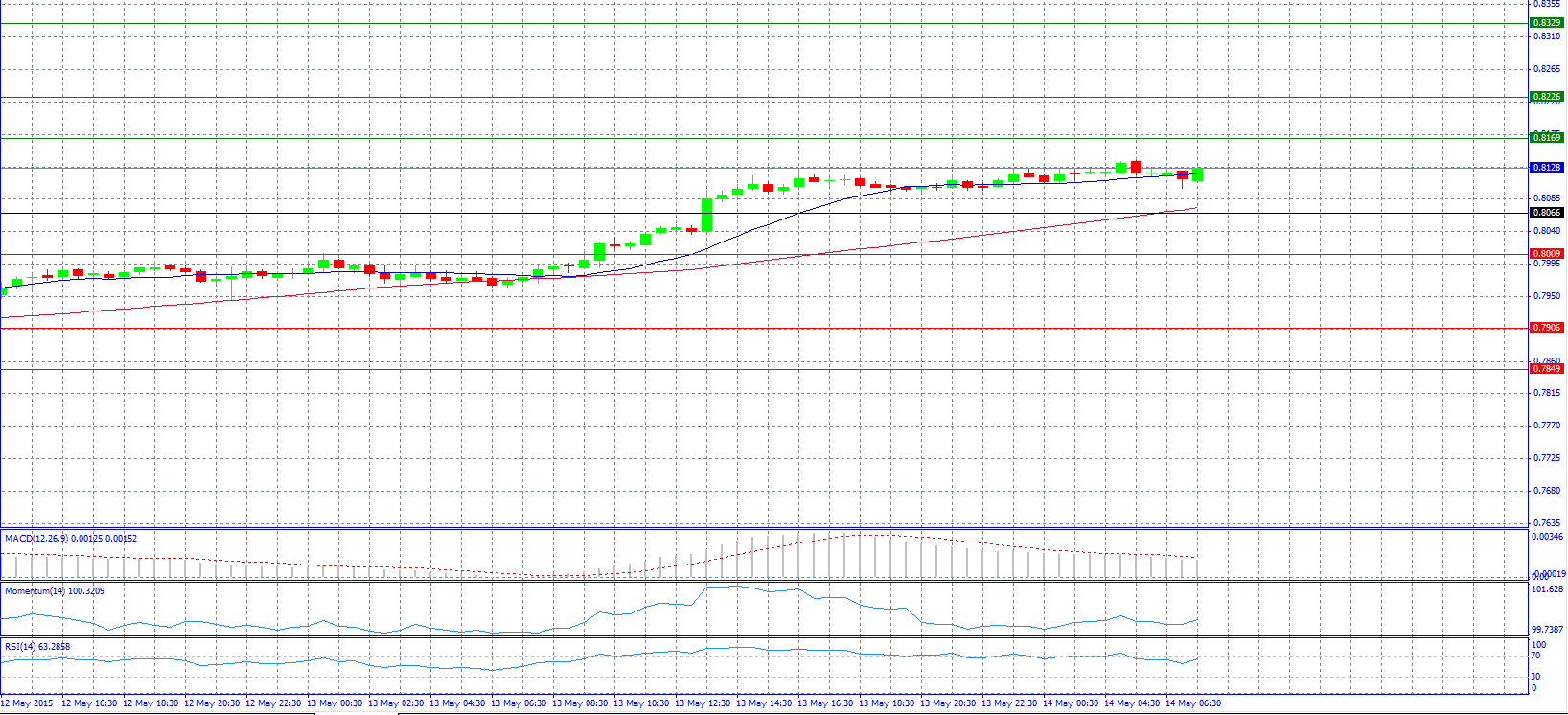

Market Scenario 1: Long positions above 0.8169 with target at 0.8226.

Market Scenario 2: Short positions below 0.8066 with target at 0.8009.

Comment: The pair is expected to extend gains and face resistance at 0.8326 according to analysts.

