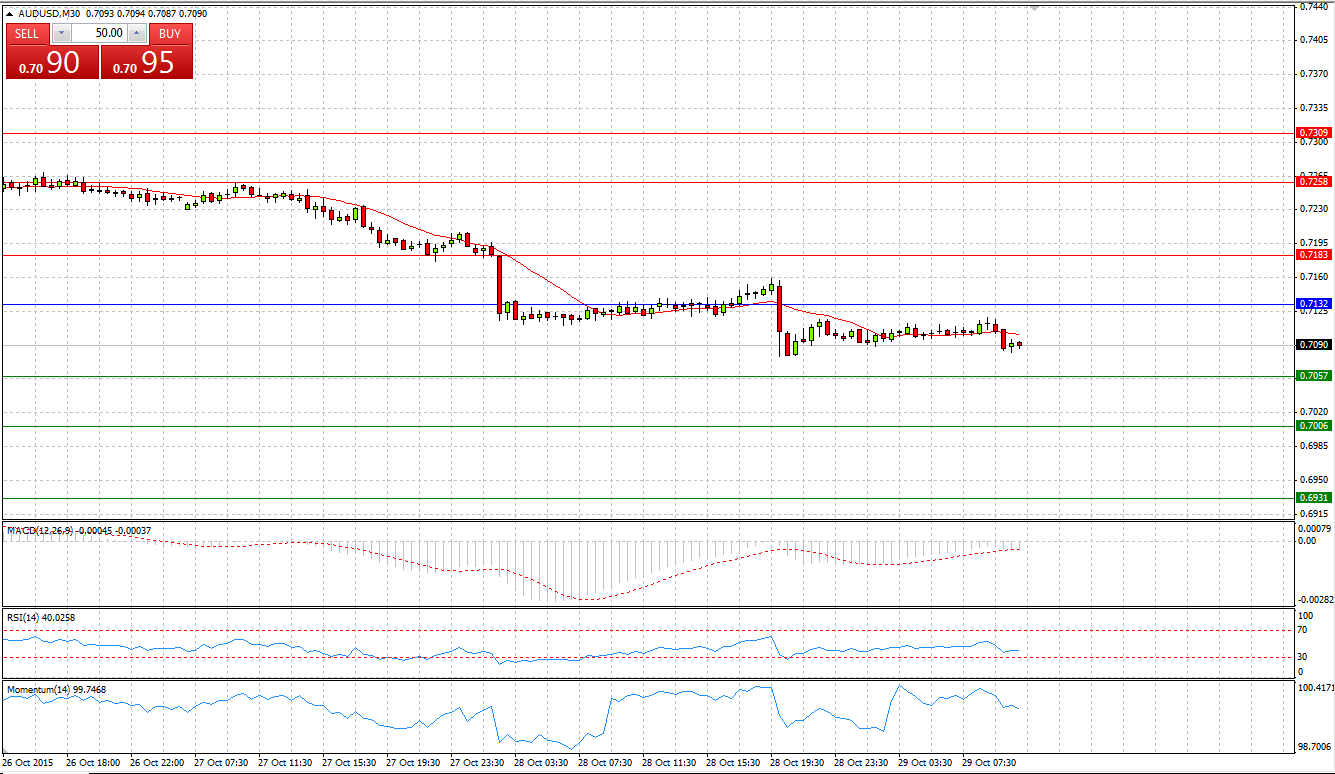

Market Scenario 1: Long positions above 0.7132 with targets at 0.7057 and 0.7006

Market Scenario 2: Short positions below 0.7132 with targets at 0.7183 and 0.7258

Comment: During yesterday’s session, AUD/USD came under selling pressure and broke through Support level at 0.7183, which supported the currency pair since 22nd of October. At the time being, the currency is trading close to the First Support level for today. Succeeded to break through it, AUD/USD may undertake attempts to test second and third Support levels

Supports and Resistances:

R3 0.7309

R2 0.7258

R1 0.7183

PP 0.7132

S1 0.7057

S2 0.7006

S3 0.6931

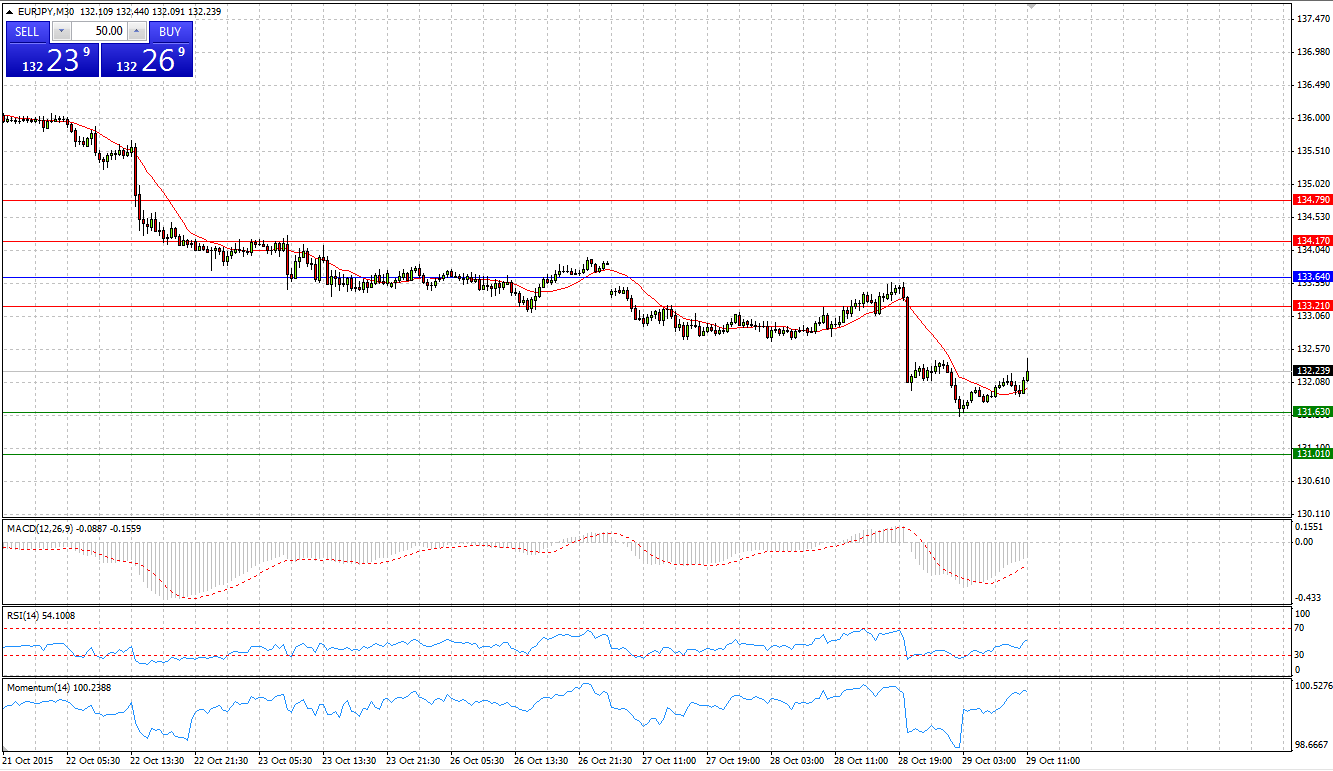

EUR/JPY

Market Scenario 1: Long positions above 133.64 with targets at 133.21 and 134.17

Market Scenario 2: Short positions below 133.64 with targets at 131.63 and 131.01

Comment: During yesterday’s session, European currency continued depreciating against Japanese yen, sinking below its lowest level reached on 4th of September at 132.31. Today, during Asian session, EUR/JPY recorded a new low at 131.574, which is slightly below the First Support level.

Supports and Resistances:

R3 134.79

R2 134.17

R1 133.21

PP 133.64

S1 131.63

S2 131.01

S3 130.05

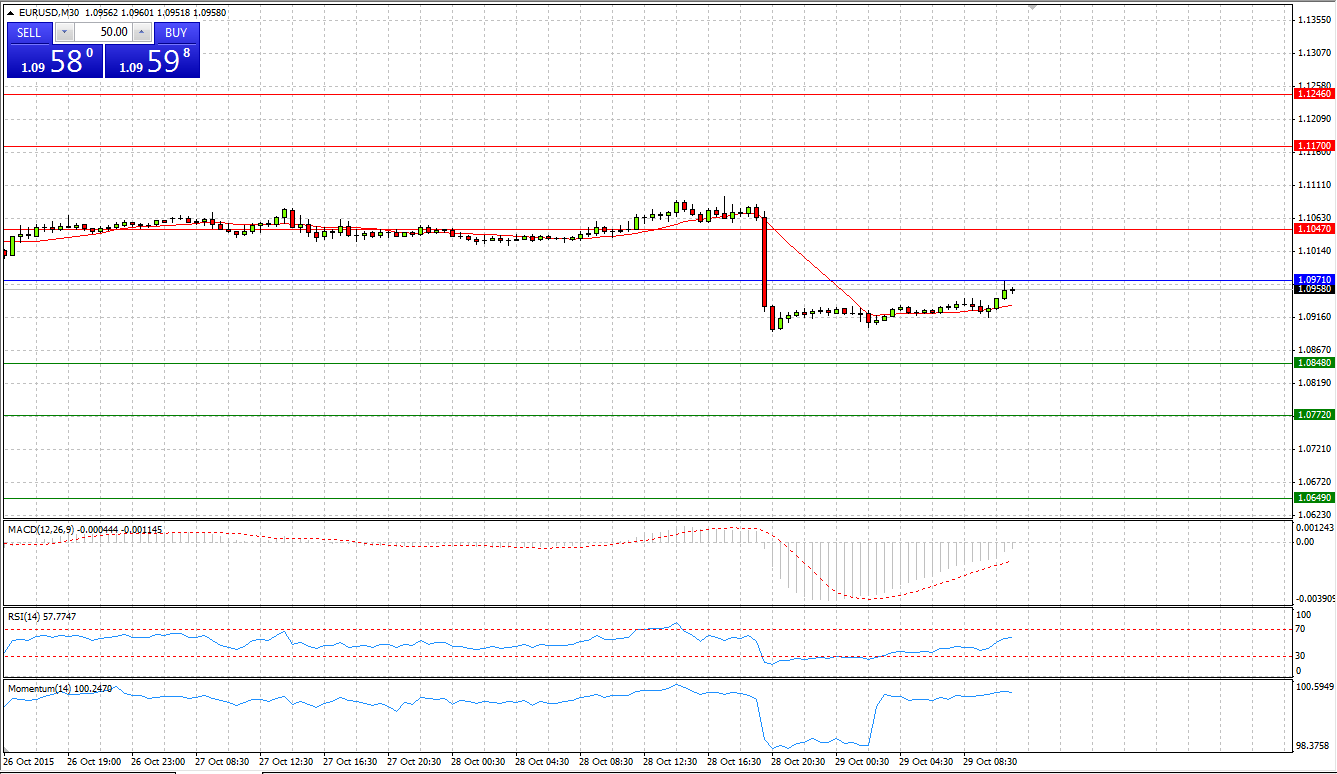

Market Scenario 1: Long positions above 1.0971 with targets at 1.1047 and 1.1170

Market Scenario 2: Short positions below 1.0971 with targets at 1.0848 and 1.0772

Comment: European currency was sold-off during yesterday’s session against US dollar, depreciating for more than 100 pips pre one day. Currently, the pair is trading slightly below Pivot Pint level, which stands close to psychologically important level of 1.10 US dollar per 1 euro.

Supports and Resistances:

R3 1.1246

R2 1.1170

R1 1.1047

PP 1.0971

S1 1.0848

S2 1.0772

S3 1.0649

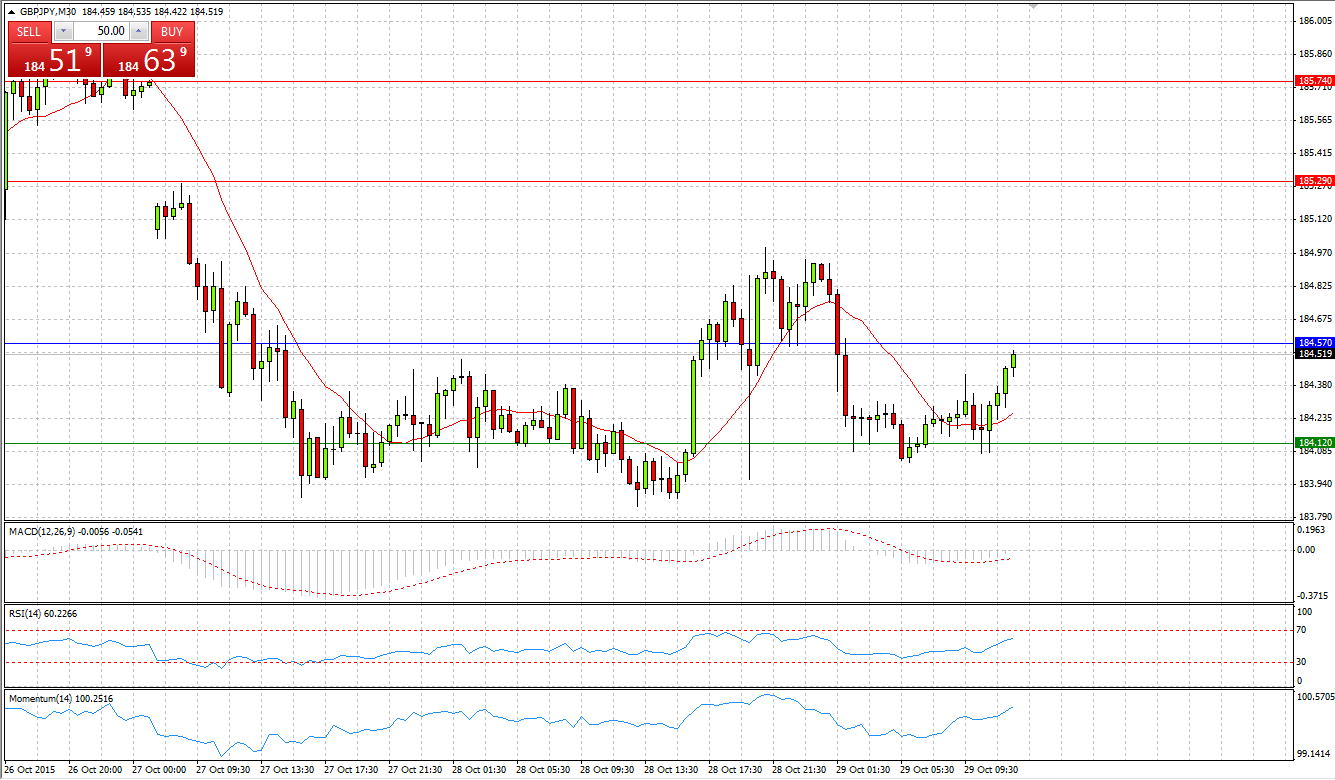

GBP/JPY

Market Scenario 1: Long positions above 184.57 with targets at 185.29 and 185.74

Market Scenario 2: Short positions below 184.57 with targets at 184.12 and 183.40

Comment: GBP/JPY continues trading slightly above the First Support level, which is close to highs reached on 9-12th of October. Currency remains under selling pressure, however, if bears won’t succeed in breaking through S1, bulls might take the control back.

Supports and Resistances:

R3 186.46

R2 185.74

R1 185.29

PP 184.57

S1 184.12

S2 183.40

S3 182.95

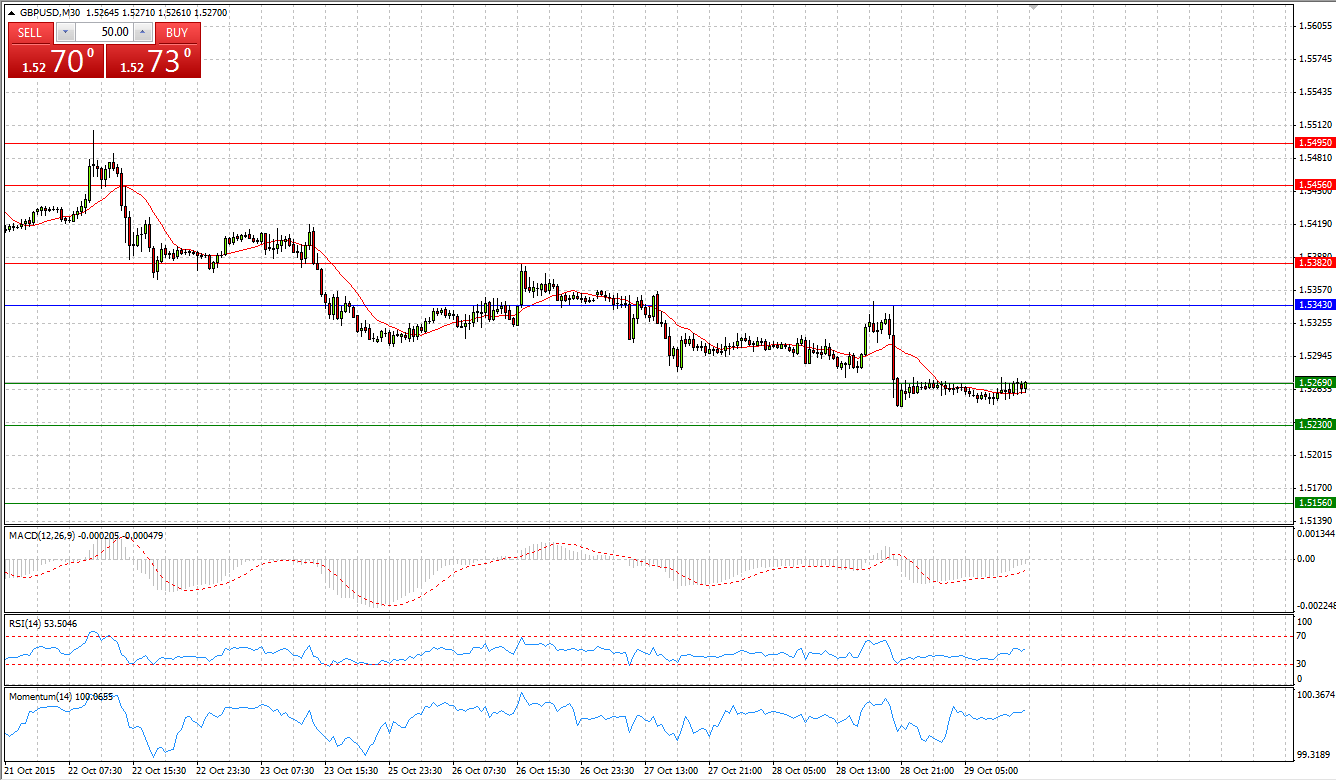

Market Scenario 1: Long positions above 1.5286 with targets at 1.5324 and 1.5384

Market Scenario 2: Short positions below 1.5286 with targets at 1.5226 and 1.5188

Comment: Sterling continues depreciating against US dollar, reaching its lowest level since 14th of October at 1.5247 during yesterday’s session. Today we have US Advanced GDP and Unemployment claims, positive reading might give additional stimulus for Bears to push the pair lower.

Supports and Resistances:

R3 1.5422

R2 1.5384

R1 1.5324

PP 1.5286

S1 1.5226

S2 1.5188

S3 1.5128

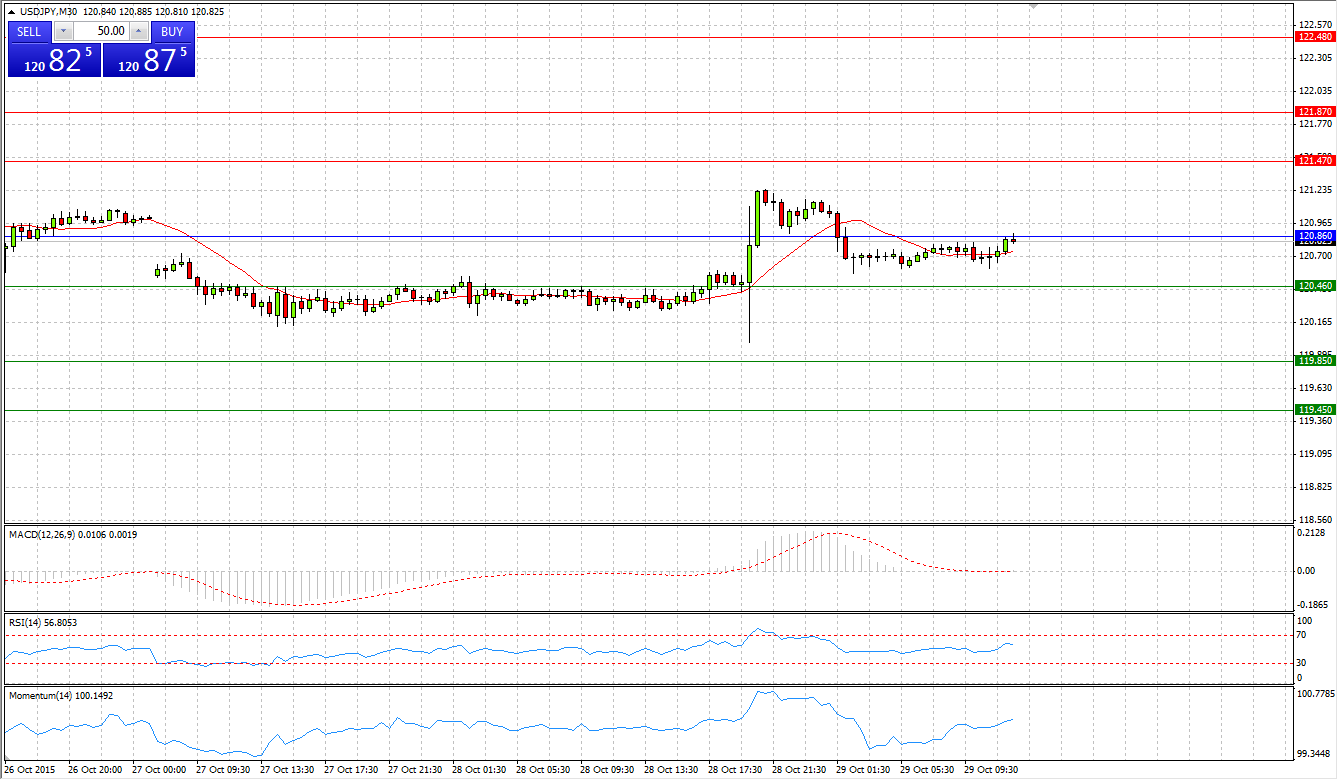

Market Scenario 1: Long positions above 120.86 with targets at 121.47 and 121.87

Market Scenario 2: Short positions below 120.86 with targets at 120.46 and 119.85

Comment: US dollar during yesterday’s session managed to regain all of his losses incurred on Wednesday against Japanese yen. However, in the bigger picture, the pair remains trading in the range between S3 and R2

Supports and Resistances:

R3 122.48

R2 121.87

R1 121.47

PP 120.86

S1 120.46

S2 119.85

S3 119.45

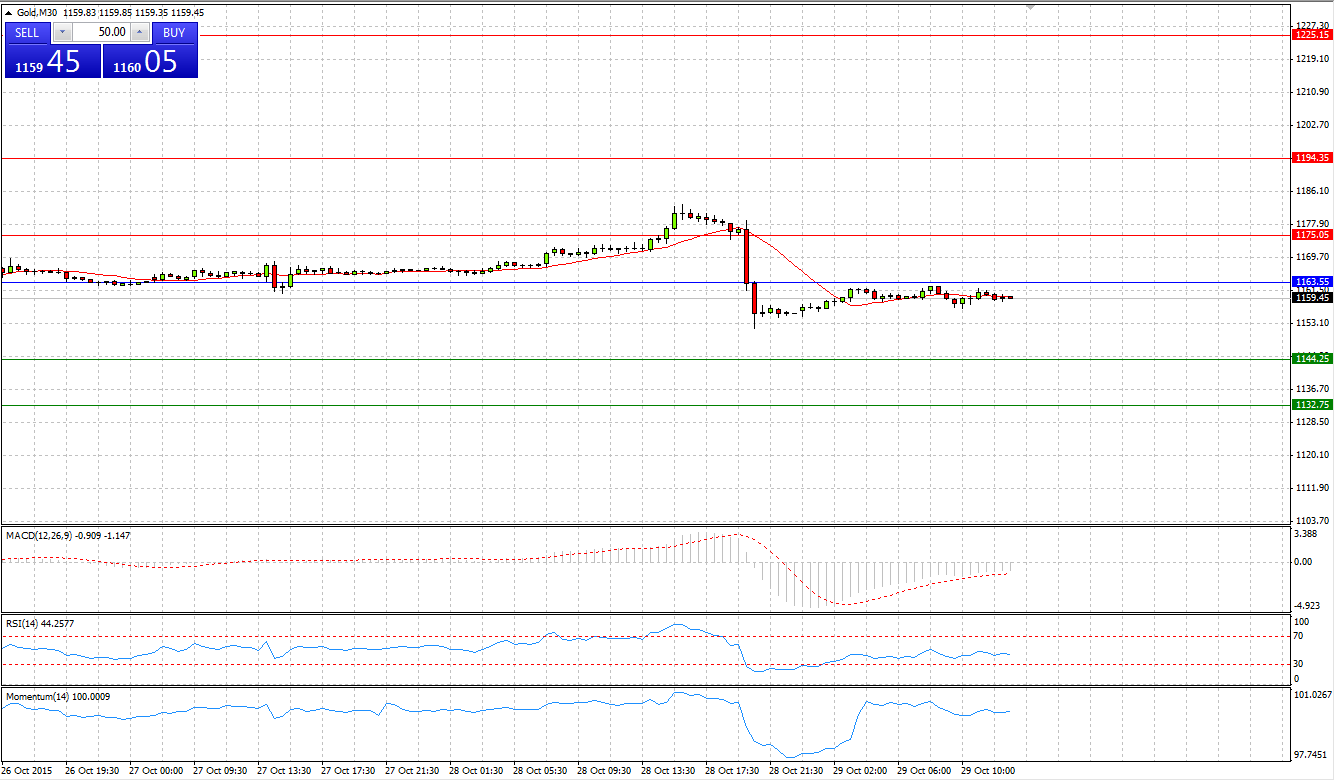

Market Scenario 1: Long positions above 1163.55 with targets at 1175.05 and 1194.35

