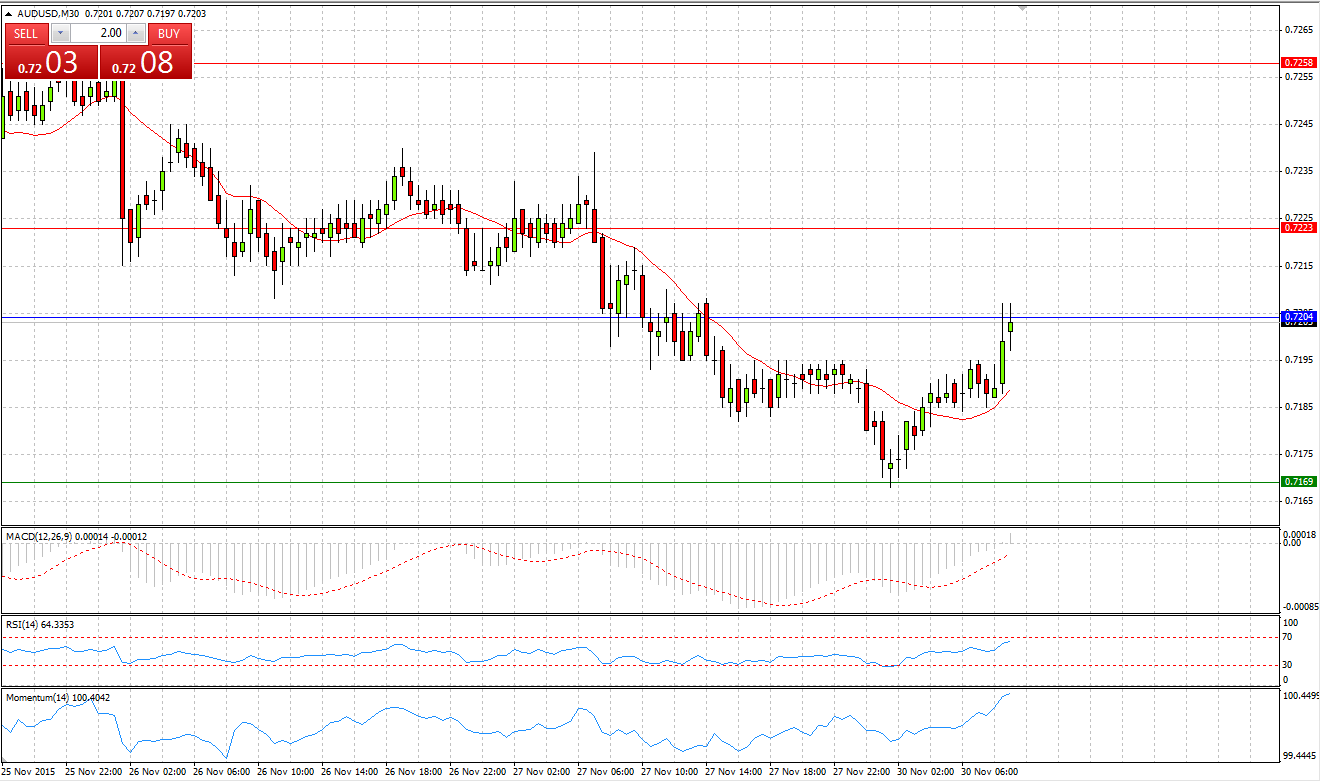

Market Scenario 1: Long positions above 0.7204 with targets at 0.7223 and 0.7258

Market Scenario 2: Short positions below 0.7204 with targets at 0.7169 and 0.7150

Comment: After losing 30 pips against US dollar on Friday’s session, Aussie managed to gather the strength heated by positive news out of Australian Bureau of Statistics, showing that Companies profit increased by 1.3% in the previous quarter, taking back almost all the losses incurred on Friday. Currently AUD/USD is testing Pivot Point level.

