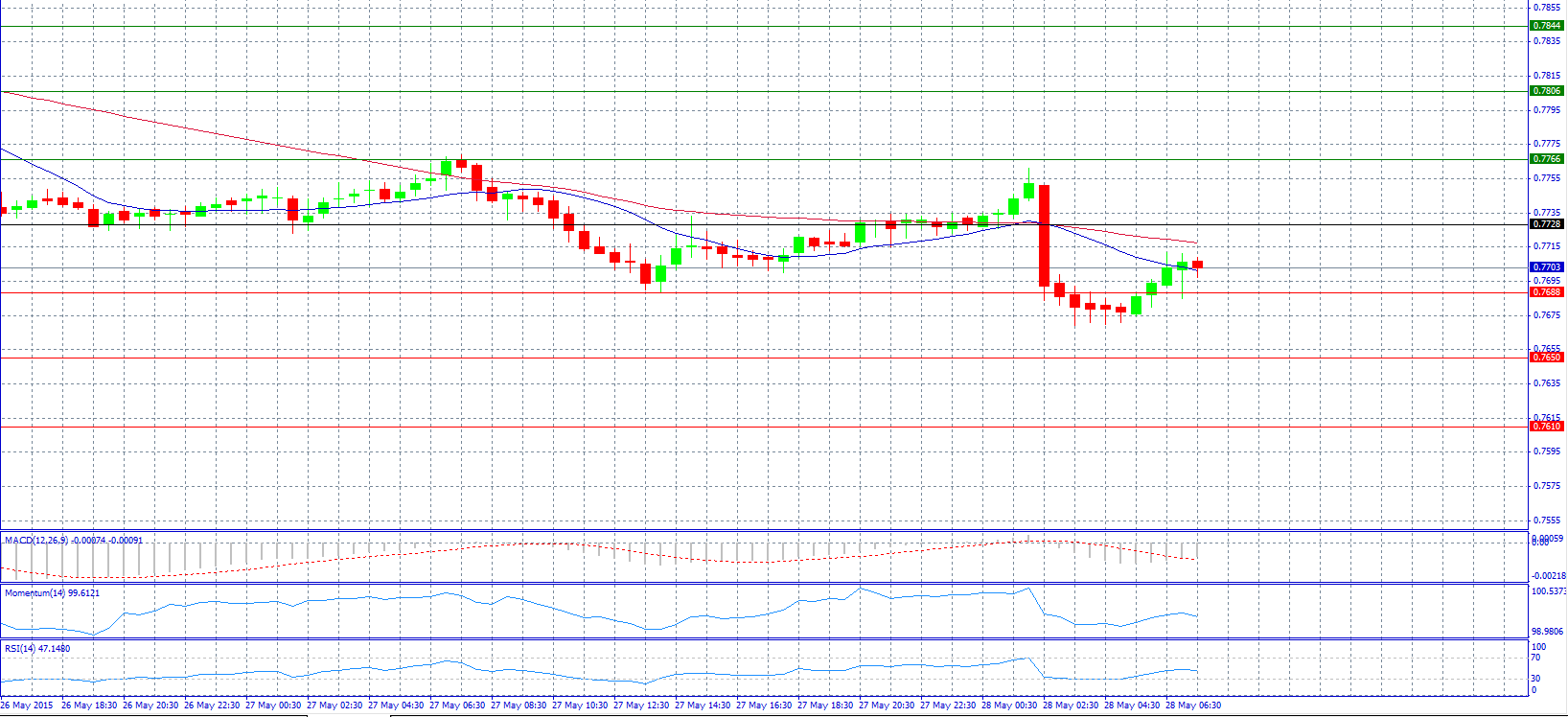

Market Scenario 1: Long positions above 0.7728 with target at 0.7766.

Market Scenario 2: Short positions below 0.7688 with target at 0.7650.

Comment: The pair recovers above 0.7700 level.

