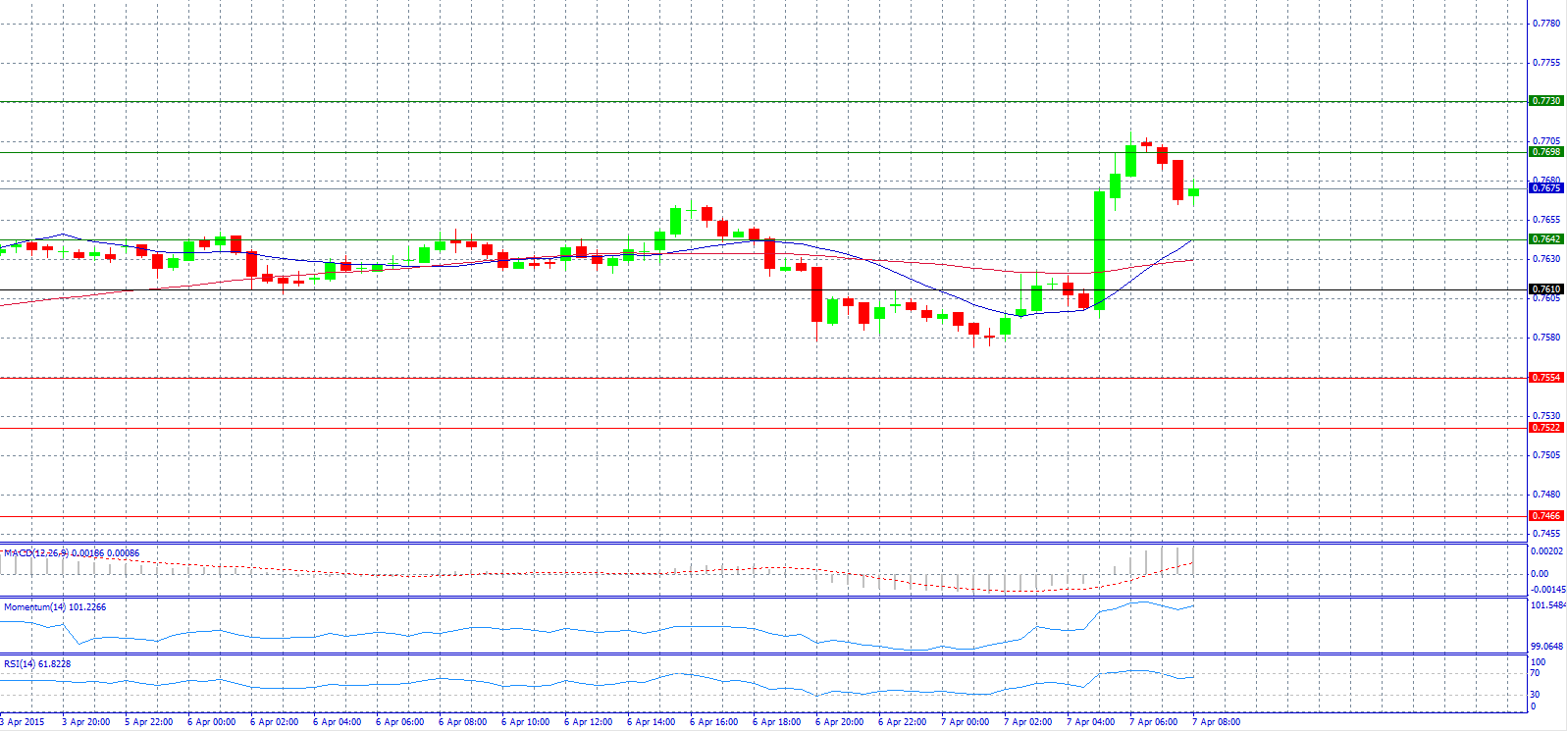

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7698 with target @ 0.7730.

Market Scenario 2: Short positions below 0.7642 with target @ 0.7610.

Comment: The pair consolidates RBA-backed gains below 0.7700 level.

Supports and Resistances:

R3 0.7730

R2 0.7698

R1 0.7642

PP 0.7610

S1 0.7554

S2 0.7522

S3 0.7466

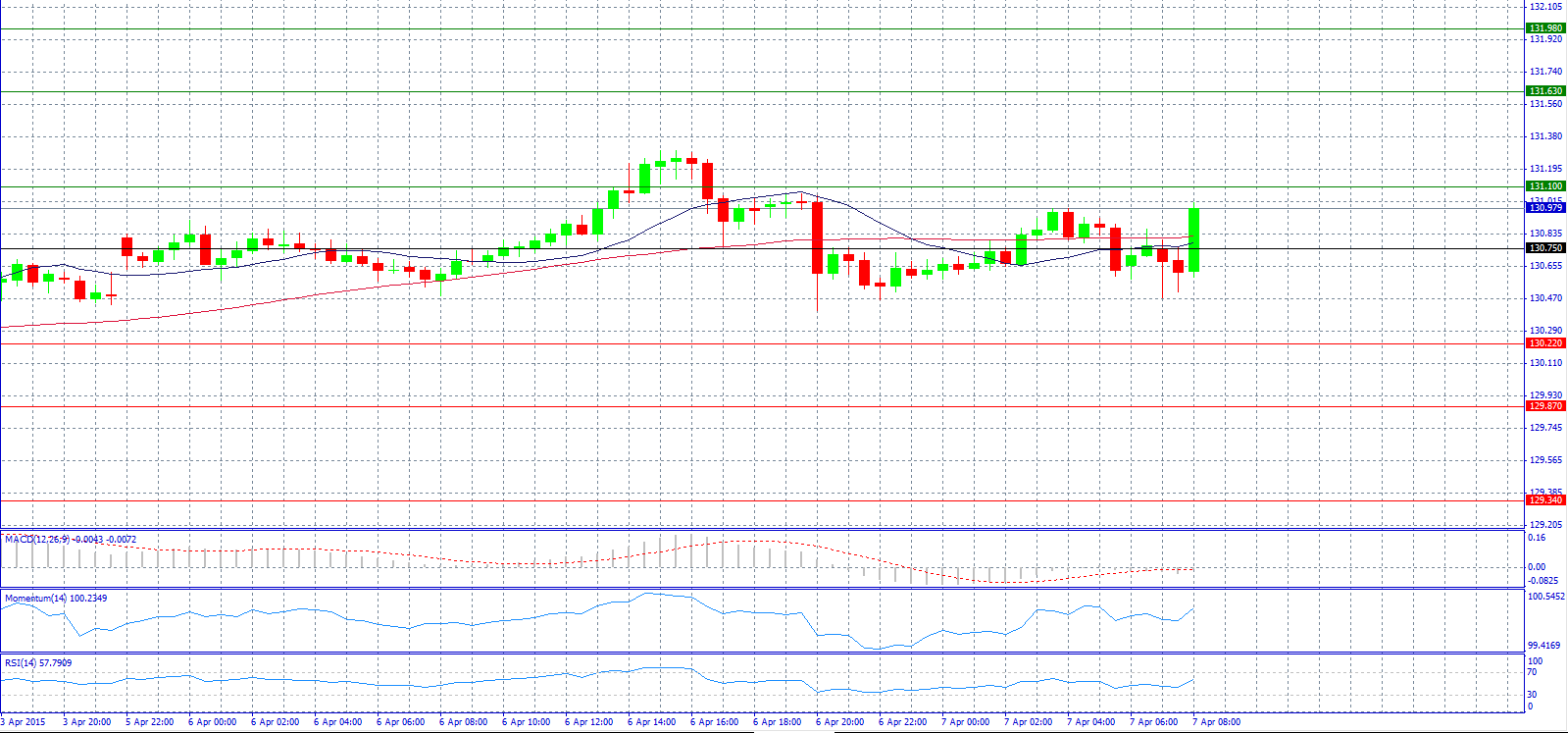

Market Scenario 1: Long positions above 131.10 with target @ 131.63.

Market Scenario 2: Short positions below 130.75 with target @ 130.22.

Comment: The pair is advancing higher near 131.00 level.

Supports and Resistances:

R3 131.98

R2 131.63

R1 131.10

PP 130.75

S1 130.22

S2 129.87

S3 129.34

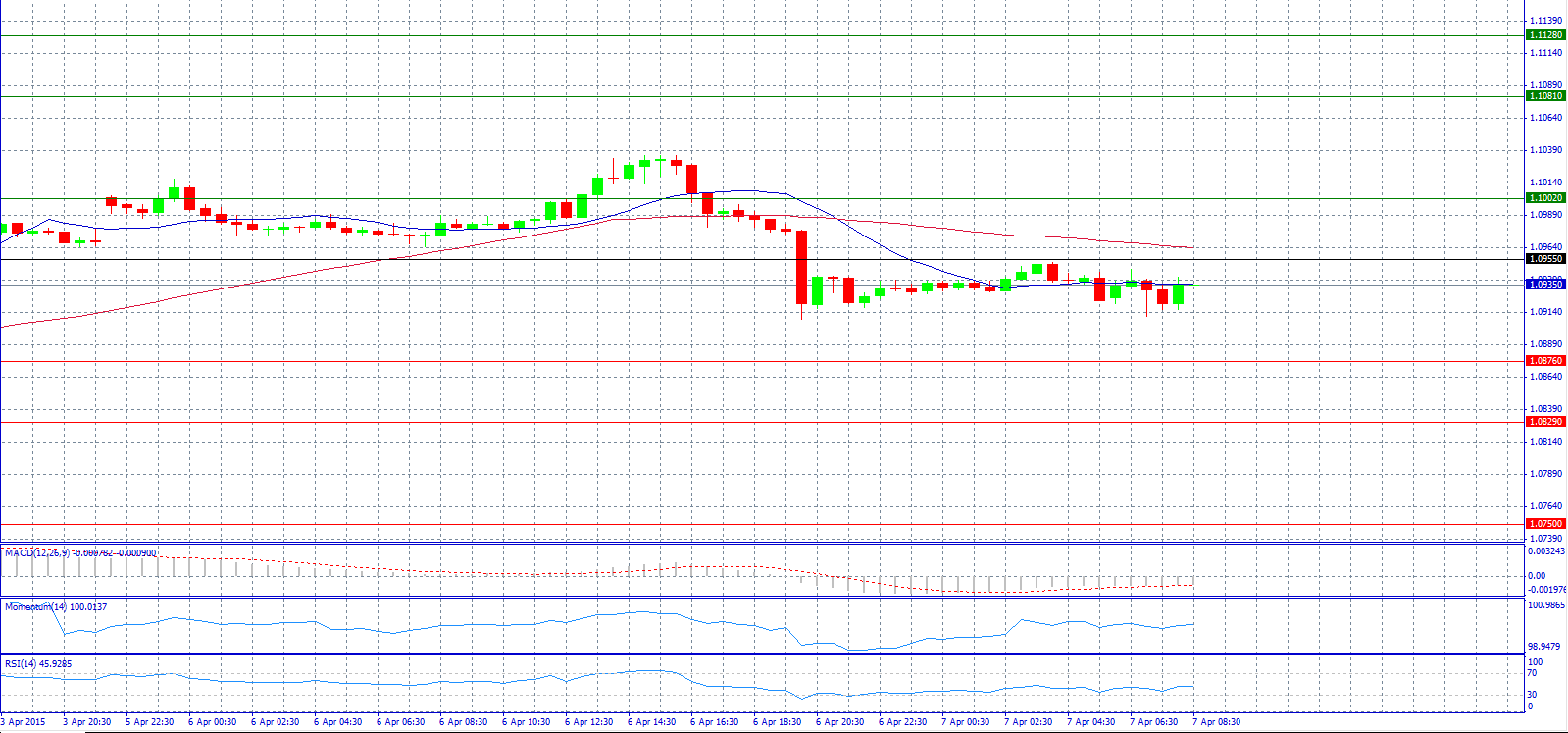

Market Scenario 1: Long positions above 1.0955 with target @ 1.1002.

Market Scenario 2: Short positions below 1.0876 with target @ 1.0829.

Comment: The pair might be pushed higher from the FOMC minutes tomorrow according to analysts.

Supports and Resistances:

R3 1.1128

R2 1.1081

R1 1.1002

PP 1.0955

S1 1.0876

S2 1.0829

S3 1.0750

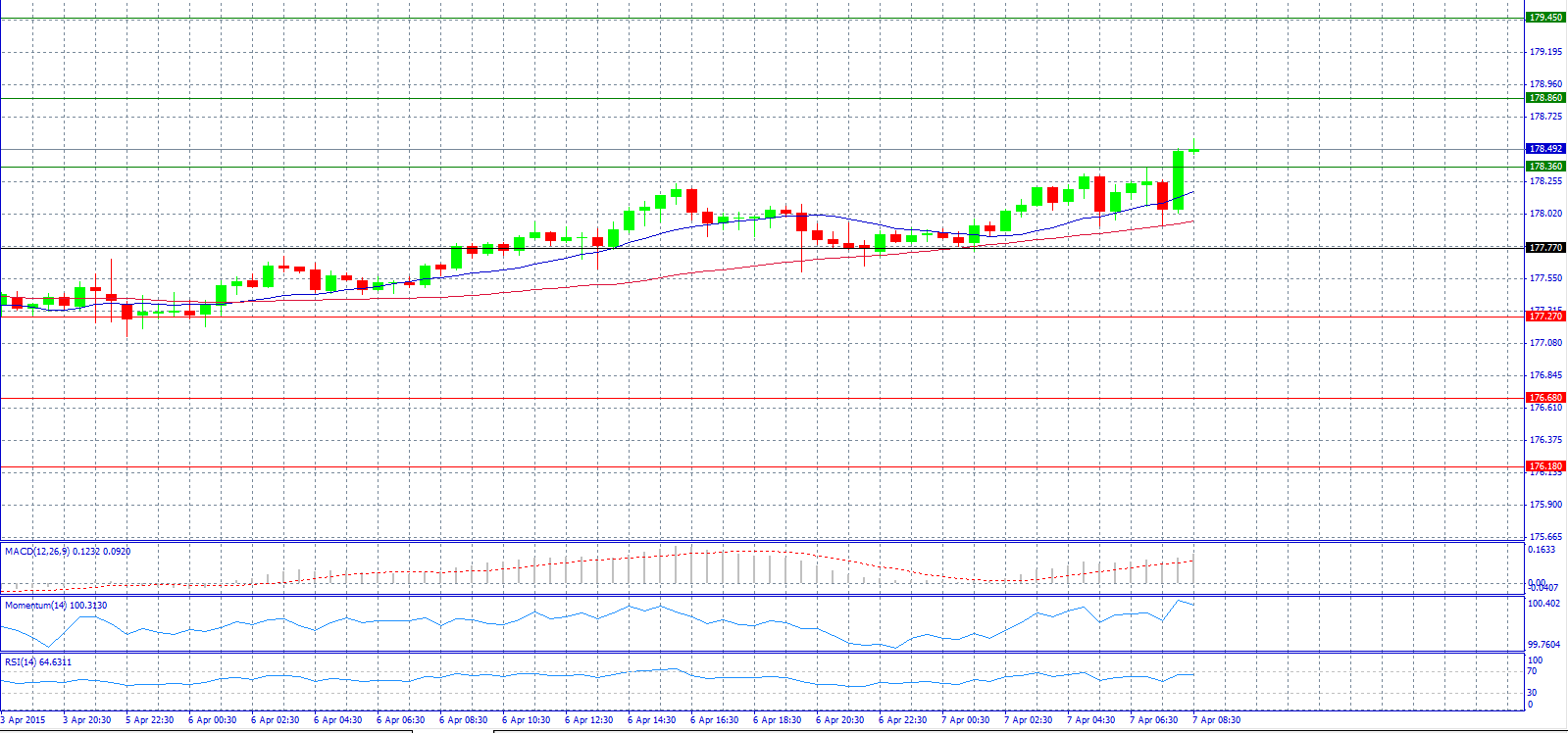

Market Scenario 1: Long positions above 178.86 with target @ 179.45.

Market Scenario 2: Short positions below 178.36 with target @ 177.77.

Comment: The pair might attract buyers because if we look long-term since 2012 the bulls have pushed this pair steadily upwards according to analysts.

Supports and Resistances:

R3 179.45

R2 178.86

R1 178.36

PP 177.77

S1 177.27

S2 176.68

S3 176.18

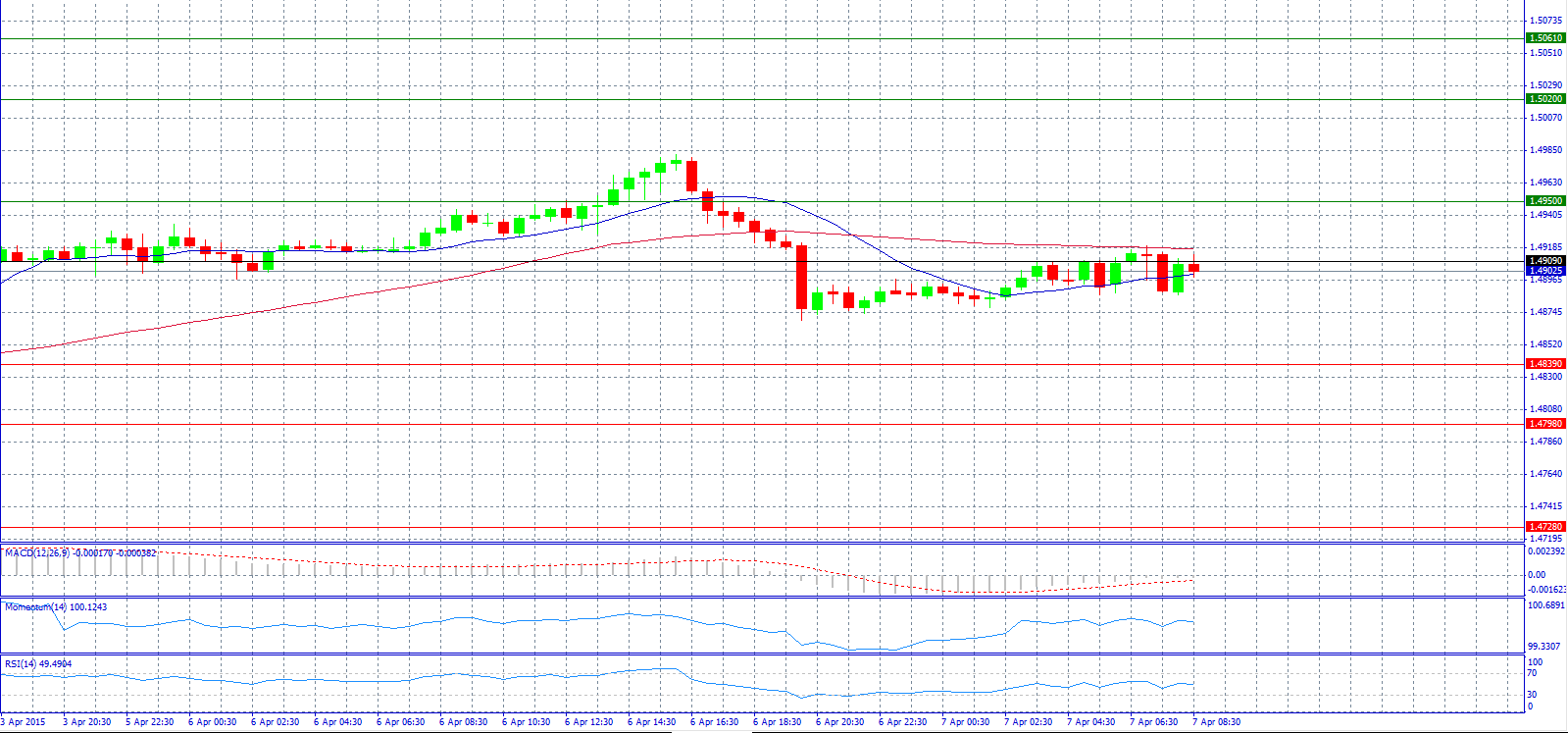

Market Scenario 1: Long positions above 1.4909 with target @ 1.4950.

Market Scenario 2: Short positions below 1.4839 with target @ 1.4798.

Comment: The offered tone on the USD is on the rise ahead of the European session, which has led the pair to a session high of 1.4914 level.

Supports and Resistances:

R3 1.5061

R2 1.5020

R1 1.4950

PP 1.4909

S1 1.4839

S2 1.4798

S3 1.4728

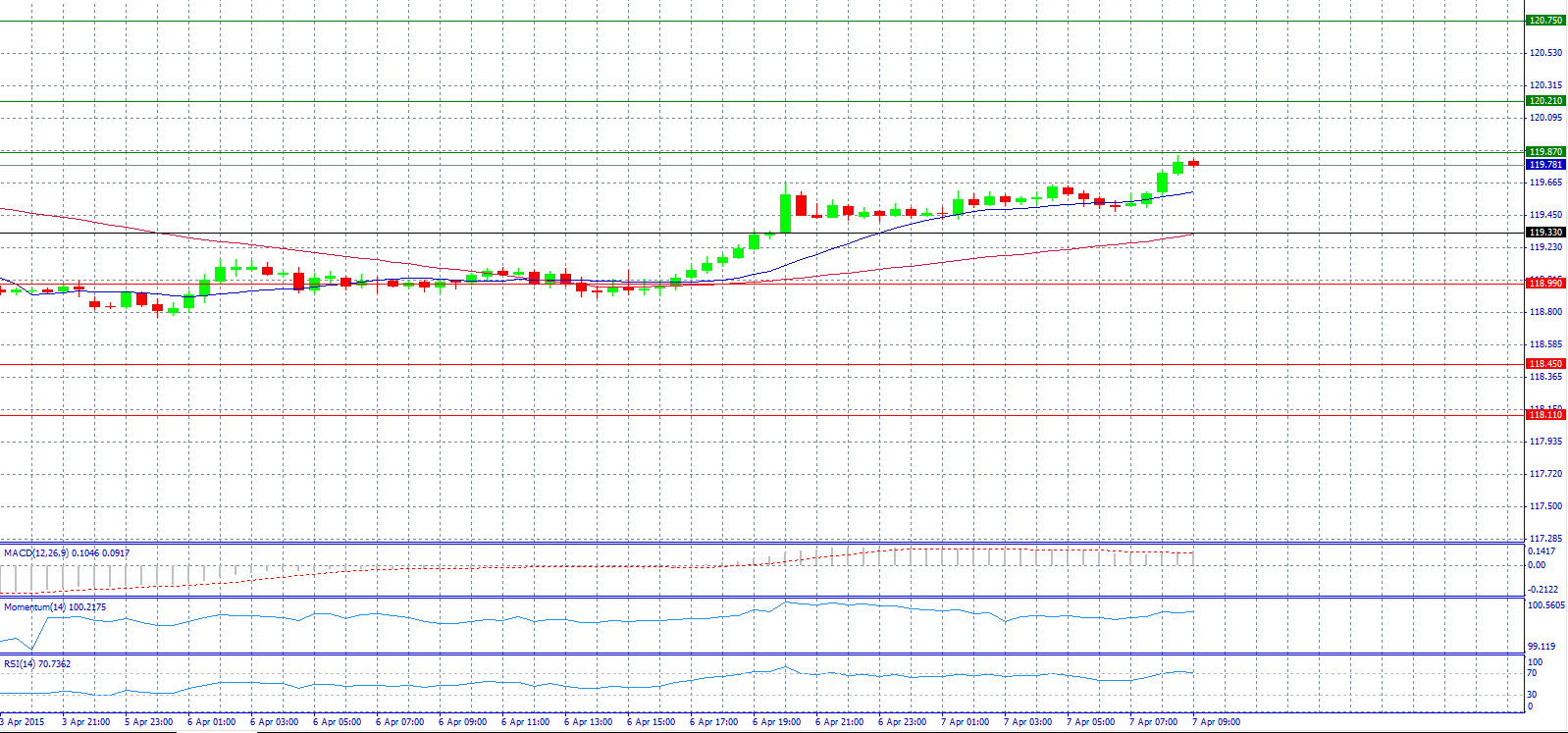

Market Scenario 1: Long positions above 119.87 with target @ 120.21.

Market Scenario 2: Short positions below 119.33 with target @ 118.99.

Comment: The pair regains upward momentum unexpectedly.

Supports and Resistances:

R3 120.75

R2 120.21

R1 119.87

PP 119.33

S1 118.99

S2 118.45

S3 118.11

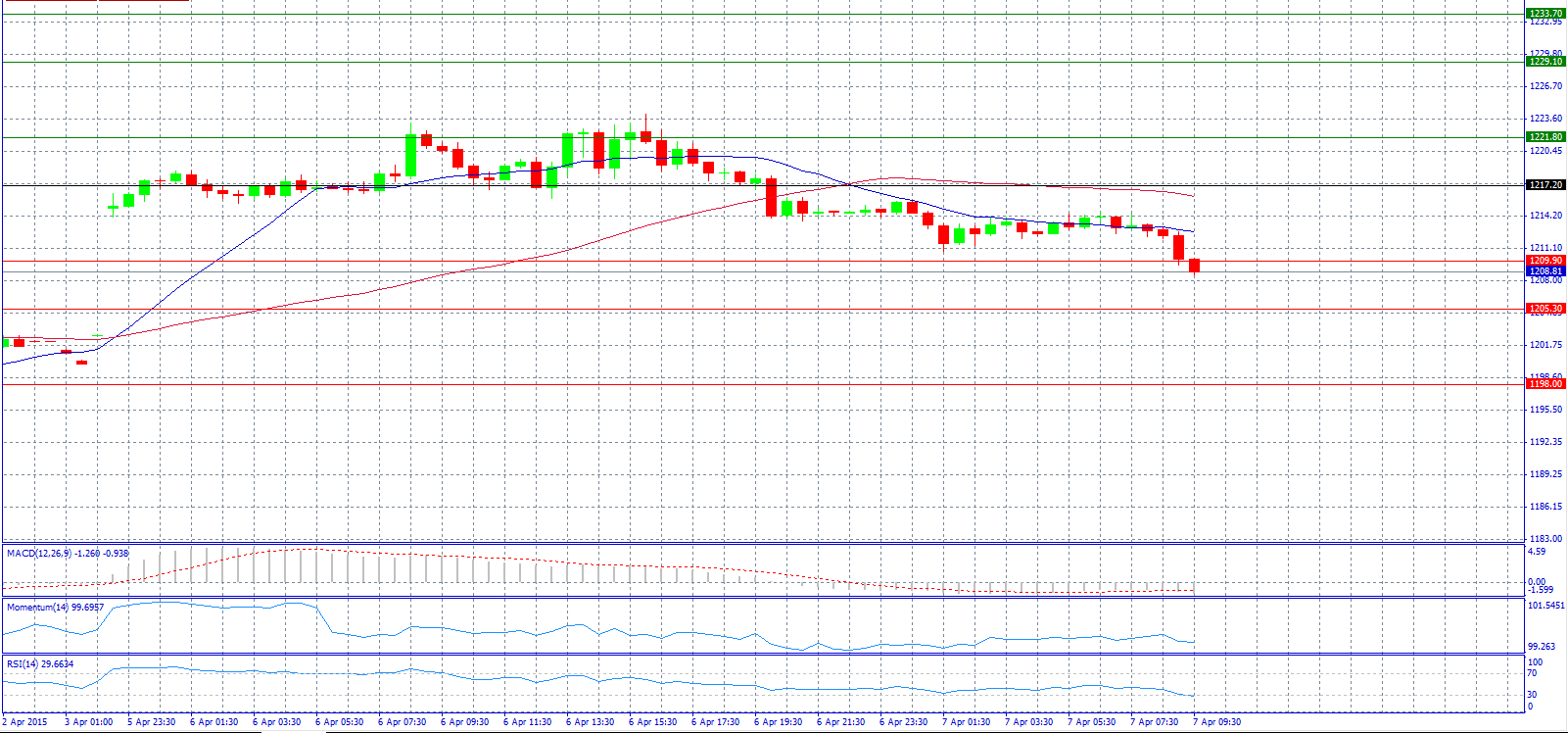

Market Scenario 1: Long positions above 1209.90 with target @ 1217.20.

Market Scenario 2: Short positions below 1205.30 with target @ 1198.98.

Comment: Gold prices have a bearish tone and trade below 1209.00 level.

Supports and Resistances:

R3 1233.70

R2 1229.10

R1 1221.80

PP 1217.20

S1 1209.90

S2 1205.30

S3 1198.00

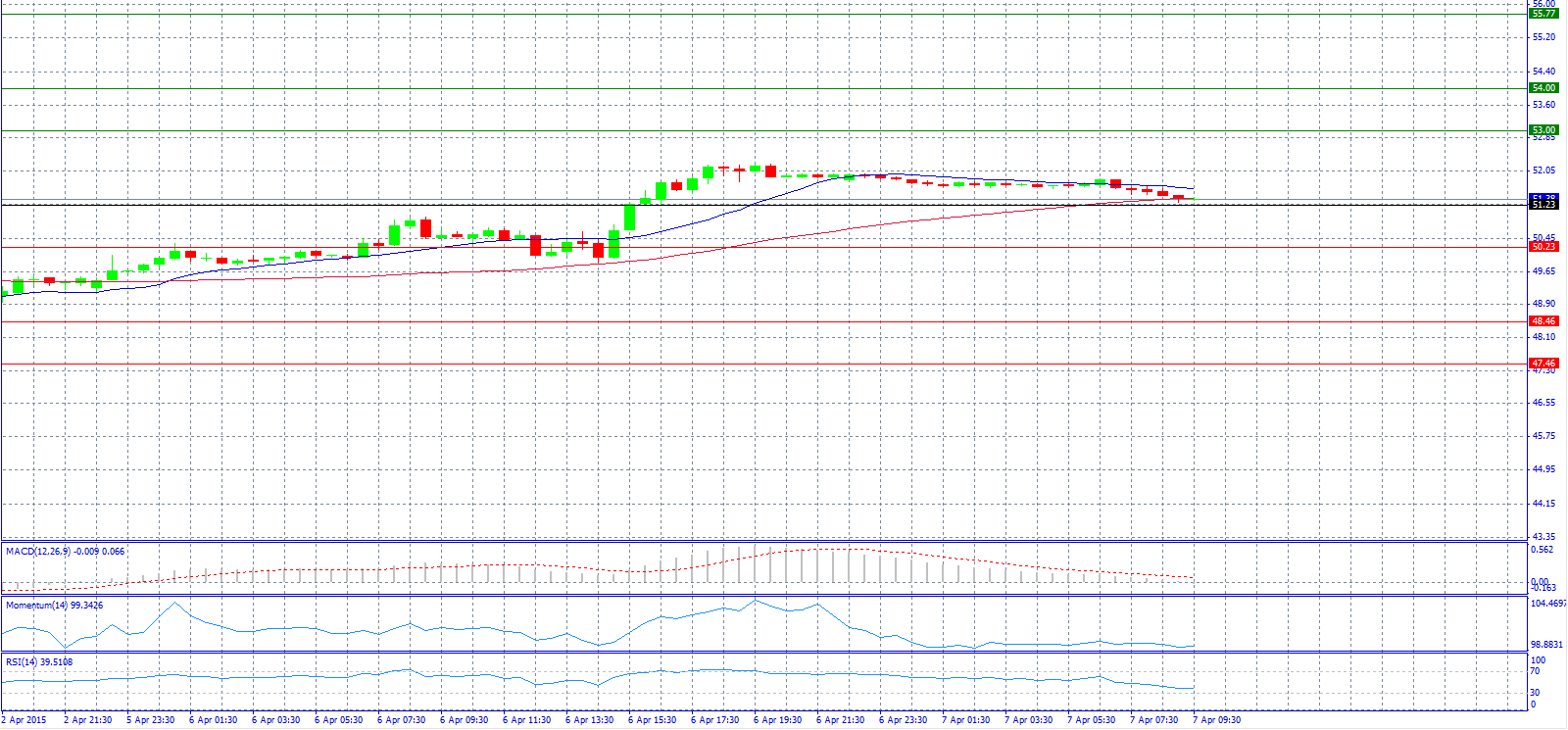

Market Scenario 1: Long positions above 53.00 with target @ 54.00.

