Market Scenario 1: Long positions above 0.7857 with target at 0.7904.

Market Scenario 2: Short positions below 0.7783 with target at 0.7736.

Comment: The pair remains oversold, which suggests that the downside for the pair might be limited today.

Supports and Resistances:

R3 0.8025

R2 0.7978

R1 0.7904

PP 0.7857

S1 0.7783

S2 0.7736

S3 0.7662

Market Scenario 1: Long positions above 134.31 with target at 134.90.

Market Scenario 2: Short positions below 133.29 with target at 132.70.

Comment: The pair falls to fresh 3-week lows on Greek issue.

Supports and Resistances:

R3 136.51

R2 135.92

R1 134.90

PP 134.31

S1 133.29

S2 132.70

S3 131.68

Market Scenario 1: Long positions above 1.1074 with target at 1.1148.

Market Scenario 2: Short positions below 1.0941 with target at 1.0867.

Comment: The pair trades around a crucial level and further declines might be ahead according to analysts.

Supports and Resistances:

R3 1.1355

R2 1.1281

R1 1.1148

PP 1.1074

S1 1.0941

S2 1.0867

S3 1.0734

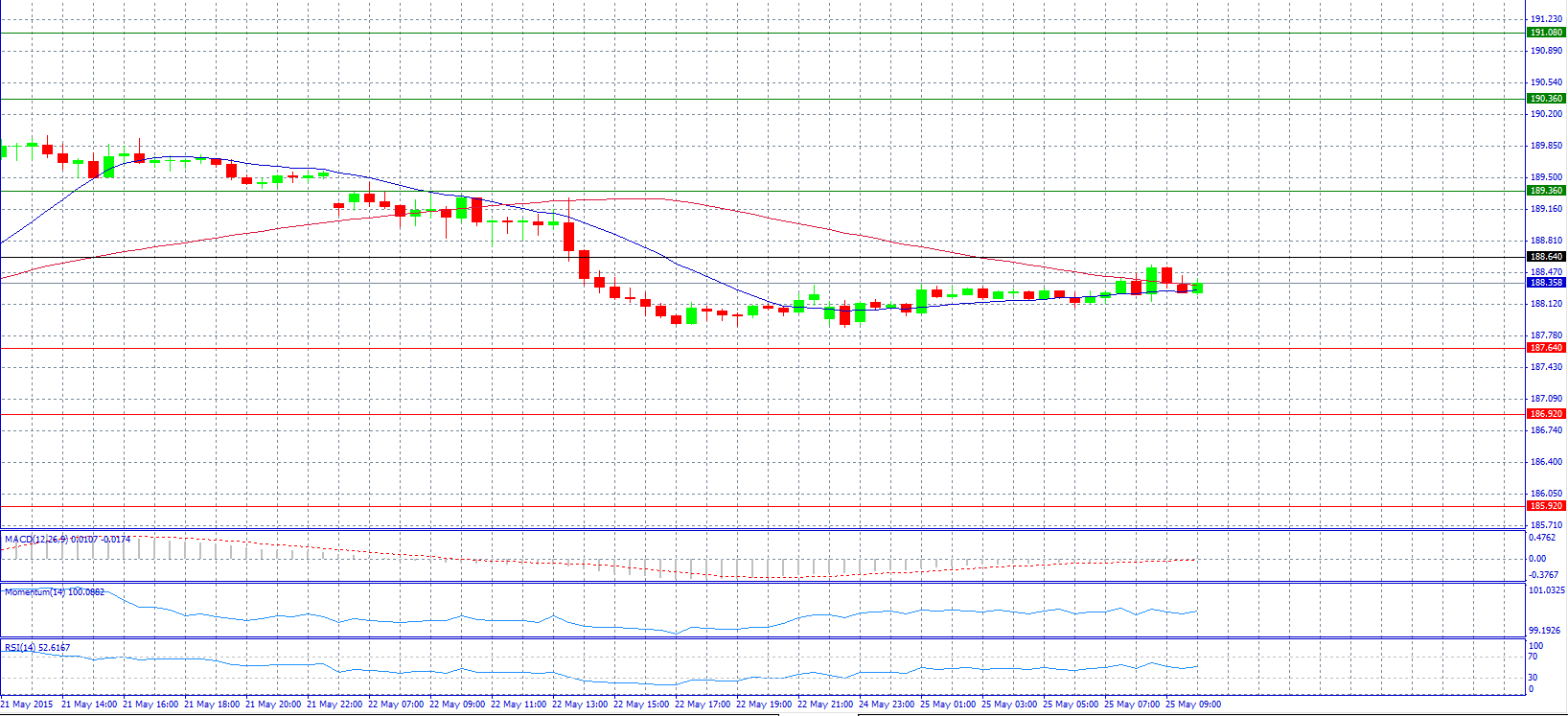

Market Scenario 1: Long positions above 188.64 with target at 189.36.

