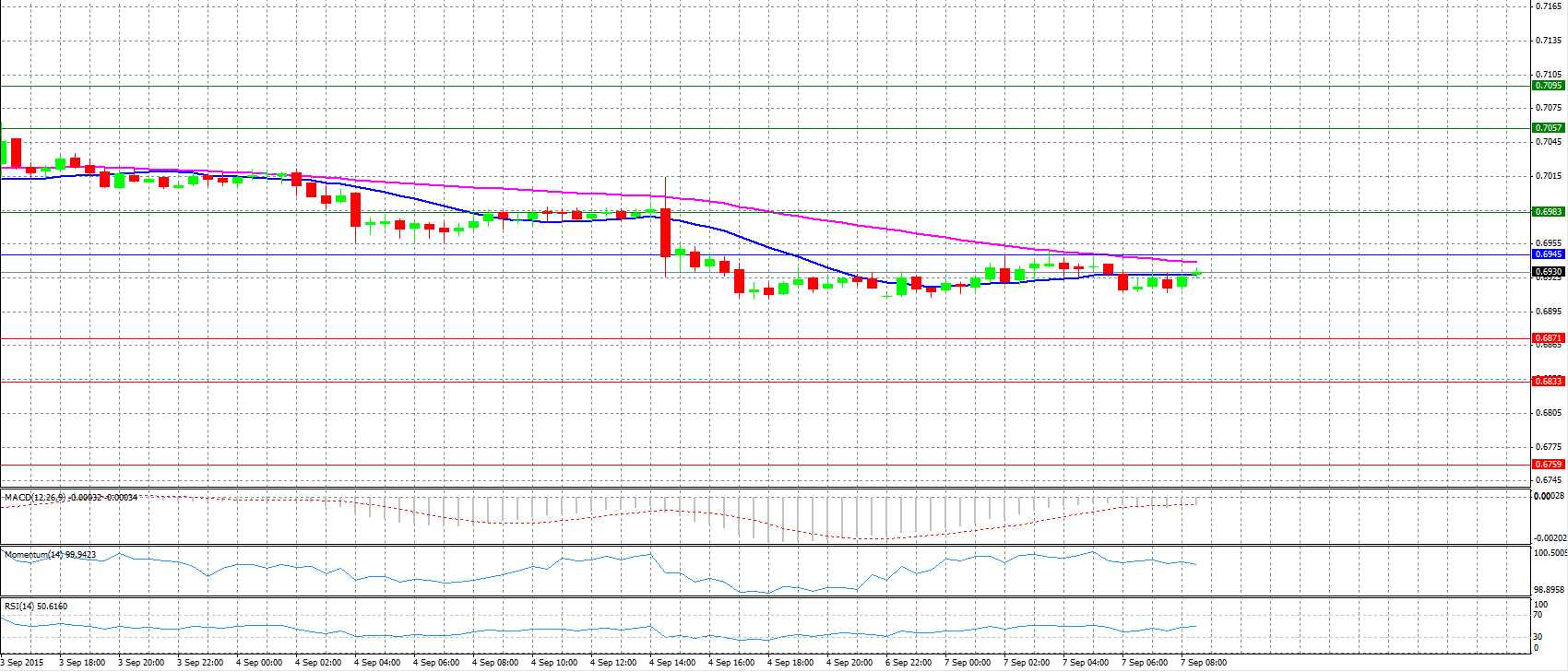

Market Scenario 1: Long positions above 0.6945 with targets at 0.6983 and 0.7057.

Market Scenario 2: Short positions below 0.6945 with targets at 0.6871 and 0.6833.

Comment: The pair strengthened after the release of Australian data for job advertisements.

