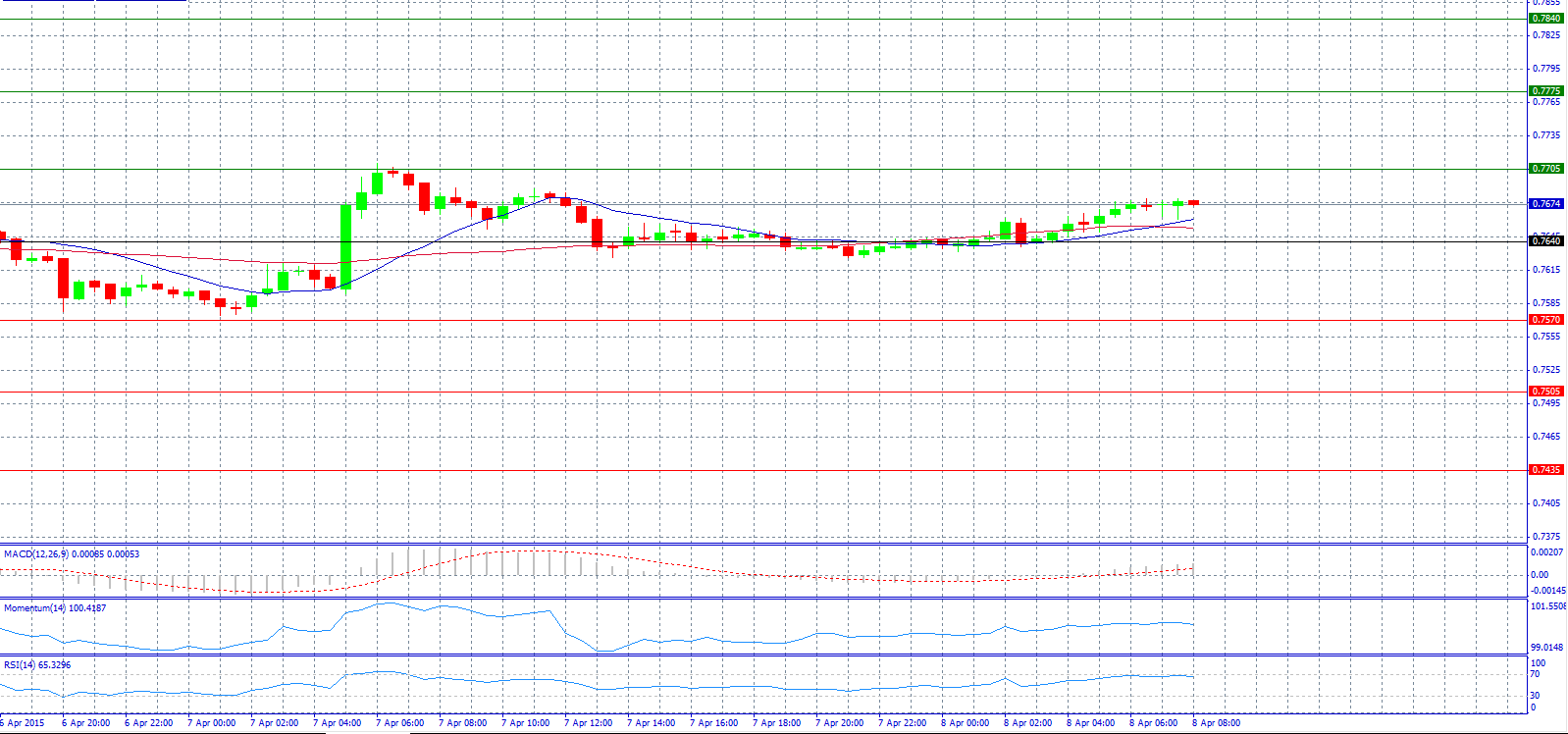

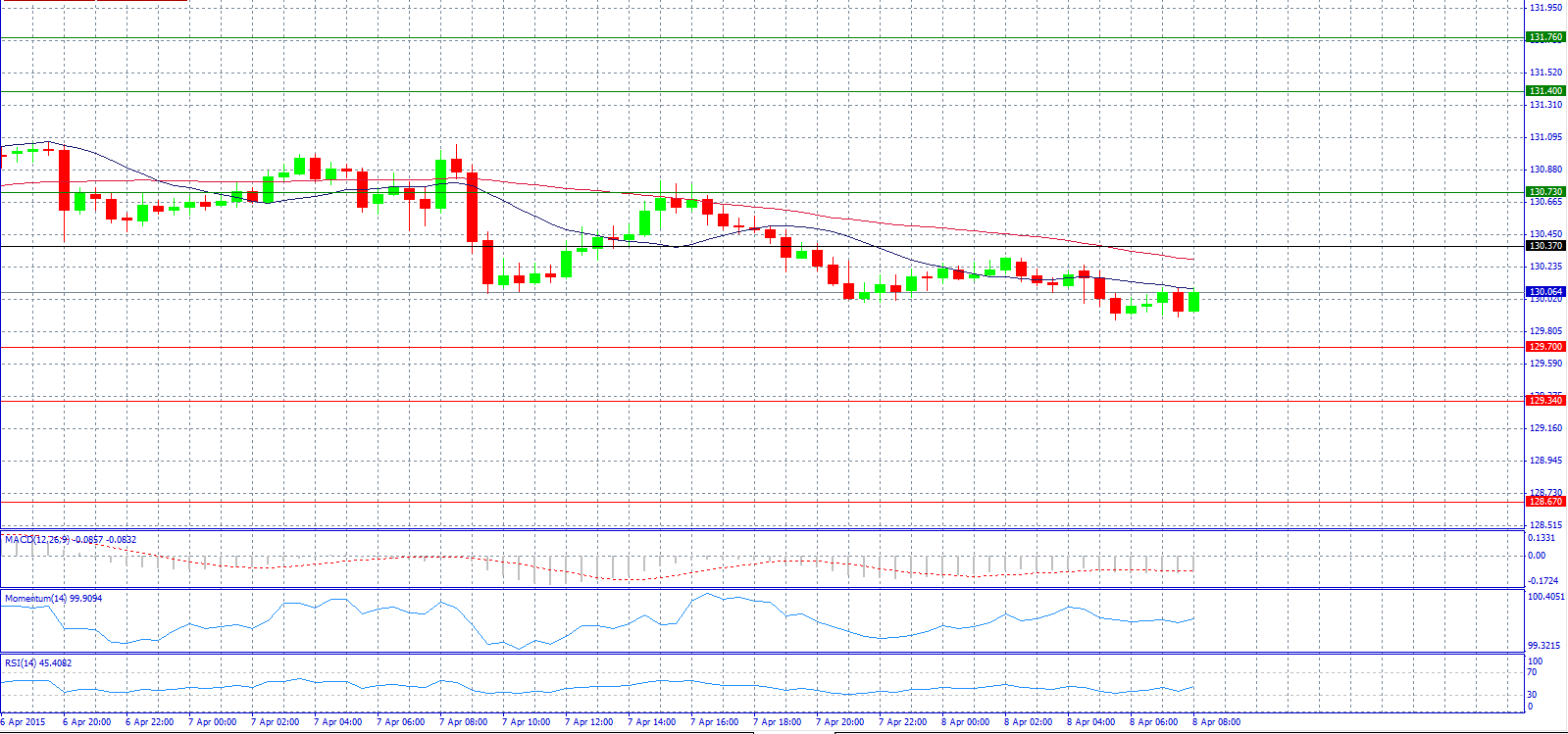

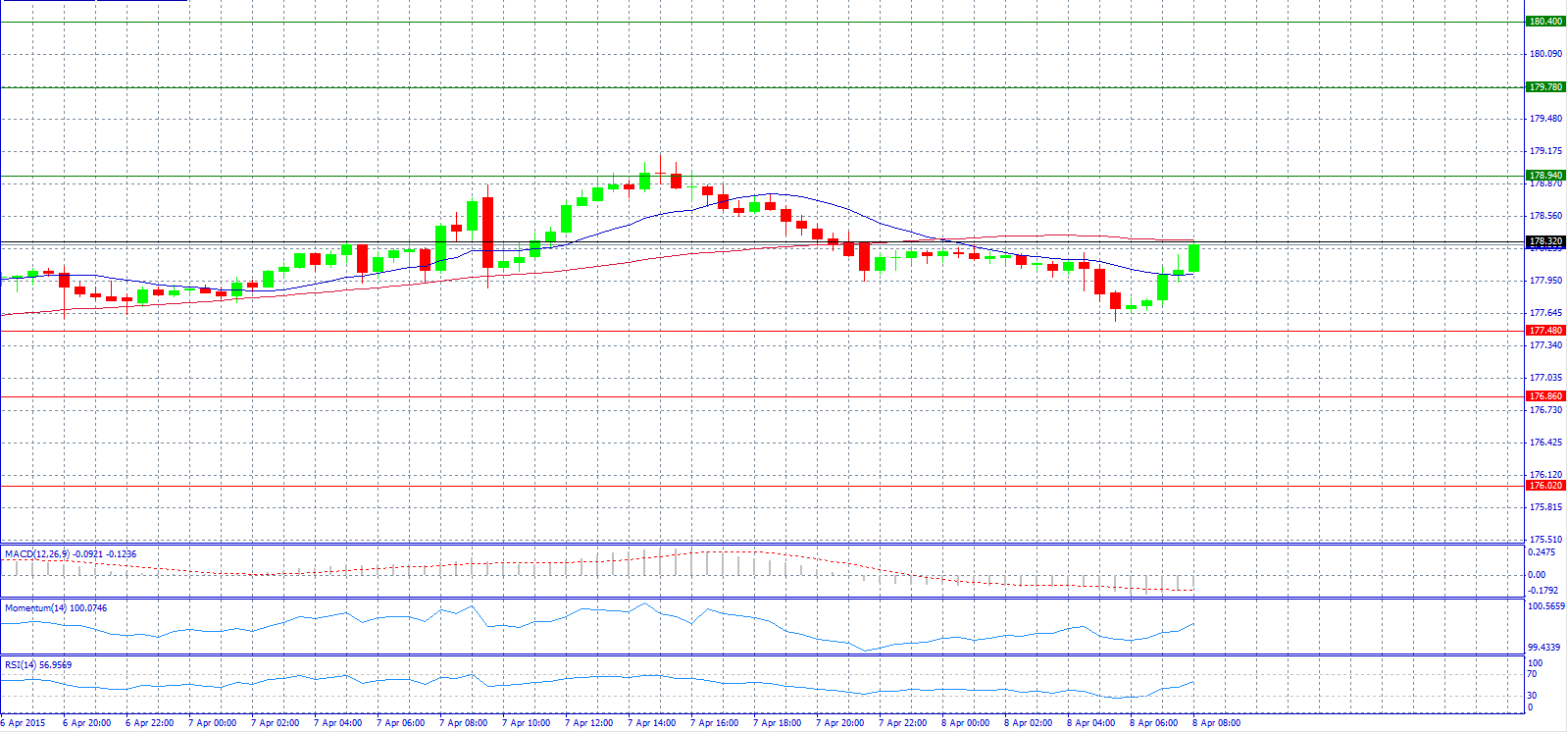

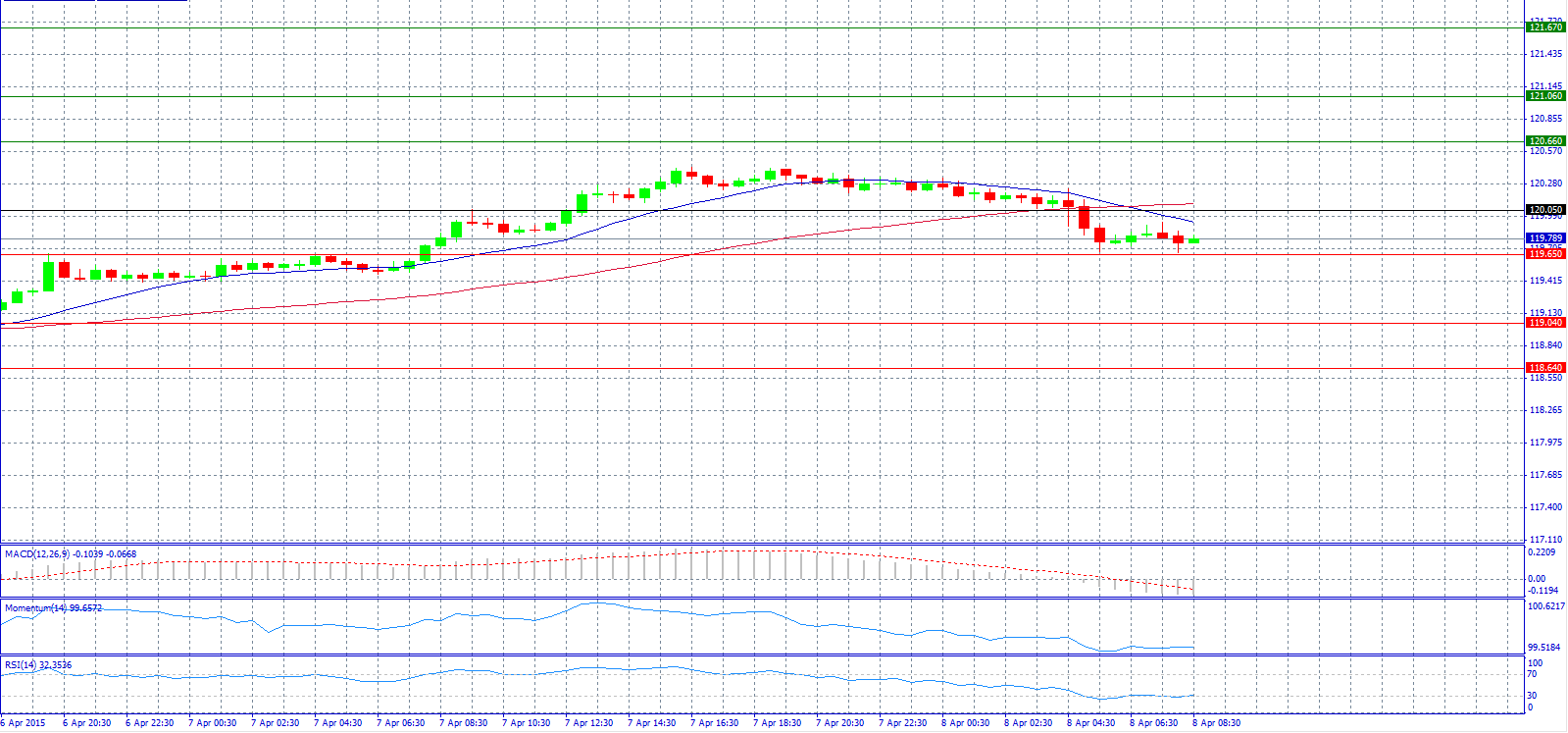

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7705 with target @ 0.7775.

Market Scenario 2: Short positions below 0.7640 with target @ 0.7570.

Comment: The pair attempts to reach 0.7700 level.

Supports and Resistances:

R3 0.7840

R2 0.7775

R1 0.7705

PP 0.7640

S1 0.7570

S2 0.7505

