Technical Analysis on April 9

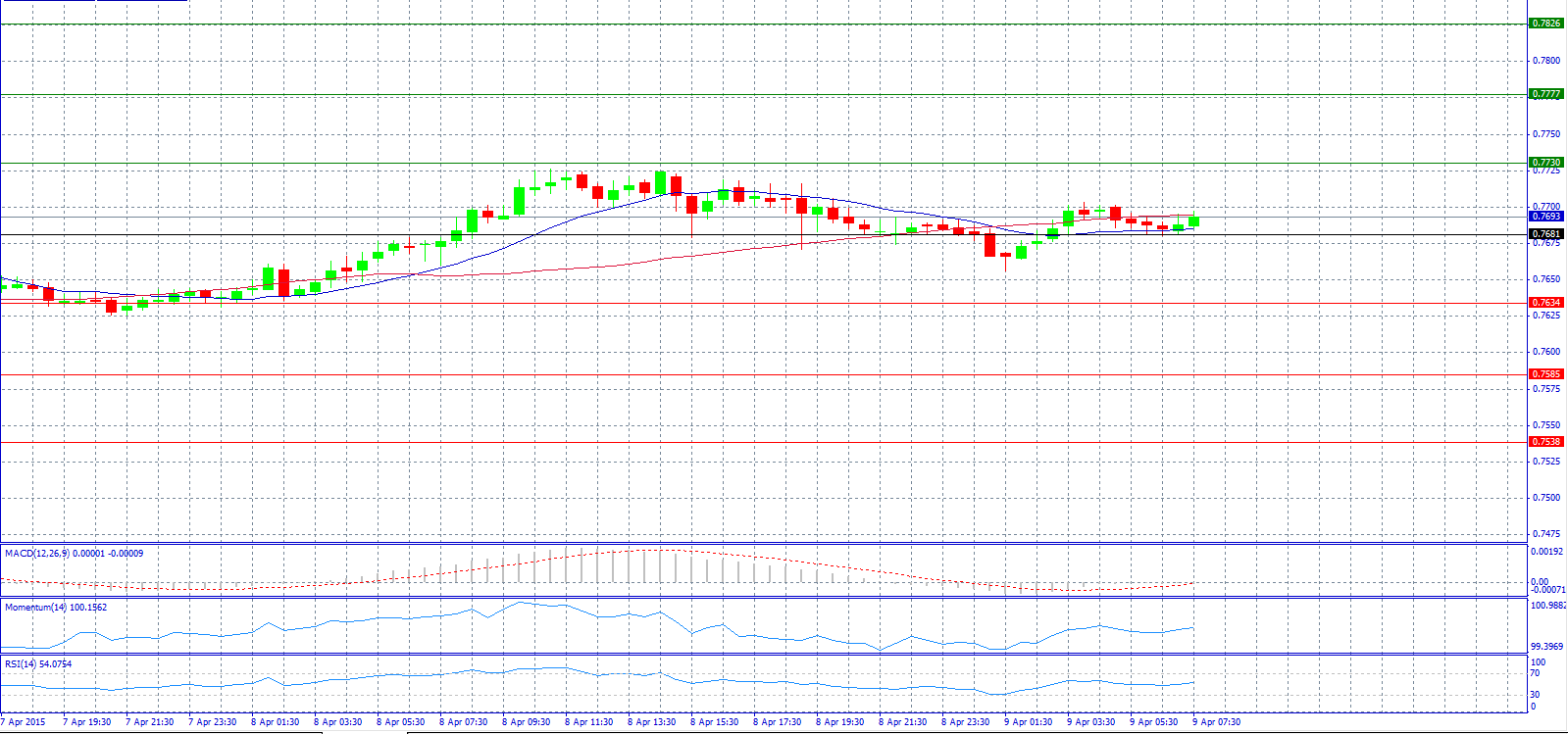

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7681 with target @ 0.7730.

Market Scenario 2: Short positions below 0.7681 with target @ 0.7634.

Comment: The pair hovers around 0.7690 level.

