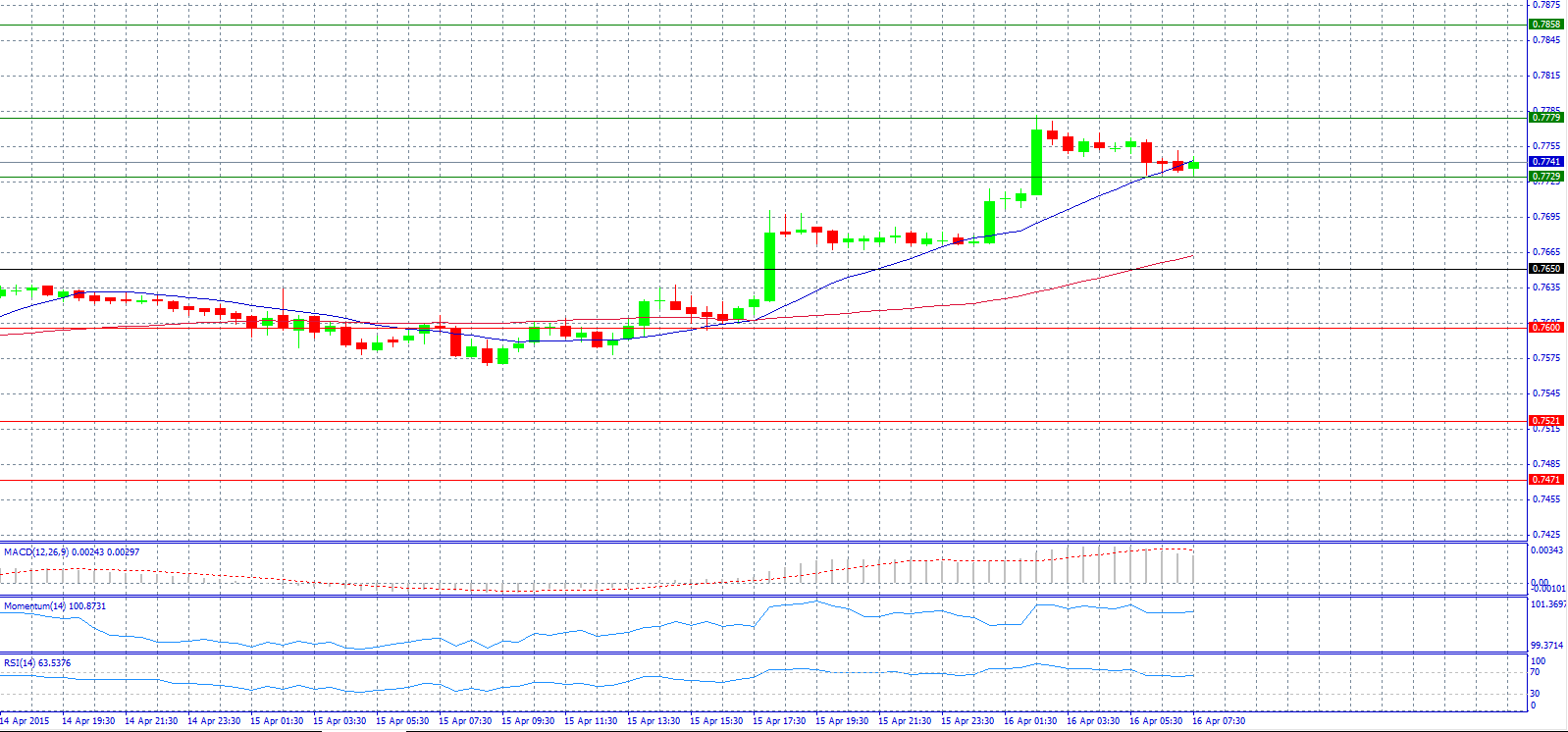

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7779 with target @ 0.7858.

Market Scenario 2: Short positions below 0.7729 with target @ 0.7650.

Comment: The pair strengthened after Australian unemployment rate surprisingly fell in March.

Supports and Resistances:

R3 0.7858

R2 0.7779

R1 0.7729

PP 0.7650

S1 0.7600

S2 0.7521

S3 0.7471

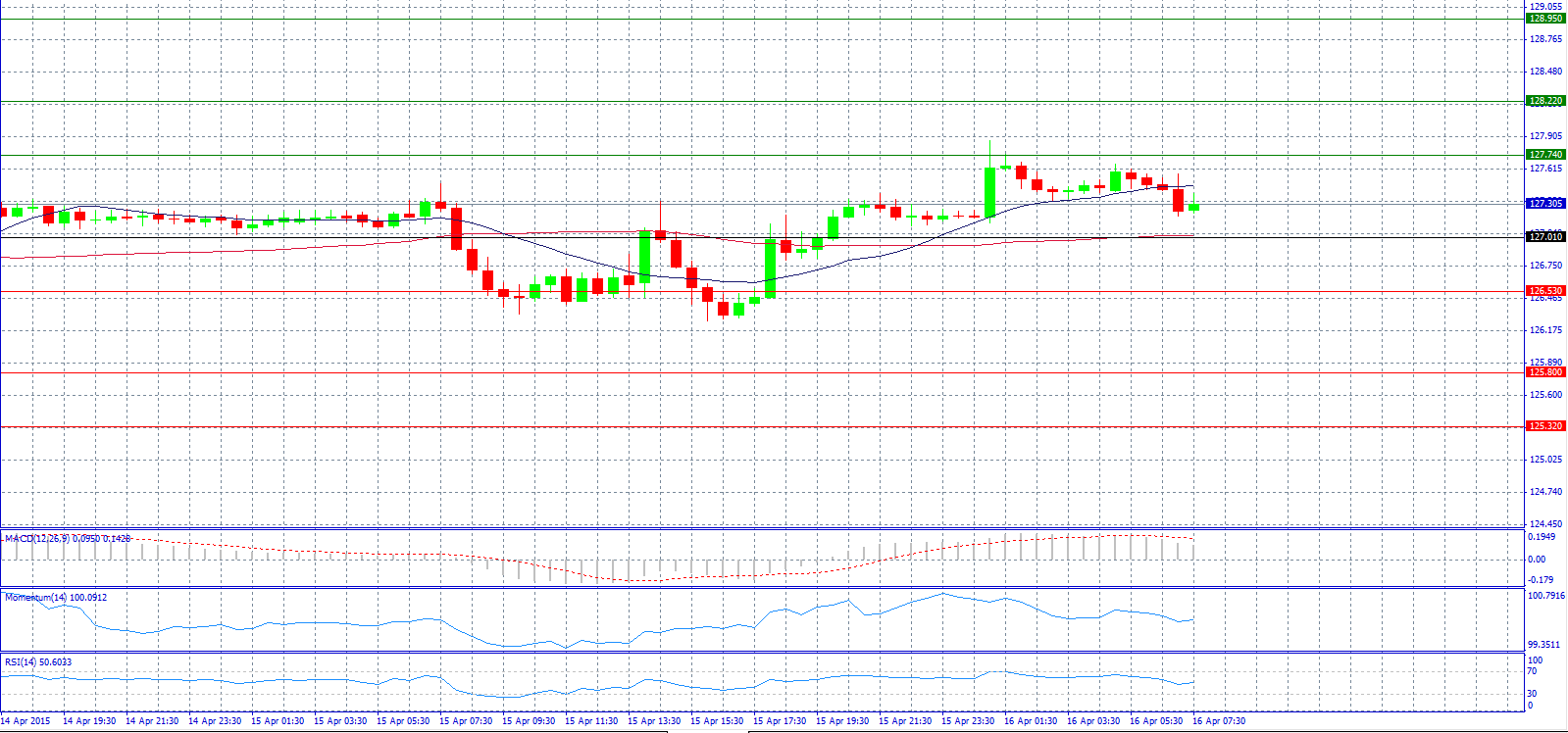

Market Scenario 1: Long positions above 127.74 with target @ 128.22.

Market Scenario 2: Short positions below 127.01 with target @ 126.53.

Comment: The pair initially fell during the course of the session on Wednesday, but found enough support to turn things back around and now trades steady near 127.30 level.

Supports and Resistances:

R3 128.95

R2 128.22

R1 127.74

PP 127.01

S1 126.53

S2 125.80

S3 125.32

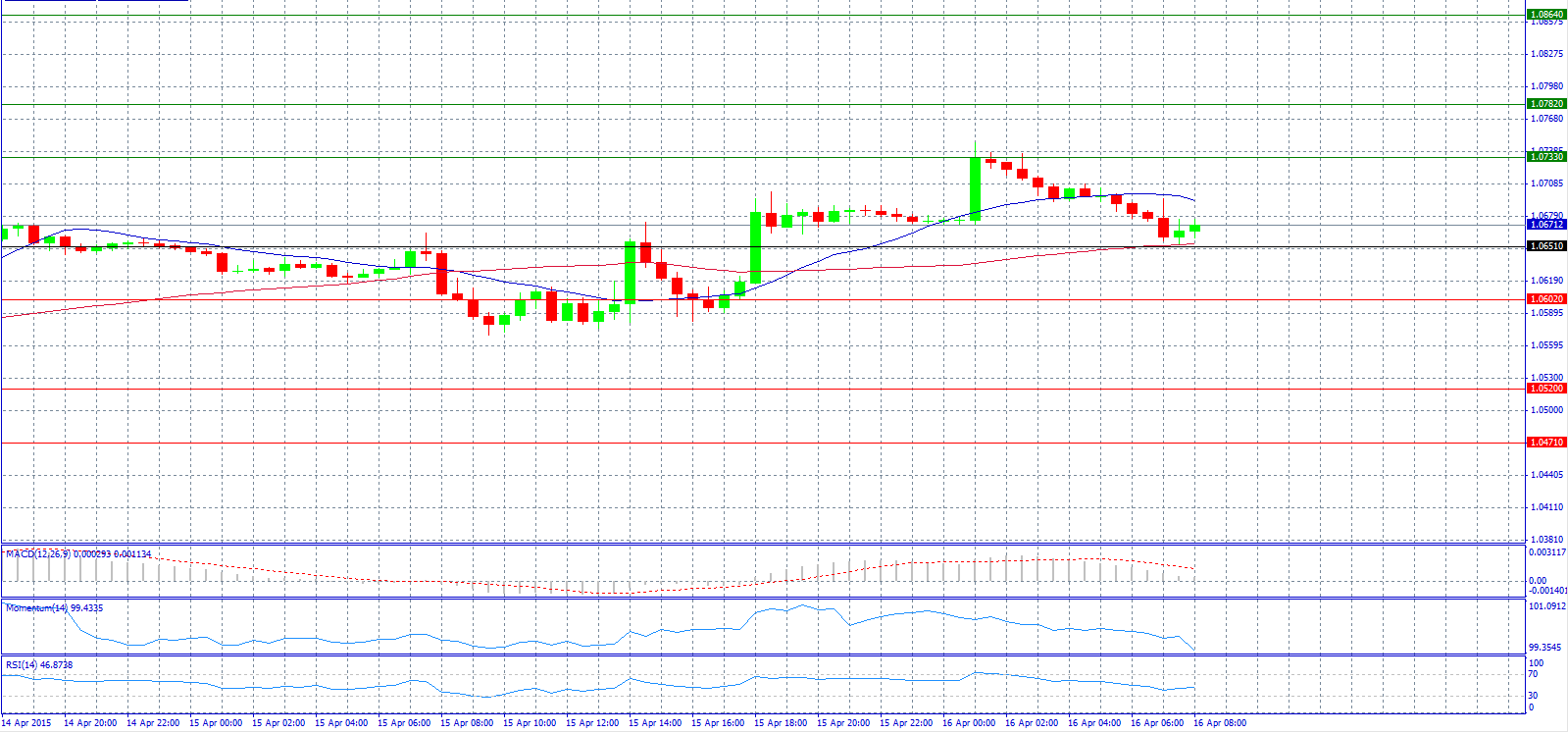

Market Scenario 1: Long positions above 1.0733 with target @ 1.0782.

Market Scenario 2: Short positions below 1.0651 with target @ 1.0602.

Comment: The pair bounce from lows but still has a bearish tone.

Supports and Resistances:

R3 1.0864

R2 1.0782

R1 1.0733

PP 1.0651

S1 1.0602

S2 1.0520

S3 1.0471

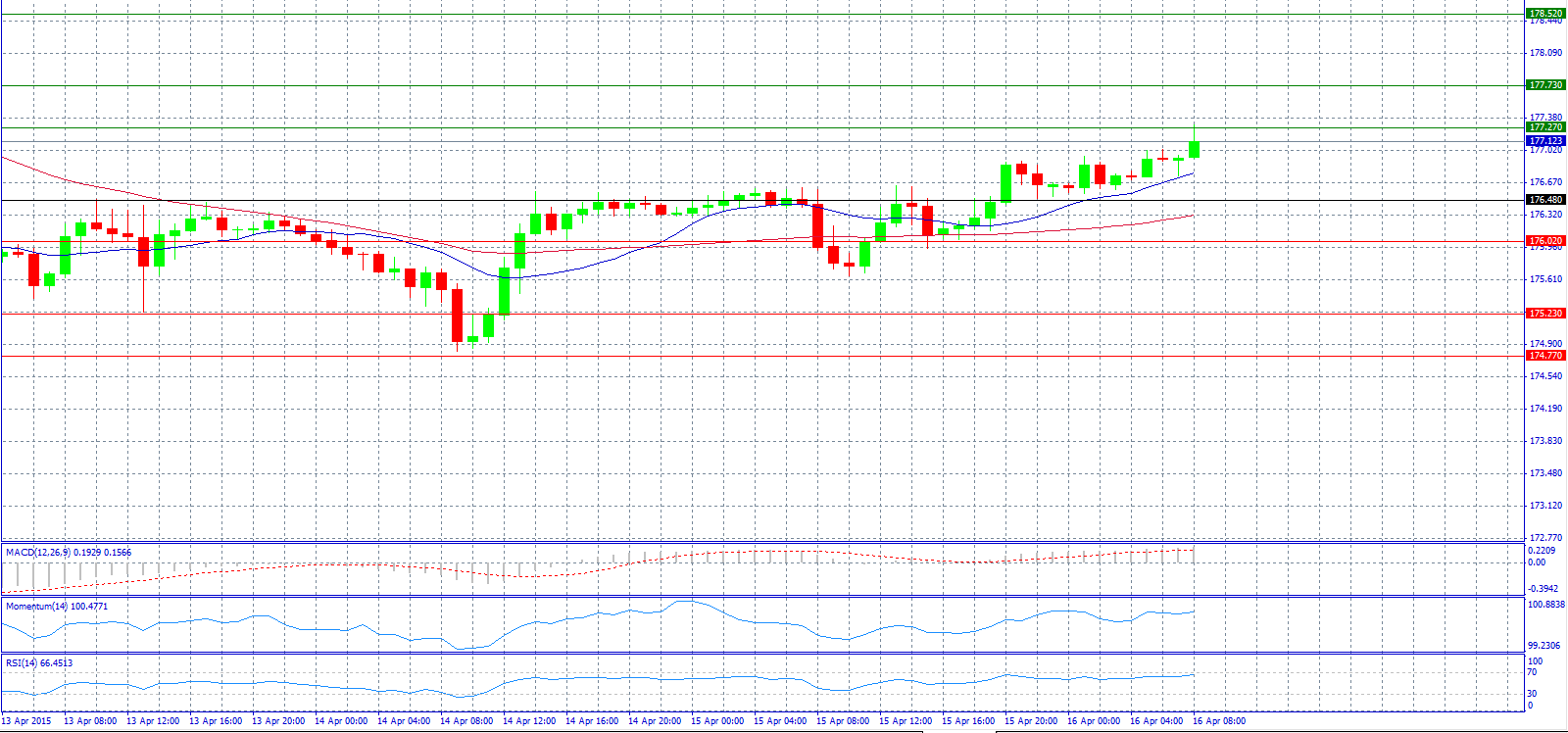

Market Scenario 1: Long positions above 177.27 with target @ 177.73.

Market Scenario 2: Short positions below 176.48 with target @ 176.02.

Comment: The pair trades steady above 177.00 level.

Supports and Resistances:

R3 178.52

R2 177.73

R1 177.27

PP 176.48

S1 176.02

S2 175.23

S3 174.77

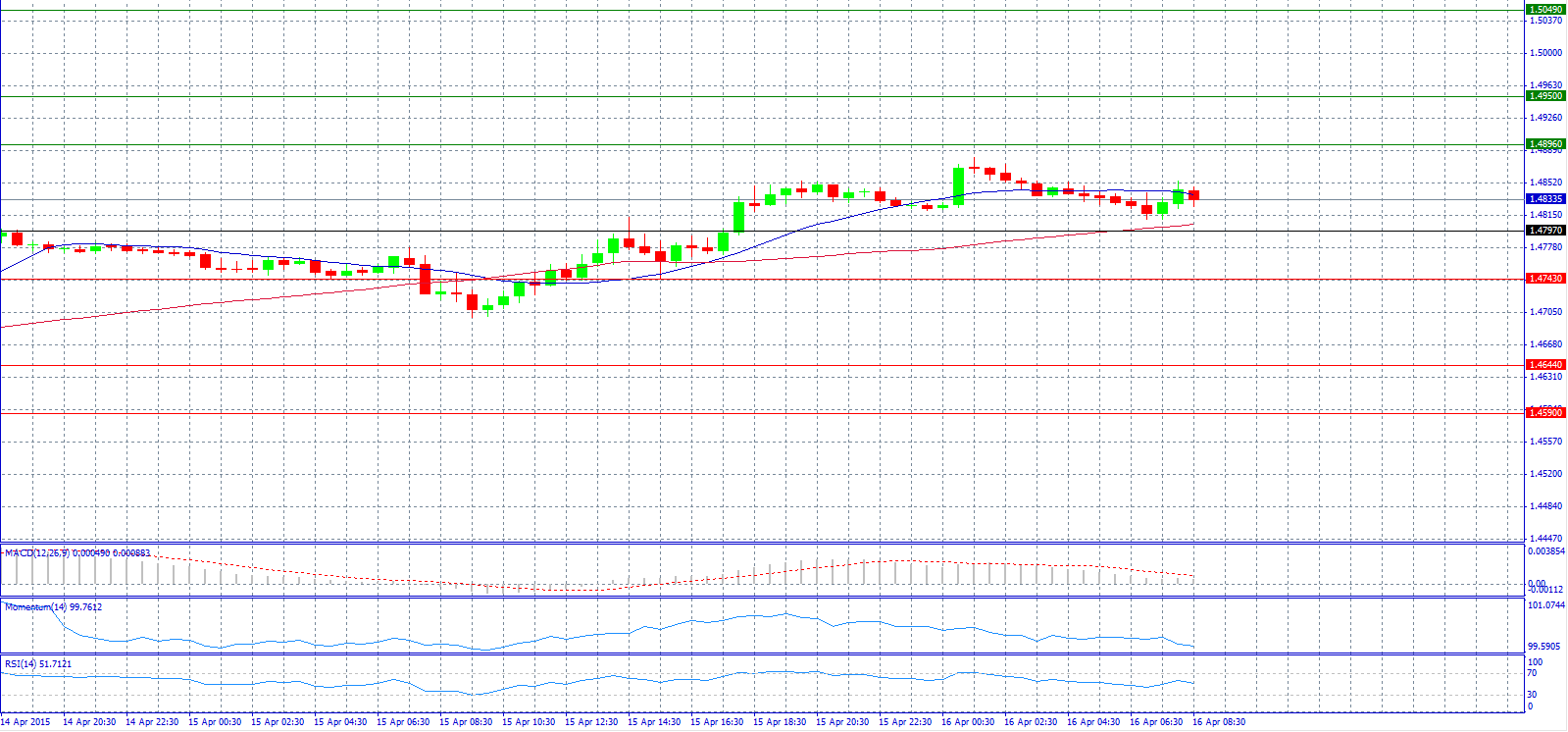

Market Scenario 1: Long positions above 1.4896 with target @ 1.4950.

Market Scenario 2: Short positions below 1.4797 with target @ 1.4743.

Comment: The pair initially fell during the session on Wednesday, but found enough momentum to the upside to break above the 1.4800 level.

Supports and Resistances:

R3 1.5049

R2 1.4950

R1 1.4896

PP 1.4797

S1 1.4743

S2 1.4644

S3 1.4590

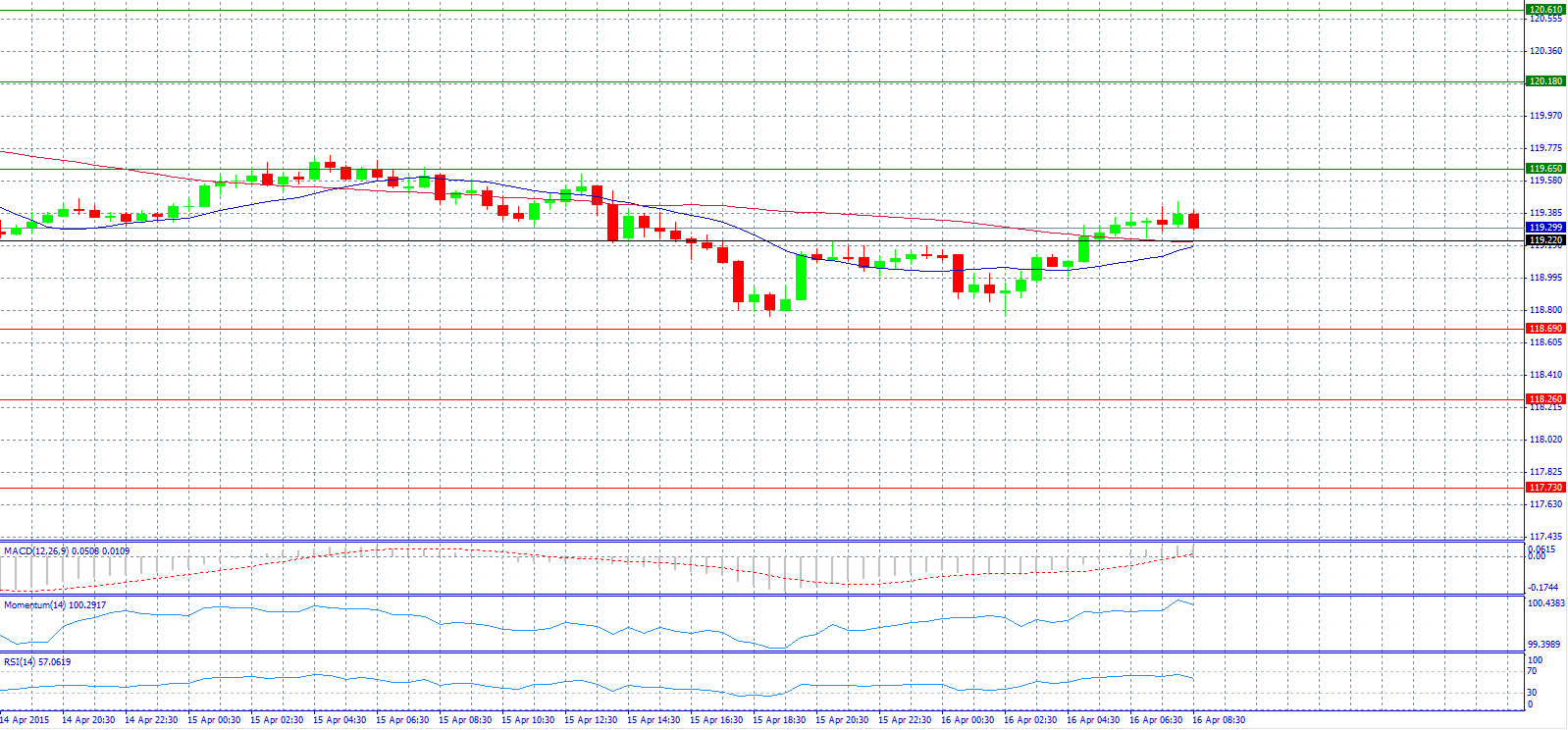

Market Scenario 1: Long positions above 119.65 with target @ 120.18.

Market Scenario 2: Short positions below 119.22 with target @ 118.69.

Comment: The pair might see further patchy downward movement, but remain above 118.55/60 levels according to analysts.

Supports and Resistances:

R3 120.61

R2 120.18

R1 119.65

PP 119.22

S1 118.69

S2 118.26

S3 117.73

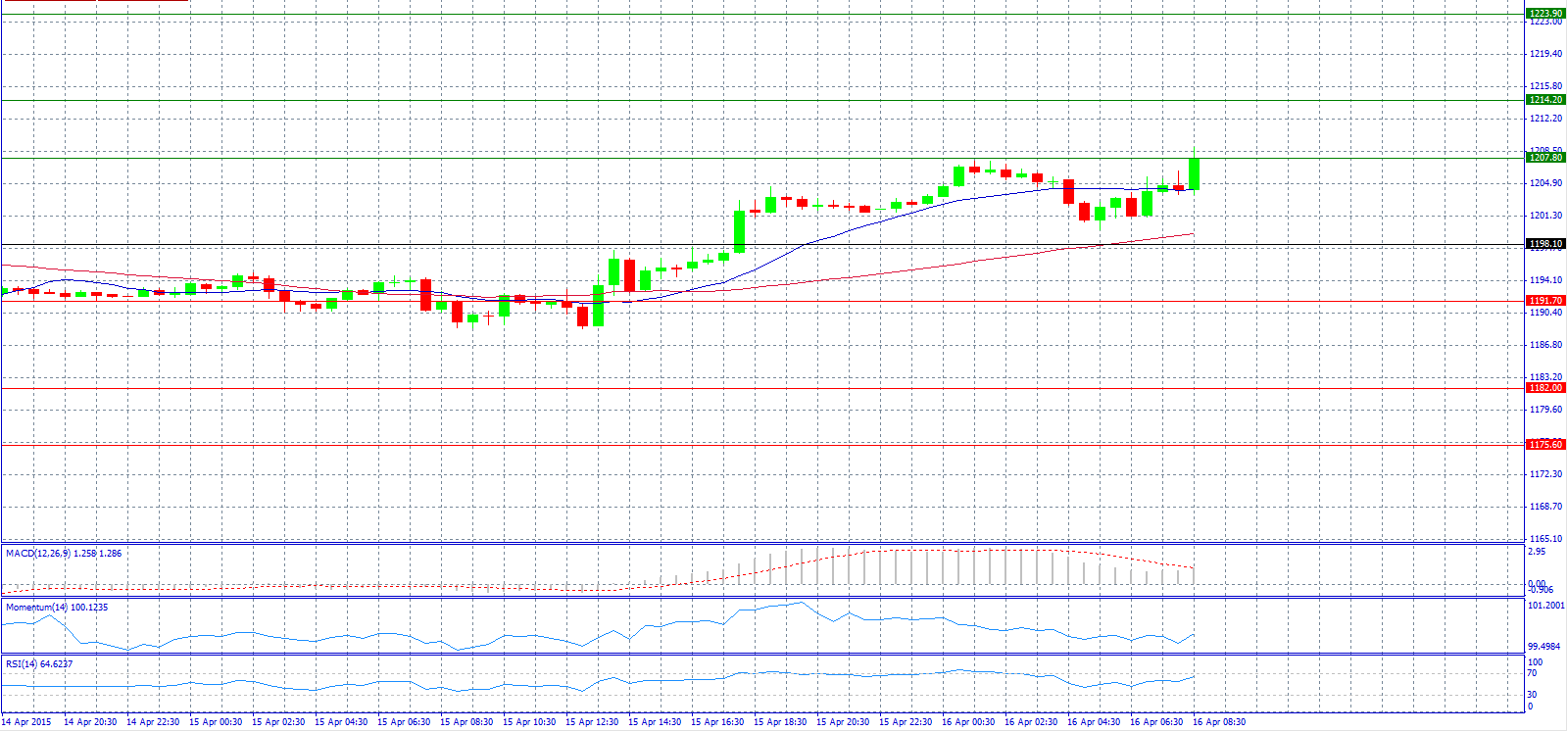

Market Scenario 1: Long positions above 1207.80 with target @ 1214.20.

Market Scenario 2: Short positions below 1207.80 with target @ 1198.10.

Comment: Gold prices trade above 1200.00 level and await for US date to be released.

Supports and Resistances:

R3 1223.90

R2 1214.20

R1 1207.80

PP 1198.10

S1 1191.70

S2 1182.00

S3 1175.60

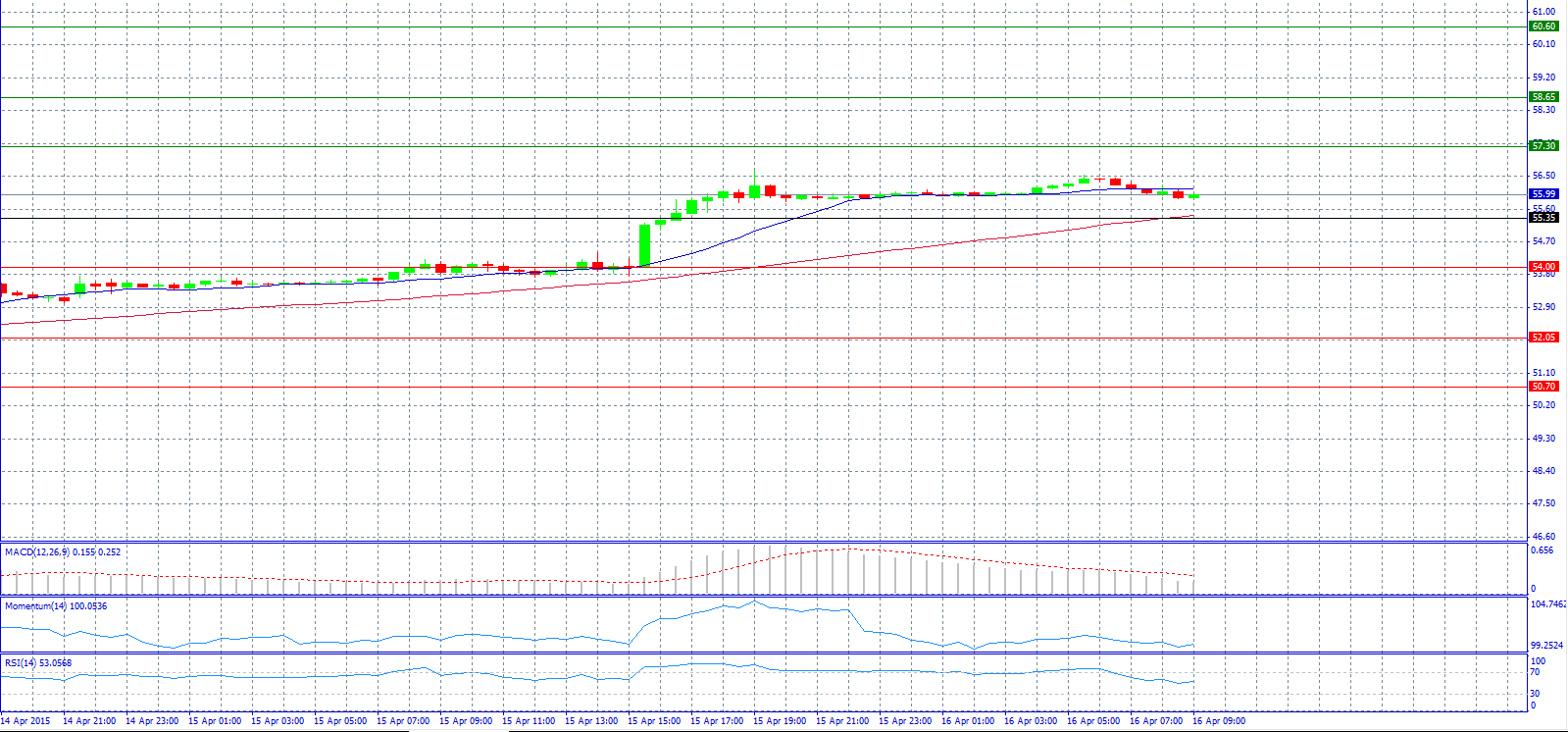

Market Scenario 1: Long positions above 57.30 with target @ 58.65.