Market Scenario 2: Short positions below 1163.55 with targets at 1144.25 and 1132.75

Comment: Bullion during yesterday’s session was very volatile, having raised almost to its recent highs. Gold came under selling pressure and dropped below its recent lows of 1158.65, closing the day 1155.75. During today’s session, gold has been trading flat, slightly below Pivot Point Level

Supports and Resistances:

R3 1225.15

R2 1194.35

R1 1175.05

PP 1163.55

S1 1144.25

S2 1132.75

S3 1101.95

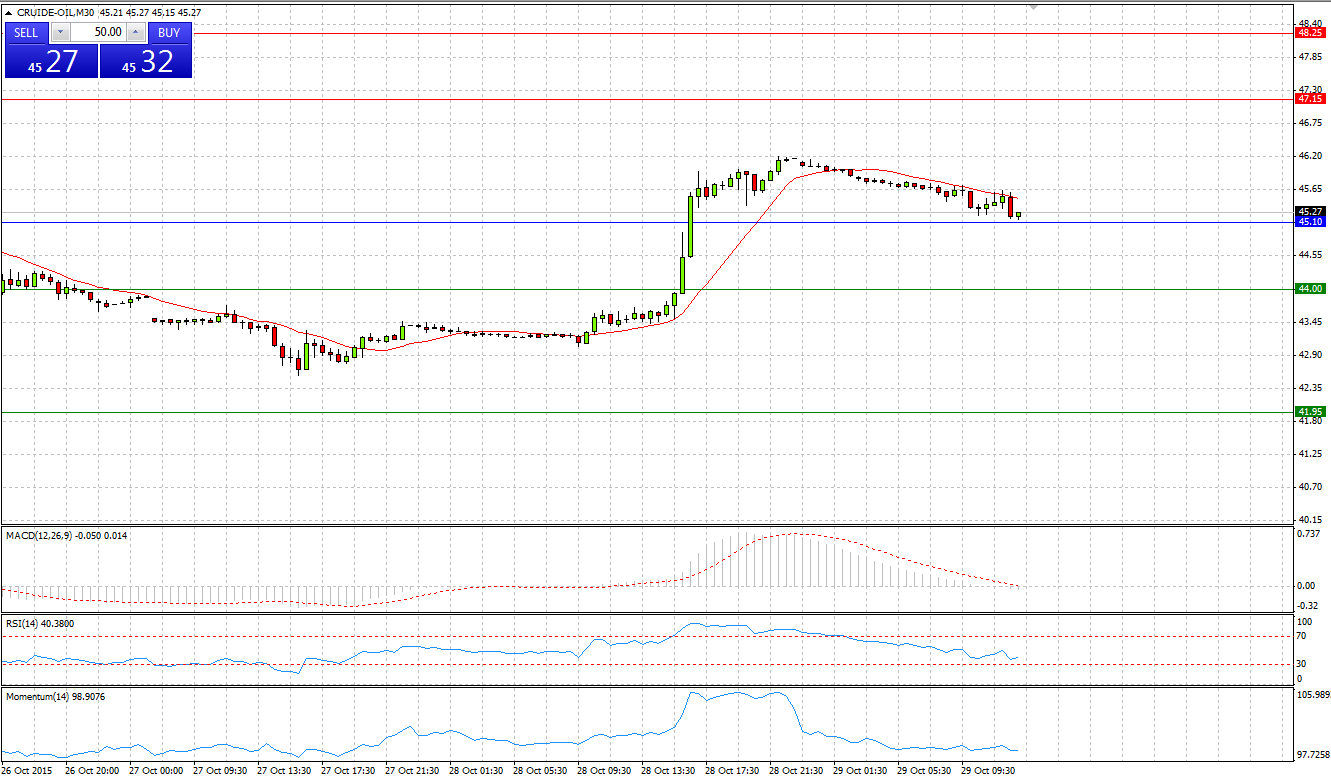

CRUDE OIL

Market Scenario 1: Long positions above 45.10 with targets at 47.15 and 48.25

Market Scenario 2: Short positions below 45.10 with targets at 44.00 and 41.95

Comment: Having reached its lowest level on Wednesday at 42.57, bulls managed to regain the control and pushed crude prices as high as 46.20 during yesterday’s session. At the time being, crude is trading slightly above Pivot Point level.

