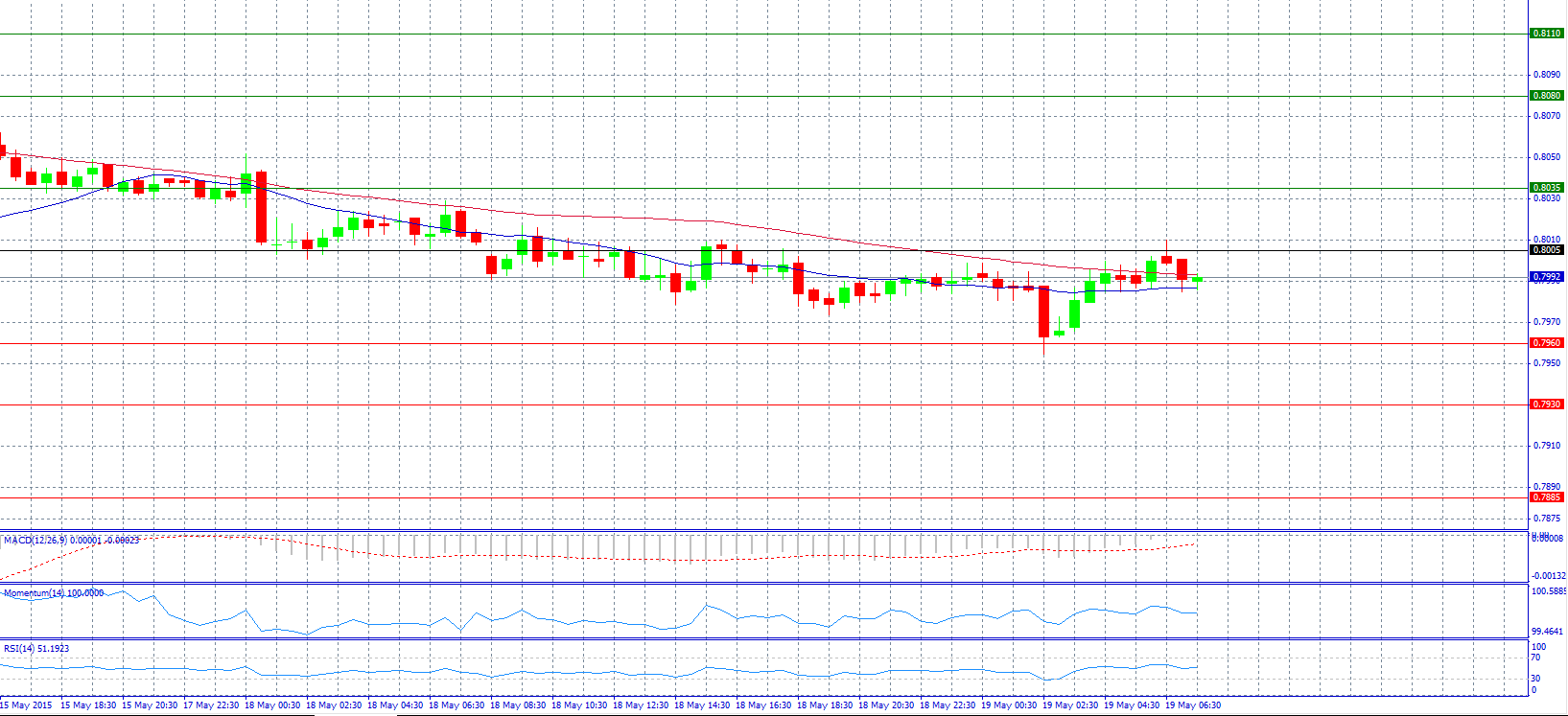

Market Scenario 1: Long positions above 0.8005 with target at 0.8035.

Market Scenario 2: Short positions below 0.7960 with target at 0.7930.

Comment: The pair recovers from 0.7957 but found resistance at pivot point 0.8005.

