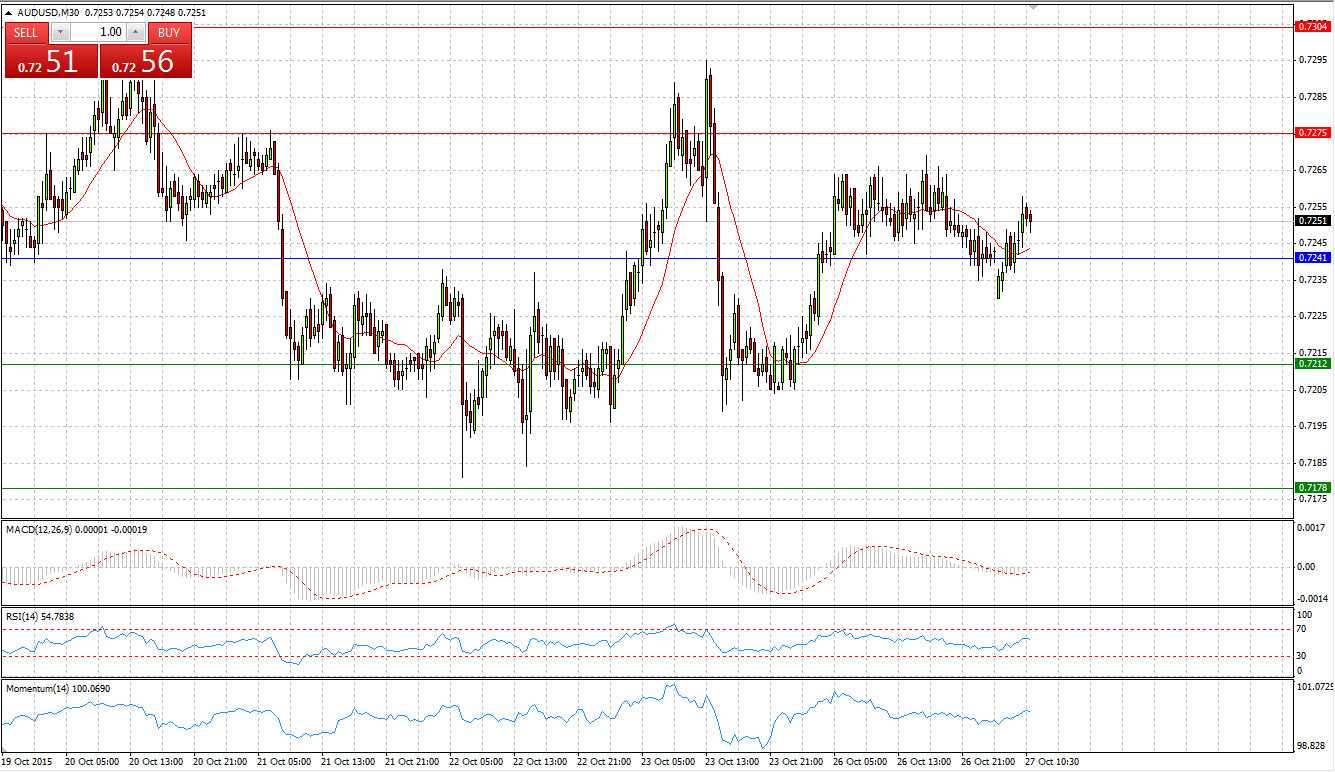

Market Scenario 1: Long positions above 0.7241 with targets @ 0.7275 & 0.7304

Market Scenario 2: Short positions below 0.7241 with targets @ 0.7212 & 0.7178

Comment: After several unsuccessful attempts to redirect AUDUSD below the Support level at 0.7195, bears retreated. During Monday’s session, Aussie managed to regain some of the losses encountered on Wednesday and ended the day with 42 pips gain at 0.7242. At the time being, AUDUSD trades above Pivot Point level.