Supports and Resistances:

R3 0.7095

R2 0.7057

R1 0.6983

PP 0.6945

S1 0.6871

S2 0.6833

S3 0.6759

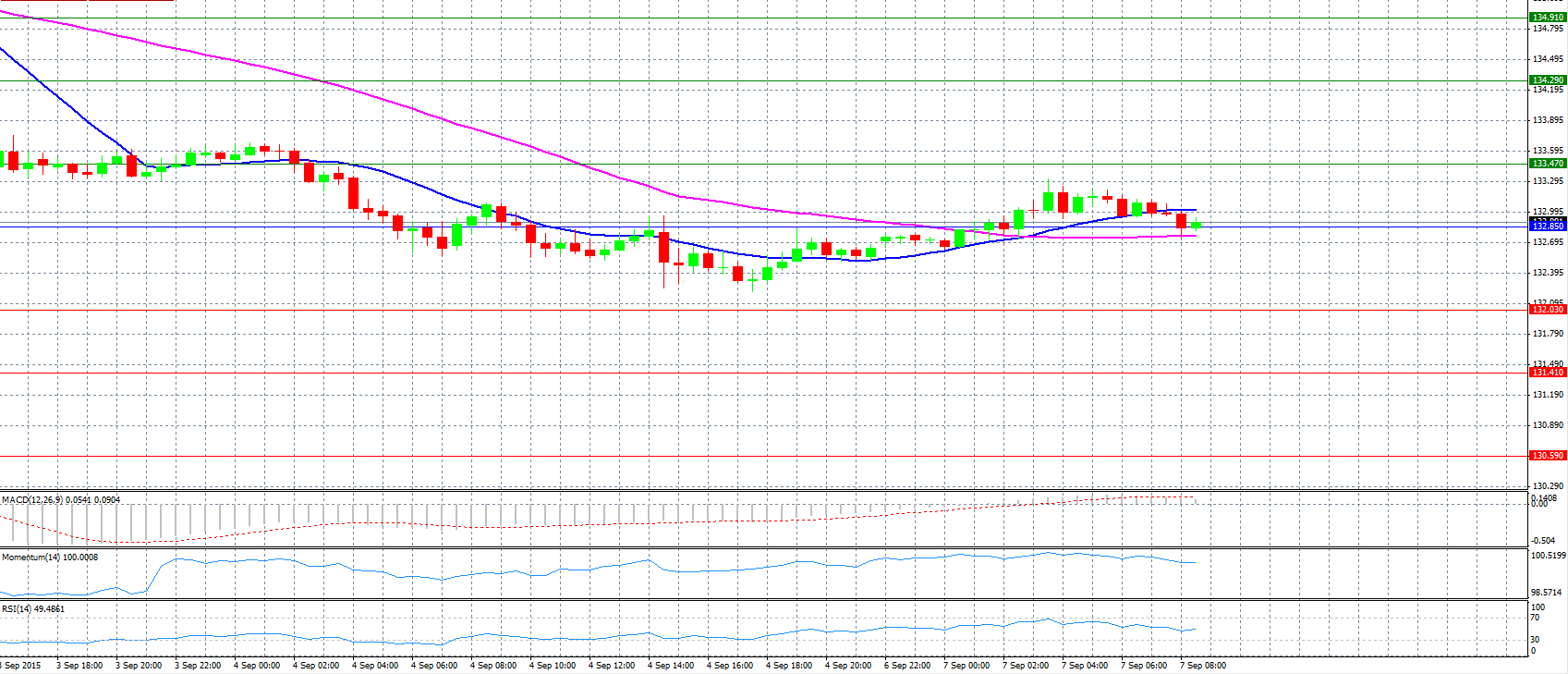

Market Scenario 1: Long positions above 132.85 with targets at 133.47 and 134.29.

Market Scenario 2: Short positions below 132.85 with targets at 132.03 and 131.41.

Comment: The pair dropped and found support at pivot point 132.85.