S3 0.7435

Market Scenario 1: Long positions above 130.37 with target @ 130.73.

Market Scenario 2: Short positions below 129.70 with target @ 129.34.

Comment: The pair trades steady near 130.00 level.

Supports and Resistances:

R3 131.76

R2 131.40

R1 130.73

PP 130.37

S1 129.70

S2 129.34

S3 128.67

Market Scenario 1: Long positions above 1.0911 with target @ 1.1009.

Market Scenario 2: Short positions below 1.0857 with target @ 1.0759.

Comment: The pair might breach the rising trend line support at 1.0822 to test 1.0748 levels according to analysts.

Supports and Resistances:

R3 1.1063

R2 1.1009

R1 1.0911

PP 1.0857

S1 1.0759

S2 1.0705

S3 1.0607

Market Scenario 1: Long positions above 178.32 with target @ 178.94.

Market Scenario 2: Short positions below 177.48 with target @ 176.86.

Comment: The pair trades near pivot point at 178.32 level.

Supports and Resistances:

R3 180.40

R2 179.78

R1 178.94

PP 178.32

S1 177.48

S2 176.86

S3 176.02

Market Scenario 1: Long positions above 1.4883 with target @ 1.4961.

Market Scenario 2: Short positions below 1.4883 with target @ 1.4843.

Comment: The pair is advancing above 1.4880 level.

Supports and Resistances:

R3 1.5001

R2 1.4961

R1 1.4883

PP 1.4843

S1 1.4765

S2 1.4725

S3 1.4647

Market Scenario 1: Long positions above 120.05 with target @ 120.66.

Market Scenario 2: Short positions below 119.65 with target @ 119.04.