Supports and Resistances:

R3 0.8329

R2 0.8226

R1 0.8169

PP 0.8066

S1 0.8009

S2 0.7906

S3 0.7849

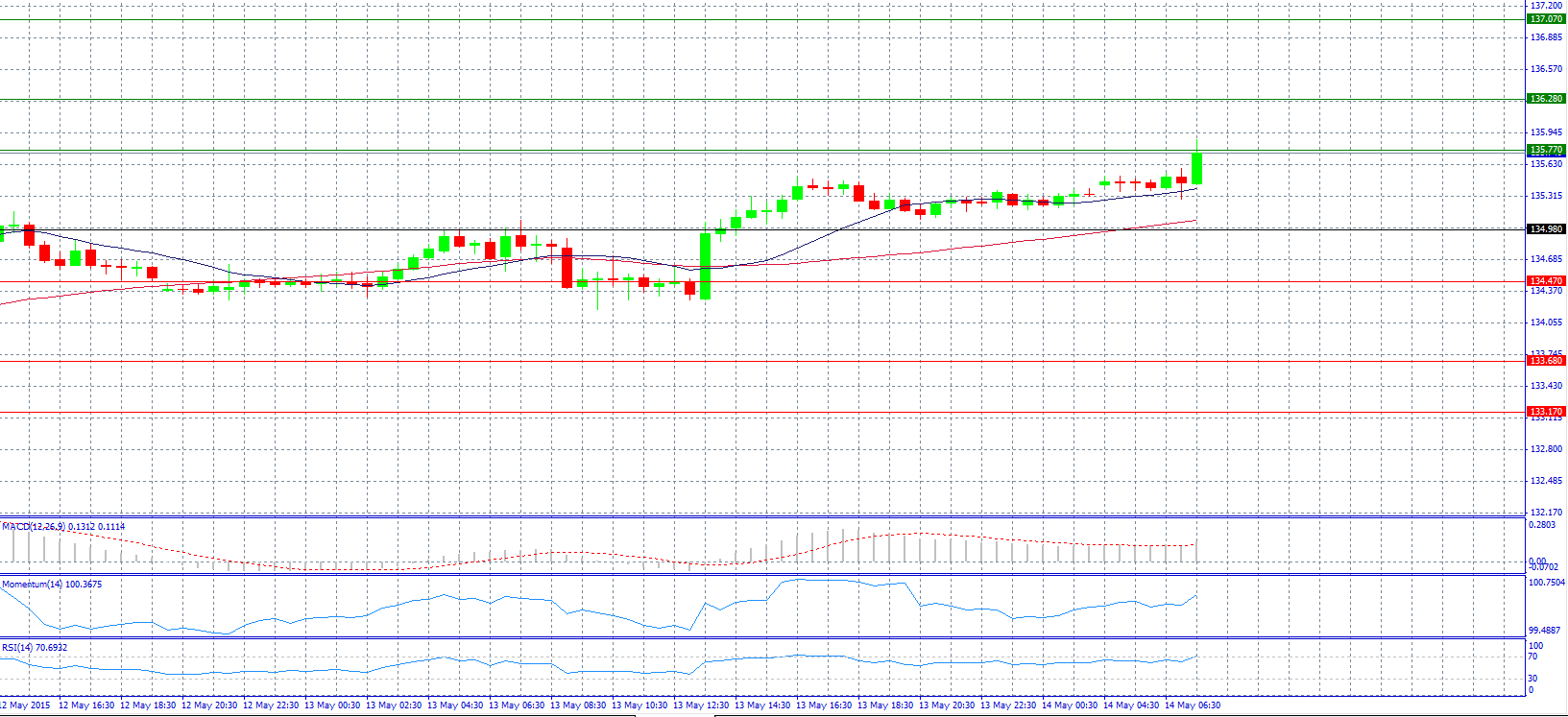

Market Scenario 1: Long positions above 135.77 with target at 136.28.

Market Scenario 2: Short positions below 134.98 with target at 134.47.

Comment: The pair continues to rise after strong data numbers on Wednesday and tries to break resistance level 135.77.

Supports and Resistances:

R3 137.07

R2 136.28

R1 135.77

PP 134.98

S1 134.47

S2 133.68

S3 133.17

Market Scenario 1: Long positions above 1.1423 with target at 1.1492.

