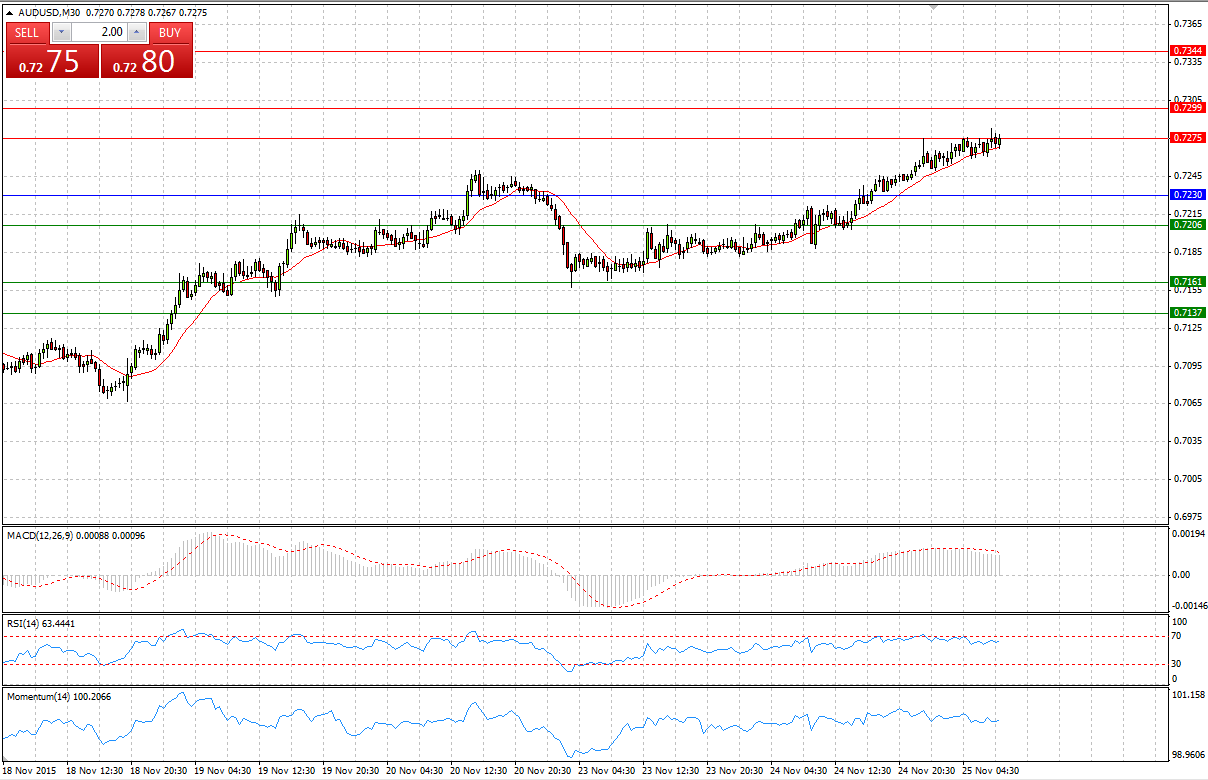

Market Scenario 1: Long positions above 0.7230 with targets at 0.7275 and 0.7299

Market Scenario 2: Short positions below 0.7230 with targets at 0.7206 and 0.7161

Comment: Aussie during yesterday’s session broke through its recent high at 0.7250 against US dollar and closed the day at 0.7260. During early Asian session, the pair was trading positively and reached a new high against US dollar at 0.7283

Supports and Resistances:

R3 0.7344

R2 0.7299

R1 0.7275

PP 0.7230

S1 0.7206

S2 0.7161

S3 0.7137

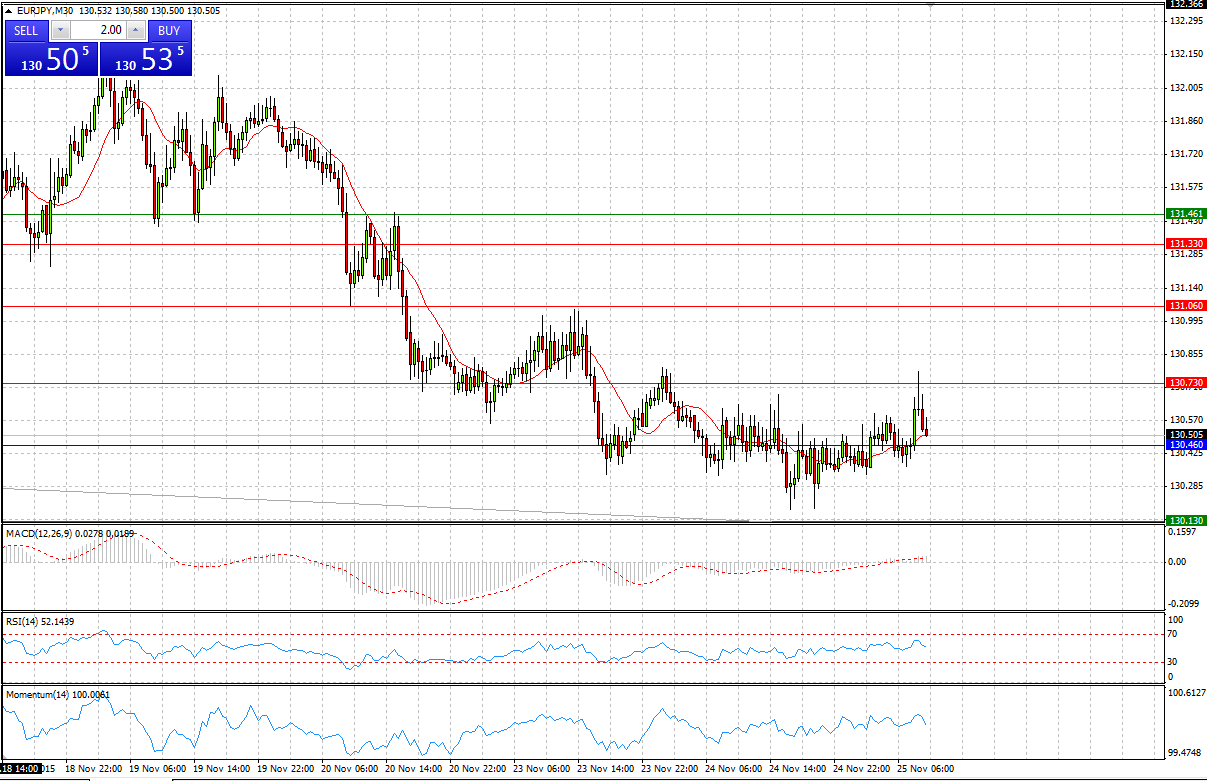

Market Scenario 1: Long positions above 130.46 with targets at 130.73 and 131.06

Market Scenario 2: Short positions below 130.46 with targets at 130.13 and 129.86

Comment: European currency recorded a new low against Japanese yen during yesterday’s session, reaching 130.18, the lowest level since 28th of April 2015. During early European session, bulls undertook an attempt to break through the First Resistance level; however, when they encountered selling pressure, bulls retreated.

Supports and Resistances:

R3 131.33

R2 131.06

R1 130.73

PP 130.46

S1 130.13

S2 129.86

S3 129.53

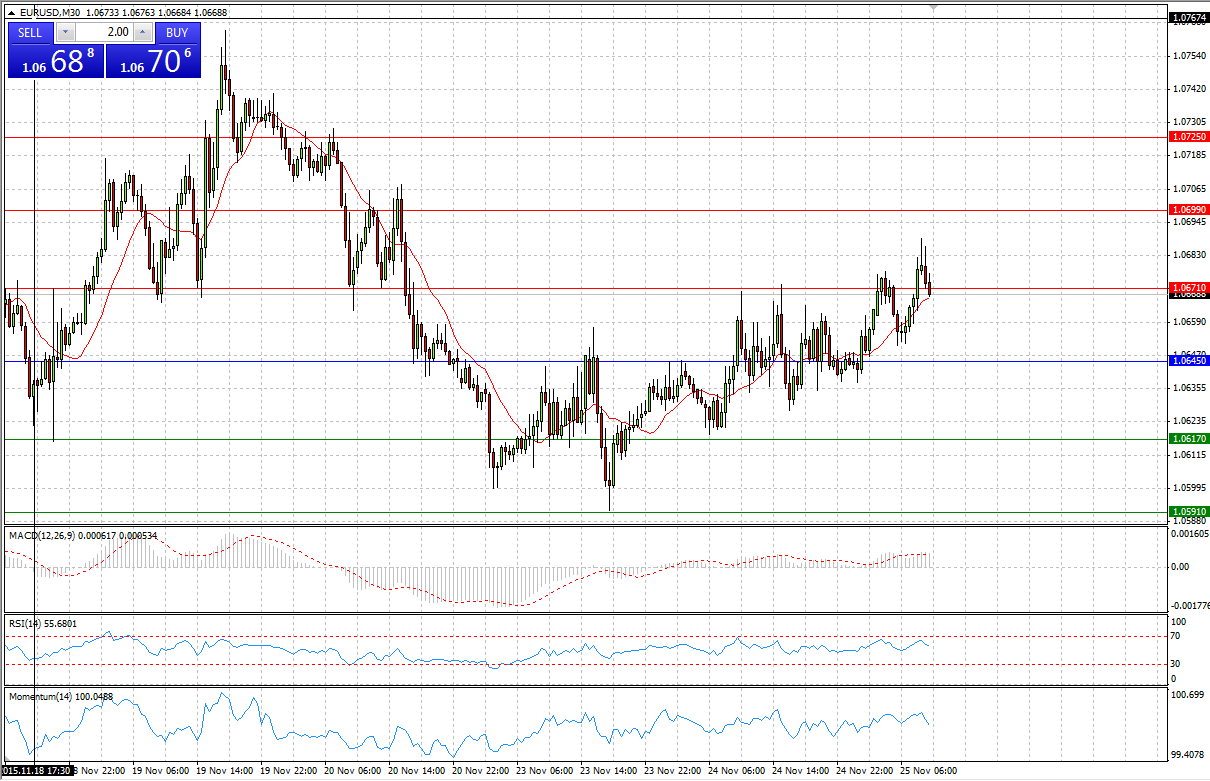

Market Scenario 1: Long positions above 1.0645 with targets at 1.0671 and 1.0699

Market Scenario 2: Short positions below 1.0645 with targets at 1.0617 and 1.0591

Comment: European currency managed to close yesterday’s session with small profit against US dollar. Today the pair is trading positively, and having managed to break through the First Resistance level, is aiming to test the Second one.

Supports and Resistances:

R3 1.0725

R2 1.0699

R1 1.0671

PP 1.0645

S1 1.0617

S2 1.0591

S3 1.0563

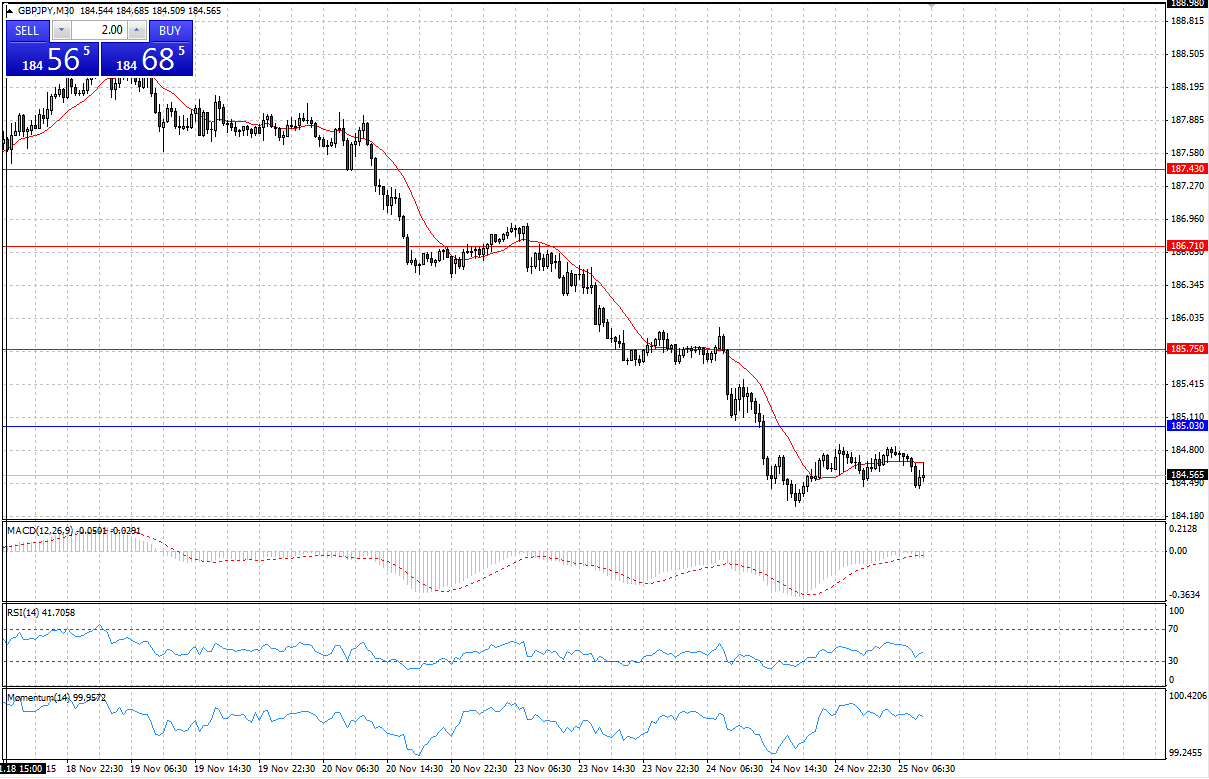

GBP/JPY

Market Scenario 1: Long positions above 185.03 with targets at 185.75 and 186.71

Market Scenario 2: Short positions below 185.03 with targets at 184.07 and 183.35

Comment: Sterling recorded 4th day of loss against Japanese yen, closing yesterday’s session as low as 184.76. Today GBP/JPY is trading flat below Pivot Point level.

Supports and Resistances:

R3 187.43

R2 186.71

R1 185.75

PP 185.03

S1 184.07

S2 183.35

S3 182.39

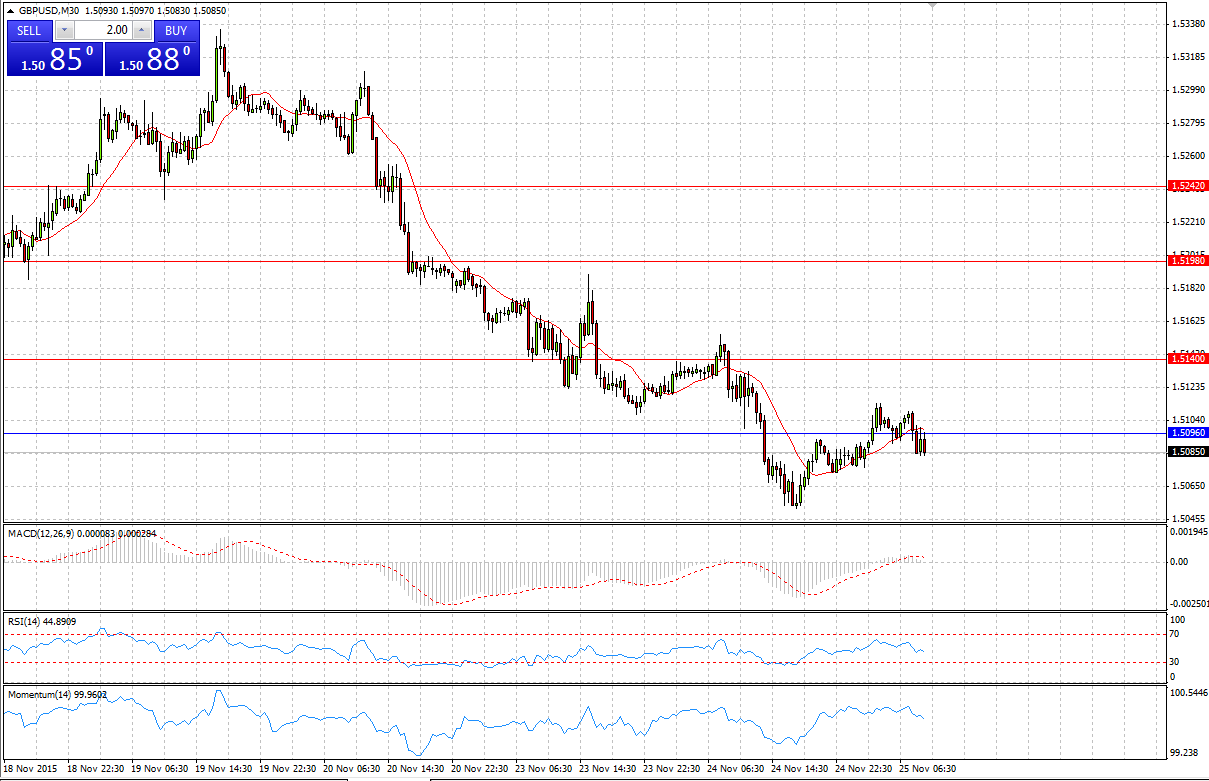

GBP/USD

Market Scenario 1: Long positions above 1.5096 with targets at 1.5140 and 1.5198

Market Scenario 2: Short positions below 1.5096 with targets at 1.5038 and 1.4994

