Market Scenario 1: Long positions above 0.8040 with target at 0.8086.

Market Scenario 2: Short positions below 0.7993 with target at 0.7947.

Comment: The pair has a bearish tone and trades near 0.8000 level.

Supports and Resistances:

R3 0.8179

R2 0.8133

R1 0.8066

PP 0.8040

S1 0.7993

S2 0.7947

S3 0.7900

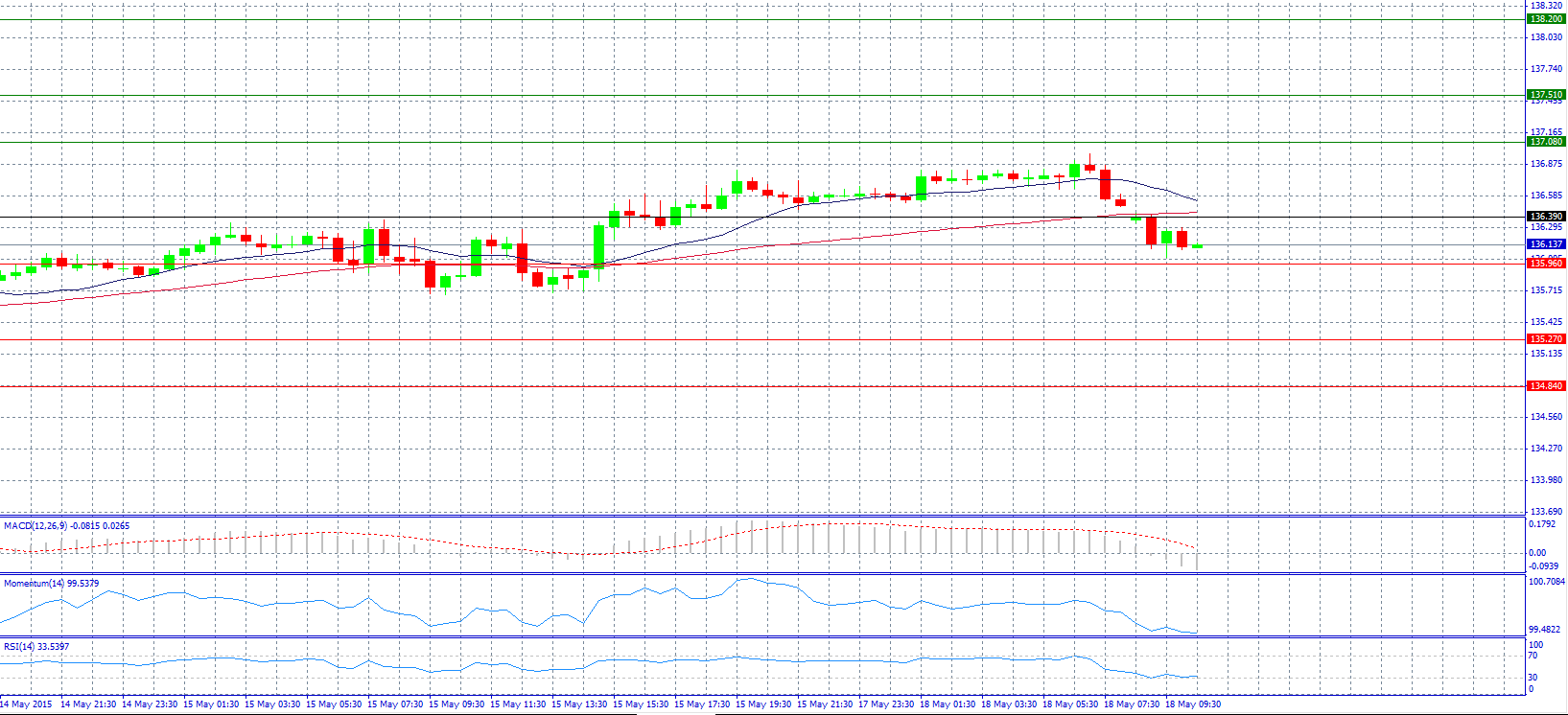

Market Scenario 1: Long positions above 136.39 with target at 137.08.

