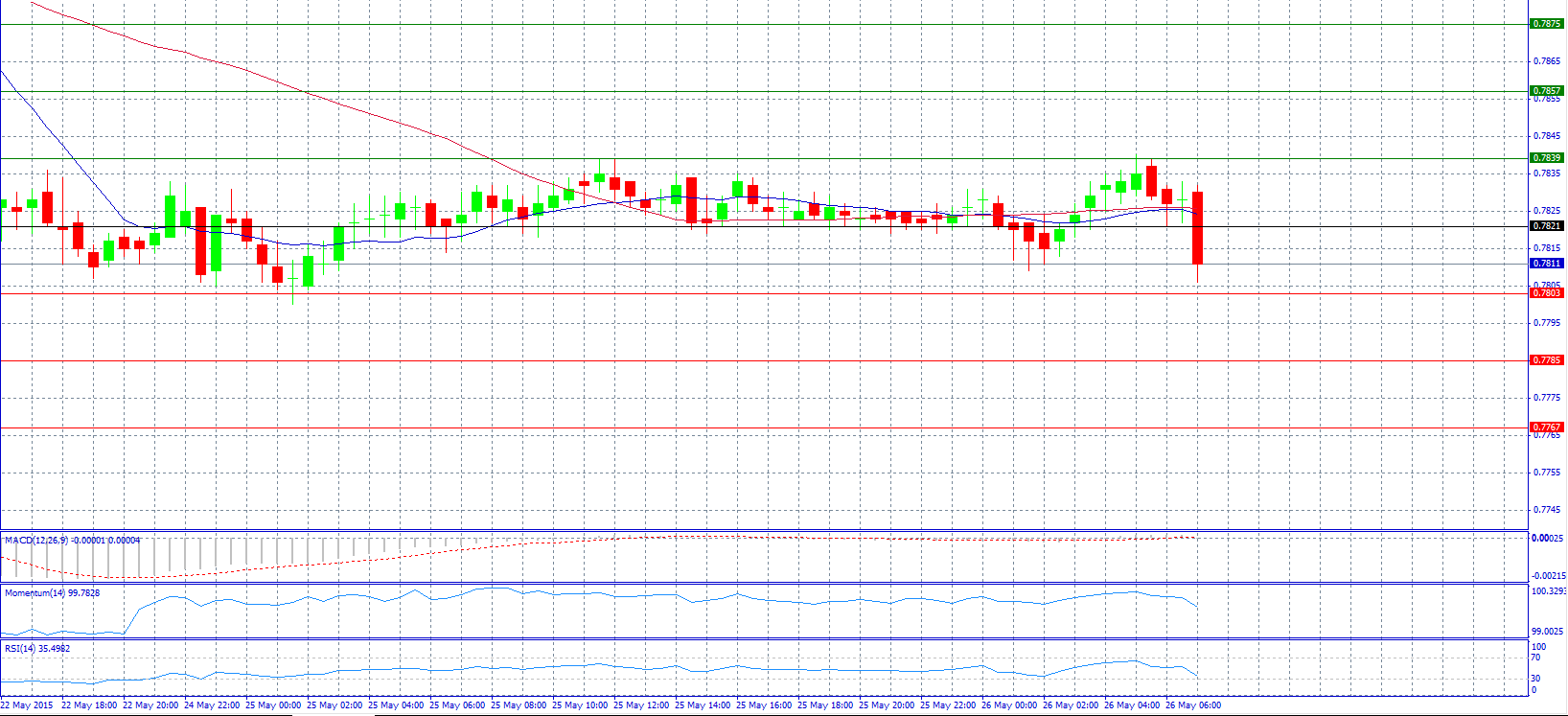

Market Scenario 1: Long positions above 0.7821 with target at 0.7857.

Market Scenario 2: Short positions below 0.7803 with target at 0.7767.

Comment: The pair risks unwinding of short positions, but a rebound in US data ahead might fuel further weakness in the pair.

Supports and Resistances:

R3 0.7875

R2 0.7857

R1 0.7839

PP 0.7821

S1 0.7803

S2 0.7785

S3 0.7767

Market Scenario 1: Long positions above 133.74 with target at 134.32.

Market Scenario 2: Short positions below 133.49 with target at 132.91.

Comment: The pair jumped and found resistance at 133.74.

