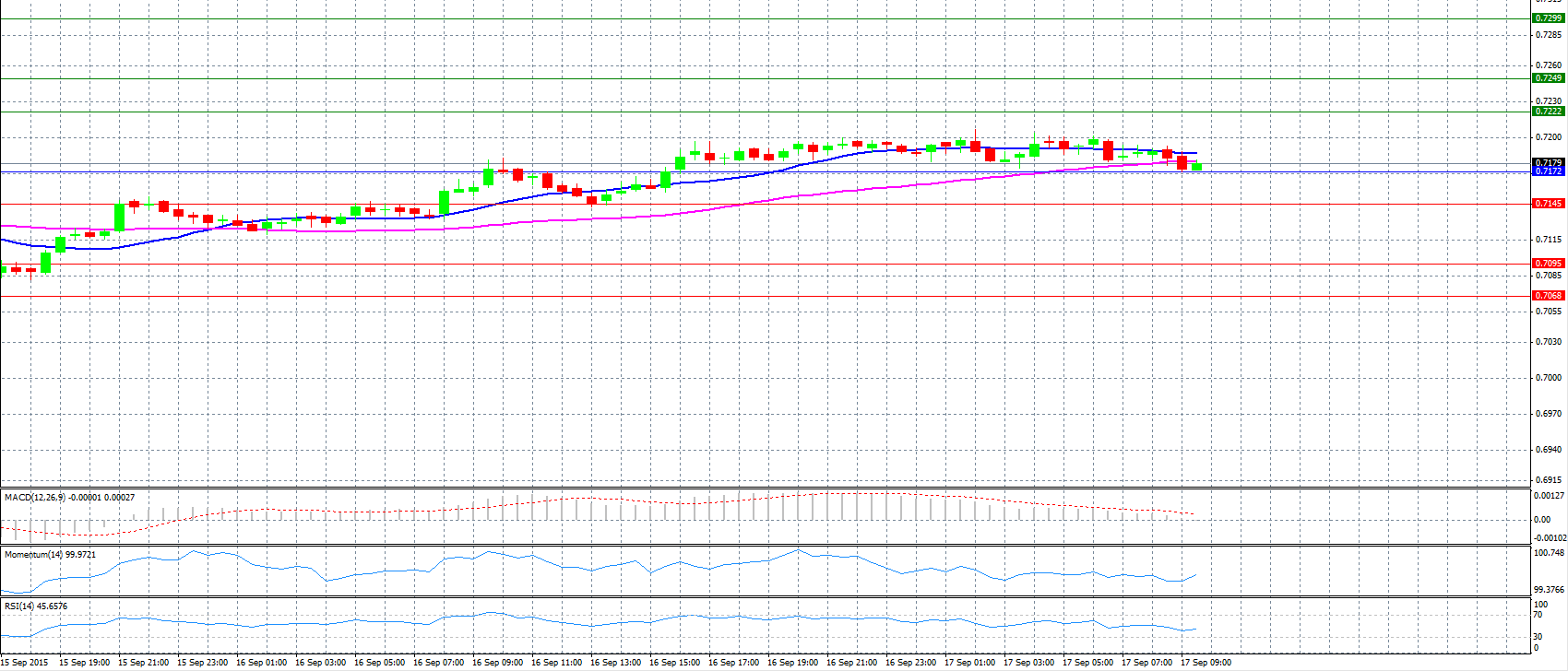

Market Scenario 1: Long positions above 0.7172 with targets @ 0.7222 & 0.7249.

Market Scenario 2: Short positions below 0.7172 with targets @ 0.7145 & 0.7095.

Comment: The pair in a range above pivot point 0.7172.

Supports and Resistances:

R3 0.7299

R2 0.7249

R1 0.7222

PP 0.7172

S1 0.7145

S2 0.7095

S3 0.7068

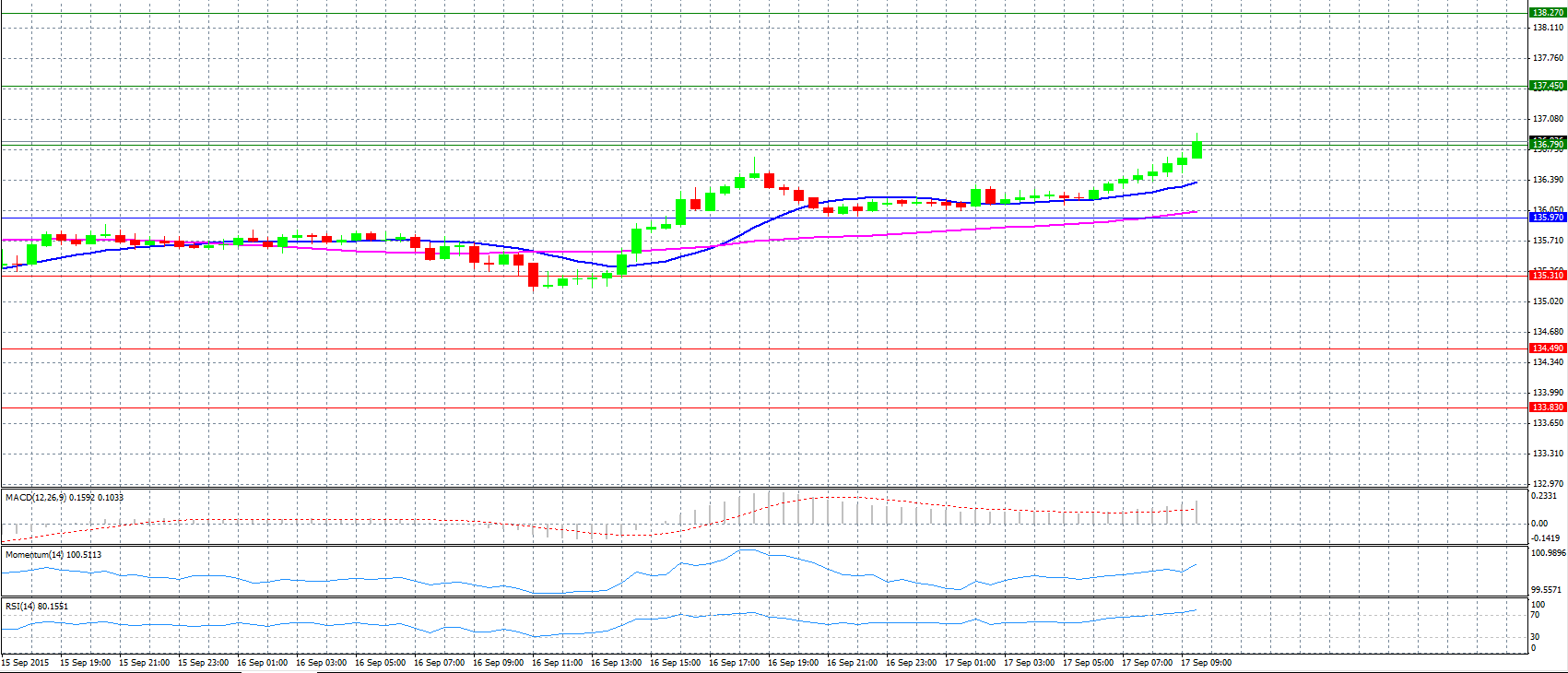

Market Scenario 1: Long positions above 135.97 with targets @ 136.79 & 137.45.

Market Scenario 2: Short positions below 135.97 with targets @ 135.31 & 134.49.

Comment: The pair strengthened and now faces the challenge to surpass resistance level 136.79.

Supports and Resistances:

R3 138.27

R2 137.45

R1 136.79

PP 135.97

S1 135.31

S2 134.49

S3 133.83

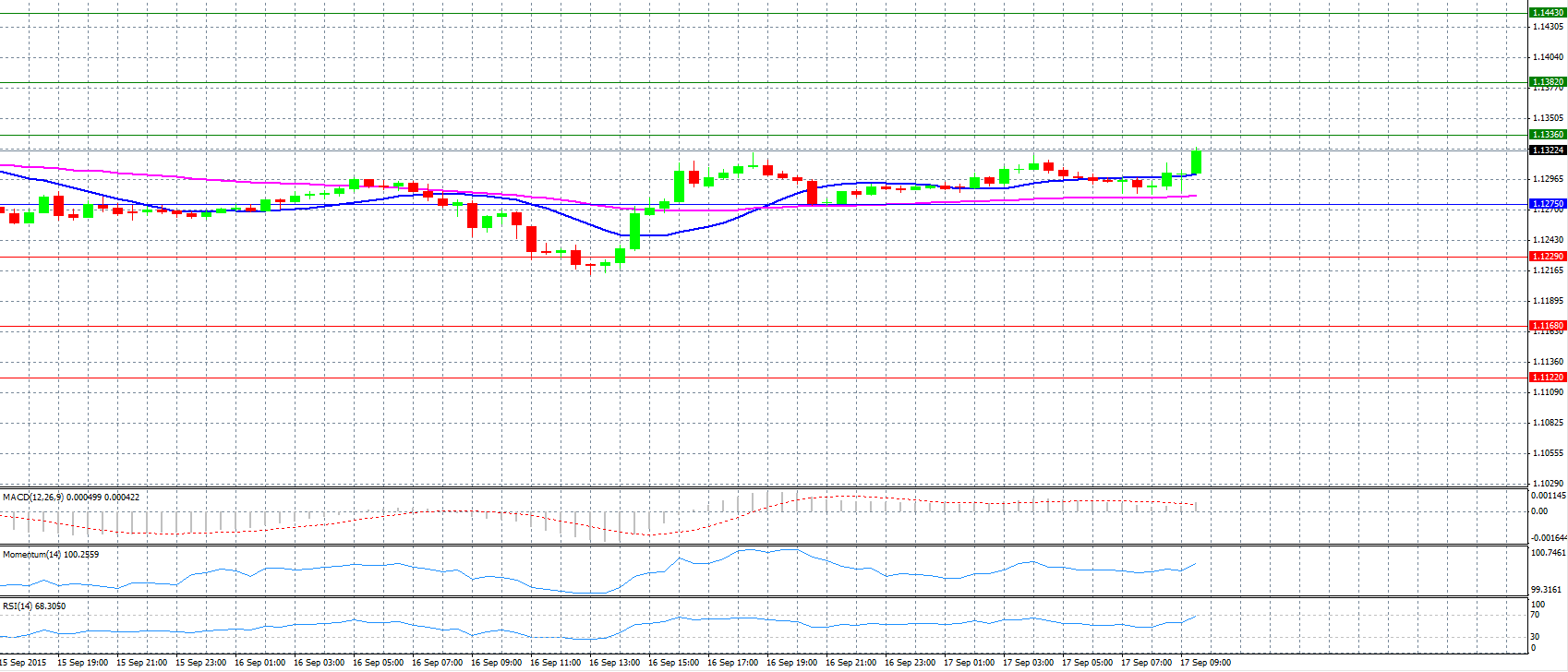

Market Scenario 1: Long positions above 1.1275 with targets @ 1.1336 & 1.1382.

Market Scenario 2: Short positions below 1.1275 with targets @ 1.1229 & 1.1168.

Comment: The pair is likely to follow the movement in the European stock markets ahead of the FOMC event due later today.

Supports and Resistances:

R3 1.1443

R2 1.1382

R1 1.1336

PP 1.1275

S1 1.1229

S2 1.1168

S3 1.1122

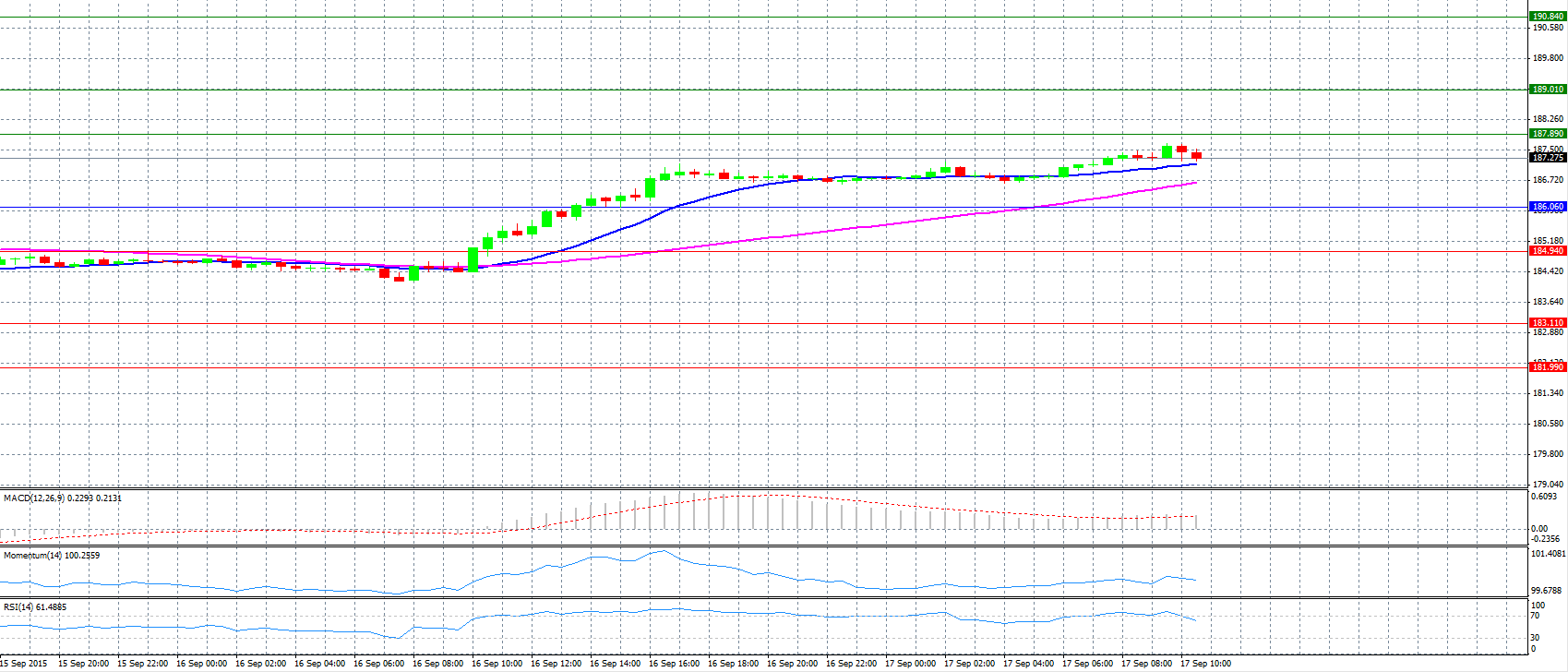

Market Scenario 1: Long positions above 186.06 with targets @ 187.89 & 189.01.

Market Scenario 2: Short positions below 186.06 with targets @ 184.94 & 183.11.

Comment: The pair has a bullish tone and trade above 187.00 level.

Supports and Resistances:

R3 190.84

R2 189.01

R1 187.89

PP 186.06

S1 184.94

S2 183.11

S3 181.99

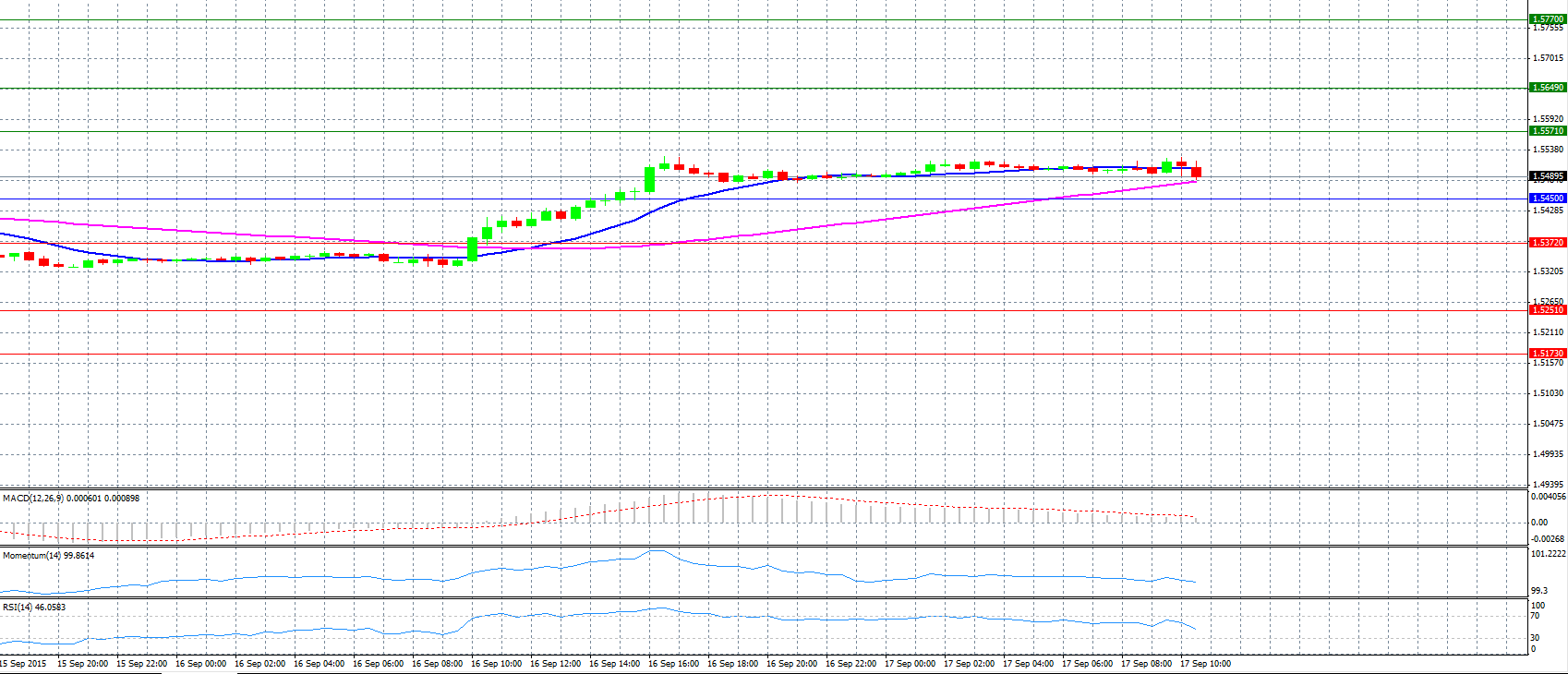

Market Scenario 1: Long positions above 1.5500 with targets @ 1.5571 & 1.5649.

Market Scenario 2: Short positions below 1.5500 with targets @ 1.5372 & 1.5251.

Comment: The pair trades neutral near 1.5500 level.

Supports and Resistances:

R3 1.5770

R2 1.5649

R1 1.5571

PP 1.5450

S1 1.5372

S2 1.5251

S3 1.5173

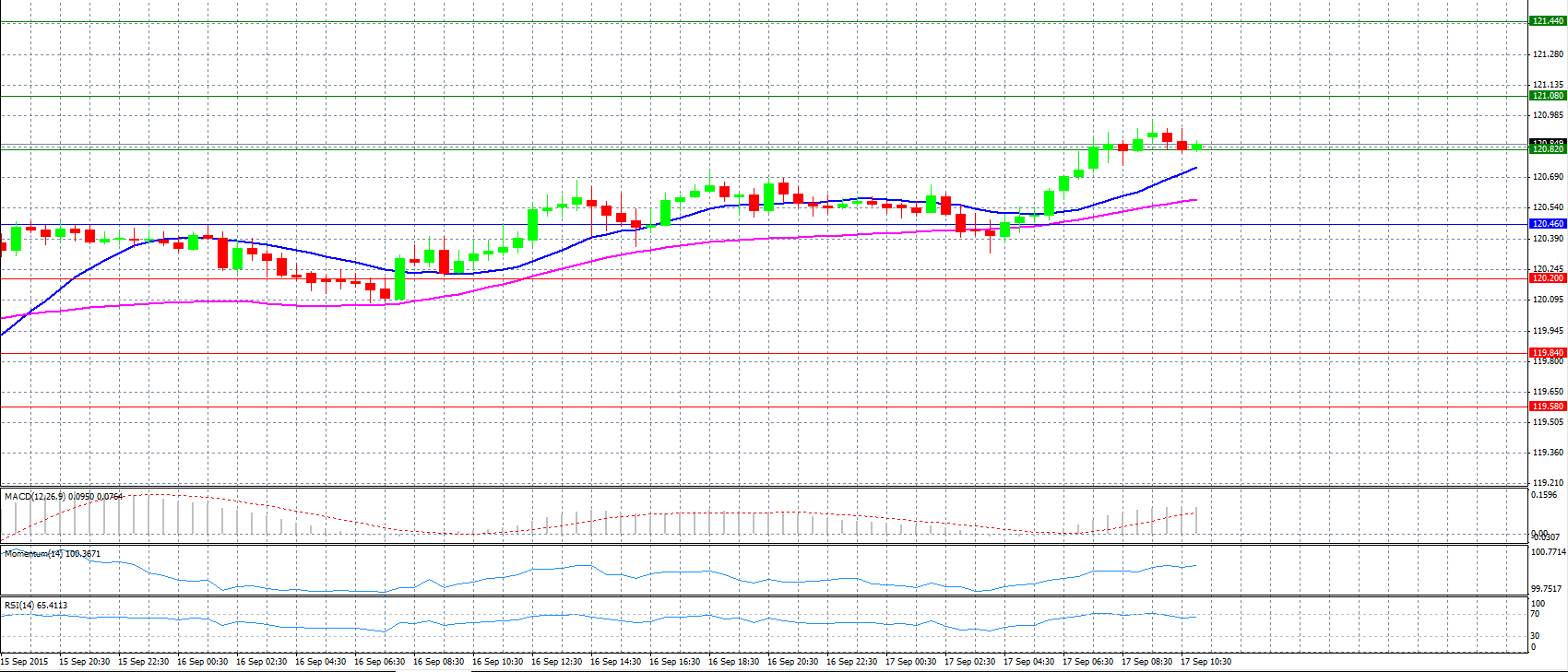

Market Scenario 1: Long positions above 120.46 with targets @ 120.82 & 121.08.

Market Scenario 2: Short positions below 120.46 with targets @ 120.20 & 119.84.

Comment: The pair advanced and struggles to stay above resistance level 120.82.

Supports and Resistances:

R3 121.44

R2 121.08

R1 120.82

PP 120.46

S1 120.20

S2 119.84

S3 119.58

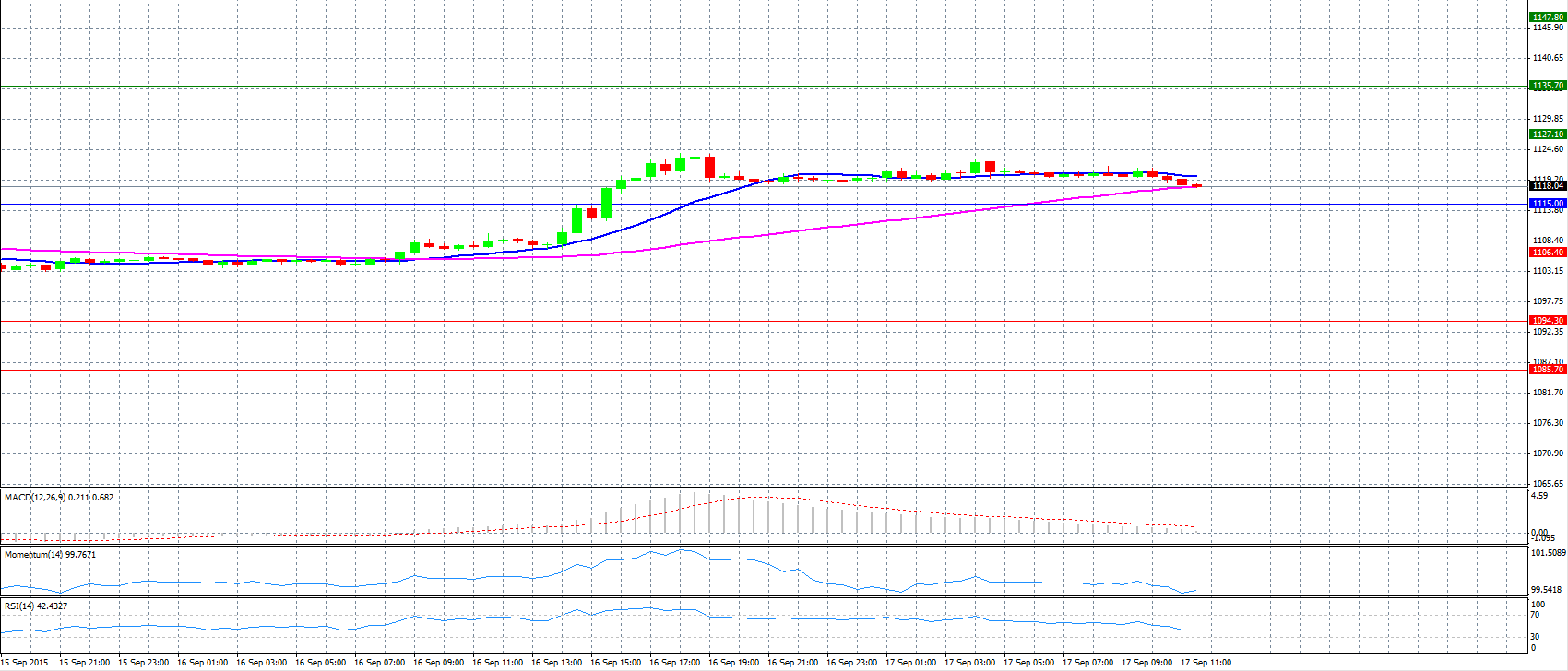

Market Scenario 1: Long positions above 1115.00 with targets @ 1127.10 & 1135.70.

Market Scenario 2: Short positions below 1115.00 with targets @ 1106.40 & 1094.30.

Comment: Gold prices extend gains ahead of Fed rate decision.

Supports and Resistances:

R3 1147.80

R2 1135.70

R1 1127.10

PP 1115.00

S1 1106.40

S2 1094.30

S3 1085.70

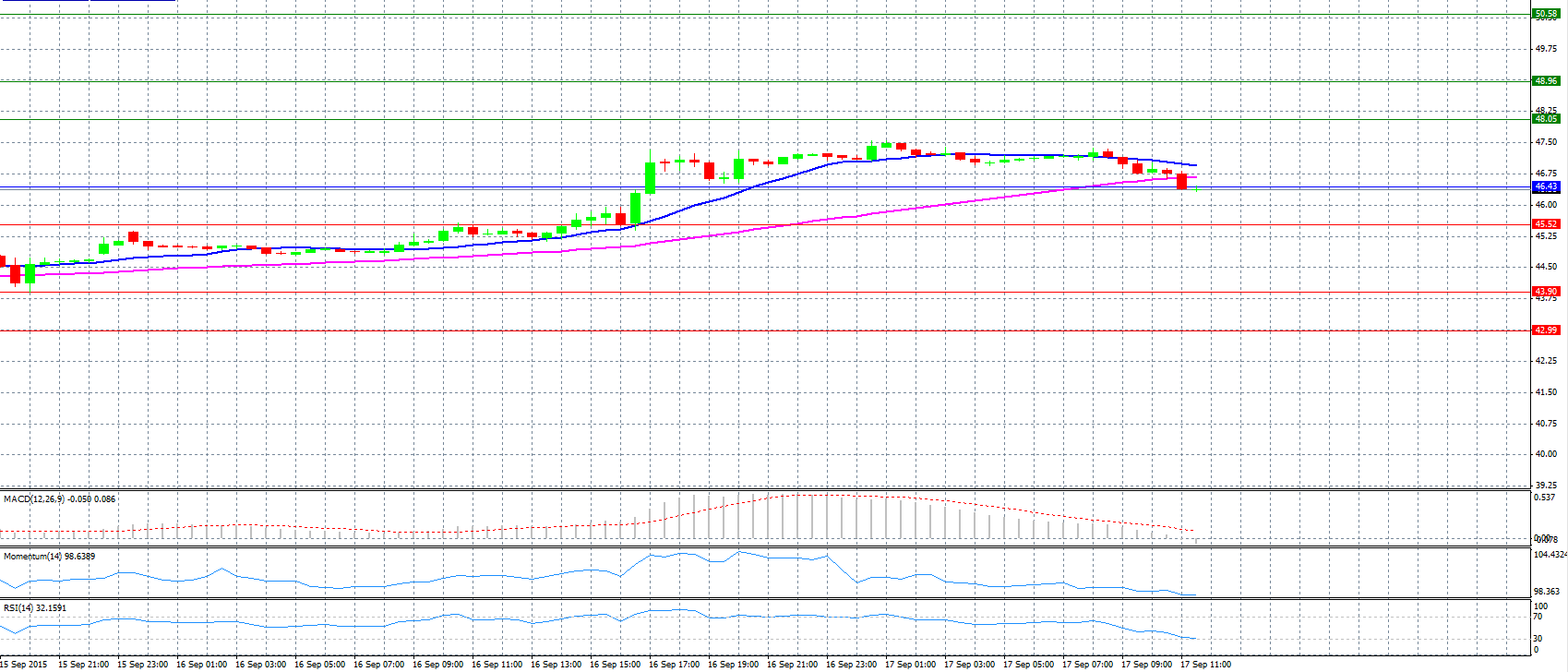

Market Scenario 1: Long positions above 46.43 with targets @ 48.05 & 48.96.

