*All the charts are 30M charts with daily pivot points.

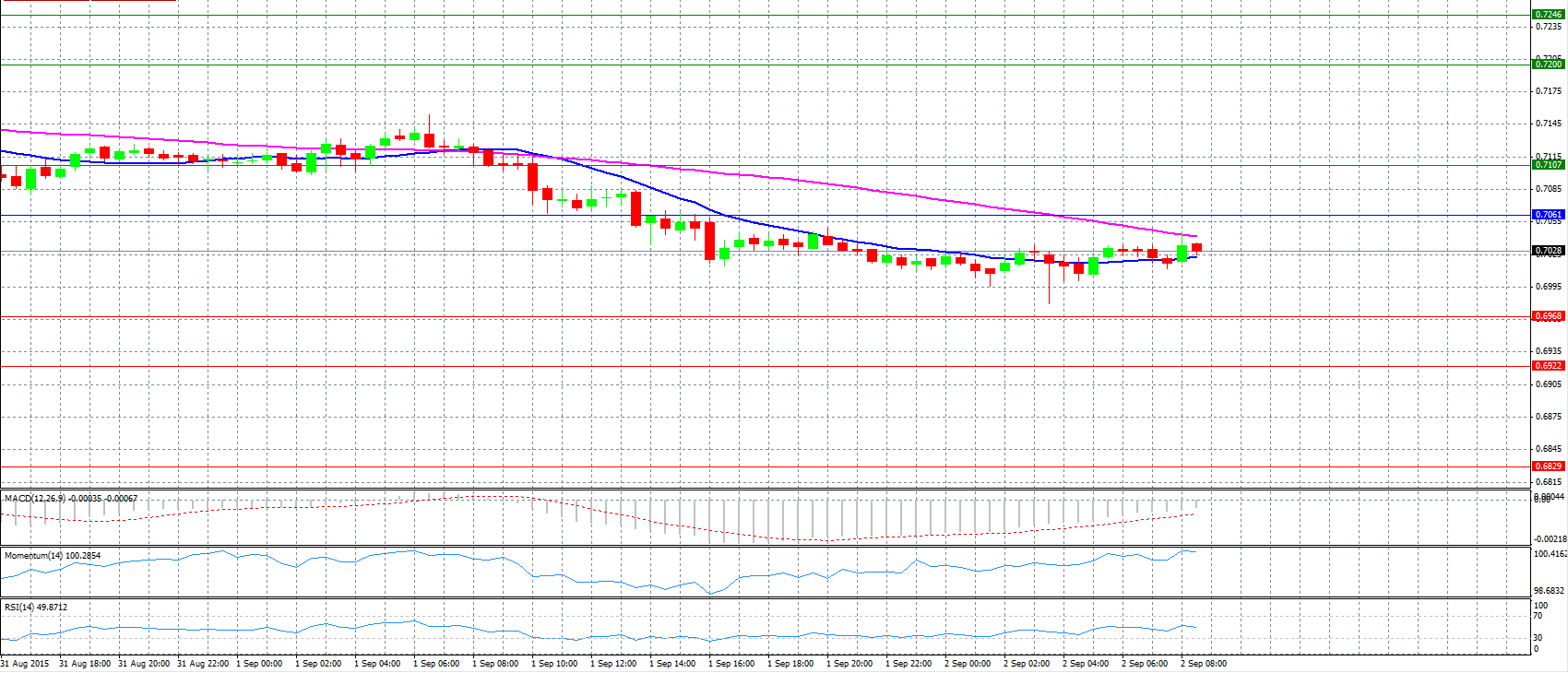

Market Scenario 1: Long positions above 0.7061 with targets at 0.7107 and 0.7200.

Market Scenario 2: Short positions below 0.7061 with targets at 0.6968 and 0.6922.

Comment: The pair rose from 6-year lows but the Australian data that were released regarding GDP still put pressure to the Australian dollar.

