*All the charts are 30M charts with daily pivot points.

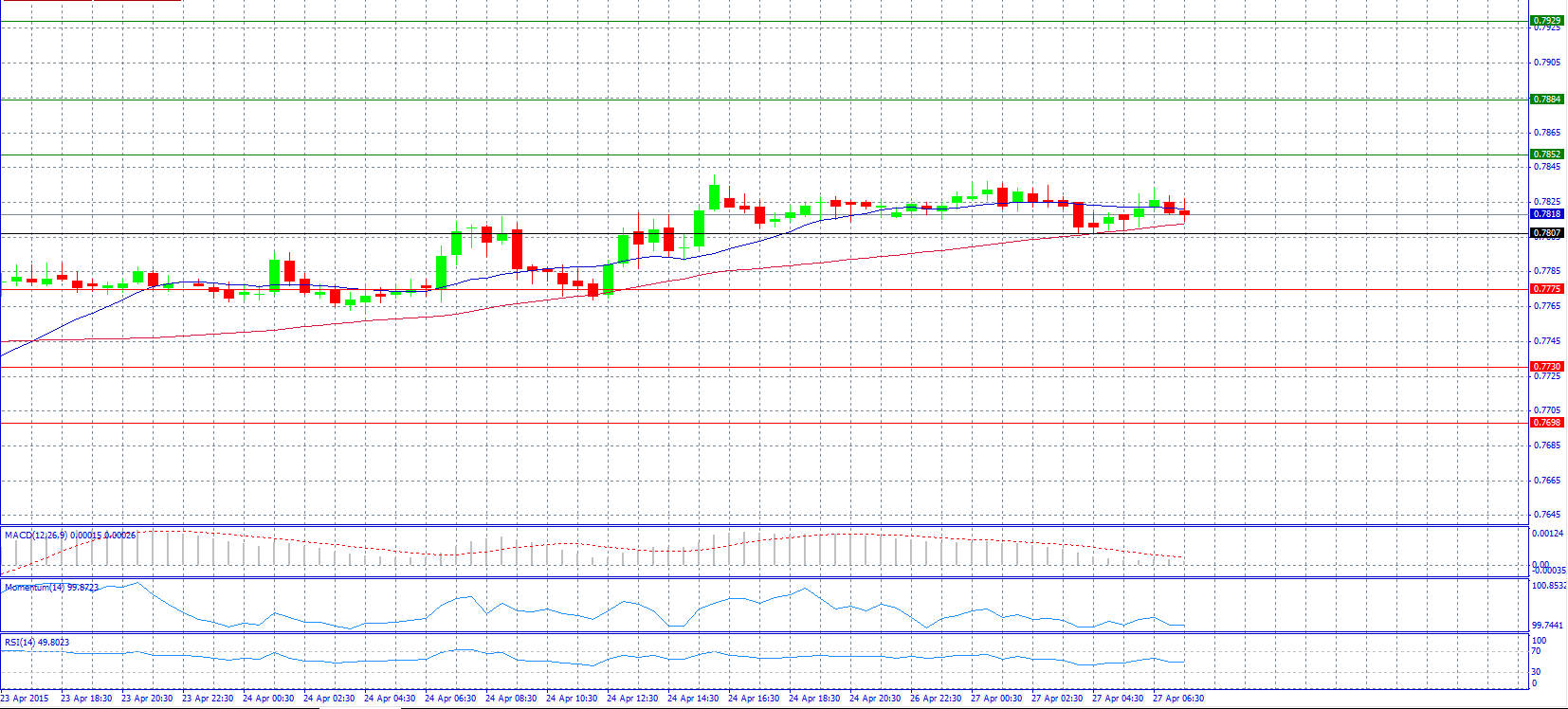

Market Scenario 1: Long positions above 0.7852 with target @ 0.7884.

Market Scenario 2: Short positions below 0.7807 with target @ 0.7775.

Comment: The pair trades almost unchanged above pivot point 0.7807.