Market Scenario 2: Short positions below 46.43 with targets @ 45.52 & 43.90.

Comment: Crude oil prices fell and found support at 56.43 level.

Supports and Resistances:

R3 50.58

R2 48.96

R1 48.05

PP 46.43

S1 45.52

S2 43.90

S3 42.99

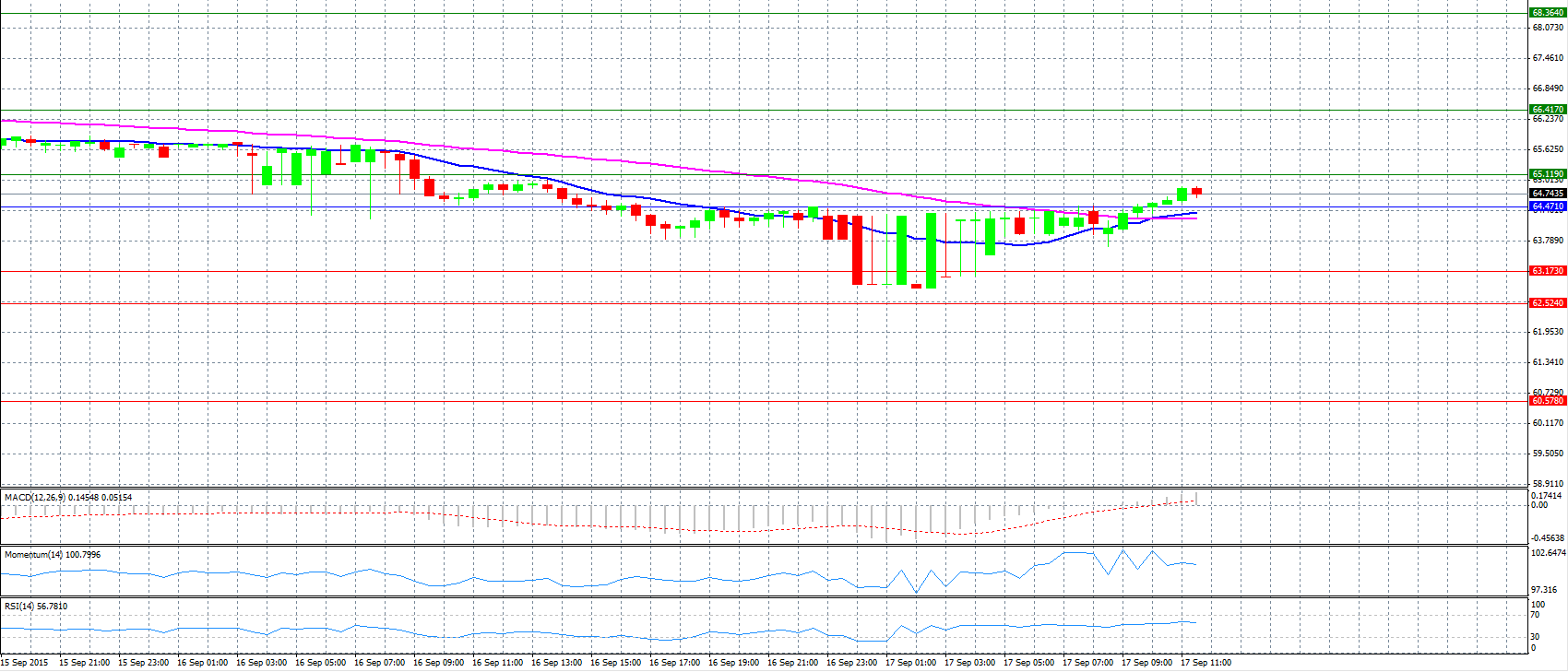

Market Scenario 1: Long positions above 64.471 with targets @ 65.119 & 66.417.

Market Scenario 2: Short positions below 64.471 with targets @ 63.173 & 62.524.

Comment: The pair advanced above pivot point 64.471.

Supports and Resistances:

R3 68.364

R2 66.417

R1 65.119

PP 64.471

S1 63.173

S2 62.524

S3 60.578