Market Scenario 2: Short positions below 135.96 with target at 135.27.

Comment: The pair dropped below 136.20 level.

Supports and Resistances:

R3 138.20

R2 137.51

R1 137.08

PP 136.39

S1 135.96

S2 135.27

S3 134.84

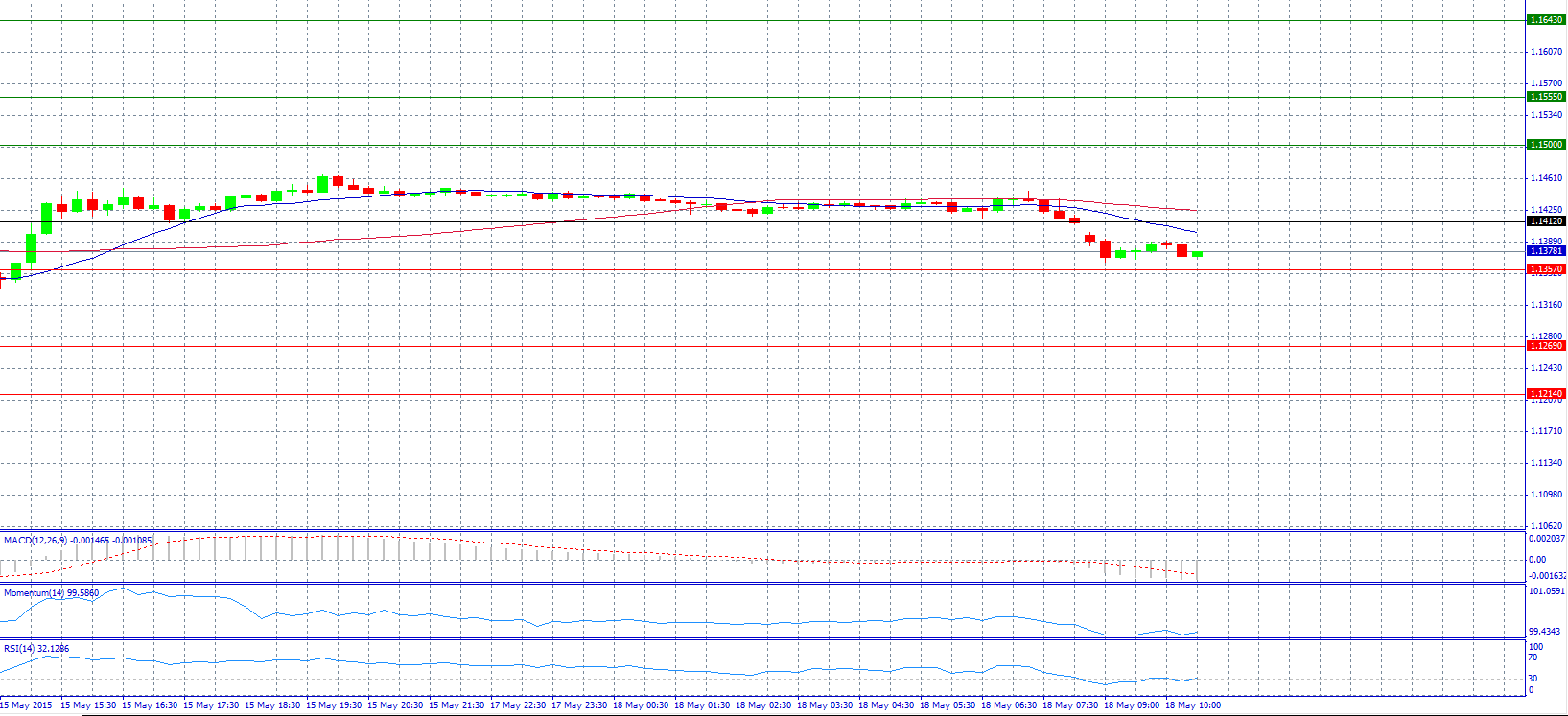

Market Scenario 1: Long positions above 1.1412 with target at 1.1500.

Market Scenario 2: Short positions below 1.1357 with target at 1.1269.

Comment: The pair is testing lows near 1.1380 level.

