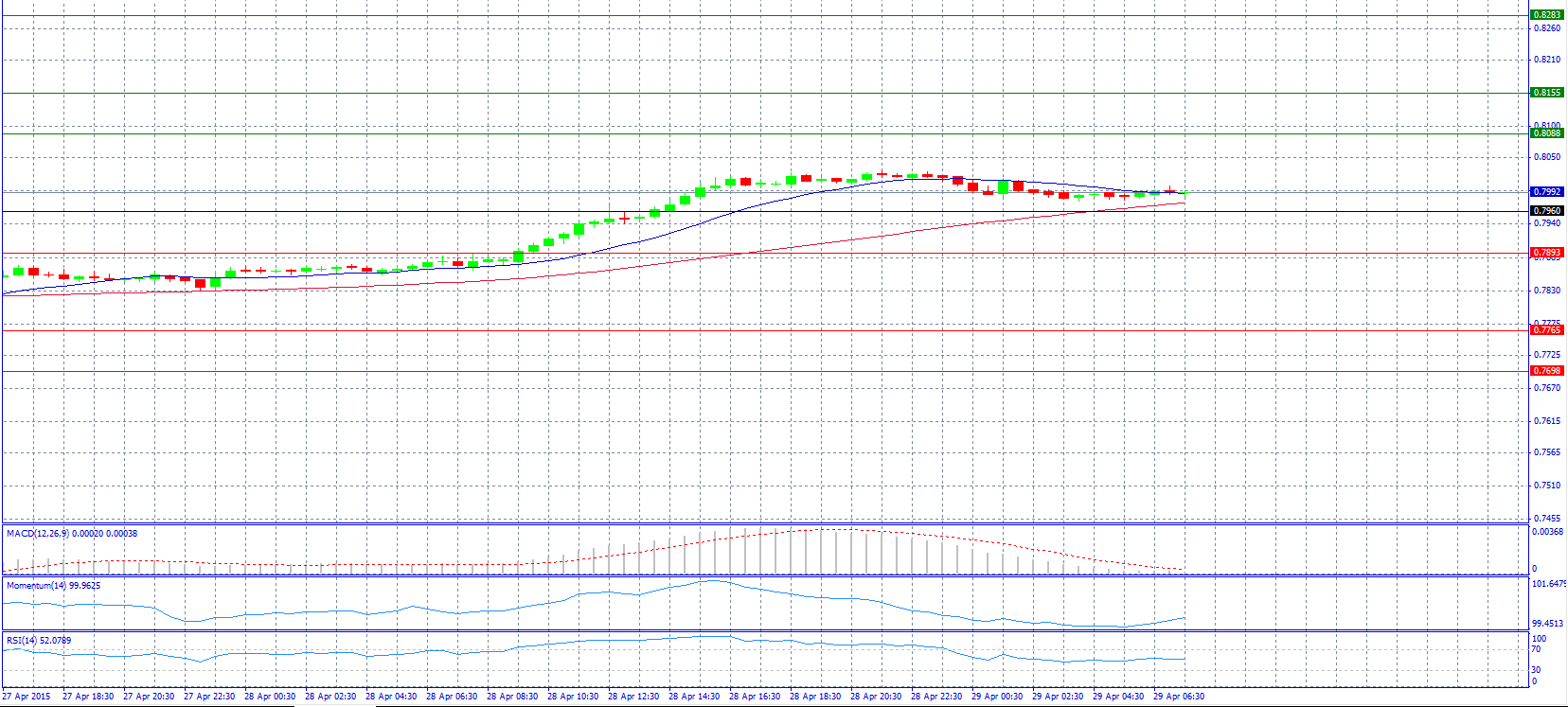

Market Scenario 1: Long positions above 0.8088 with target at 0.8155.

Market Scenario 2: Short positions below 0.7960 with target at 0.7893.

Comment: The pair hovers around 0.7990 level.

