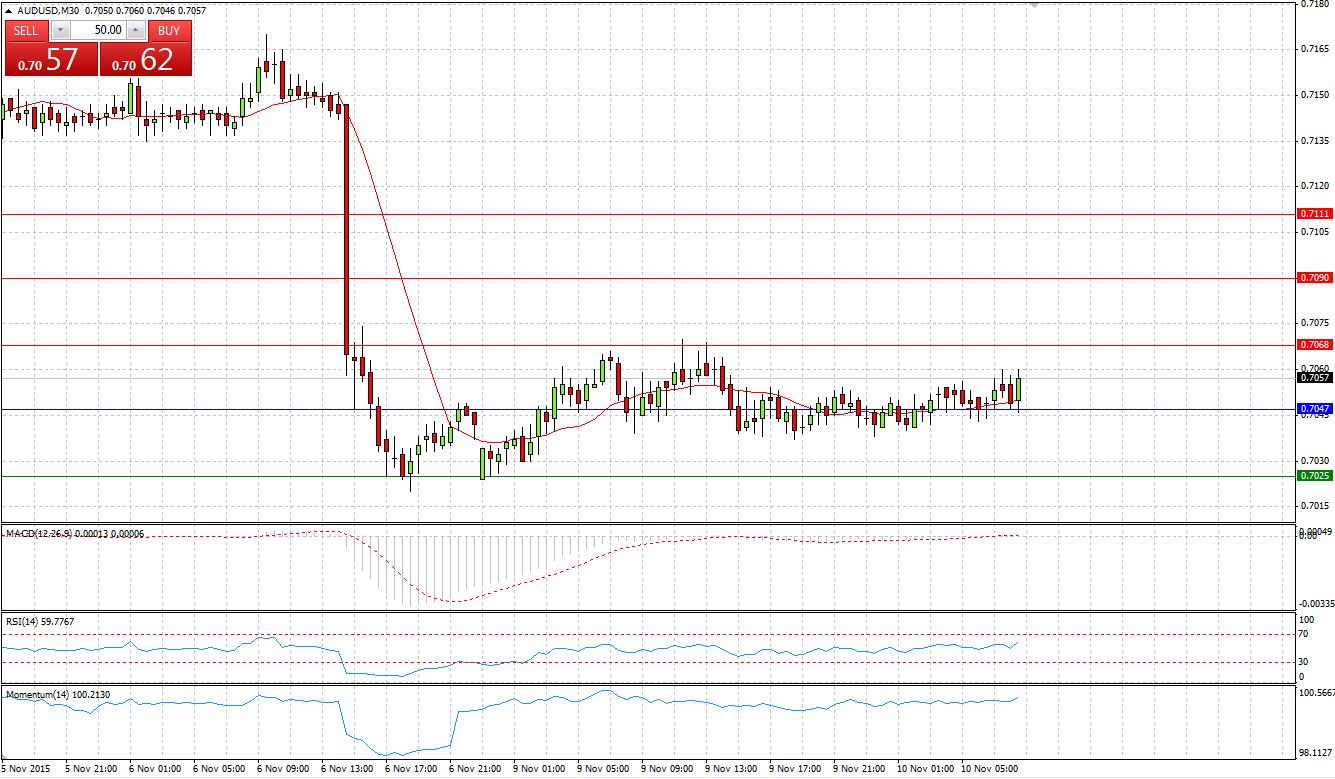

Market Scenario 1: Long positions above 0.7047 with targets @ 0.7068 & 0.7090

Market Scenario 2: Short positions below 0.7047 with targets @ 0.7025 & 0.7004

Comment: Aussie continues trading flat against US. Dollar. With a day lacking news, it is expected to continue trading in the range.

Supports and Resistances:

R3 0.7111

R2 0.7090

R1 0.7068

PP 0.7047

S1 0.7025

S2 0.7004

S3 0.6982

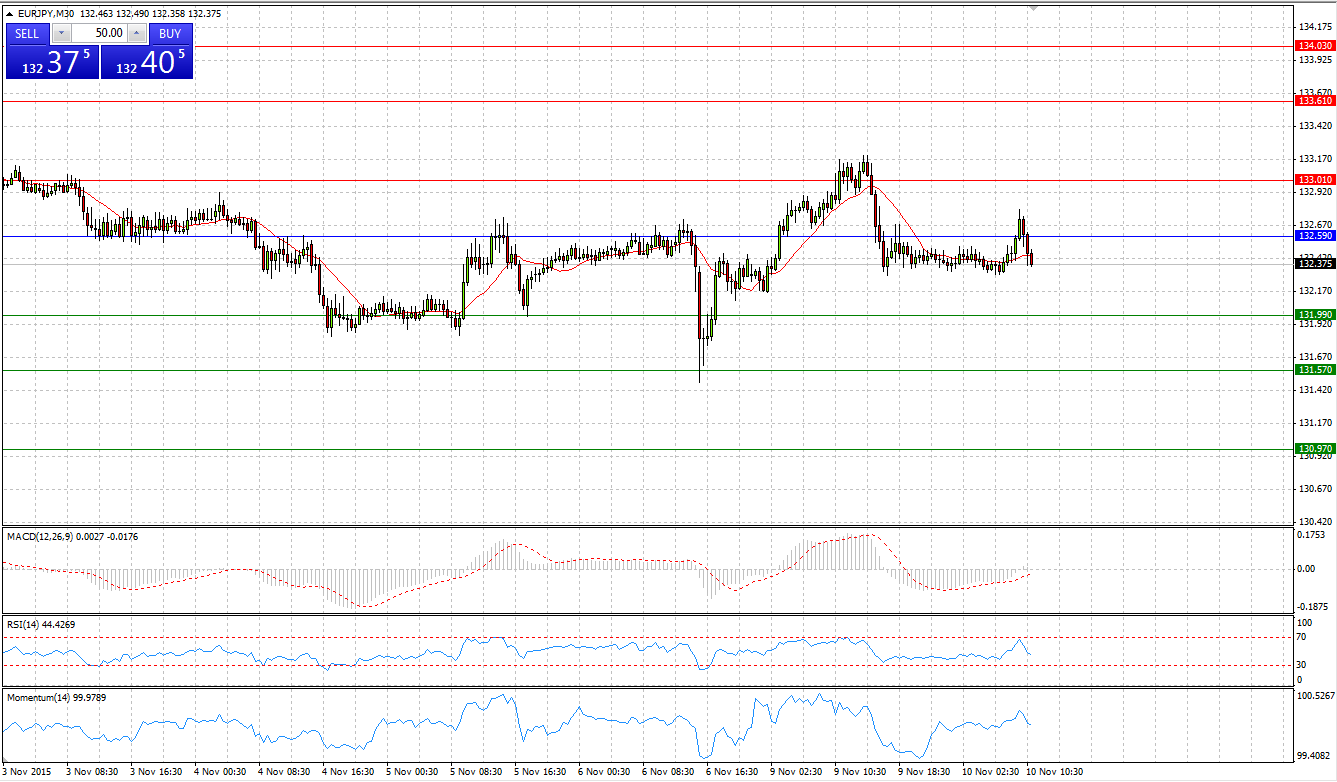

Market Scenario 1: Long positions above 132.59 with targets @ 133.01 & 133.61

Market Scenario 2: Short positions below 132.59 with targets @ 131.99 & 131.57

Comment: During yesterday’s session European currency undertook an attempt and almost broke through the First Resistance level at 133.01 against Japanese Yen, however encountering with selling pressure the pair was pushed back, closing the day virtually unchanged. At the time being the pair is trading below Pivot Point level.

Supports and Resistances:

R3 134.03

R2 133.61

R1 133.01

PP 132.59

S1 131.99

S2 131.57

S3 130.97

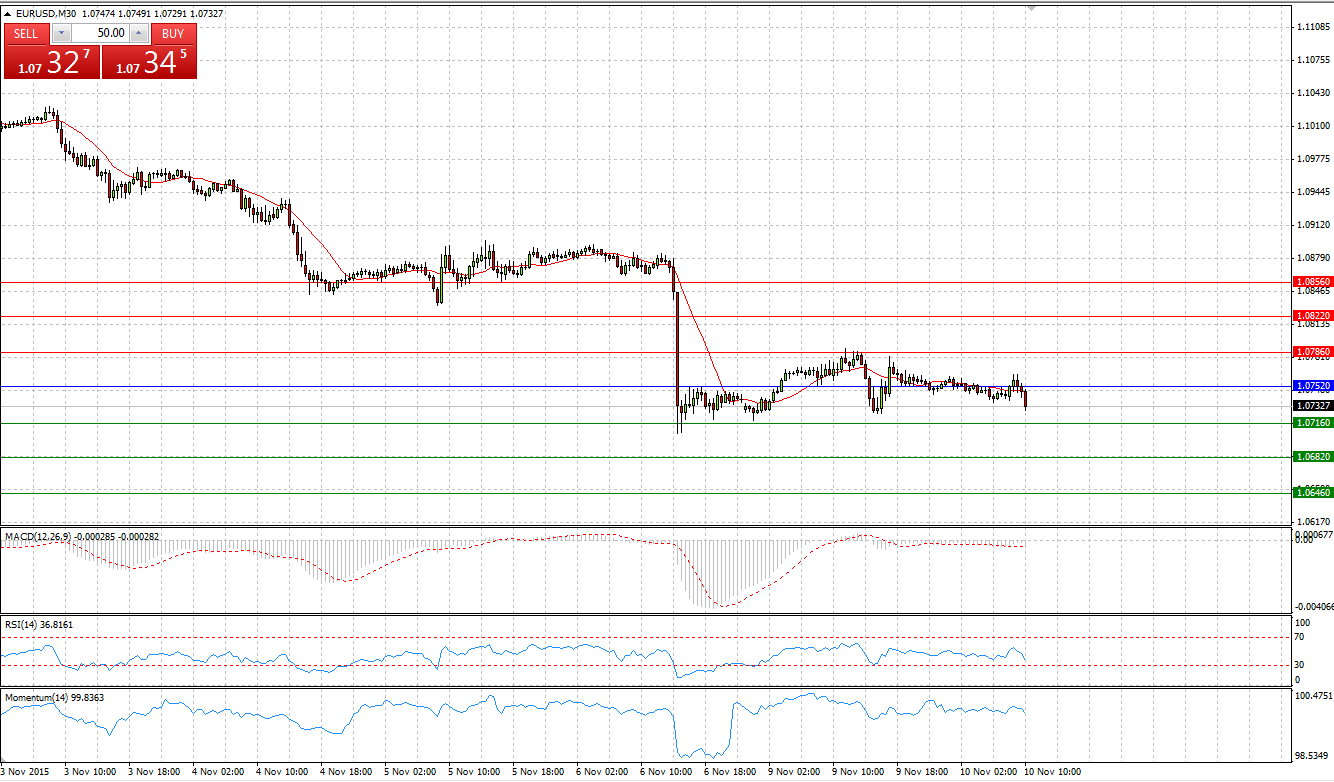

Market Scenario 1: Long positions above 1.0752 with targets @ 1.0786 & 1.0822

Market Scenario 2: Short positions below 1.0752 with targets @ 1.0716 & 1.0682

Comment: After heavy sell-off on Friday European currency traded flat against US dollar during Monday’s session. Today is expected that the currency pair will continue trading flat, as there are no major news scheduled for today.

Supports and Resistances:

R3 1.0856

R2 1.0822

R1 1.0786

PP 1.0752

S1 1.0716

S2 1.0682

S3 1.0646

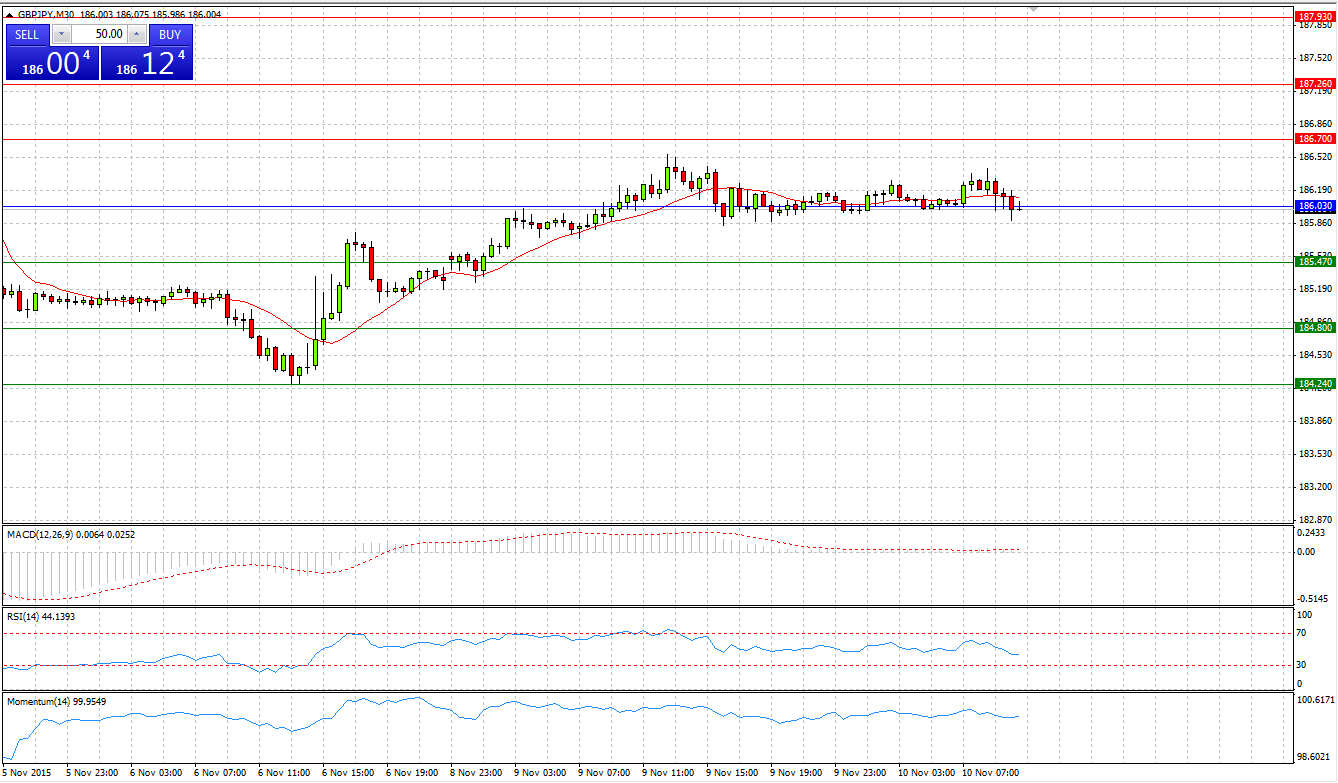

Market Scenario 1: Long positions above 185.09 with targets @ 186.00 & 186.72

Market Scenario 2: Short positions below 185.09 with targets @ 184.37 & 183.46

Comment: Gradually Sterling returning its losses incurred during Thursday’s session against Japanese Yen closing the second session in the positive territory. Currently the pair found support slightly below Pivot Point level near the threshold of 186 Yen per GBP.

Supports and Resistances:

R3 187.93

R2 187.26

R1 186.70

PP 186.03

S1 185.47

S2 184.80

S3 184.24

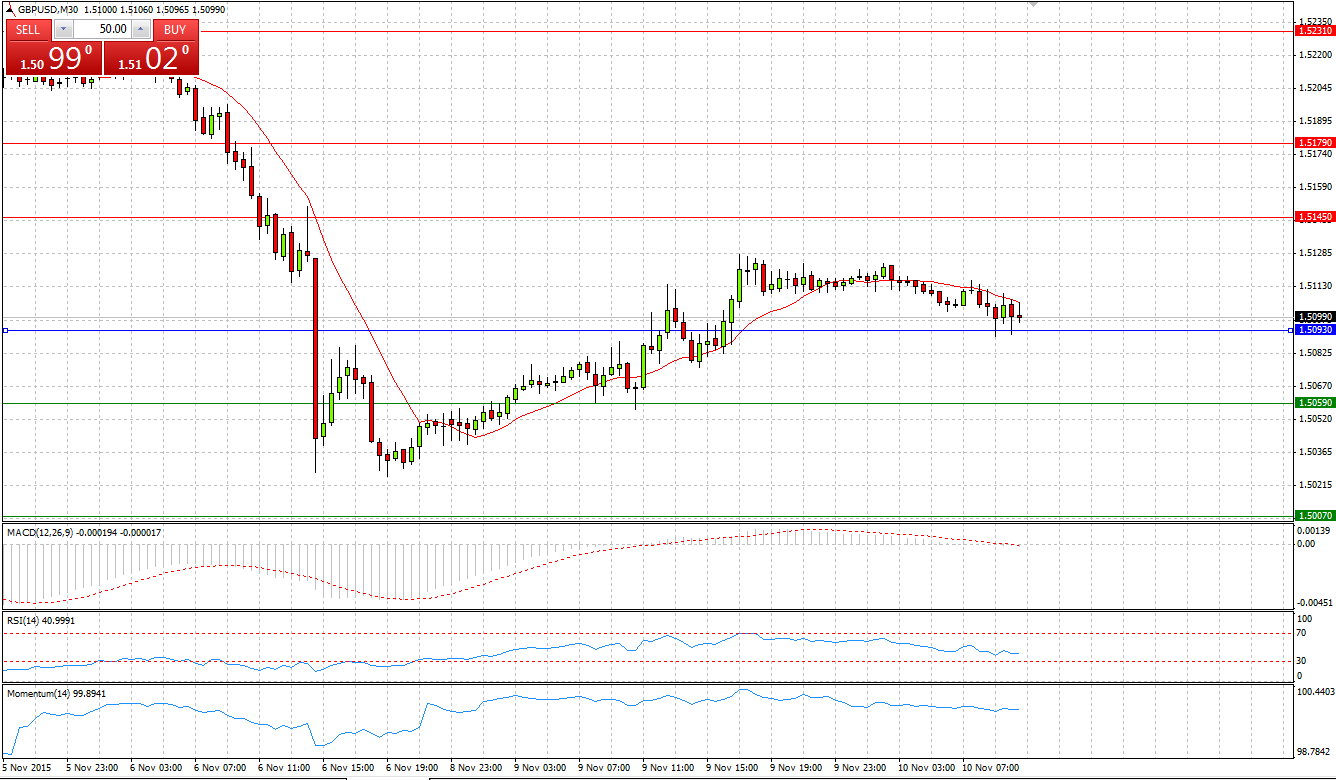

Market Scenario 1: Long positions above 1.5093 with targets @ 1.5145 & 1.5179

Market Scenario 2: Short positions below 1.5093 with targets @ 1.5059 & 1.5007

Comment: During yesterday’s session Sterling managed to take back some of its losses against US Dollar incurred on Friday’s session, however, it’s too early to say that bulls regained the control back. The pair is still remains under pressure even though trading above Pivot Point level.

Supports and Resistances:

R3 1.5231

R2 1.5179

R1 1.5145

PP 1.5093

S1 1.5059

S2 1.5007

S3 1.4973

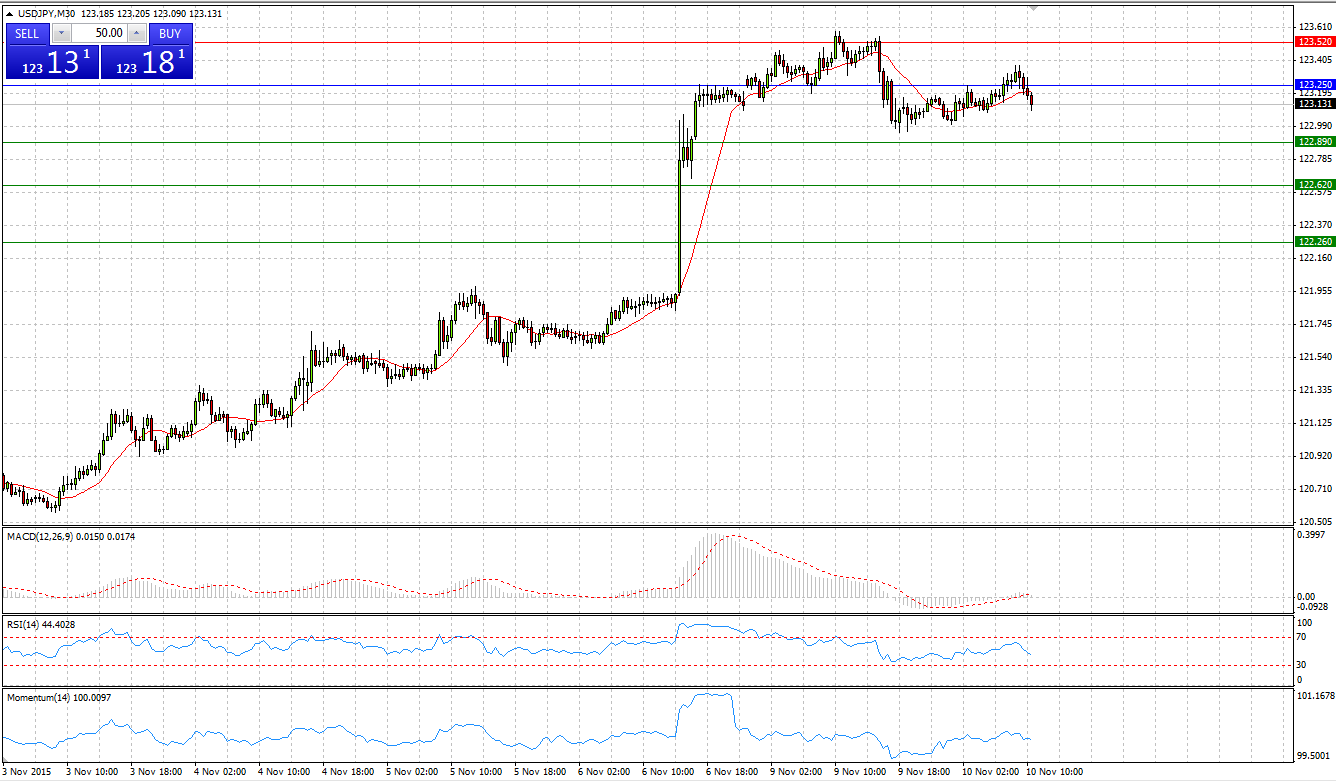

Market Scenario 1: Long positions above 123.25 with targets @ 123.52 & 123.88

Market Scenario 2: Short positions below 123.25 with targets @ 122.89 & 122.62

Comment: Having reached a new high at 123.58 the pair came under selling pressure and closed the day in negative territory. Currently the pair is trading slightly below Pivot Point Level. Nonetheless, another attempts to test the First Resistance level can be undertaken by bulls.

Supports and Resistances:

R3 124.15

R2 123.88

R1 123.52

PP 123.25

S1 122.89

S2 122.62

S3 122.26

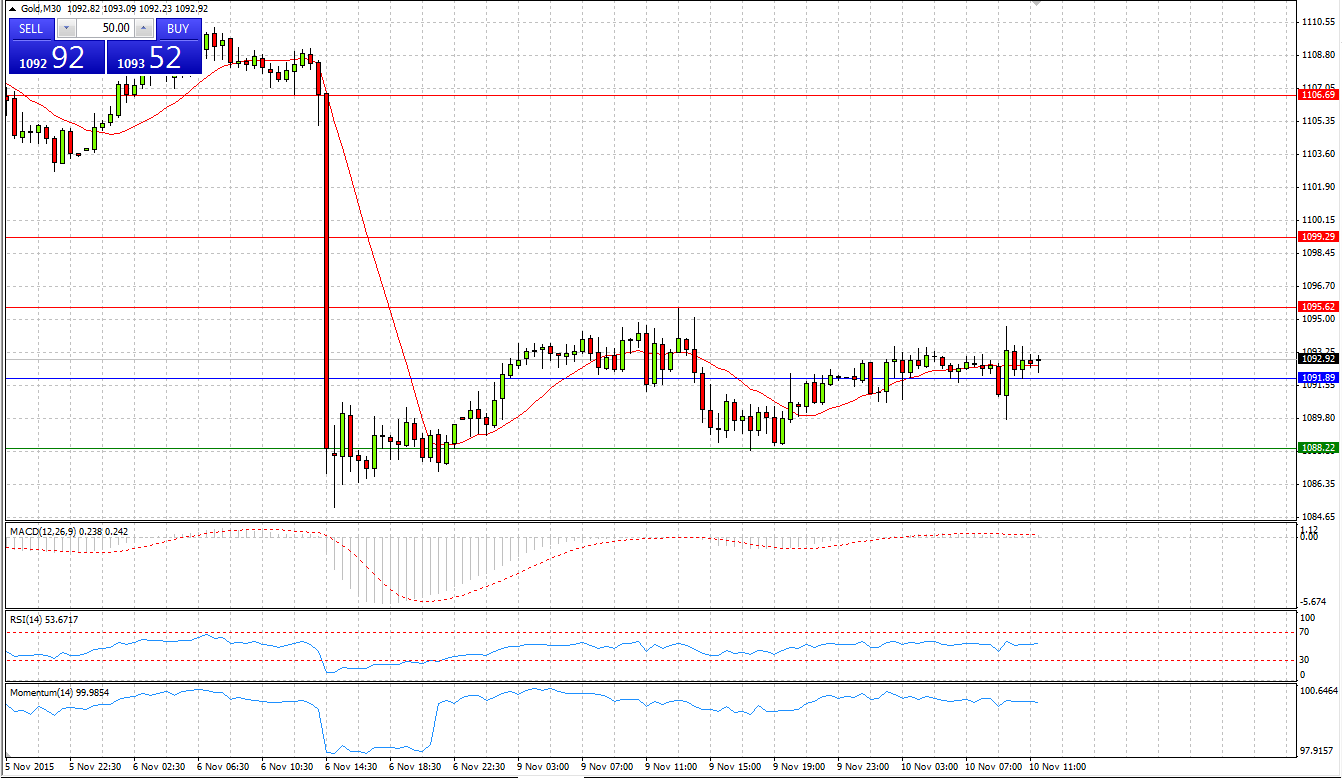

Market Scenario 1: Long positions above 1094.98 with targets @ 1104.81 & 1120.11

Market Scenario 2: Short positions below 1094.98 with targets @ 1079.68 & 1069.85

Comment: After extended period of losses Gold managed on Yesterday’s session to close the day in the positive territory. Nonetheless, it would be recklessly to assume that Gold market bottomed as further depreciation might take place amid possibility of rate hike by Fed Reserve in December.

Supports and Resistances:

R3 1106.69

R2 1099.29

R1 1095.62

PP 1091.89

S1 1088.22

S2 1084.49

S3 1077.09

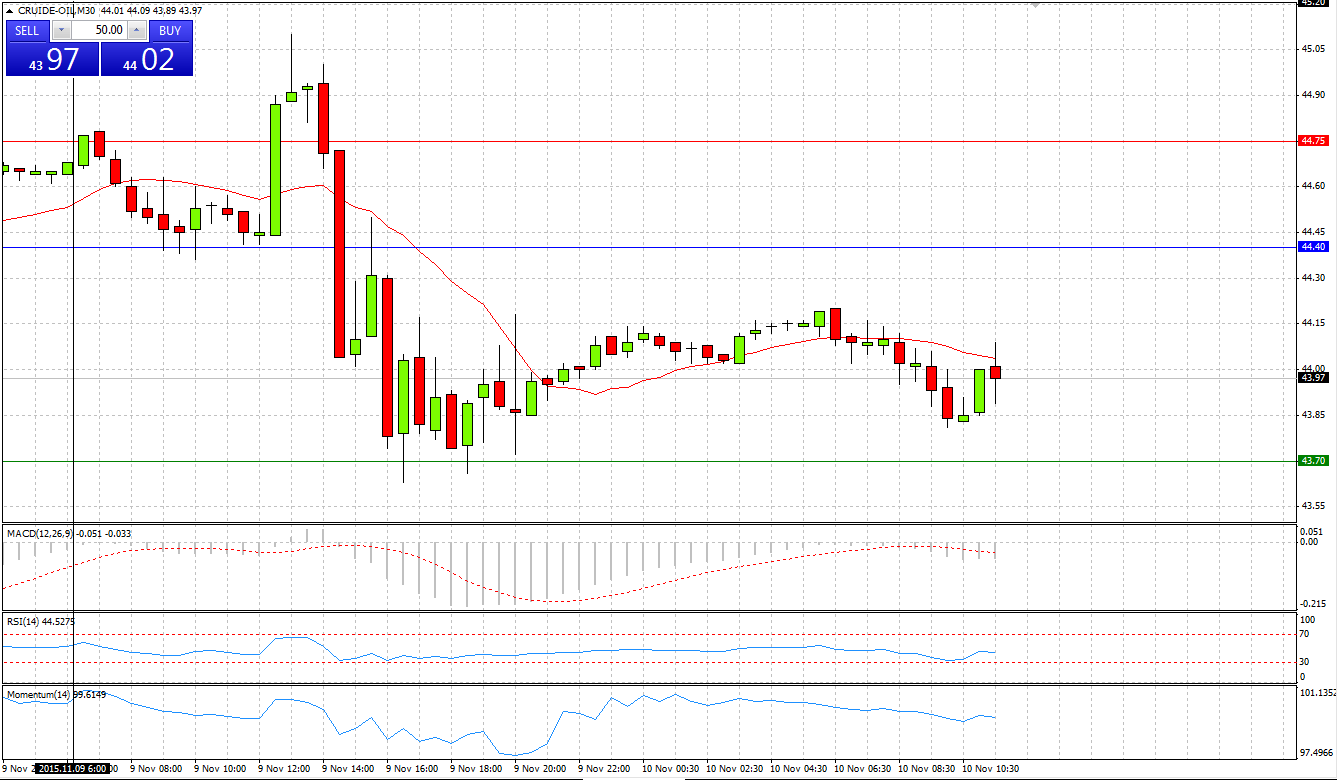

Market Scenario 1: Long positions above 44.40 with targets @ 44.75 & 45.45

Market Scenario 2: Short positions below 44.40 with targets @ 43.70 & 43.35

Comment: Crude recorded 4th day in the row of consecutive losses against US Dollar, closing the day at 44.05. Today Crude continues depreciating trading below 44 USD per ounce.