Supports and Resistances:

R3 1.1643

R2 1.1550

R1 1.1500

PP 1.1412

S1 1.1357

S2 1.1269

S3 1.1214

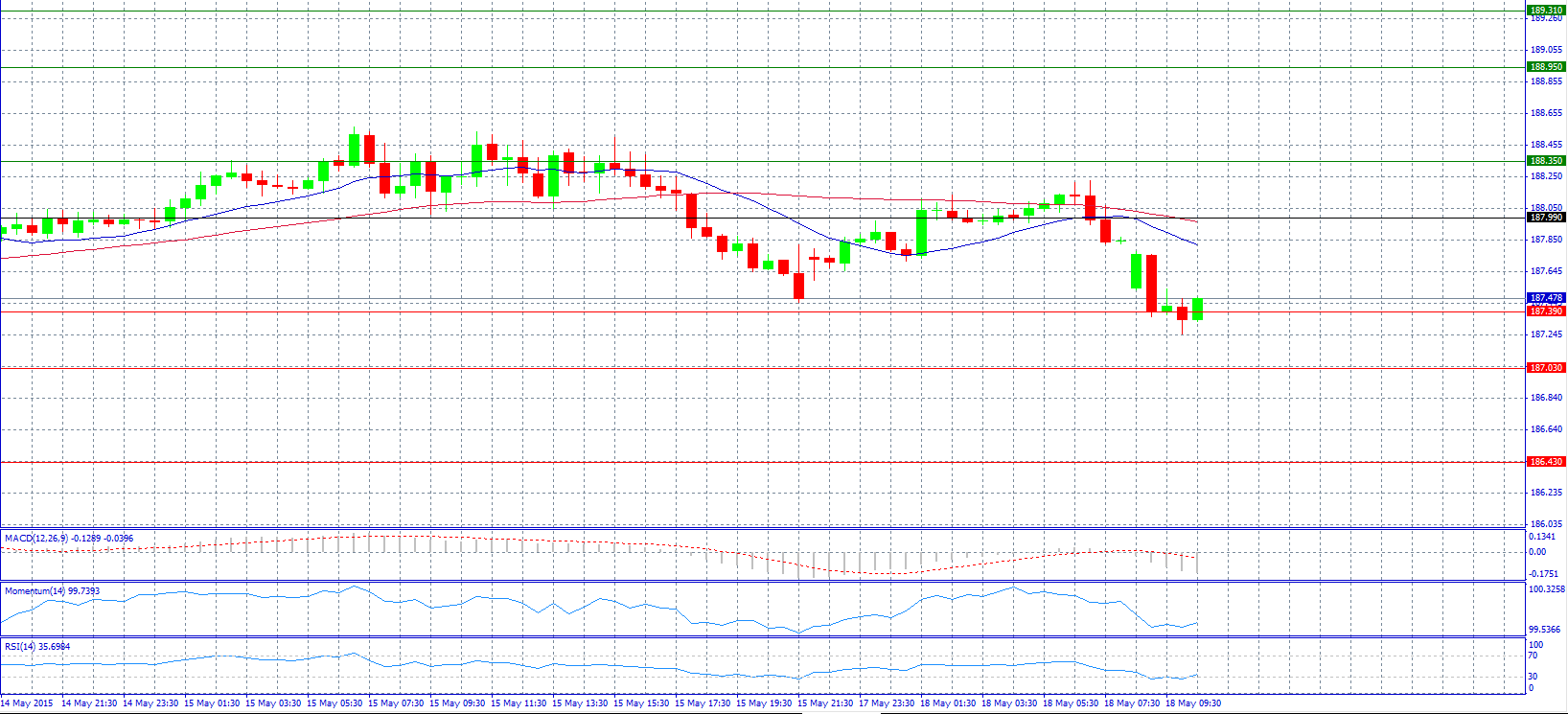

Market Scenario 1: Long positions above 187.99 with target at 188.35.

Market Scenario 2: Short positions below 187.39 with target at 187.03.

Comment: The pair fought but couldn’t break the support level 187.39.

Supports and Resistances:

R3 189.31

R2 188.95

R1 188.35

PP 187.99

S1 187.39

S2 187.03

S3 186.43

Market Scenario 1: Long positions above 1.5683 with target at 1.5745.