Supports and Resistances:

R3 134.91

R2 134.29

R1 133.47

PP 132.85

S1 132.03

S2 131.41

S3 130.59

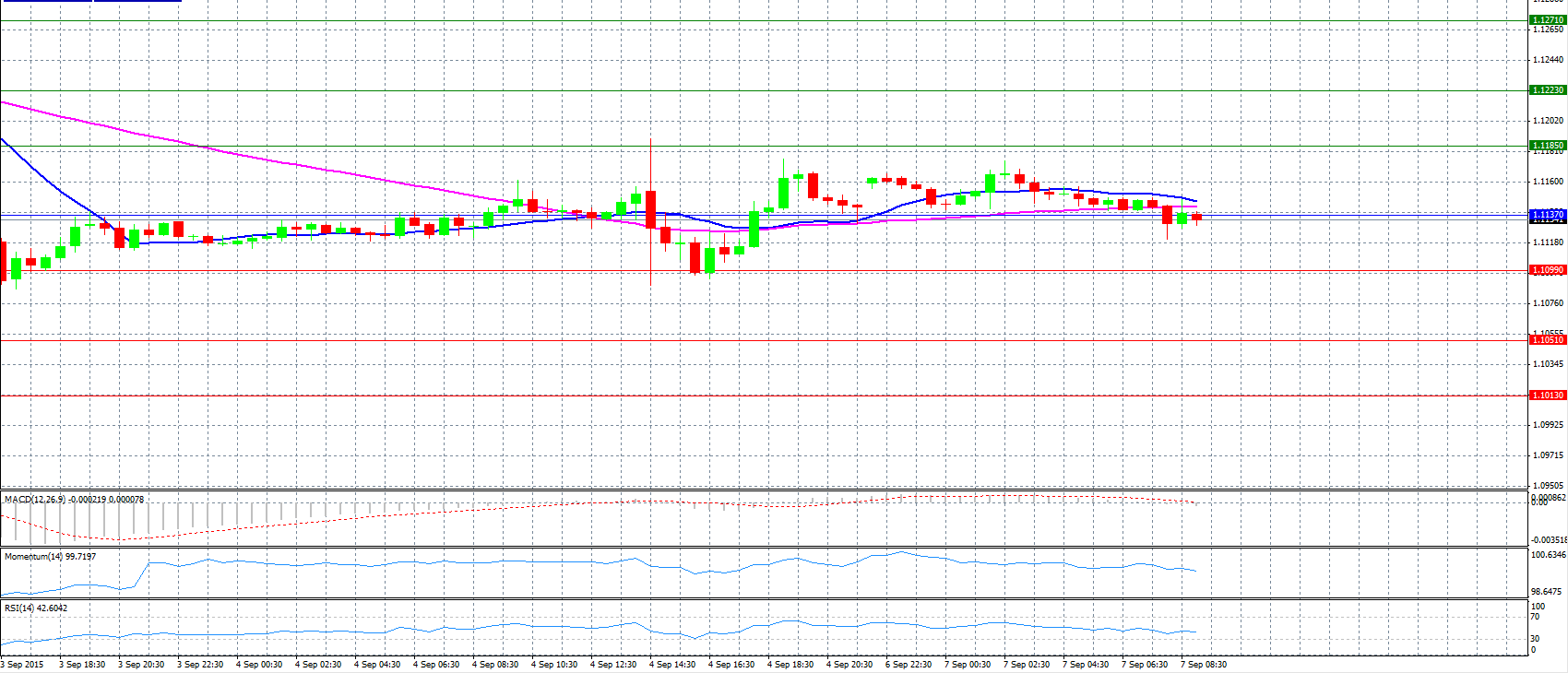

Market Scenario 1: Long positions above 1.1137 with targets at 1.1185 and 1.1223.

Market Scenario 2: Short positions below 1.1137 with targets at 1.1099 and 1.1051.

Comment: The pair dropped to 1.1130 level as mixed releases of German industrial production figures failed to provide any respite to the EUR bulls.

Supports and Resistances:

R3 1.1271

R2 1.1223

R1 1.1185

PP 1.1137

S1 1.1099

S2 1.1051

S3 1.1013

Market Scenario 1: Long positions above 181.45 with targets at 182.42 and 184.31.