Supports and Resistances:

R3 0.8283

R2 0.8155

R1 0.8088

PP 0.7960

S1 0.7893

S2 0.7765

S3 0.7698

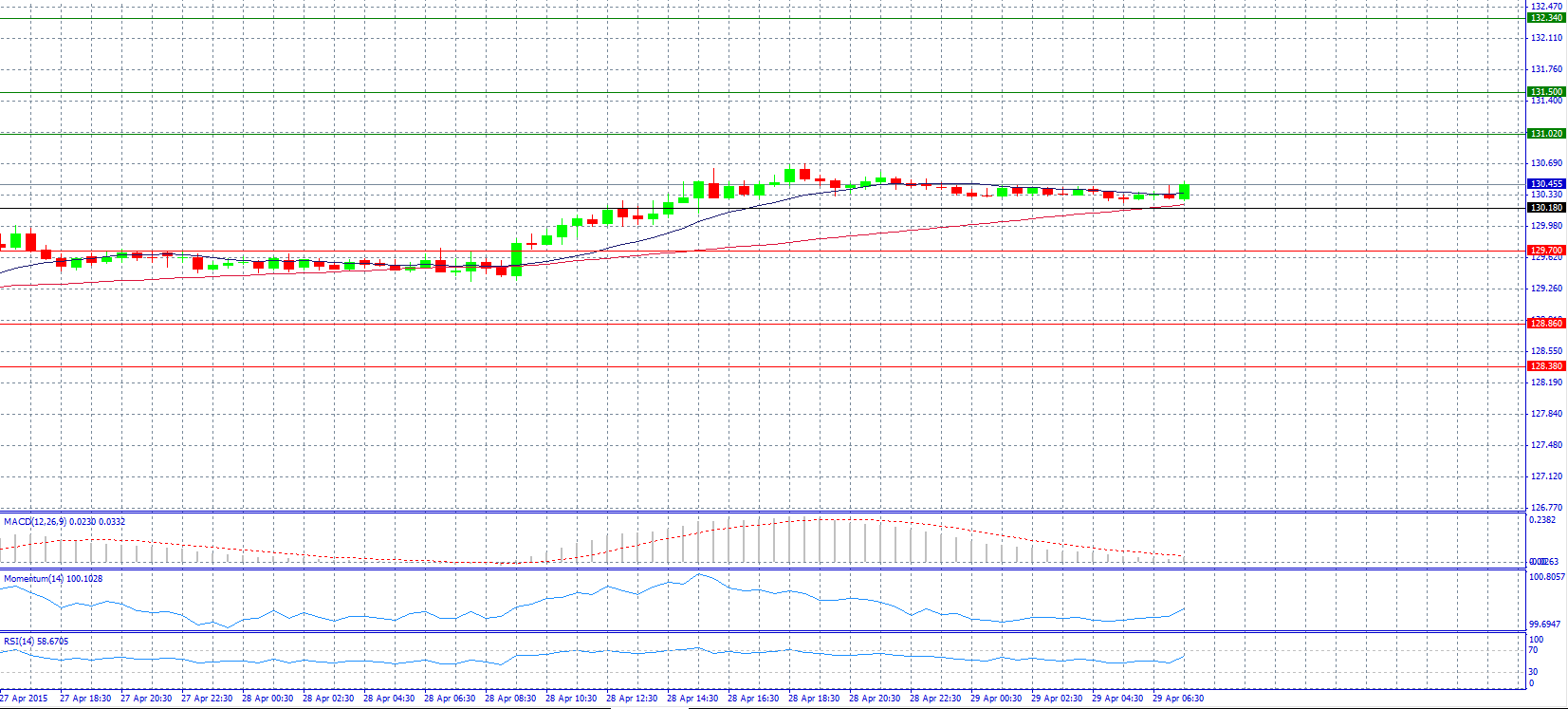

Market Scenario 1: Long positions above 131.02 with target at 131.50.

Market Scenario 2: Short positions below 130.18 with target at 129.70.

Comment: The pair extended gains above 130.00 level.