Market Scenario 2: Short positions below 1.5639 with target at 1.5577.

Comment: The pair fell below 1.5700 level.

Supports and Resistances:

R3 1.5895

R2 1.5851

R1 1.5789

PP 1.5745

S1 1.5683

S2 1.5639

S3 1.5577

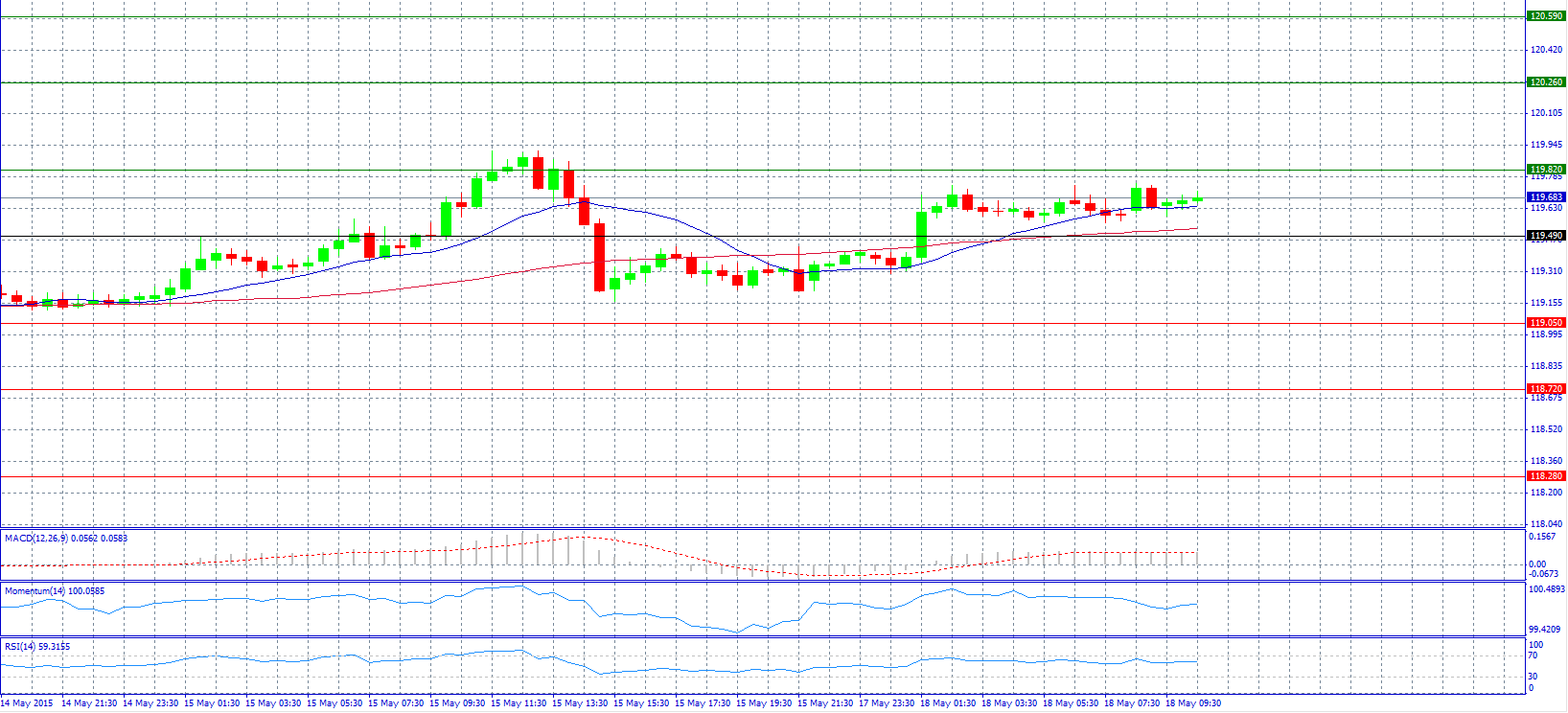

Market Scenario 1: Long positions above 119.82 with target at 120.26.

Market Scenario 2: Short positions below 119.49 with target at 119.05.

