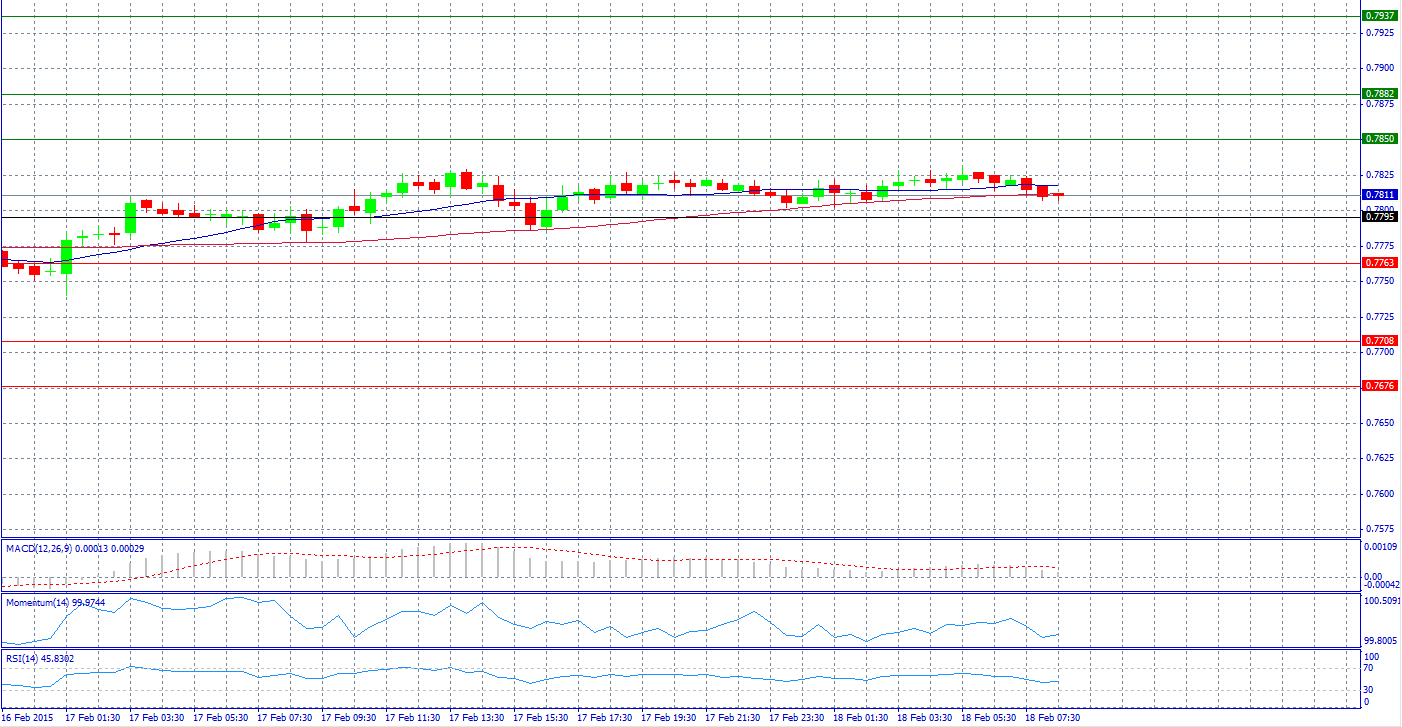

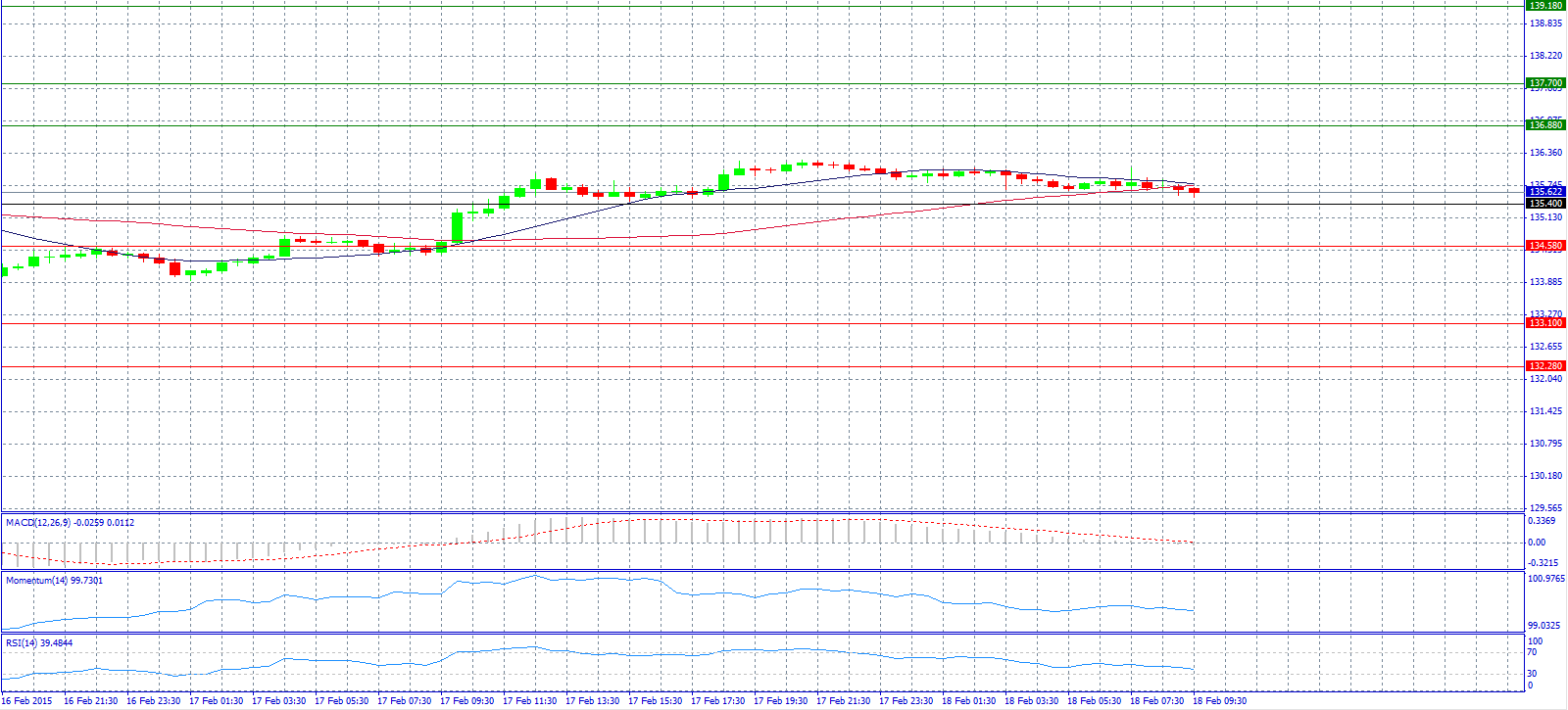

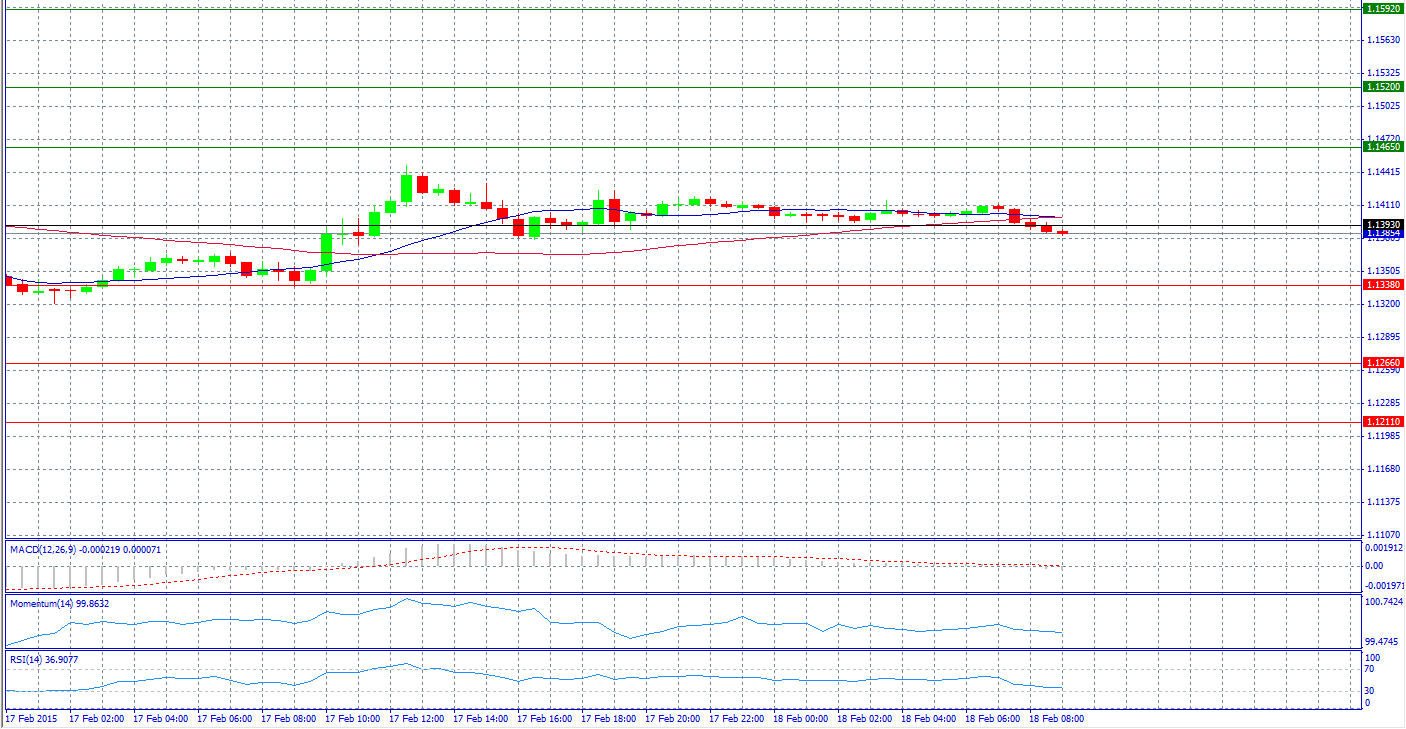

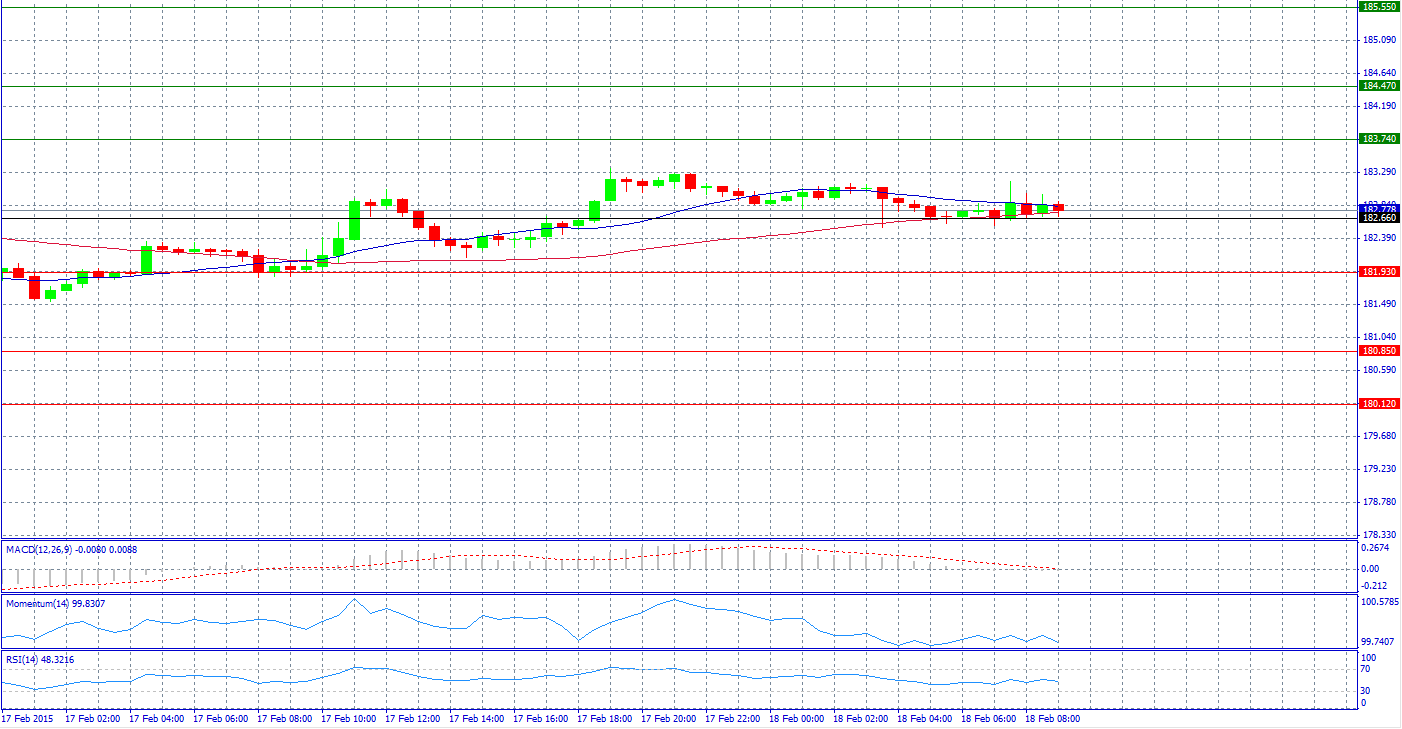

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7795 with targets @ 0.7850 and 0.7882.

Market Scenario 2: Short positions below 0.7795 with targets @ 0.7763 and 0.7708.

Comment: The pair steadies above 0.7800.

Supports and Resistances:

R3 0.7937

R2 0.7882

R1 0.7850

PP 0.7795

S1 0.7763

S2 0.7708

S3 0.7676

Market Scenario 1: Long positions above 135.40 with targets @ 136.88 and 137.70.

Market Scenario 2: Short positions below 135.40 with targets @ 134.58 and 133.10.

Comment: The pair recovered partial losses on BOJ Kuroda’s comments.

Supports and Resistances:

R3 139.18

R2 137.70

R1 136.88

PP 135.40

S1 134.58

S2 133.10

S3 132.28

Market Scenario 1: Long positions above 1.1393 with targets @ 1.1465 and 1.1520.

Market Scenario 2: Short positions below 1.1393 with targets @ 1.1338 and 1.1266.

Comment: The pair remains below 1.1400.

Supports and Resistances:

R3 1.1592

R2 1.1520

R1 1.1465

PP 1.1393

S1 1.1338

S2 1.1266

S3 1.1211

Market Scenario 1: Long positions above 182.66 with targets @ 183.74 and 184.47.

Market Scenario 2: Short positions below 182.66 with targets @ 181.93 and 180.85.

Comment: The pair could be pushed higher due to rising US rates and strong data.

Supports and Resistances:

R3 185.55

R2 184.47

R1 183.74

PP 182.66

S1 181.93

S2 180.85

S3 180.12

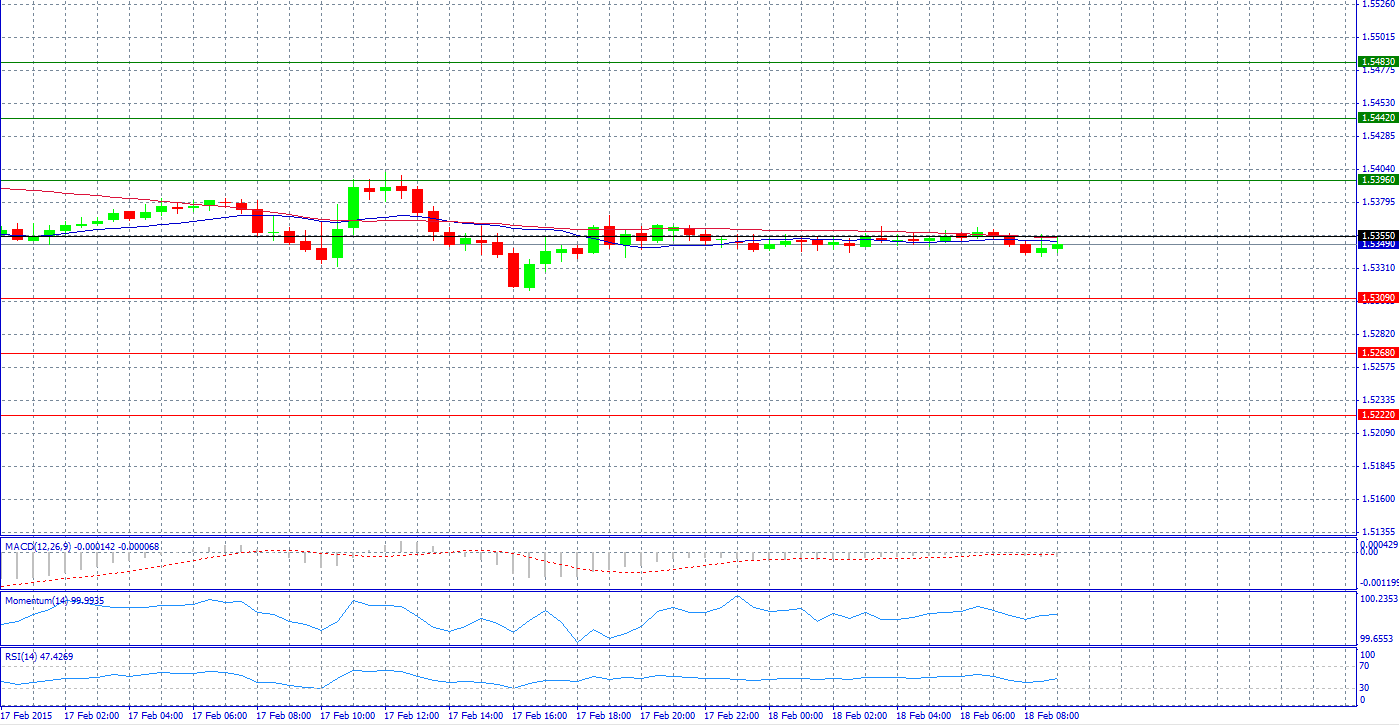

Market Scenario 1: Long positions above 1.5355 with targets @ 1.5396 and 1.5442.

Market Scenario 2: Short positions below 1.5355 with targets @ 1.5309 and 1.5268.

Comment: The pair traded with almost no changes at all in the early European morning.

Supports and Resistances:

R3 1.5483

R2 1.5442

R1 1.5396

PP 1.5355

S1 1.5309

S2 1.5268

S3 1.5222

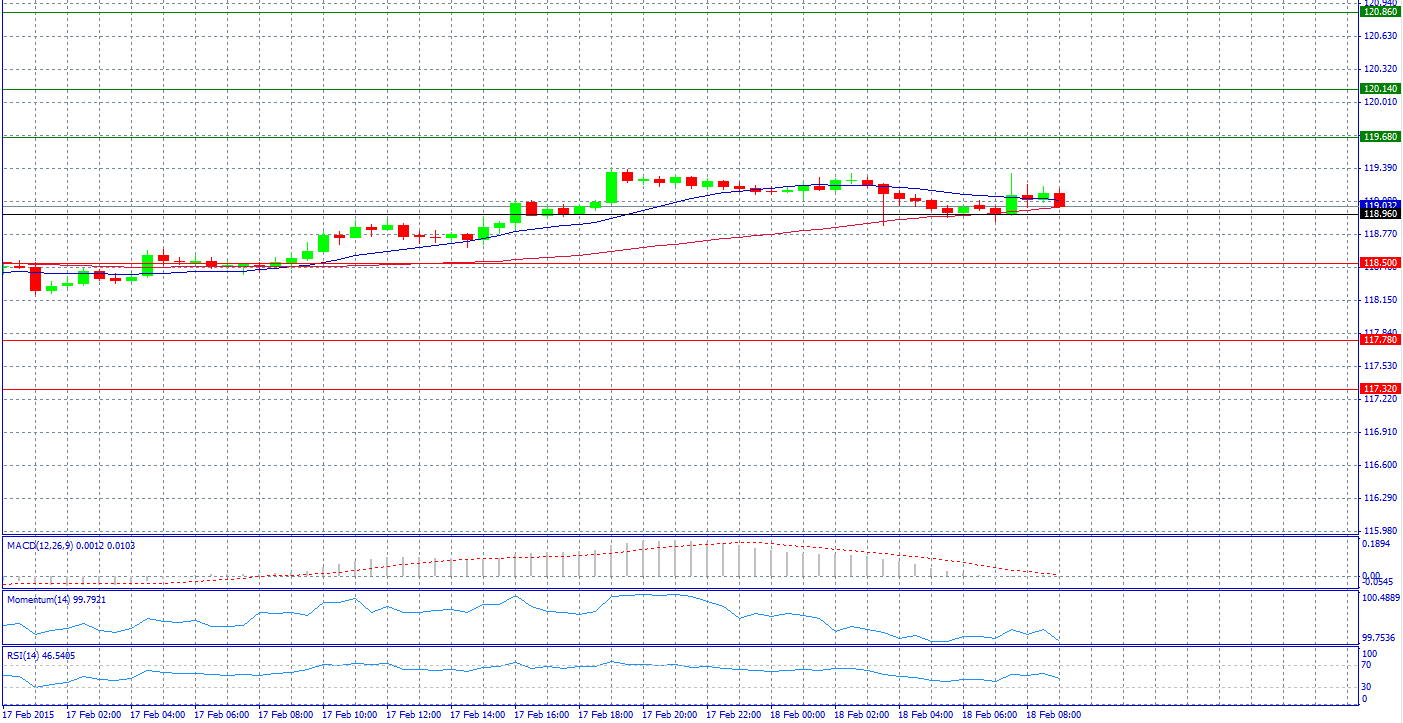

Market Scenario 1: Long positions above 118.96 with targets @ 119.68 and 120.14.

Market Scenario 2: Short positions below 118.96 with targets @ 118.50 and 117.78.

