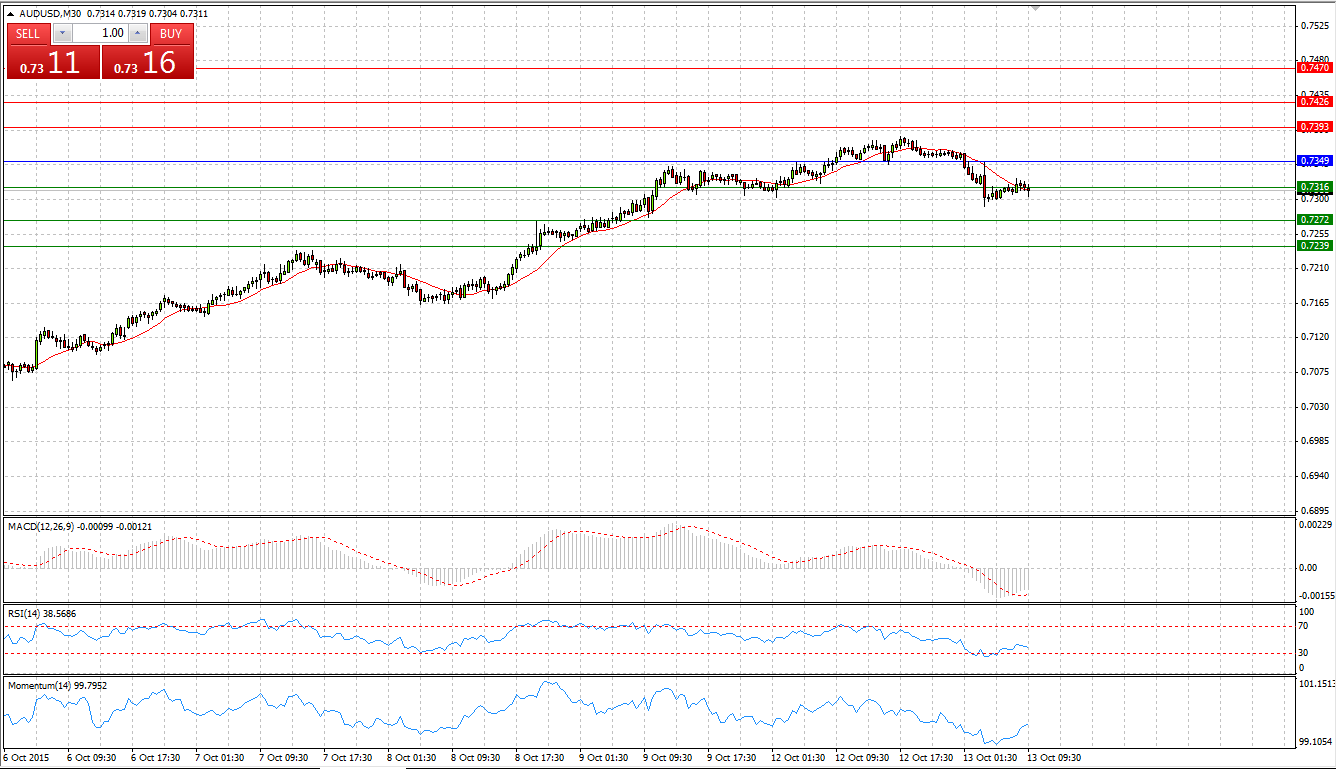

Market Scenario 1: Long positions above 0.7316 with targets at 0.7349 and 0. 0.7349

Market Scenario 2: Short positions below 0.7316 with targets at 0.7272 and 0.7272

Comment: Aussie surged last week against US dollar, gaining about 300 pips amid dovish Federal Reserve minutes as well as weaker than expected US economic data such as Services PMI and Trade Balance. Having reached its recent high, Aussie encountered with a selling pressure at 0.7382 and was pushed below Pivot Point level. However, in the bigger picture AUD/USD is still in an uptrend. Just slightly overheated due to extensive period of gains. S2 is a strong support level, which stands exactly at 17-18th of October High.