Market Scenario 2: Short positions below 181.45 with targets at 179.56 and 178.59.

Comment: The pair advanced but found resistance at pivot point 181.45.

Supports and Resistances:

R3 185.28

R2 184.31

R1 182.42

PP 181.45

S1 179.56

S2 178.59

S3 176.70

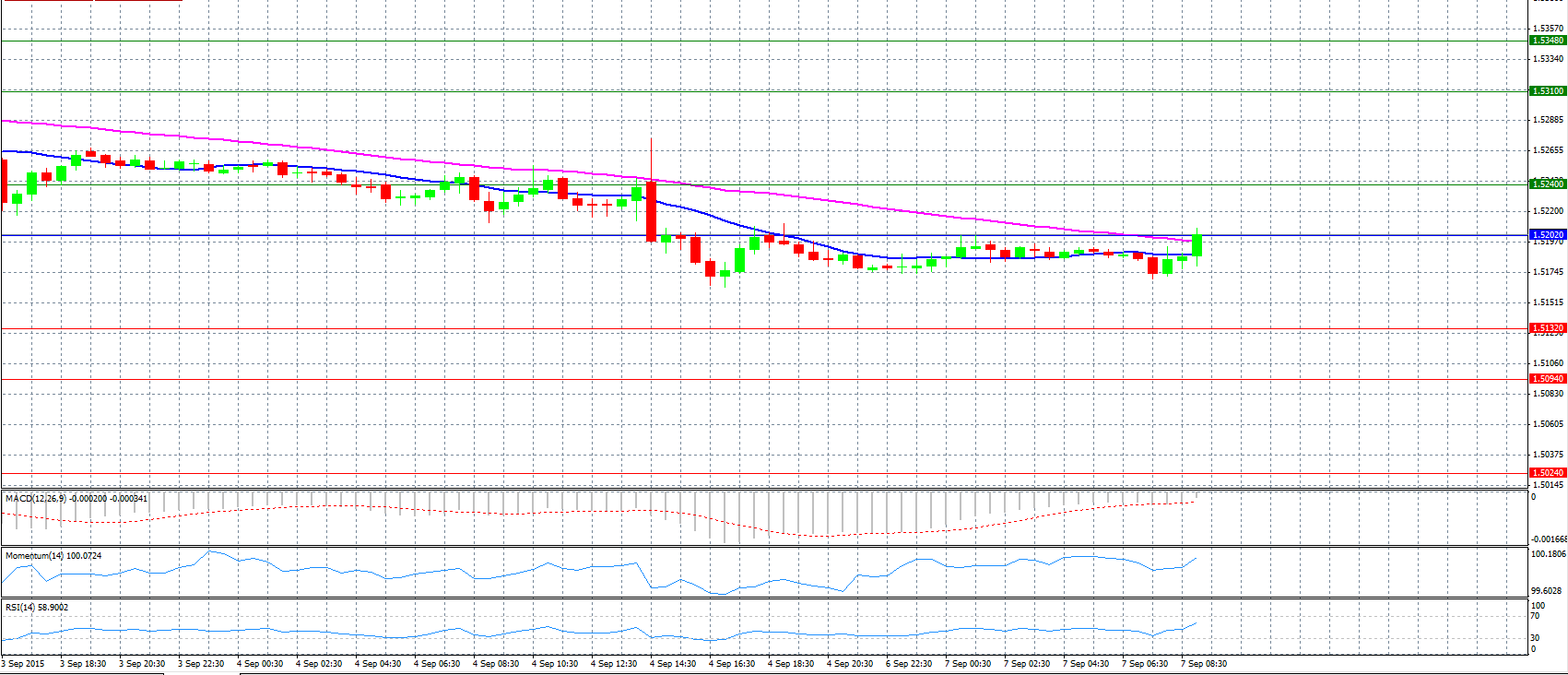

Market Scenario 1: Long positions above 1.5202 with targets at 1.5240 and 1.5310.

Market Scenario 2: Short positions below 1.5202 with targets at 1.5132 and 1.5094.