Comment: The pair fell to session lows as BOJ Kuroda defends QQE program.

Supports and Resistances:

R3 120.86

R2 120.14

R1 119.68

PP 118.96

S1 118.50

S2 117.78

S3 117.32

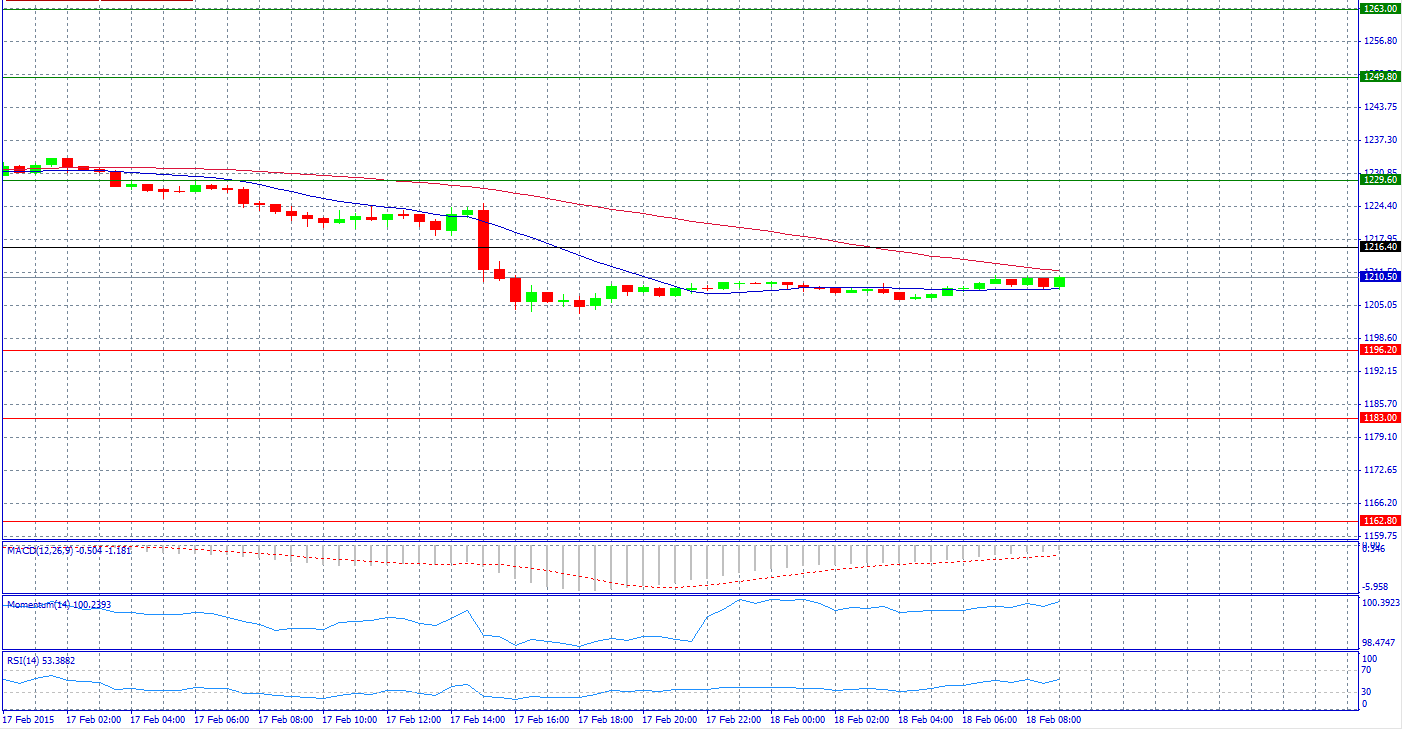

Market Scenario 1: Long positions above 1216.40 with targets @ 1229.60 and 1249.80.