Market Scenario 2: Short positions below 1.1312 with target at 1.1243.

Comment: The pair reached a 3-month high and made an assault to the 1.1400 level.

Supports and Resistances:

R3 1.1603

R2 1.1492

R1 1.1423

PP 1.1312

S1 1.1243

S2 1.1132

S3 1.1063

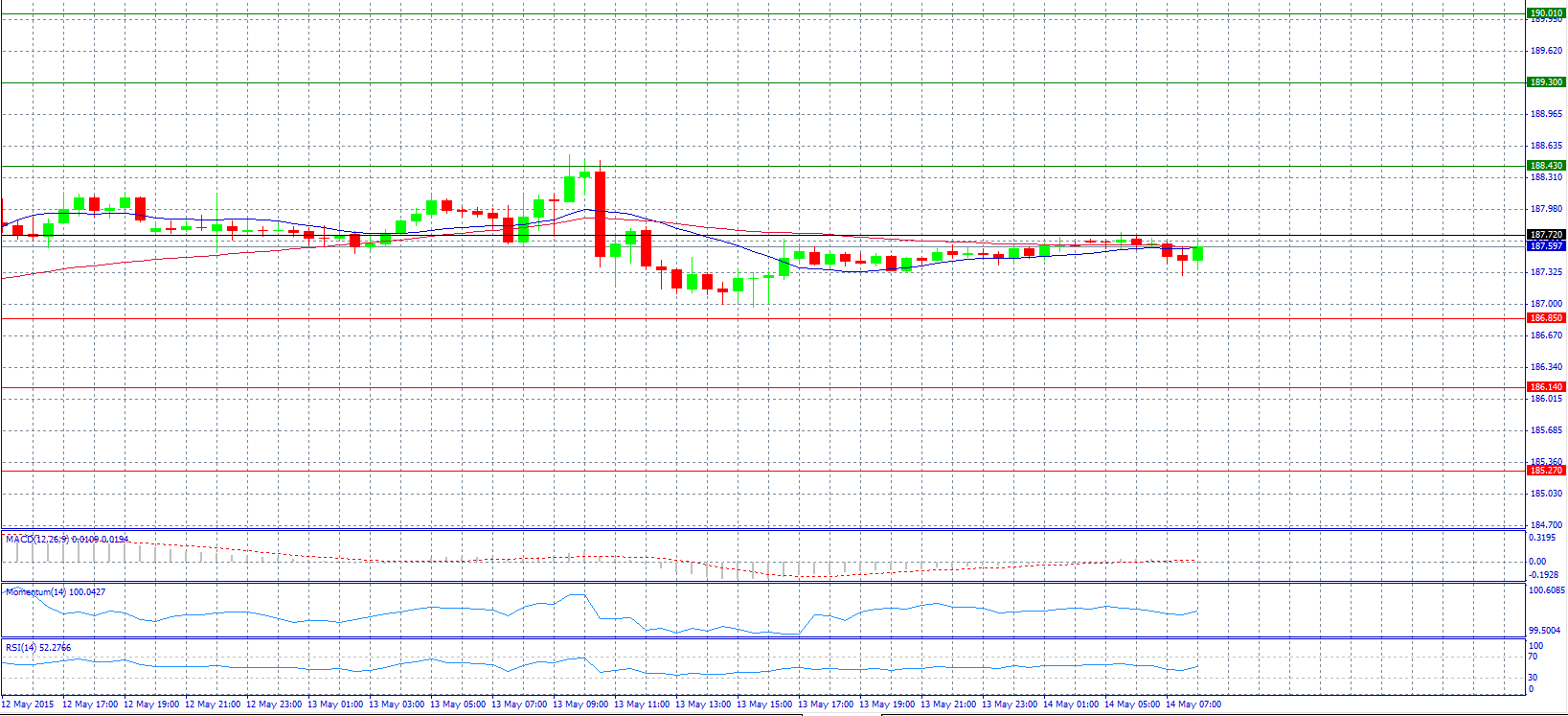

Market Scenario 1: Long positions above 187.72 with target at 188.43.

Market Scenario 2: Short positions below 186.85 with target at 186.14.