Comment: The pair is trading below 120.00 level following the press conference by Governor Kuroda after the steady stance from the Bank of Japan in today’s meeting.

Supports and Resistances:

R3 121.67

R2 121.06

R1 120.66

PP 120.05

S1 119.65

S2 119.04

S3 118.64

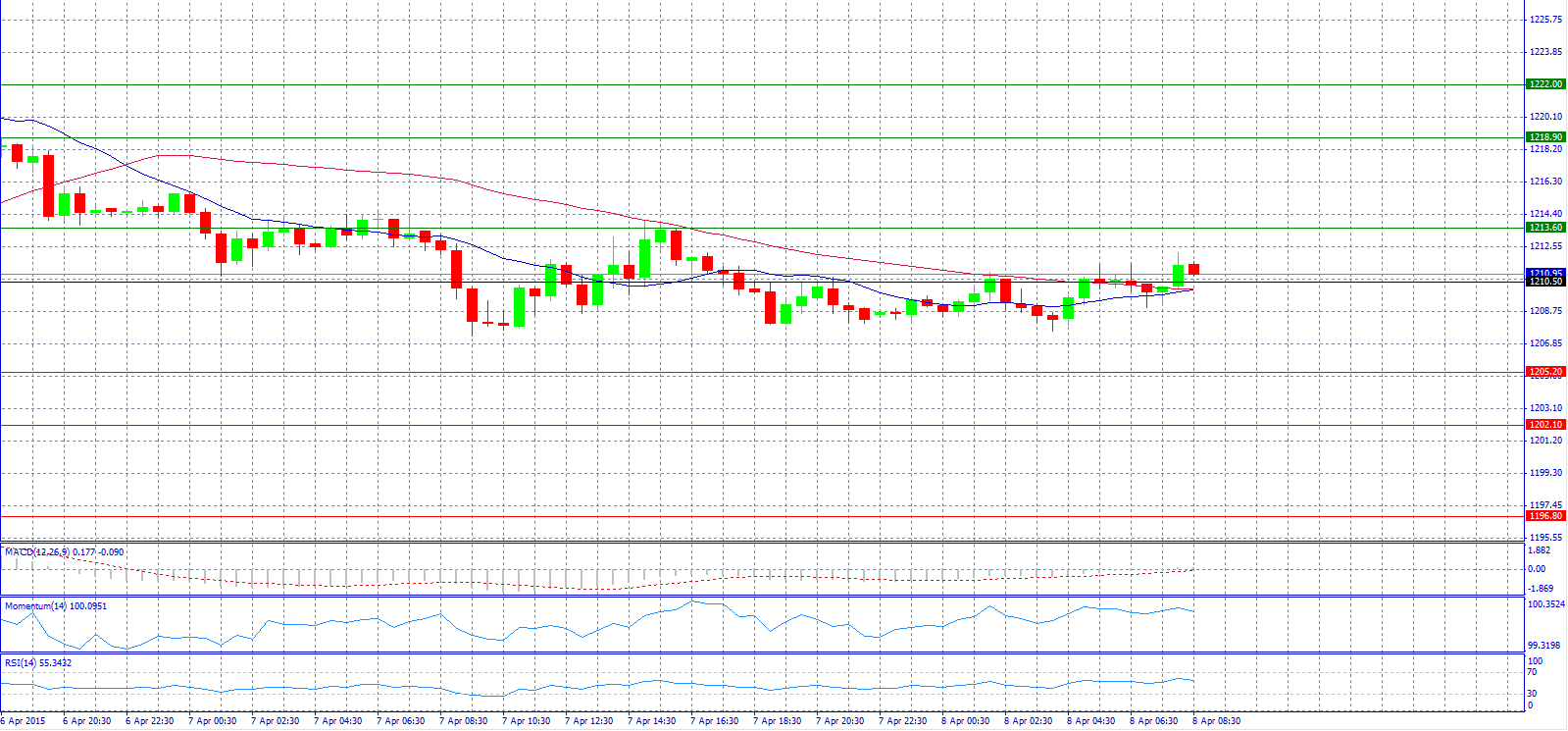

Market Scenario 1: Long positions above 1213.60 with target @ 1218.90.

Market Scenario 2: Short positions below 1210.50 with target @ 1205.20.

