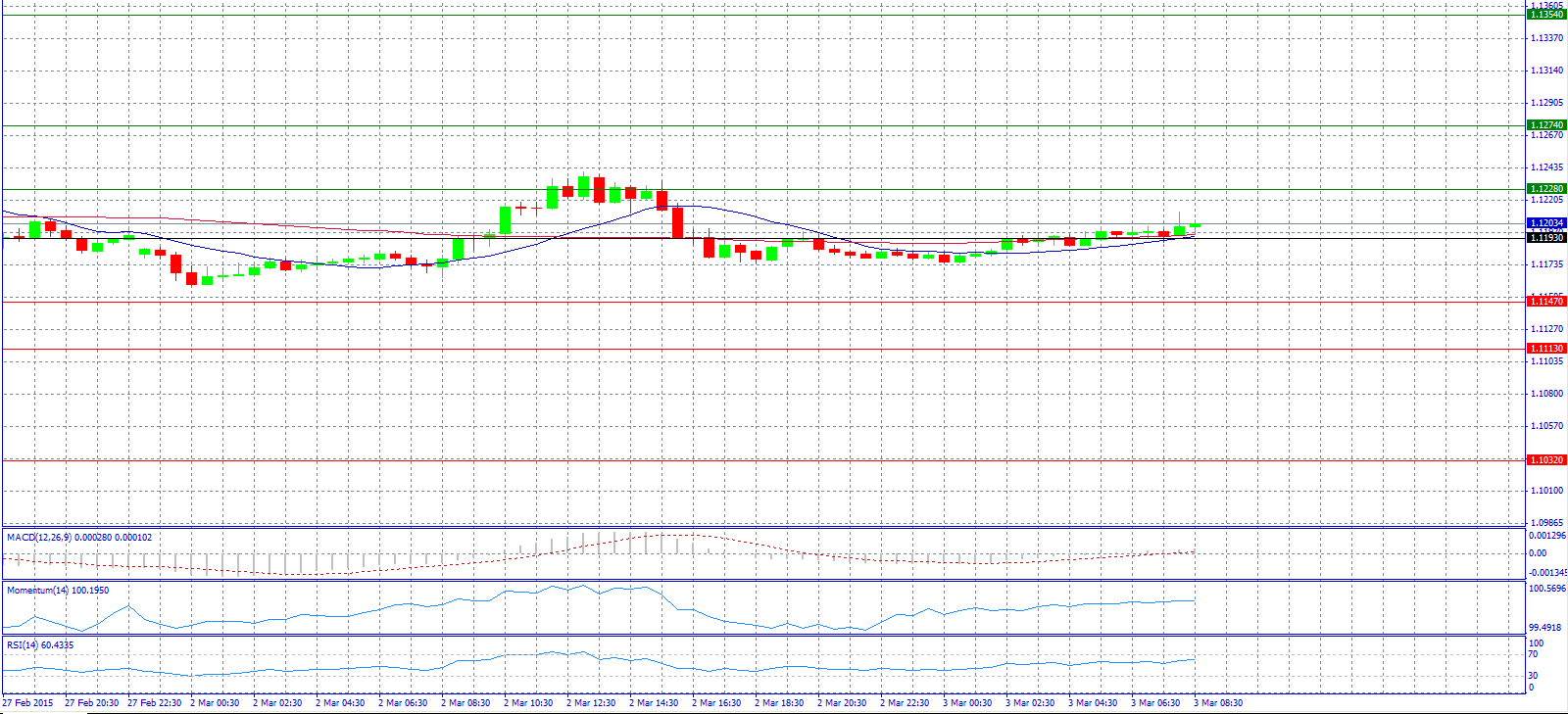

Market Scenario 1: Long positions above 1.1193 with target @ 1.1274.

Market Scenario 2: Short positions below 1.1193 with target @ 1.1147.

Comment: The pair surpassed 1.1200 level after the German Retail Sales release.