Supports and Resistances:

R3 0.7826

R2 0.7777

R1 0.7730

PP 0.7681

S1 0.7634

S2 0.7585

S3 0.7538

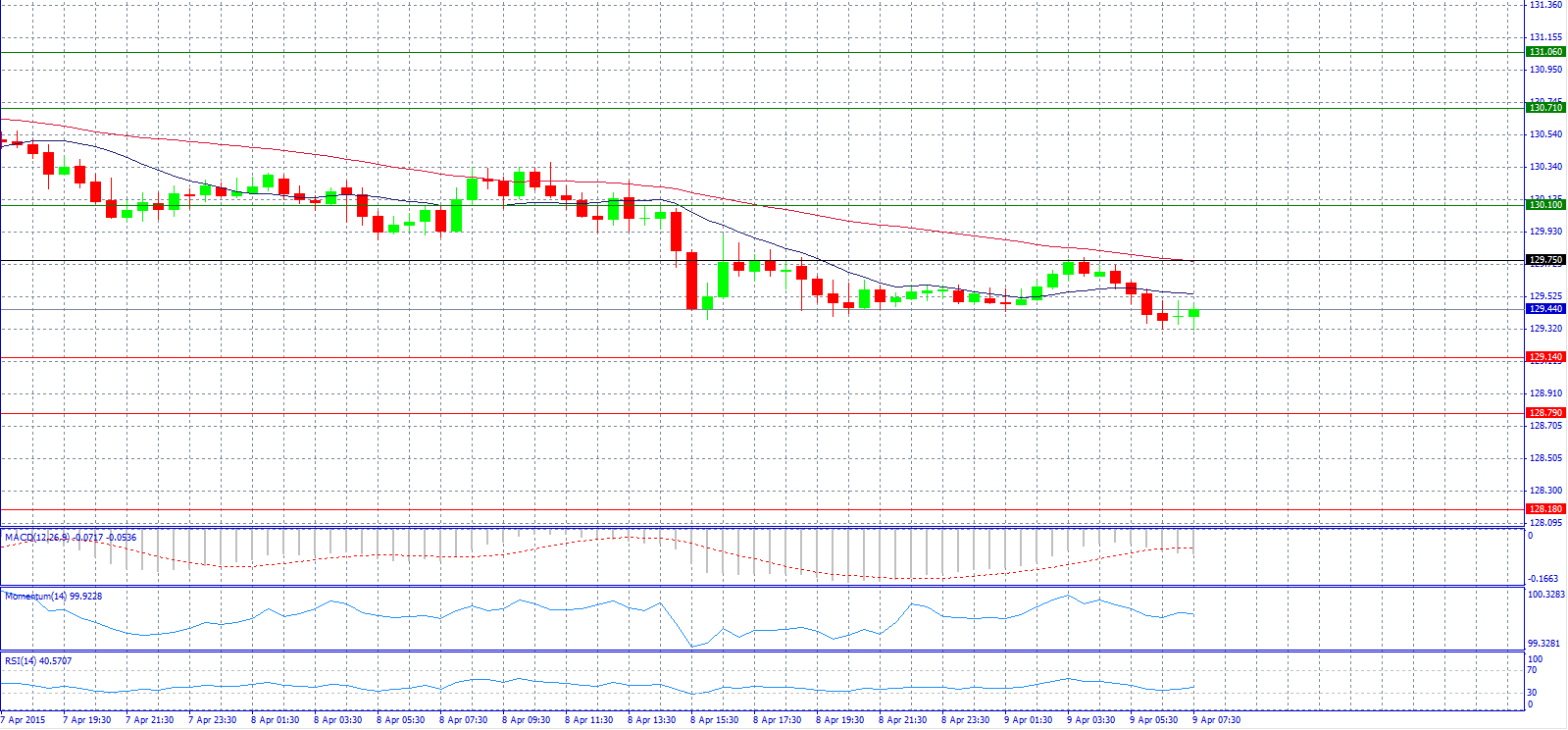

Market Scenario 1: Long positions above 129.75 with target @ 130.10.

Market Scenario 2: Short positions below 129.14 with target @ 128.79.

Comment: The pair is virtually unchanged for almost three weeks, but there is a cautiously bearish bias.