Comment: Sterling continue losing its positions against US dollar for the third day in the row, closing yesterday’s session below 1.51. Today, GBP/USD tried to stabilize above Pivot Point level, nonetheless, being unable to withstand the onslaught, the pair retreated and now trading below PP.

Supports and Resistances:

R3 1.5242

R2 1.5198

R1 1.5140

PP 1.5096

S1 1.5038

S2 1.4994

S3 1.4936

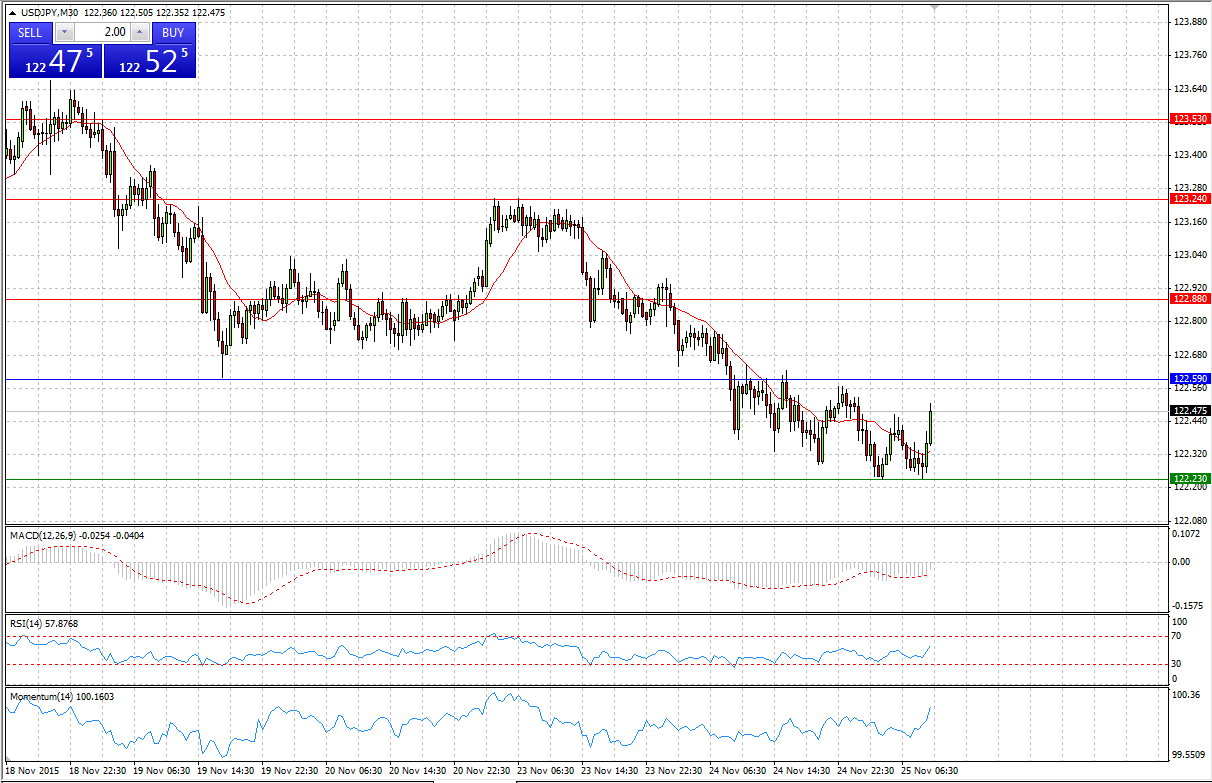

Market Scenario 1: Long positions above 122.59 with targets at 122.88 and 123.24

Market Scenario 2: Short positions below 122.59 with targets at 122.23 and 121.94

Comment: US dollar, after a number of unsuccessful trading days, approached to its recent low of 16th of November at 122.20 against Japanese yen, which is close to the First Support level. We can see that the pair found support at this level and moved higher aiming to test the Pivot Point level.