Supports and Resistances:

R3 0.7470

R2 0.7426

R1 0.7393

PP 0.7349

S1 0.7316

S2 0.7272

S3 0.7239

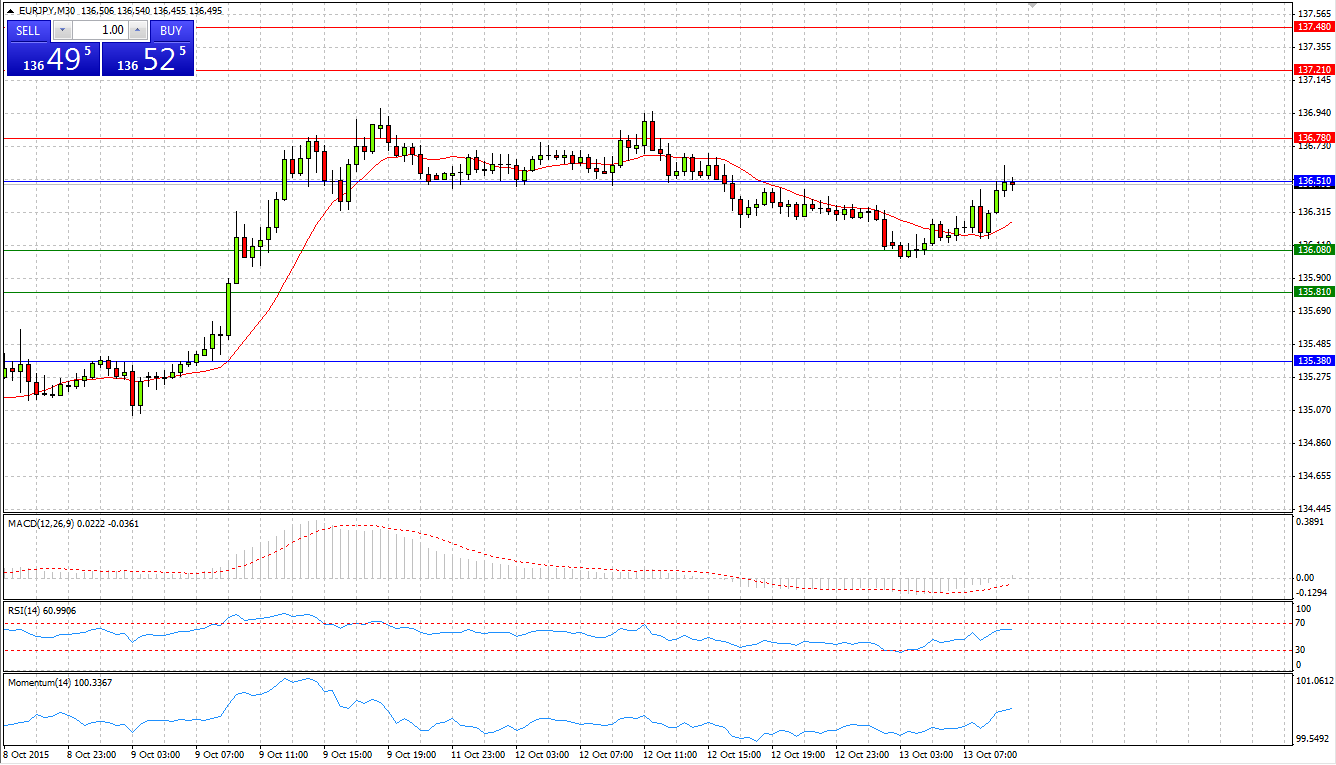

EUR/JPY

Market Scenario 1: Long positions above 136.08 with targets at 136.51 and 136.78

Market Scenario 2: Short positions below 136.51 with targets at 136.08 and 135.81

Comment: EUR/JPY bulls are currently trying to take back Pivot Point level, which had been taken by bears yesterday. Succeeding to do so EUR/JPY might undertake another attempt to break through and entrench itself above recent highs.