Comment: The pair regains 1.5200 level amid a data-empty EUR calendar.

Supports and Resistances:

R3 1.5348

R2 1.5310

R1 1.5240

PP 1.5202

S1 1.5132

S2 1.5094

S3 1.5024

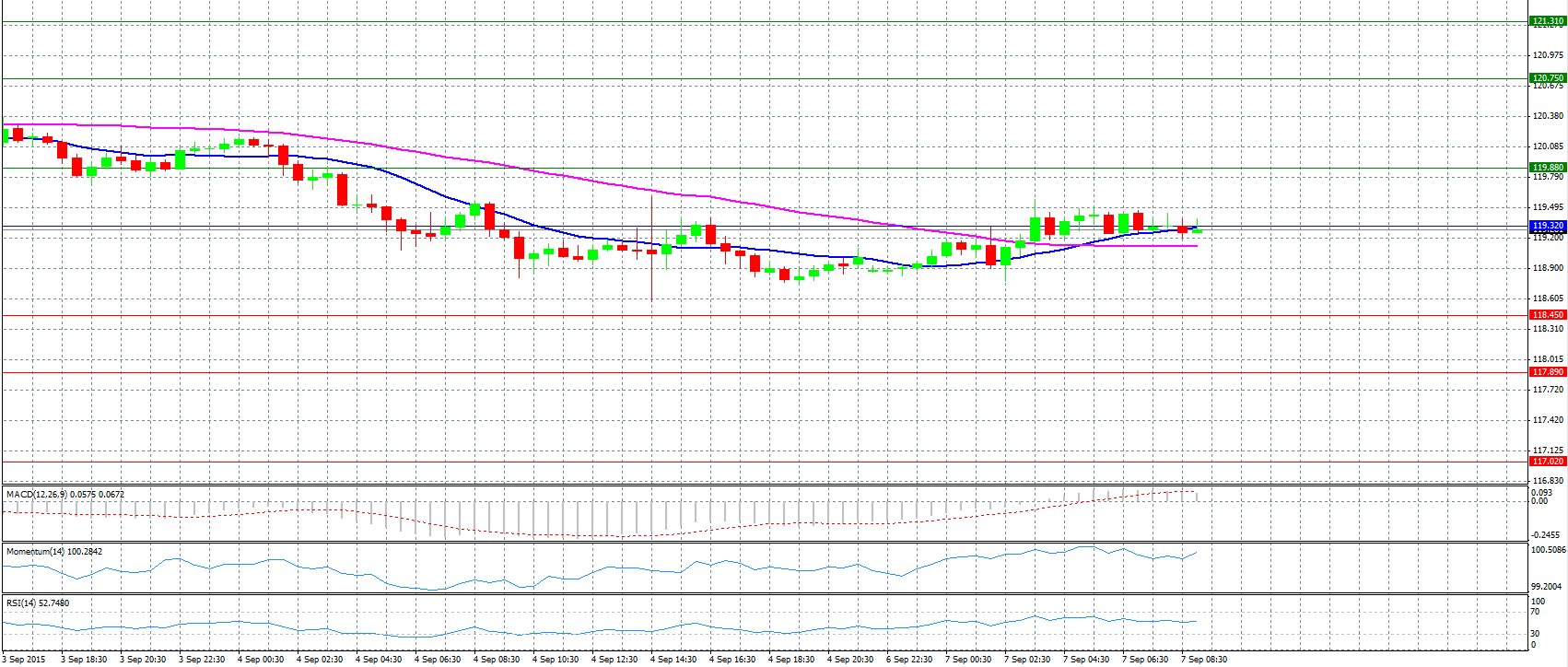

Market Scenario 1: Long positions above 119.32 with targets at 119.88 and 120.75.

Market Scenario 2: Short positions below 119.32 with targets at 118.45 and 117.89.

Comment: The pair trims gains near 119.30 level amid rebounding risk sentiment and thin trading as US remains closed today on account of Labour Day.