Supports and Resistances:

R3 0.7338

R2 0.7304

R1 0.7275

PP 0.7241

S1 0.7212

S2 0.7178

S3 0.7149

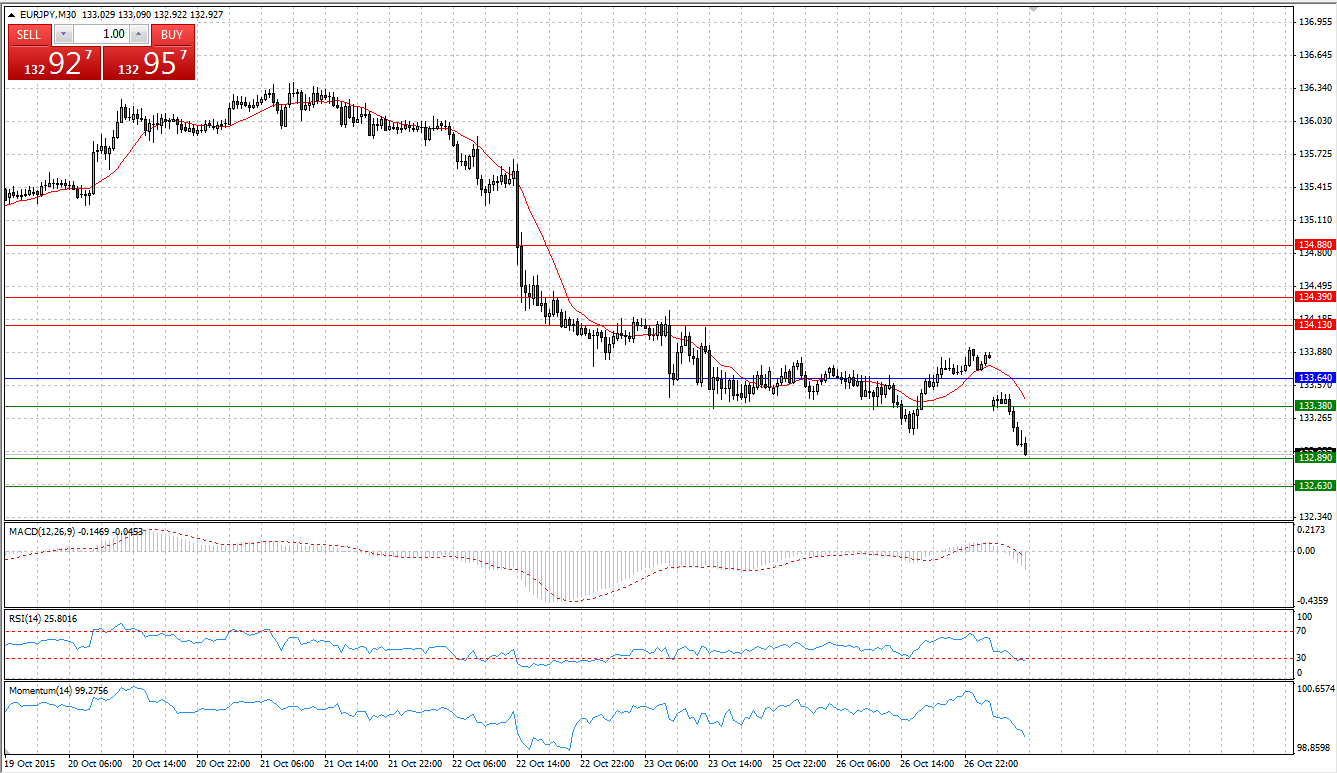

Market Scenario 1: Long positions above 133.38 with targets @ 132.89 & 132.63

Market Scenario 2: Short positions below 133.38 with targets @ 133.64 & 134.13

Comment: European currency continues depreciating against Japanese Yen reaching its lowest level at 133.115 since the 8th of August. Currently, the pair broke through Yesterday’s low and dropped below 133. Japanese Yen per Euro is near to the Second Support level.