Comment: The pair broke its 6-day win streak and trades neutral near 187.60 level.

Supports and Resistances:

R3 190.01

R2 189.30

R1 188.43

PP 187.72

S1 186.85

S2 186.14

S3 185.27

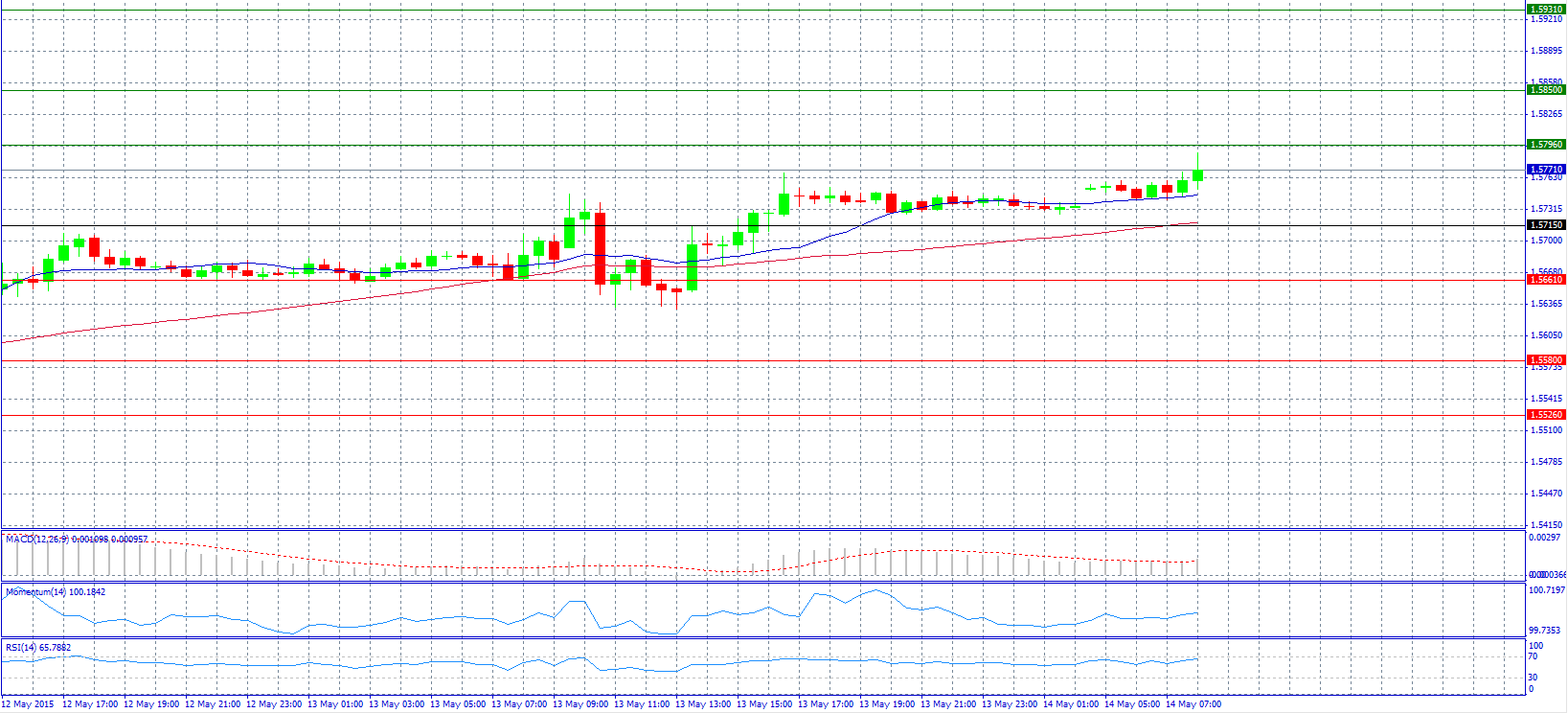

Market Scenario 1: Long positions above 1.5796 with target at 1.5850.

Market Scenario 2: Short positions below 1.5715 with target at 1.5661.

Comment: The pair might see a dip towards 1.57-1.5720 area, breaking below which might pave way for 1.5650 levels, according to analysts.

