Market Scenario 1: Long positions above 0.8021 with target at 0.8067.

Market Scenario 2: Short positions below 0.7953 with target at 0.7907.

Comment: The pair trades steady below 0.7980 level.

Supports and Resistances:

R3 0.8135

R2 0.8067

R1 0.8021

PP 0.7953

S1 0.7907

S2 0.7839

S3 0.7793

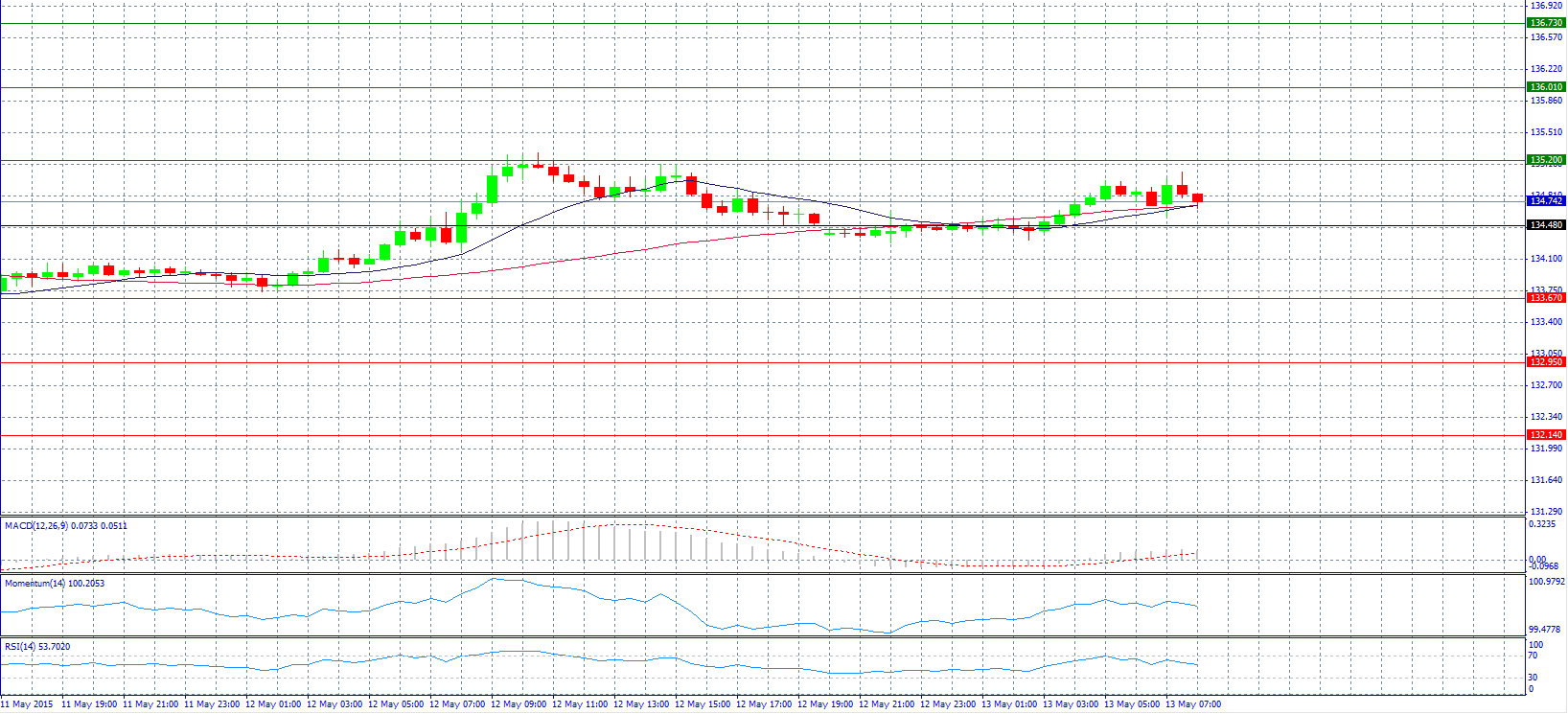

Market Scenario 1: Long positions above 135.20 with target at 136.01.

Market Scenario 2: Short positions below 134.48 with target at 133.67.