Supports and Resistances:

R3 46.50

R2 45.45

R1 44.75

PP 44.40

S1 43.70

S2 43.35

S3 42.30

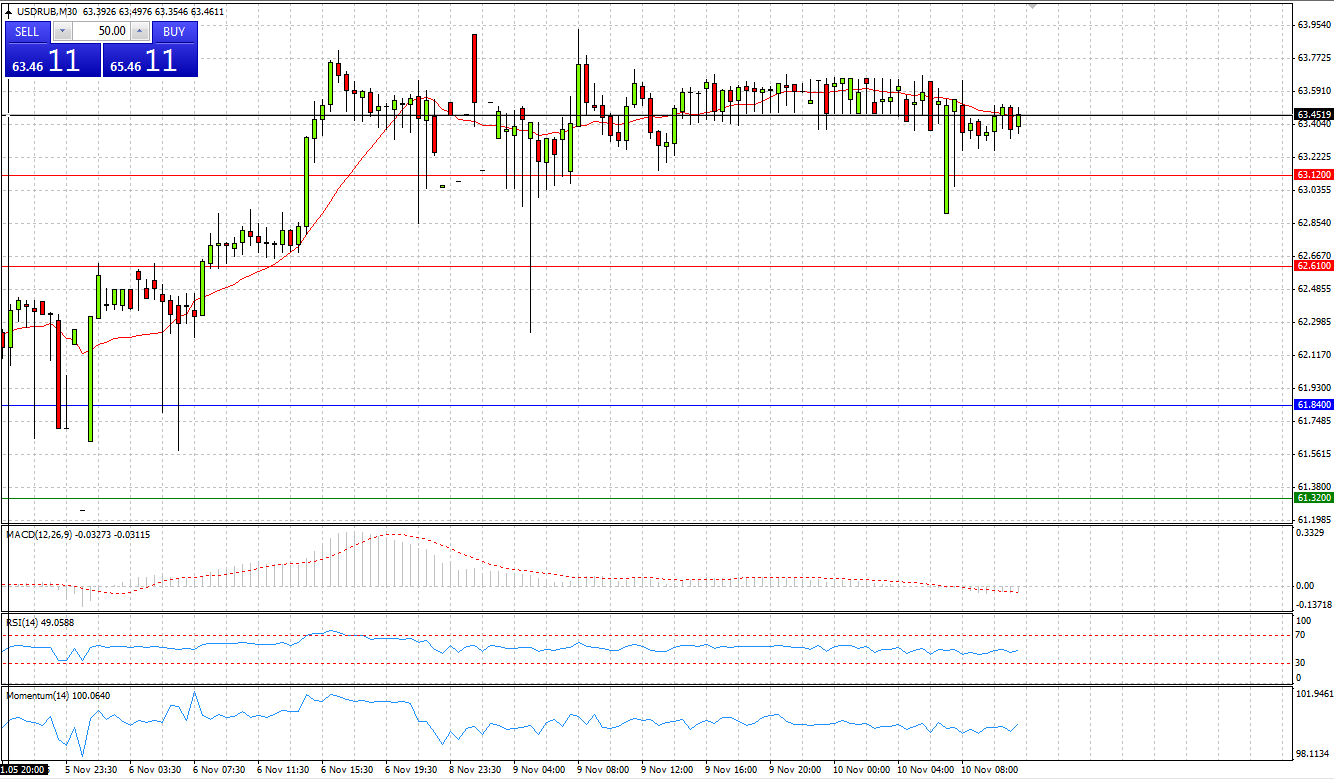

Market Scenario 1: Long positions above 63.21 with targets @ 64.18 & 64.90

Market Scenario 2: Short positions below 63.21 with targets @ 62.49 & 61.52

Comment: The pair is trading close to its highs. Disappointing news from crude and positive economic data out of US inspire bulls to undertake attempts to test new highs.

Supports and Resistances:

R3 66.59

R2 64.90

R1 64.18

PP 63.21

S1 62.49

S2 61.52

S3 59.83