Supports and Resistances:

R3 0.7277

R2 0.7258

R1 0.7223

PP 0.7204

S1 0.7169

S2 0.7150

S3 0.7115

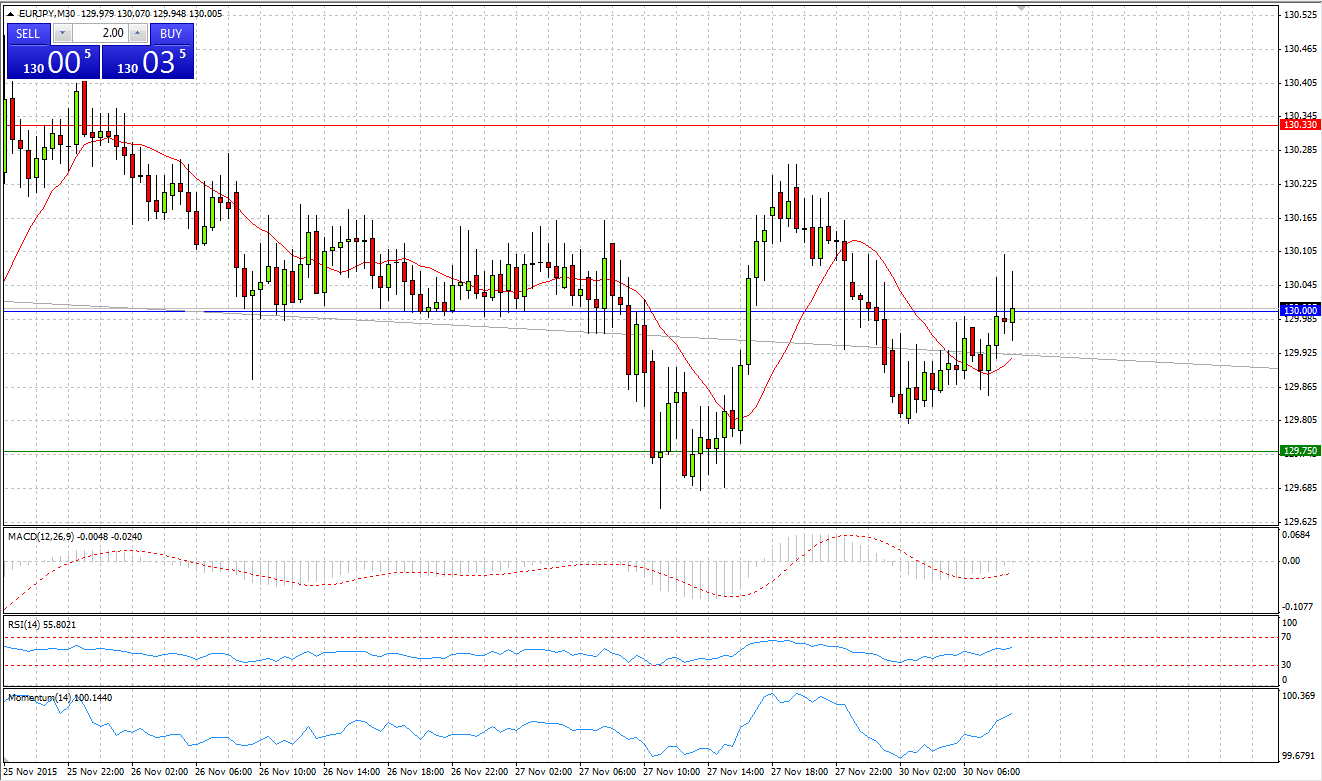

Market Scenario 1: Long positions above 130.00 with targets at 130.33 and 130.63

Market Scenario 2: Short positions below 130.00 with targets at 129.75 and 129.42

Comment: European currency reached a new low at 129.65 against Japanese yen during Friday’s session, however it found support, and the pair managed to close the day in positive territory. Currently the pair is trading slightly above Pivot Point level, which stands at 130 Japanese yen per US dollar.

Supports and Resistances:

R3 130.91

R2 130.58

R1 130.33

PP 130.00

S1 129.75

S2 129.42

S3 129.17

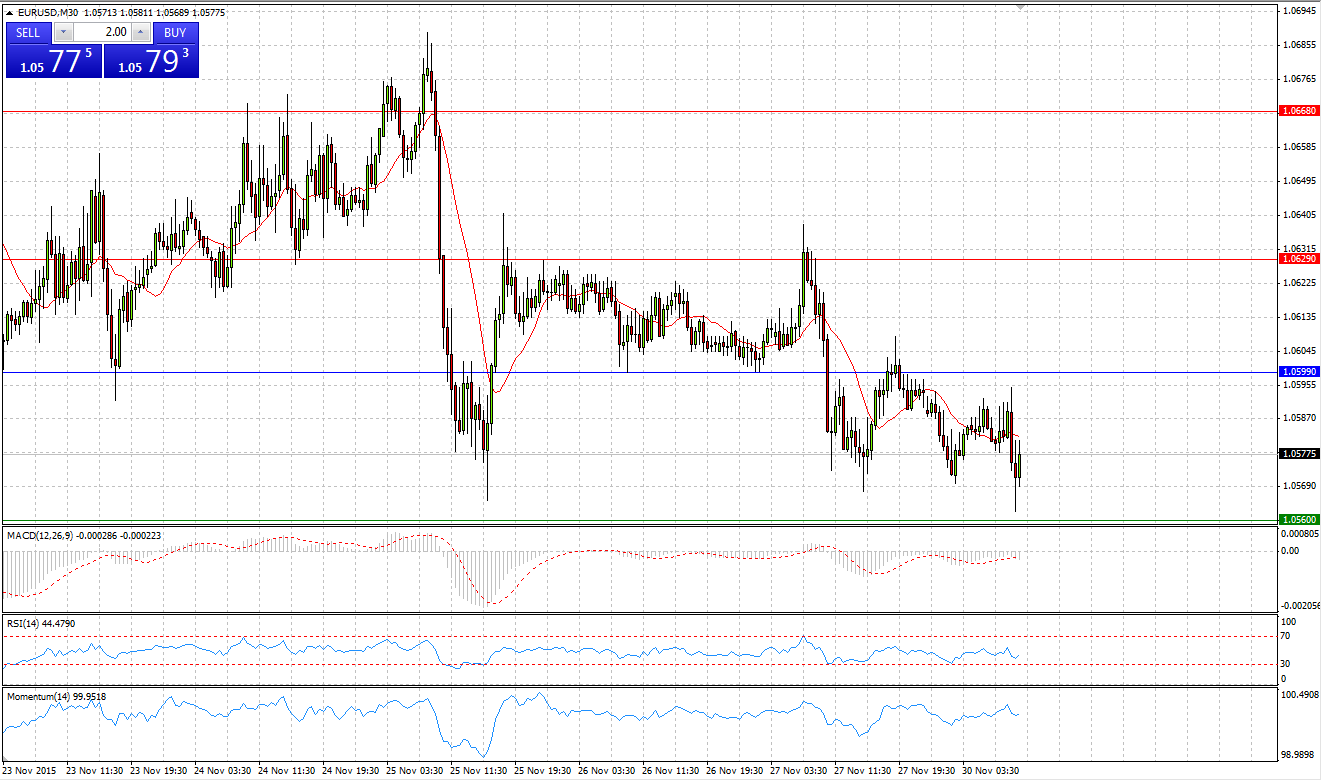

EUR/USD

Market Scenario 1: Long positions above 1.0599 with targets at 1.0629 and 1.0668

Market Scenario 2: Short positions below 1.0599 with targets at 1.0560 and 1.0530

Comment: European currency continue shifting lower against US dollar for the third day in the row. Currently EUR/USD is trading below Pivot Point level with the aim to test the first Support level.

Supports and Resistances:

R3 1.0698

R2 1.0668

R1 1.0629

PP 1.0599

S1 1.0560

S2 1.0530

S3 1.0491

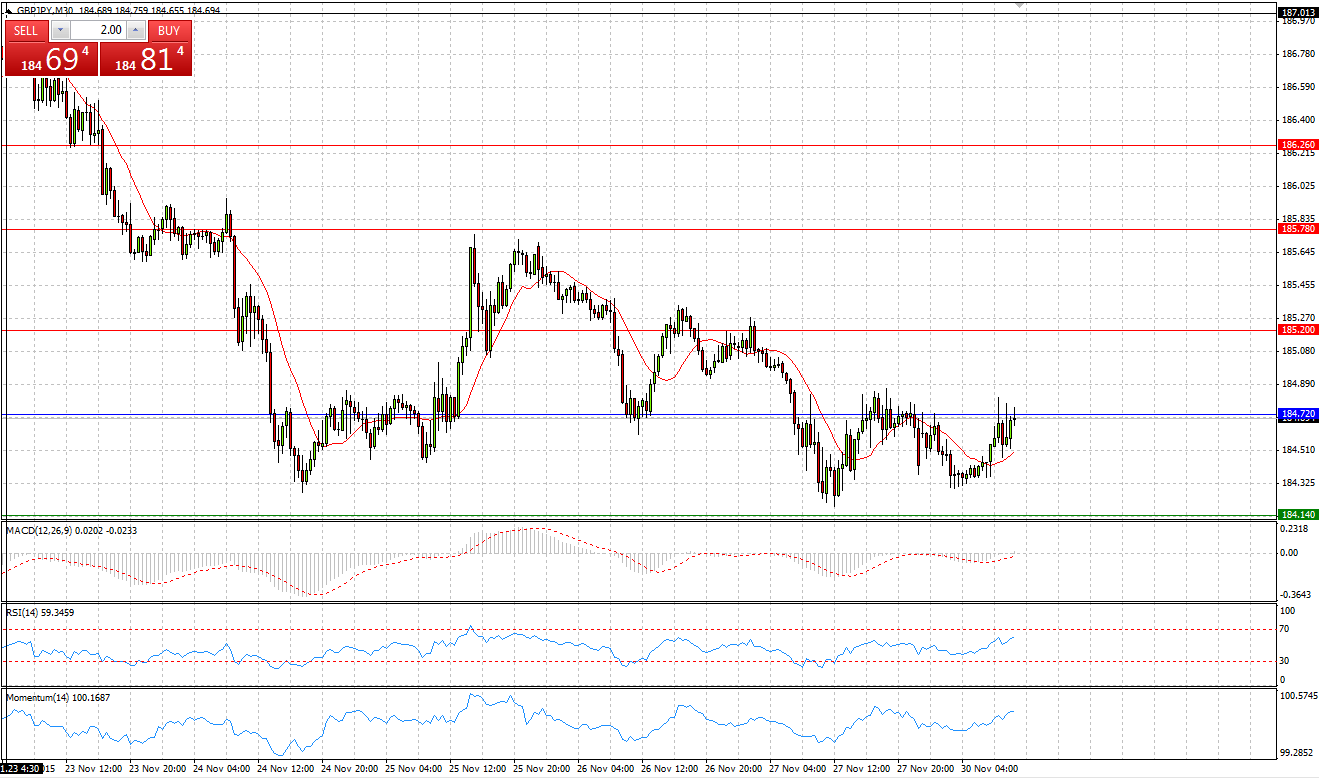

Market Scenario 1: Long positions above 184.72 with targets at 185.20 and 185.78

Market Scenario 2: Short positions below 184.72 with targets at 184.14 and 183.66

Comment: Sterling came under selling pressure on Friday’s session and lost almost 100 pips per 1 day against Japanese yen, closing the day at 184.42. Currently the pair is trading flat, close to Pivot Point level.

Supports and Resistances:

R3 186.26

R2 185.78

R1 185.20

PP 184.72

S1 184.14

S2 183.66

S3 183.08

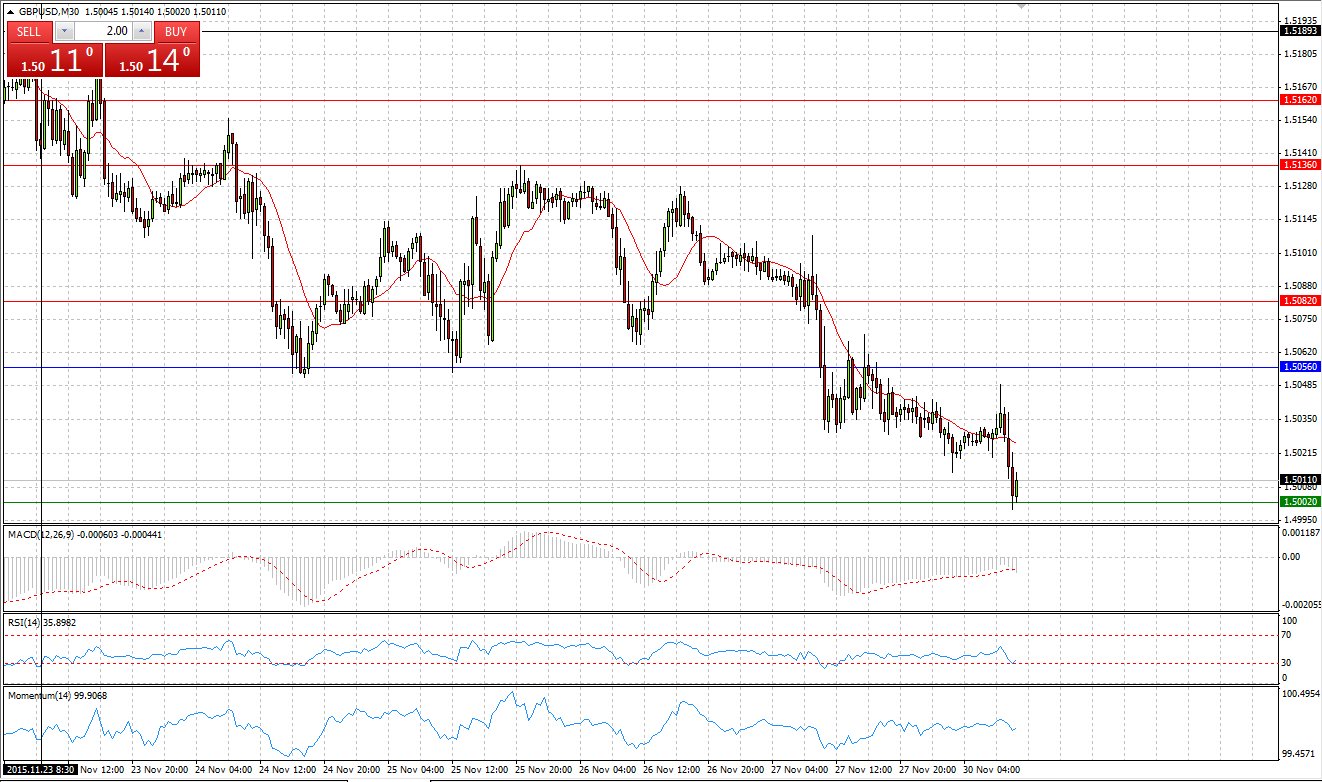

Market Scenario 1: Long positions above 1.5056 with targets at 1.5082 and 1.5136

Market Scenario 2: Short positions below 1.5056 with targets at 1.5002 and 1.4976

Comment: Sterling during Friday’s session came under selling pressure and was sent below its recent low closing the day at $1.50285, the lowest level since 23rd of April. Today, sterling continue depreciating against US dollar, reaching psychologically important level at 1.50 US dollar per sterling.

Supports and Resistances:

R3 1.5162

R2 1.5136

R1 1.5082

PP 1.5056

S1 1.5002

S2 1.4976

S3 1.4922

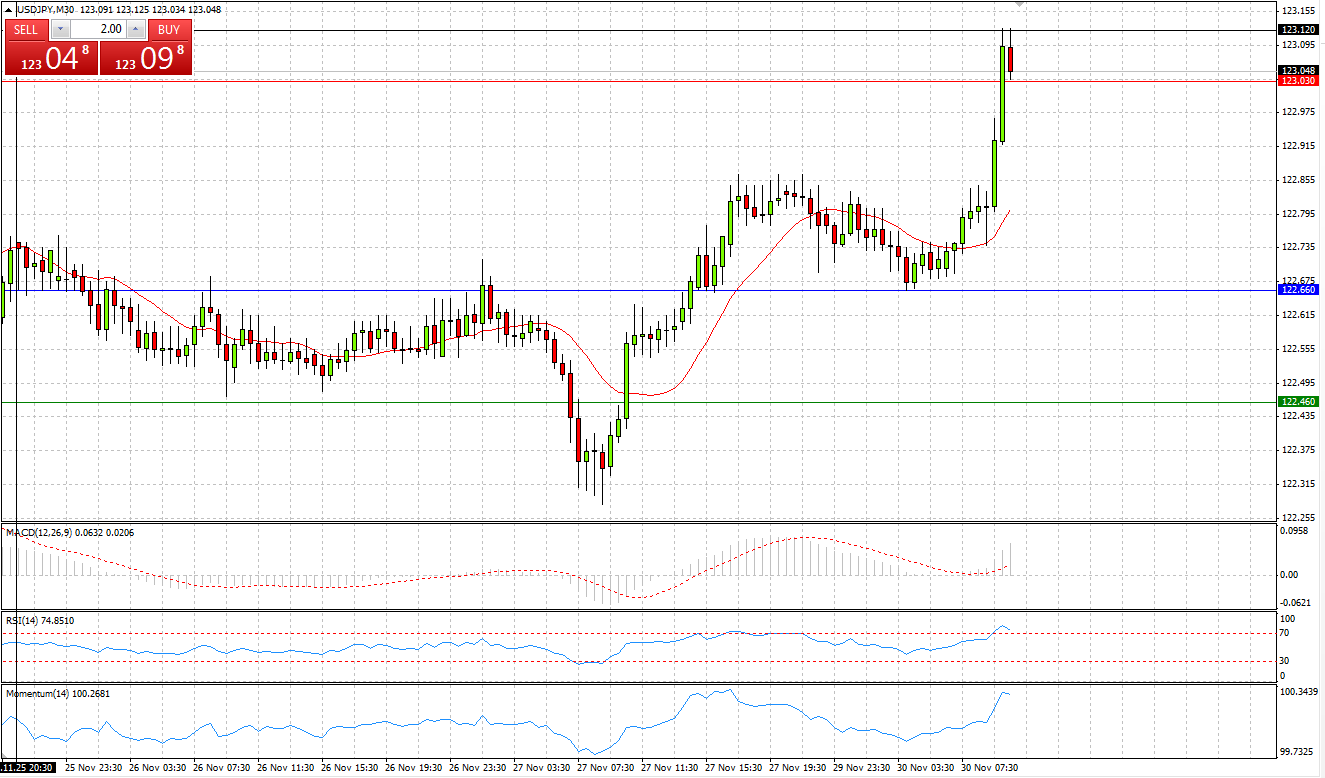

USD/JPY

Market Scenario 1: Long positions above 122.66 with targets at 123.03 and 123.23

Market Scenario 2: Short positions below 122.66 with targets at 122.46 and 122.09

Comment: Being unable to break through the Mid First Support level at 122.22 after number of attempts bears retreated. USD/JPY, having tested the level at 122.22 on Friday session rose, closed the day in positive territory. Today the pair continued its upward move, breaking through the First resistance level.

Supports and Resistances:

R3 123.60

R2 123.23

R1 123.03

PP 122.66

S1 122.46

S2 122.09

S3 121.89

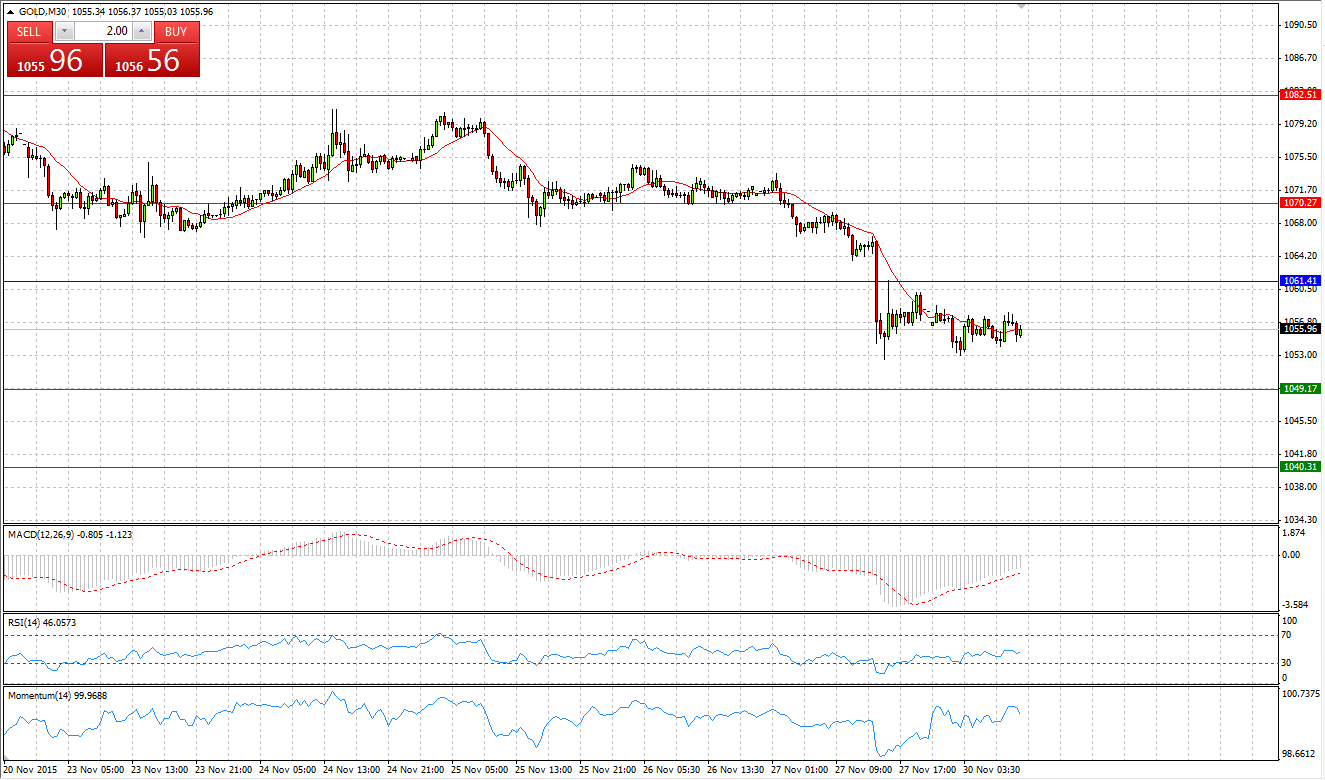

GOLD

Market Scenario 1: Long positions above 1061.41 with targets at 1070.27 and 1082.51