Supports and Resistances:

R3 132.34

R2 131.50

R1 131.02

PP 130.18

S1 129.70

S2 128.86

S3 128.38

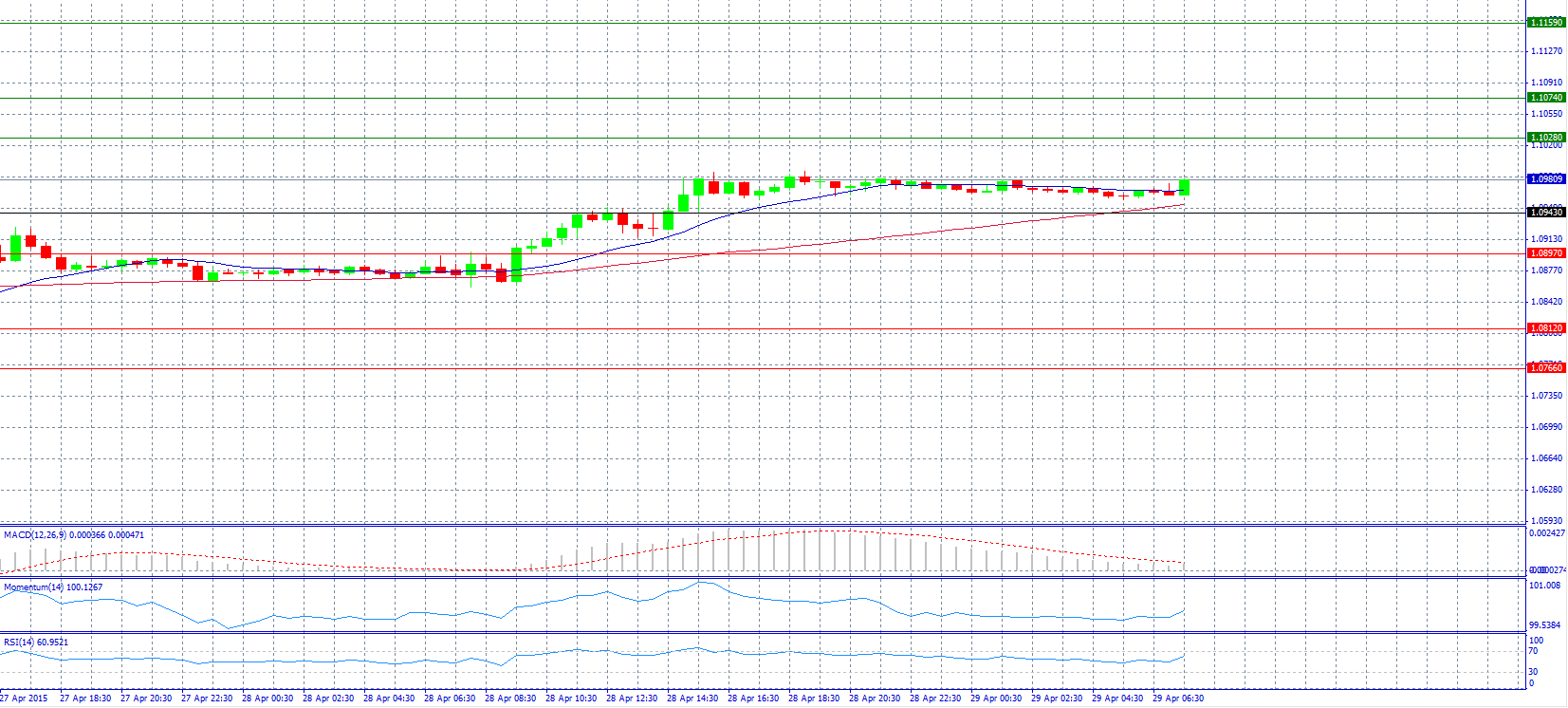

Market Scenario 1: Long positions above 1.1028 with target at 1.1074.

Market Scenario 2: Short positions below 1.0943 with target at 1.0897.

Comment: The pair continues advancing above 1.0980 level and the focus is on FOMC Data.