Supports and Resistances:

R3 0.7929

R2 0.7884

R1 0.7852

PP 0.7807

S1 0.7775

S2 0.7730

S3 0.7698

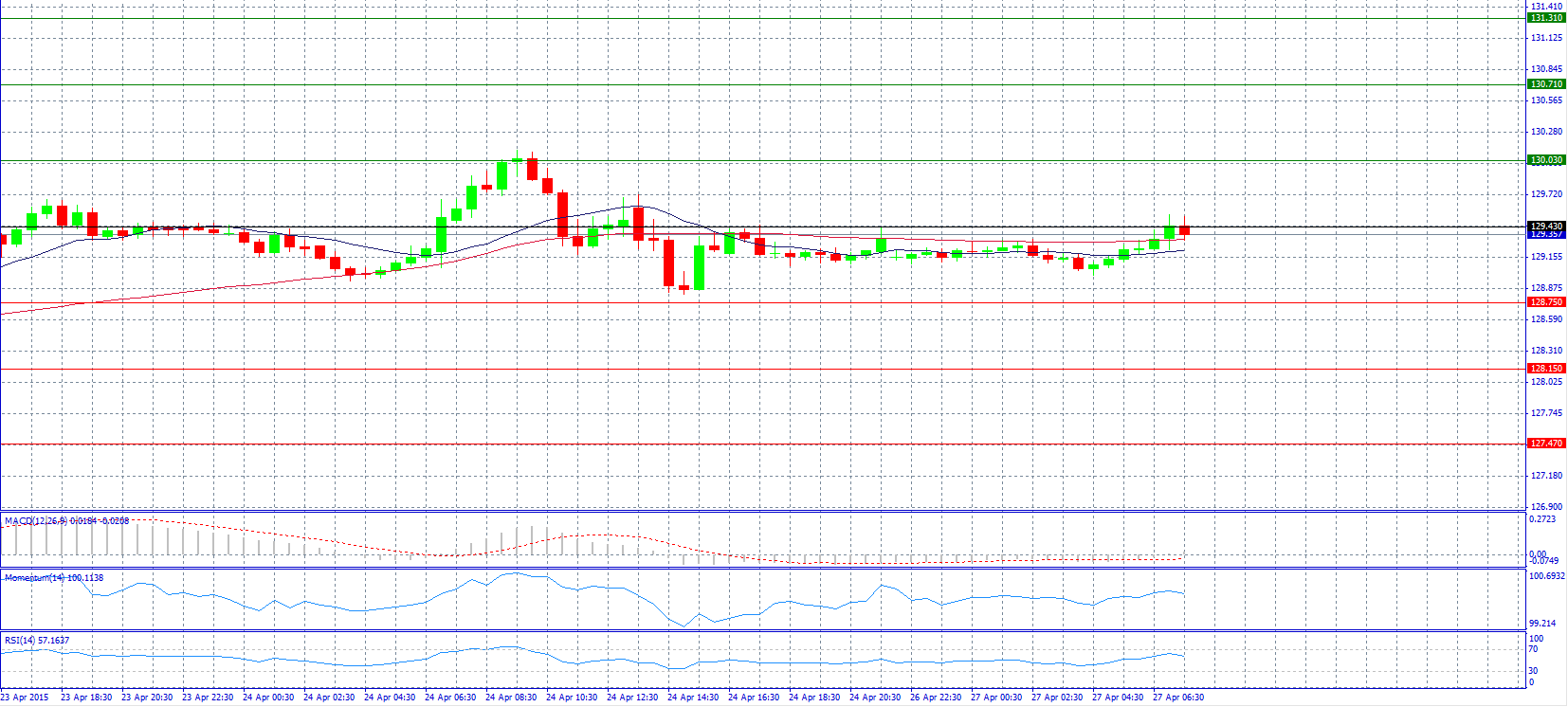

Market Scenario 1: Long positions above 129.43 with target @ 130.03.

Market Scenario 2: Short positions below 129.43 with target @ 128.75.

Comment: The pair tries to break resistance on pivot point 129.43.

Supports and Resistances:

R3 131.31

R2 130.71

R1 130.03

PP 129.43

S1 128.75

S2 128.15

S3 127.47

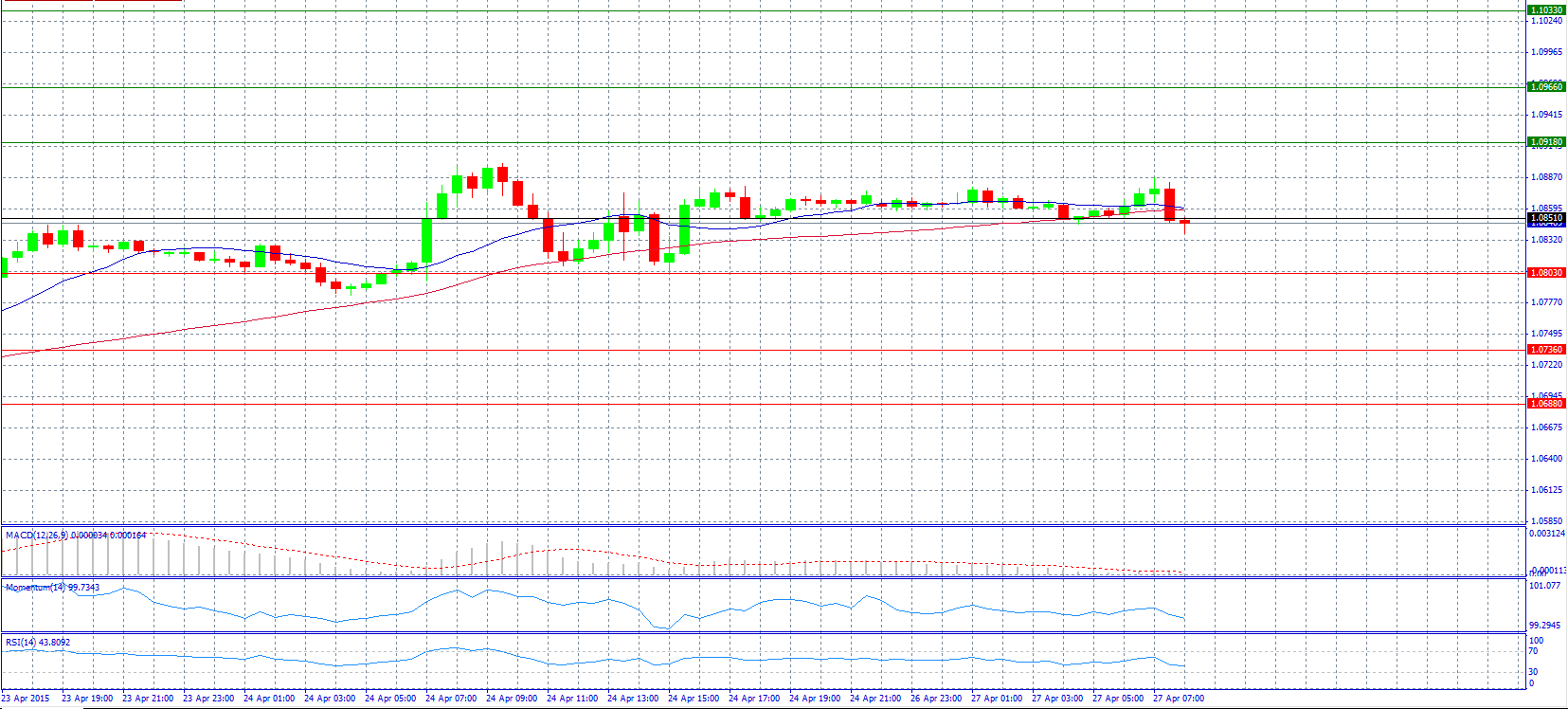

Market Scenario 1: Long positions above 1.0918 with target @ 1.0966.

Market Scenario 2: Short positions below 1.0851 with target @ 1.0803.

Comment: The pair weakened and breaks pivot point support level 1.0851.

Supports and Resistances:

R3 1.1033

R2 1.0966

R1 1.0918

PP 1.0851

S1 1.0803

S2 1.0736

S3 1.0688

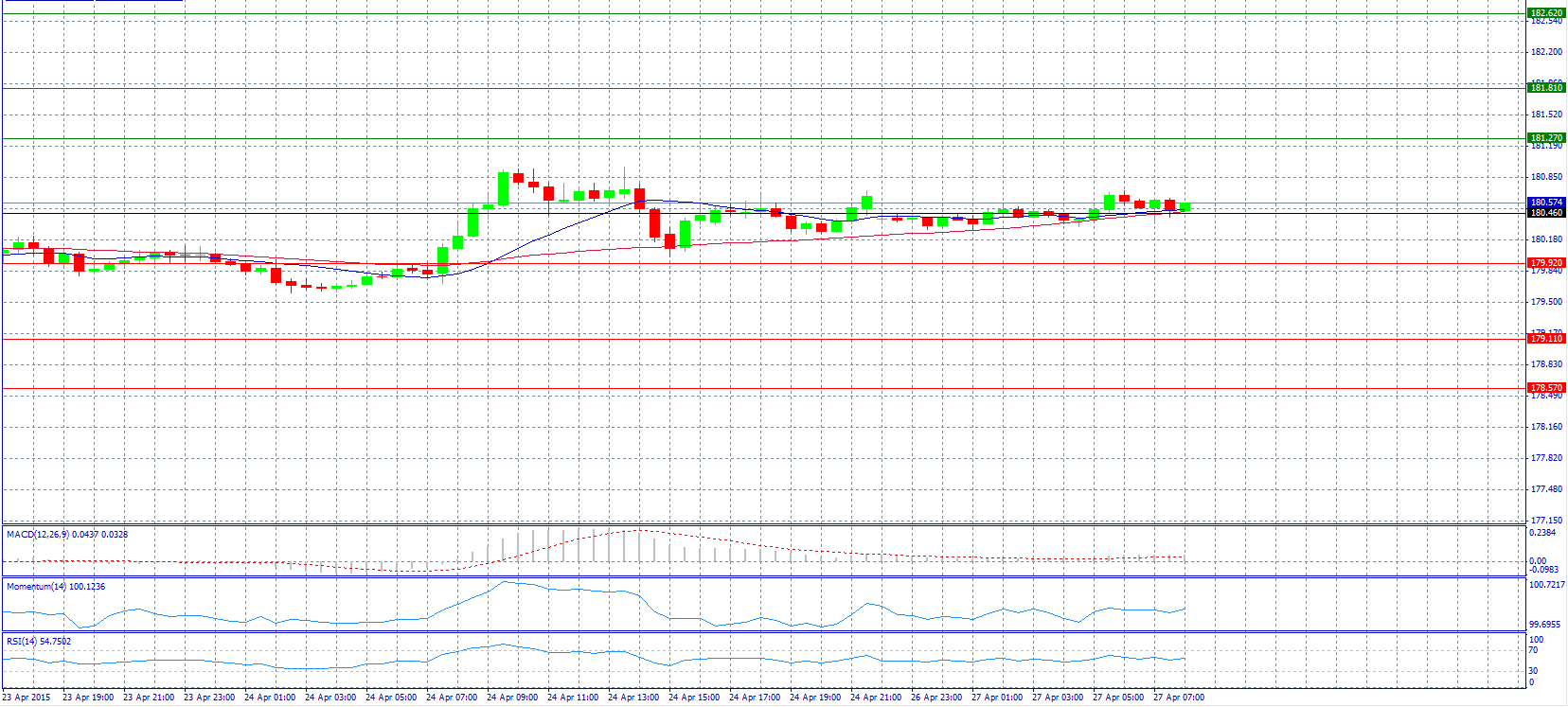

Market Scenario 1: Long positions above 180.46 with target @ 181.27.

Market Scenario 2: Short positions below 180.46 with target @ 179.92.

Comment: The pair is trading around an important support area and if it is breached more losses are possible.

Supports and Resistances:

R3 182.62

R2 181.81

R1 181.27

PP 180.46

S1 179.92

S2 179.11

S3 178.57

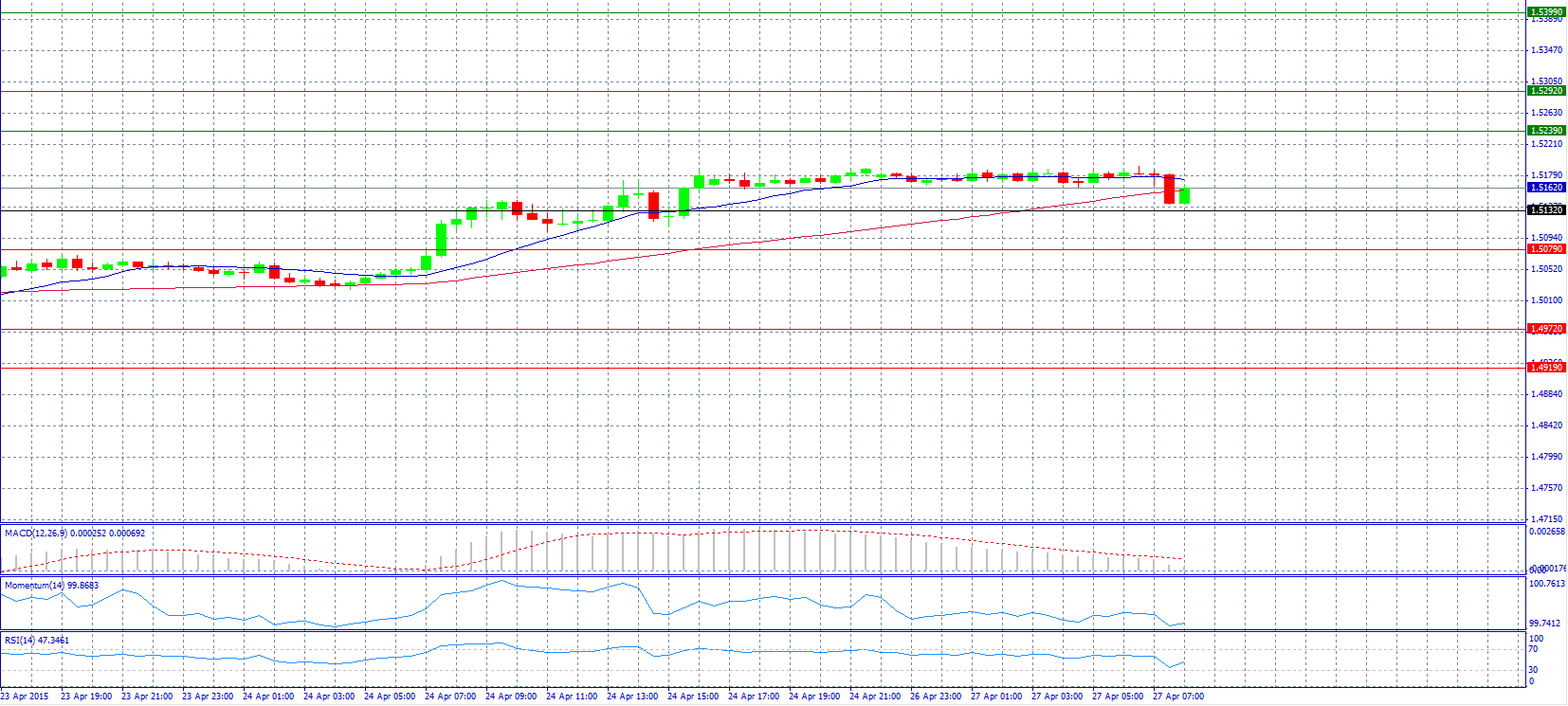

Market Scenario 1: Long positions above 1.5239 with target @ 1.5292.

Market Scenario 2: Short positions below 1.5132 with target @ 1.5079.

Comment: The pair made another attempt to reach 1.5200 level but failed again.

Supports and Resistances:

R3 1.5399

R2 1.5292

R1 1.5239

PP 1.5132

S1 1.5079

S2 1.4972

S3 1.4919

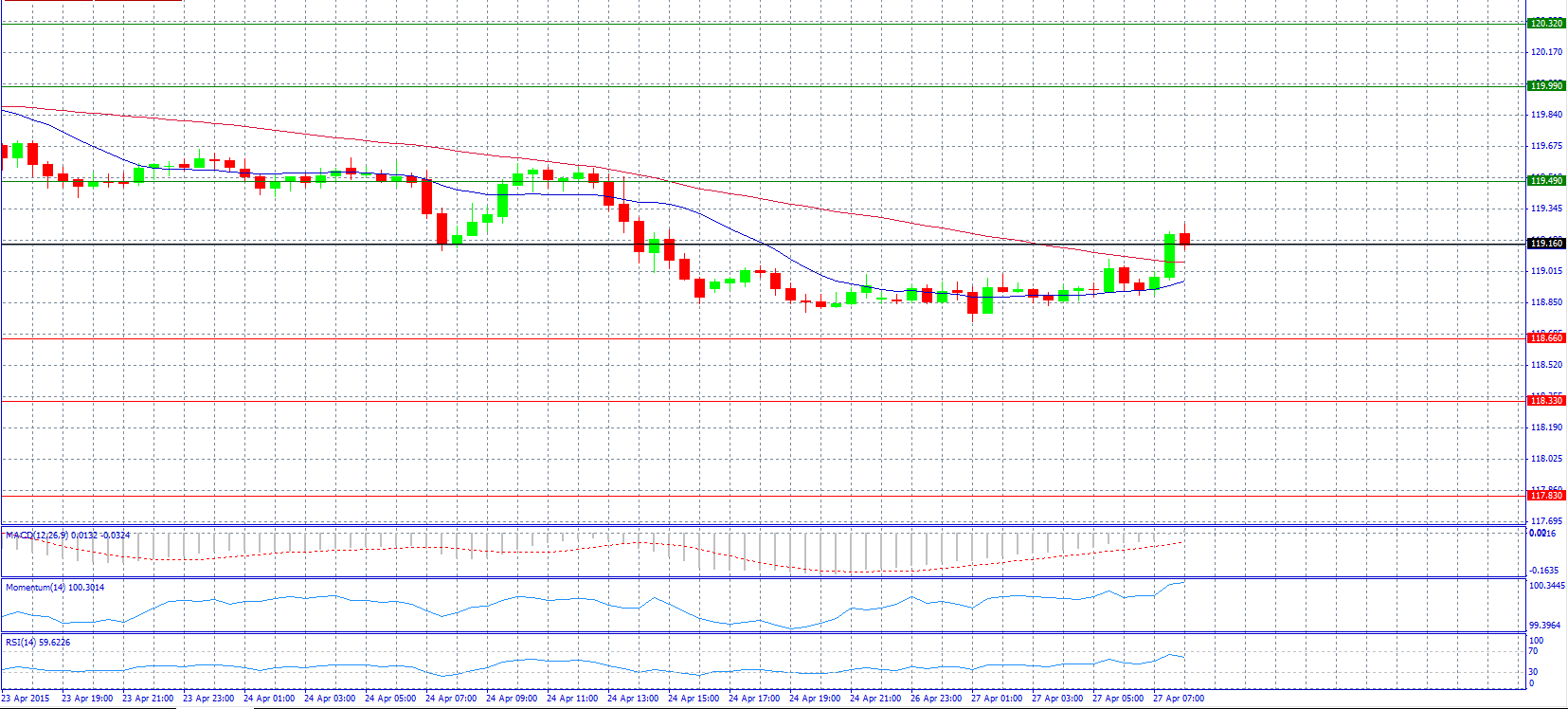

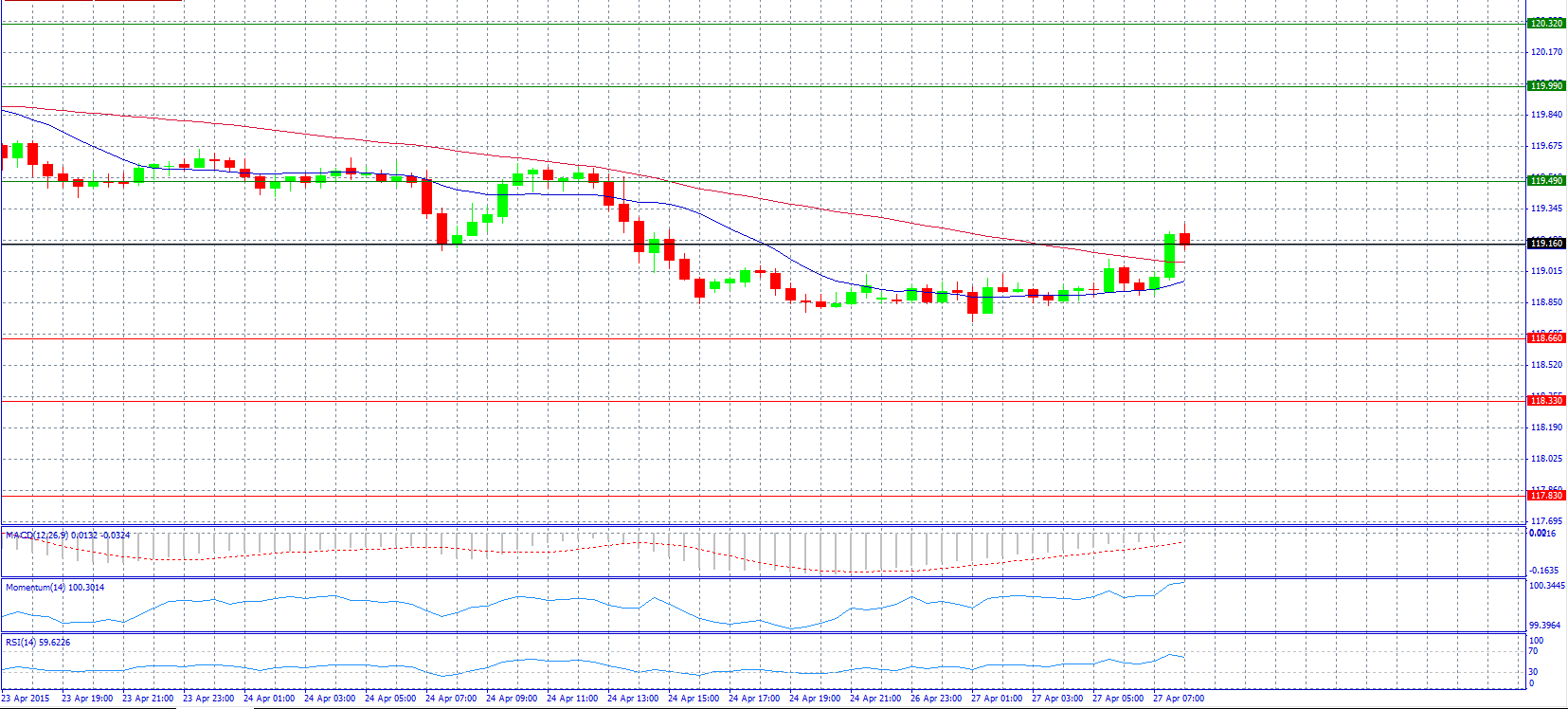

Market Scenario 1: Long positions above 119.16 with target @ 119.49.