Supports and Resistances:

R3 0.7844

R2 0.7806

R1 0.7766

PP 0.7728

S1 0.7688

S2 0.7650

S3 0.7610

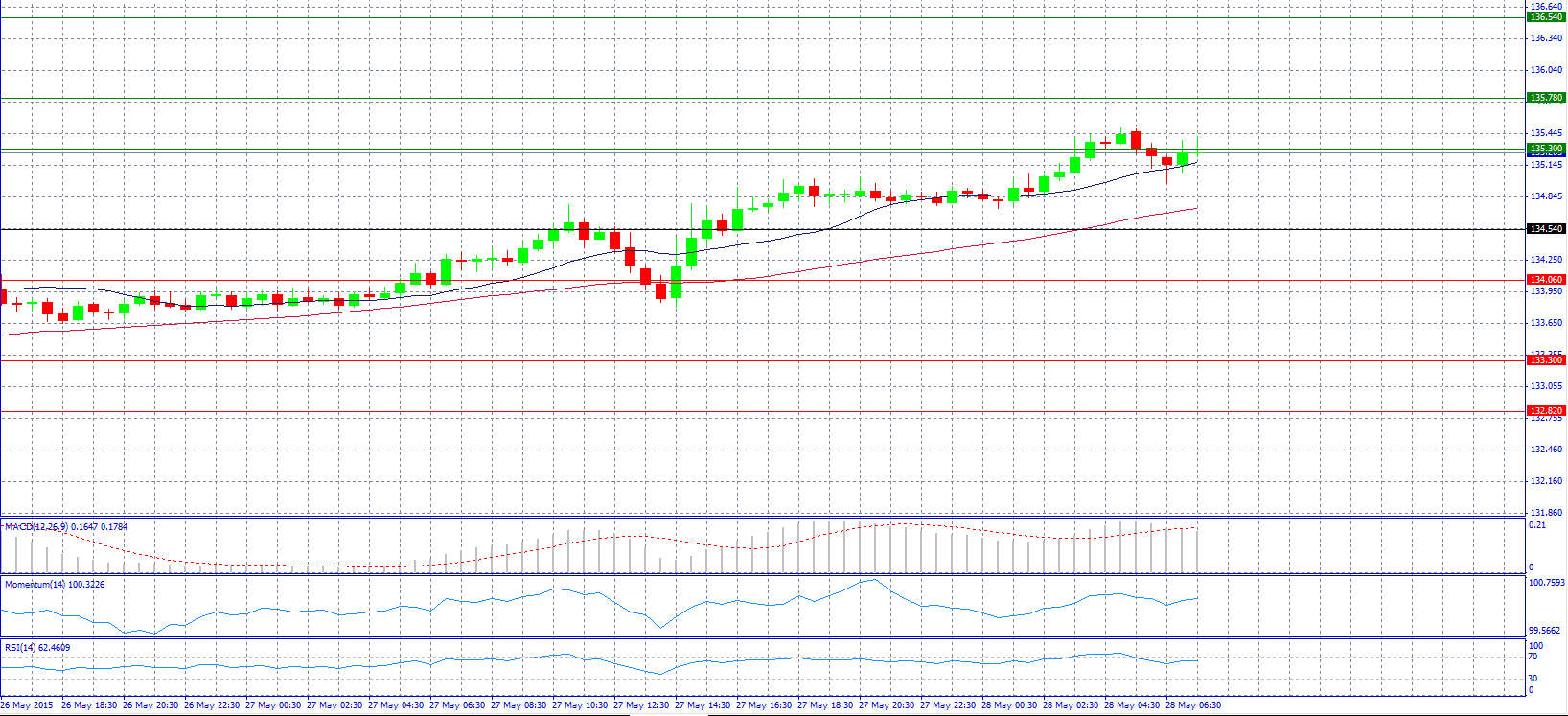

Market Scenario 1: Long positions above 135.30 with target at 135.78.

Market Scenario 2: Short positions below 135.30 with target at 134.54.

Comment: The pair advanced and makes attempts to break resistance level 135.30.

