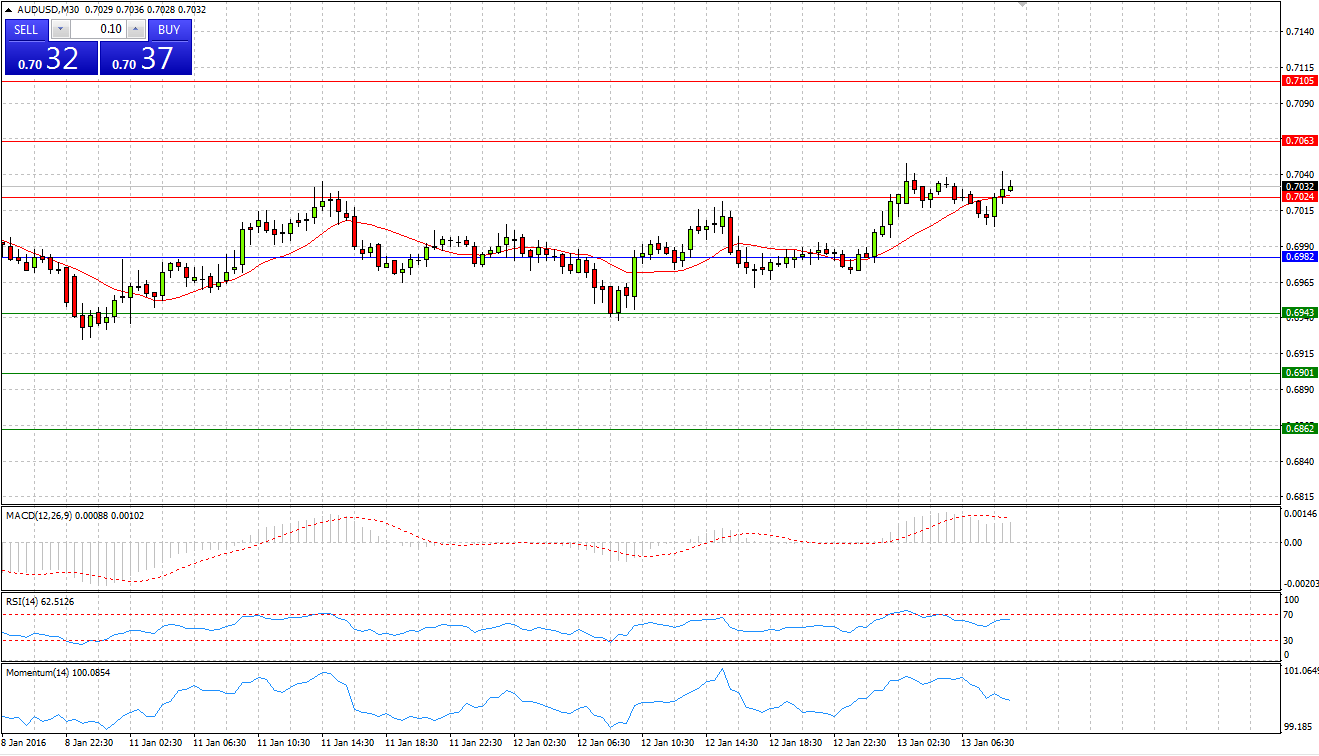

Market Scenario 1: Long positions above 0.6982 with targets @ 0.7024 & 0.7063

Market Scenario 2: Short positions below 0.6982 with targets @ 0.6943 & 0.6901

Comment: Aussie during yesterday’s session was trading in the range between R1 and S1. Today the pair managed to break through the First resistance level and aiming to test the Second one.

Supports and Resistances:

R3 0.7105

R2 0.7063

R1 0.7024

PP 0.6982

S1 0.6943

S2 0.6901

S3 0.6862

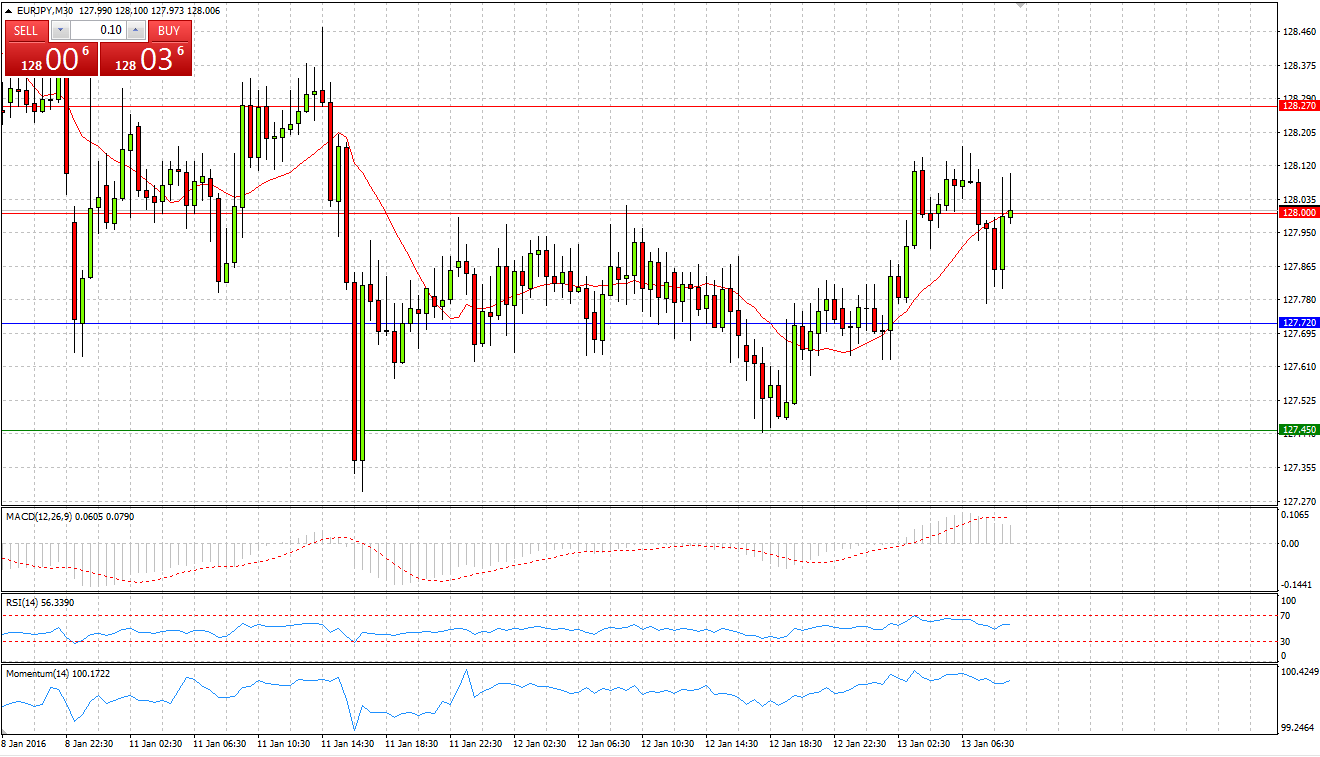

Market Scenario 1: Long positions above 127.72 with targets @ 128.00 & 128.27

Market Scenario 2: Short positions below 127.72 with targets @ 127.45 & 127.17

Comment: European currency since it reached its lowest level at 126.77 on 7th of January against Japanese Yen has been trading flat between R2 and S2. Today the pair is trading positively slightly above the First Resistance level.

Supports and Resistances:

R3 128.55

R2 128.27

R1 128.00

PP 127.72

S1 127.45

S2 127.17

S3 126.90

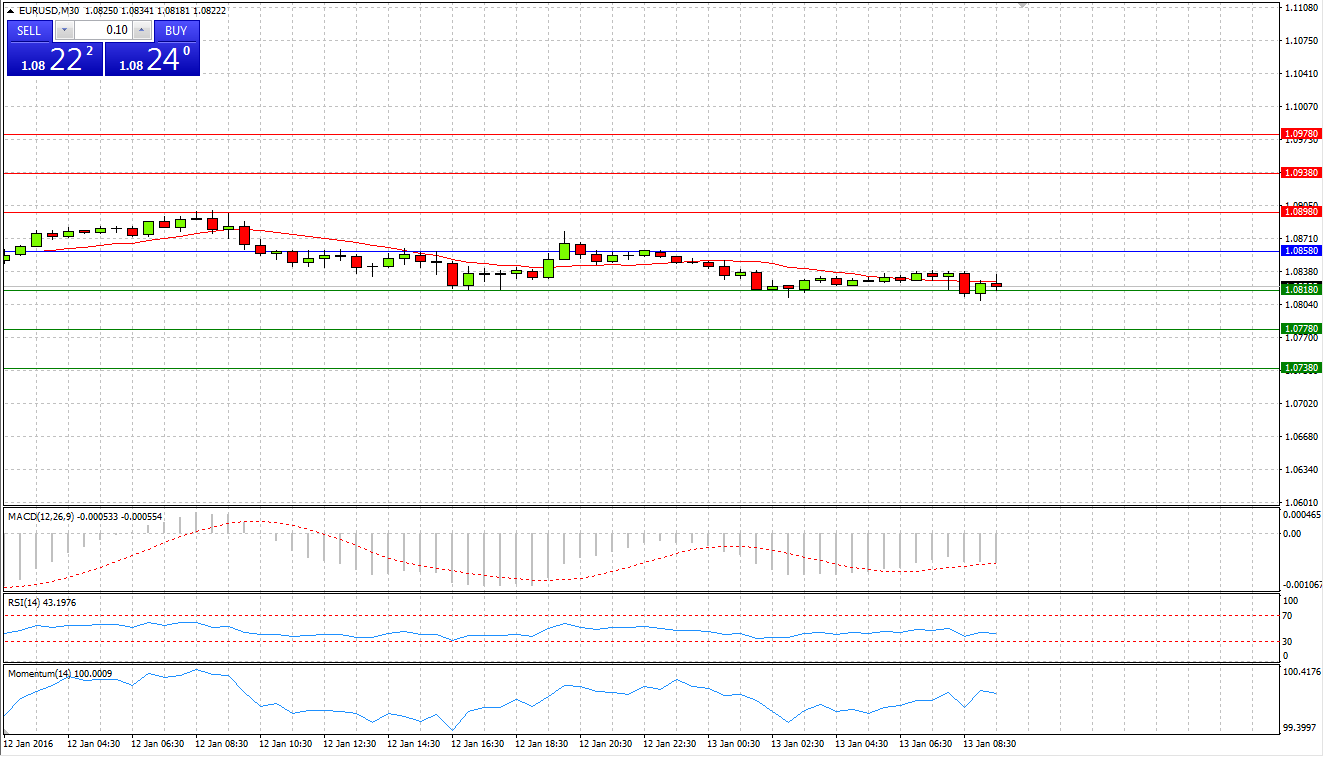

Market Scenario 1: Long positions above 1.0858 with targets @ 1.0898 & 1.0938

Market Scenario 2: Short positions below 1.0858 with targets @ 1.0818 & 1.0778

Comment: European currency during yesterday’s session recorded second day in a row in negative territory against US Dollar, closing the session 1.0847. Today the pair continues its downward move and already undertook an attempt to test the first Support level at 1.0818

Supports and Resistances:

R3 1.0978

R2 1.0938

R1 1.0898

PP 1.0858

S1 1.0818

S2 1.0778

S3 1.0738

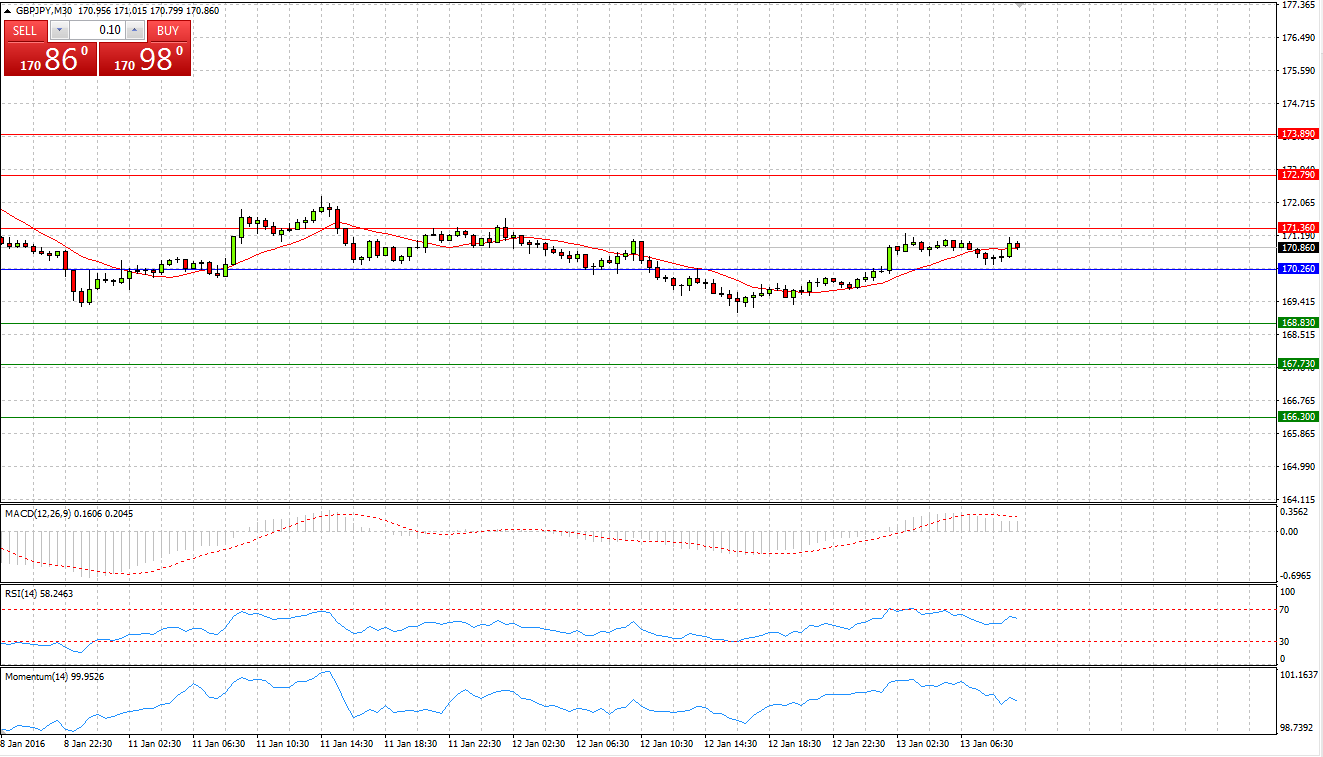

Market Scenario 1: Long positions above 170.26 with targets @ 171.36 & 172.79

Market Scenario 2: Short positions below 170.26 with targets @ 168.83 & 167.73

Comment: Sterling during yesterday’s session recorded a new low at 169.11 against Japanese Yen, this was the lowest level since 15th of October 2014. Today the pair is trading with positive bias above Pivot Point level and close to the First Resistance level

Supports and Resistances:

R3 173.89

R2 172.79

R1 171.36

PP 170.26

S1 168.83

S2 167.73

S3 166.30

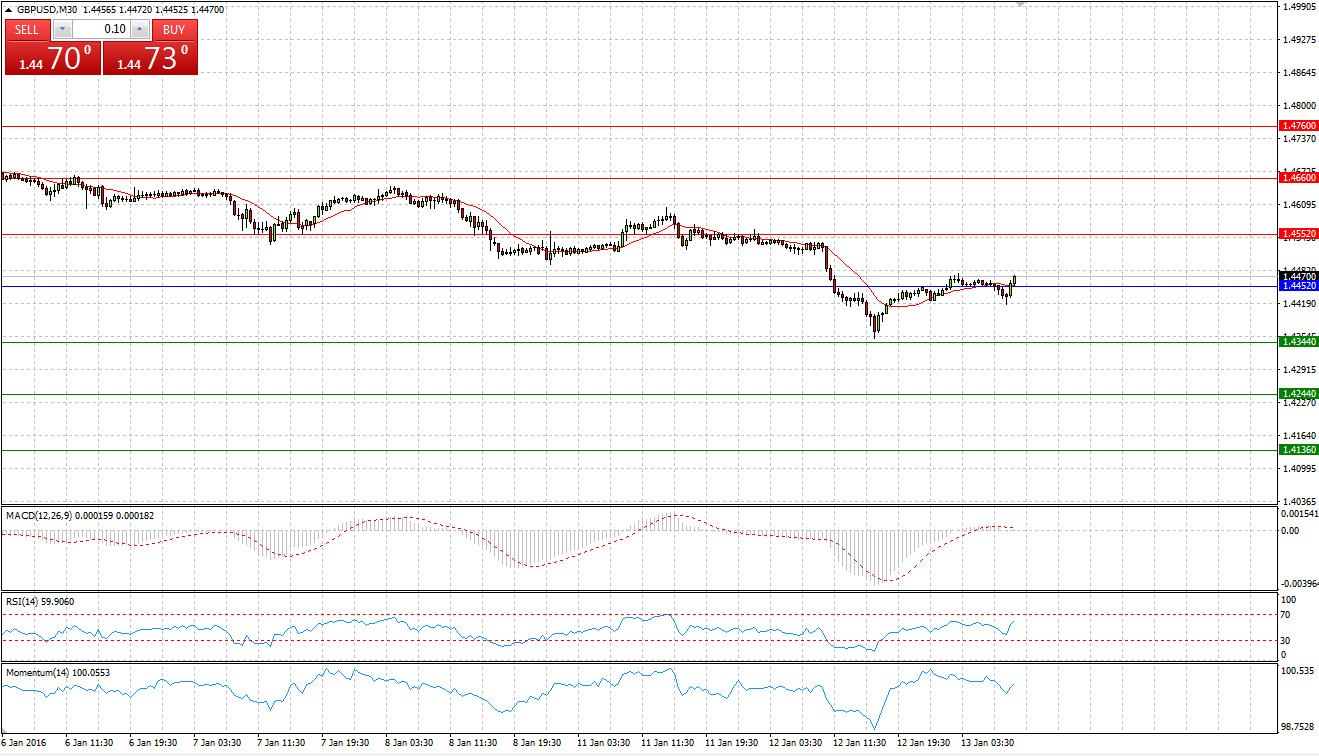

Market Scenario 1: Long positions above 1.4452 with targets @ 1.4552 & 1.4660

Market Scenario 2: Short positions below 1.4452 with targets @ 1.4344 & 1.4244

Comment: Sterling came under selling pressure against US Dollar and was sent as low as 1.4350 the lowest level since 8thof June 2010. Today the pair is trading above Pivot Point level, however, overall movement is downwards.

Supports and Resistances:

R3 1.4760

R2 1.4660

R1 1.4552

PP 1.4452

S1 1.4344

S2 1.4244

S3 1.4136

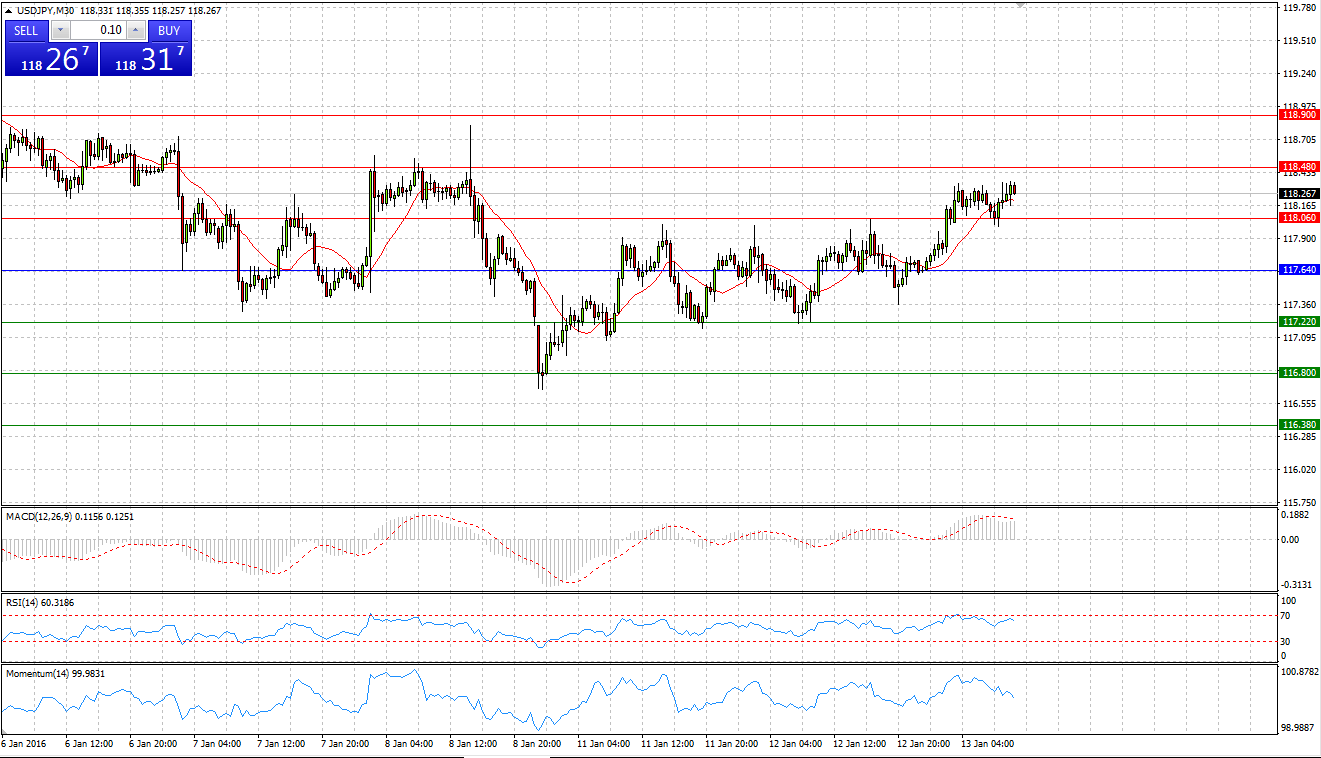

Market Scenario 1: Long positions above 117.64 with targets @ 118.06 & 118.48

Market Scenario 2: Short positions below 117.64 with targets @ 117.22 & 116.80

Comment: US Dollar since it’s reached its lowest level at 116.66 on Monday 10thof January, it found support returned all the losses incurred during previous 2 trading sessions and kept rising. Today the pair broke through the First Resistance level and moving toward the Second one.

Supports and Resistances:

R3 118.90

R2 118.48

R1 118.06

PP 117.64

S1 117.22

S2 116.80

S3 116.38

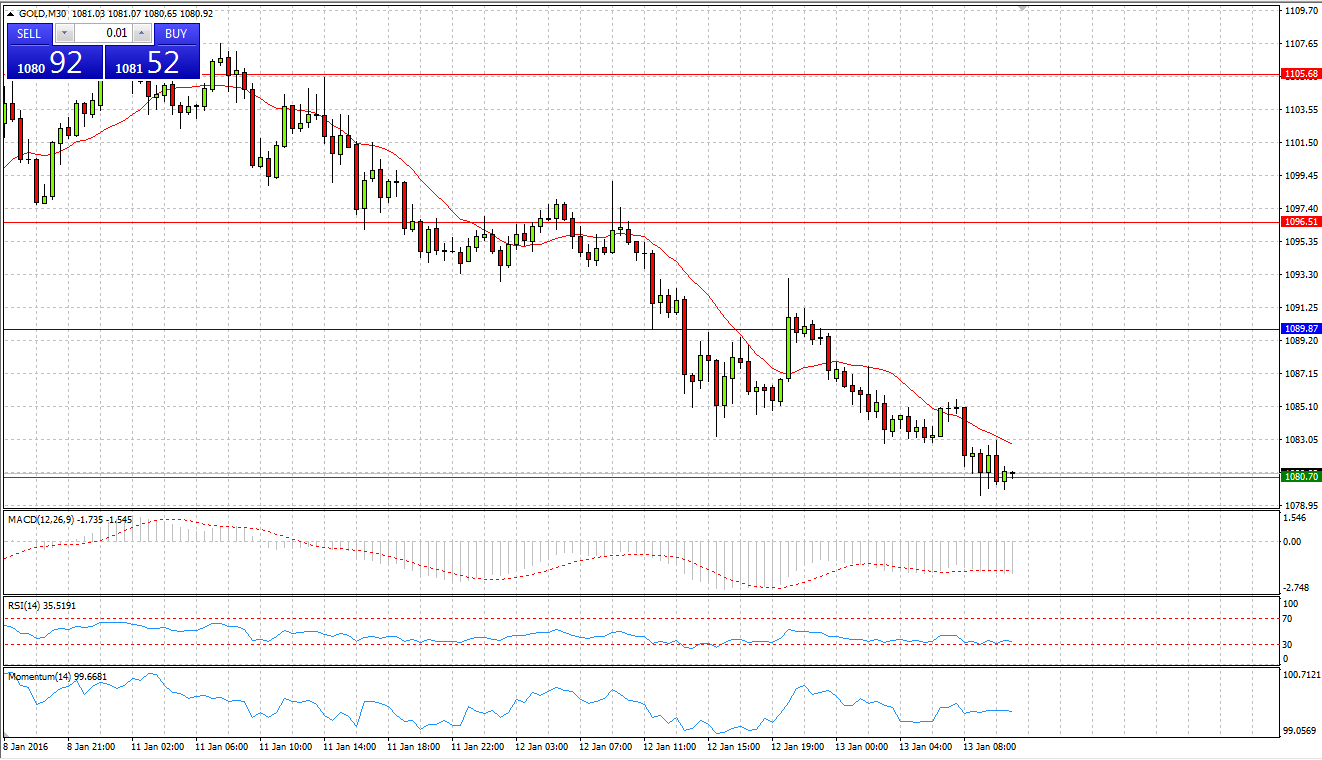

GOLD

Market Scenario 1: Long positions above 1089.87 with targets @ 1096.51 & 1105.68

Market Scenario 2: Short positions below 1089.87 with targets @ 1080.70 & 1074.06

Comment: Gold, since it came under selling pressure on Friday 8th of January has been falling against the US Dollar. During yesterday’s session gold dropped to 1087.33 and today it already tested the First Support level at 1080.70.