Supports and Resistances:

R3 0.7246

R2 0.7200

R1 0.7107

PP 0.7061

S1 0.6968

S2 0.6922

S3 0.6829

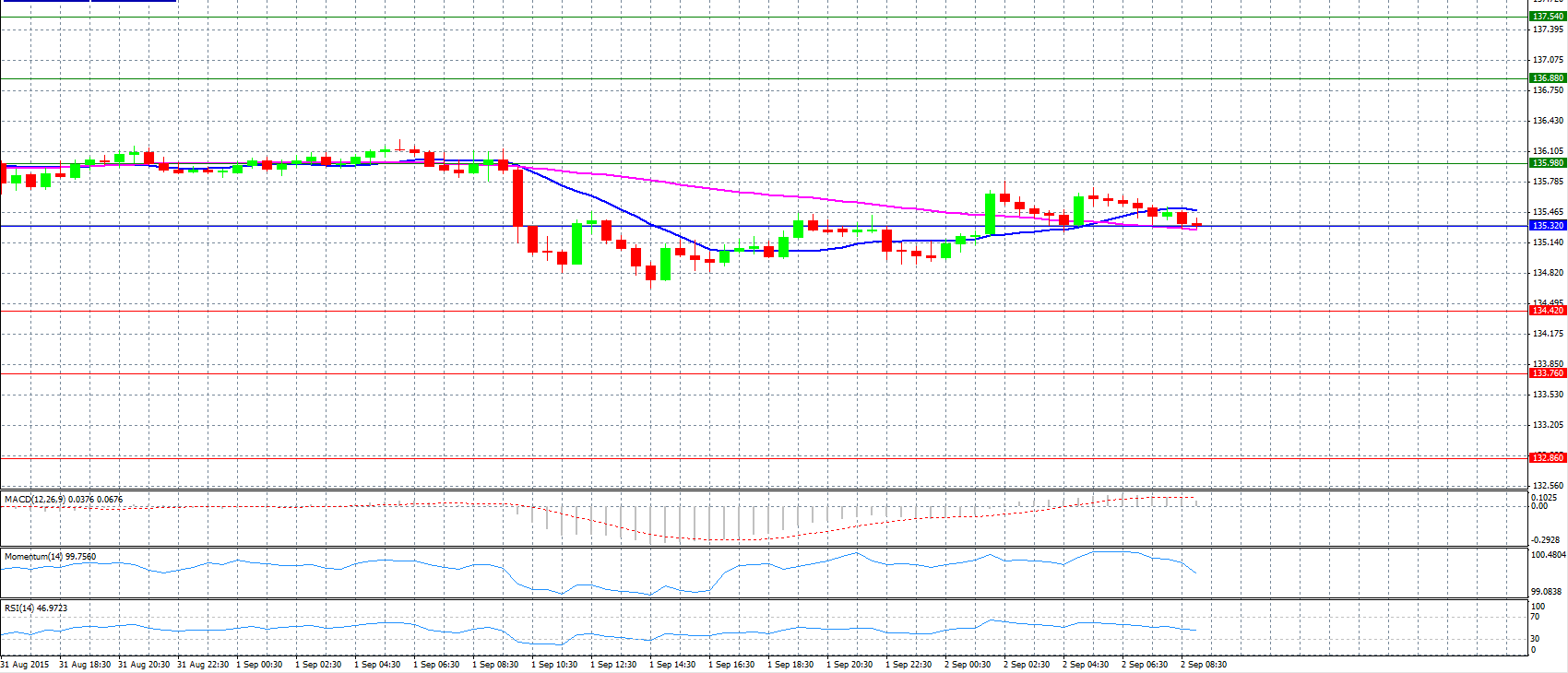

Market Scenario 1: Long positions above 135.32 with targets at 135.98 and 136.88.

Market Scenario 2: Short positions below 135.32 with targets at 134.42 and 133.76.

Comment: The pair is pushed down for second time to find support at pivot point 135.32.