Supports and Resistances:

R3 131.06

R2 130.71

R1 130.10

PP 129.75

S1 129.14

S2 128.79

S3 128.18

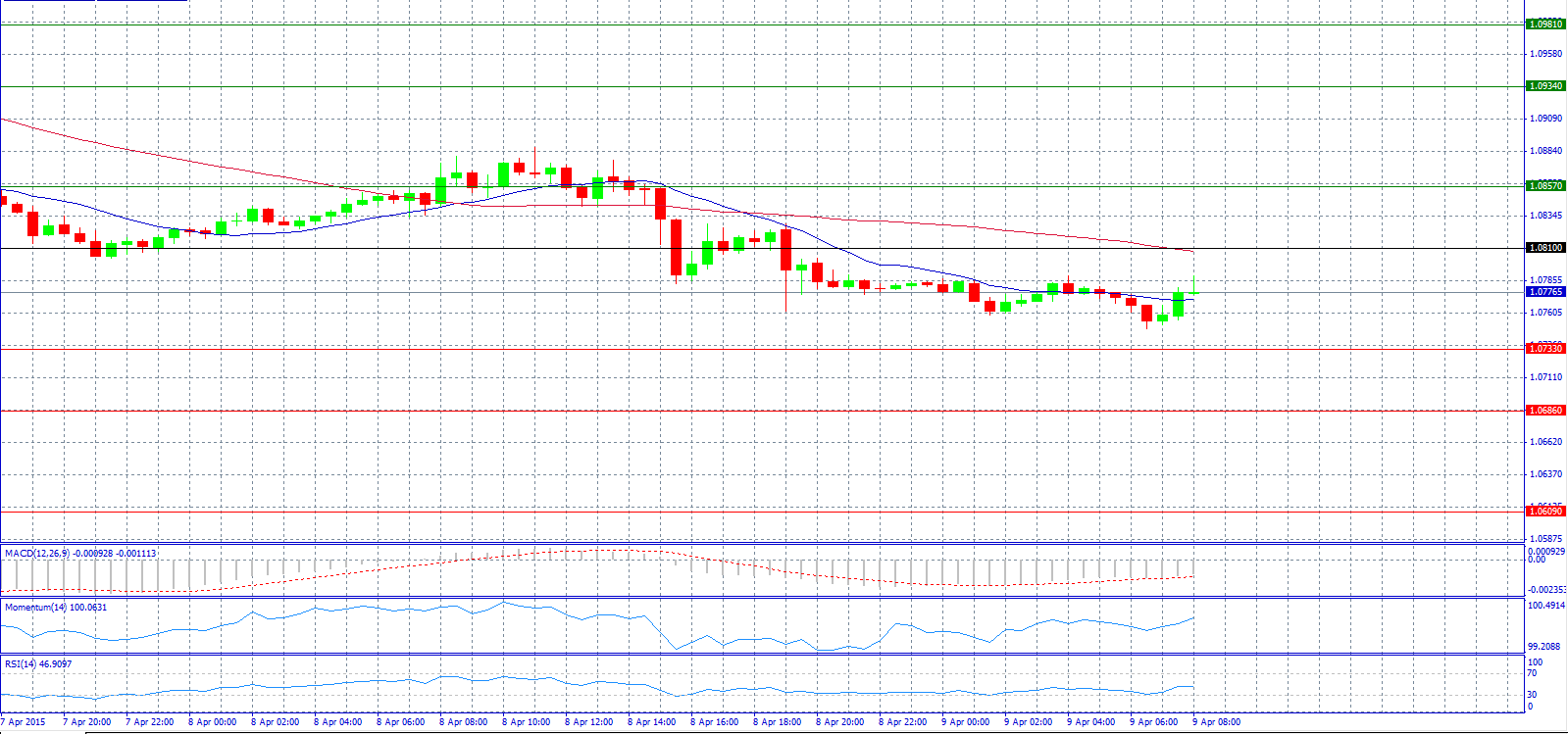

Market Scenario 1: Long positions above 1.0810 with target @ 1.0857.

Market Scenario 2: Short positions below 1.0733 with target @ 1.0686.

Comment: The pair might make another attempt towards 1.0825 level according to analysts.