R3 134.88

R2 134.39

R1 134.13

PP 133.64

S1 133.38

S2 132.89

S3 132.63

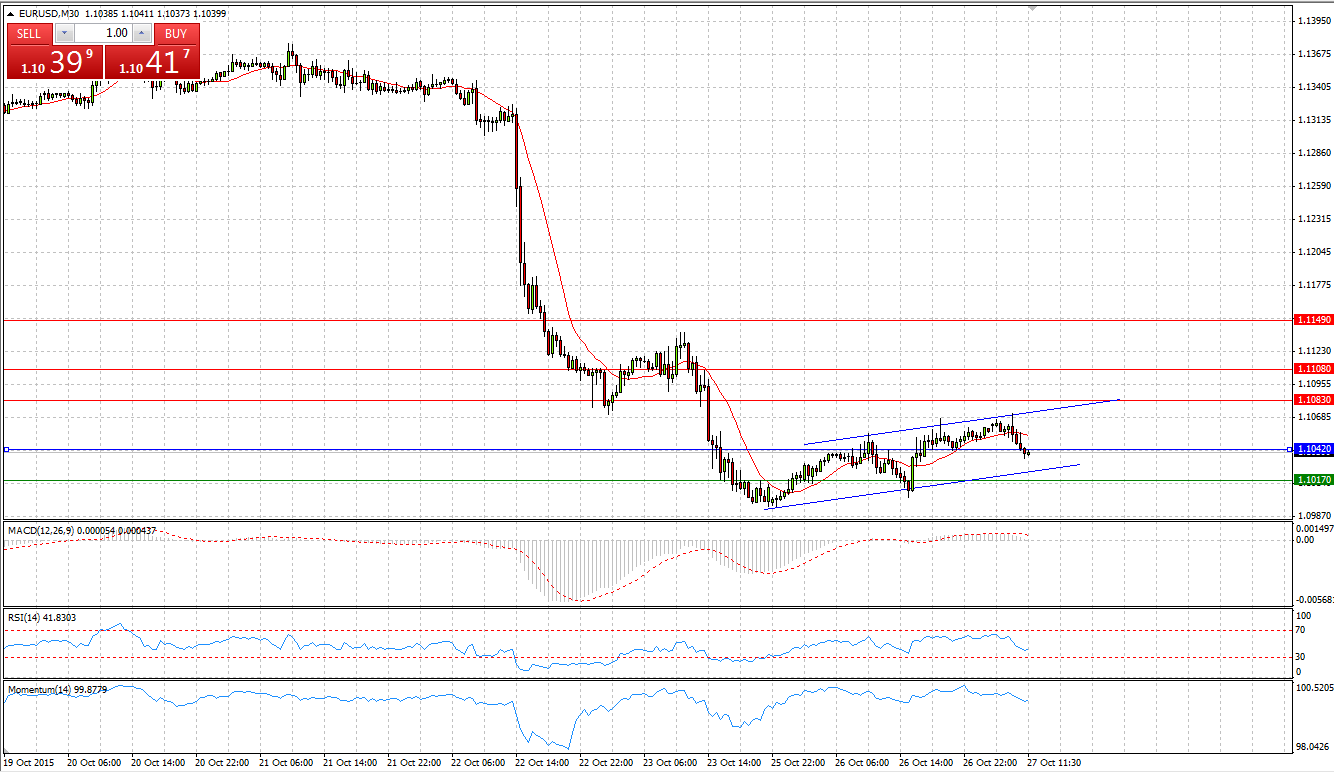

Market Scenario 1: Long positions above 1.1042 with targets @ 1.1083 & 1.1108

Market Scenario 2: Short positions below 1.1042 with targets @ 1.1017& 1.0976

Comment: After heavy sell-off during Thursday’s and Friday’s sessions, European currency is trading flat against US dollar. However, it doesn’t seem that bulls regained the control over the pair yet, as European currency still remains weak. From technical point of view the chart is drawing a Rising Wedge, which is known as a continuation sign.

Supports and Resistances:

R3 1.1149

R2 1.1108

R1 1.1083

PP 1.1042

S1 1.1017

S2 1.0976

S3 1.0951

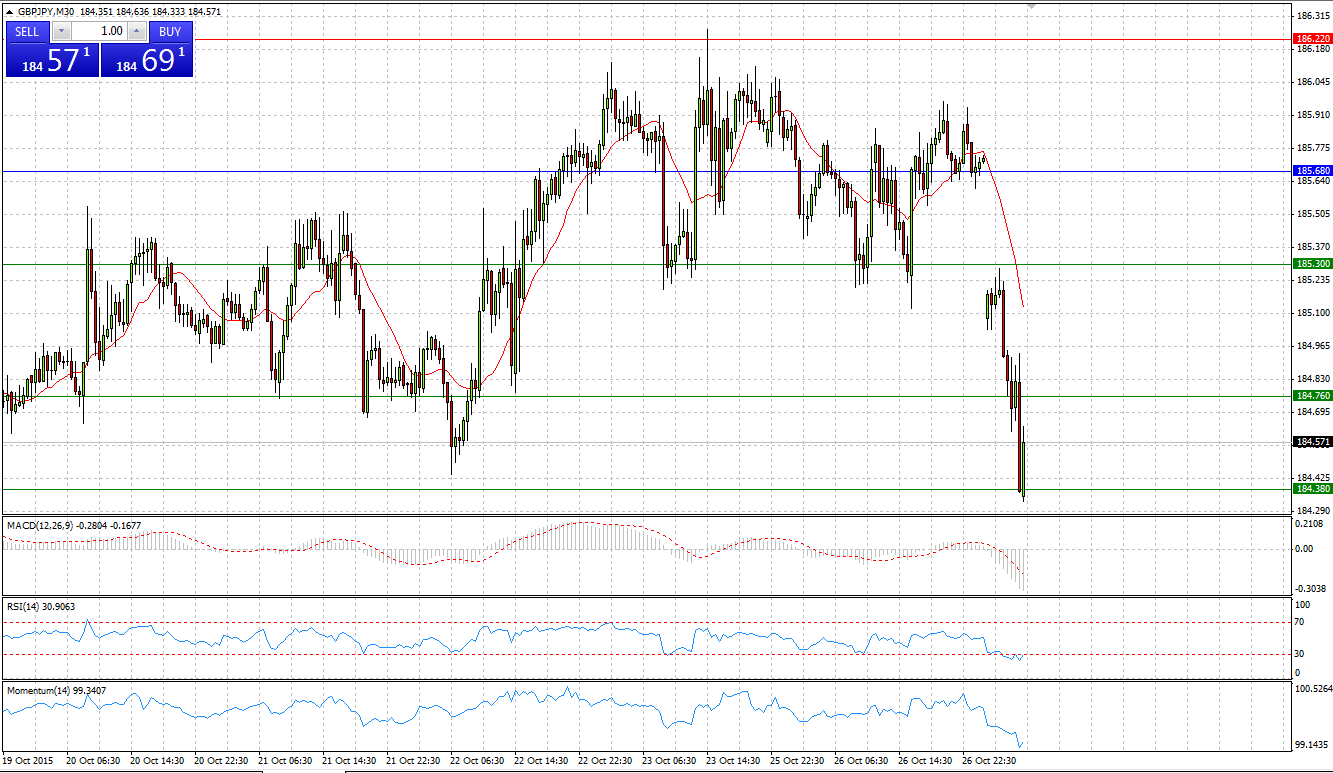

GBP/JPY

Market Scenario 1: Long positions above 185.82 with targets @ 186.40 & 186.87

Market Scenario 2: Short positions below 185.82 with targets @ 185.35 & 185.35

Comment: GBPJPY came under selling pressure and lost more than 100 pips since Asian session breaking both Support levels and testing the last one S3. Sudden strength of the Yen adversely affected the basket of currency pairs along with Crude, Cupper, US and China’s Stock Market.

Supports and Resistances:

R3 187.14

R2 186.60

R1 186.22

PP 185.68

S1 185.30

S2 184.76

S3 184.38

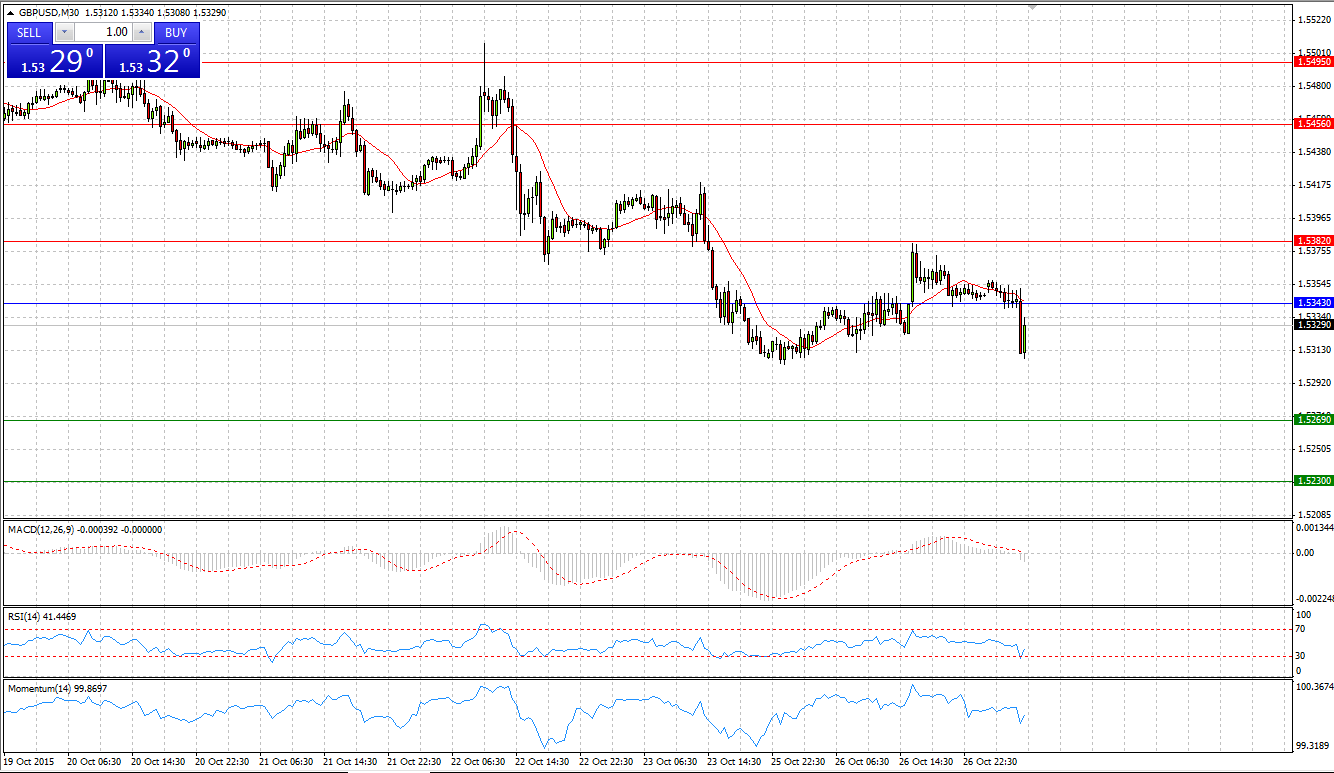

GBP/USD

Market Scenario 1: Long positions above 1.5345 with targets @ 1.5386 & 1.5420

Market Scenario 2: Short positions below 1.5345 with targets @ 1.5311 & 1.5270

Comment: GBPUSD managed to return some of the losses in yesterday’s session, however, the pair remains trading significantly below its recent highs at 1.55. At the time being, the currency pair is trading below Pivot Point level.

Supports and Resistances:

R3 1.5461

R2 1.5420

R1 1.5386

PP 1.5345

S1 1.5311

S2 1.5270

S3 1.5236

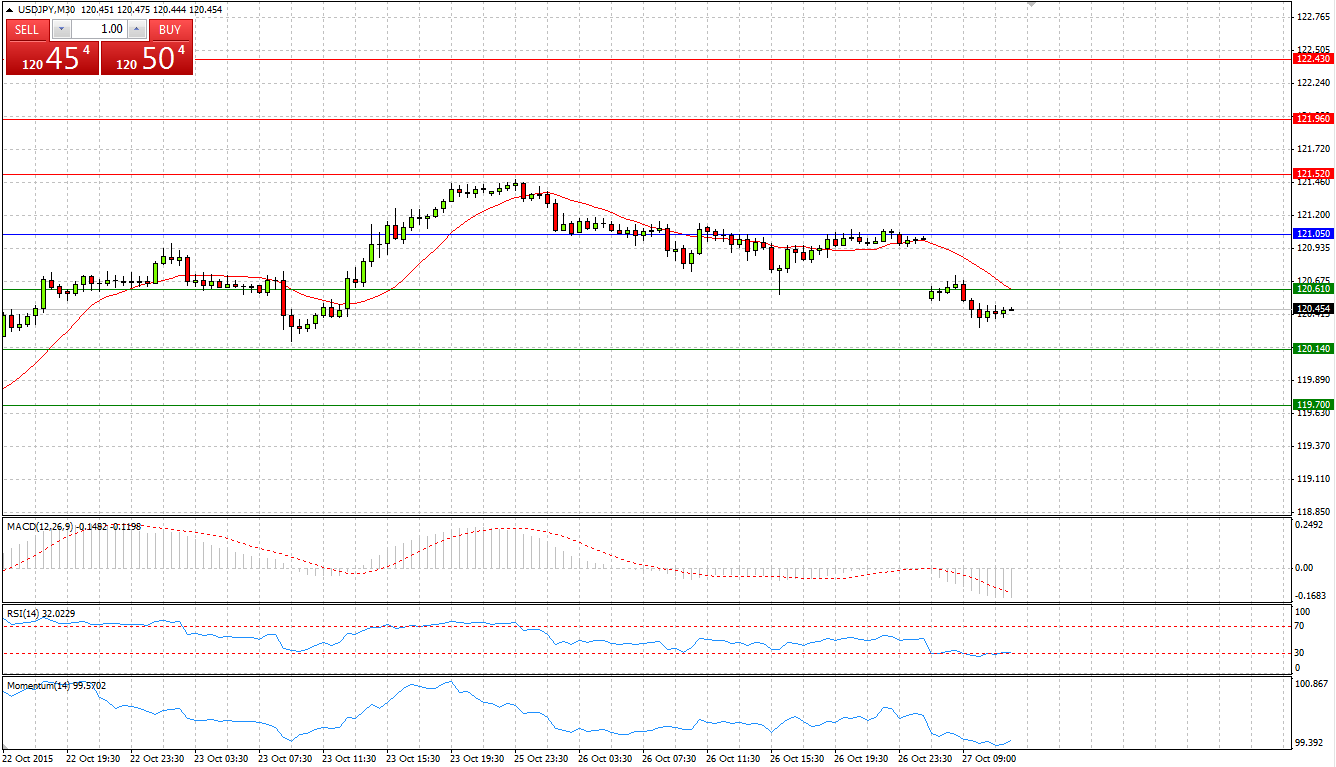

Market Scenario 1: Long positions above 121.05 with targets @ 121.75 & 122.30

Market Scenario 2: Short positions below 121.05 with targets @ 120.62 & 119.80

Comment: Japanese Yen strengthened against all its peers sending the US. Dollar as low as 120.4. The pair hasn’t managed to break through the First Resistance level at 121.75 and was sent back to the consolidation area in which the pair had been trading since 30 of August.

Supports and Resistances:

R3 122.43

R2 121.96

R1 121.52

PP 121.05

S1 120.61

S2 120.14

S3 119.70

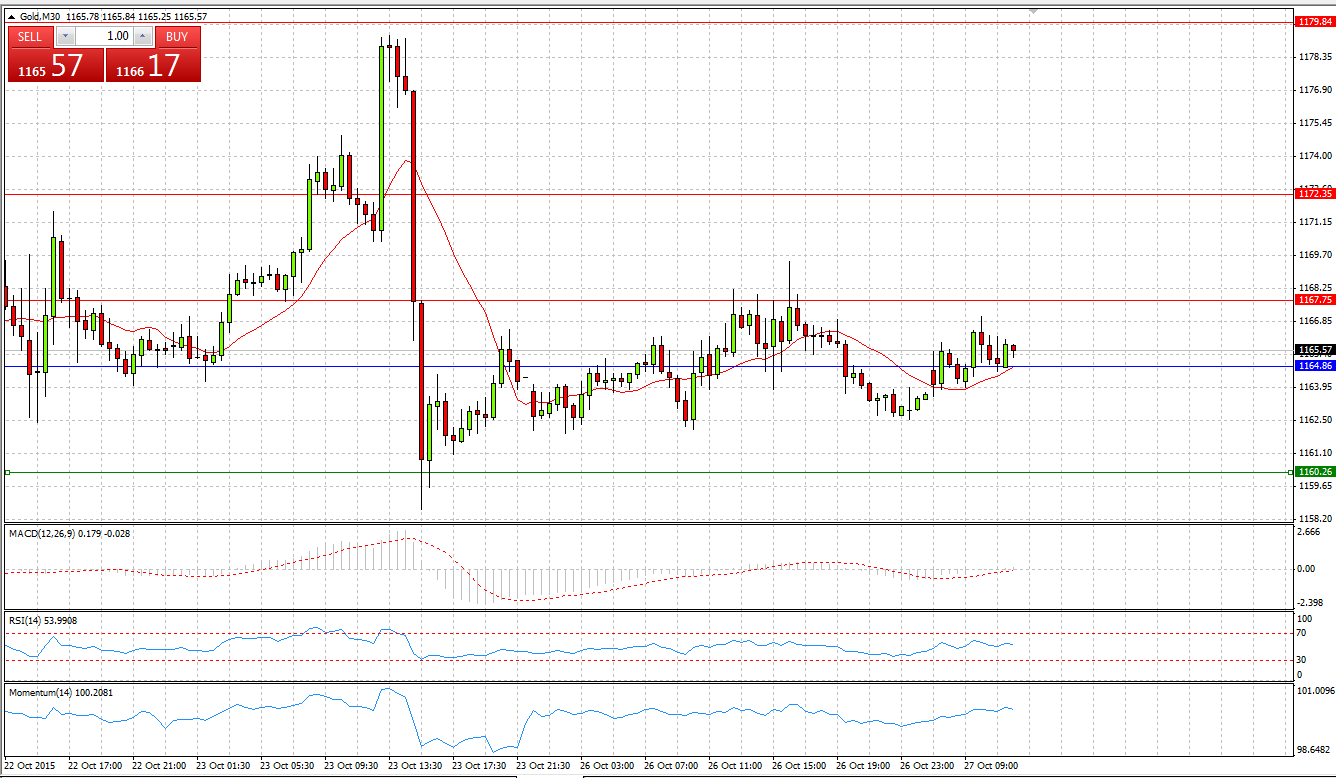

GOLD

Market Scenario 1: Long positions above 1164.86 with targets @ 1167.75 & 1172.35

Market Scenario 2: Short positions below 1164.86 with targets @ 1160.26 & 1157.37

Comment: After heavy sell-off, Gold continue trading in a range slightly above Pivot Point level. If Gold succeeds to break through the First resistance level it will open a way to R2.

Supports and Resistances:

R3 1179.84

R2 1172.35

R1 1167.75

PP 1164.86

S1 1160.26

S2 1157.37

S3 1149.88

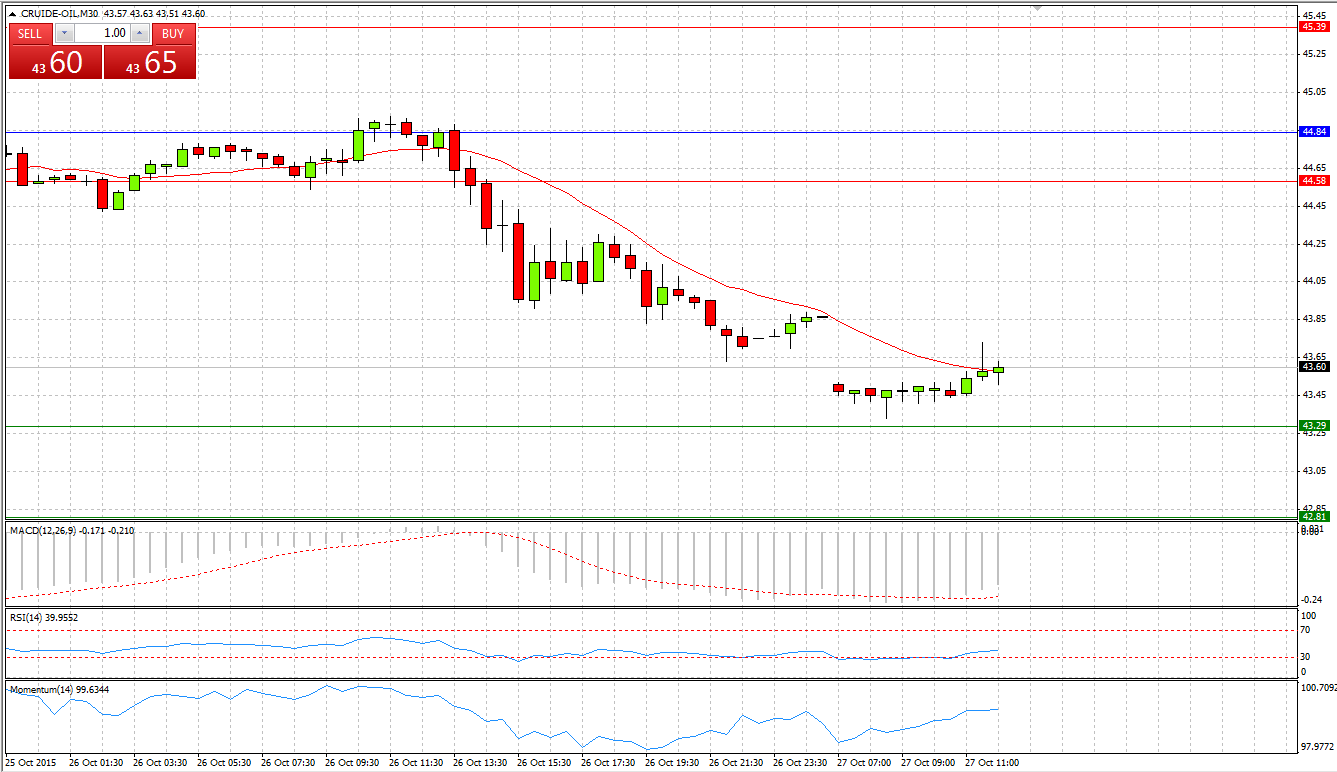

CRUDE OIL

Market Scenario 1: Long positions above 44.84 with targets @ 45.50 & 46.38

Market Scenario 2: Short positions below 44.84 with targets @ 43.96 & 43.30

Comment: During Yesterday’s session Crude sunk lower and reached its lowest level at 43.63 since 28th of August. During early Asian session bulls continued pushing prices for crude even lower. During today’s session, Crude reached a new low at 43.33 US Dollar per barrel.