Supports and Resistances:

R3 136.54

R2 135.78

R1 135.30

PP 134.54

S1 134.06

S2 133.30

S3 132.82

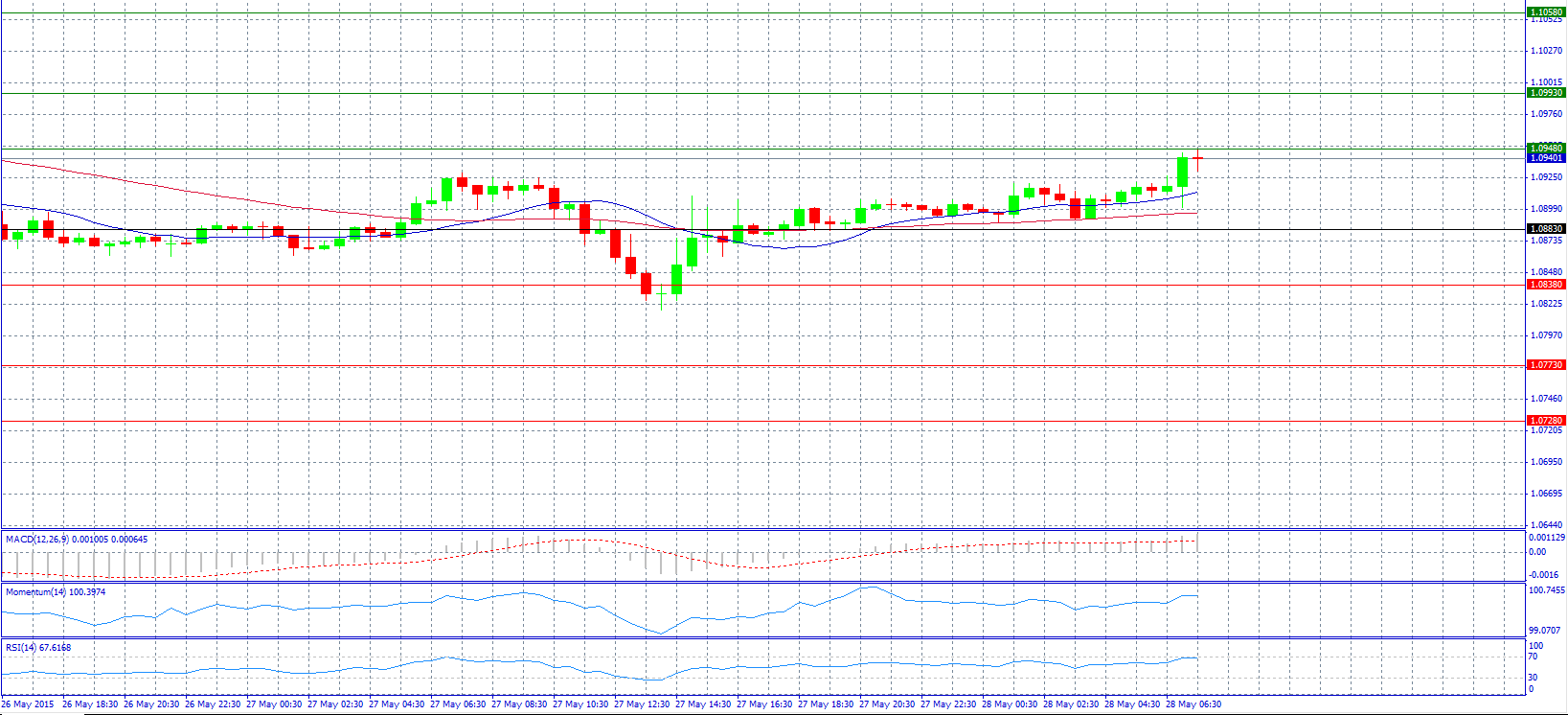

Market Scenario 1: Long positions above 1.0948 with target at 1.0993.

Market Scenario 2: Short positions below 1.0948 with target at 1.0883.

Comment: The pair rose near 1.0940 level.

Supports and Resistances:

R3 1.1058

R2 1.0993

R1 1.0948

PP 1.0883

S1 1.0838

S2 1.0773

S3 1.0728

Market Scenario 1: Long positions above 190.41 with target at 190.93.

Market Scenario 2: Short positions below 189.81 with target at 189.29.

Comment: The pair weakened and dropped to 190.00 level.