Supports and Resistances:

R3 1.1159

R2 1.1074

R1 1.1028

PP 1.0943

S1 1.0897

S2 1.0812

S3 1.0766

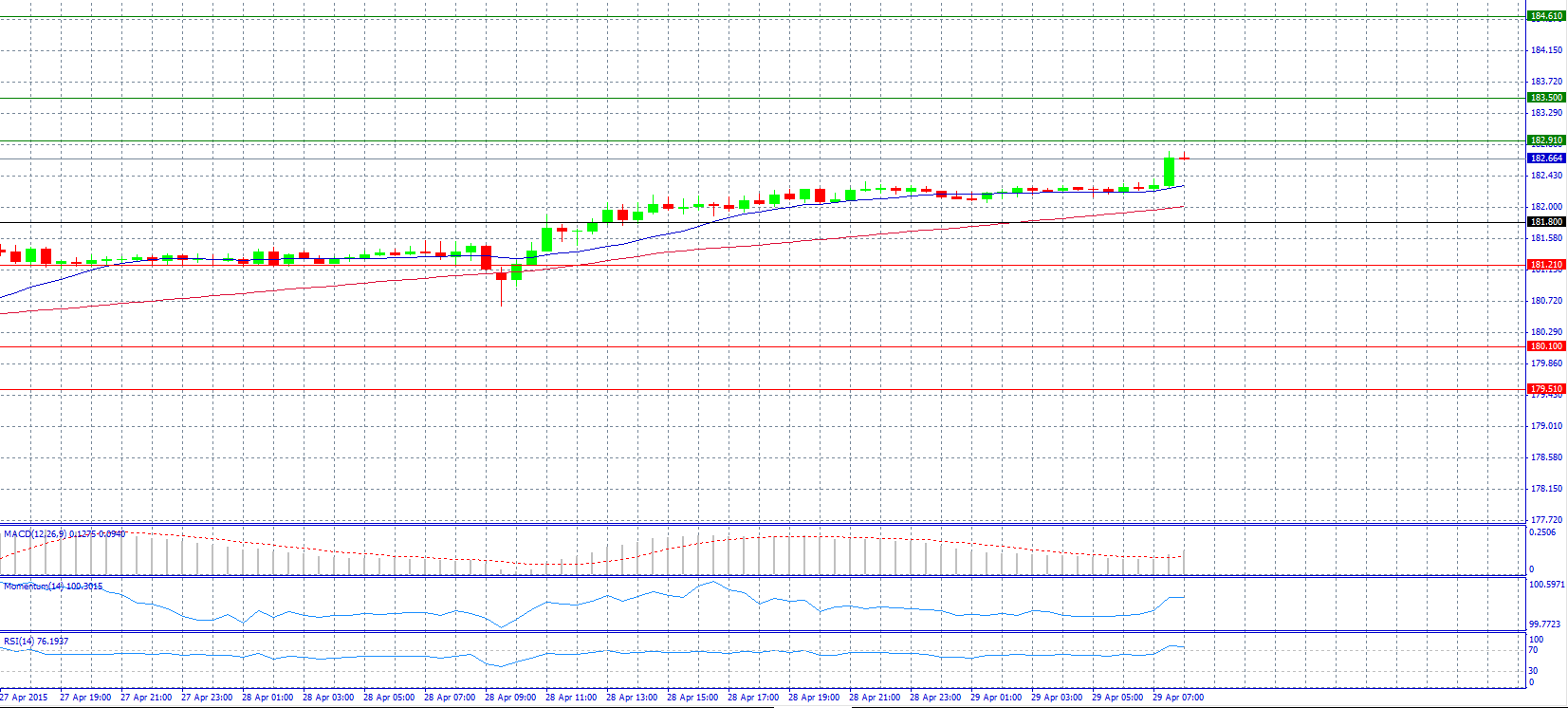

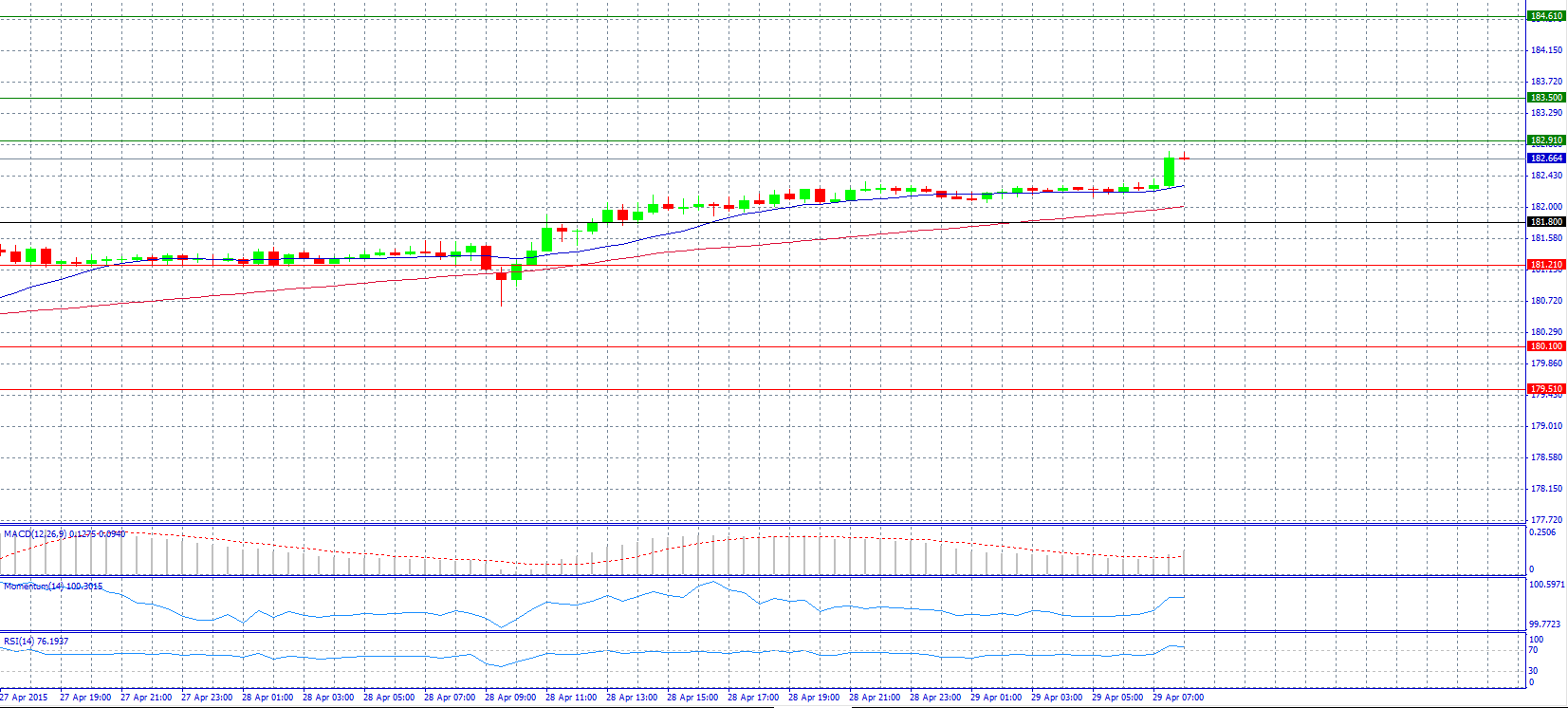

Market Scenario 1: Long positions above 182.91 with target at 183.50.

Market Scenario 2: Short positions below 181.80 with target at 181.21.

Comment: The pair strengthened and trades near 182.70 level.

Supports and Resistances:

R3 184.61

R2 183.50

R1 182.91

PP 181.80

S1 181.21

S2 180.10

S3 179.51

Market Scenario 1: Long positions above 1.5395 with target at 1.5452.

Market Scenario 2: Short positions below 1.5285 with target at 1.5228.

Comment: The trades over 1.5360 level on a fresh monthly high.