Supports and Resistances:

R3 1.5931

R2 1.5850

R1 1.5796

PP 1.5715

S1 1.5661

S2 1.5580

S3 1.5526

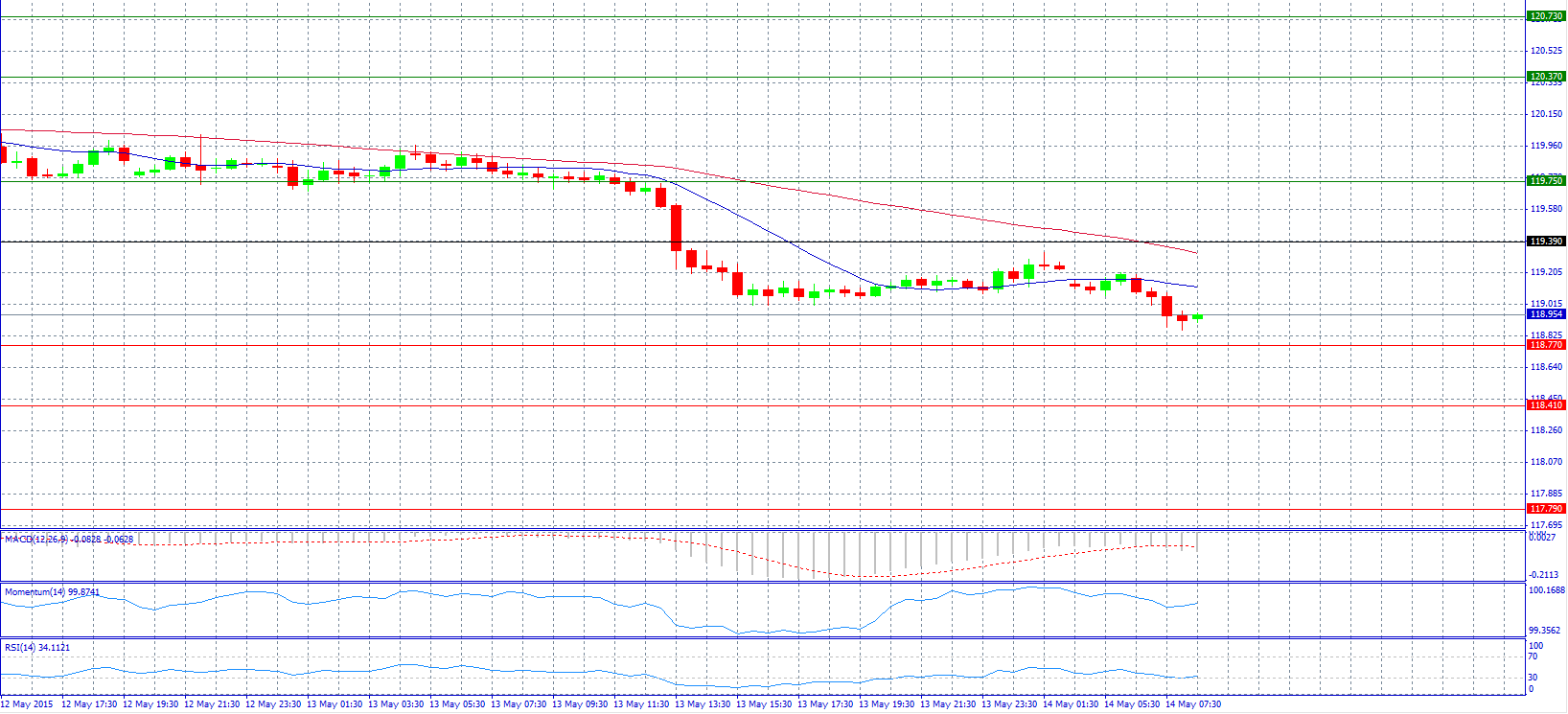

Market Scenario 1: Long positions above 119.39 with target at 119.75.

Market Scenario 2: Short positions below 118.77 with target at 118.41.

Comment: The pair manages to stay above 119.00 level as the strength in the US treasury yields offset the effects of broad US dollar weakness backed by downbeat US news.