Supports and Resistances:

R3 0.8110

R2 0.8080

R1 0.8035

PP 0.8005

S1 0.7960

S2 0.7930

S3 0.7885

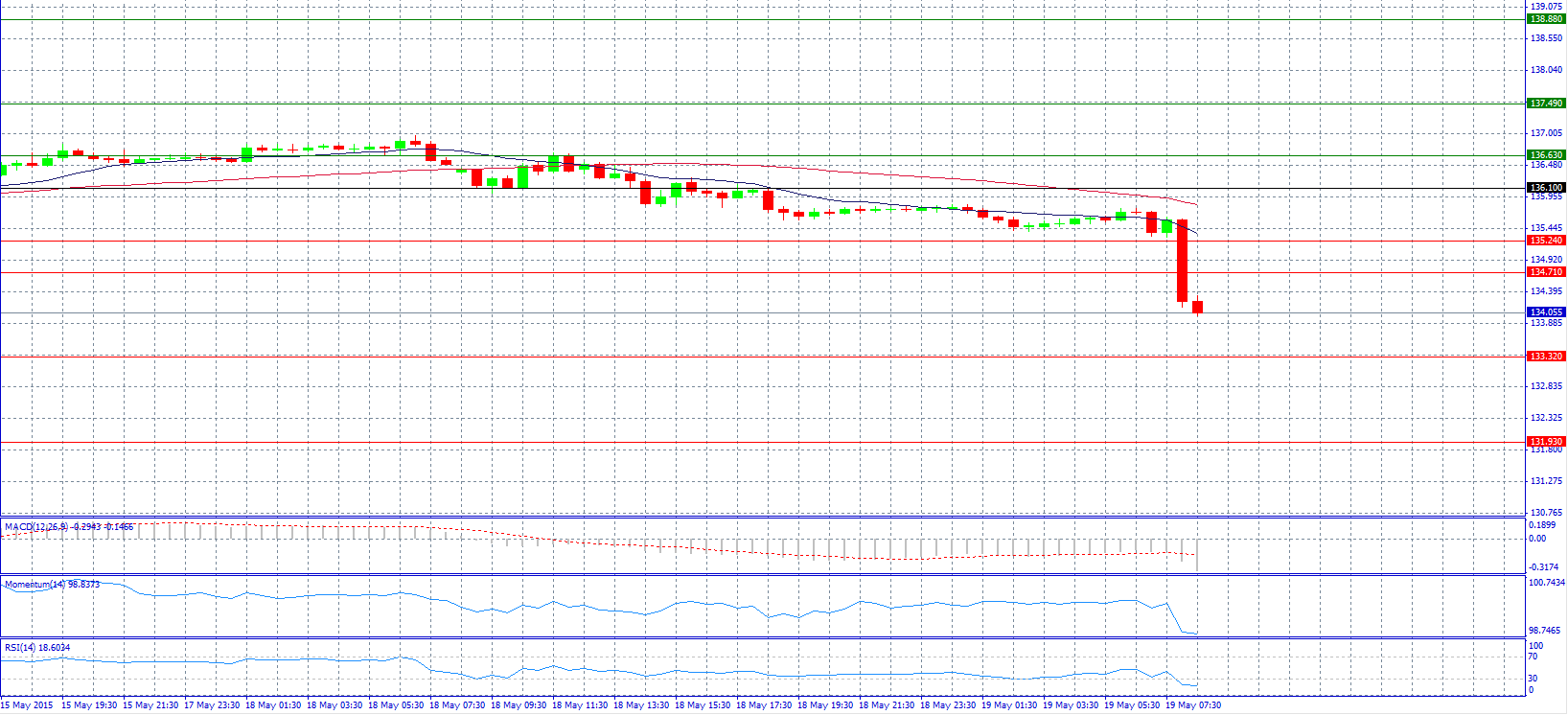

Market Scenario 1: Long positions above 134.71 with target at 135.24.

Market Scenario 2: Short positions below 133.32 with target at 131.93.

Comment: The pair dropped below 134.10 level as ECB may “accelerate” QE.

Supports and Resistances:

R3 138.88

R2 137.49

R1 136.63

PP 136.10

S1 135.24

S2 134.71

S3 133.32

S4 131.93

Market Scenario 1: Long positions above 1.1204 with target at 1.1259.

Market Scenario 2: Short positions below 1.1055 with target at 1.0906.