Comment: The pair rose and found resistance at 135.20 level and after that it trades in the range around 134.80-135.20.

Supports and Resistances:

R3 136.73

R2 136.01

R1 135.20

PP 134.48

S1 133.67

S2 132.95

S3 132.14

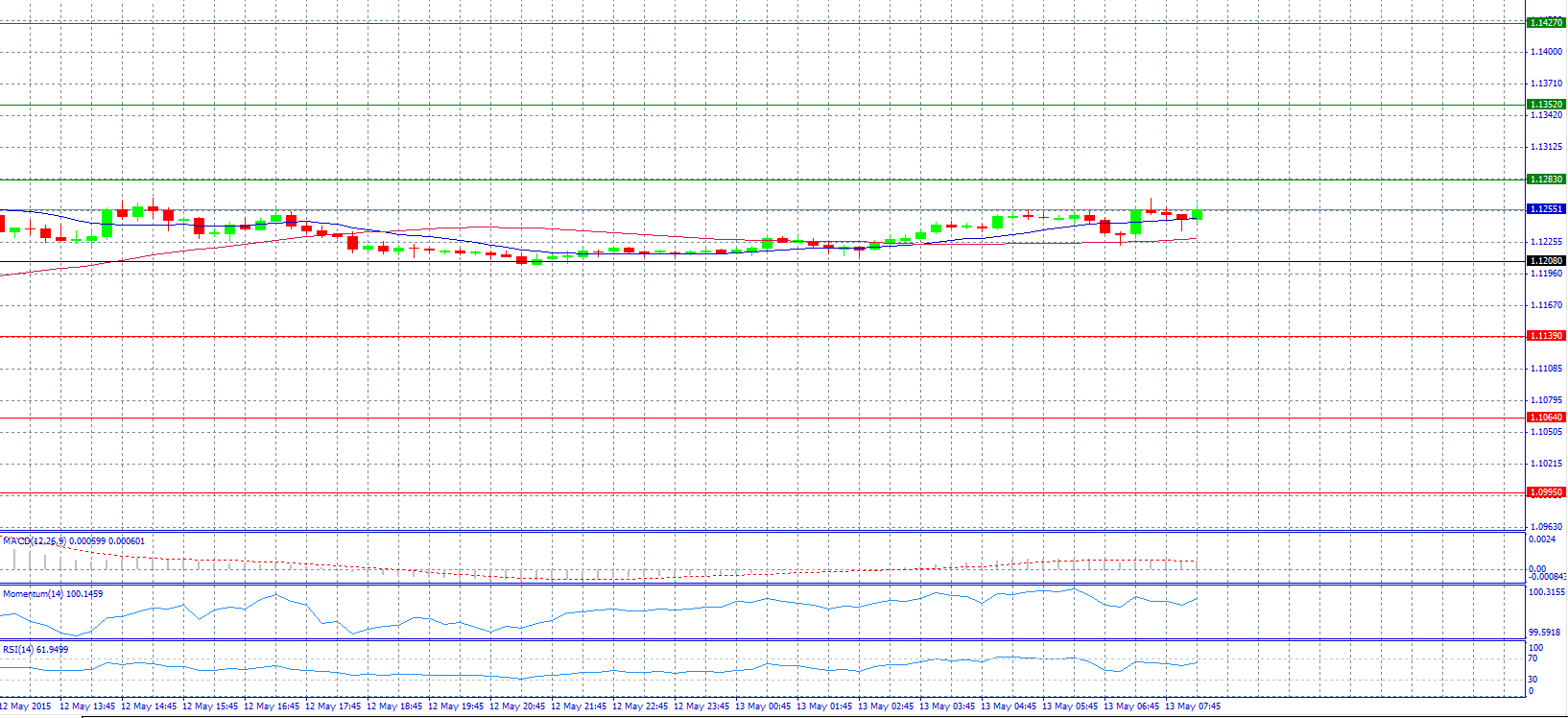

Market Scenario 1: Long positions above 1.1283 with target at 1.1352.

Market Scenario 2: Short positions below 1.1208 with target at 1.1139.

Comment: The pair might continue to trade based to the risk on / risk off in the near term according to analysts.