R3 137.48

R2 137.21

R1 136.78

PP 136.51

S1 136.08

S2 135.81

S3 135.38

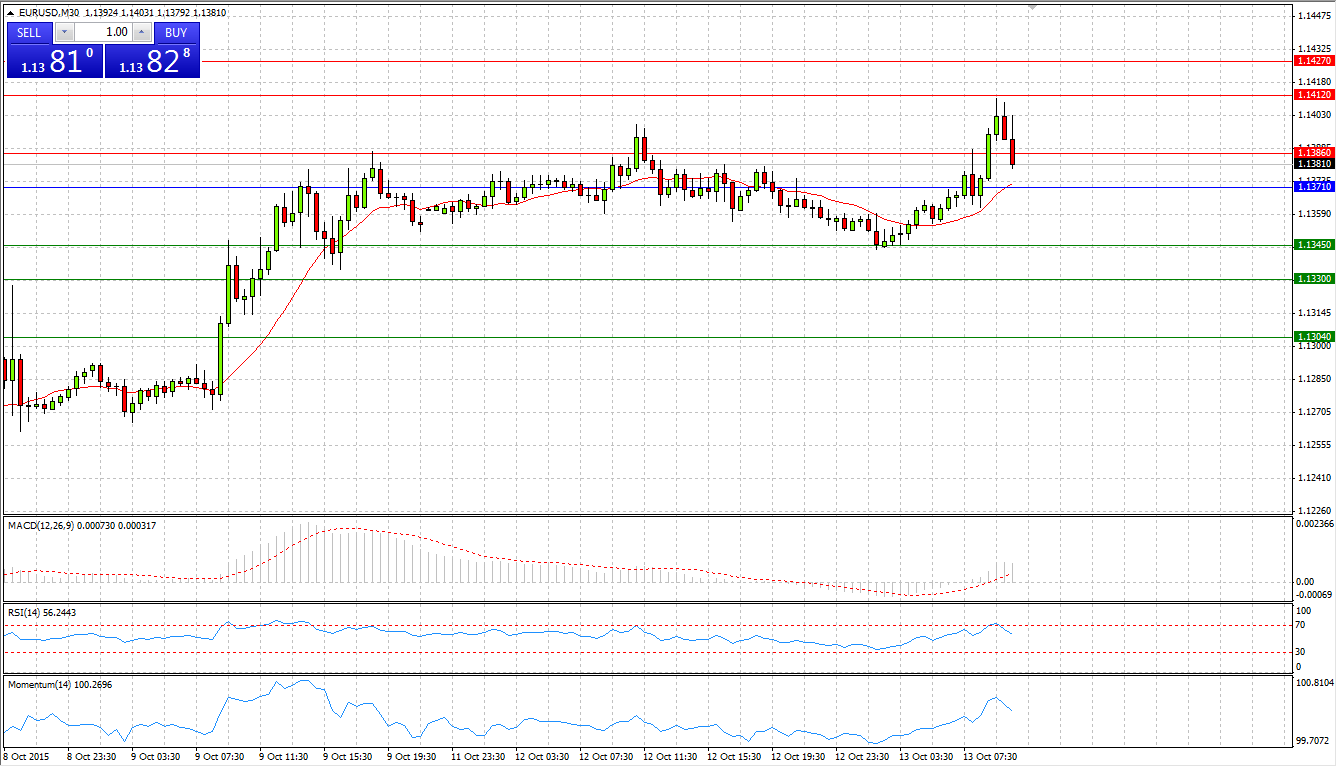

EUR/USD

Market Scenario 1: Long positions above 1.1386 with targets at 1.1412 and 1.1427

Market Scenario 2: Short positions below 1.1386 with targets at 1.1345 and 1.1345

Comment: EUR/USD managed to break through its recent high at 1.1391 and now testing second resistance level. Successful break out through this level will lead to further appreciation of European currency against US dollar.