Supports and Resistances:

R3 123.53

R2 123.24

R1 122.88

PP 122.59

S1 122.23

S2 121.94

S3 121.58

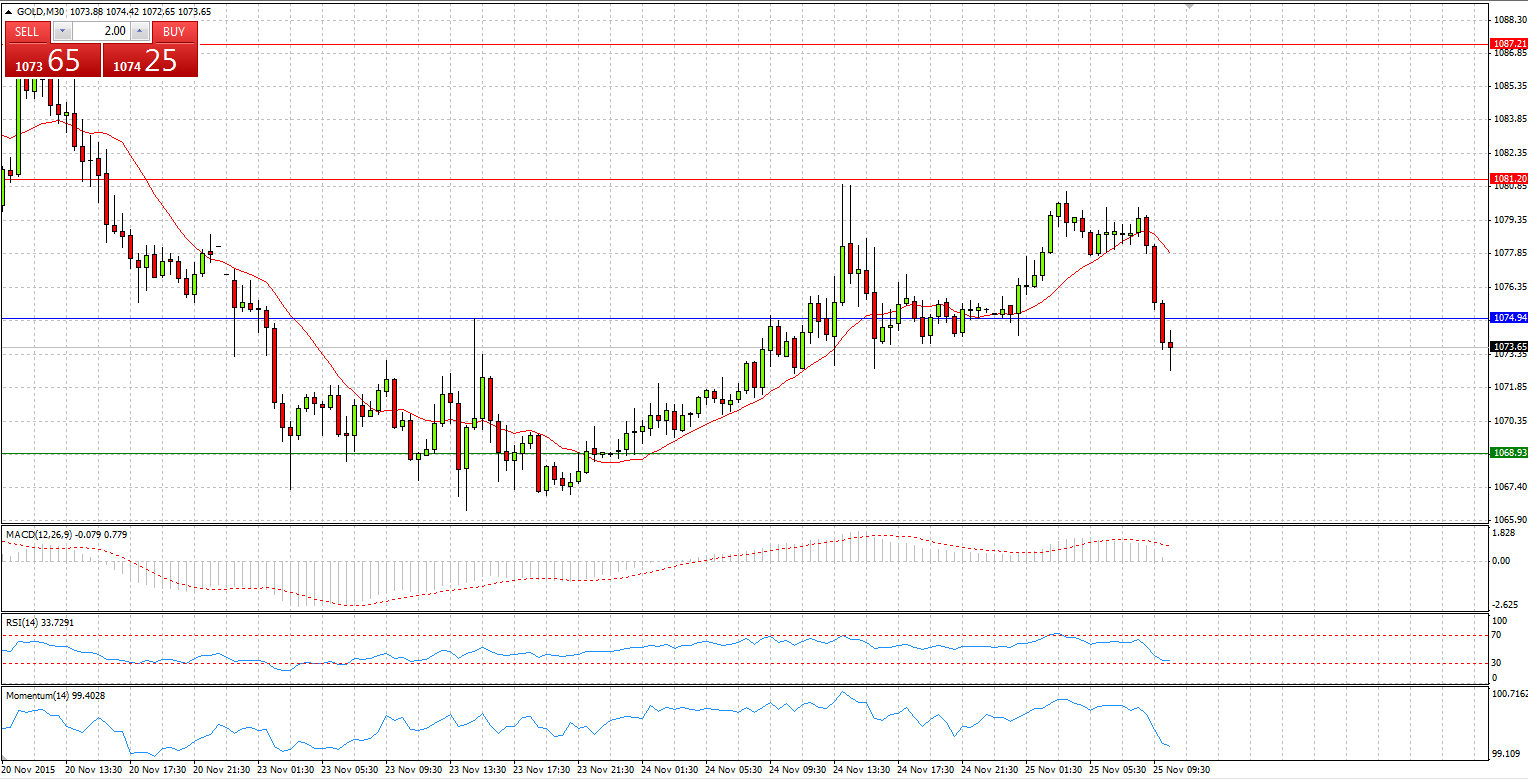

GOLD

Market Scenario 1: Long positions above 1074.94 with targets at 1081.20 and 1087.21