Supports and Resistances:

R3 1.0981

R2 1.0934

R1 1.0857

PP 1.0810

S1 1.0733

S2 1.0686

S3 1.0609

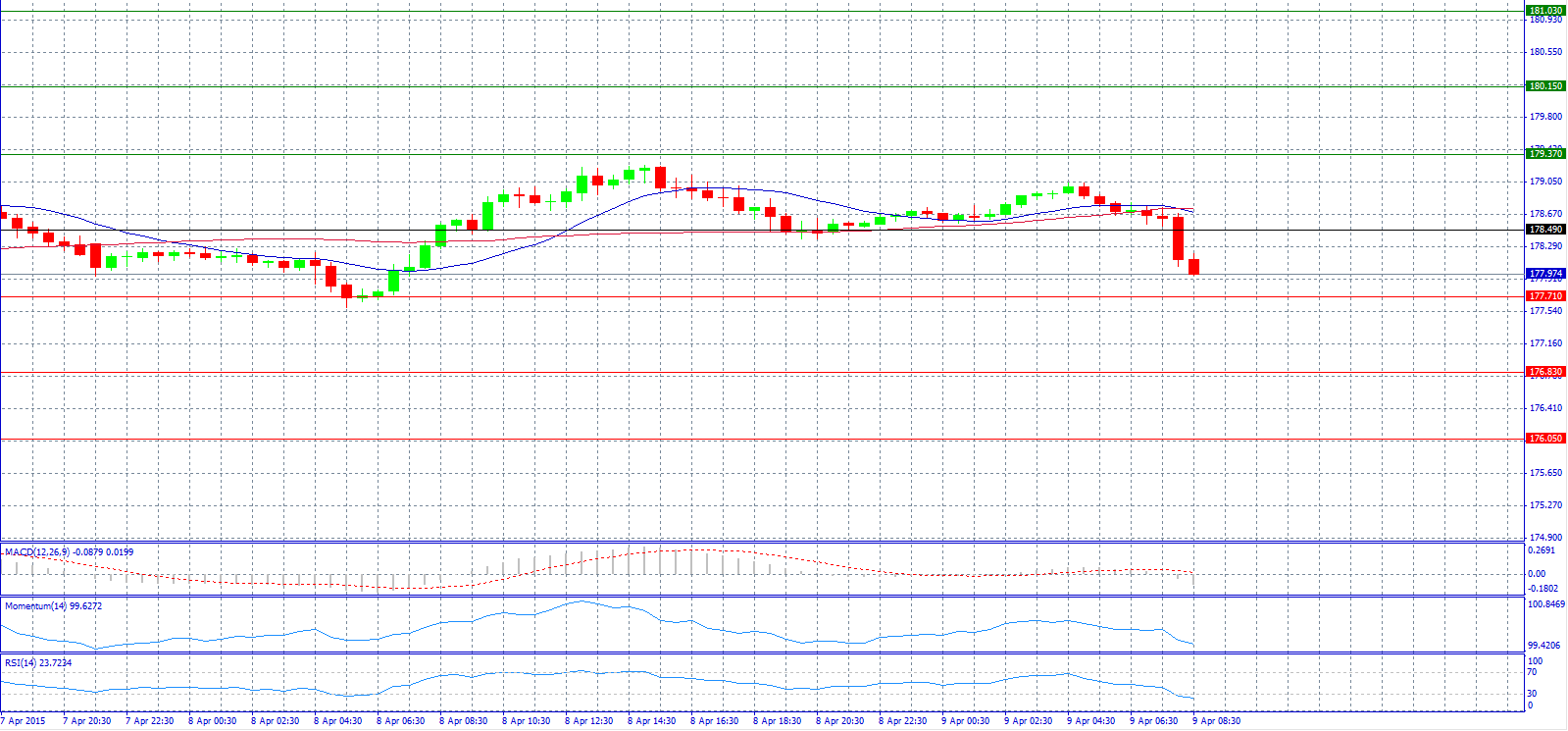

Market Scenario 1: Long positions above 178.49 with target @ 179.37.

Market Scenario 2: Short positions below 177.71 with target @ 176.83.

Comment: The pair has a bearish tone and trades below 178.00 level.