Supports and Resistances:

R3 1.1427

R2 1.1412

R1 1.1386

PP 1.1371

S1 1.1345

S2 1.1330

S3 1.1304

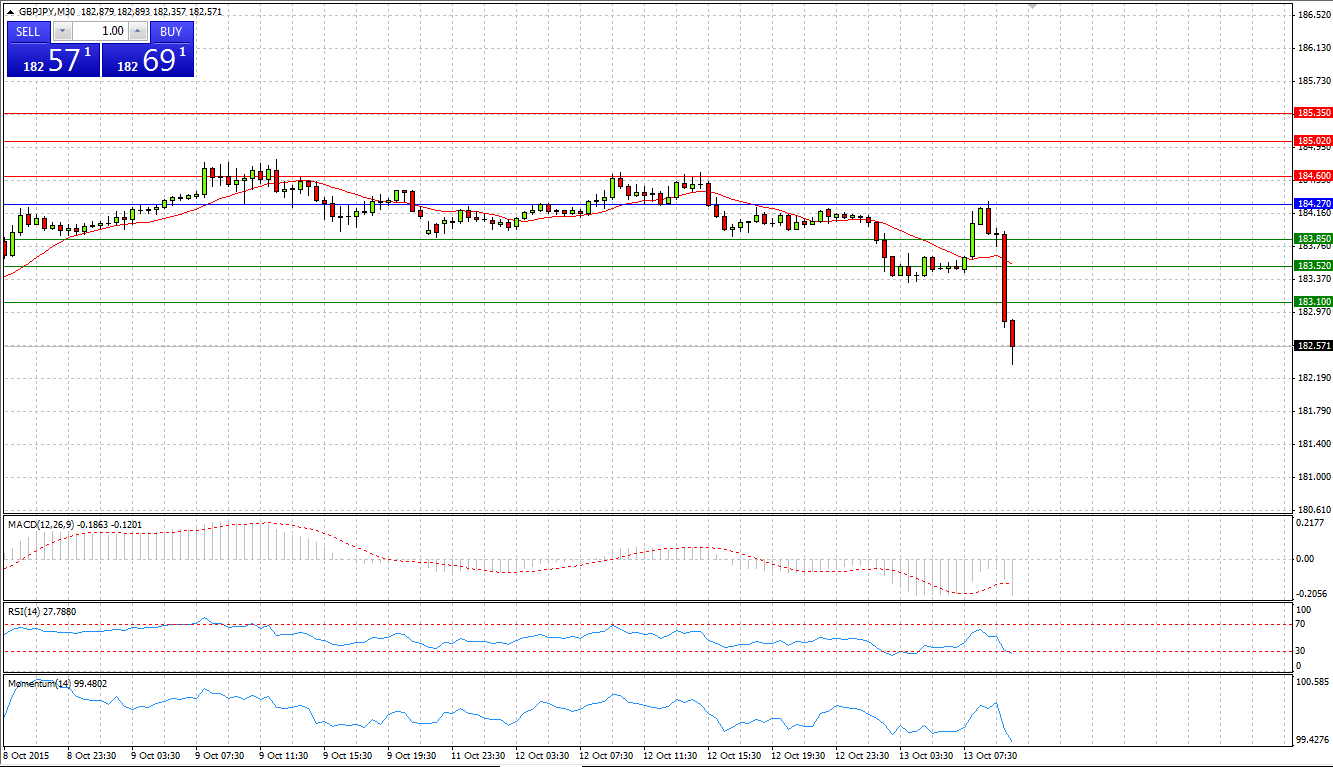

GBP/JPY

Market Scenario 1: Long positions above 183.10 with targets at 183.52 and 183.85

Market Scenario 2: Short positions below 183.10 with targets at 182 and 181

Comment: GBP/JPY didn’t succeed to break through first resistance level and was pushed below Pivot Point Level. Then, just 5 minutes ahead of the release of UK CPI, bulls apparently realized their profit, making GBP to depreciate even further.