Comment: The pair is testing lows below 1.1180 level after the ECB’s Coeure said that the bank may front-load its QE program before summer for seasonal reasons.

Supports and Resistances:

R3 1.1651

R2 1.1502

R1 1.1408

PP 1.1353

S1 1.1259

S2 1.1204

S3 1.1055

S4 1.0906

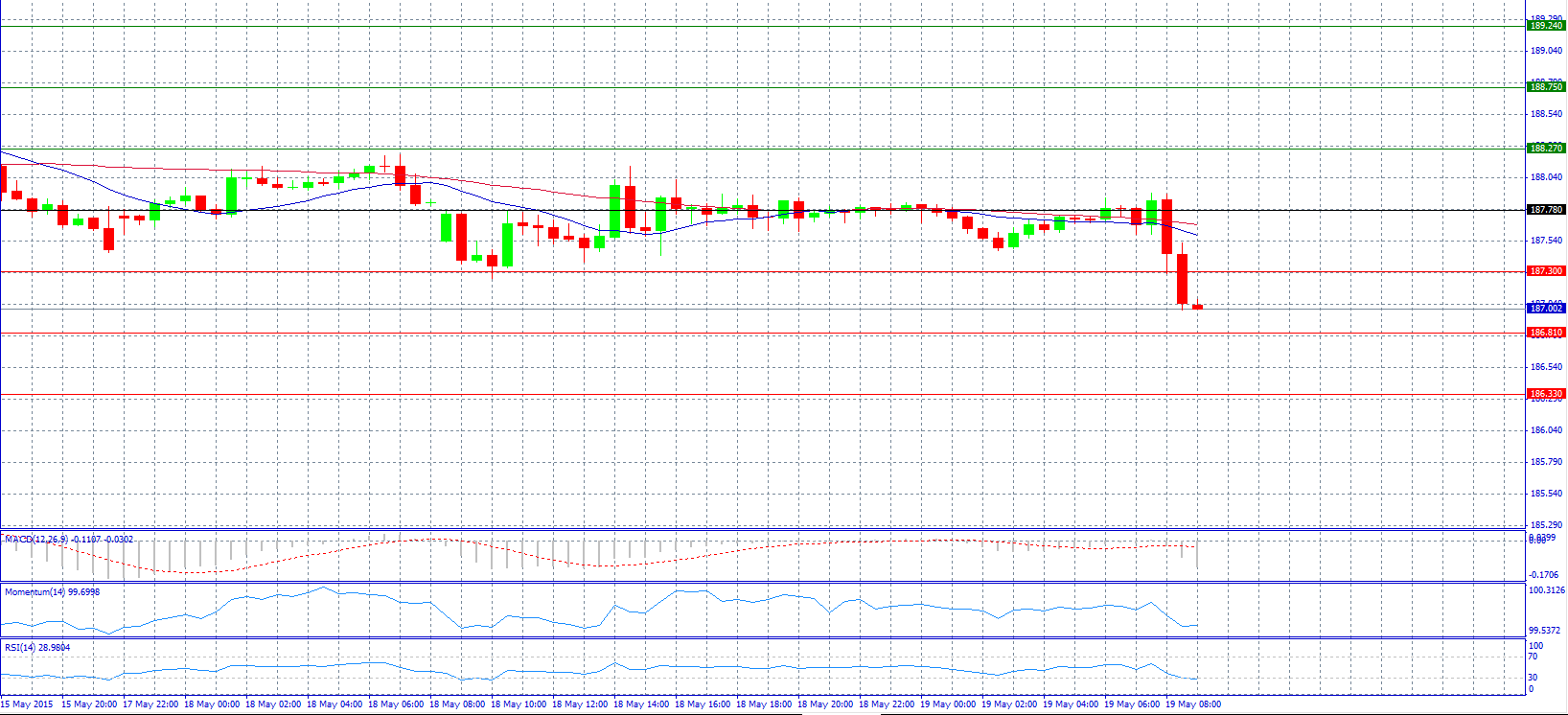

Market Scenario 1: Long positions above 187.30 with target at 187.78.

Market Scenario 2: Short positions below 186.81 with target at 186.33.

Comment: The pair dropped sharply to 187.00 level.