Supports and Resistances:

R3 181.03

R2 180.15

R1 179.37

PP 178.49

S1 177.71

S2 176.83

S3 176.05

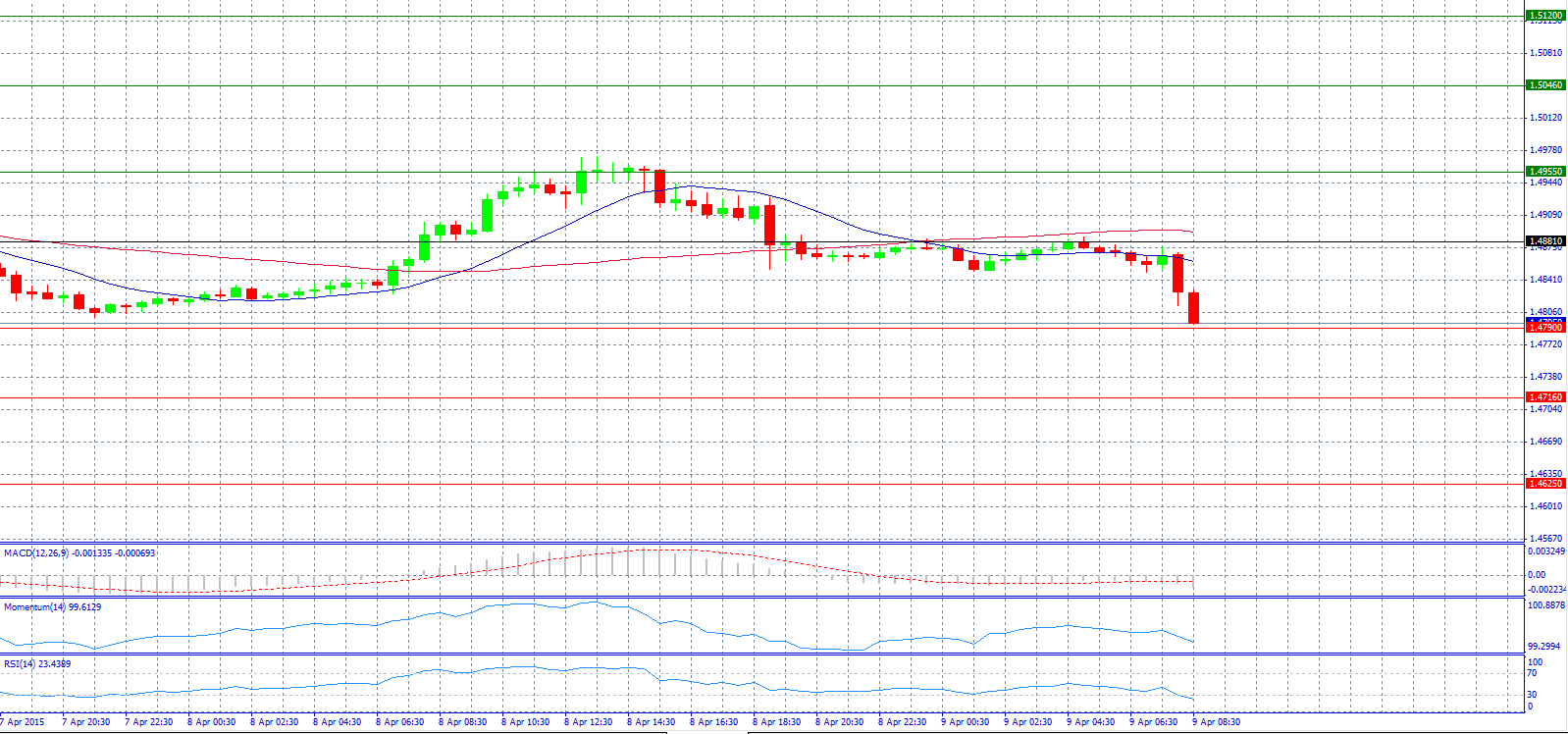

Market Scenario 1: Long positions above 1.4790 with target @ 1.4881.

Market Scenario 2: Short positions below 1.4790 with target @ 1.4716.

Comment: The pair drops to 1.4800 level.