Supports and Resistances:

R3 120.73

R2 120.37

R1 119.75

PP 119.39

S1 118.77

S2 118.41

S3 117.79

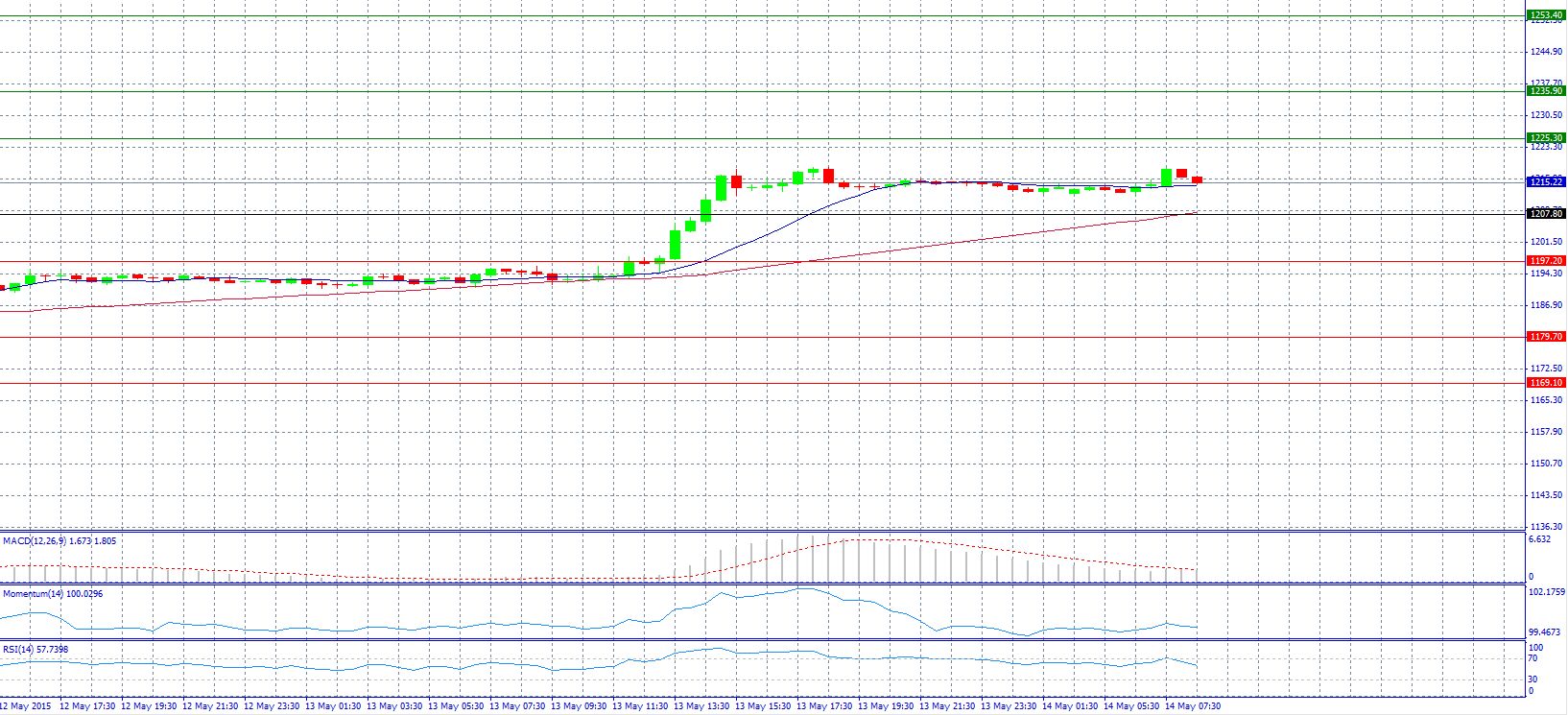

Market Scenario 1: Long positions above 1225.30 with target at 1235.90.

Market Scenario 2: Short positions below 1207.80 with target at 1197.20.

Comment: Gold prices stopped the rally and now trade neutral near 1215.00 level.