Supports and Resistances:

R3 1121.49

R2 1105.68

R1 1096.51

PP 1089.87

S1 1080.70

S2 1074.06

S3 1058.25

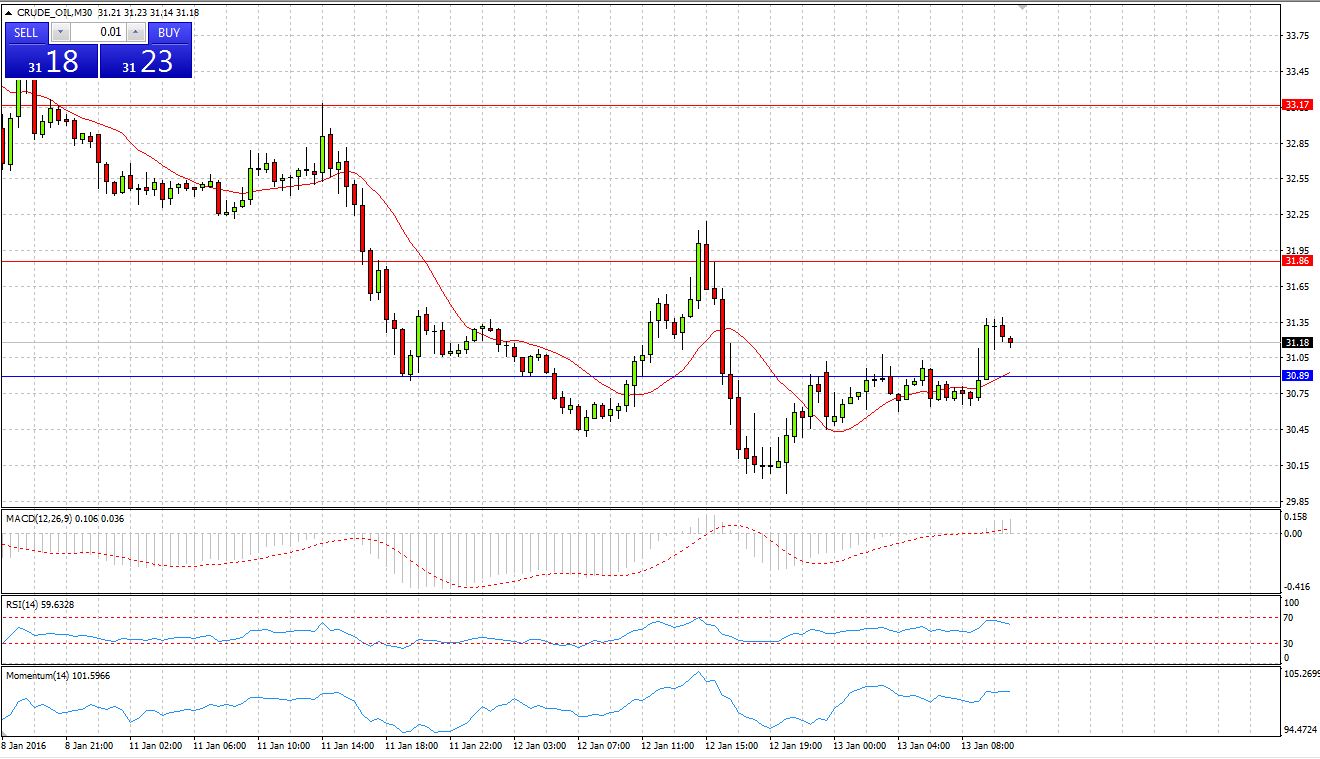

CRUDE OIL

Market Scenario 1: Long positions above 30.89 with targets @ 31.86 & 33.17

Market Scenario 2: Short positions below 30.89 with targets @ 30.89 & 28.61

Comment: Crude Oil during yesterday’s session dropped even lower, recording 7th day in the row of consecutive losses against US Dollar and reaching its lowest level at 29.91. Today Crude is trying to return some of the losses incurred during yesterday’s session and currently trading at 31.28