Supports and Resistances:

R3 189.24

R2 188.75

R1 188.27

PP 187.78

S1 187.30

S2 186.81

S3 186.33

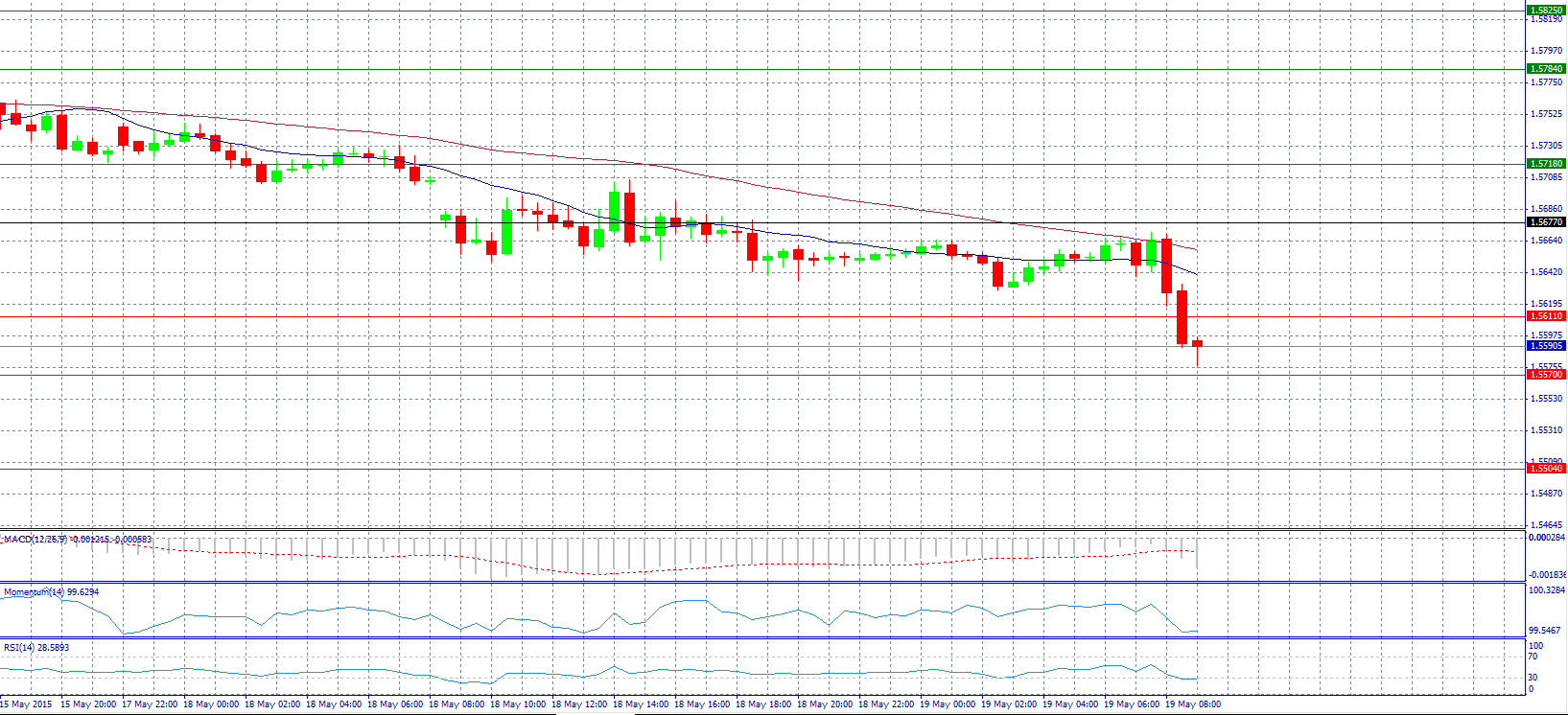

Market Scenario 1: Long positions above 1.5611 with target at 1.5677.

Market Scenario 2: Short positions below 1.5570 with target at 1.5504.

Comment: The pair weakened again and dropped to lows near 1.5590 level.