Supports and Resistances:

R3 137.54

R2 136.88

R1 135.98

PP 135.32

S1 134.42

S2 133.76

S3 132.86

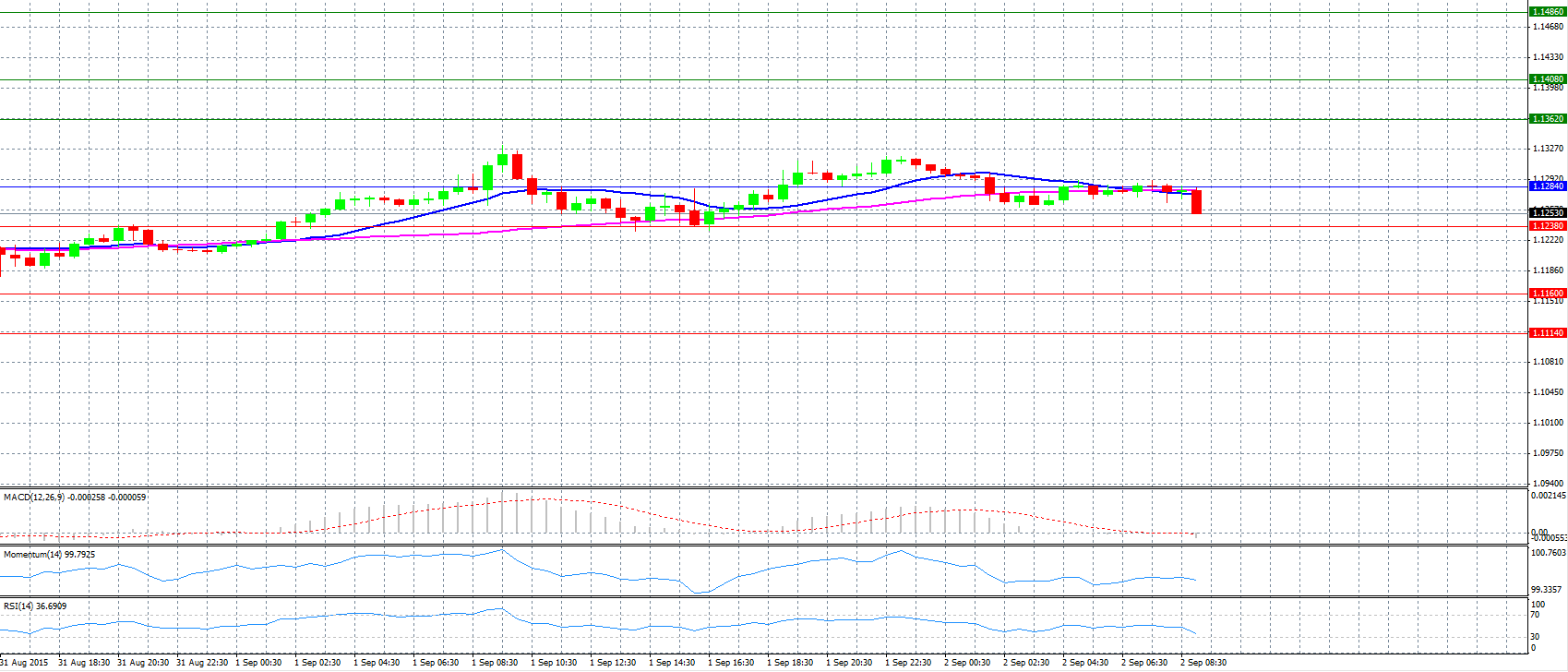

Market Scenario 1: Long positions above 1.1284 with targets at 1.1362 and 1.1408.

Market Scenario 2: Short positions below 1.1284 with targets at 1.1238 and 1.1160.

Comment: The pair is weakened more and now tests the levels of 1.1250/60.

Supports and Resistances:

R3 1.1486

R2 1.1408

R1 1.1362

PP 1.1284

S1 1.1238

S2 1.1160

S3 1.1114

Market Scenario 1: Long positions above 183.81 with targets at 185.08 and 187.50.

Market Scenario 2: Short positions below 183.81 with targets at 181.39 and 180.12.