Comment: Gold prices trade above 1200.00 level and await for FOMC minutes.

Supports and Resistances:

R3 1222.00

R2 1218.90

R1 1213.60

PP 1210.50

S1 1205.20

S2 1202.10

S3 1196.80

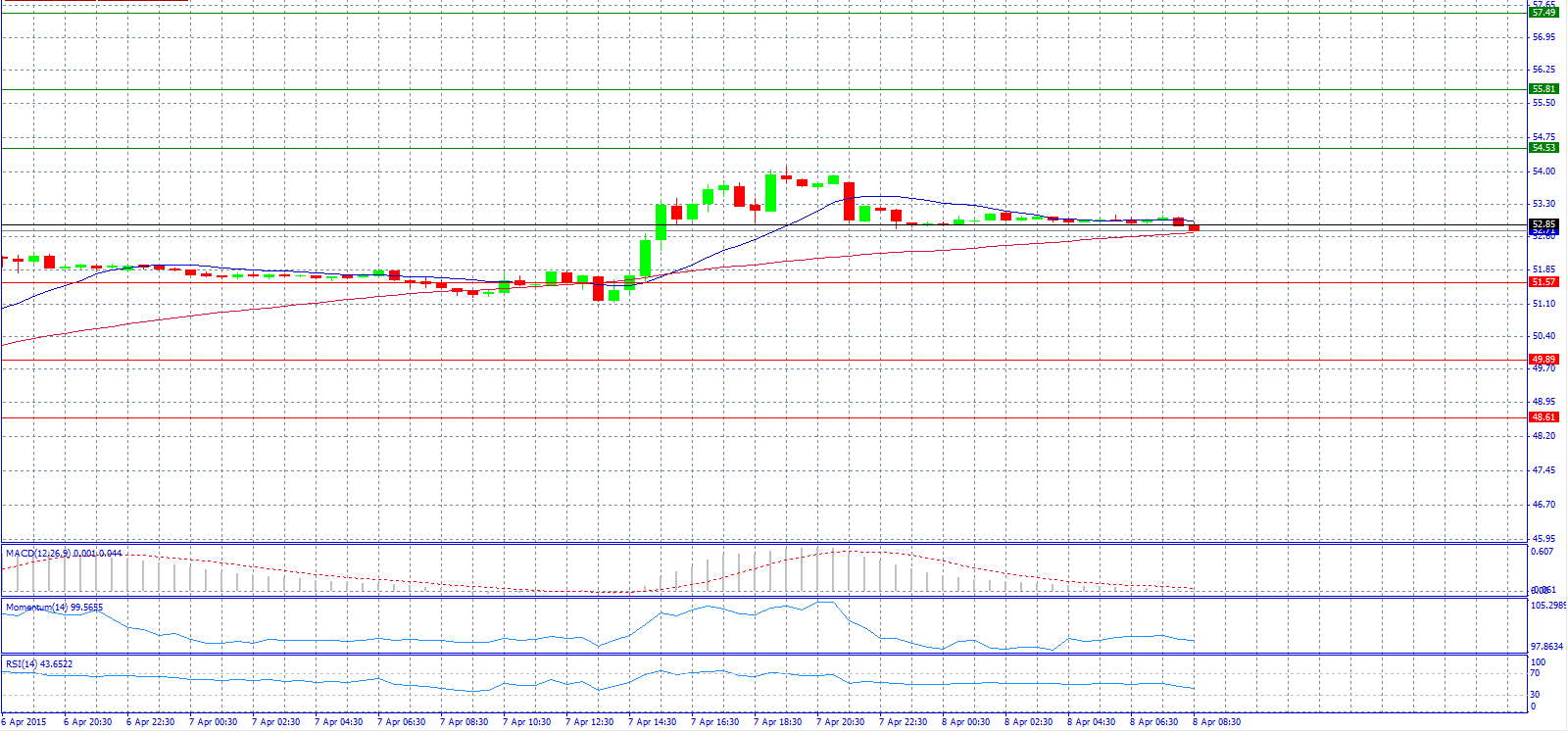

Market Scenario 1: Long positions above 52.85 with target @ 54.53.

Market Scenario 2: Short positions below 51.57 with target @ 49.89.

Comment: Crude oil prices trade below pivot point at 52.85 level.