Supports and Resistances:

R3 1.5825

R2 1.5784

R1 1.5718

PP 1.5677

S1 1.5611

S2 1.5570

S3 1.5504

Market Scenario 1: Long positions above 120.25 with target at 120.53.

Market Scenario 2: Short positions below 119.75 with target at 119.47.

Comment: The pair trades steady below 120.00 level.

Supports and Resistances:

R3 121.03

R2 120.53

R1 120.25

PP 119.75

S1 119.47

S2 118.97

S3 118.69

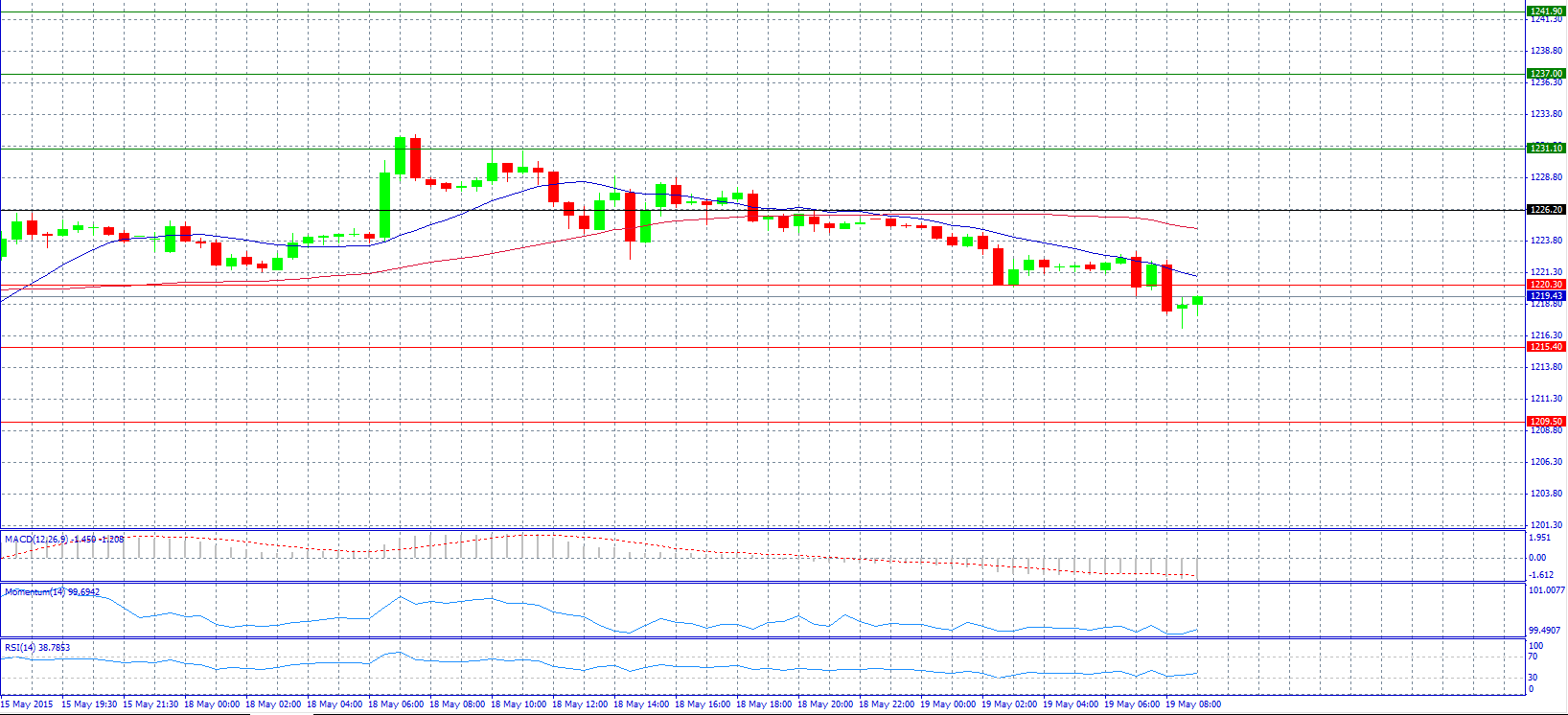

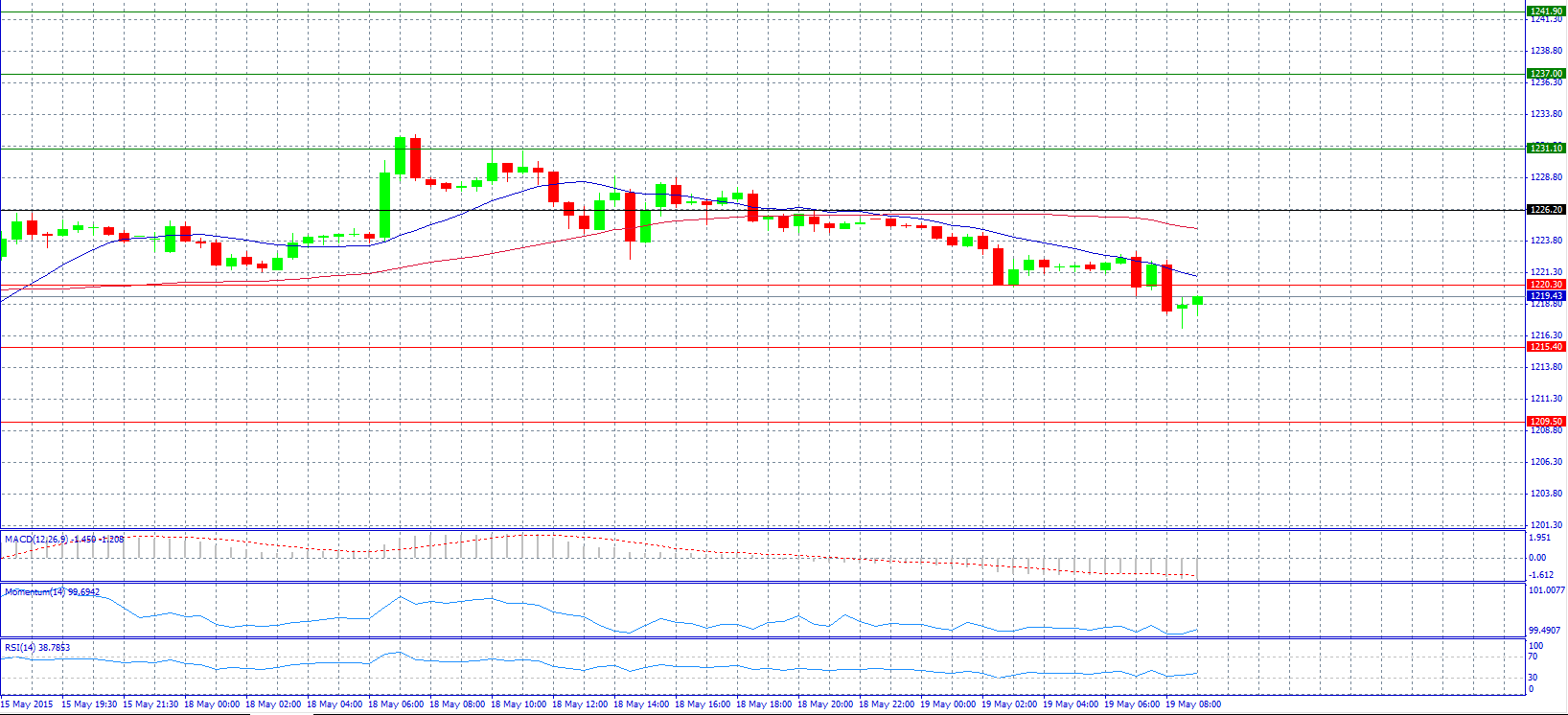

Market Scenario 1: Long positions above 1220.30 with target at 1226.20.

Market Scenario 2: Short positions below 1215.40 with target at 1209.50.

Comment: Gold prices have a bearish tone and broke support level 1220.30.

Supports and Resistances:

R3 1241.90

R2 1237.00

R1 1231.10

PP 1226.20

S1 1220.30

S2 1215.40

S3 1209.50

Market Scenario 1: Long positions above 59.57 with target at 60.64.

Market Scenario 2: Short positions below 58.78 with target at 57.71.

Comment: Crude oil prices found support at 58.78 level.