Comment: The pair trades steady above 119.50 level.

Supports and Resistances:

R3 120.59

R2 120.26

R1 119.82

PP 119.49

S1 119.05

S2 118.72

S3 118.28

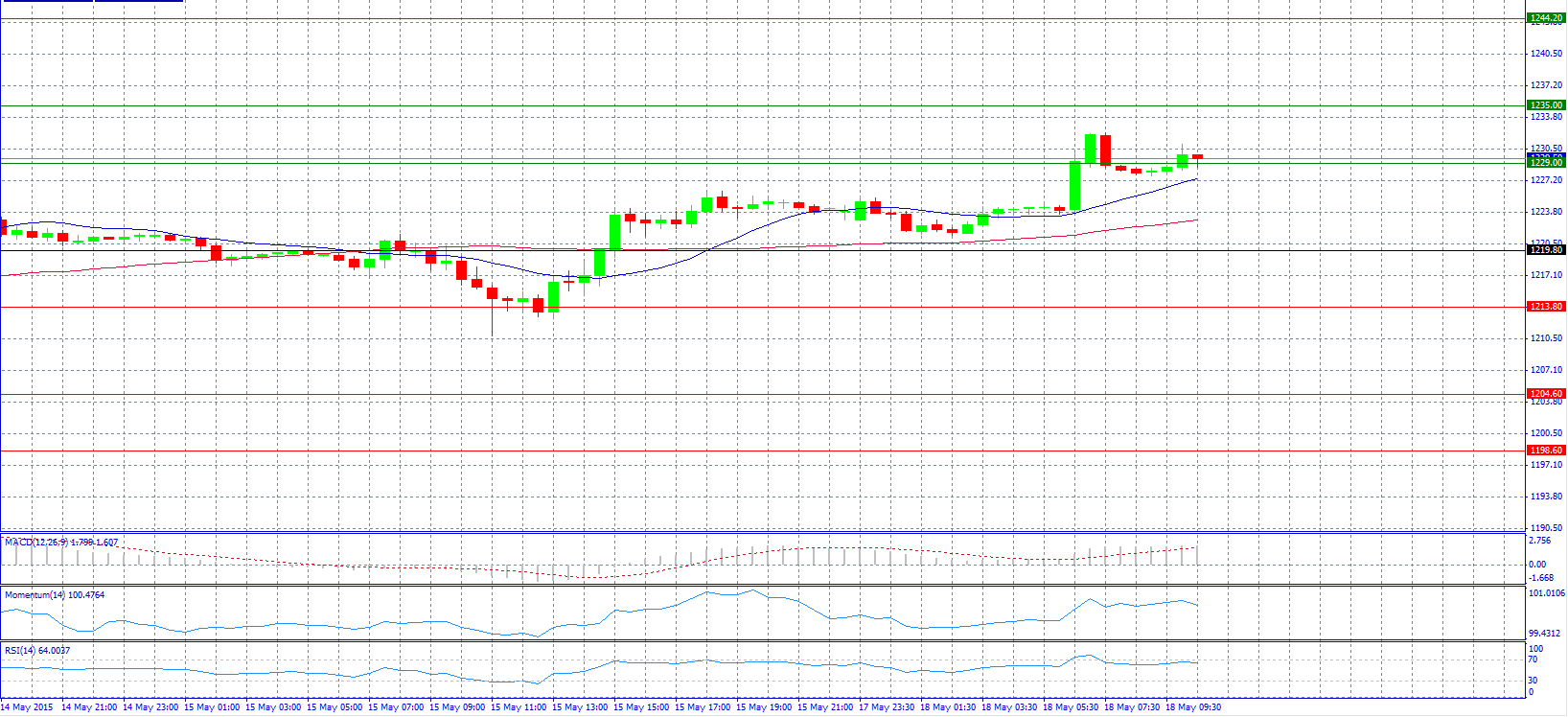

Market Scenario 1: Long positions above 1235.00 with target at 1244.20.

Market Scenario 2: Short positions below 1229.00 with target at 1219.80.

Comment: Gold prices continued to build on gains made in the previous week today, with increased fears over a Greek exit from the Eurozone and the prospect of a delay to the normalization of US monetary policy providing support.