Market Scenario 2: Short positions below 187.64 with target at 186.92.

Comment: The pair advanced again and gave some gains back.

Supports and Resistances:

R3 191.08

R2 190.36

R1 189.36

PP 188.64

S1 187.64

S2 186.92

S3 185.92

Market Scenario 1: Long positions above 1.5548 with target at 1.5637.

Market Scenario 2: Short positions below 1.5407 with target at 1.5318.

Comment: The pair tried to break 1.5500 level but went back below it.

Supports and Resistances:

R3 1.5867

R2 1.5778

R1 1.5637

PP 1.5548

S1 1.5407

S2 1.5318

S3 1.5177

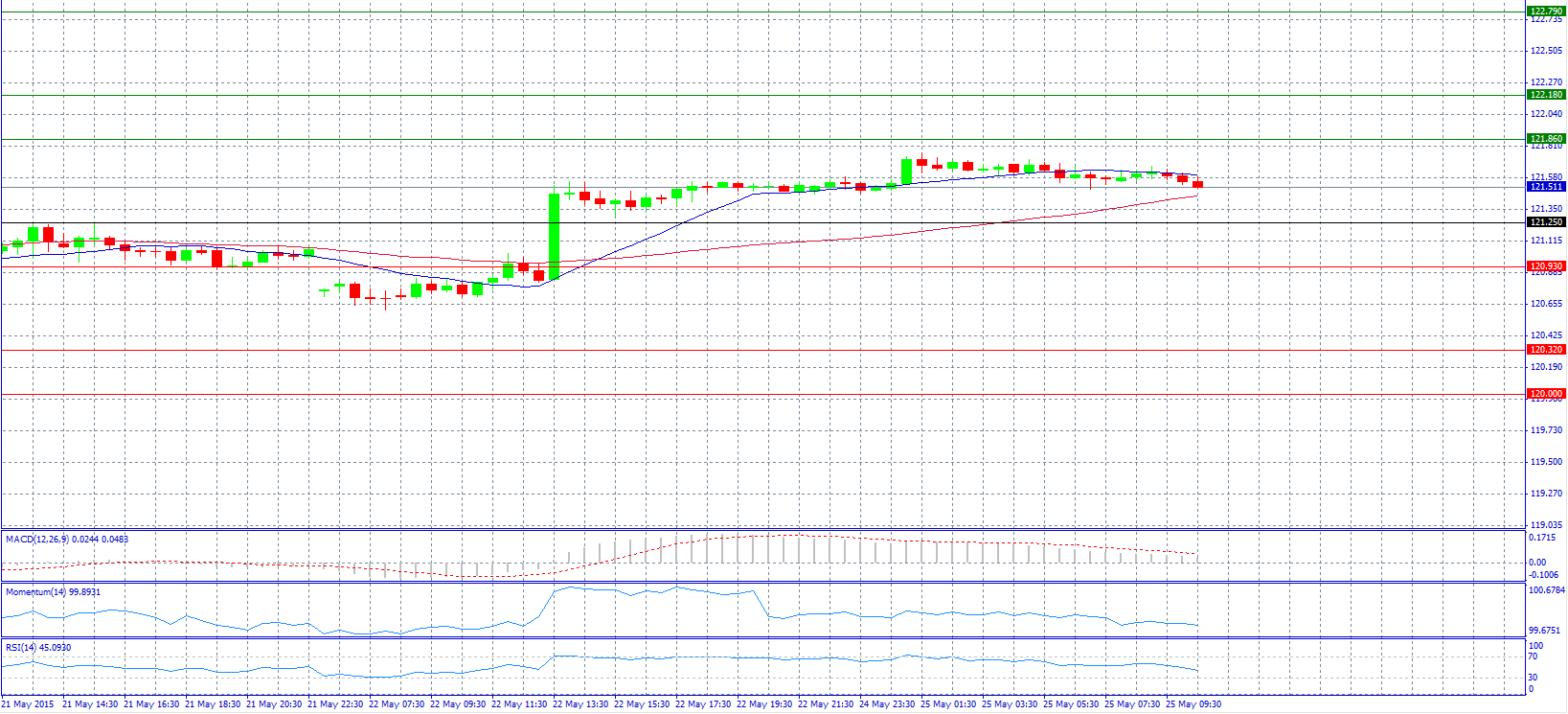

Market Scenario 1: Long positions above 121.86 with target at 122.18.