Supports and Resistances:

R3 185.35

R2 185.02

R1 184.60

PP 184.27

S1 183.85

S2 183.52

S3 183.10

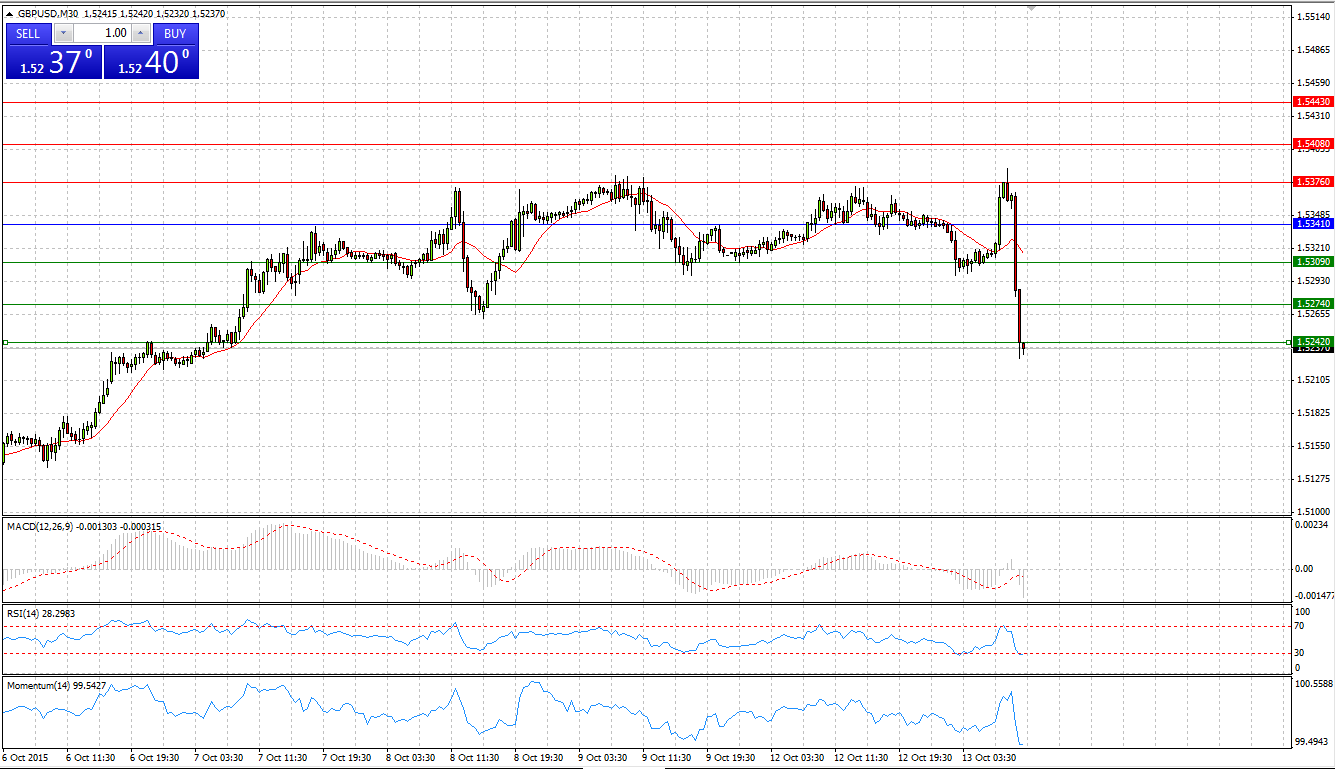

GBP/USD

Market Scenario 1: Long positions above 1.5242 with targets at 1.5274 and 1.5309

Market Scenario 2: Short positions below 1.5274 with targets at 1.5242 and 1.52

Comment: GBP/USD didn’t succeed in breaking through first resistance level after number of attempts, which lasted for the last 4 trading days. As a result of this failure, bulls decided to close and realize their profits, which led to imbalance of selling and buying sides that drove GBP/USD to a drastic selloff.