Supports and Resistances:

R3 1244.20

R2 1235.00

R1 1229.00

PP 1219.80

S1 1213.80

S2 1204.60

S3 1198.60

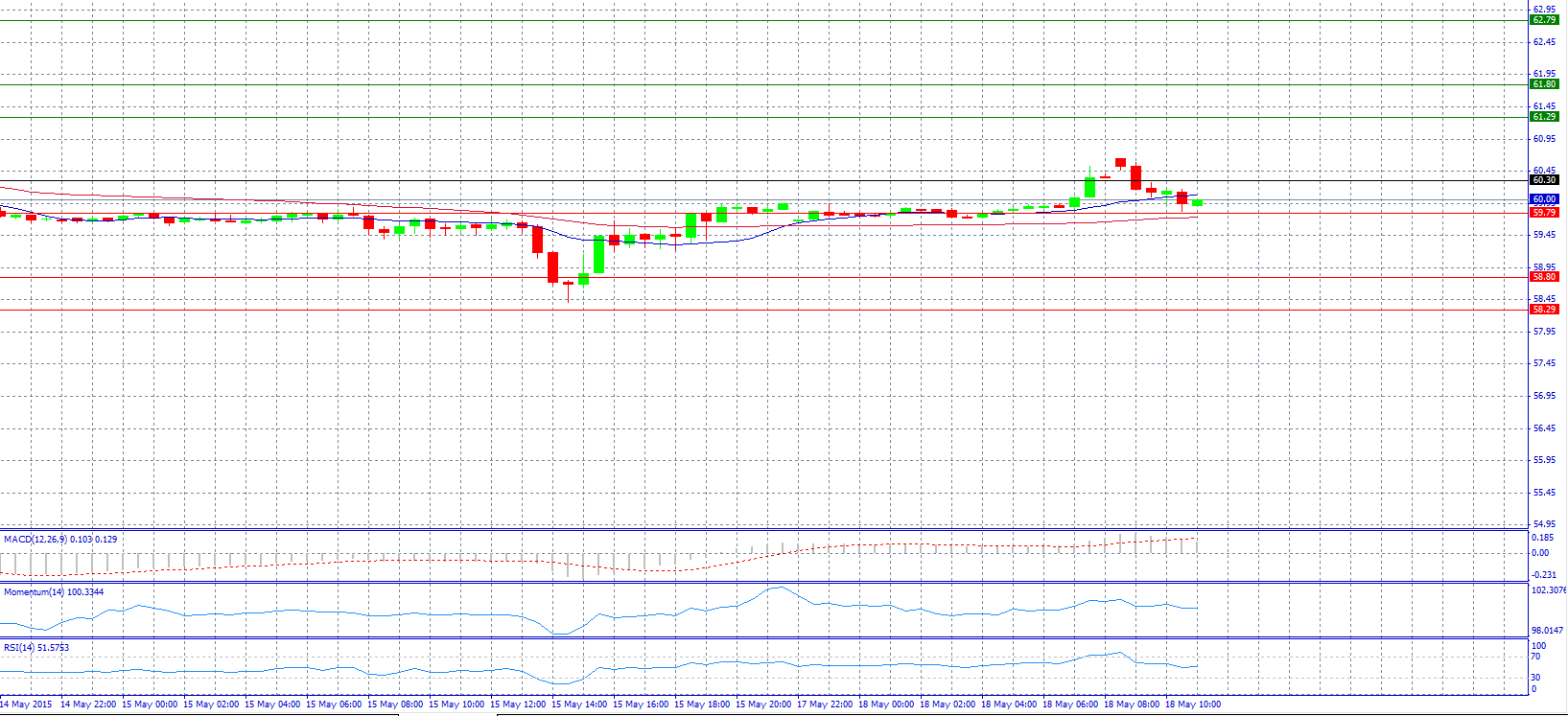

Market Scenario 1: Long positions above 60.30 with target at 61.29.

Market Scenario 2: Short positions below 59.79 with target at 58.80.

Comment: Crude oil prices found resistance at 60.30 level and currently trade at 60.00 level.