Supports and Resistances:

R3 1.5120

R2 1.5046

R1 1.4955

PP 1.4881

S1 1.4790

S2 1.4716

S3 1.4625

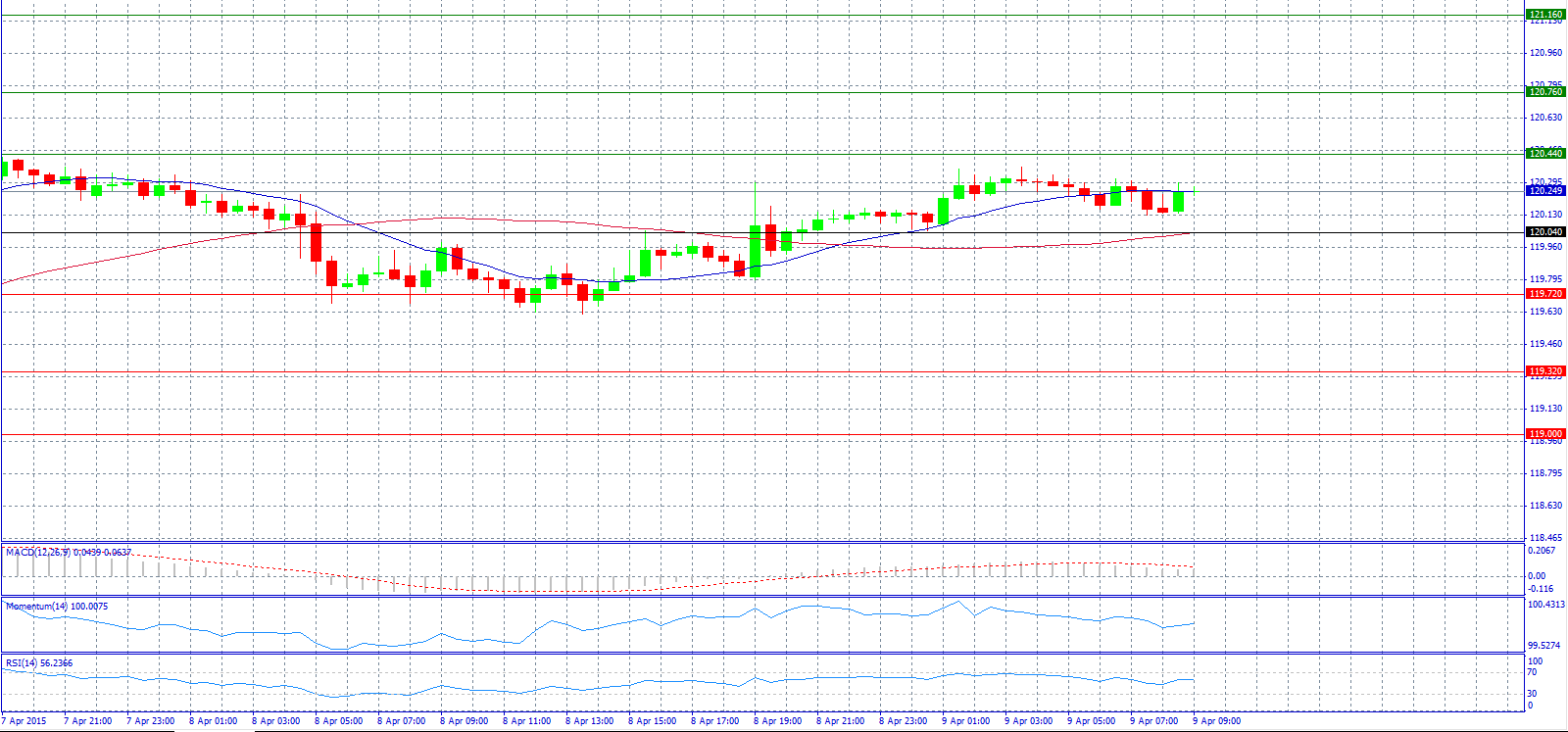

Market Scenario 1: Long positions above 120.44 with target @ 120.76.

Market Scenario 2: Short positions below 120.04 with target @ 119.72.

Comment: The pair suffers a minor setback.