Market Scenario 2: Short positions below 1061.41 with targets at 1049.17 and 1040.31

Comment: Gold during Friday’s session reached a new low at 1052.55, the lowest level since February 2010. Bears are obviously controlling the gold market and they may undertake an attempt to test psychologically important level of 1050 US dollar per ounce.

Supports and Resistances:

R3 1103.61

R2 1082.51

R1 1070.27

PP 1061.41

S1 1049.17

S2 1040.31

S3 1019.21

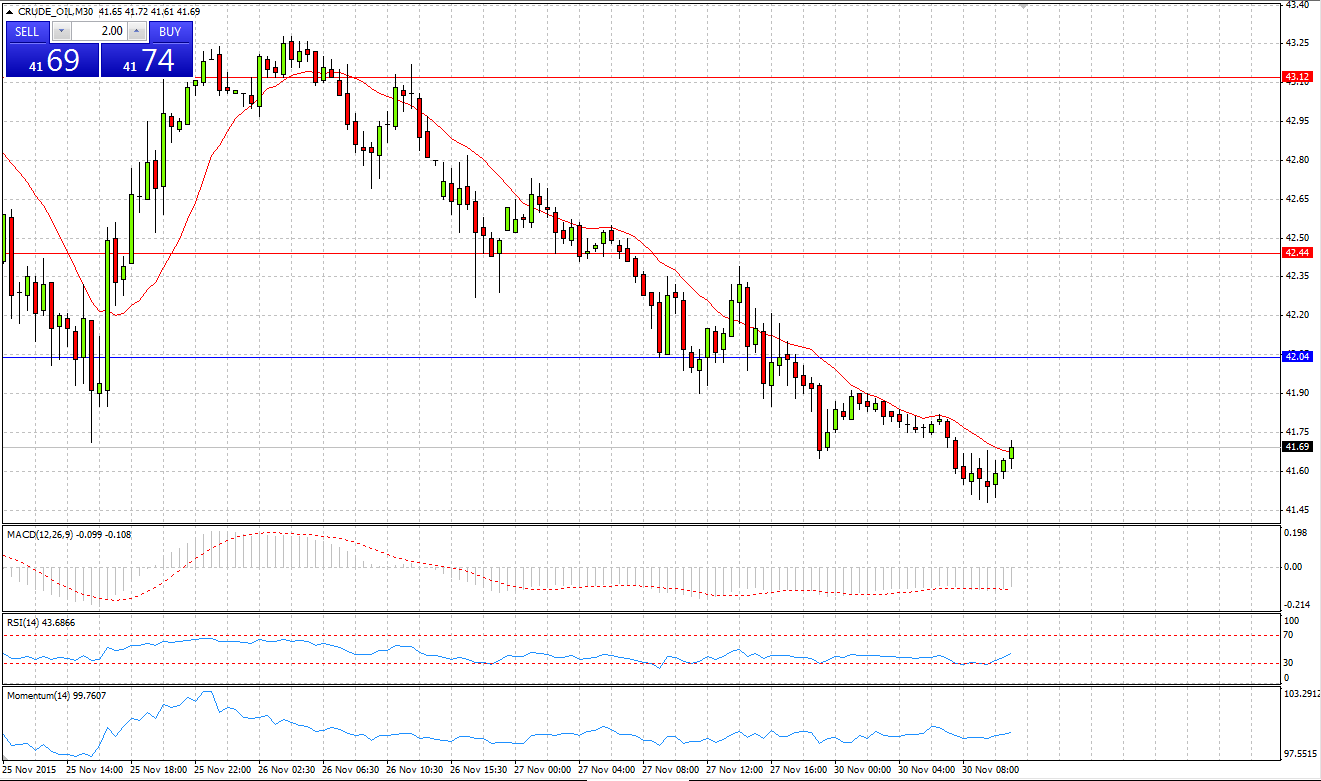

CRUDE OIL

Market Scenario 1: Long positions above 42.04 with targets at 42.44 and 43.12

Market Scenario 2: Short positions below 42.04 with targets at 41.36 and 40.96

Comment: Crude continues trading under selling pressure, closing Friday’s session with 77 US cents loss. On December 4th, this Friday, OPEC meeting is scheduled. According to Saudi Arabia officials, they will try to address the issue with enormous supply in order to stabilize prices.