Comment: The pair couldn’t hold above pivot point 183.81 and retraced near 183.40 level.

Supports and Resistances:

R3 188.77

R2 187.50

R1 185.08

PP 183.81

S1 181.39

S2 180.12

S3 177.70

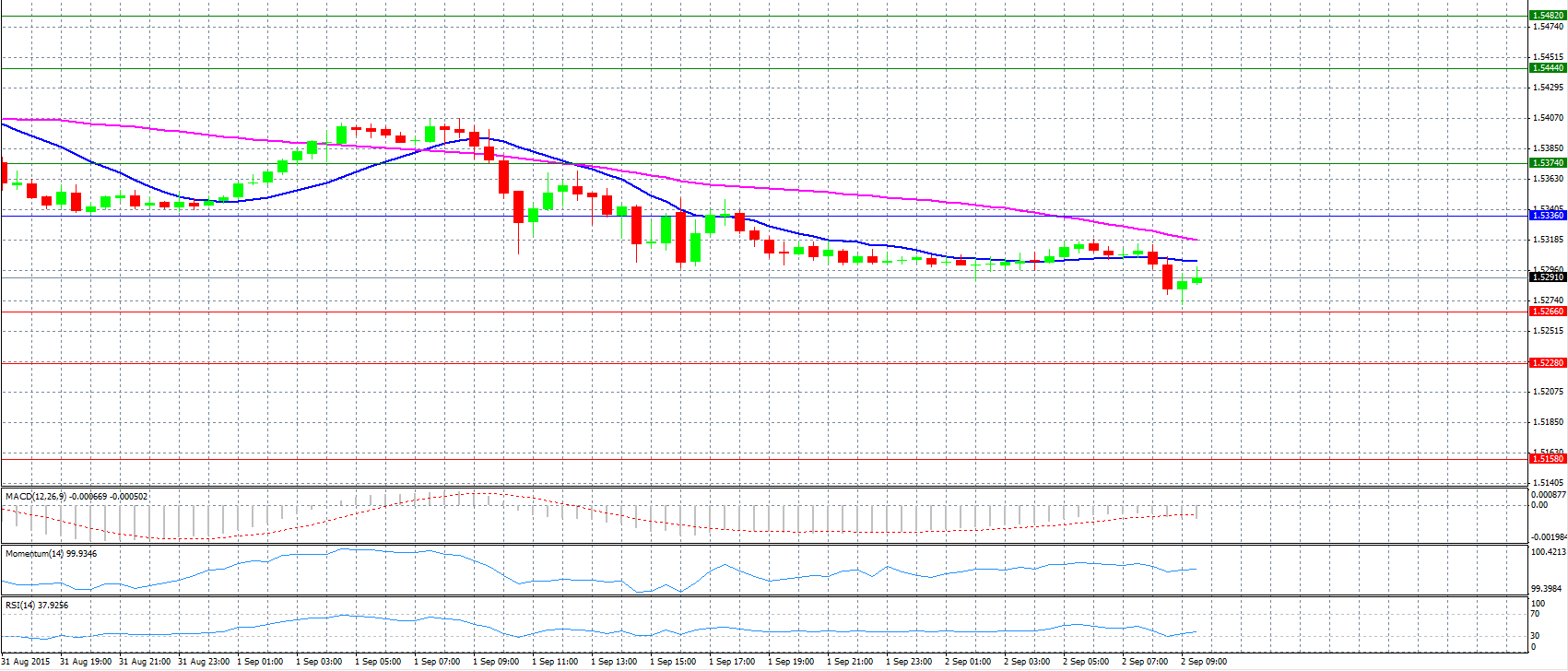

Market Scenario 1: Long positions above 1.5336 with targets at 1.5374 and 1.5444.

Market Scenario 2: Short positions below 1.5336 with targets at 1.5266 and 1.5228.

Comment: The pair breaks below 1.5300 level and tracks European equity futures.