Supports and Resistances:

R3 134.32

R2 134.07

R1 133.74

PP 133.49

S1 133.16

S2 132.91

S3 132.58

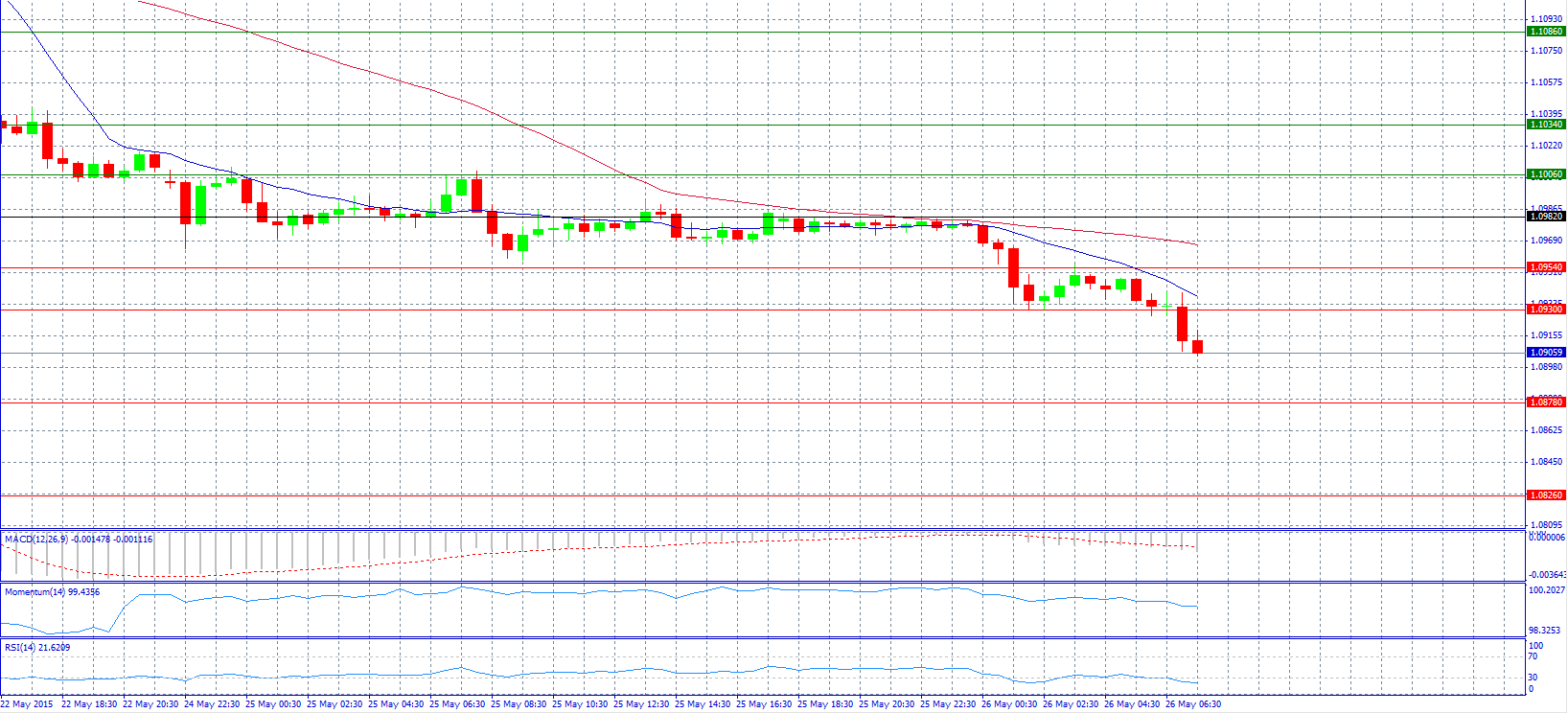

Market Scenario 1: Long positions above 1.0930 with target at 1.0982.

Market Scenario 2: Short positions below 1.0878 with target at 1.0826.

Comment: The pair is expected to drop below 1.0900 and might reach 1.0846, according to analysts.

Supports and Resistances:

R3 1.1086

R2 1.1034

R1 1.1006

PP 1.0982

S1 1.0954

S2 1.0930

S3 1.0878

S4 1.0826

Market Scenario 1: Long positions above 188.93 with target at 189.74.

Market Scenario 2: Short positions below 188.50 with target at 188.12.

Comment: The pair advanced and now faces resistance level 188.93.