Market Scenario 2: Short positions below 1074.94 with targets at 1068.93 and 1062.67

Comment: During yesterday’s session, gold managed to close the day in positive territory, regaining most of the losses incurred on 23rd of November. It appears that bulls managed to stabilize gold price close to the First Support level at 1068.93

Supports and Resistances:

R3 1099.48

R2 1087.21

R1 1081.20

PP 1074.94

S1 1068.93

S2 1062.67

S3 1050.40

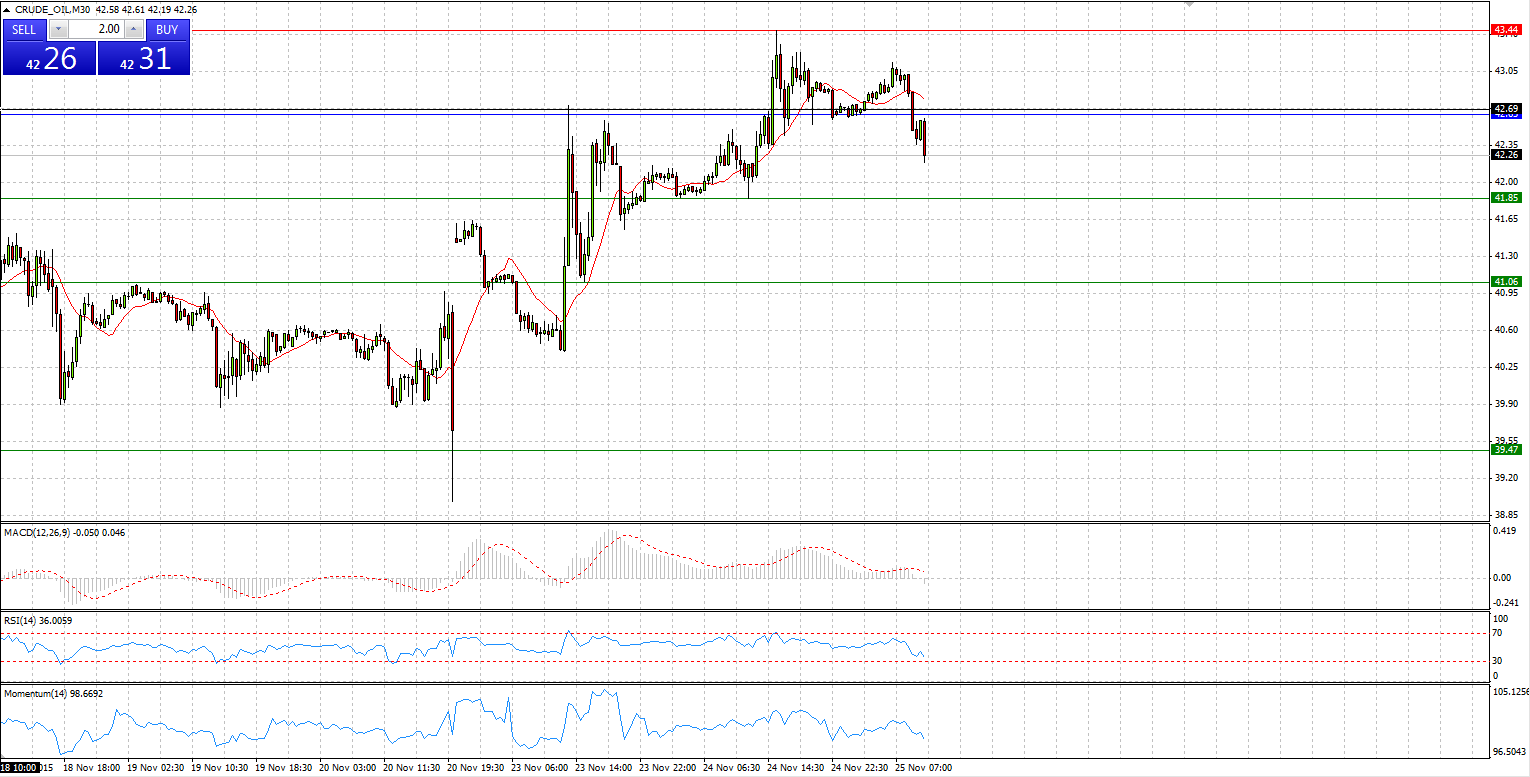

CRUDE OIL

Market Scenario 1: Long positions above 42.65 with targets at 43.44 and 44.24

Market Scenario 2: Short positions below 42.65 with targets at 41.85 and 41.06

Comment: Crude rose for the second day in the row, supported by Saudi Arabia’s pledge to work with global oil producers in an effort to stabilize prices. Currently, crude is trading below Pivot Point level.