Market Scenario 2: Short positions below 121.25 with target at 120.93.

Comment: The pair has a bearish tone and trades below 121.50 level.

Supports and Resistances:

R3 122.79

R2 122.18

R1 121.86

PP 121.25

S1 120.93

S2 120.32

S3 120.00

Market Scenario 1: Long positions above 1207.00 with target at 1213.00.

Market Scenario 2: Short positions below 1199.40 with target at 1193.40.

Comment: Gold prices are nearly flat in Asian trade with a stream of recent weak U.S. economic data keeping the precious metal just above a psychological threshold of 1,200 level. Investors expect the U.S. Federal Reserve to increase interest rates only later in the year, which is a positive for gold.

Supports and Resistances:

R3 1226.60

R2 1220.60

R1 1213.00

PP 1207.00

S1 1199.40

S2 1193.40

S3 1185.80

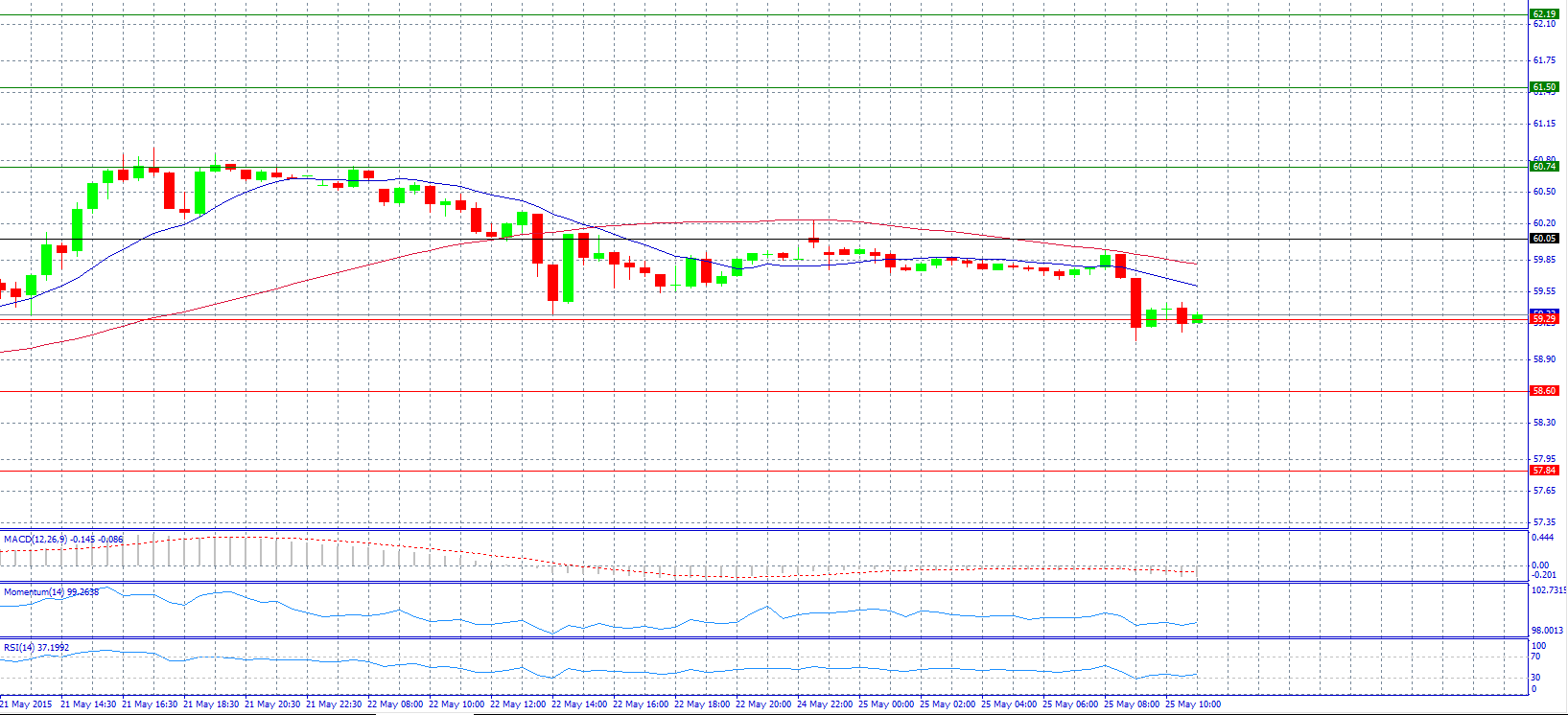

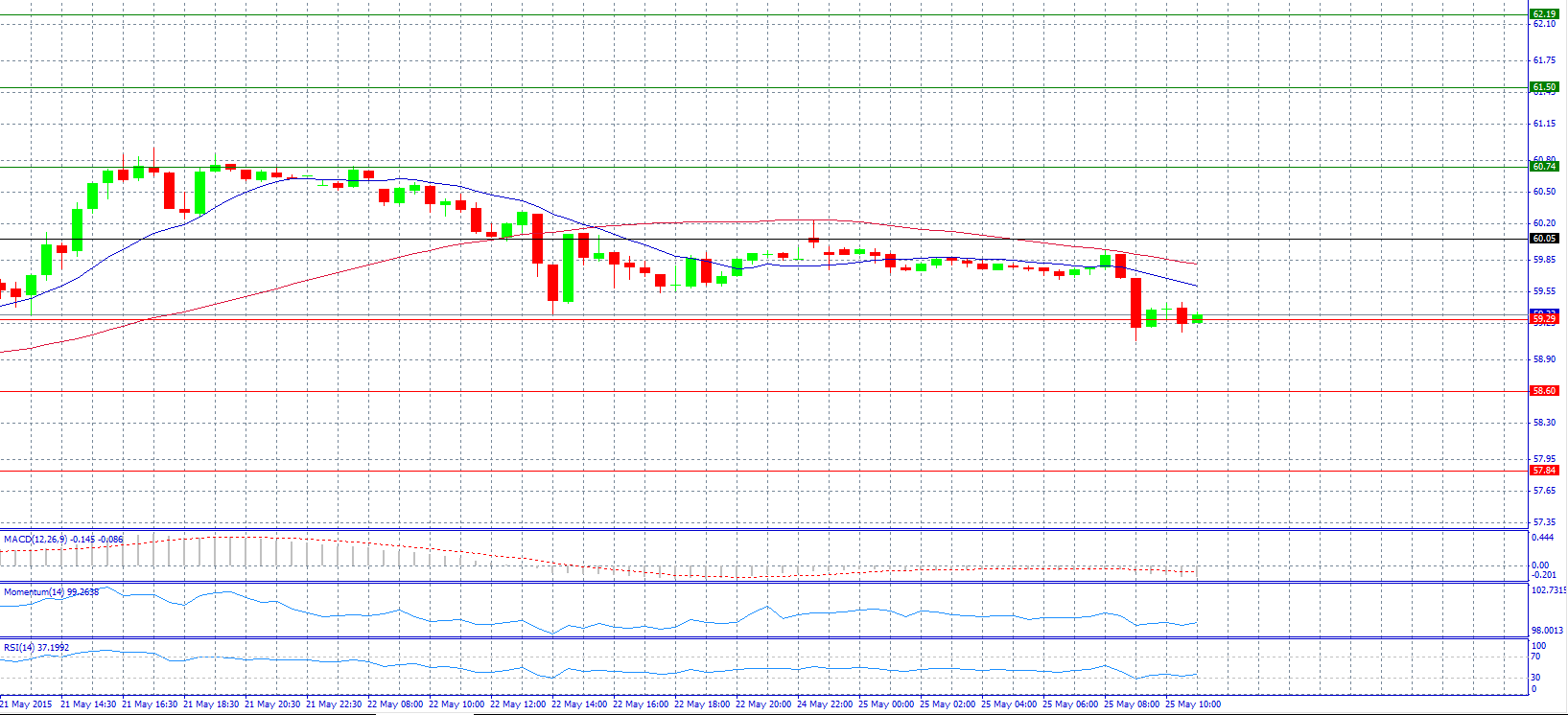

CRUDE OIL

Market Scenario 1: Long positions above 59.29 with target at 60.05.

Market Scenario 2: Short positions below 59.29 with target at 58.60.

Comment: Crude oil prices dropped sharply but found support at 59.29 level.

Supports and Resistances:

R3 62.19

R2 61.50

R1 60.74

PP 60.05

S1 59.29

S2 58.60

S3 57.84

Market Scenario 1: Long positions above 49.187 with target at 49.493.

Market Scenario 2: Short positions below 48.793 with target at 48.487.

Comment: The pair advanced and broke resistance level 48.793.

Supports and Resistances:

R3 50.193

R2 49.493

R1 49.187

PP 48.793

S1 48.487

S2 48.093

S3 47.393