Supports and Resistances:

R3 44.20

R2 43.12

R1 42.44

PP 42.04

S1 41.36

S2 40.96

S3 39.88

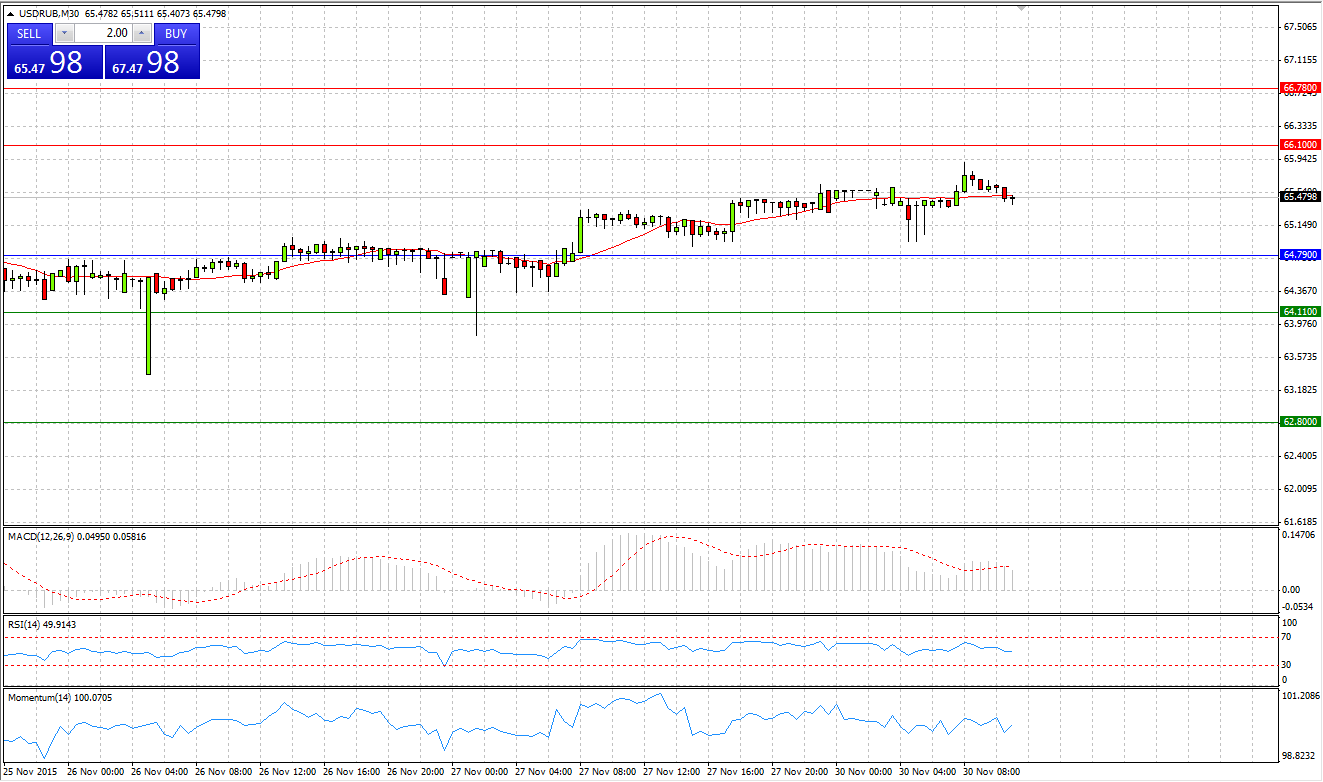

Market Scenario 1: Long positions above 64.79 with targets at 66.10 and 66.78

Market Scenario 2: Short positions below 64.79 with targets at 64.11 and 62.80

Comment: US dollar during Friday’s session appreciate against Russian ruble closing the session at 65.42. Today the pair is trading flat between R1 and PP.

Supports and Resistances:

R3 68.77

R2 66.78

R1 66.10

PP 64.79

S1 64.11

S2 62.80

S3 60.81