Market Scenario 2: Short positions below 1216.40 with targets @ 1196.20 and 1183.00.

Comment: Gold declines as Treasury yields rise.

Supports and Resistances:

R3 1263.00

R2 1249.80

R1 1229.60

PP 1216.40

S1 1196.20

S2 1183.00

S3 1162.80

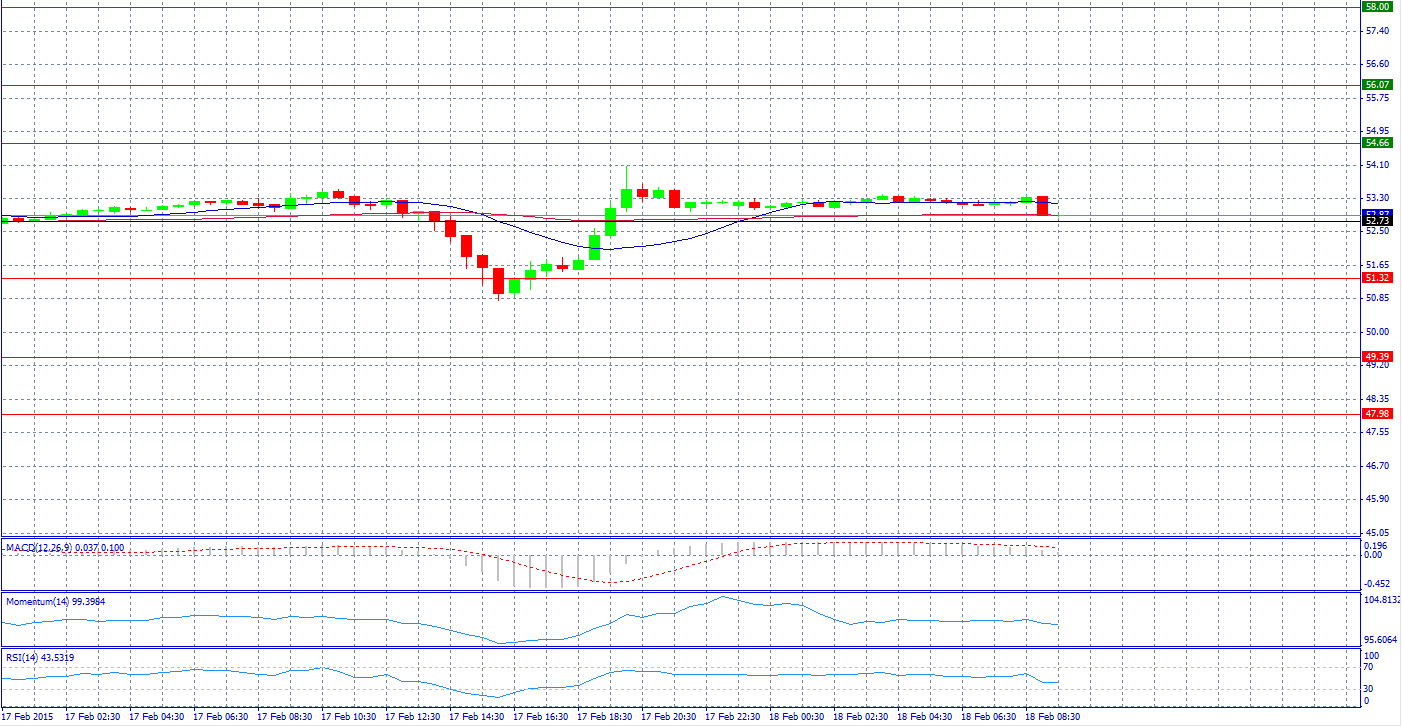

Market Scenario 1: Long positions above 52.73 with targets @ 54.66 and 56.07.

Market Scenario 2: Short positions below 52.73 with targets @ 51.32 and 49.39.