Supports and Resistances:

R3 121.31

R2 120.75

R1 119.88

PP 119.32

S1 118.45

S2 117.89

S3 117.02

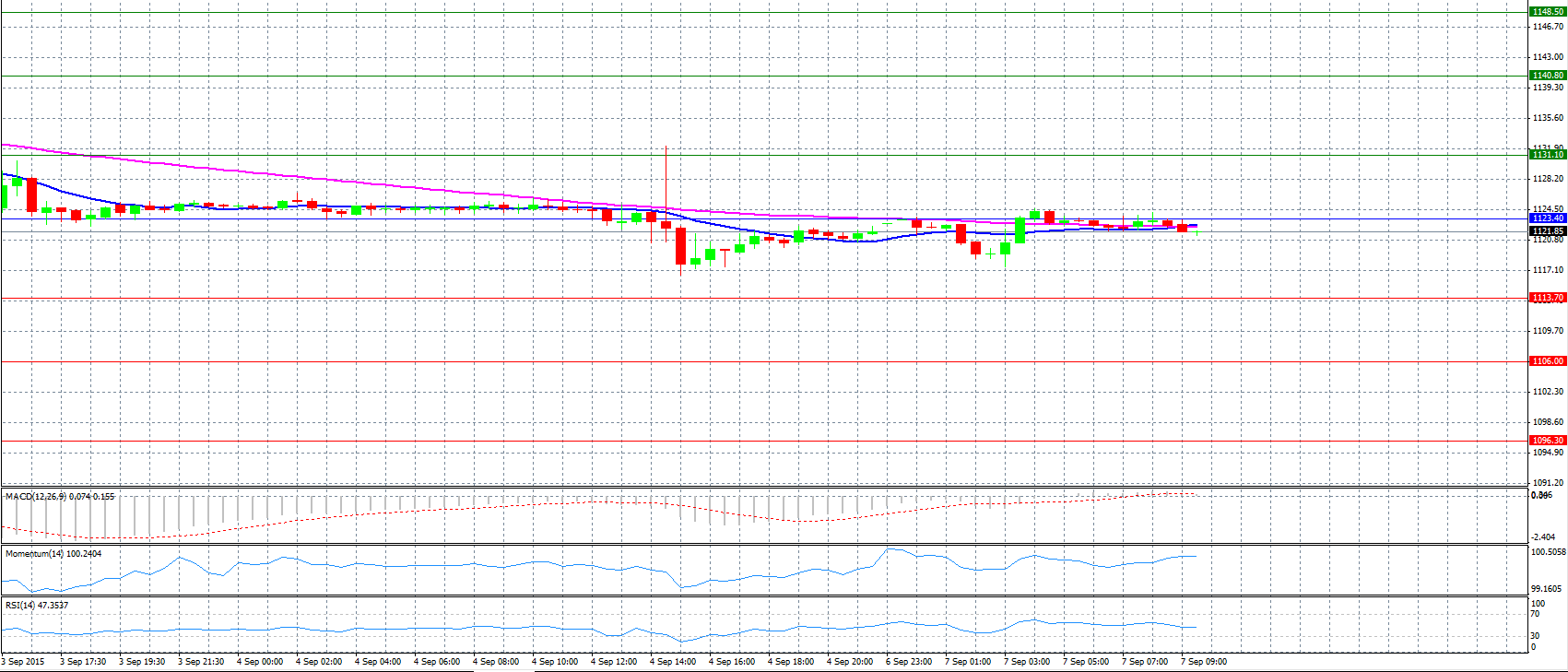

Market Scenario 1: Long positions above 1123.40 with targets at 1131.10 and 1140.80.

Market Scenario 2: Short positions below 1123.40 with targets at 1113.70 and 1106.00.

Comment: Gold prices trade muted as markets still digest the recent US jobs report and reassess chances of Fed rate hike as early as next week.