Supports and Resistances:

R3 1.5482

R2 1.5444

R1 1.5374

PP 1.5336

S1 1.5266

S2 1.5228

S3 1.5158

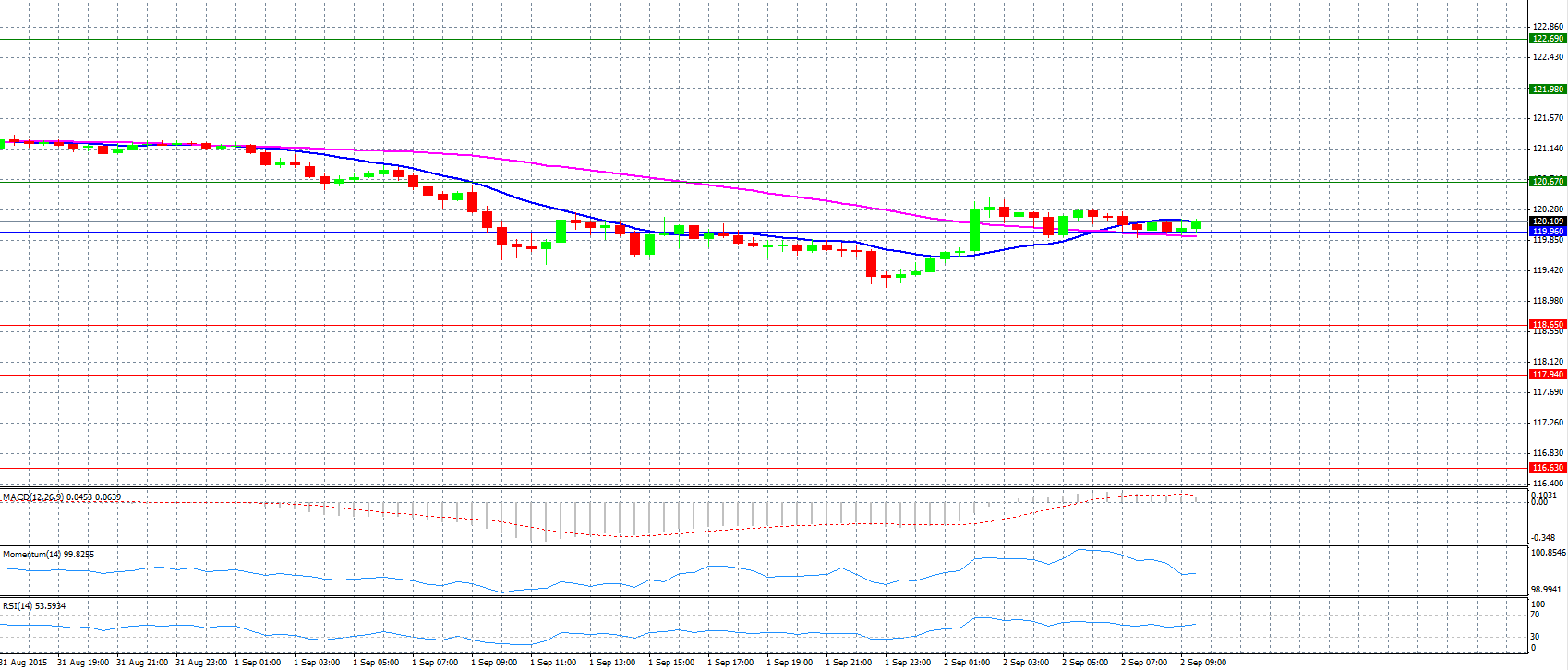

Market Scenario 1: Long positions above 122.69 with targets at 120.67 and 121.98.

Market Scenario 2: Short positions below 122.69 with targets at 118.65 and 117.94.

Comment: The pair fell from highs of 120.46 earlier and now seems that it tries to reach 120.00 level again.