Supports and Resistances:

R3 191.53

R2 190.93

R1 190.41

PP 189.81

S1 189.29

S2 188.69

S3 188.17

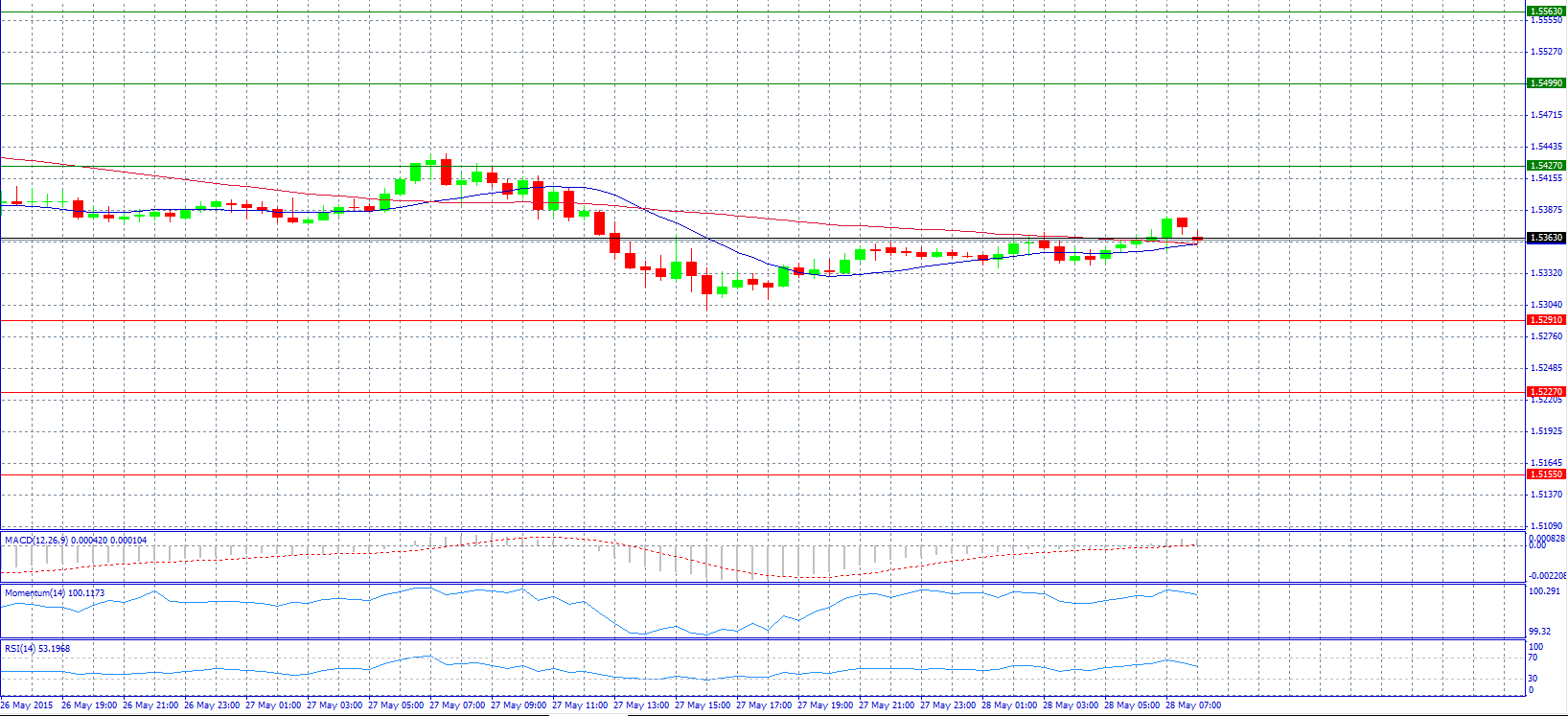

Market Scenario 1: Long positions above 1.5363 with target at 1.5427.

Market Scenario 2: Short positions below 1.5363 with target at 1.5291.

Comment: The pair tried several times to surpass pivot point 1.5363 and stay above it, but failed.