Supports and Resistances:

R3 57.49

R2 55.81

R1 54.53

PP 52.85

S1 51.57

S2 49.89

S3 48.61

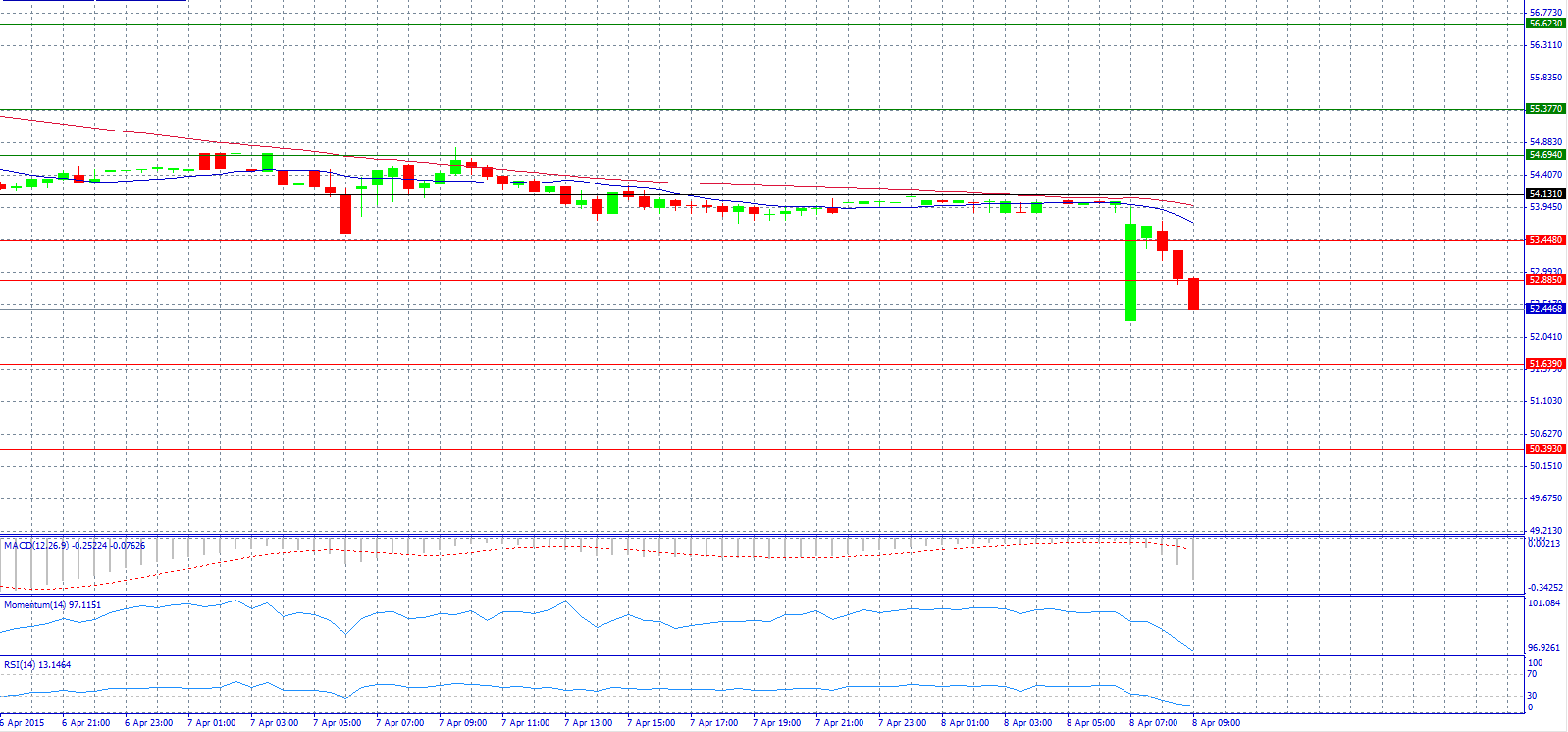

Market Scenario 1: Long positions above 52.885 with target @ 53.448.

Market Scenario 2: Short positions below 51.639 with target @ 50.393.

Comment: The pair has a bearish tone and trades below 52.900 level.

Supports and Resistances:

R3 56.623

R2 55.377

R1 54.694

PP 54.131

S1 53.448

S2 52.885

S3 51.639

S4 50.393