Supports and Resistances:

R3 121.16

R2 120.76

R1 120.44

PP 120.04

S1 119.72

S2 119.32

S3 119.00

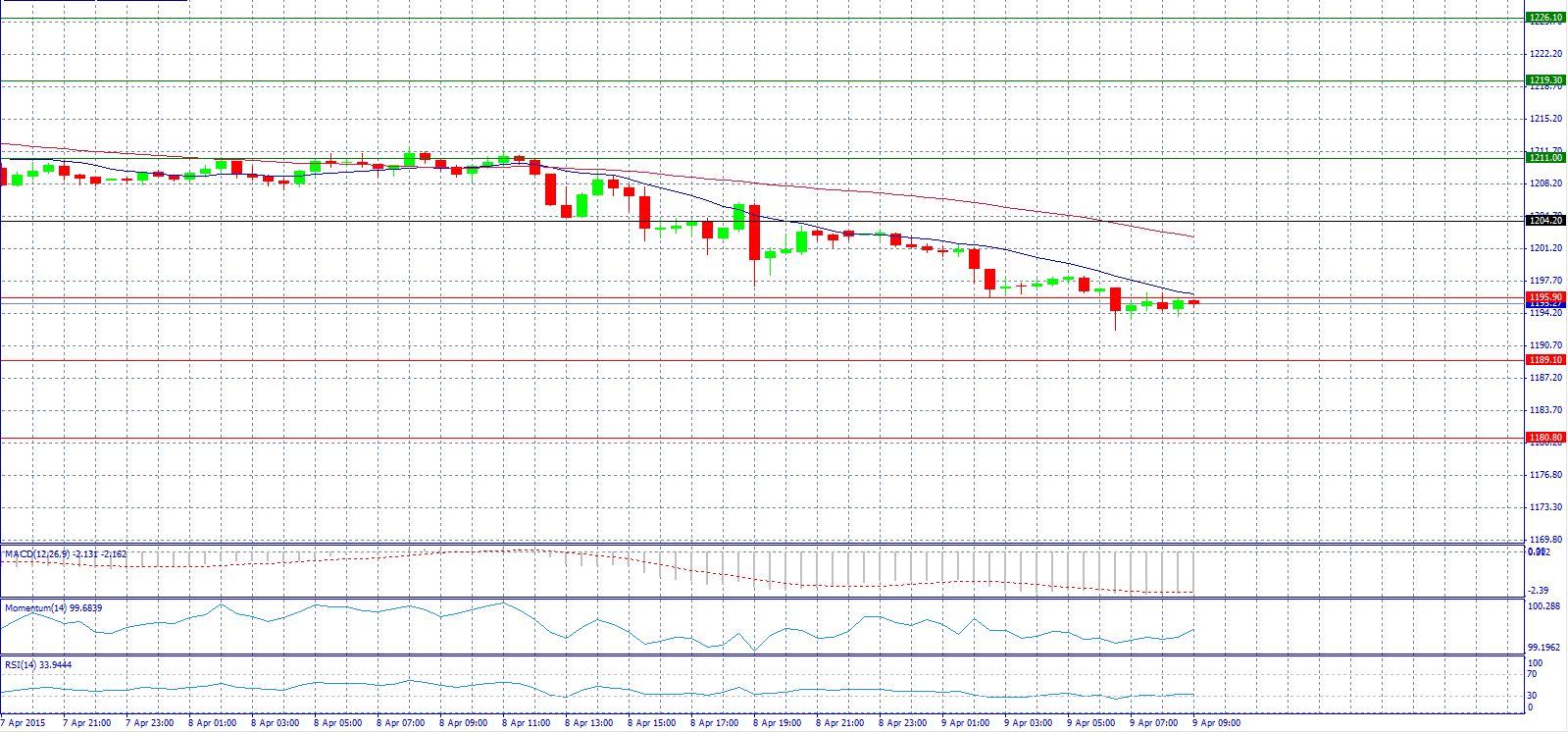

Market Scenario 1: Long positions above 1195.90 with target @ 1204.20.

Market Scenario 2: Short positions below 1195.90 with target @ 1189.10.

Comment: Gold prices drop for the third session in a row on Thursday after comments from Federal Reserve officials suggested that a rate increase in June remained on the cards despite recent weak data.