Supports and Resistances:

R3 1.5563

R2 1.5499

R1 1.5427

PP 1.5363

S1 1.5291

S2 1.5227

S3 1.5155

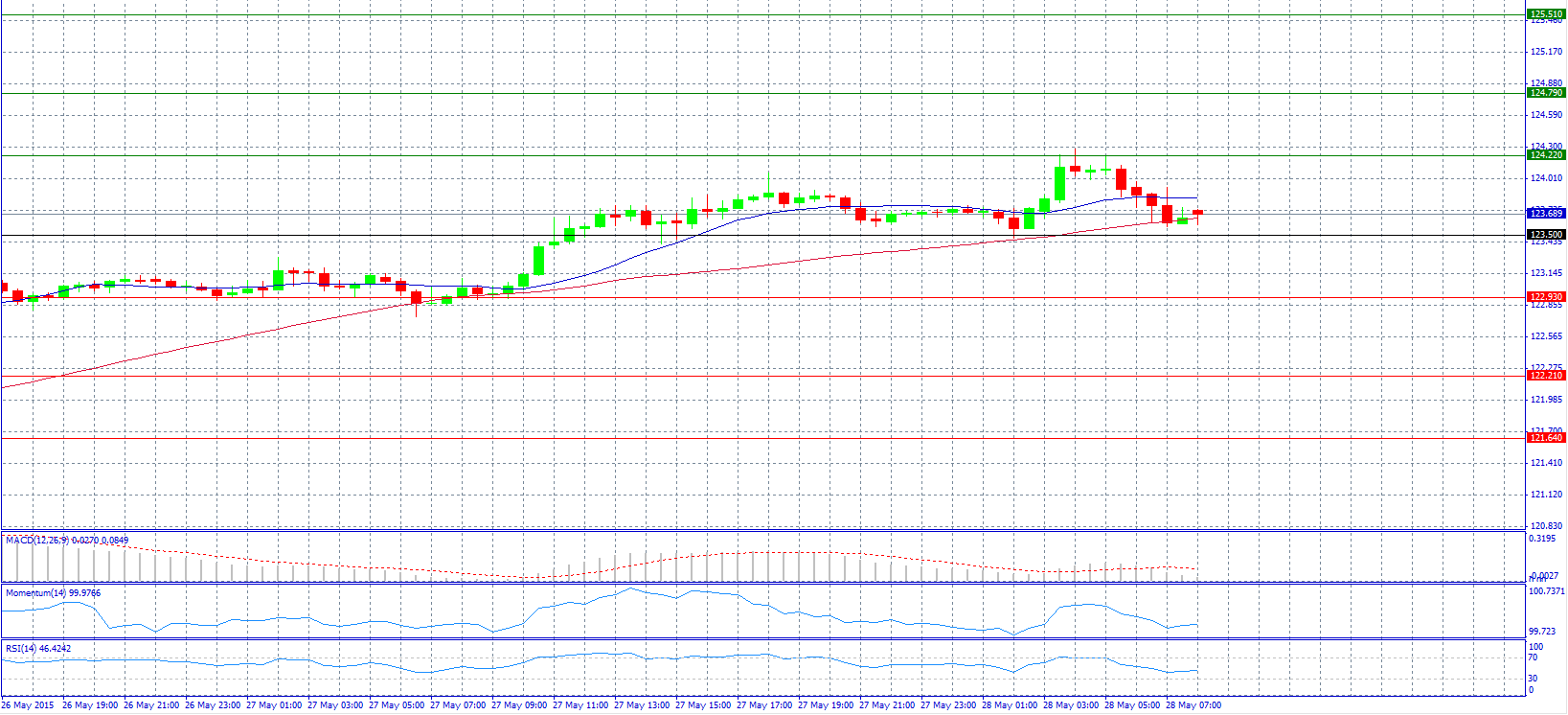

Market Scenario 1: Long positions above 124.22 with target at 124.79.

Market Scenario 2: Short positions below 123.50 with target at 122.93.

Comment: The pair rejected 124.30 and fell near to 123.70.