Market Scenario 2: Short positions below 119.16 with target @ 118.66.

Comment: The pair advanced and broke resistance level 119.16.

Supports and Resistances:

R3 120.32

R2 119.99

R1 119.49

PP 119.16

S1 118.66

S2 118.33

S3 117.83

Market Scenario 1: Long positions above 1183.10 with target @ 1192.20.

Market Scenario 2: Short positions below 1183.10 with target @ 1170.90.

Comment: Gold prices are expected to trade sideways as stronger dollar in today’s session will exert downside pressure while poor economic data from the US will boost the safe haven appeal of the metal, according to analysts.

Supports and Resistances:

R3 1213.50

R2 1204.40

R1 1192.20

PP 1183.10

S1 1170.90

S2 1161.80

S3 1149.60

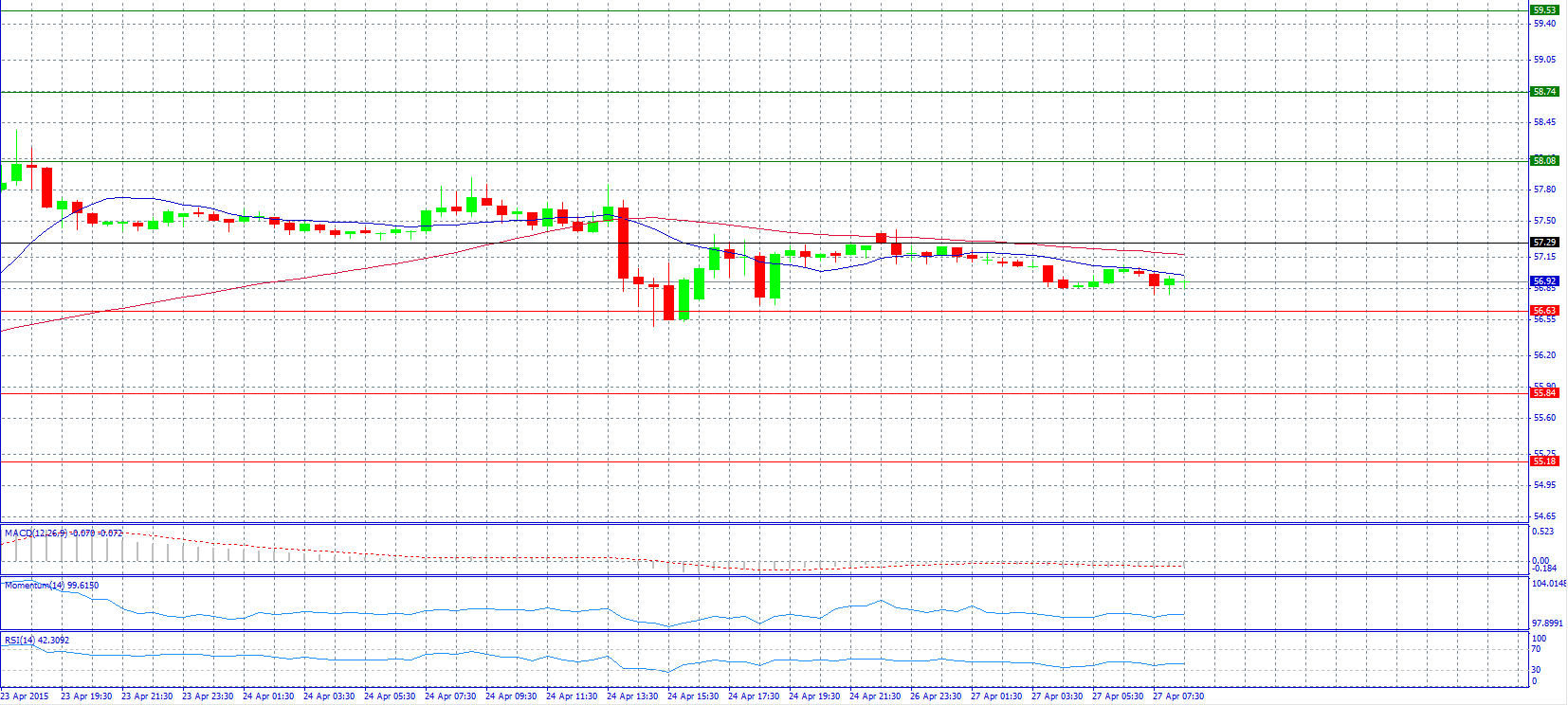

Market Scenario 1: Long positions above 57.29 with target @ 58.08.