Supports and Resistances:

R3 62.79

R2 61.80

R1 61.29

PP 60.30

S1 59.79

S2 58.80

S3 58.29

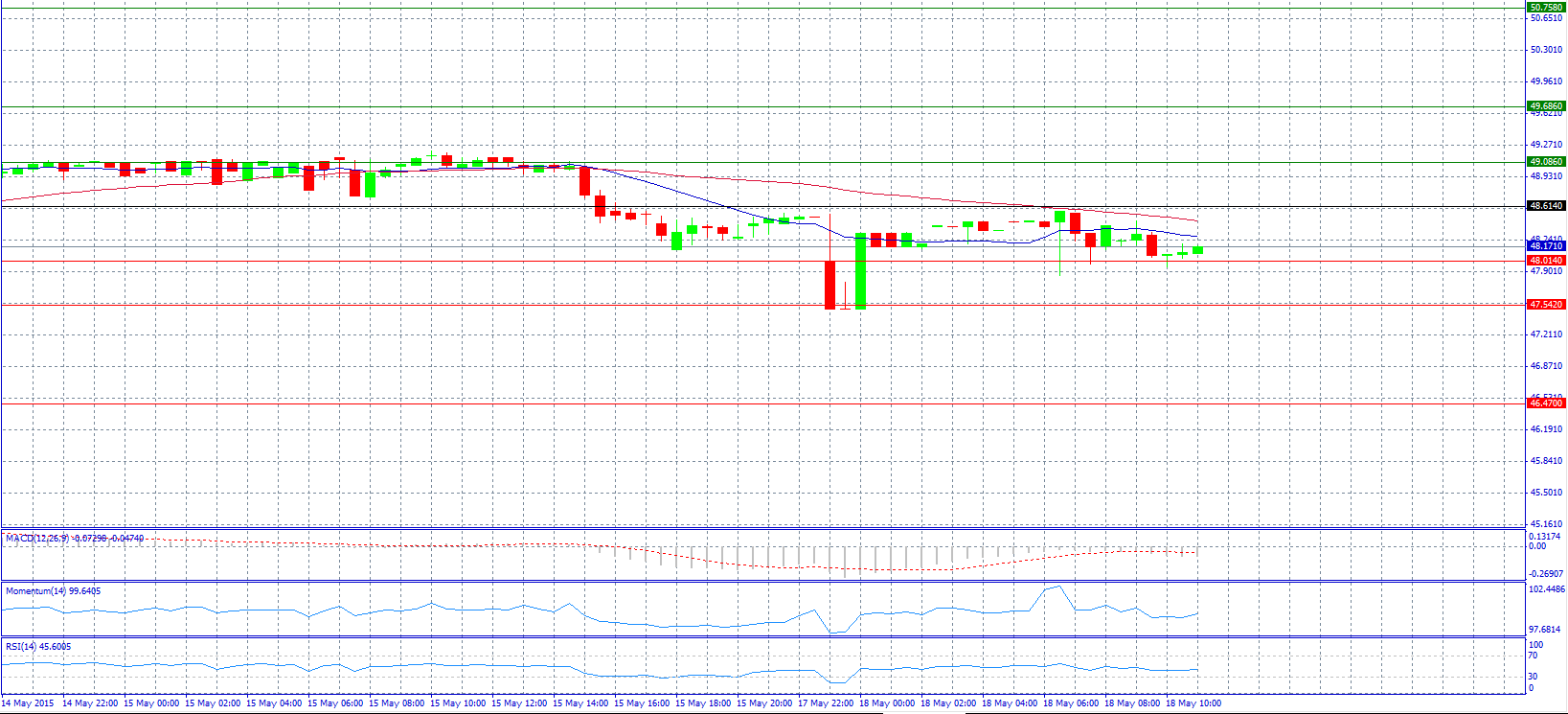

Market Scenario 1: Long positions above 48.614 with target at 49.086.

Market Scenario 2: Short positions below 48.014 with target at 47.542.

Comment: The pair found resistance at pivot point 48.614 trades neutral near 48.170 level.

Supports and Resistances:

R3 50.758

R2 49.686

R1 49.086

PP 48.614

S1 48.014

S2 47.542

S3 46.470