*All the charts are 30M charts with daily pivot points.

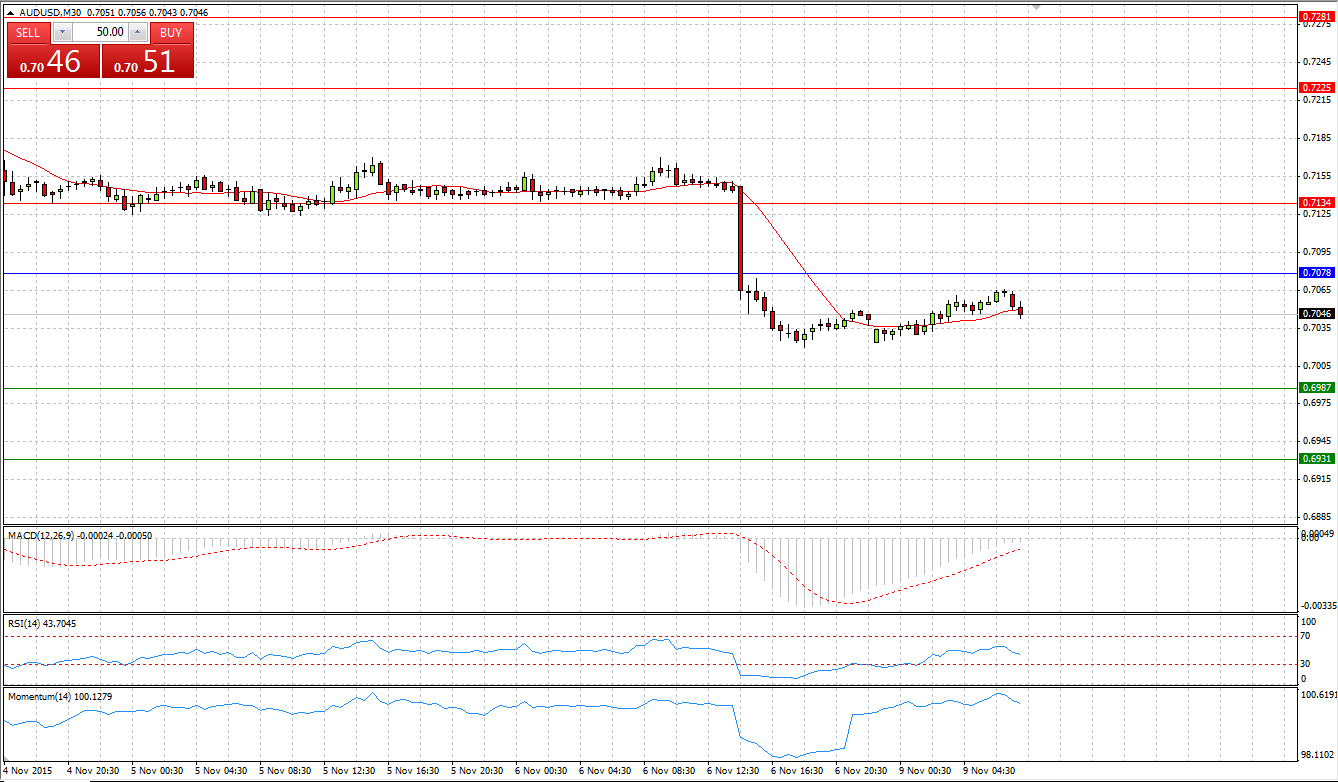

Market Scenario 1: Long positions above 0.7078 with targets at 0.7134 and 0.7225

Market Scenario 2: Short positions below 0.7078 with targets at 0.6987 and 0.6931

Comment: Aussie during Friday’s session lost more than 100 pips against US dollar, closing the day below Pivot Point level at 0.7042. Currently, AUD/USD is trading flat.

Supports and Resistances:

R3 0.7281

R2 0.7225

R1 0.7134

PP 0.7078

S1 0.6987

S2 0.6931

S3 0.6840

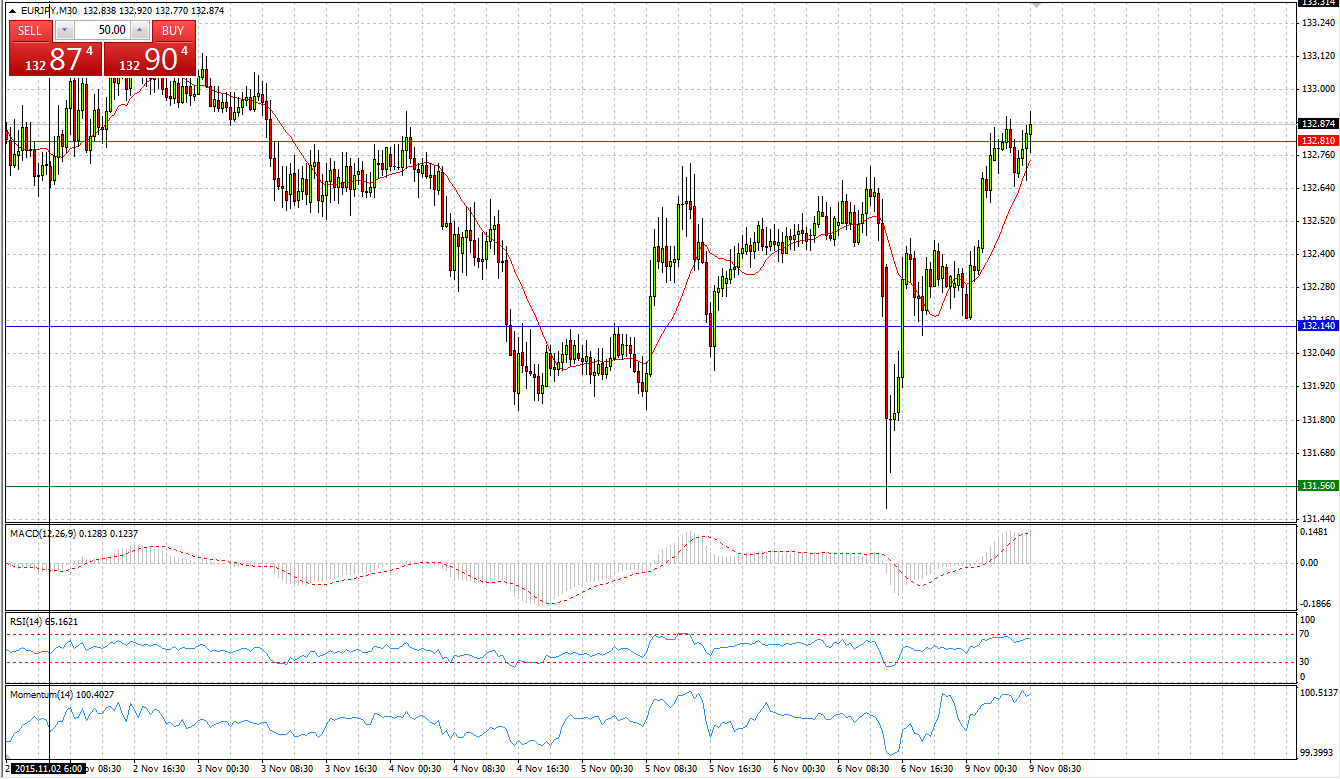

EUR/JPY

Market Scenario 1: Long positions above 132.14 with targets at 132.81 and 133.39

Market Scenario 2: Short positions below 132.14 with targets at 131.56 and 130.89

Comment: During Friday’s session, European currency was sent to its lowest level at 131.48 since 30th of April 2015 against Japanese yen; however, thanks to the support at 131.50, the pair managed to climb almost to its opening price of the session. During early Asian session, EUR/JPY bounced up from PP and it currently is testing the First Resistance level.

Supports and Resistances:

R3 134.06

R2 133.39

R1 132.81

PP 132.14

S1 131.56

S2 130.89

S3 130.31

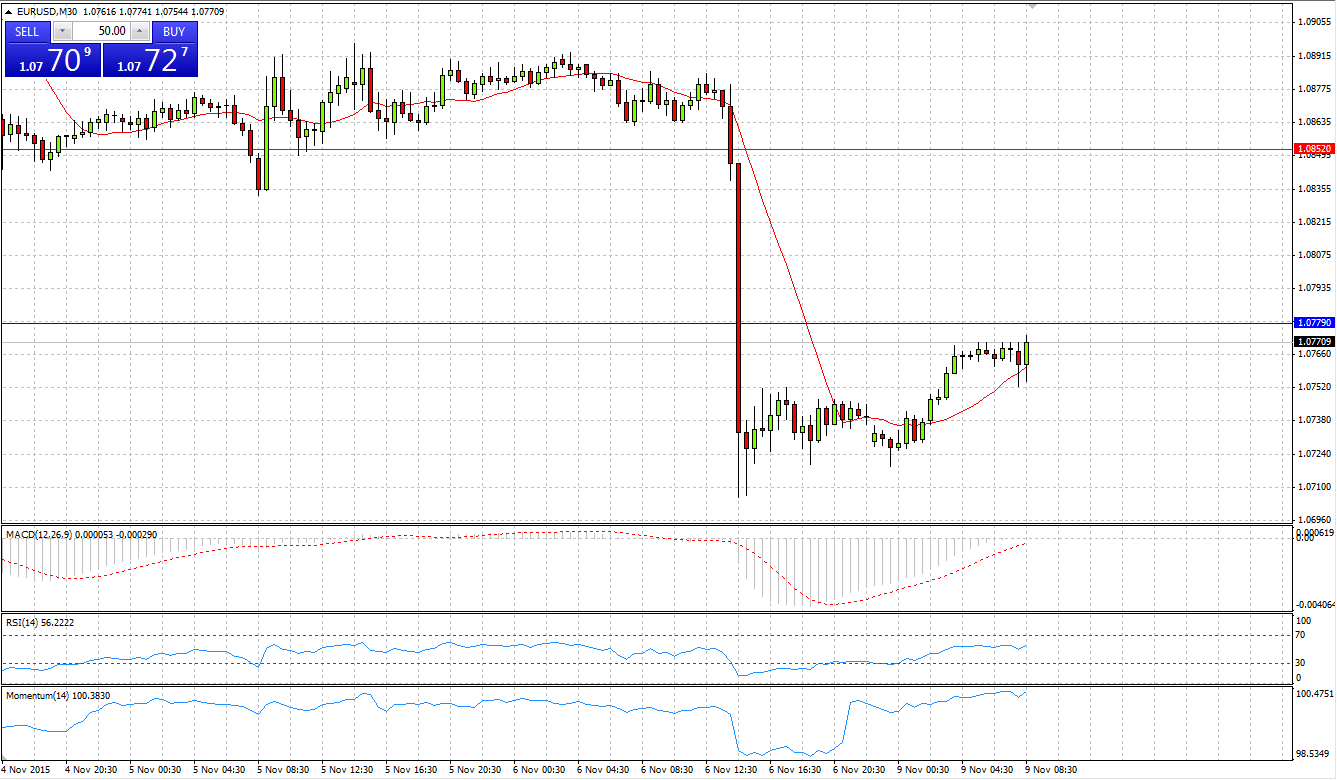

EUR/USD

Market Scenario 1: Long positions above 1.0779 with targets at 1.0852 and 1.0967

Market Scenario 2: Short positions below 1.0779 with targets at 1.0664 and 1.0591

Comment: After better than expected figures of US Non-Farm Payrolls, EUR/USD came under selling pressure and lost within half an hour more than 100 pips. During early Asian session, European currency managed to regain some of its losses incurred on Friday; however, the pair remains trading under selling pressure, below Pivot Point Level.

Supports and Resistances:

R3 1.1040

R2 1.0967

R1 1.0852

PP 1.0779

S1 1.0664

S2 1.0591

S3 1.0476

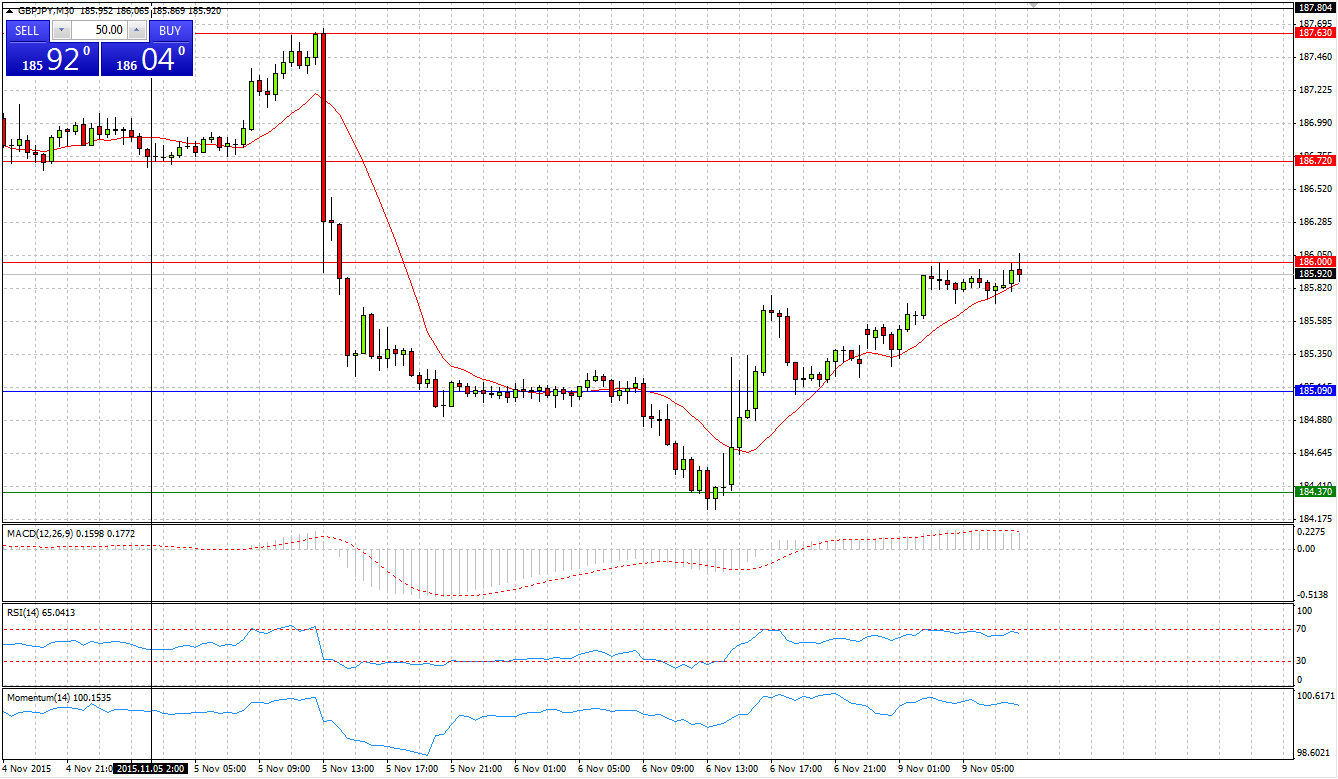

GBP/JPY

Market Scenario 1: Long positions above 185.09 with targets at 186.00 and 186.72

Market Scenario 2: Short positions below 185.09 with targets at 184.37 and 183.46

Comment: On Friday, sterling came under selling pressure against Japanese yen during early European session; however, by the end of the day, it managed to recover all of the losses and closed the day in the positive territory. Today, GBP/JPY is trading firm, trying to break through the First Resistance level.

Supports and Resistances:

R3 187.63

R2 186.72

R1 186.00

PP 185.09

S1 184.37

S2 183.46

S3 182.74

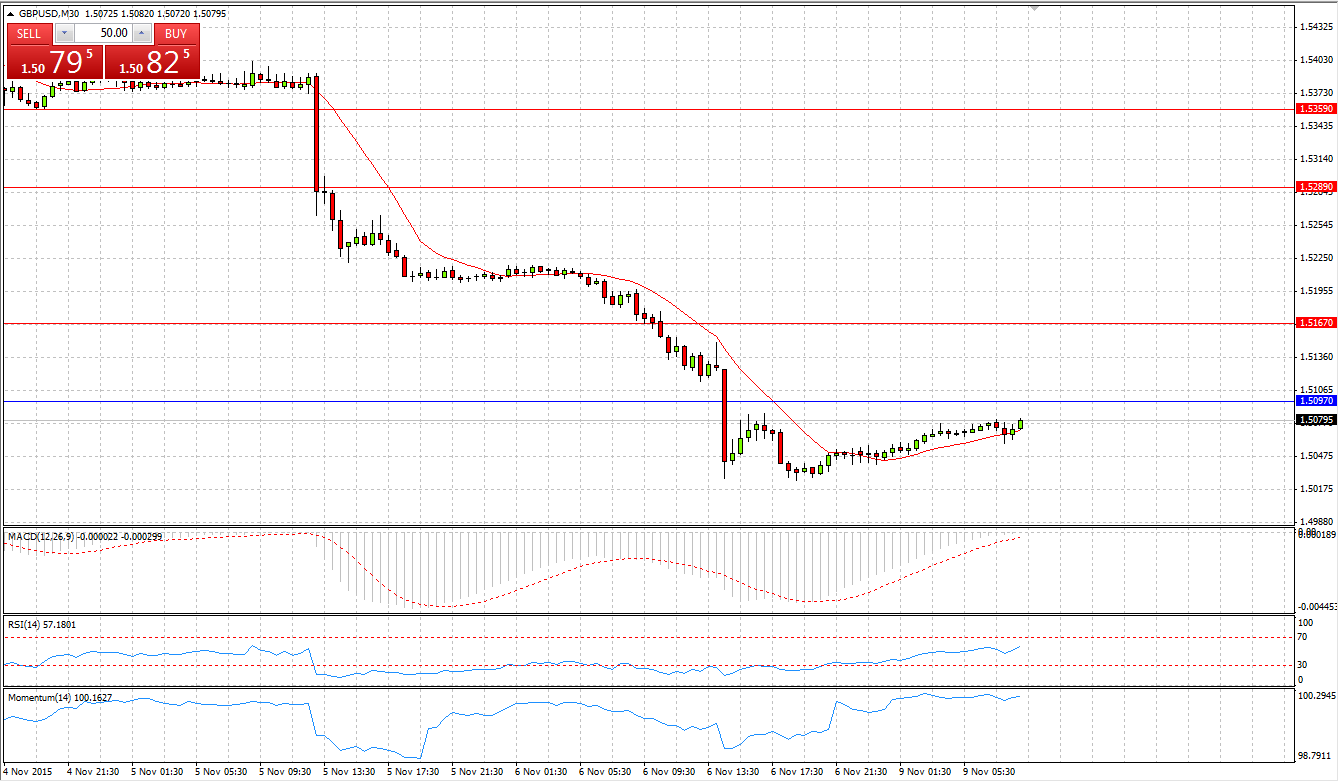

GBP/USD

Market Scenario 1: Long positions above 1.5097 with targets at 1.5167 and 1.5289

Market Scenario 2: Short positions below 1.5097 with targets at 1.4975 and 1.4905

Comment: During Thursday’s and Friday’s sessions, sterling recorded its biggest two-day losses in the row against US dollar, dropping to its lowest level at 1.5022 since 23rd of April. GBP/USD is currently trading below Pivot Point level.

Supports and Resistances:

R3 1.5359

R2 1.5289

R1 1.5167

PP 1.5097

S1 1.4975

S2 1.4905

S3 1.4783

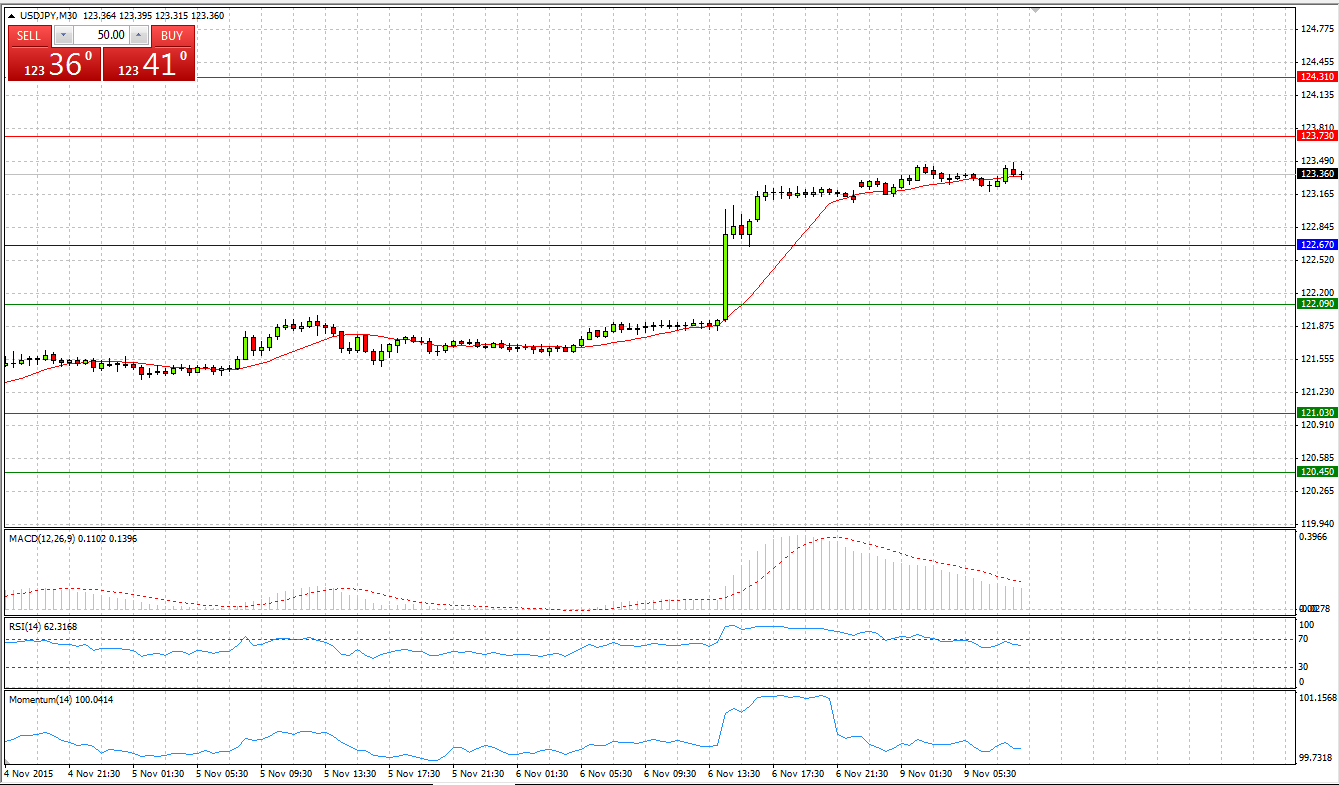

USD/JPY

Market Scenario 1: Long positions above 122.67 with targets at 123.73 and 124.31

Market Scenario 2: Short positions below 122.67 with targets at 122.09 and 121.03

Comment: US dollar supported by positive news of Non-Farm Payrolls reached a new high during Friday’s session against Japanese yen at 123.25. Today USD/JPY is trading in a range well above Pivot Point level.

Supports and Resistances:

R3 125.37

R2 124.31

R1 123.73

PP 122.67

S1 122.09

S2 121.03

S3 120.45

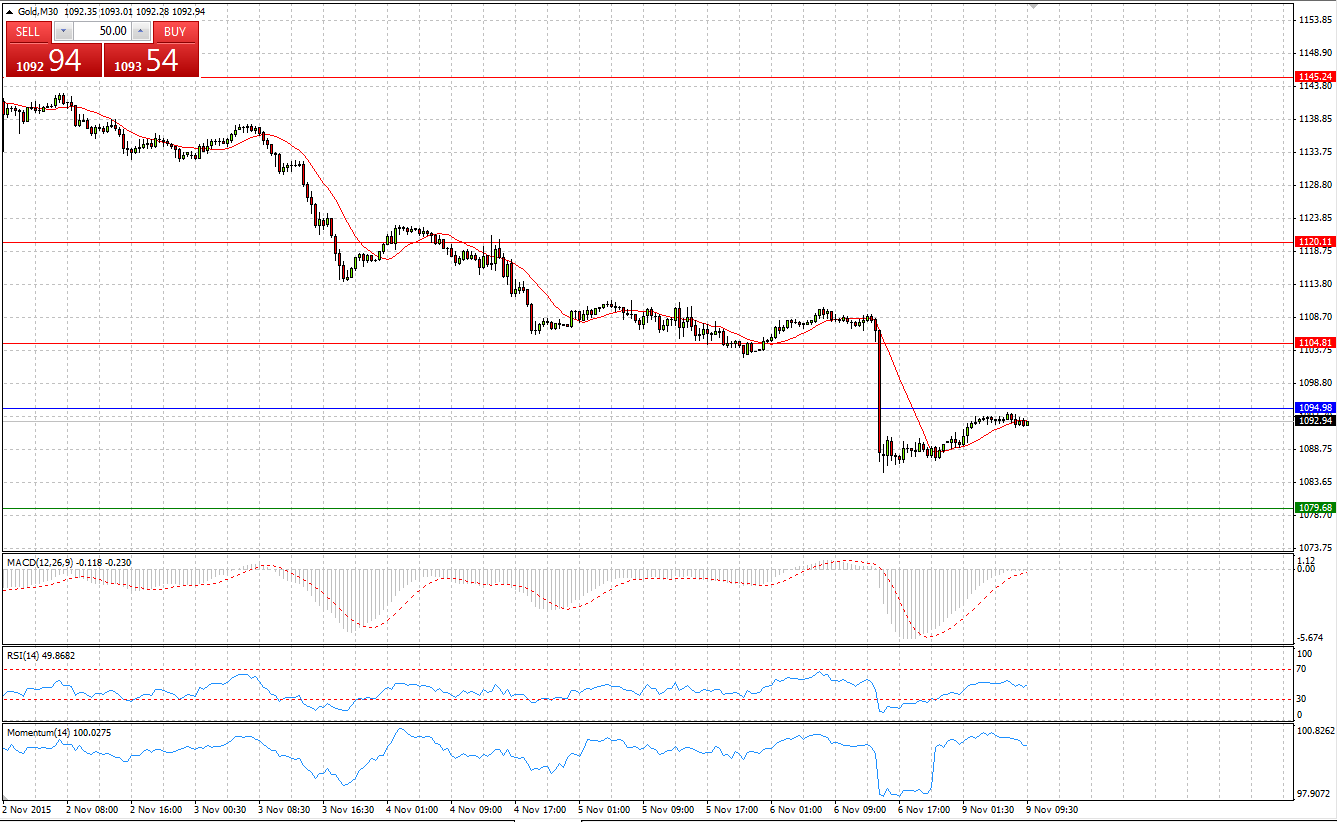

GOLD

Market Scenario 1: Long positions above 1094.98 with targets at 1104.81 and 1120.11

