*All the charts are 30M charts with daily pivot points.

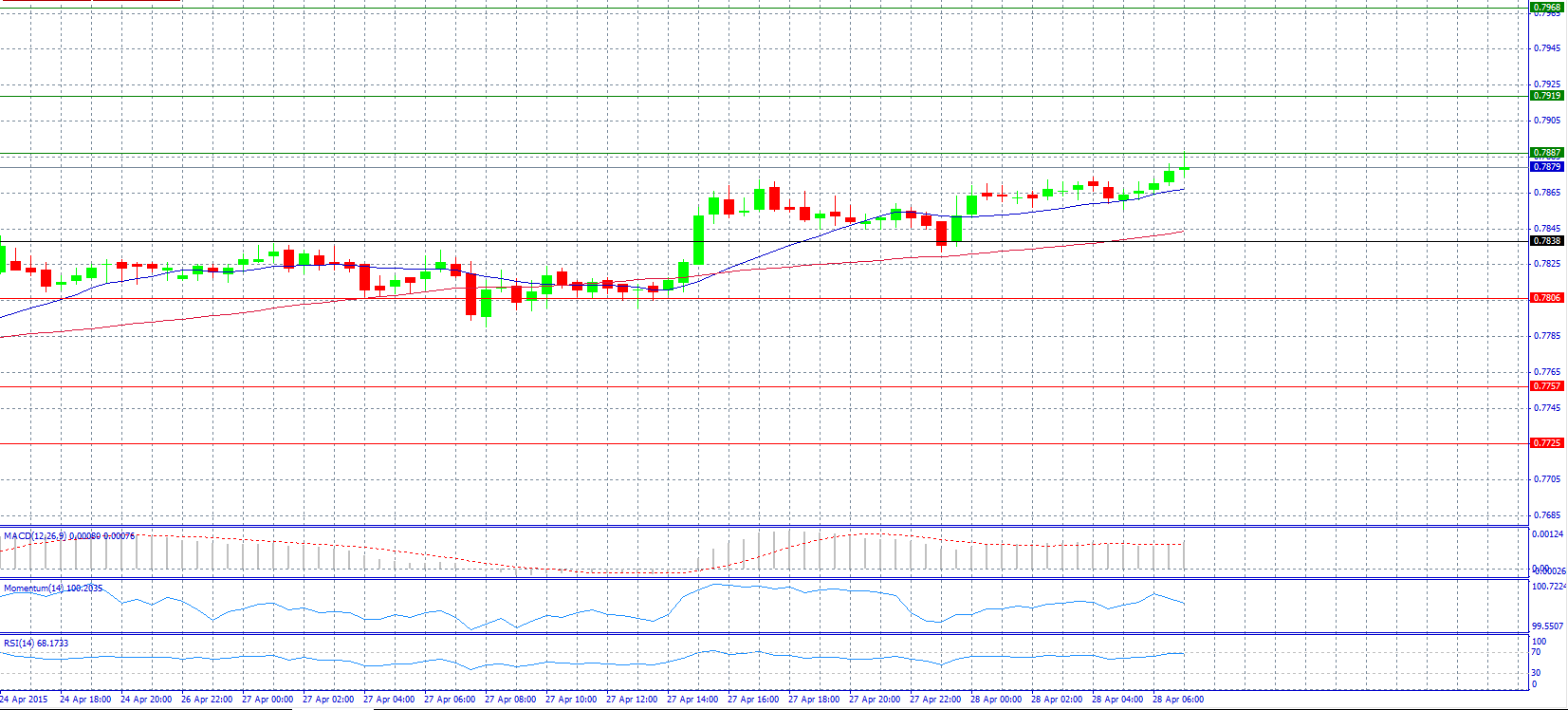

Market Scenario 1: Long positions above 0.7887 with target @ 0.7919.

Market Scenario 2: Short positions below 0.7838 with target @ 0.7806.

Comment: The pair strengthened and advances near 0.7880 level.