Supports and Resistances:

R3 1.1427

R2 1.1352

R1 1.1283

PP 1.1208

S1 1.1139

S2 1.1064

S3 1.0995

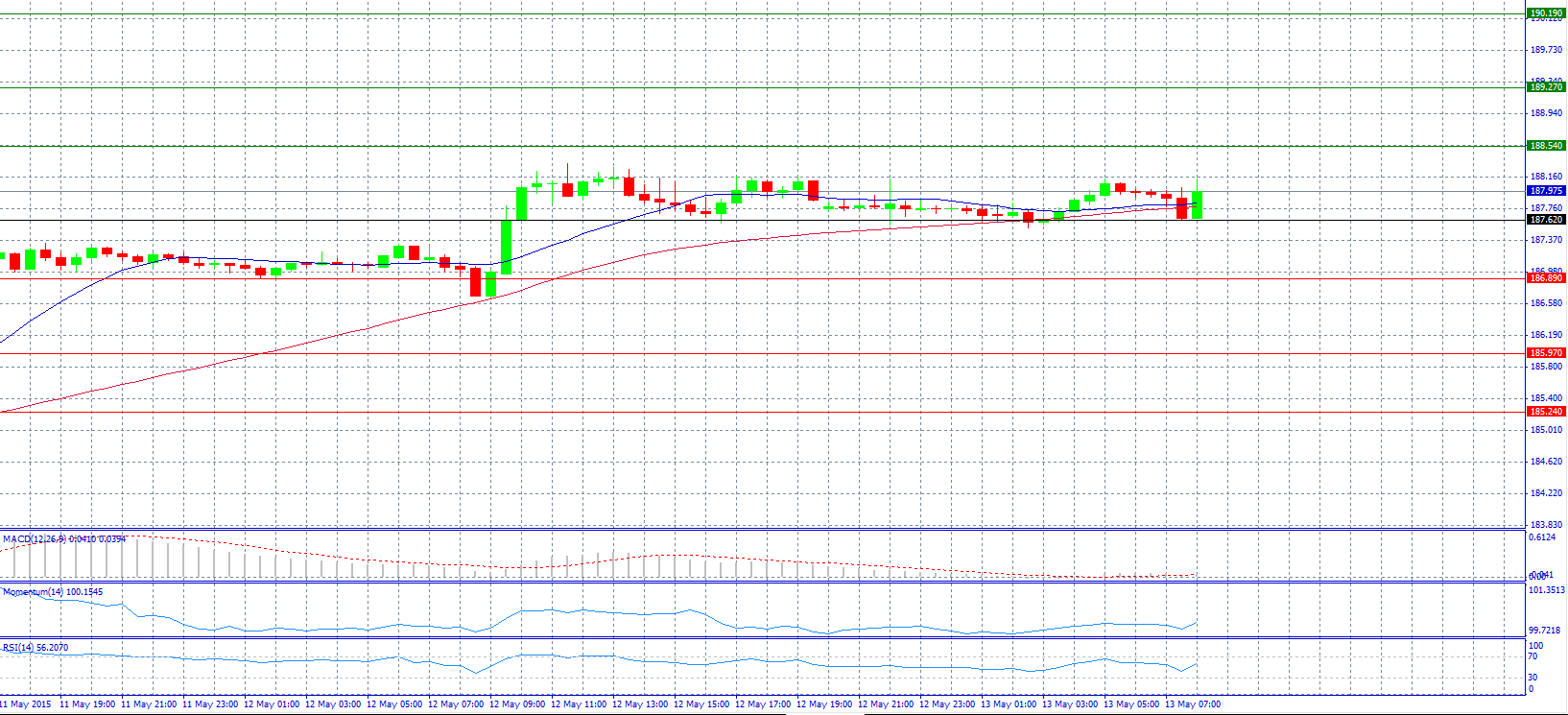

Market Scenario 1: Long positions above 188.54 with target at 189.27.

Market Scenario 2: Short positions below 187.62 with target at 186.89.

Comment: The pair tried to break resistance at pivot point 187.62 but failed multiple times.