Supports and Resistances:

R3 1.1354

R2 1.1274

R1 1.1228

PP 1.1193

S1 1.1147

S2 1.1113

S3 1.1032

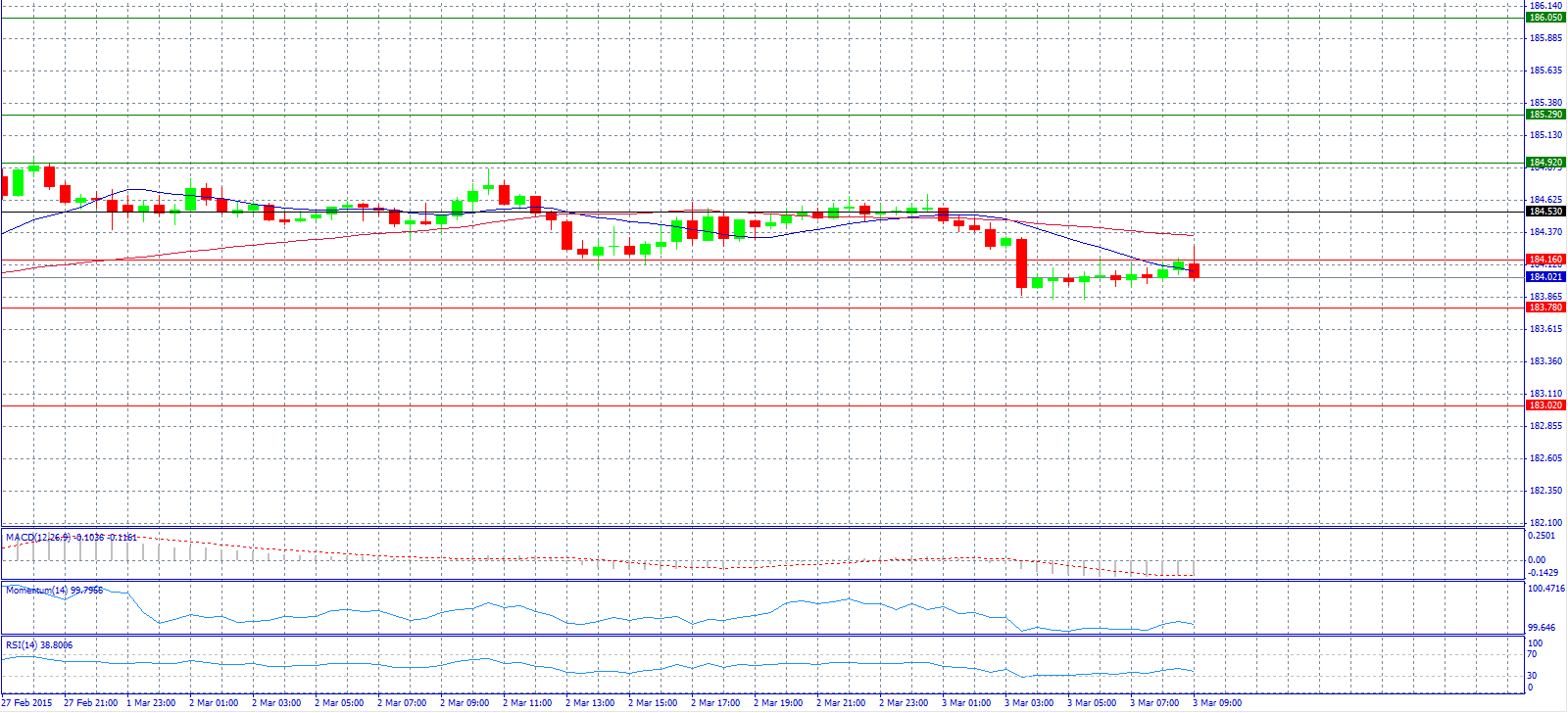

Market Scenario 1: Long positions above 184.53 with target @ 184.92.

Market Scenario 2: Short positions below 184.53 with target @ 183.78.

Comment: The pair continues to show weakness as it trades near 184.00 level.

Supports and Resistances:

R3 186.05

R2 185.29

R1 184.92

PP 184.53

S1 184.16

S2 183.78

S3 183.02

Market Scenario 1: Long positions above 1.5381 with target @ 1.5411.

Market Scenario 2: Short positions below 1.5381 with target @ 1.5334.

Comment: The pair is trading below 1.5400 level and awaits for Construction PMI to be released.