Supports and Resistances:

R3 1.5562

R2 1.5452

R1 1.5395

PP 1.5285

S1 1.5228

S2 1.5118

S3 1.5061

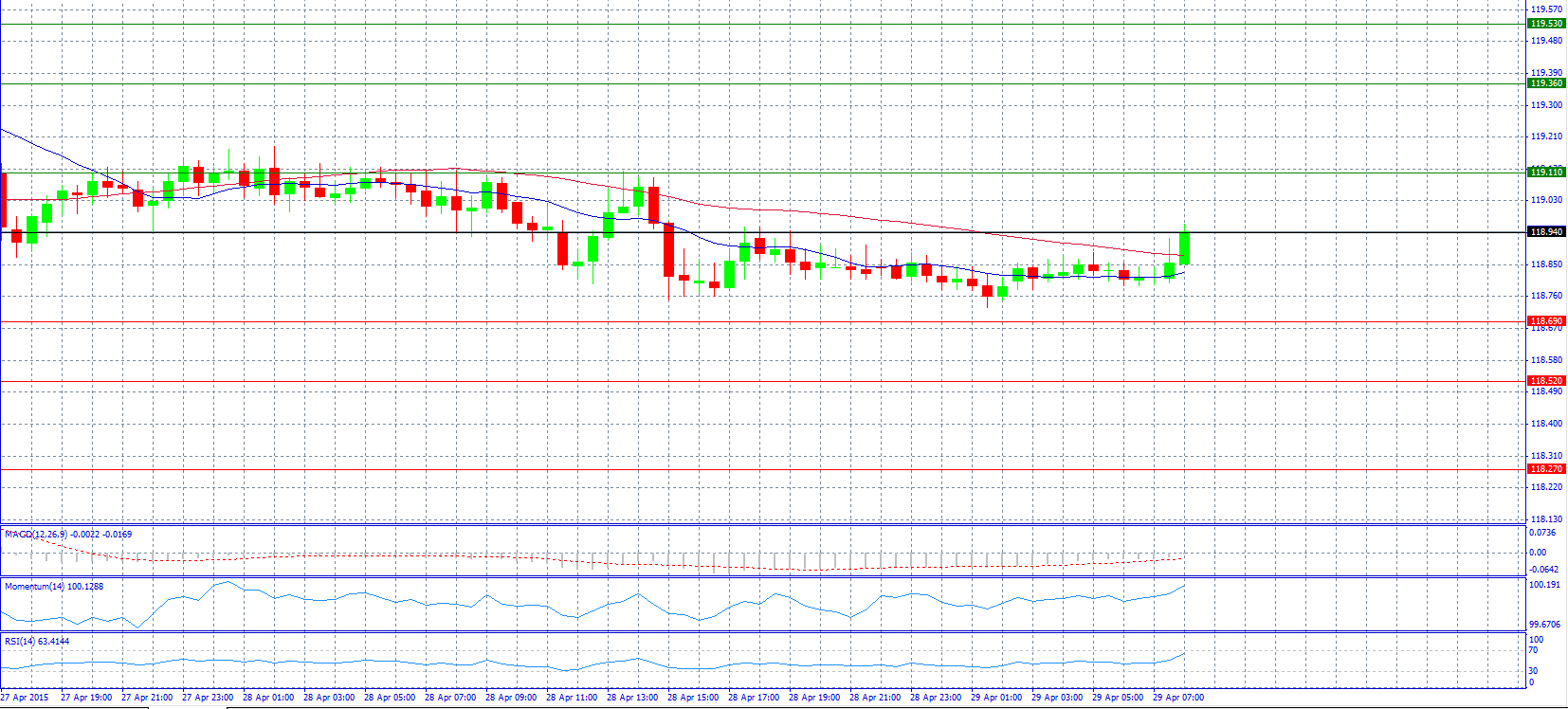

Market Scenario 1: Long positions above 118.94 with target at 119.11.

Market Scenario 2: Short positions below 118.69 with target at 118.52.

Comment: The pair advances and tries to surpass pivot point 118.94.

