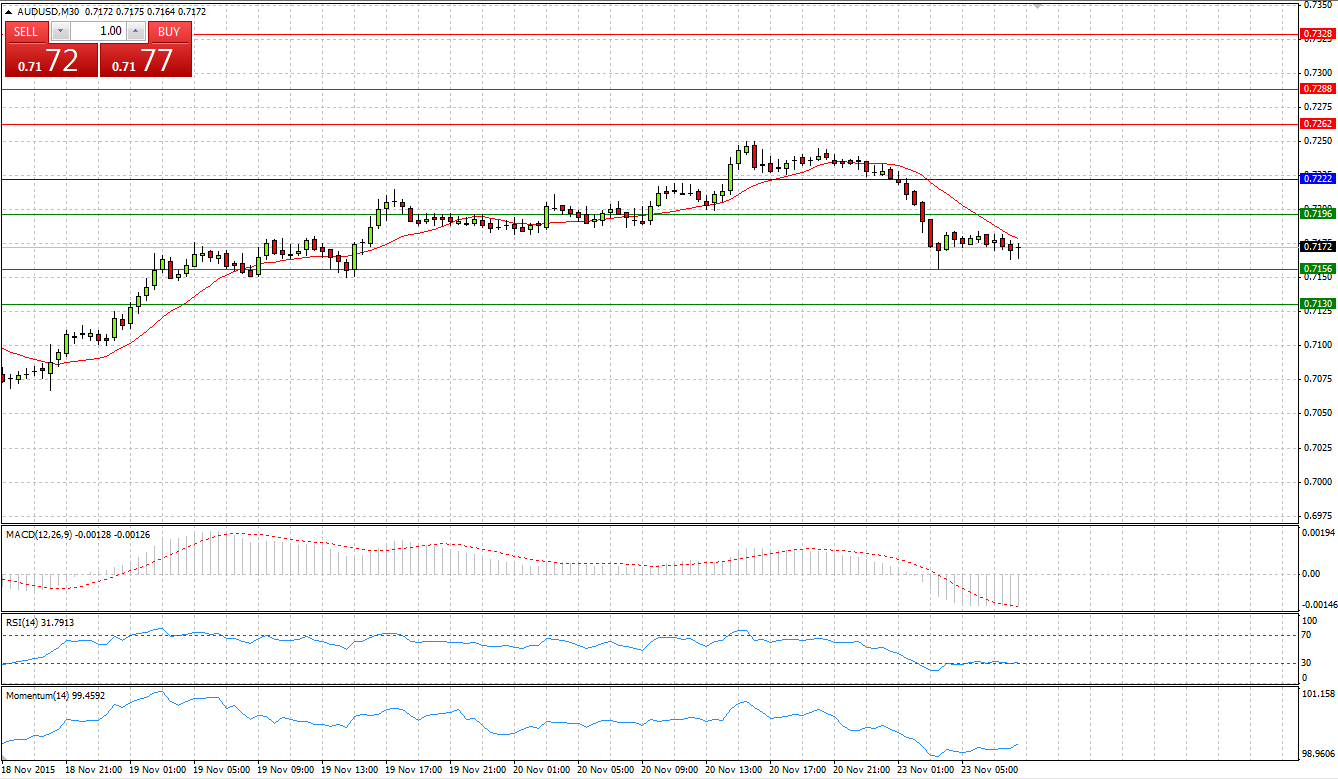

Market Scenario 1: Long positions above 0.7222 with targets at 0.7262 and 0.7288

Market Scenario 2: Short positions below 0.7222 with targets at 0.7196 and 0.7156

Comment: Aussie during early Asian session came under pressure and by the opening of European session lost more than 50 pips against US dollar. AUD/USD is currently trading below the First Support level aiming to test the Second one.

Supports and Resistances:

R3 0.7328

R2 0.7288

R1 0.7262

PP 0.7222

S1 0.7196

S2 0.7156

S3 0.7130

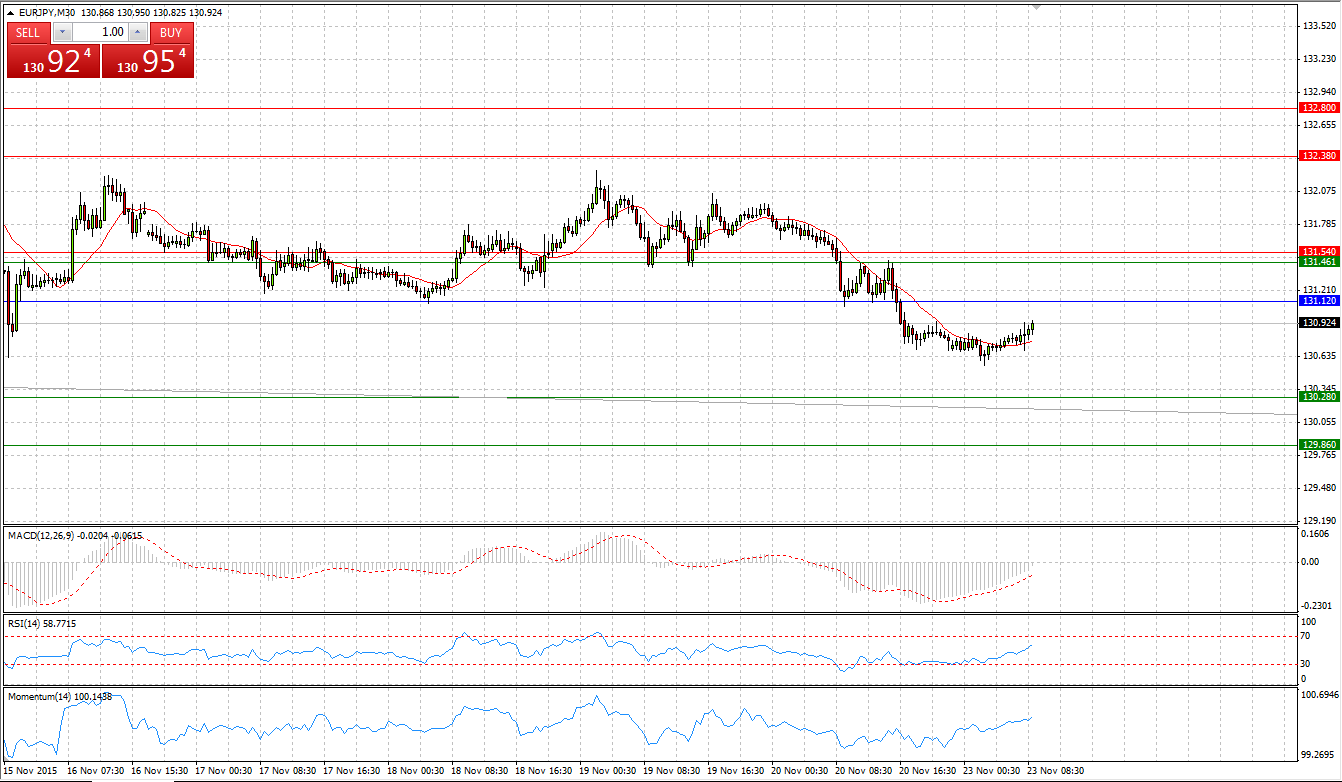

EUR/JPY

Market Scenario 1: Long positions above 131.12 with targets at 131.54 and 132.38

Market Scenario 2: Short positions below 131.12 with targets at 130.28 and 129.86

Comment: During Friday’s session, European Currency came under selling pressure and was sent to its low against Japanese yen. Today EUR/JPY reached a new low against at 130.55, the lowest level since 29th of April. The pair is trading below Pivot Point level

Supports and Resistances:

R3 132.80

R2 132.38

R1 131.54

PP 131.12

S1 130.28

S2 129.86

S3 129.02

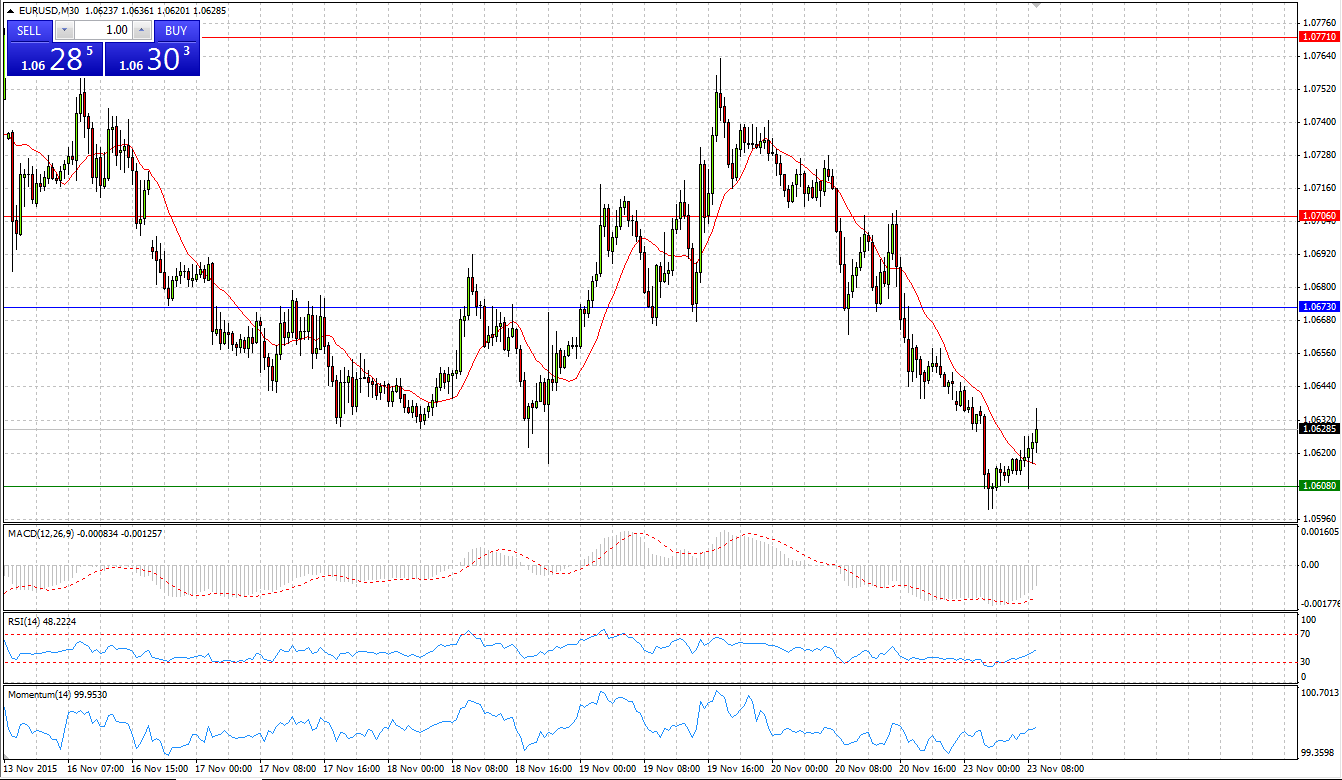

EUR/USD

Market Scenario 1: Long positions above 1.0673 with targets at 1.0706 and 1.0771

Market Scenario 2: Short positions below 1.0673 with targets at 1.0608 and 1.0575

Comment: European currency continues depreciating against US dollar amid dovish comments of ECB President Mario Draghi. During early Asian session, EUR/USD reached a new low at 1.0599, the lowest level since 15th of April. At the time being, the pair is trading close to the First Support level.

Supports and Resistances:

R3 1.0804

R2 1.0771

R1 1.0706

PP 1.0673

S1 1.0608

S2 1.0575

S3 1.0510

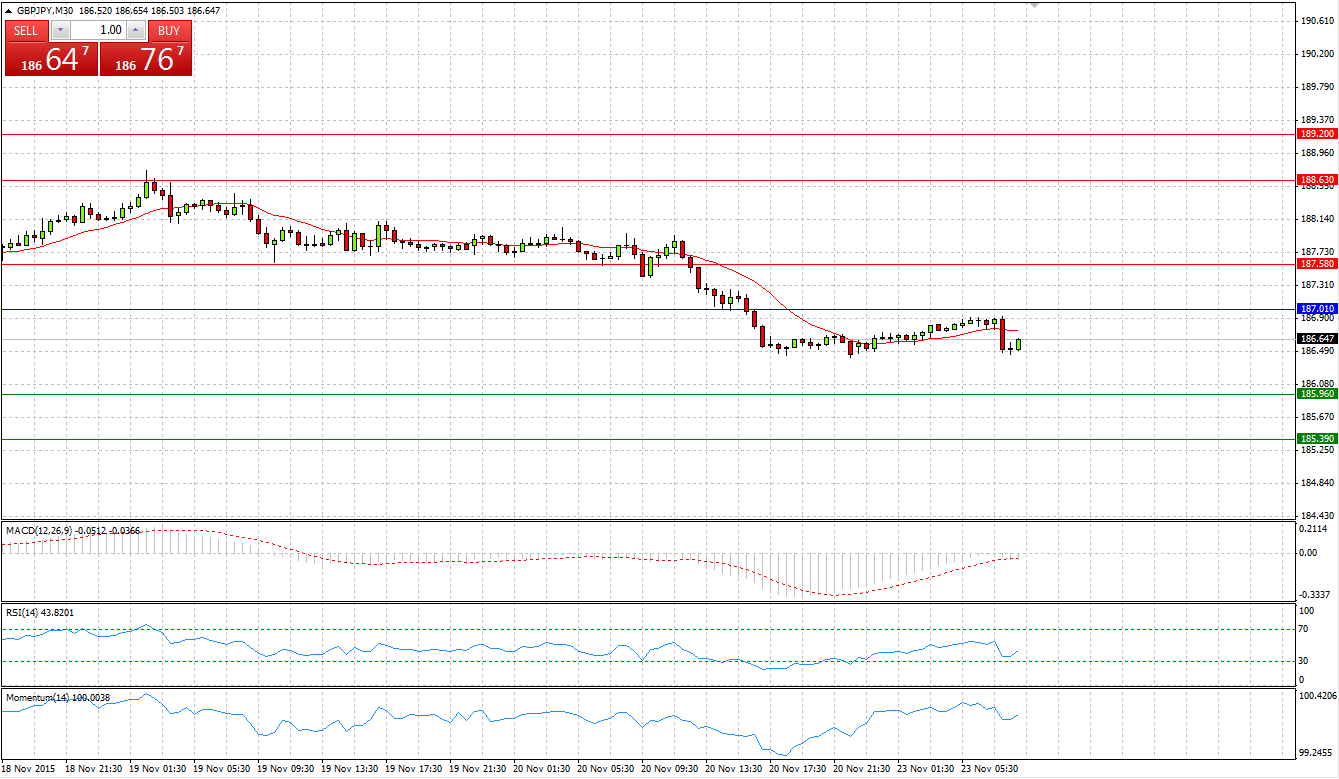

Market Scenario 1: Long positions above 187.01 with targets at 187.58 and 188.63

Market Scenario 2: Short positions below 187.01 with targets at 185.96 and 185.39

Comment: Having reached a new high on Thursday’s session at 188.75, sterling came under selling pressure and closed Friday’s session at 186.45 against the Japanese yen, that is 230 pips lower its recent high. During today’s trading session, the pair is trading flat, slightly below Pivot Point Level.

Supports and Resistances:

R3 189.20

R2 188.63

R1 187.58

PP 187.01

S1 185.96

S2 185.39

S3 184.34

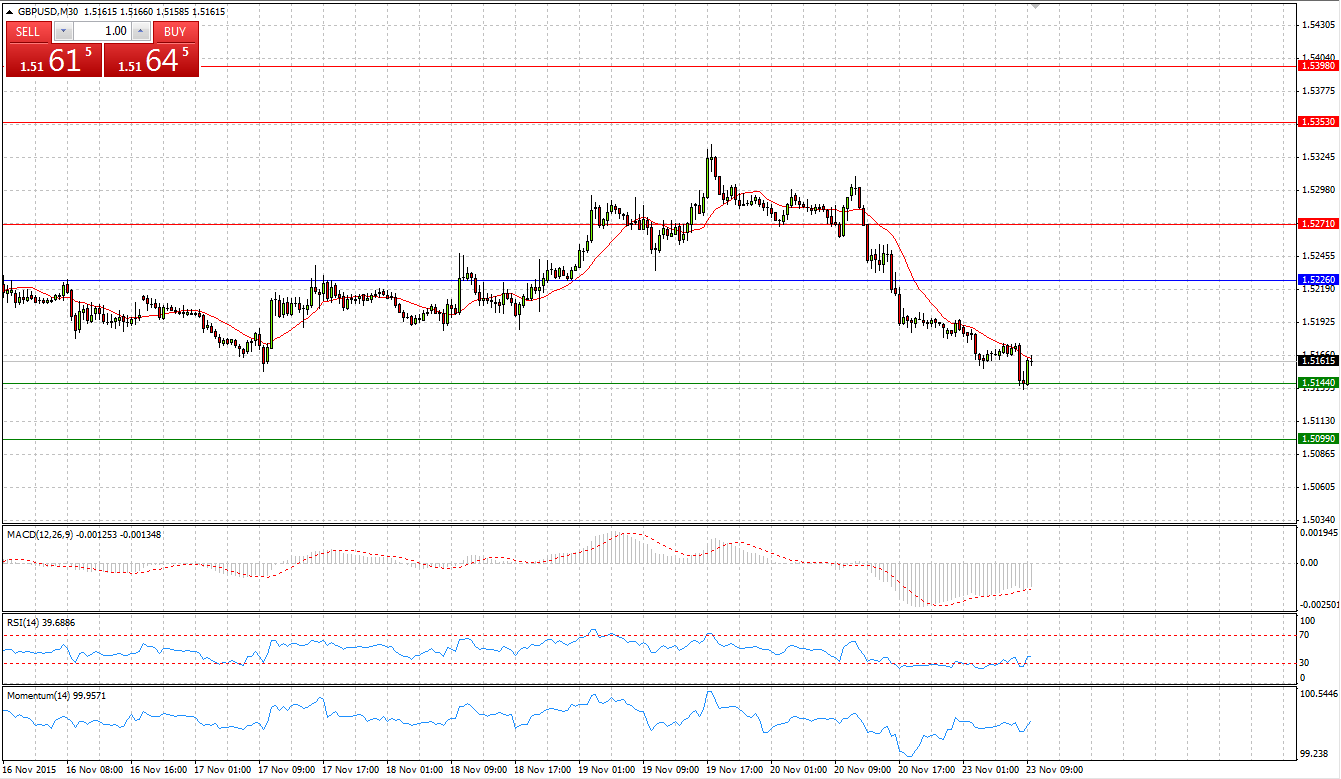

Market Scenario 1: Long positions above 1.5226 with targets at 1.5271 and 1.5353

Market Scenario 2: Short positions below 1.5226 with targets at 1.5144 and 1.5099

Comment: Sterling during Friday’s session lost its positions against US dollar, closing the day with almost 100 pips loss. Today the pair was already sent to test the First Support level, however, the level managed to sustain the pressure.

Supports and Resistances:

R3 1.5398

R2 1.5353

R1 1.5271

PP 1.5226

S1 1.5144

S2 1.5099

S3 1.5017

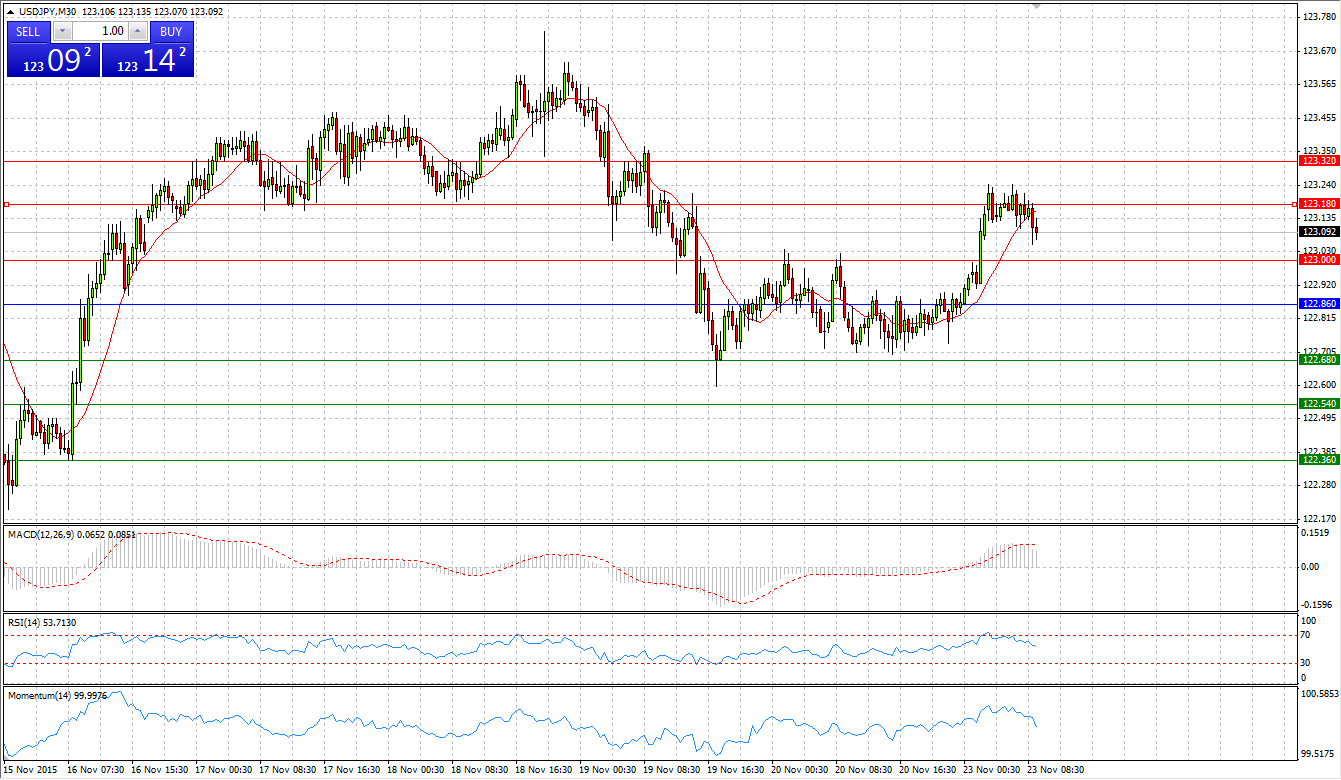

Market Scenario 1: Long positions above 122.86 with targets at 123.00 and 123.18

Market Scenario 2: Short positions below 122.86 with targets at 122.68 and 122.54

Comment: US dollar is trading positively against Japanese yen, having managed to break through the First Resistance level and tested the Second one.

Supports and Resistances:

R3 123.32

R2 123.18

R1 123.00

PP 122.86

S1 122.68

S2 122.54

S3 122.36

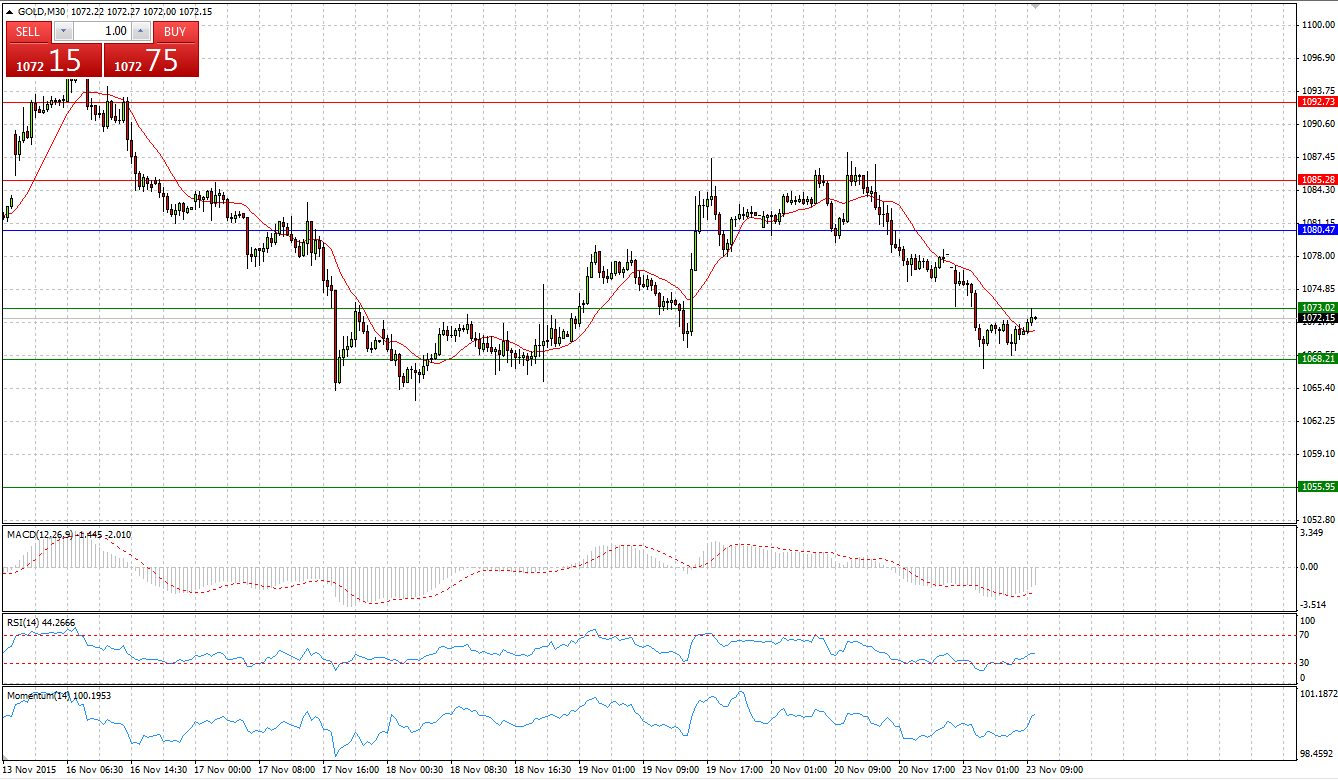

GOLD

Market Scenario 1: Long positions above 1080.47 with targets at 1085.28 and 1092.73