Market Scenario 2: Short positions below 51.23 with target @ 50.23.

Comment: Crude oil prices decline on weak trend in overseas market.

Supports and Resistances:

R3 55.77

R2 54.00

R1 53.00

PP 51.23

S1 50.23

S2 48.46

S3 47.46

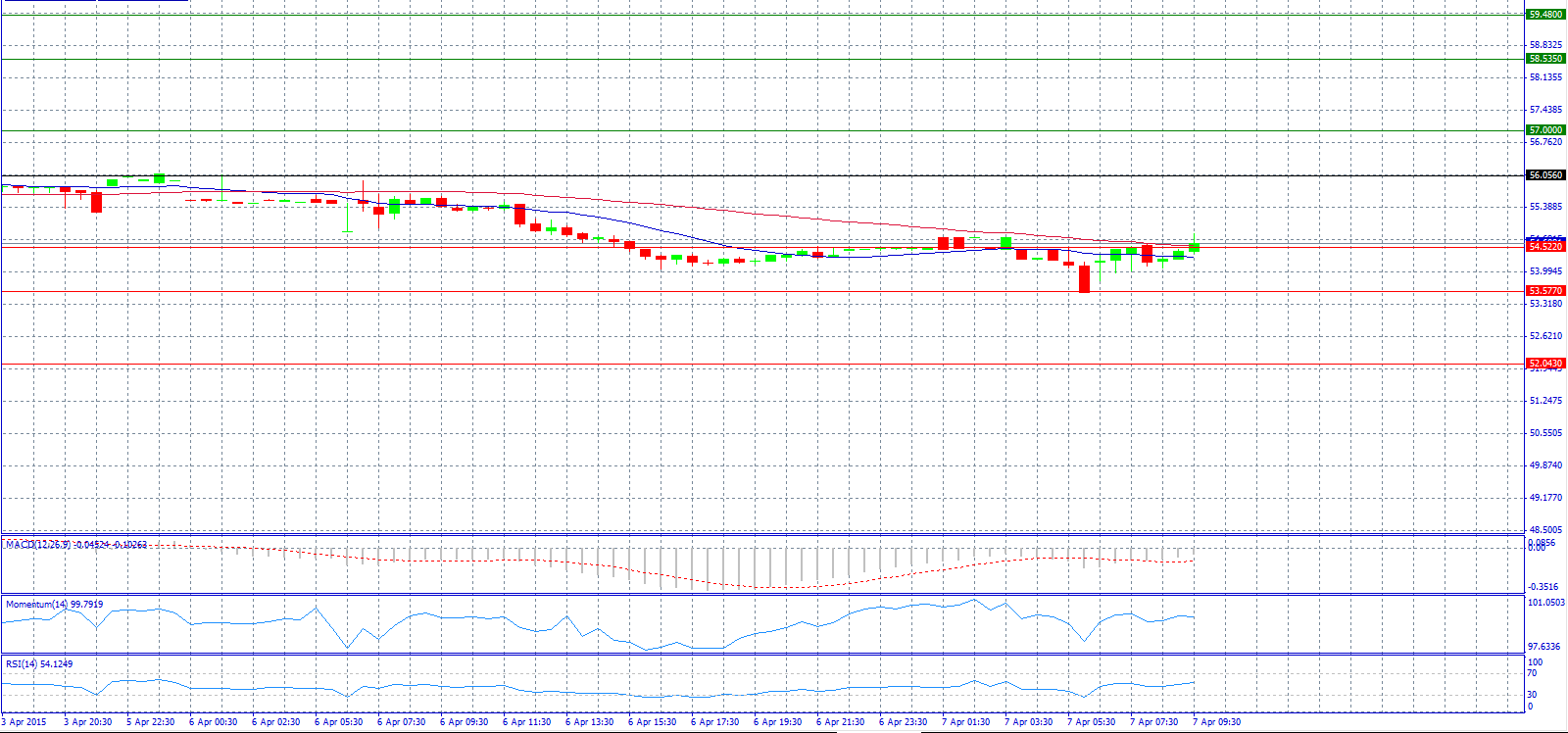

Market Scenario 1: Long positions above 54.522 with target @ 56.056.

Market Scenario 2: Short positions below 53.577 with target @ 52.043.

Comment: The Russian ruble strengthened today morning, extending gains from Monday evening when the pair hit a new 2015 low affected by the international oil price.

Supports and Resistances:

R3 59.480

R2 58.535

R1 57.000

PP 56.056

S1 54.522

S2 53.577

S3 52.043