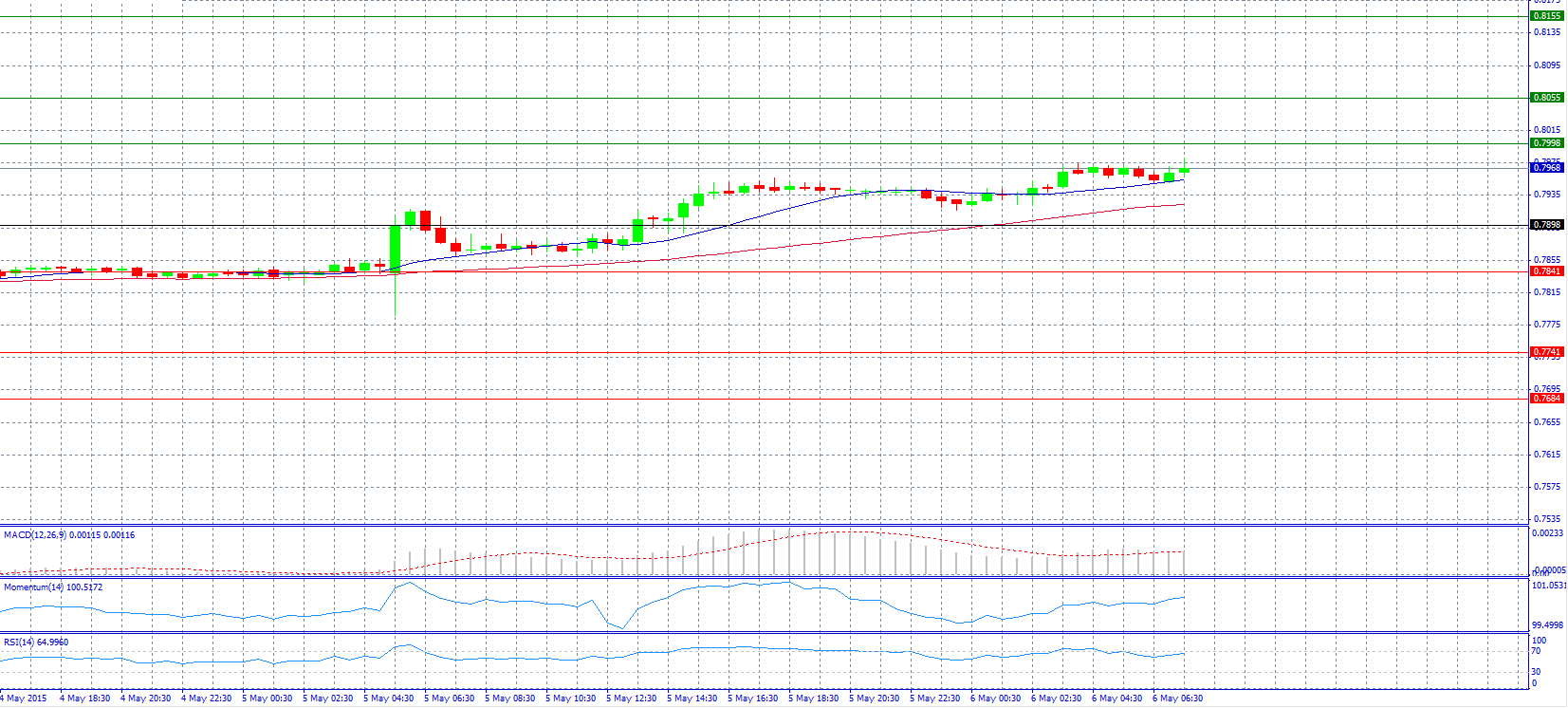

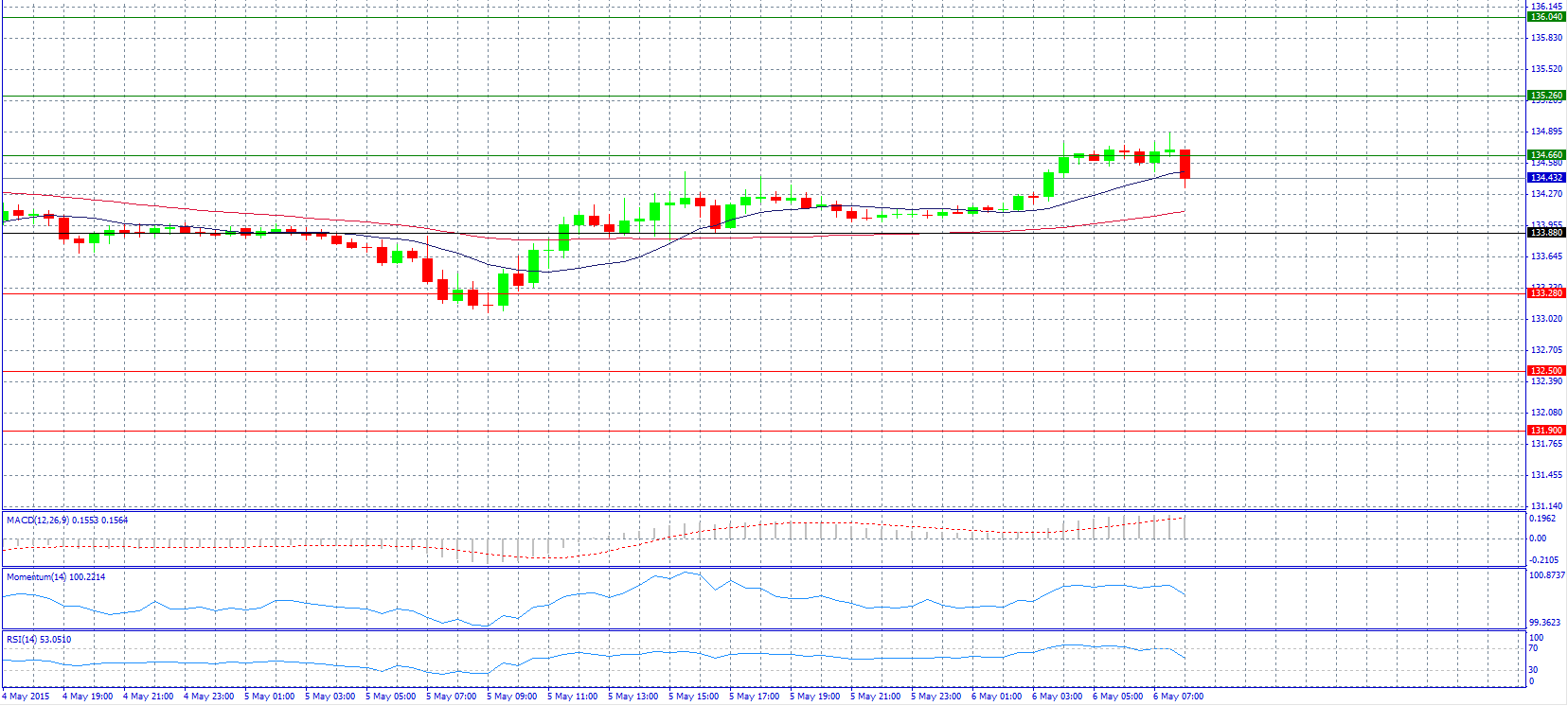

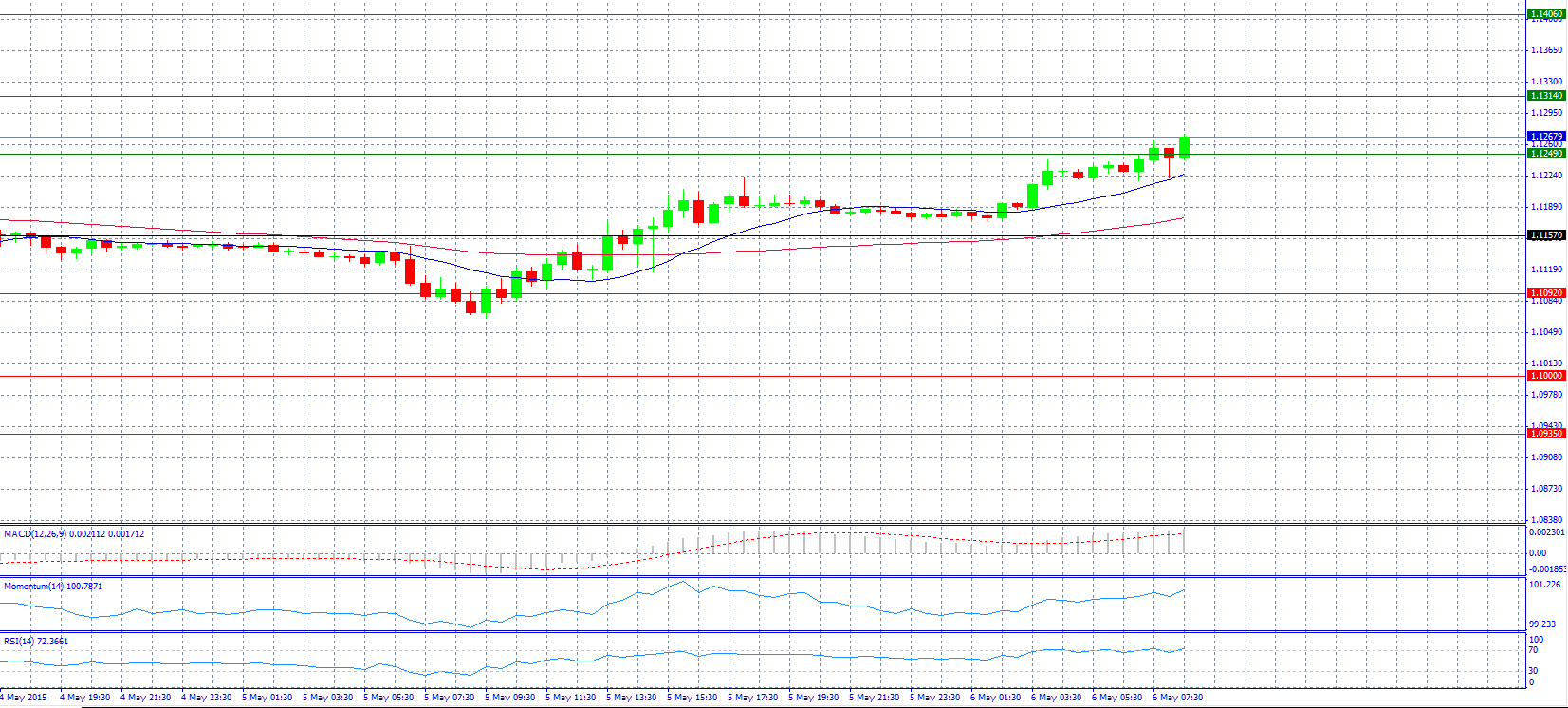

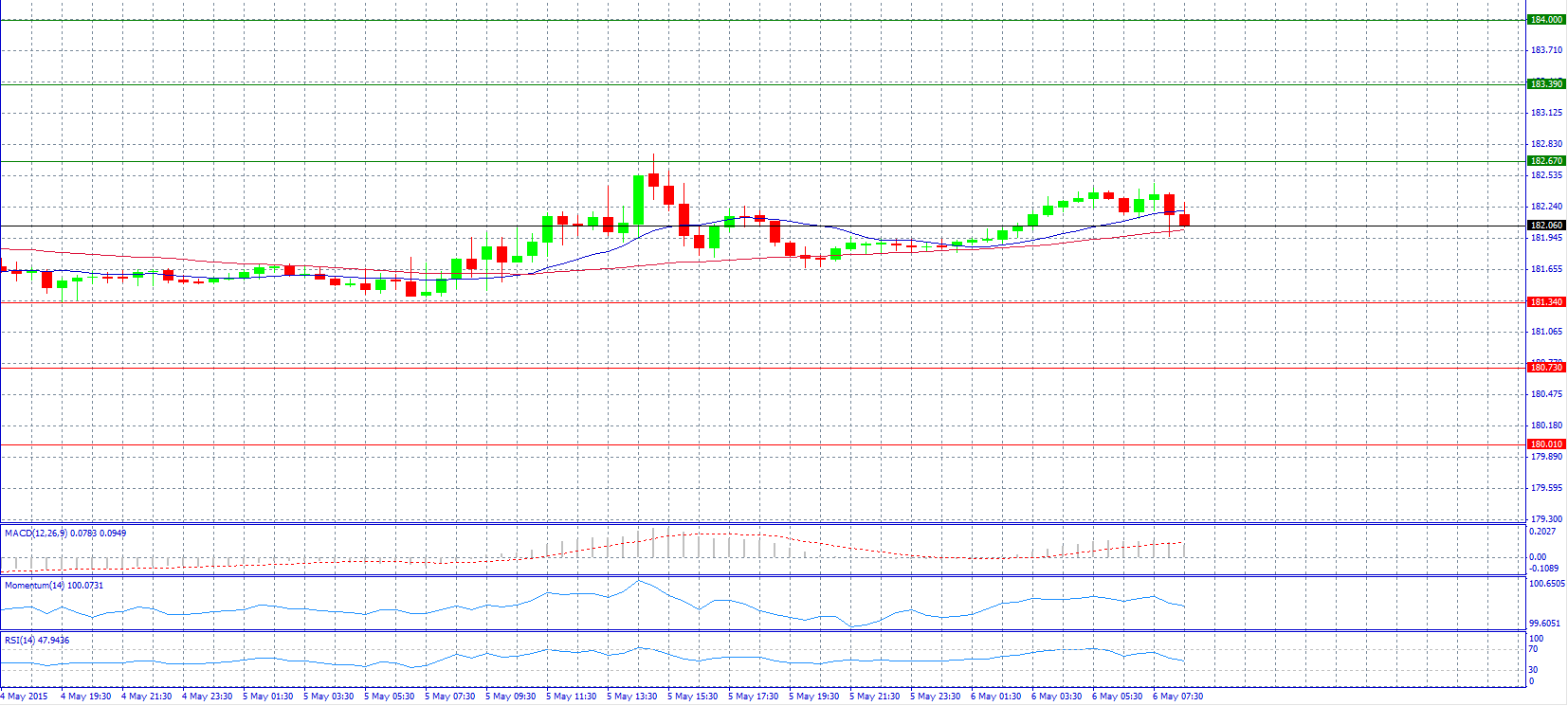

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7998 with target @ 0.8055.

Market Scenario 2: Short positions below 0.7898 with target @ 0.7841.

Comment: The pair advanced today as the Dalian Iron ore futures rose their highest since the end of March.

Supports and Resistances:

R3 0.8155

R2 0.8055

R1 0.7998

PP 0.7898

S1 0.7841

S2 0.7741

S3 0.7684

Market Scenario 1: Long positions above 134.66 with target @ 135.26.

Market Scenario 2: Short positions below 133.88 with target @ 133.28.

Comment: The pair found resistance at 134.66 level and now trades below 134.50.

Supports and Resistances:

R3 136.04

R2 135.26

R1 134.66

PP 133.88

S1 133.28

S2 132.50

S3 131.90

Market Scenario 1: Long positions above 1.1314 with target @ 1.1406.

Market Scenario 2: Short positions below 1.1249 with target @ 1.1157.

Comment: The pair advances higher and surpasses 1.1260 level.

Supports and Resistances:

R3 1.1406

R2 1.1314

R1 1.1249

PP 1.1157

S1 1.1092

S2 1.1000

S3 1.0935

Market Scenario 1: Long positions above 182.06 with target @ 182.67.

Market Scenario 2: Short positions below 182.06 with target @ 181.34.

Comment: The pair weakened and trades near pivot point 182.06.