Market Scenario 2: Short positions below 56.63 with target @ 55.84.

Comment: Crude oil net bullish positions rose sharply.

Supports and Resistances:

R3 59.53

R2 58.74

R1 58.08

PP 57.29

S1 56.63

S2 55.84

S3 55.18

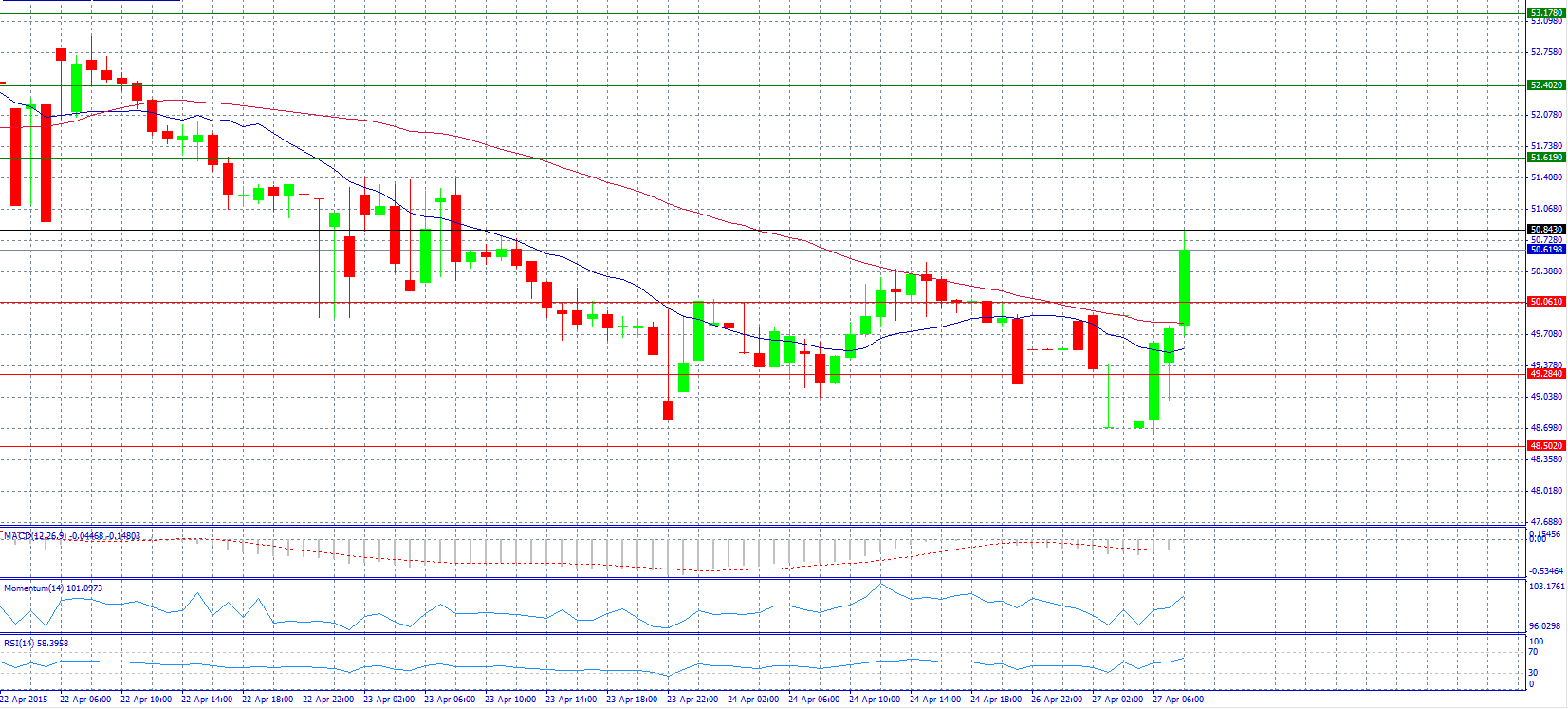

Market Scenario 1: Long positions above 50.843 with target @ 51.619.

Market Scenario 2: Short positions below 50.061 with target @ 49.284.

Comment: The pair strengthened and advanced above 50.600 level.

Supports and Resistances:

R3 53.178

R2 52.402

R1 51.619

PP 50.843

S1 50.061

S2 49.284

S3 48.502