Supports and Resistances:

R3 1148.50

R2 1140.80

R1 1131.10

PP 1123.40

S1 1113.70

S2 1106.00

S3 1096.30

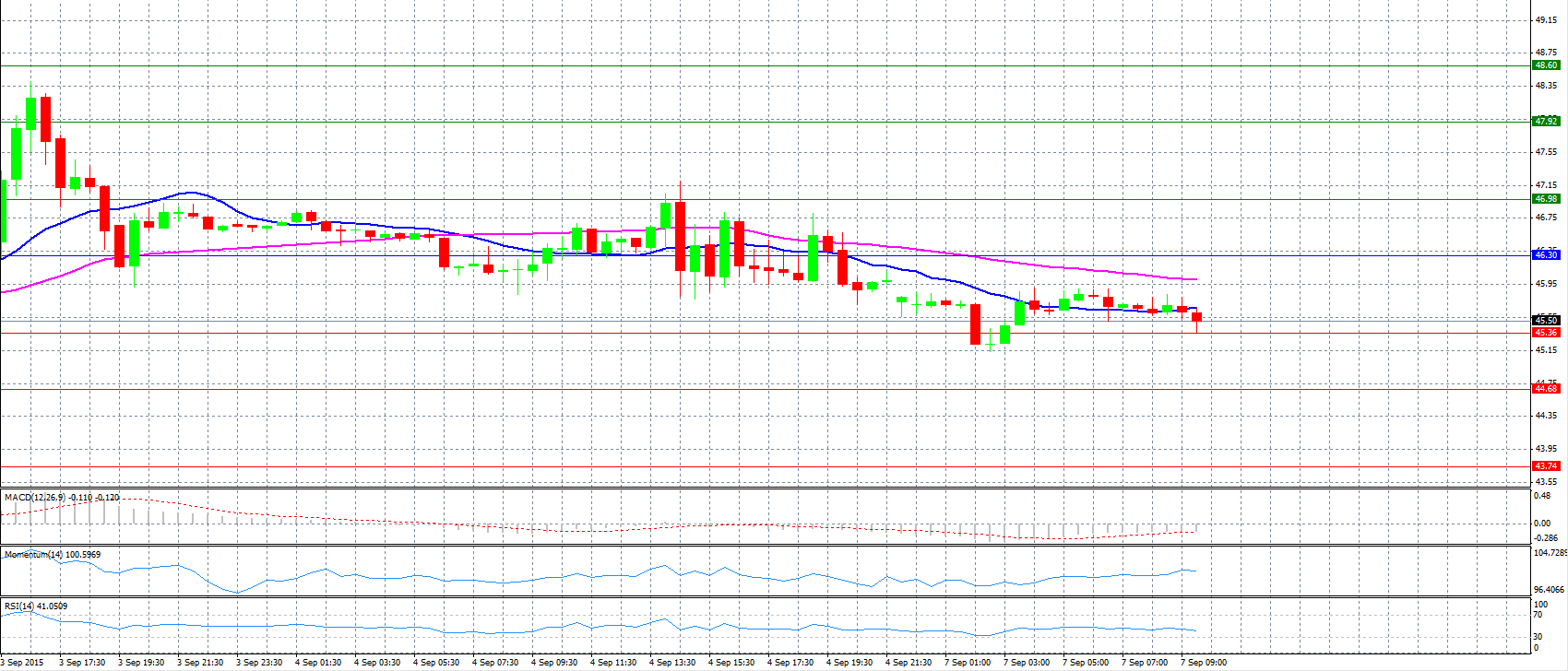

CRUDE OIL

Market Scenario 1: Long positions above 46.30 with targets at 46.98 and 47.92.

Market Scenario 2: Short positions below 46.30 with targets at 45.36 and 44.68.

Comment: Crude oil prices eased in Asian trade today as dealers await the US Federal Reserve's decision on whether to raise interest rates following a mixed August jobs report, analysts said.