Supports and Resistances:

R3 122.69

R2 121.98

R1 120.67

PP 122.69

S1 118.65

S2 117.94

S3 116.63

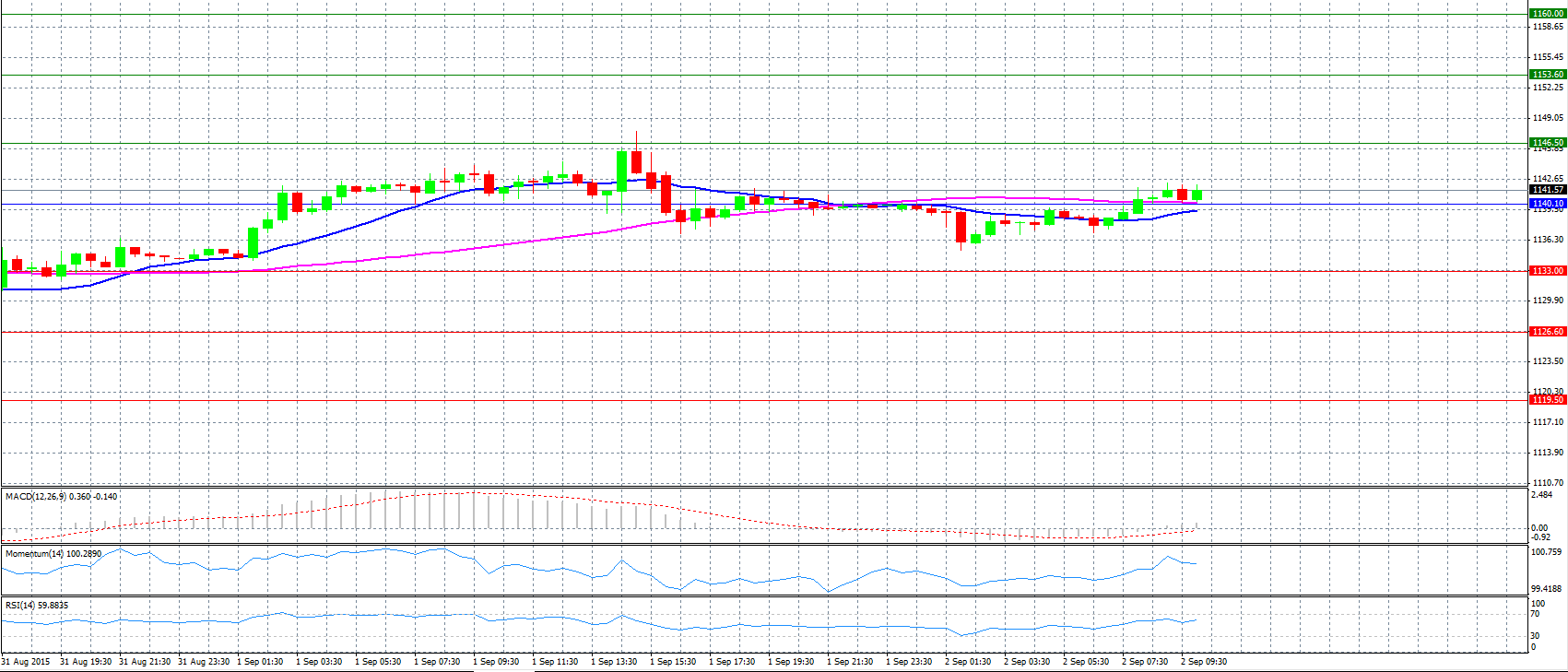

Market Scenario 1: Long positions above 1140.10 with targets at 1146.50 and 1153.60.

Market Scenario 2: Short positions below 1140.10 with targets at 1133.00 and 1126.60.

Comment: Gold prices struggle on greenback and fail to benefit from falling equities.

Supports and Resistances:

R3 1160.00

R2 1153.60

R1 1146.50

PP 1140.10

S1 1133.00

S2 1126.60

S3 1119.50

CRUDE OIL

Market Scenario 1: Long positions above 45.74 with targets at 47.32 and 50.46.

Market Scenario 2: Short positions below 45.74 with targets at 42.60 and 41.02.