Supports and Resistances:

R4 190.55

R3 189.74

R2 188.93

R1 188.50

PP 188.12

S1 187.69

S2 187.31

S3 186.51

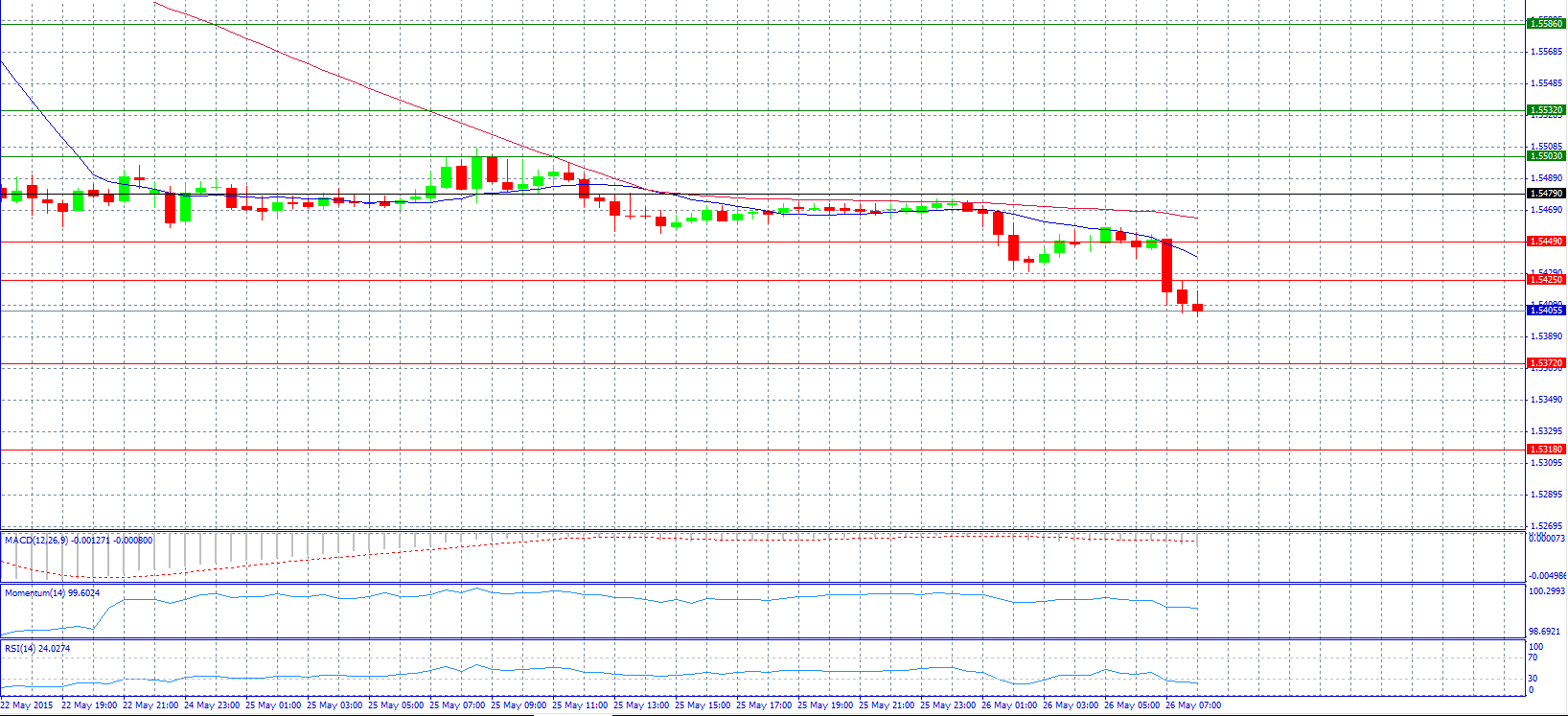

Market Scenario 1: Long positions above 1.5425 with target at 1.5479.

Market Scenario 2: Short positions below 1.5372 with target at 1.5318.

Comment: The pair’s weakness is probably leading it to break below 1.5400 level.

Supports and Resistances:

R3 1.5586

R2 1.5532

R1 1.5503

PP 1.5479

S1 1.5449

S2 1.5425

S3 1.5372

S4 1.5318

Market Scenario 1: Long positions above 122.29 with target at 122.64.

Market Scenario 2: Short positions below 122.29 with target at 121.93.

Comment: The pair rose higher near to 122.60 as fresh bids entered once the pair breached the March 2015 high of 122.00.

Supports and Resistances:

R4 122.64

R3 122.29

R2 121.93

R1 121.74

PP 121.58

S1 121.39

S2 121.22

S3 120.87

Market Scenario 1: Long positions above 1199.69 with target at 1203.24.

Market Scenario 2: Short positions below 1193.20 with target at 1186.71.

Comment: Gold prices go back under 1200.00 level as dollar strength weighs.