Supports and Resistances:

R3 1.5443

R2 1.5408

R1 1.5376

PP 1.5341

S1 1.5309

S2 1.5274

S3 1.5242

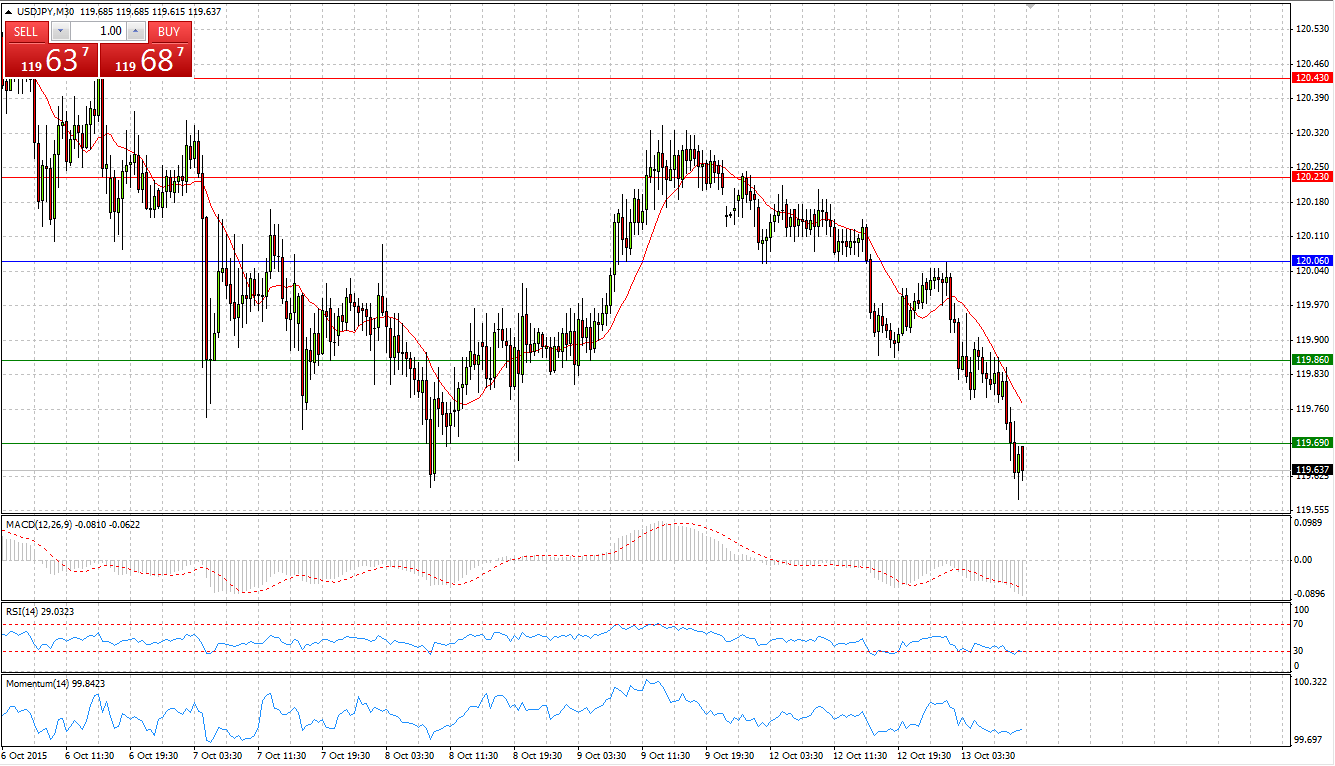

Market Scenario 1: Long positions above 119.49 with targets at 119.69 and 119.86

Market Scenario 2: Short positions below 120.23 with targets at 120.06 and 119.69

Comment: The pair broke through Pivot point Level and tested it as a Resistance level. However, in the bigger picture, the pair continues trading in the range. Hence, Range – Bound strategy can be applied.