Supports and Resistances:

R3 48.60

R2 47.92

R1 46.98

PP 46.30

S1 45.36

S2 44.68

S3 43.74

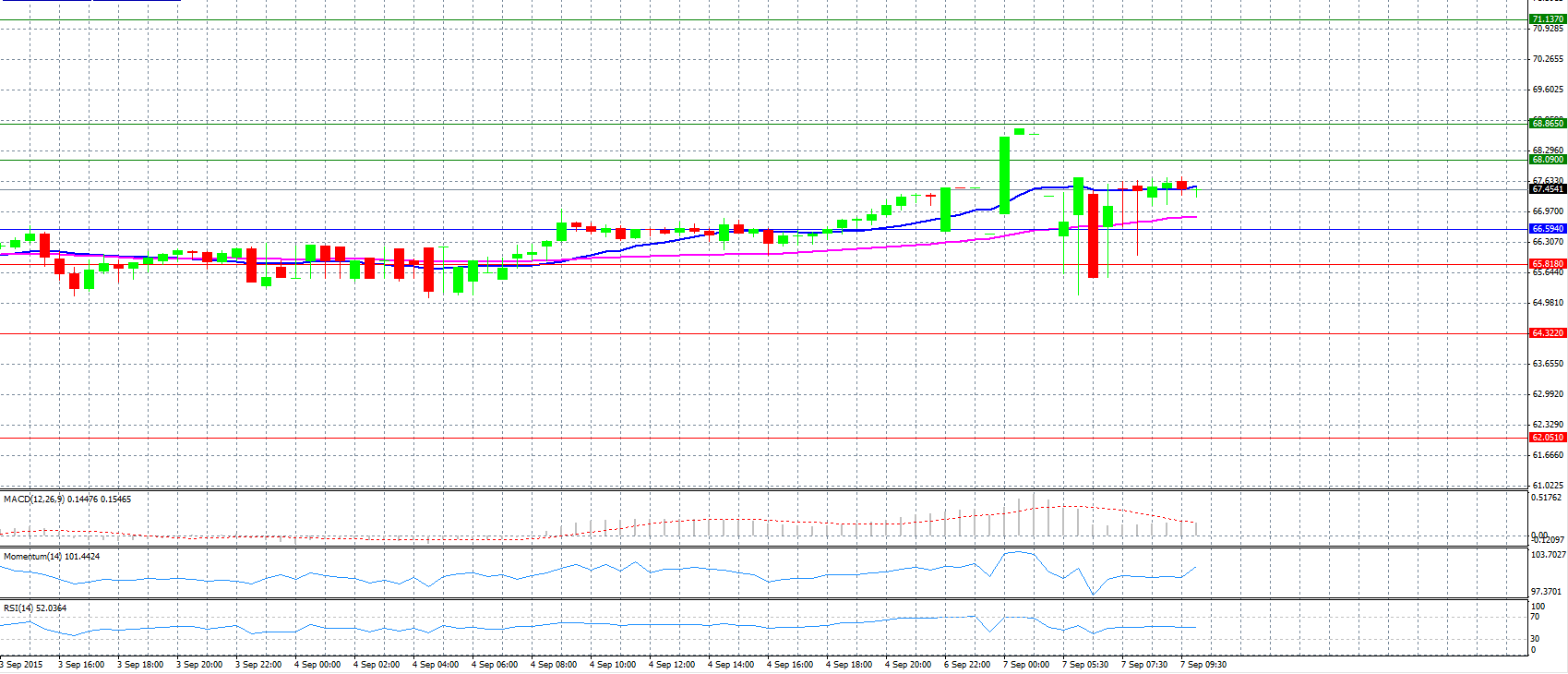

Market Scenario 1: Long positions above 66.594 with targets at 68.090 and 68.865.

Market Scenario 2: Short positions below 66.594 with targets at 65.818 and 64.322.

Comment: The pair fell from highs of 68.762 level and trades near 67.400.

Supports and Resistances:

R3 71.137

R2 68.865

R1 68.090

PP 66.594

S1 65.818

S2 64.322

S3 62.051