Supports and Resistances:

R3 51.40

R2 48.25

R1 47.15

PP 45.10

S1 44.00

S2 41.95

S3 38.80

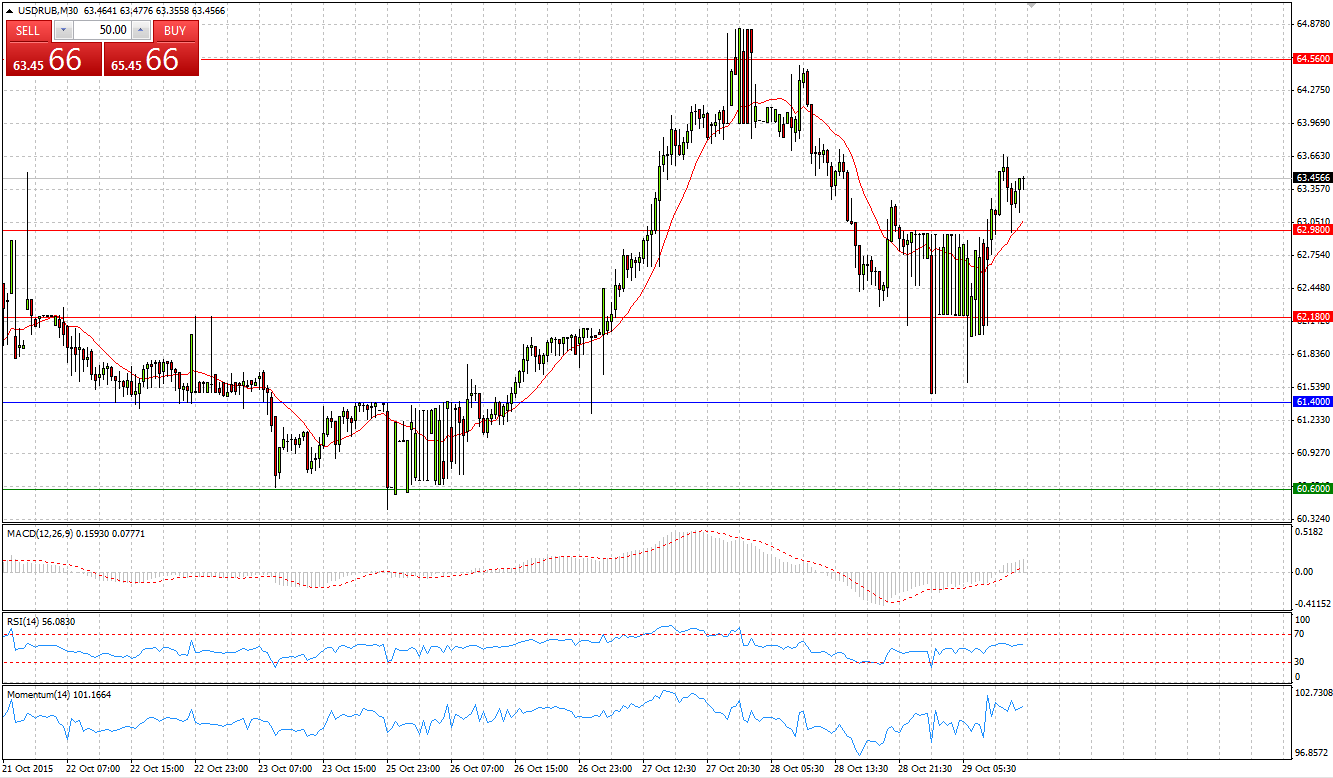

USD/RUB

Market Scenario 1: Long positions above 61.57 with targets at 62.59 and 63.09

Market Scenario 2: Short positions below 61.57 with targets at 61.06 and 60.04

Comment: USD/RUB amid increased prices of crude oil dropped from its highest level since 6th of October of 64.8453 to close the day 62.94. Further appreciation of crude prices will push the pair lower.

Supports and Resistances:

R3 64.62

R2 63.09

R1 62.59

PP 61.57

S1 61.06

S2 60.04

S3 58.51