Supports and Resistances:

R3 125.51

R2 124.79

R1 124.22

PP 123.50

S1 122.93

S2 122.21

S3 121.64

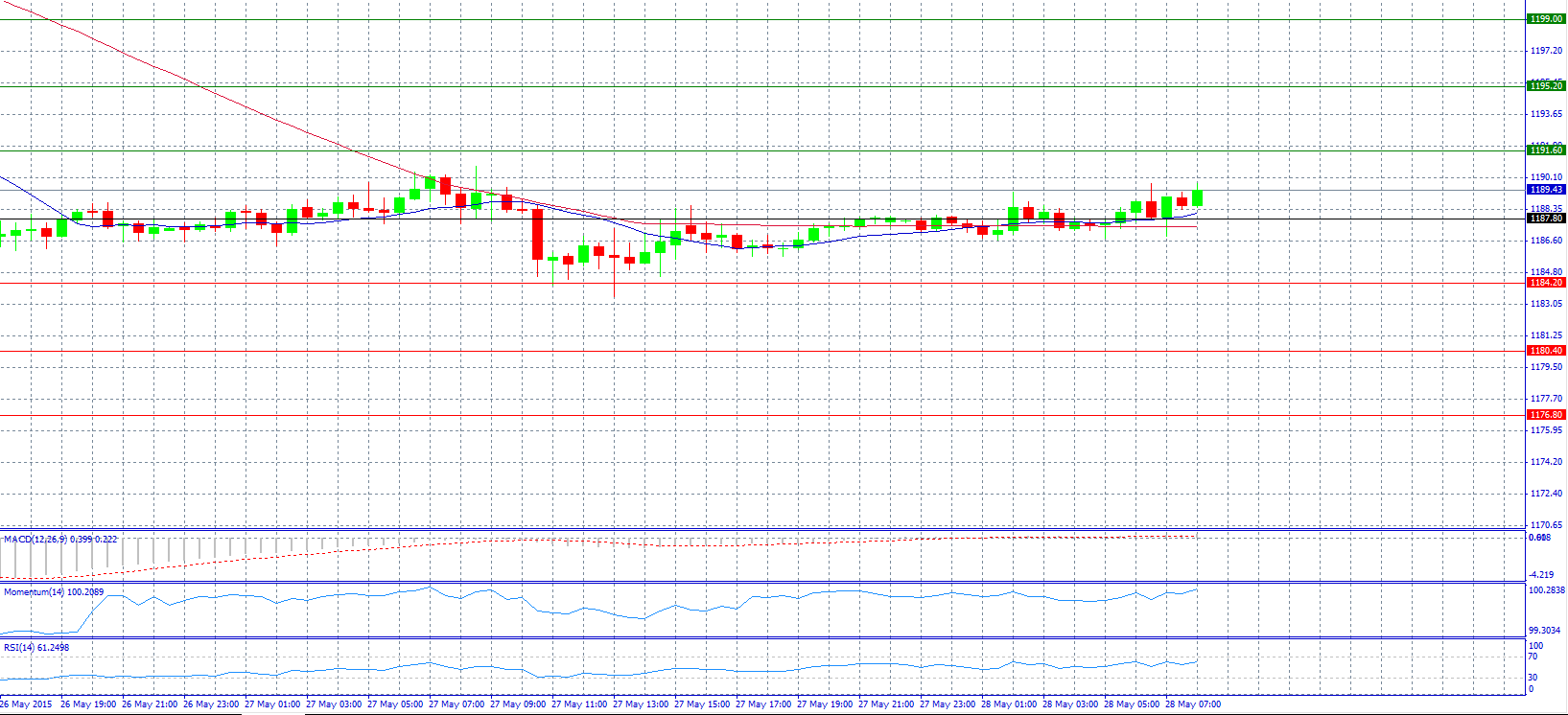

Market Scenario 1: Long positions above 1191.60 with target at 1195.20.

Market Scenario 2: Short positions below 1187.80 with target at 1184.20.

Comment: Gold prices trade steady, but still remain near 2-week low.

Supports and Resistances:

R3 1199.00

R2 1195.20

R1 1191.60

PP 1187.80

S1 1184.20

S2 1180.40

S3 1176.80

Market Scenario 1: Long positions above 57.99 with target at 58.61.

Market Scenario 2: Short positions below 57.99 with target at 57.02.

Comment: Crude oil prices broke downward after spending much of May in consolidation mode.