Supports and Resistances:

R3 0.7968

R2 0.7919

R1 0.7887

PP 0.7838

S1 0.7806

S2 0.7757

S3 0.7725

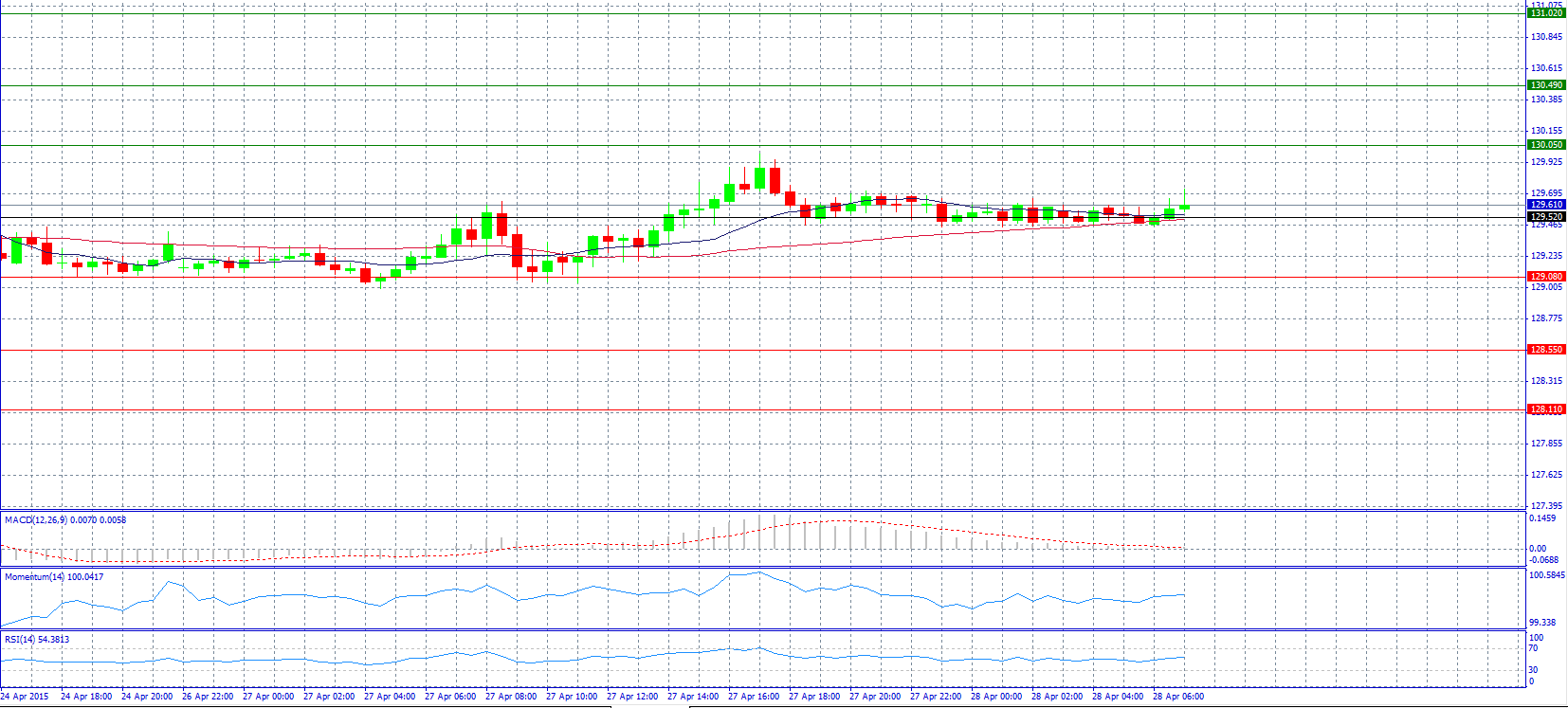

Market Scenario 1: Long positions above 129.52 with target @ 130.05.

Market Scenario 2: Short positions below 129.52 with target @ 129.08.

Comment: The pair trades neutral near pivot point 129.52.

Supports and Resistances:

R3 131.02

R2 130.49

R1 130.05

PP 129.52

S1 129.08

S2 128.55

S3 128.11

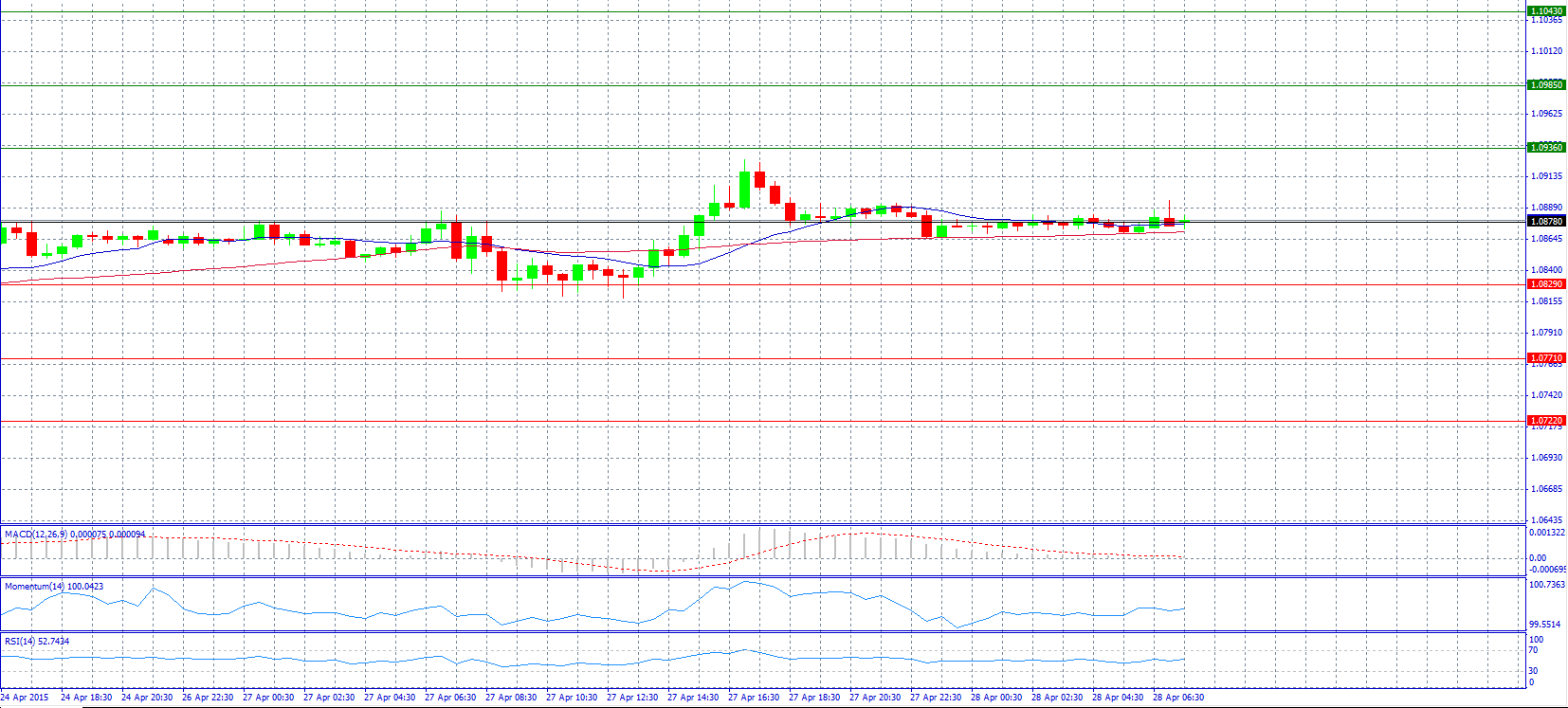

Market Scenario 1: Long positions above 1.0878 with target @ 1.0936.

Market Scenario 2: Short positions below 1.0878 with target @ 1.0829.

Comment: The pair trades on a softer tone around 1.0880 level.

Supports and Resistances:

R3 1.1043

R2 1.0985

R1 1.0936

PP 1.0878

S1 1.0829

S2 1.0771

S3 1.0722

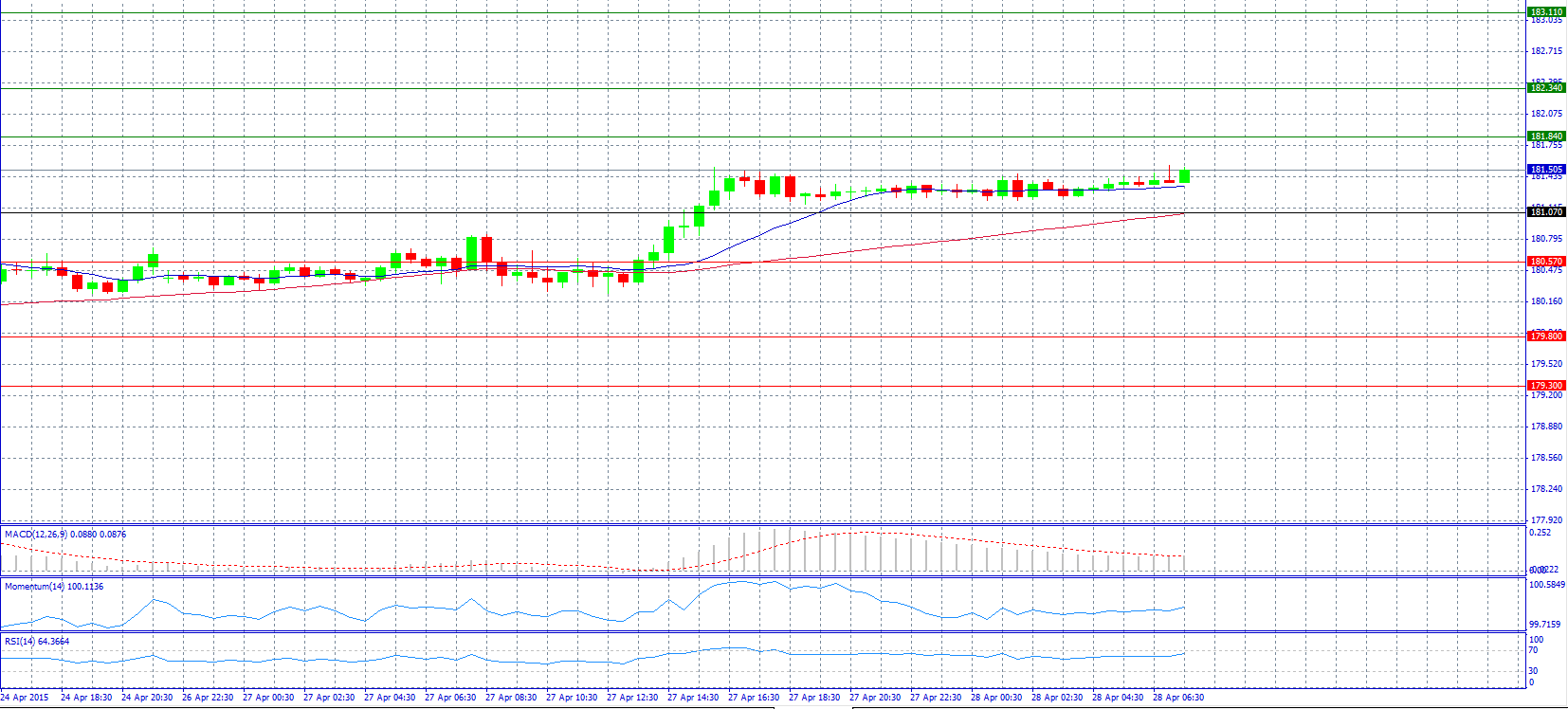

Market Scenario 1: Long positions above 181.84 with target @ 182.34.

Market Scenario 2: Short positions below 181.07 with target @ 180.57.

Comment: The pair advances and tries to reach 181.50 level.

Supports and Resistances:

R3 183.11

R2 182.34

R1 181.84

PP 181.07

S1 180.57

S2 179.80

S3 179.30

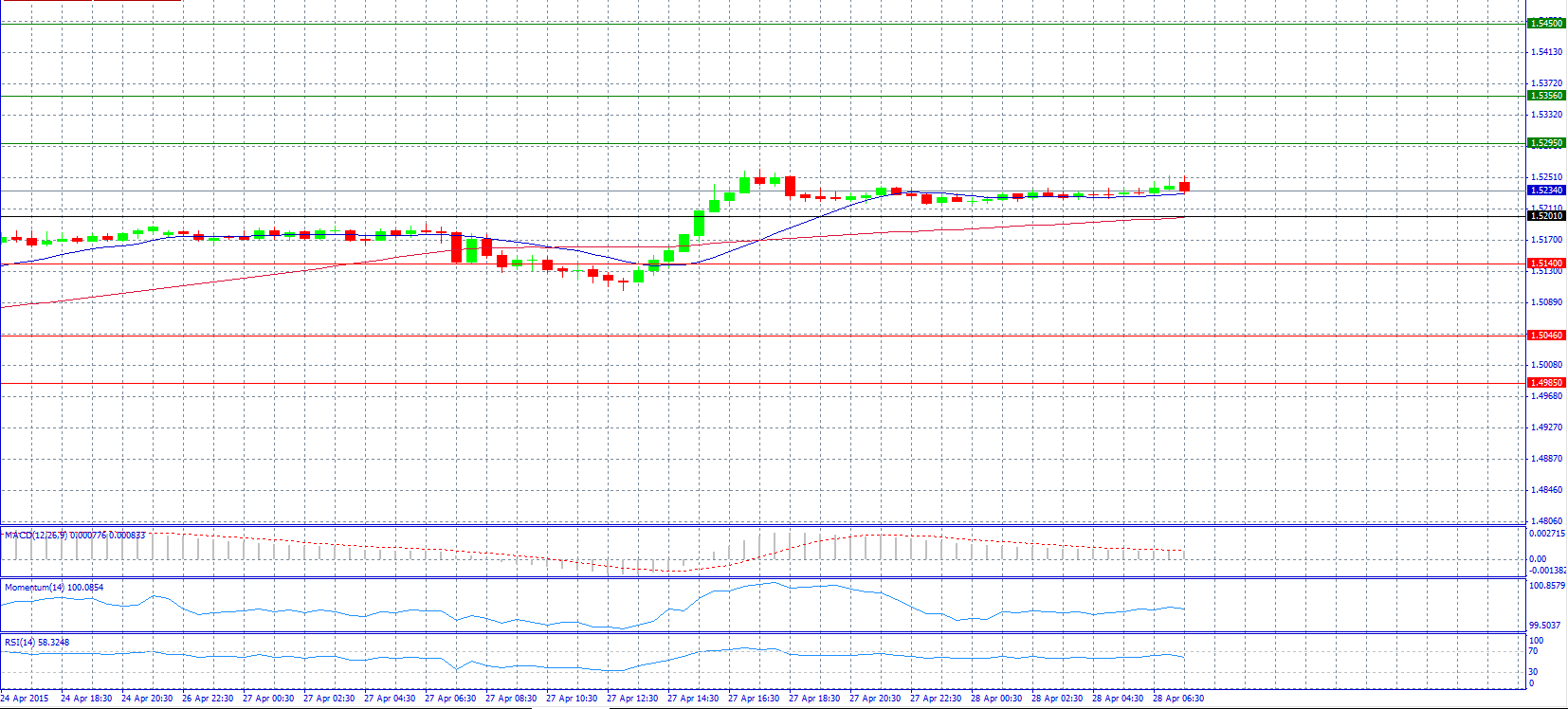

Market Scenario 1: Long positions above 1.5295 with target @ 1.5356.

Market Scenario 2: Short positions below 1.5201 with target @ 1.5140.

Comment: The British pound strengthened due to dollar weakness as demand for the greenback was limited.

Supports and Resistances:

R3 1.5450

R2 1.5356

R1 1.5295

PP 1.5201

S1 1.5140

S2 1.5046

S3 1.4985

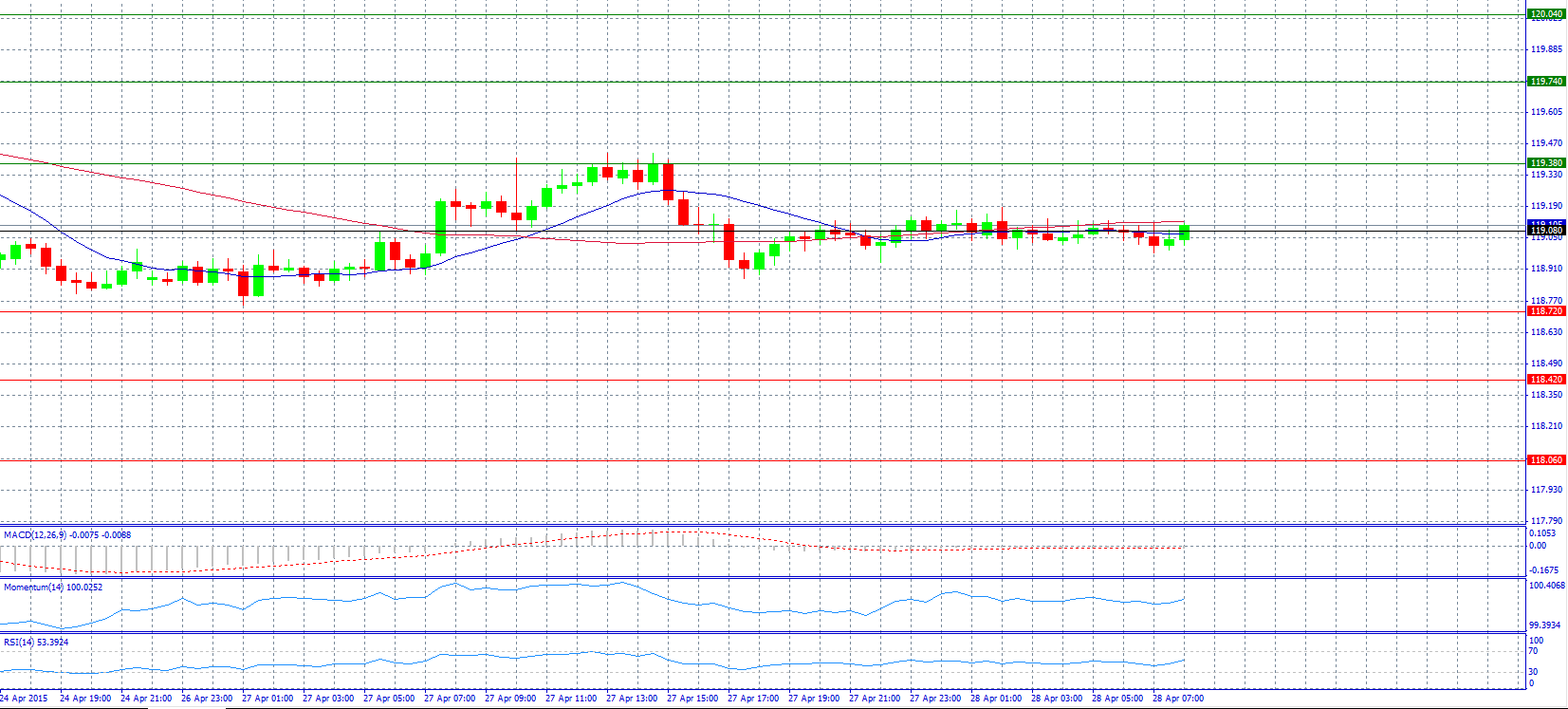

Market Scenario 1: Long positions above 119.08 with target @ 119.38.

Market Scenario 2: Short positions below 119.08 with target @ 118.72.

Comment: The pair frozen above 119.00 level.

Supports and Resistances:

R3 120.04

R2 119.74

R1 119.38

PP 119.08

S1 118.72

S2 118.42

S3 118.06

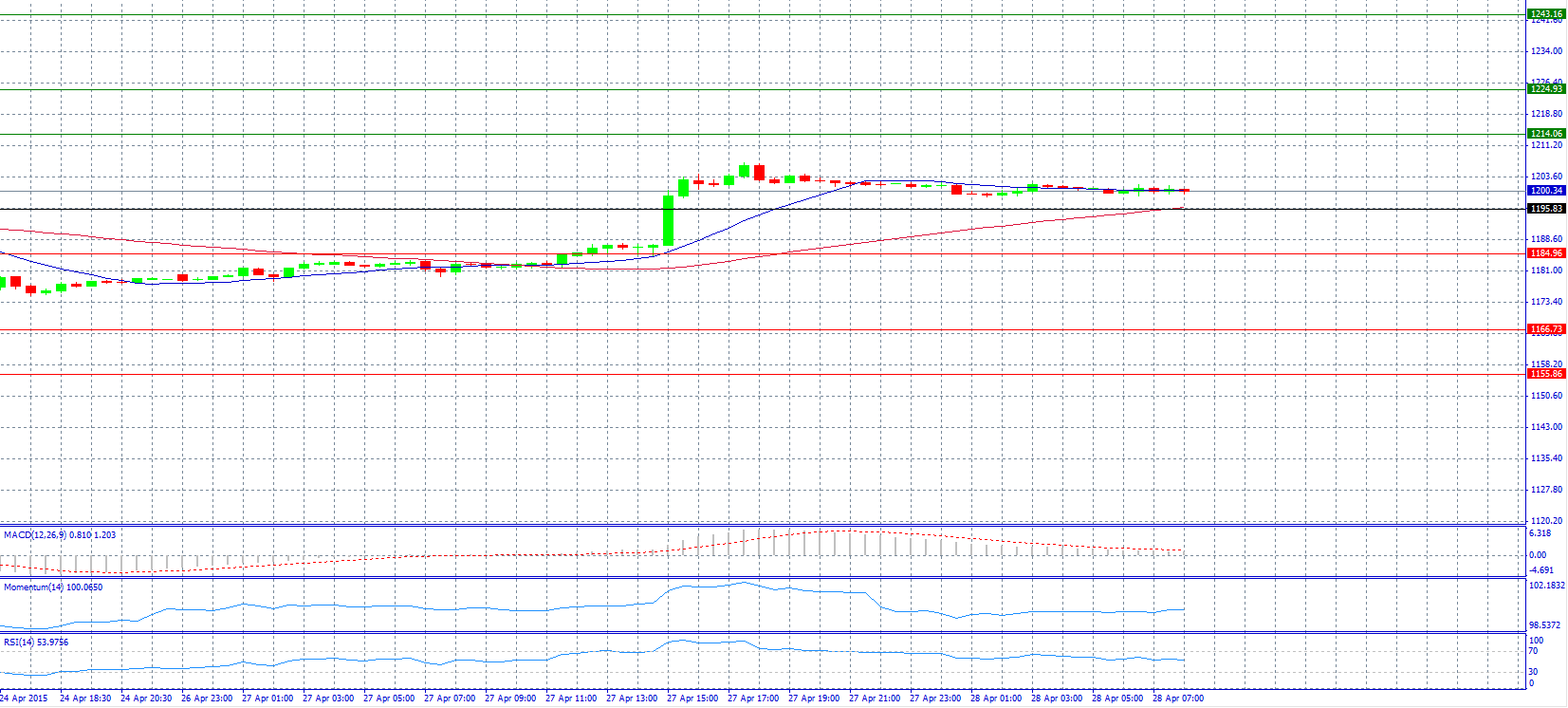

Market Scenario 1: Long positions above 1214.06 with target @ 1224.93.