Supports and Resistances:

R3 184.00

R2 183.39

R1 182.67

PP 182.06

S1 181.34

S2 180.73

S3 180.01

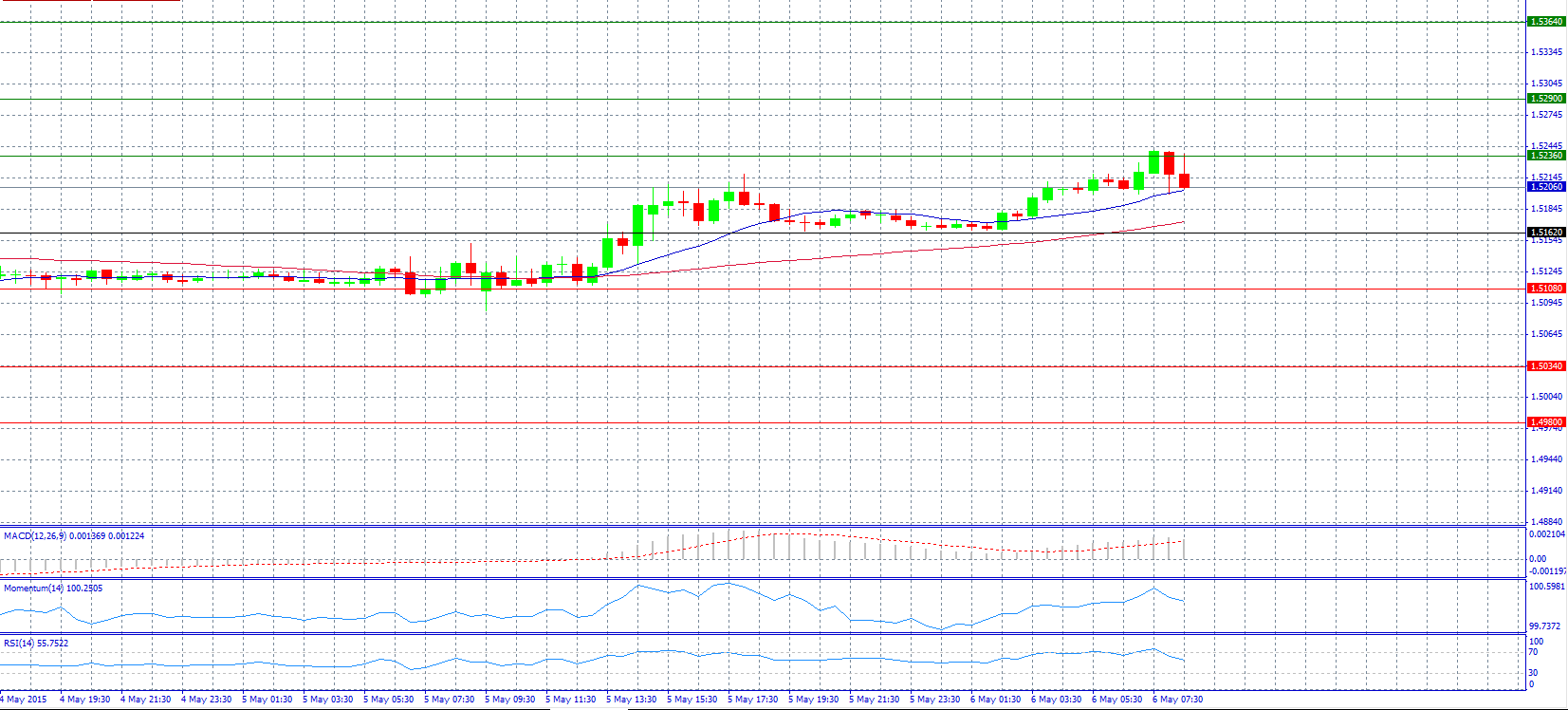

Market Scenario 1: Long positions above 1.5236 with target @ 1.5290.

Market Scenario 2: Short positions below 1.5162 with target @ 1.5108.

Comment: The pair found resistance at 1.5236 level and now is retreating.

Supports and Resistances:

R3 1.5364

R2 1.5290

R1 1.5236

PP 1.5162

S1 1.5108

S2 1.5034

S3 1.4980

Market Scenario 1: Long positions above 120.03 with target @ 120.33.

Market Scenario 2: Short positions below 119.55 with target @ 119.25.

Comment: The pair tries hard to break resistance level at pivot point 120.13.