Market Scenario 2: Short positions below 1080.47 with targets at 1073.02 and 1068.21

Comment: Gold continues trading close to its lows against US dollar. During today’s session, bears sent the gold below the First Support level and tested the second one. If bears manages to break through the second support level, gold may reached a new low at the 3rd Support level at 1055.95

Supports and Resistances:

R3 1104.99

R2 1092.73

R1 1085.28

PP 1080.47

S1 1073.02

S2 1068.21

S3 1055.95

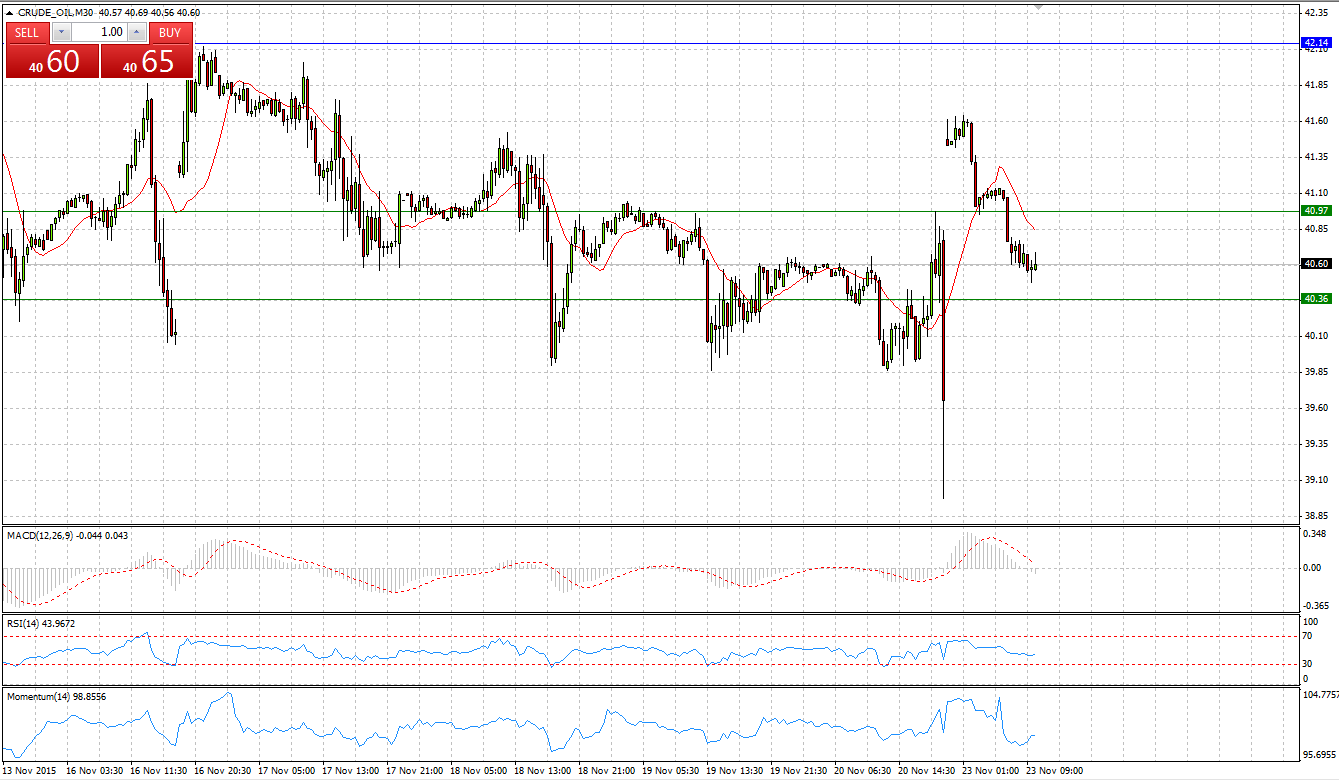

CRUDE OIL

Market Scenario 1: Long positions above 39.87 with targets at 40.76 and 41.86

Market Scenario 2: Short positions below 39.87 with targets at 38.77 and 37.88

Comment: Crude oil during Friday’s session reached its lowest level at 38.98 since 27th of August. At the opening of today’s session, crude experienced a positive gap, opened at 41.47; however, bears almost immediately took the control back and currently crude is trading below 41 US dollar a barrel.