Supports and Resistances:

R3 45.83

R2 44.24

R1 43.44

PP 42.65

S1 41.85

S2 41.06

S3 39.47

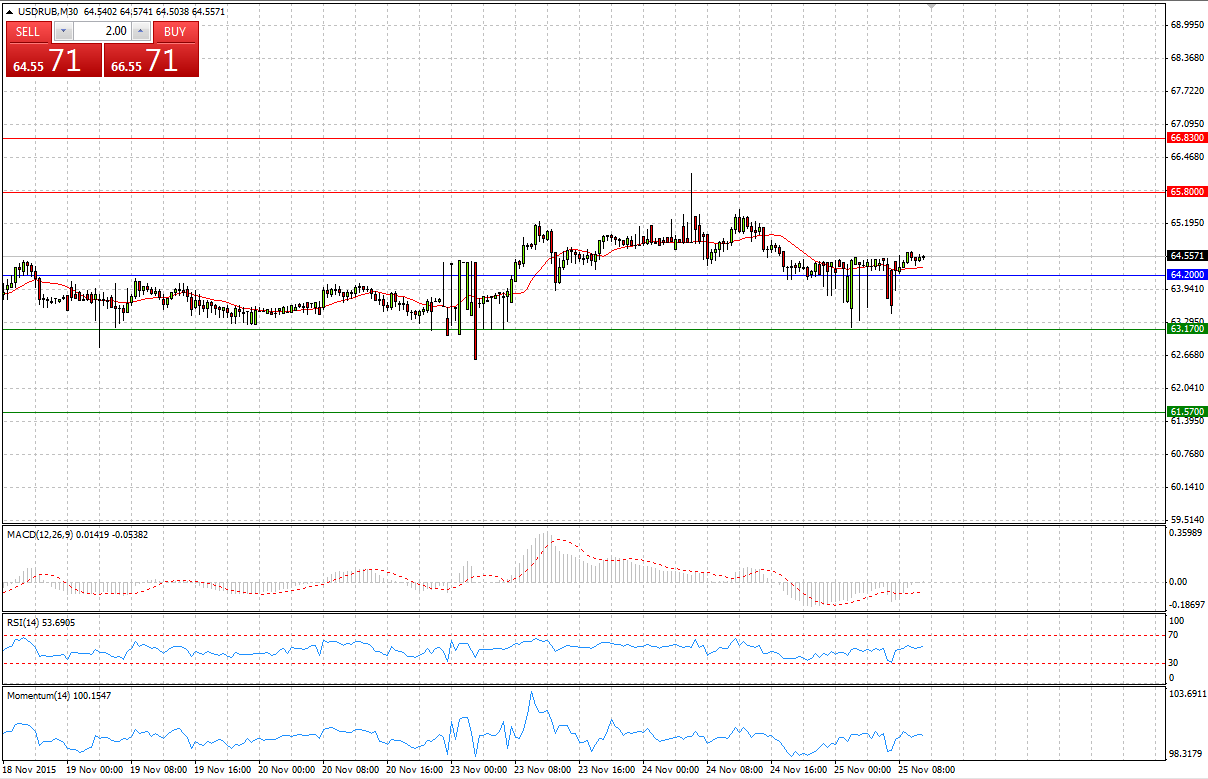

USD/RUB

Market Scenario 1: Long positions above 64.80 with targets at 65.79 and 67.14

Market Scenario 2: Short positions below 64.80 with targets at 63.45 and 62.46

Comment: USD/RUB during yesterday’s session didn’t manage to break through the First Resistance level and retreated below 65 ruble per USD. Today, bears undertook an attempt to break through the First support level, however, after it encountered buying pressure, the pair was sent above Pivot Point level.

Supports and Resistances:

R3 69.48

R2 67.14

R1 65.79

PP 64.80

S1 63.45

S2 62.46

S3 60.12