Supports and Resistances:

R3 121.11

R2 120.81

R1 120.33

PP 120.03

S1 119.55

S2 119.25

S3 118.77

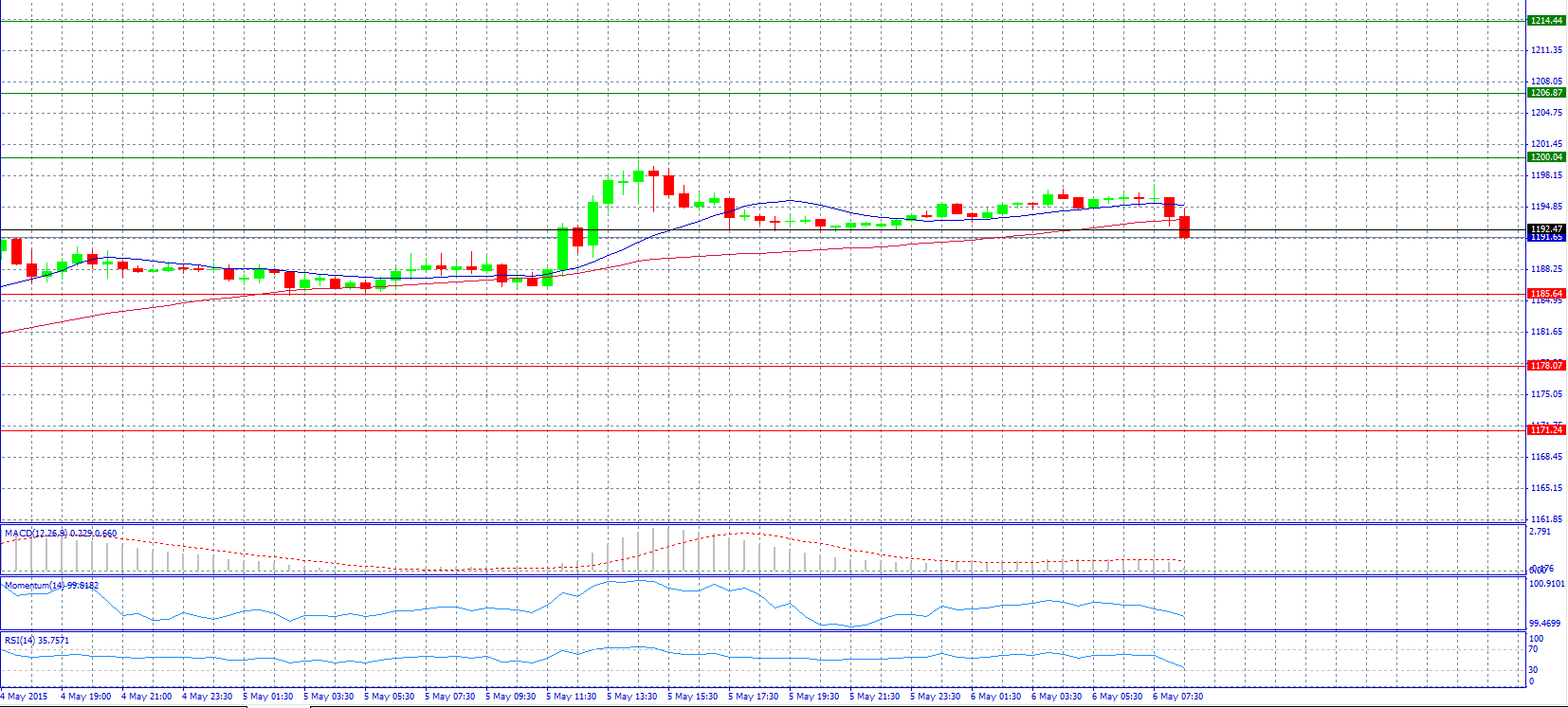

Market Scenario 1: Long positions above 1192.47 with target @ 1200.04.

Market Scenario 2: Short positions below 1192.47 with target @ 1185.64.

Comment: Gold prices broke support level at pivot point 1192.47 and trade near 1190.00 level.