Supports and Resistances:

R3 1253.40

R2 1235.90

R1 1225.30

PP 1207.80

S1 1197.20

S2 1179.70

S3 1169.10

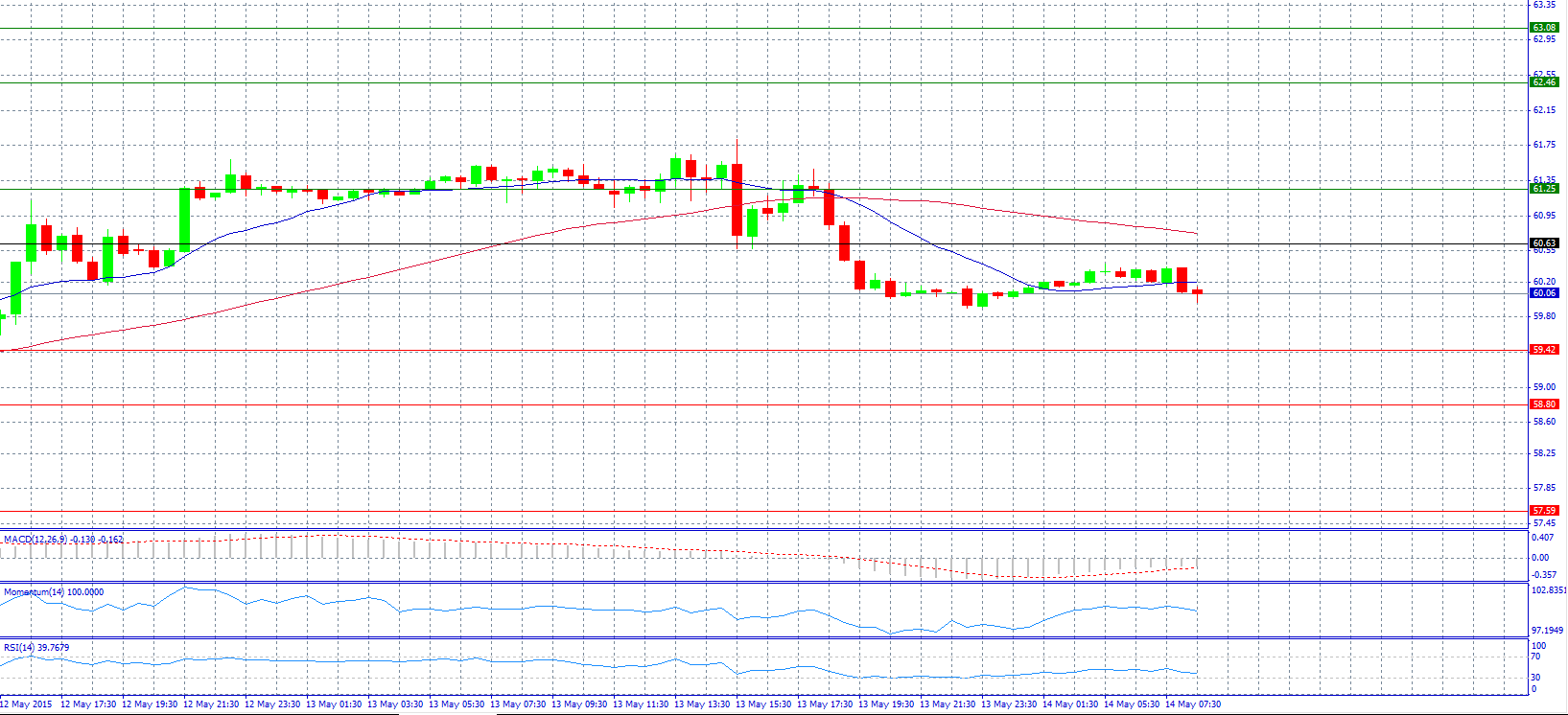

Market Scenario 1: Long positions above 60.63 with target at 61.25.

Market Scenario 2: Short positions below 59.42 with target at 58.80.

Comment: Crude oil prices have a bearish tone and trade near 60.00 level.