Supports and Resistances:

R3 1226.10

R2 1219.30

R1 1211.00

PP 1204.20

S1 1195.90

S2 1189.10

S3 1180.80

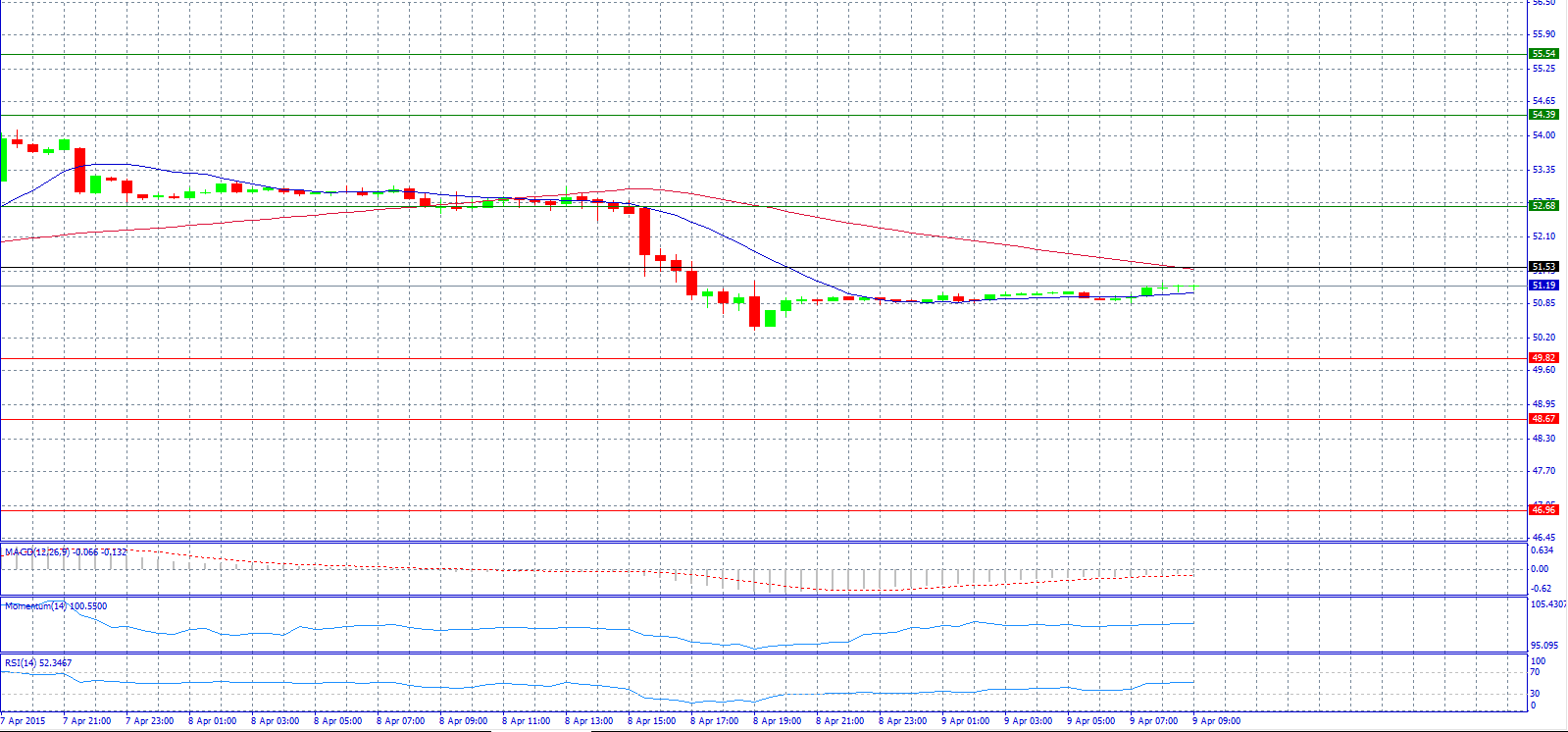

Market Scenario 1: Long positions above 51.53 with target @ 52.68.

Market Scenario 2: Short positions below 51.53 with target @ 49.82.

Comment: Crude oil prices took back some lost ground following a steep plunge overnight triggered by a rise in U.S. stocks and news of record Saudi oil production.

Supports and Resistances:

R3 55.54

R2 54.39

R1 52.68

PP 51.53

S1 49.82

S2 48.67

S3 46.96

Market Scenario 1: Long positions above 51.752 with target @ 52.923.

Market Scenario 2: Short positions below 51.113 with target @ 49.303.

Comment: The pair continues to drop and trades below 51.600 level.

Supports and Resistances:

R3 56.543

R2 54.733

R1 53.562

PP 52.923

S1 51.752

S2 51.113

S3 49.303

S4 47.493