Supports and Resistances:

R3 35.45

R2 33.17

R1 31.86

PP 30.89

S1 29.58

S2 28.61

S3 26.33

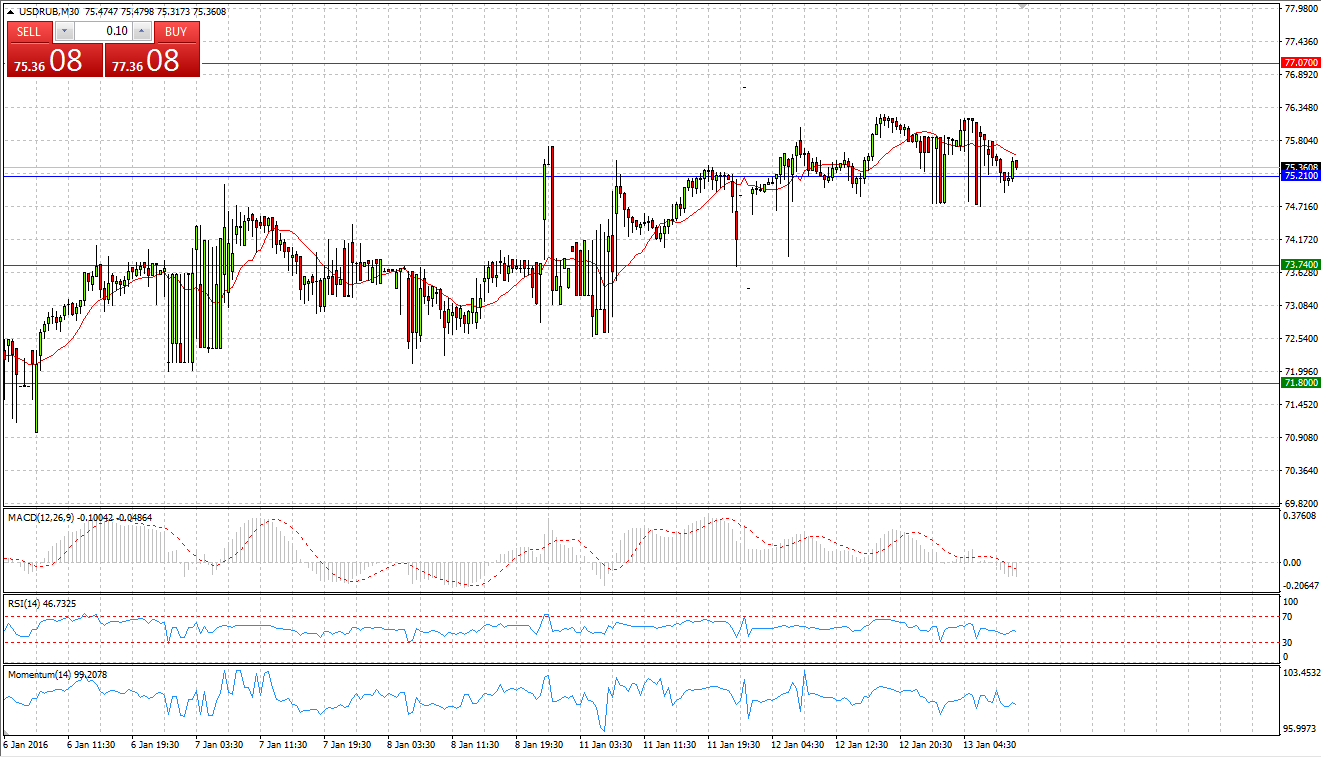

Market Scenario 1: Long positions above 75.21 with targets @ 77.07 & 78.54

Market Scenario 2: Short positions below 75.21 with targets @ 73.74 & 71.8

Comment: US Dollar continues appreciating against Russian rubble recording a new high at 76.68 amid depreciating prices of Crude Oil, which during yesterday’s session reached a record low, dropping below the psychologically important level of 30 US Dollars a barrel. Today the pair continues trading under pressure close to 76 Russian Rubles pre US Dollar

Supports and Resistances:

R3 81.87

R2 78.54

R1 77.07

PP 75.21

S1 73.74

S2 71.8

S3 68.55