Supports and Resistances:

R3 120.60

R2 120.43

R1 120.23

PP 120.06

S1 119.86

S2 119.69

S3 119.49

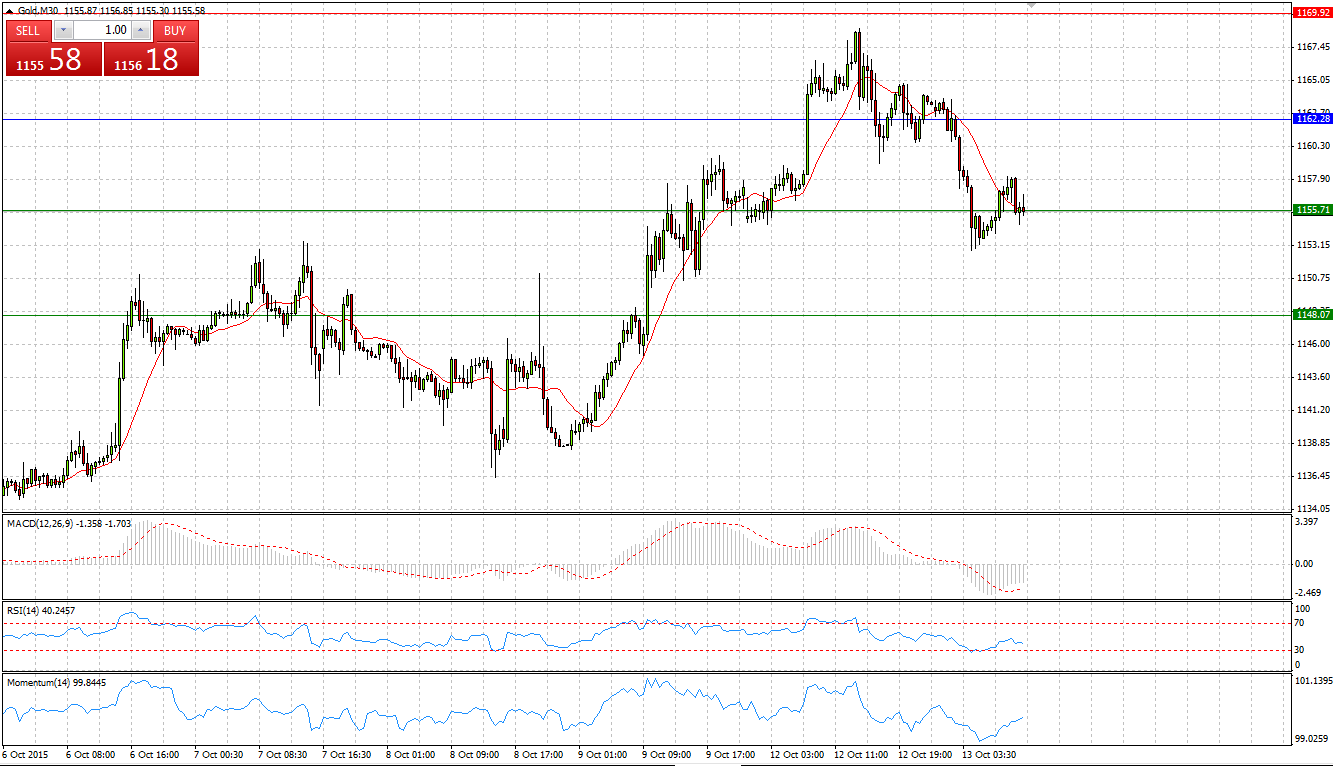

GOLD

Market Scenario 1: Long positions above 1155.71 with targets at 1162.28 and 1169.92

Market Scenario 2: Short positions below 1155.71 with targets at 1148.07 and 1133.86

Comment: Having tested 24th of August highs, gold retreated to the first support level. However, another attempt might be undertaken later today.

Supports and Resistances:

R3 1190.70

R2 1176.49

R1 1169.92

PP 1162.28

S1 1155.71

S2 1148.07

S3 1133.86

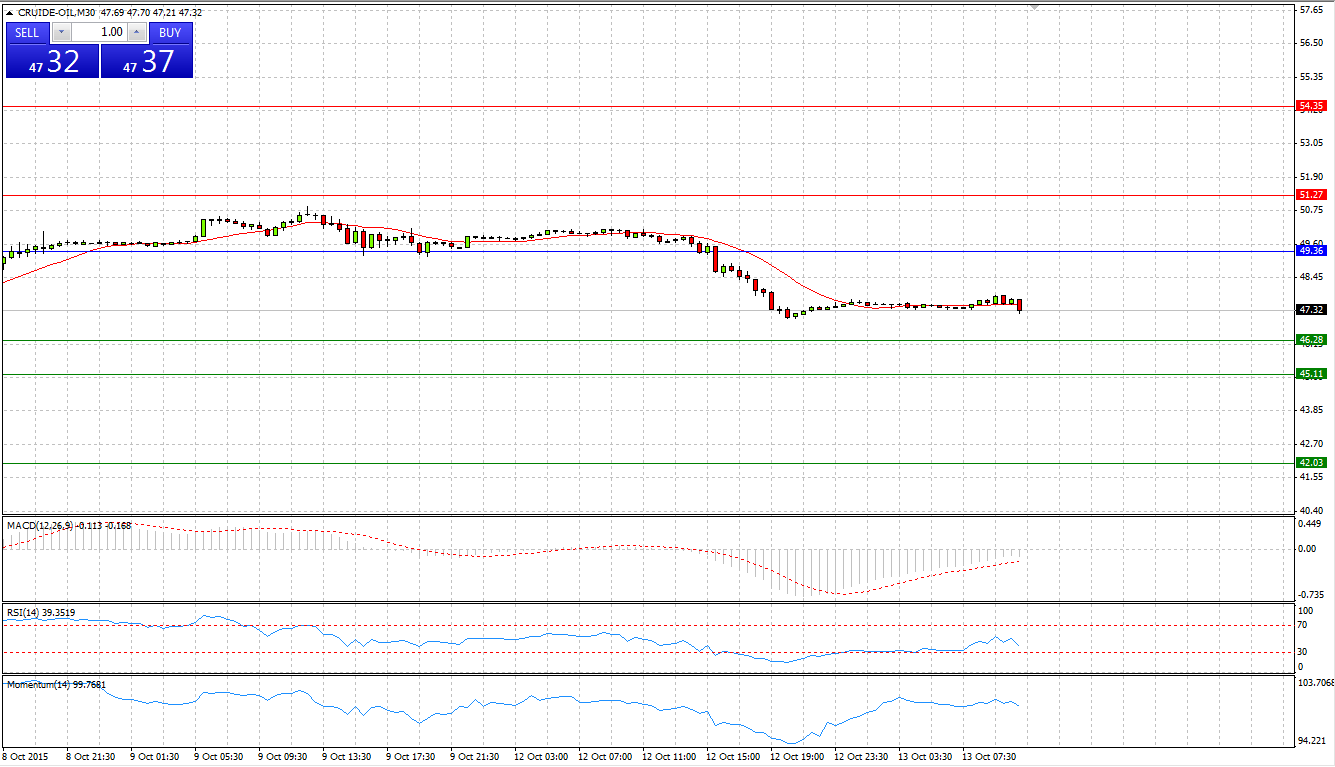

CRUDE OIL

Market Scenario 1: Long positions above 48.19 with targets at 49.36 and 51.27

Market Scenario 2: Short positions below 48.19 with targets at 46.28 and 45.11

Comment: Crude didn’t manage to retain its position above 50 USD per barrel and was drastically sold off, giving up earlier gains. Crude is currently trading below Pivot Point level close to the first Support Level.

Supports and Resistances:

R3 54.35

R2 51.27

R1 49.36

PP 48.19

S1 46.28

S2 45.11

S3 42.03

Market Scenario 1: Long positions above 60.72 with targets at 61.75 and 62.56

Market Scenario 2: Short positions below 60.72 with targets at 59.90 and 58.87

Comment: Ruble depreciated against US dollar amid heavy sell off of crude oil. It appears that Friday’s late retracement in crude oil was in fact a sign that the bears are once again regaining control and further losses could lie ahead. Decrease in oil prices will have negative effect on ruble

Supports and Resistances:

R3 64.41

R2 62.56

R1 61.75

PP 60.72

S1 59.90

S2 58.87

S3 57.03