Supports and Resistances:

R3 43.85

R2 41.86

R1 40.76

PP 39.87

S1 38.77

S2 37.88

S3 35.89

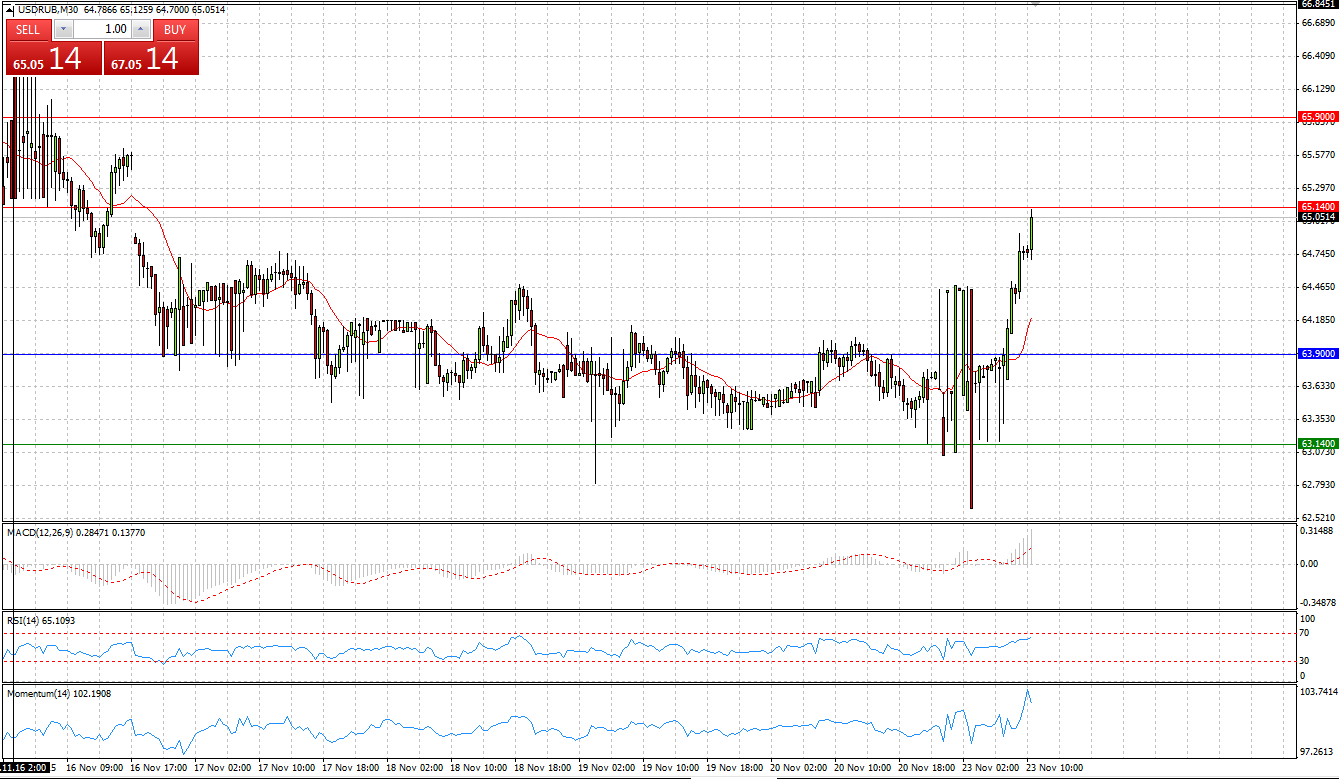

USD/RUB

Market Scenario 1: Long positions above 63.64 with targets at 64.14 and 64.54

Market Scenario 2: Short positions below 63.64 with targets at 63.24 and 62.74

Comment: US dollar continues appreciating against Russian ruble amid slump of commodity prices. Today USD/RUB reached a new high at 65.12, which is close to the First Resistance level.

Supports and Resistances:

R3 65.44

R2 64.54

R1 64.14

PP 63.64

S1 63.24

S2 62.74

S3 61.84