Supports and Resistances:

R3 1214.44

R2 1206.87

R1 1200.04

PP 1192.47

S1 1185.64

S2 1178.07

S3 1171.24

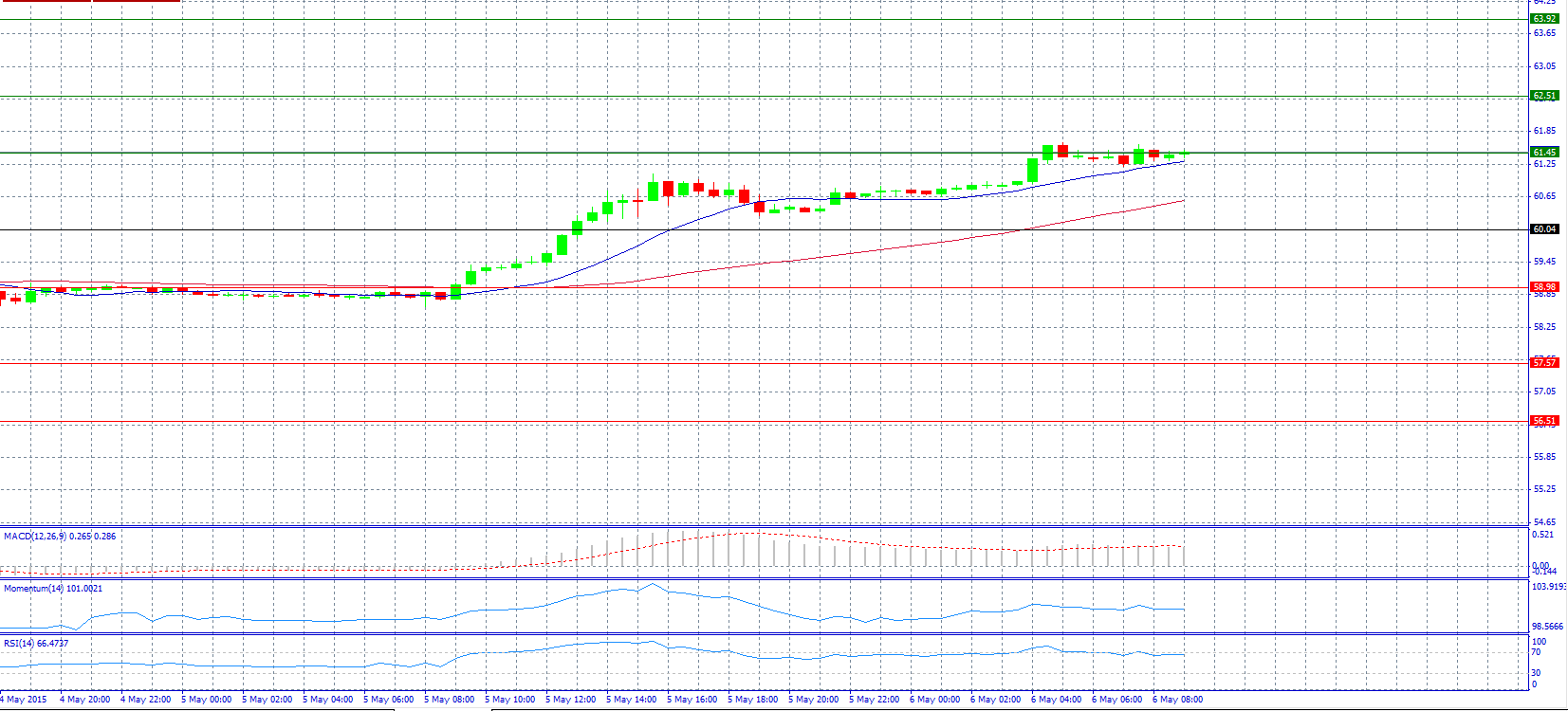

Market Scenario 1: Long positions above 61.45 with target @ 62.51.

Market Scenario 2: Short positions below 61.45 with target @ 60.04.

Comment: Crude oil prices trade neutral near resistance level 61.45.

Supports and Resistances:

R3 63.92

R2 62.51

R1 61.45

PP 60.04

S1 58.98

S2 57.57

S3 56.51

Market Scenario 1: Long positions above 49.753 with target @ 51.046.

Market Scenario 2: Short positions below 48.919 with target @ 47.626.

Comment: The pair found support at 48.919 level.

Supports and Resistances:

R3 54.007

R2 53.173

R1 51.880

PP 51.046

S1 49.753

S2 48.919

S3 47.626