Market Scenario 2: Short positions below 1195.83 with target @ 1184.96.

Comment: Gold prices struggle to extend gains above 1200.00 level.

Supports and Resistances:

R3 1243.16

R2 1224.93

R1 1214.06

PP 1195.83

S1 1184.96

S2 1166.73

S3 1155.86

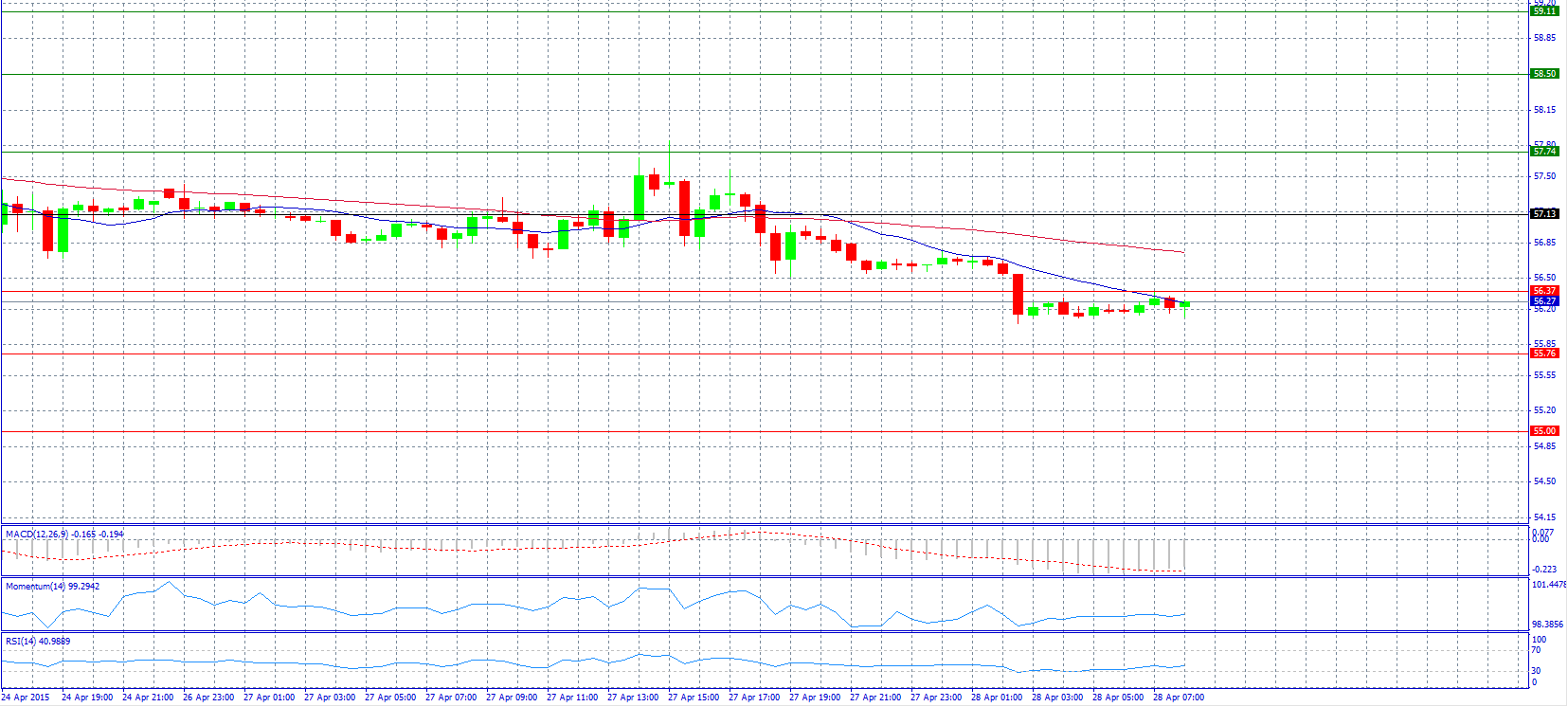

Market Scenario 1: Long positions above 56.37 with target @ 57.13.