Supports and Resistances:

R3 119.53

R2 119.36

R1 119.11

PP 118.94

S1 118.69

S2 118.52

S3 118.27

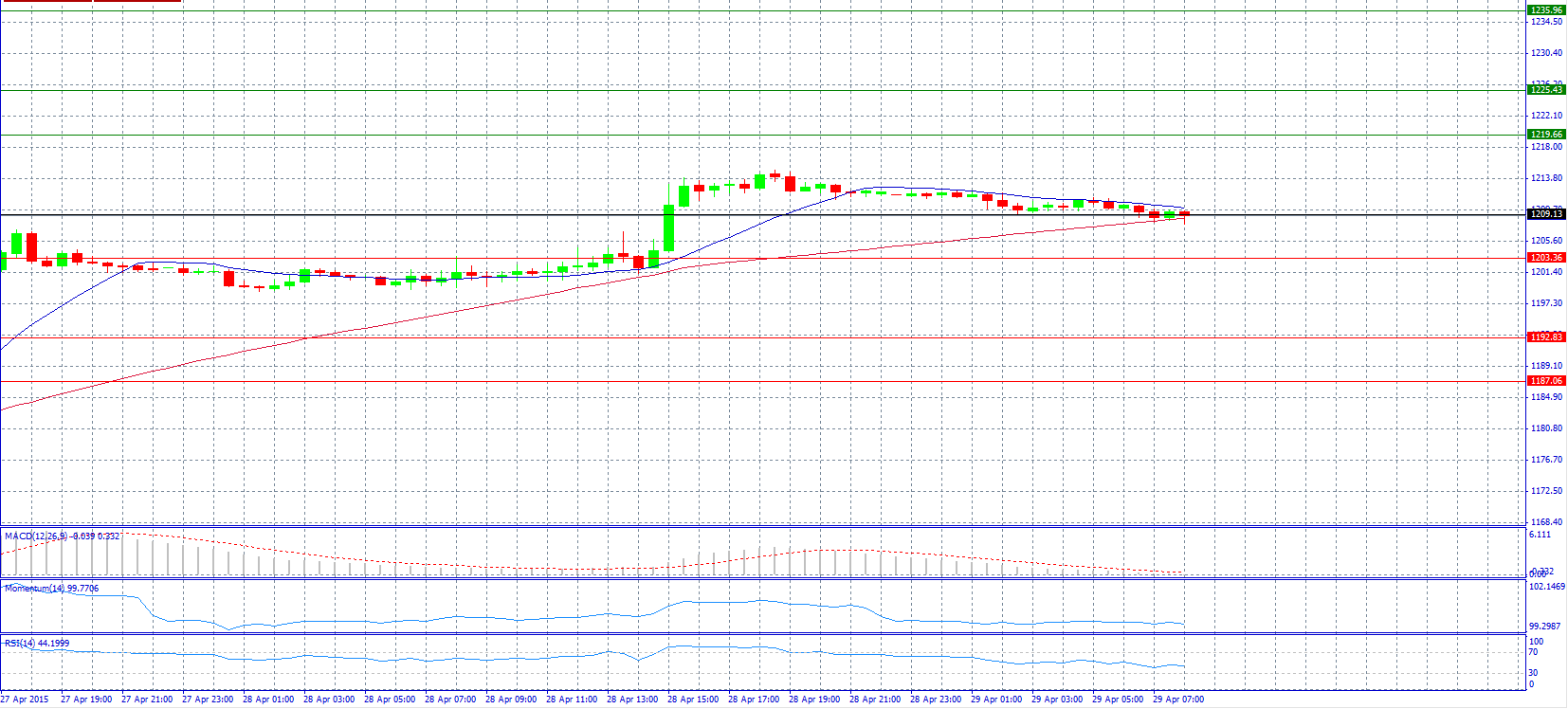

Market Scenario 1: Long positions above 1209.13 with target at 1219.66.

Market Scenario 2: Short positions below 1209.13 with target at 1203.36.

Comment: Gold prices holds near 3-week high and await for Fed statement.