Market Scenario 2: Short positions below 1094.98 with targets at 1079.68 and 1069.85

Comment: Gold recorded 8th day of consecutive losses against US dollar, depreciating during this period for 77 US dollar per ounce. Gold is trading 15 USD away from its lowest level reached on 20th of July 2015.

Supports and Resistances:

R3 1145.24

R2 1120.11

R1 1104.81

PP 1094.98

S1 1079.68

S2 1069.85

S3 1044.72

CRUDE OIL

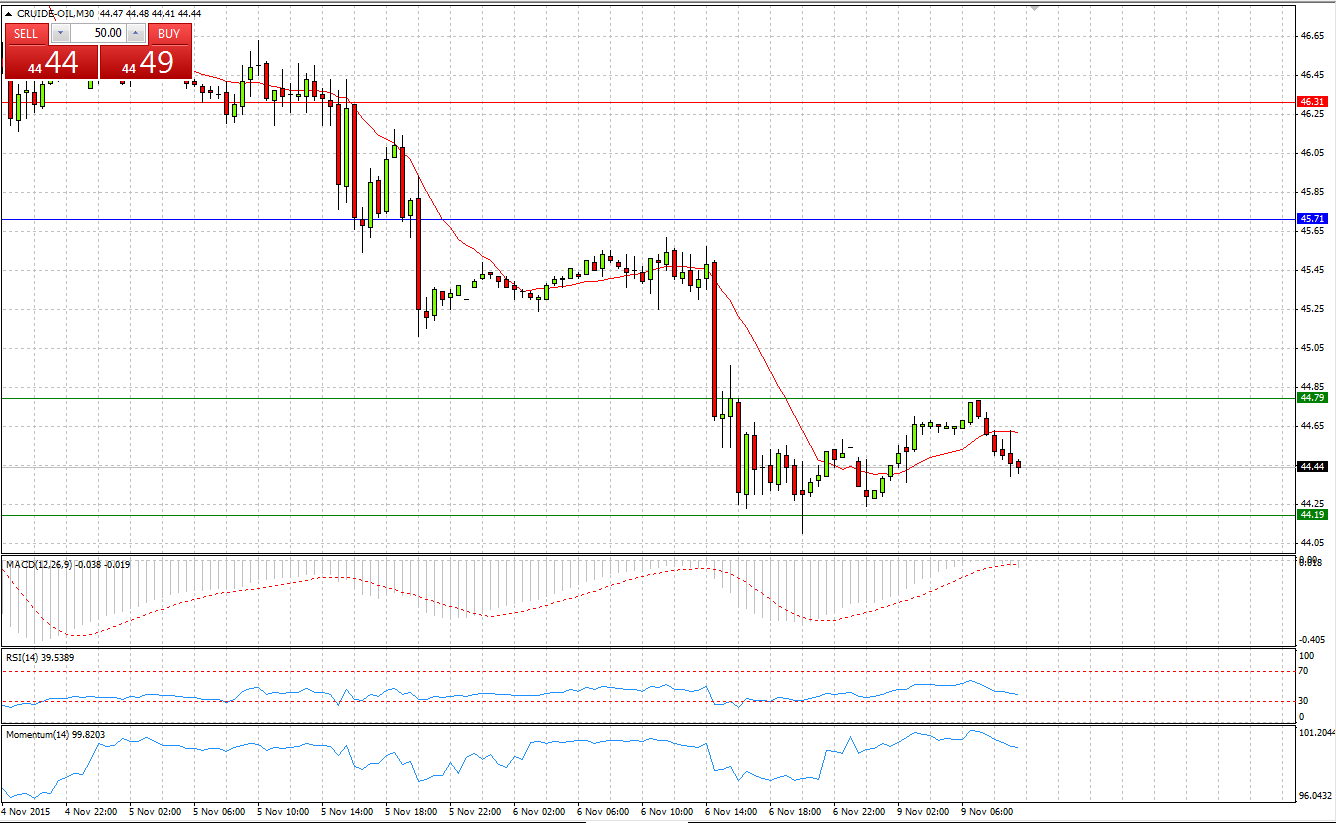

Market Scenario 1: Long positions above 44.79 with targets at 45.71 and 46.31

Market Scenario 2: Short positions below 44.79 with targets at 44.19 and 42.67

Comment: Crude during Friday’s session dropped below the psychologically important level of 45 US Dollar per Barrel amid positive news from US. At the time being, crude is below First Support level, which currently acts as a Resistance level.