Market Scenario 2: Short positions below 55.76 with target @ 55.00.

Comment: Crude oil prices extend losses as ample global supply blunted support from the conflict in Yemen and the falling number of U.S. rigs drilling for oil.

Supports and Resistances:

R3 59.11

R2 58.50

R1 57.74

PP 57.13

S1 56.37

S2 55.76

S3 55.00

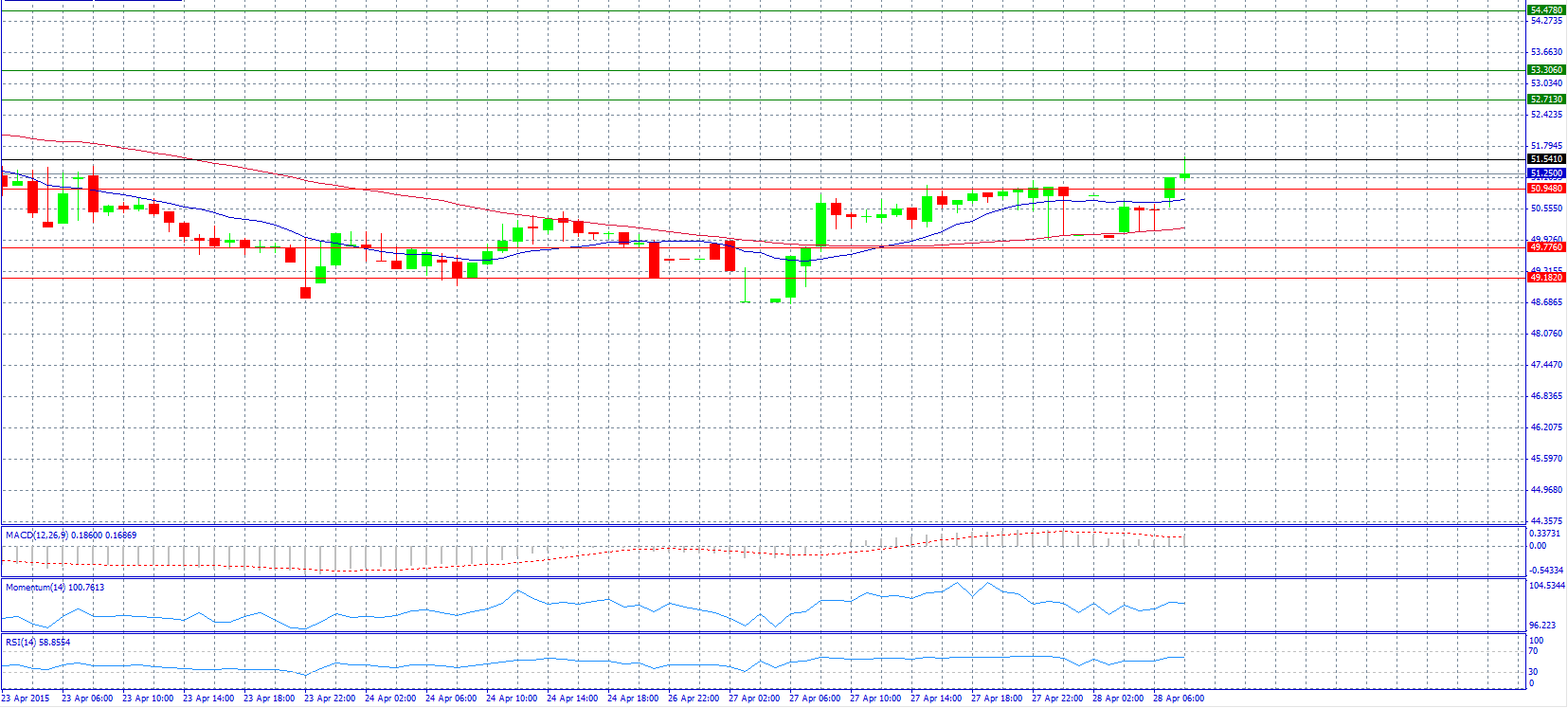

Market Scenario 1: Long positions above 51.541 with target @ 52.713.

Market Scenario 2: Short positions below 50.948 with target @ 49.776.

Comment: The pair rises and tries to reach 51.500 level.

Supports and Resistances:

R3 54.478

R2 53.306

R1 52.713

PP 51.541

S1 50.948

S2 49.776

S3 49.182