Supports and Resistances:

R3 190.19

R2 189.27

R1 188.54

PP 187.62

S1 186.89

S2 185.97

S3 185.24

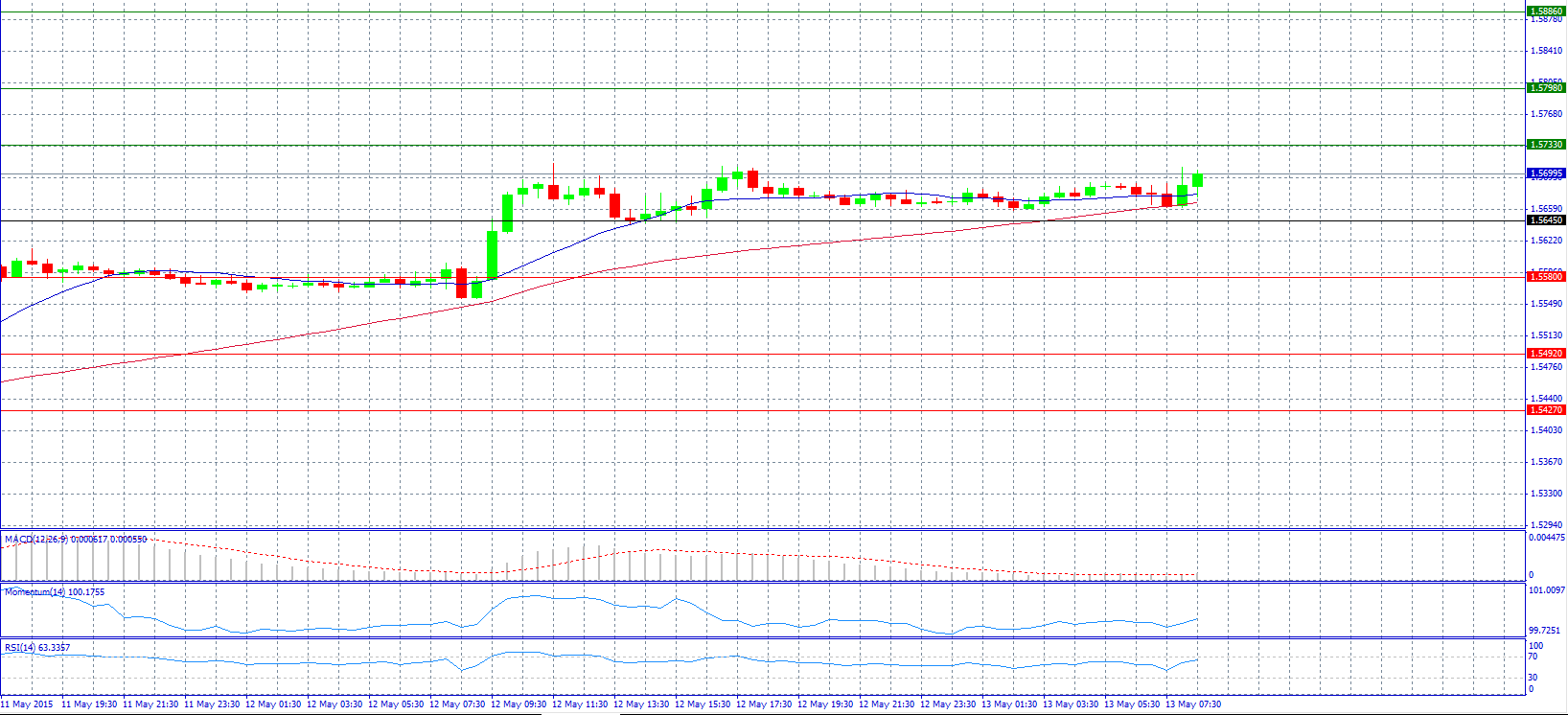

Market Scenario 1: Long positions above 1.5733 with target at 1.5798.

Market Scenario 2: Short positions below 1.5645 with target at 1.5580.

Comment: The pair strengthened again and tries to surpass 1.5700 level.

Supports and Resistances:

R3 1.5886

R2 1.5798

R1 1.5733

PP 1.5645

S1 1.5580

S2 1.5492

S3 1.5427

Market Scenario 1: Long positions above 119.97 with target at 120.15.

Market Scenario 2: Short positions below 119.66 with target at 119.48.

Comment: The pair weakened and falls due to soft data.