Supports and Resistances:

R3 1219.16

R2 1212.67

R1 1209.73

PP 1206.18

S1 1203.24

S2 1199.69

S3 1193.20

S4 1186.71

Market Scenario 1: Long positions above 59.72 with target at 60.35.

Market Scenario 2: Short positions below 59.20 with target at 58.57.

Comment: Crude oil markets were supported by a reported decline in U.S. production and crude oil inventories last week, but prices failed to re-test the highs set earlier in the month, analysts said.

Supports and Resistances:

R3 61.50

R2 60.87

R1 60.35

PP 59.72

S1 59.20

S2 58.57

S3 58.05

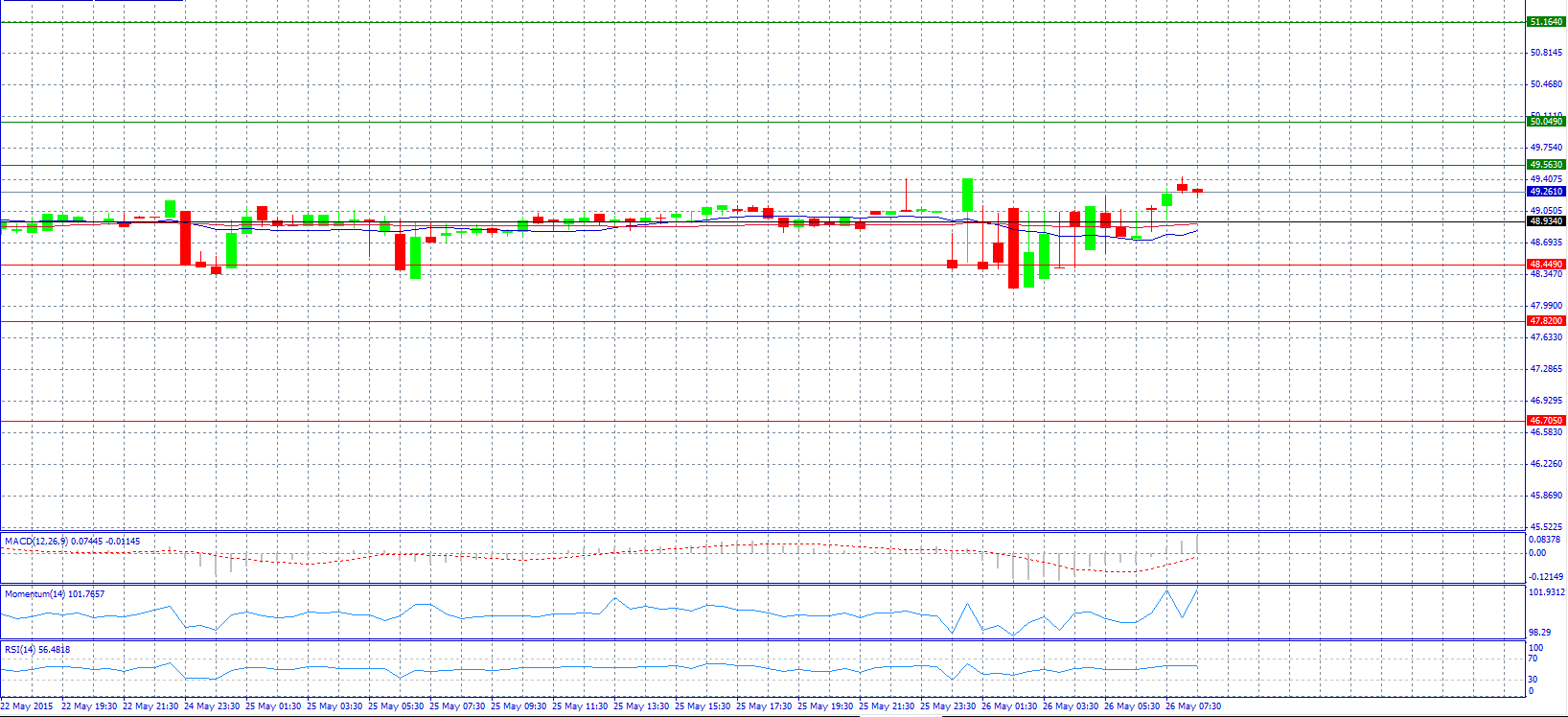

Market Scenario 1: Long positions above 49.563 with target at 50.049.

Market Scenario 2: Short positions below 48.934 with target at 48.449.

Comment: The pair advanced and trades above 49.200 level.

Supports and Resistances:

R3 51.164

R2 50.049

R1 49.563

PP 48.934

S1 48.449

S2 47.820

S3 46.705