Supports and Resistances:

R3 60.20

R2 59.58

R1 58.61

PP 57.99

S1 57.02

S2 56.40

S3 55.43

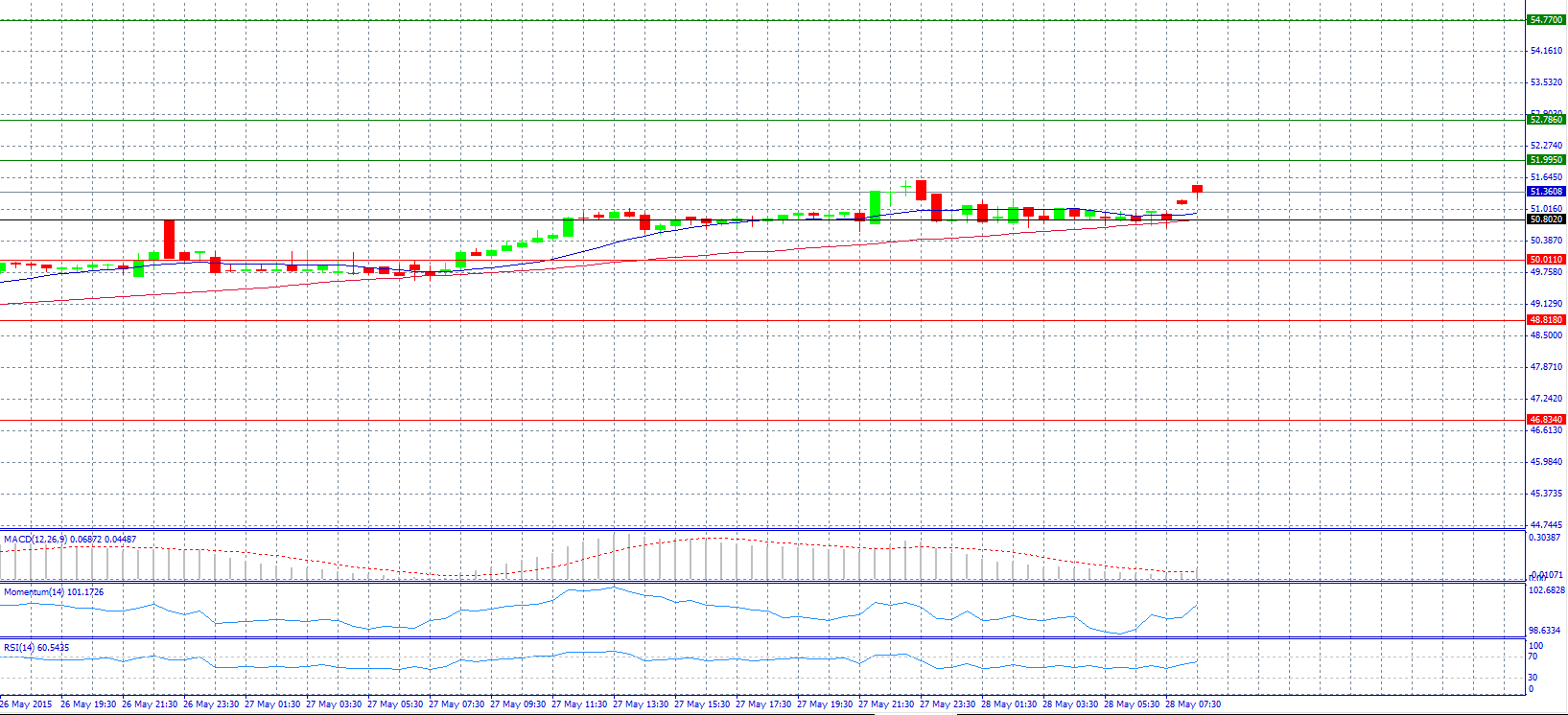

Market Scenario 1: Long positions above 51.995 with target at 52.786.

Market Scenario 2: Short positions below 50.802 with target at 50.011.

Comment: The pair rose slightly above 51.300 level.

Supports and Resistances:

R3 54.770

R2 52.786

R1 51.995

PP 50.802

S1 50.011

S2 48.818

S3 46.834