Supports and Resistances:

R3 120.64

R2 120.46

R1 120.15

PP 119.97

S1 119.66

S2 119.48

S3 119.17

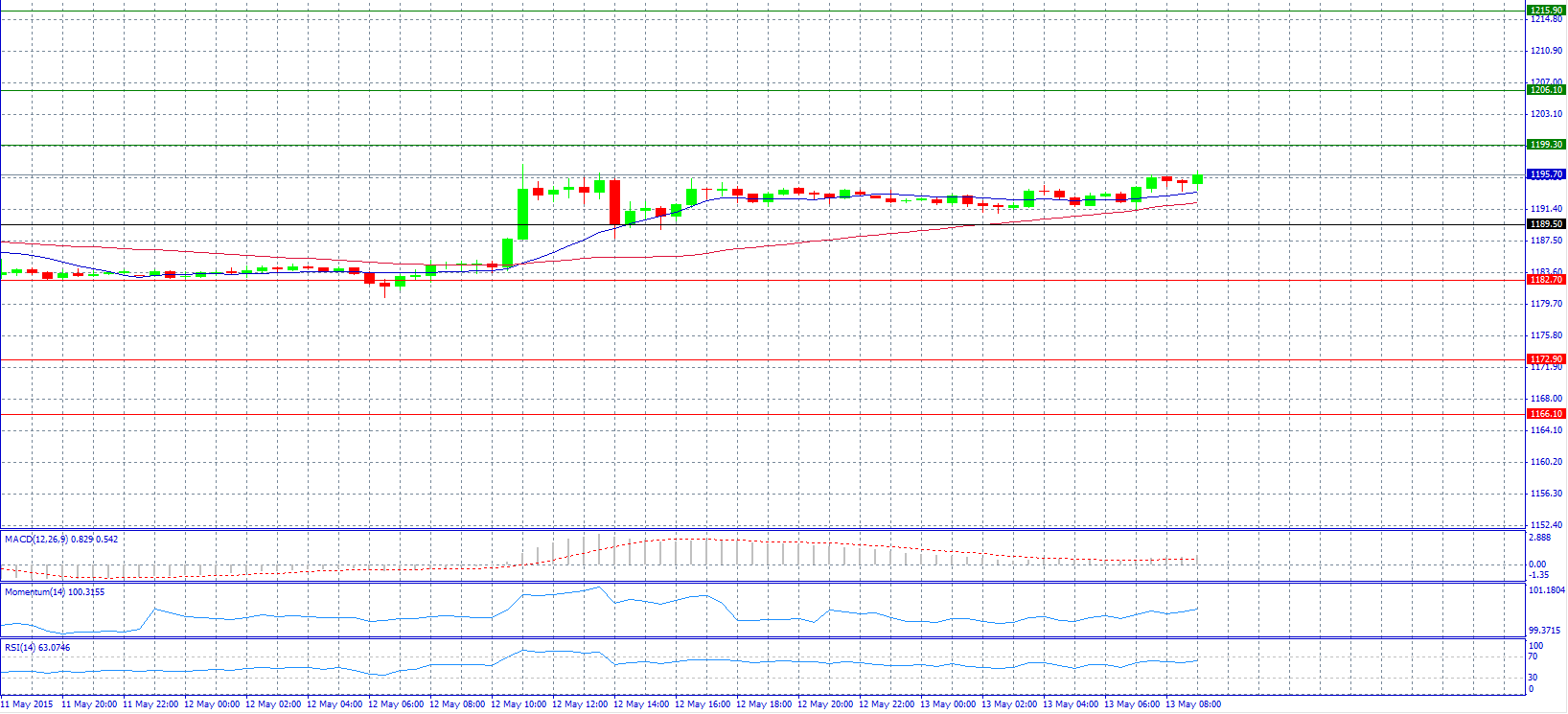

Market Scenario 1: Long positions above 1199.30 with target at 1206.10.

Market Scenario 2: Short positions below 1189.50 with target at 1182.70.

Comment: Gold prices might extend gains at 1200.00 level.