Comment: Crude oil prices trade neutral near 44.35 level.

Supports and Resistances:

R3 52.04

R2 50.46

R1 47.32

PP 45.74

S1 42.60

S2 41.02

S3 37.88

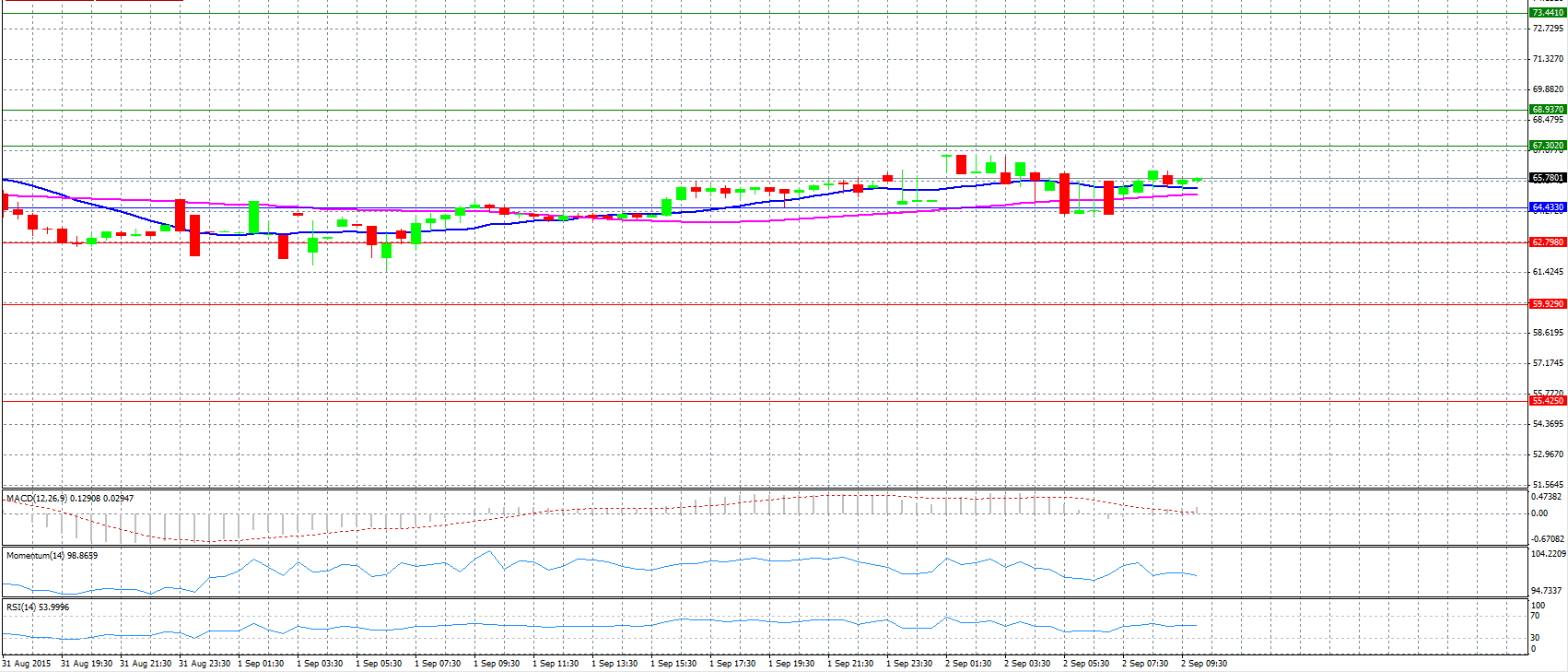

Market Scenario 1: Long positions above 64.433 with targets at 67.302 and 68.937.

Market Scenario 2: Short positions below 64.433 with targets at 62.798 and 59.929.

Comment: The pair trades flat near 65.800 level.

Supports and Resistances:

R3 73.441

R2 68.937

R1 67.302

PP 64.433

S1 62.798

S2 59.929

S3 55.425