Supports and Resistances:

R3 46.68

R2 45.39

R1 44.58

PP 44.84

S1 43.29

S2 42.81

S3 41.52

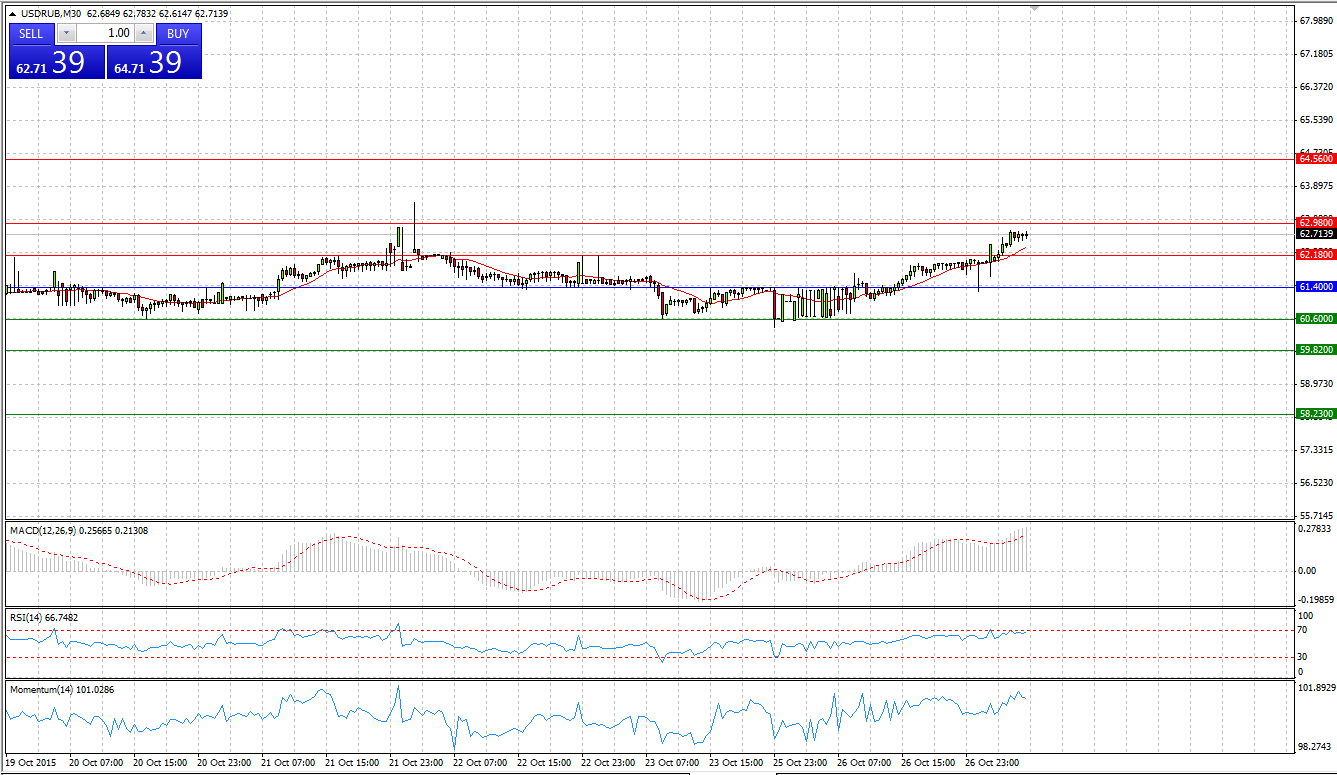

USD/RUB

Market Scenario 1: Long positions above 61.57 with targets @ 62.59 & 63.09

Market Scenario 2: Short positions below 61.57 with targets @ 61.06 & 60.04

Comment: USDRUB reached a new high during today’s trading session at 62.80 amid falling prices on Crude oil. If crude oil continues depreciating against the US. Dollar, US dollar will continue appreciating against Russian Rubble.

Supports and Resistances:

R3 64.62

R2 63.09

R1 62.59

PP 61.57

S1 61.06

S2 60.04

S3 58.51