Supports and Resistances:

R3 1215.90

R2 1206.10

R1 1199.30

PP 1189.50

S1 1182.70

S2 1172.90

S3 1166.10

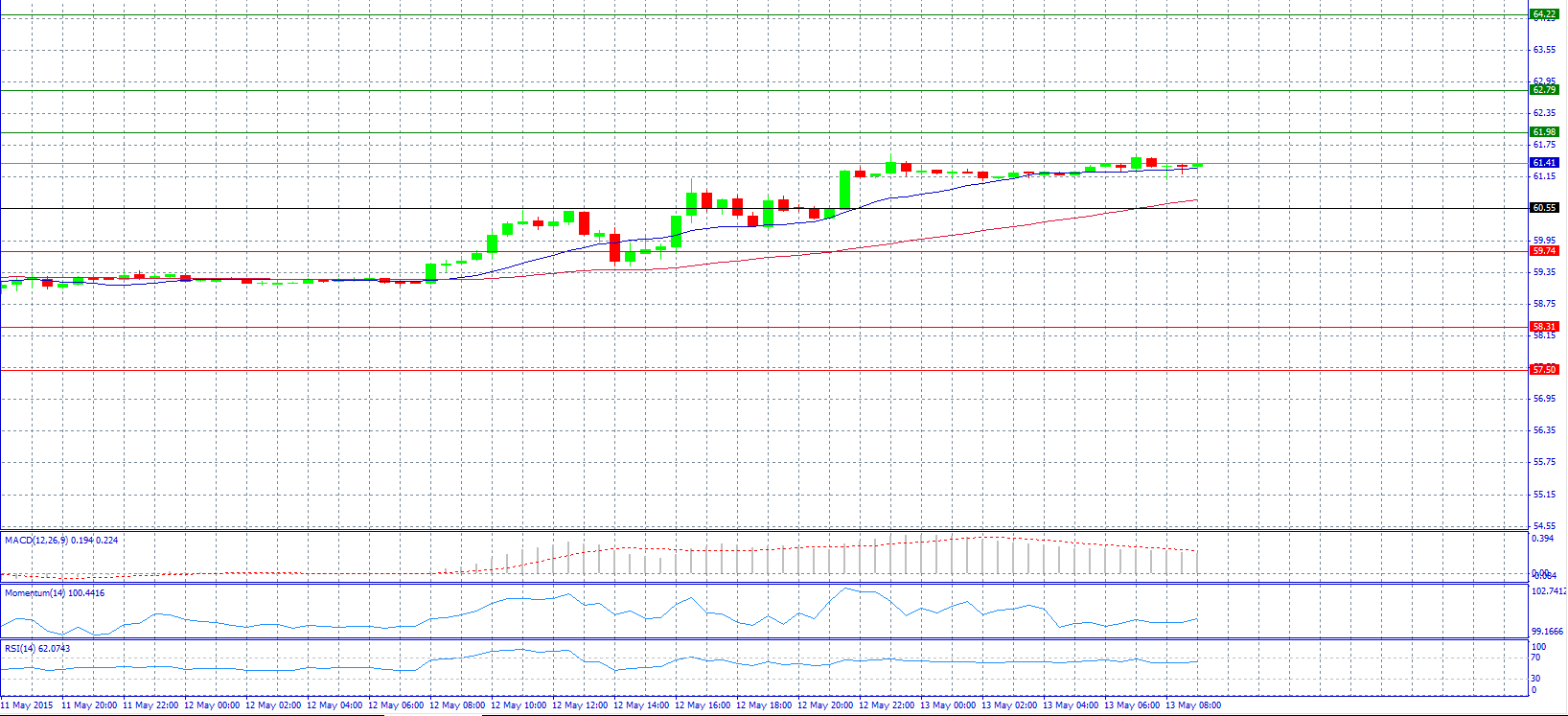

Market Scenario 1: Long positions above 61.98 with target at 62.79.

Market Scenario 2: Short positions below 60.55 with target at 59.74.

Comment: Crude oil prices trade steady below 61.50 level.

Supports and Resistances:

R3 64.22

R2 62.79

R1 61.98

PP 60.55

S1 59.74

S2 58.31

S3 57.50

Market Scenario 1: Long positions above 49.515 with target at 50.199.

Market Scenario 2: Short positions below 48.498 with target at 47.814.

Comment: The pair has a bearish tone and tries to break support level 48.498.

Supports and Resistances:

R3 52.917

R2 51.216

R1 50.199

PP 49.515

S1 48.498

S2 47.814

S3 46.113