Supports and Resistances:

R3 63.08

R2 62.46

R1 61.25

PP 60.63

S1 59.42

S2 58.80

S3 57.59

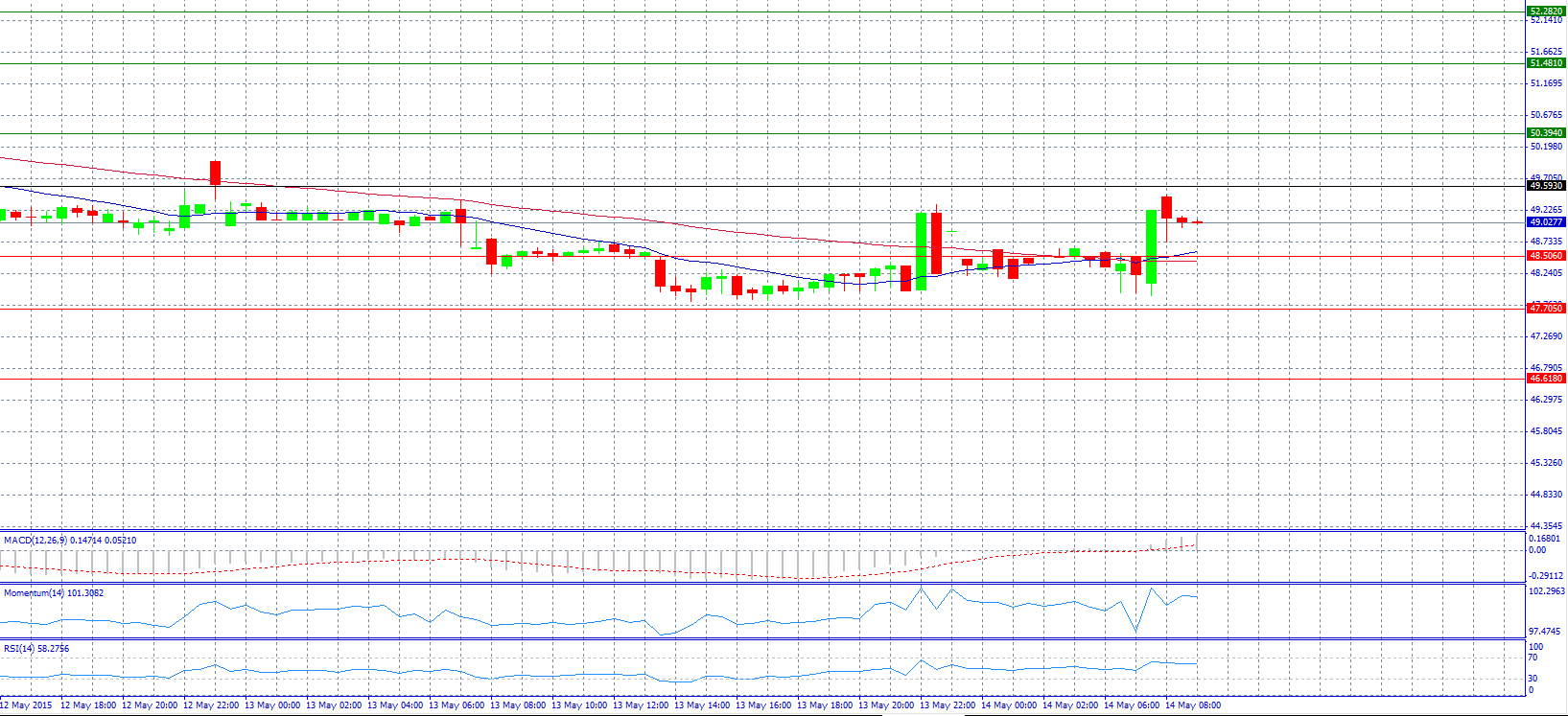

Market Scenario 1: Long positions above 49.593 with target at 50.394.

Market Scenario 2: Short positions below 48.506 with target at 47.705.

Comment: The pair tries to find the strength to stay above 49.000 level.

Supports and Resistances:

R3 52.282

R2 51.481

R1 50.394

PP 49.593

S1 48.506

S2 47.705

S3 46.618