Market Scenario 2: Short positions below 55.35 with target @ 54.00.

Comment: Crude oil price reached56.39 level which is the highest price this year, after the Energy Department said that storage of crude rose by the smallest amount in three months.

Supports and Resistances:

R3 60.60

R2 58.65

R1 57.30

PP 55.35

S1 54.00

S2 52.05

S3 50.70

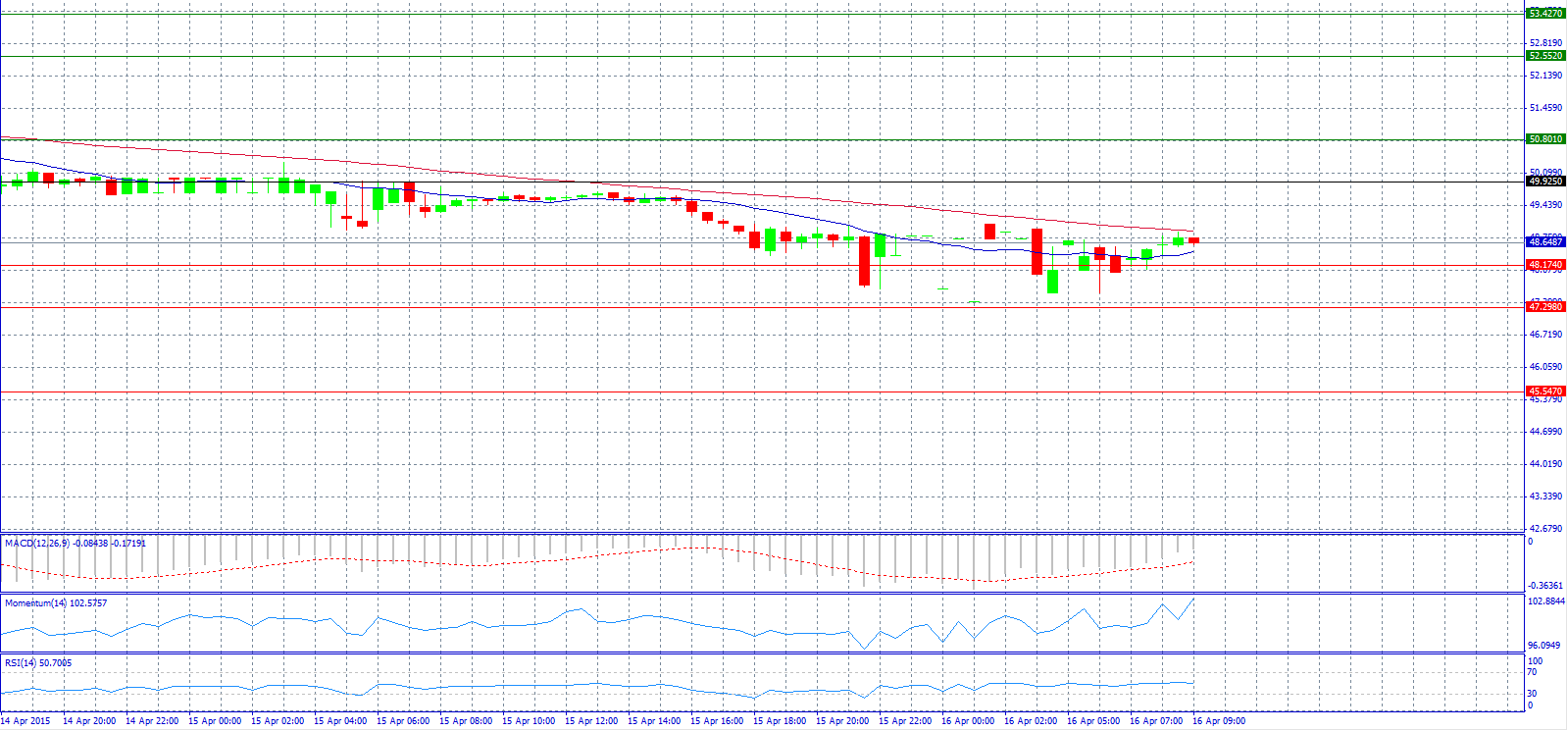

Market Scenario 1: Long positions above 49.925 with target @ 50.801.

Market Scenario 2: Short positions below 48.174 with target @ 47.298.

Comment: The pair reached a new 2015 low as oil jumped.

Supports and Resistances:

R3 53.427

R2 52.552

R1 50.801

PP 49.925

S1 48.174

S2 47.298

S3 45.547