Comment: Crude Oil hovers around USD 54/ barrel.

Supports and Resistances:

R3 58.00

R2 56.07

R1 54.66

PP 52.73

S1 51.32

S2 49.39

S3 47.98

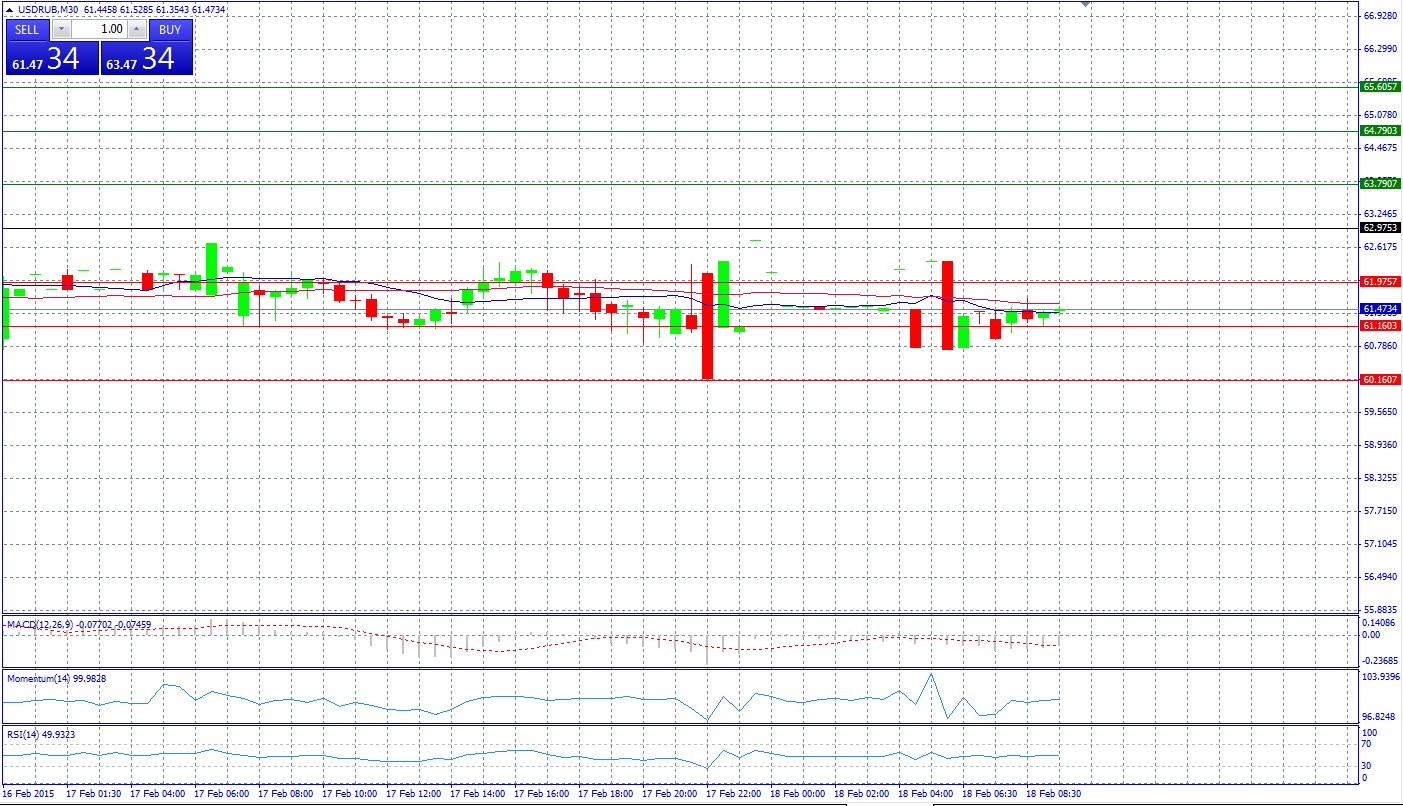

Market Scenario 1: Long positions above 62.9753 with targets @ 63.7907 and 64.7903.

Market Scenario 2: Short positions below 62.9753 with targets @ 61.1603 and 60.1607.

Comment: Russia stocks were lower at close of trade and the pair was down 0.49%.

Supports and Resistances:

R3 65.6057

R2 64.7903

R1 63.7907

PP 62.9753

S1 61.9757

S2 61.1603

S3 60.1607