Supports and Resistances:

R3 48.75

R2 47.23

R1 46.31

PP 45.71

S1 44.79

S2 44.19

S3 42.67

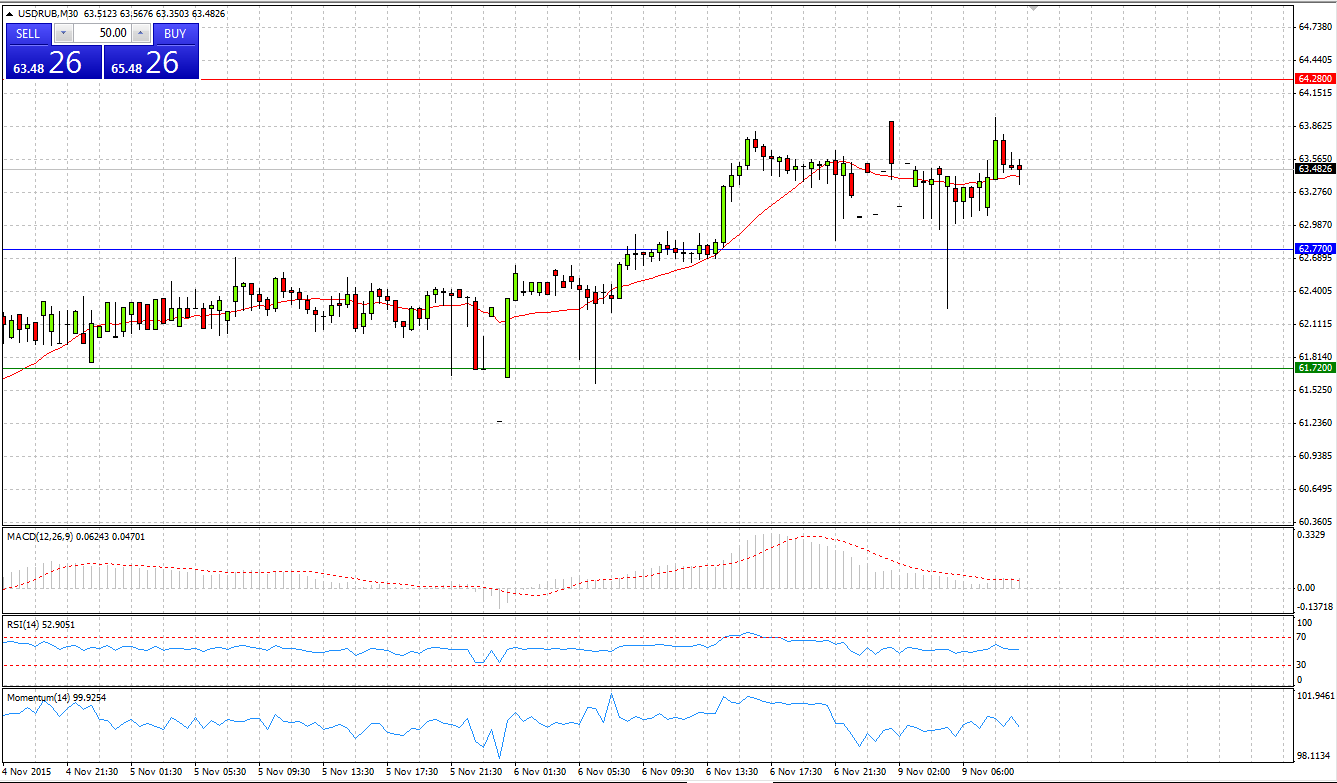

USD/RUB

Market Scenario 1: Long positions above 62.77 with targets at 64.28 and 65.33

Market Scenario 2: Short positions below 62.77 with targets at 61.72 and 60.21

Comment: US dollar continues appreciating against Russian ruble amid positive economic data and depreciating prices of crude oil. Today USD/RUB recorded a new high at 63.93

Supports and Resistances:

R3 67.89

R2 65.33

R1 64.28

PP 62.77

S1 61.72

S2 60.21

S3 57.65