Supports and Resistances:

R3 1235.96

R2 1225.43

R1 1219.66

PP 1209.13

S1 1203.36

S2 1192.83

S3 1187.06

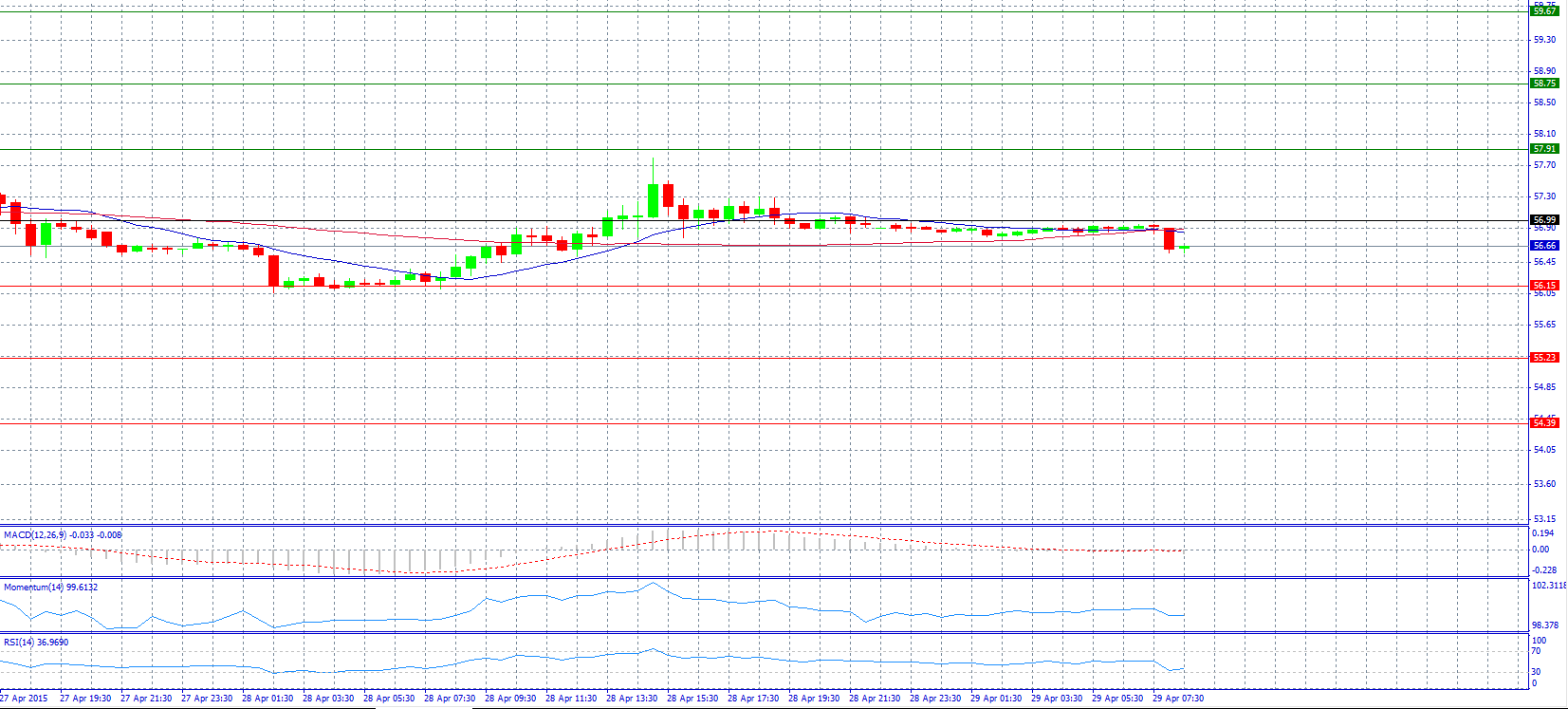

Market Scenario 1: Long positions above 56.99 with target at 57.91.

Market Scenario 2: Short positions below 56.15 with target at 55.23.

Comment: Crude oil prices weakened on weak Asian cues.

Supports and Resistances:

R3 59.67

R2 58.75

R1 57.91

PP 56.99

S1 56.15

S2 55.23

S3 54.39

Market Scenario 1: Long positions above 50.850 with target at 51.732.

Market Scenario 2: Short positions below 50.214 with target at 49.332.

Comment: The pair tries to break resistance level 50.850.

Supports and Resistances:

R3 53.886

R2 53.250

R1 52.368

PP 51.732

S1 50.850

S2 50.214

S3 49.332