Supports and Resistances:

R3 1.5535

R2 1.5458

R1 1.5411

PP 1.5381

S1 1.5334

S2 1.5304

S3 1.5226

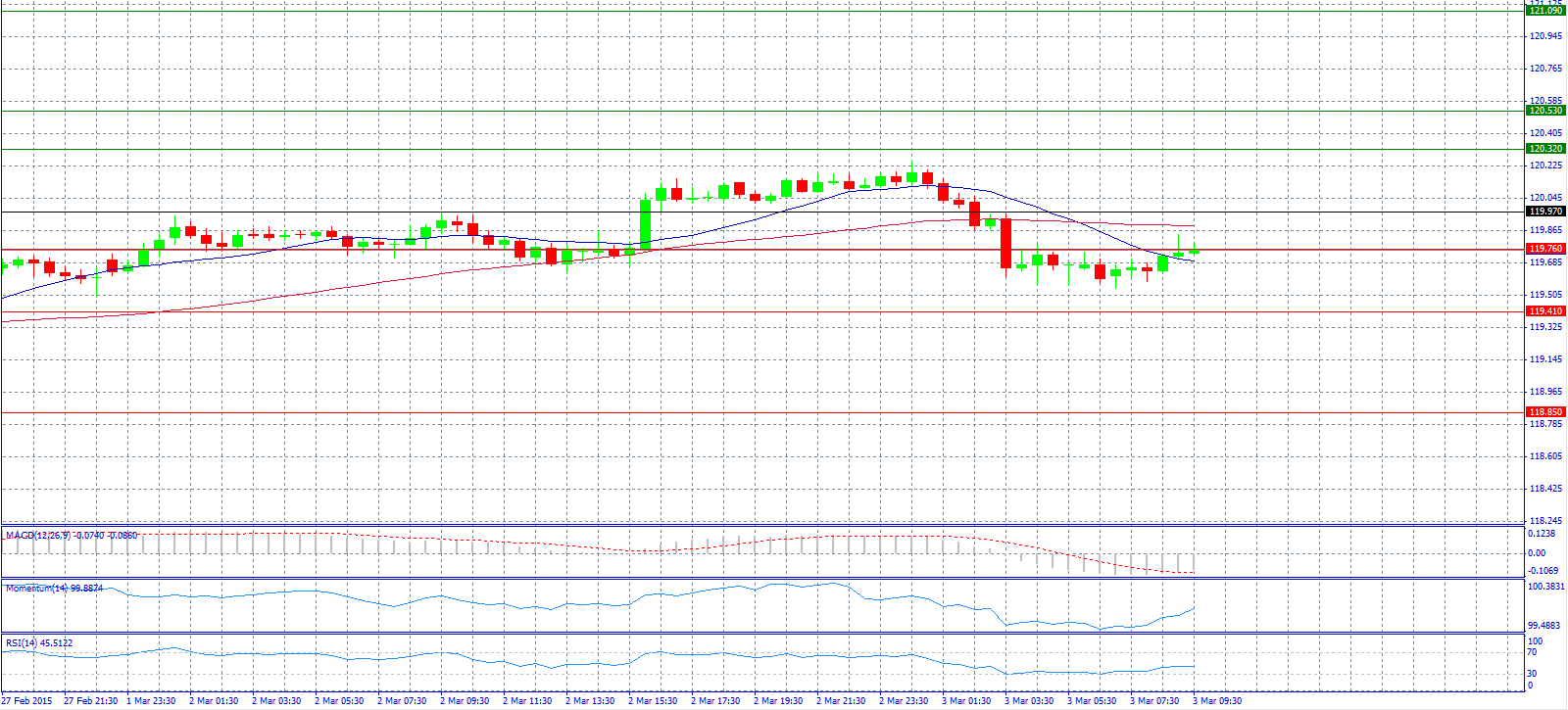

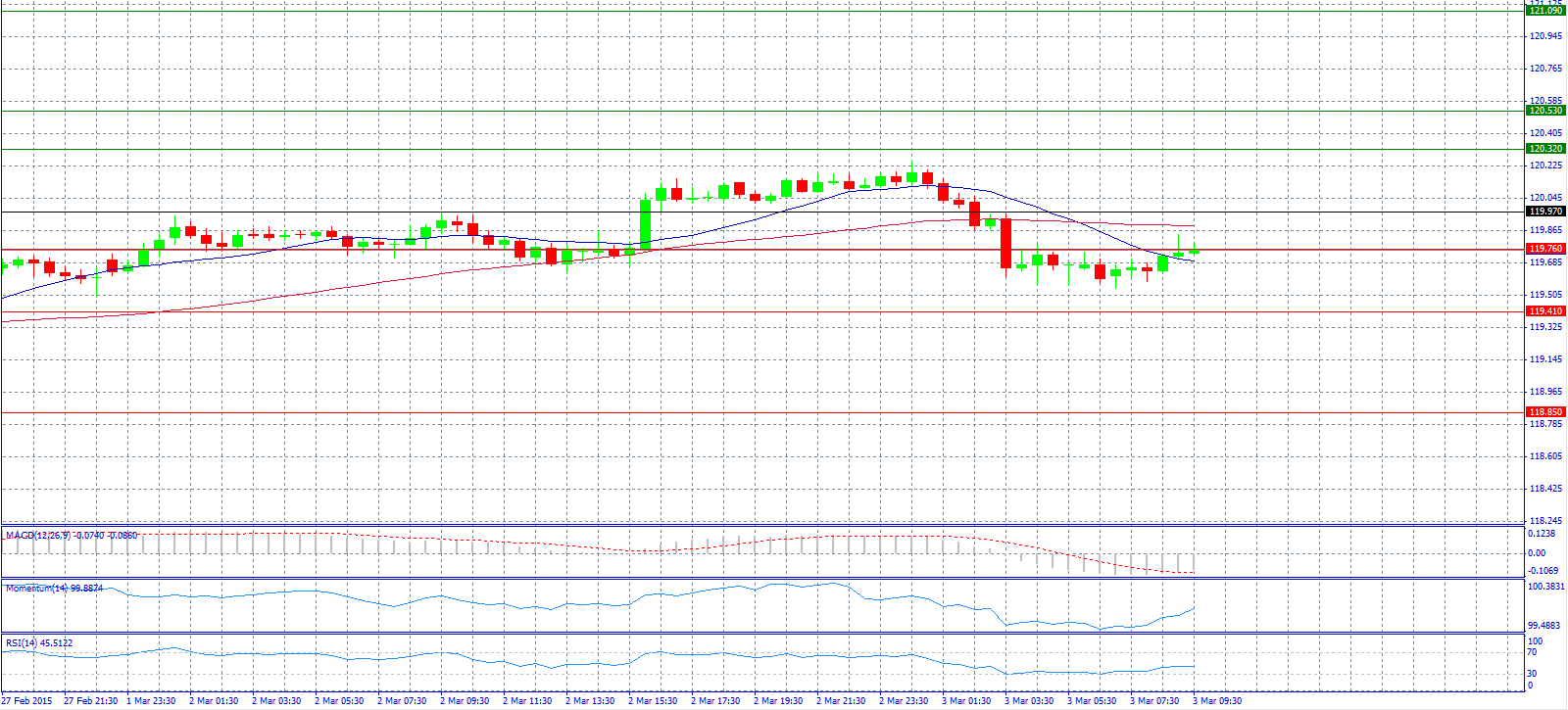

Market Scenario 1: Long positions above 119.97 with target @ 120.32.

Market Scenario 2: Short positions below 119.97 with target @ 119.41.

Comment: The pair is heading for 120.00 level.

Supports and Resistances:

R3 121.09

R2 120.53

R1 120.32

PP 119.97

S1 119.76

S2 119.41

S3 118.85

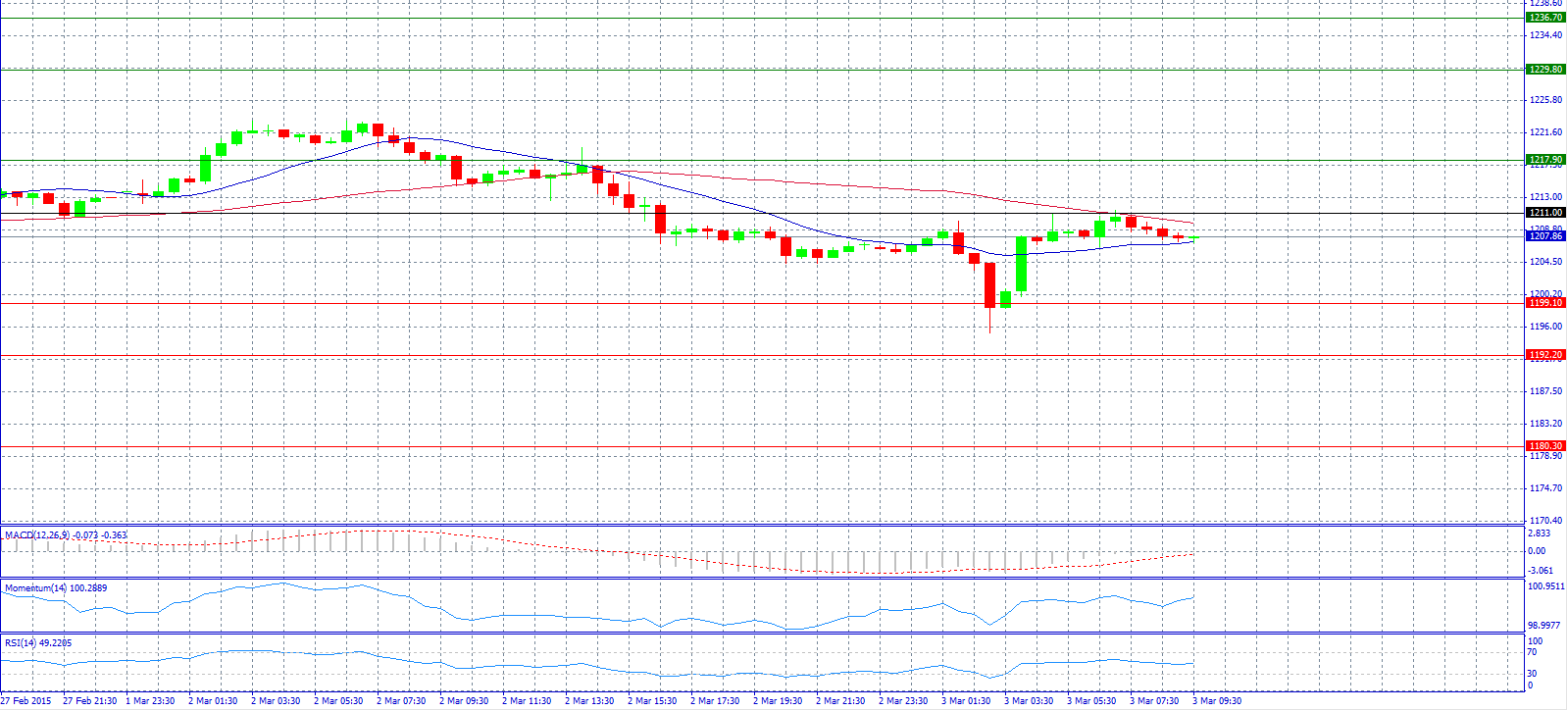

GOLD

Market Scenario 1: Long positions above 1211.00 with target @ 1217.90.

Market Scenario 2: Short positions below 1211.00 with target @ 1192.20.

Comment: Gold prices recover as dollar slips.

Supports and Resistances:

R3 1236.70

R2 1229.80

R1 1217.90

PP 1211.30

S1 1199.10

S2 1192.20

S3 1180.30

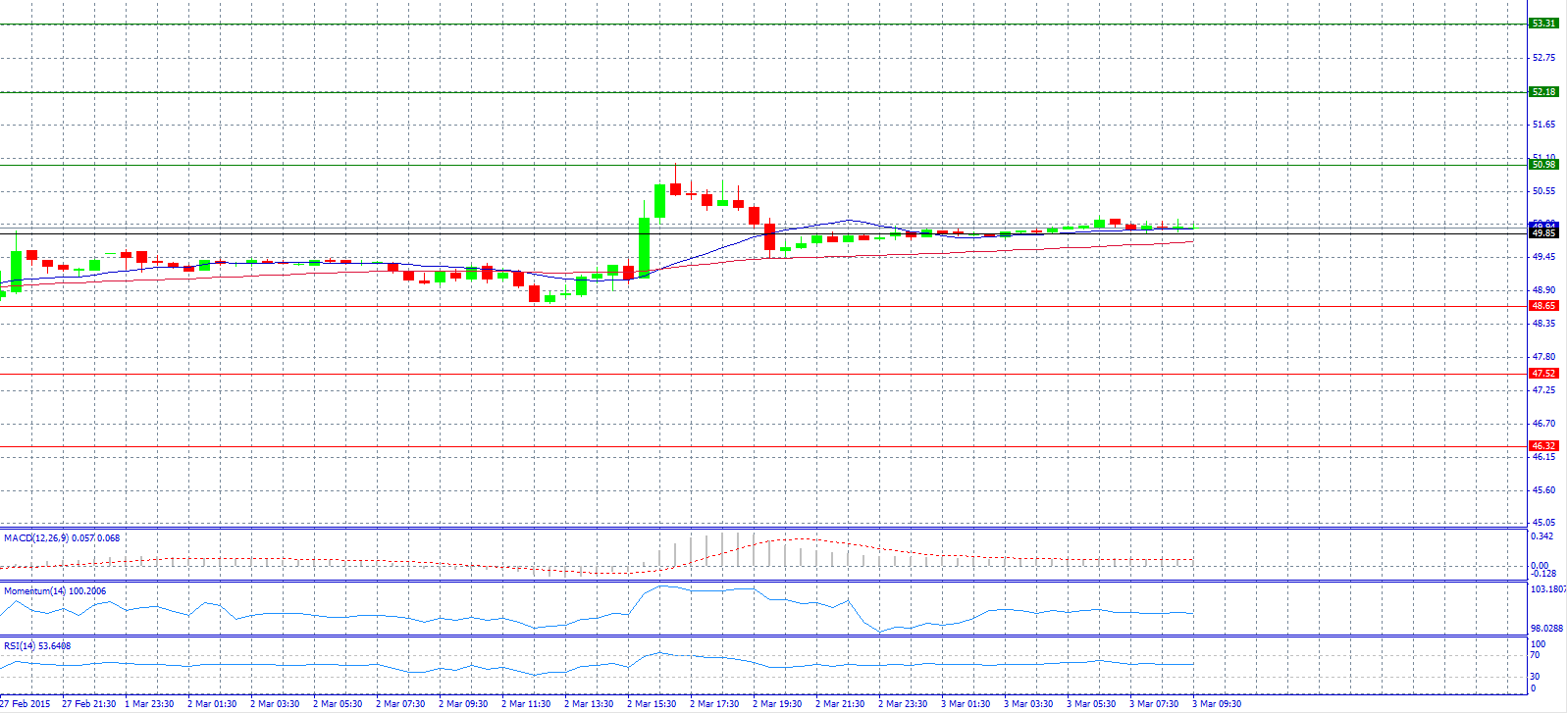

CRUDE OIL

Market Scenario 1: Long positions above 49.85 with target @ 50.98.

Market Scenario 2: Short positions below 49.85 with target @ 48.65.

Comment: Crude oil prices still trade steady around 50.00 level.

Supports and Resistances:

R3 53.31

R2 52.18

R1 50.98

PP 49.85

S1 48.65

S2 47.52

S3 46.32

Market Scenario 1: Long positions above 62.514 with target @ 63.983.

Market Scenario 2: Short positions below 62.514 with target @ 59.693.

Comment: The ruble is stabilizing as geopolitical tensions ease.

Supports and Resistances:

R3 66.804

R2 65.335

R1 63.983

PP 62.514

S1 61.162

S2 59.693

S3 58.340

Forexcorporate Marketing Research Department Disclosures:

1. Information on this page / e-mail / letter is not a recommendation to buy or sell and of course, can not guarantee a profit, it should be considered only as information that may assist you in making good decisions in your trading. Information and graphics presented above have been obtained from reliable sources, but their accuracy can not be fully guaranteed. Forexcorporate, its representatives, employees, and other authors will not be liable for any loss resulted from the use of this information.

2. The purpose of this risk disclaimer is to inform users of the potential financial risks involved in trading in foreign currencies. The transaction or operations in the Forex or OTC markets does involve a substantial degree of risk, and should not be undertaken until the user has carefully evaluate whether their financial situation is appropriate for such transactions. Trading may result in a substantial or complete loss of funds and therefore should only be undertaken with risk capital.