Supports and Resistances:

R3 63.29

R2 62.50

R1 61.43

PP 60.64

S1 59.57

S2 58.78

S3 57.71

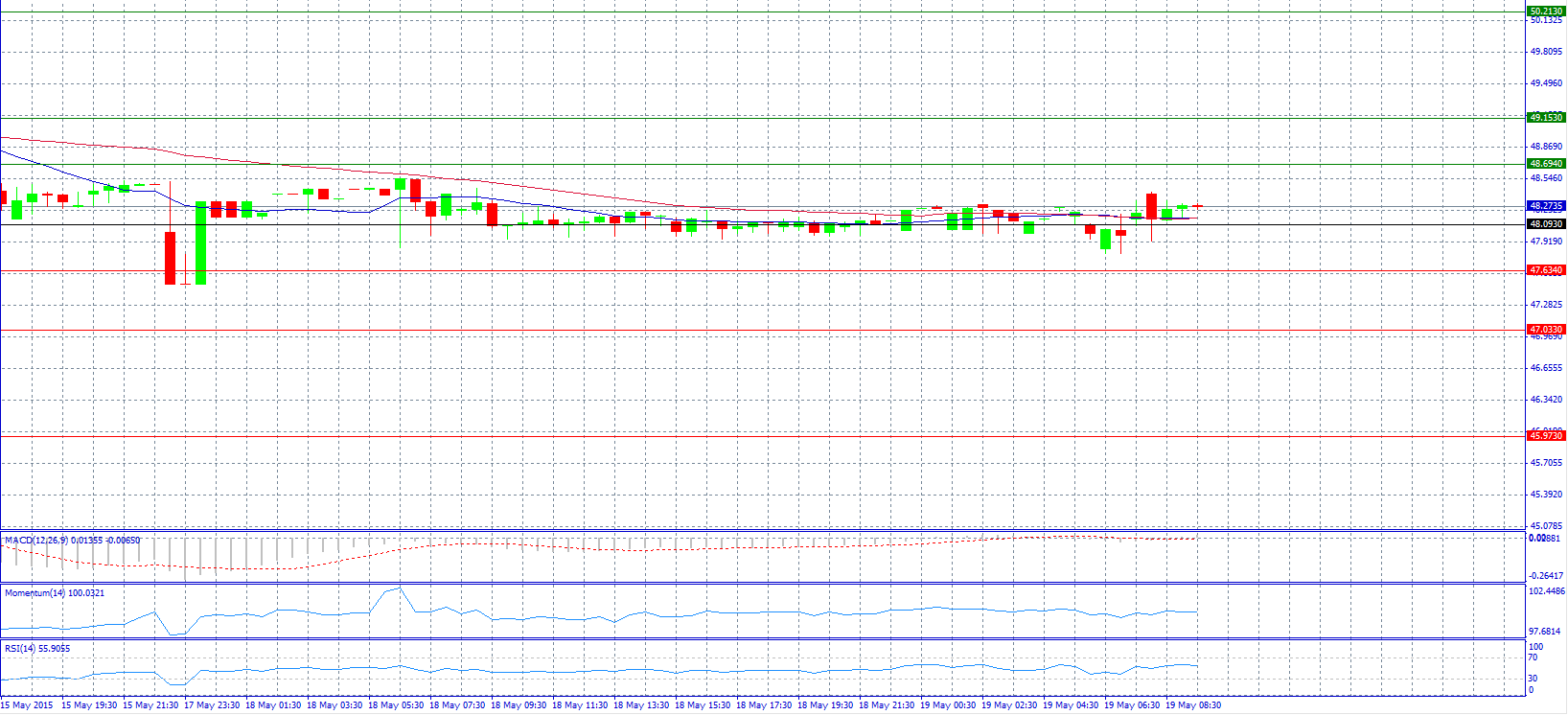

Market Scenario 1: Long positions above 48.694 with target at 49.153.

Market Scenario 2: Short positions below 48.093 with target at 47.634.

Comment: The pair trades neutral below 48.300 level.

Supports and Resistances:

R3 50.213

R2 49.153

R1 48.694

PP 48.093

S1 47.634

S2 47.033

S3 45.973