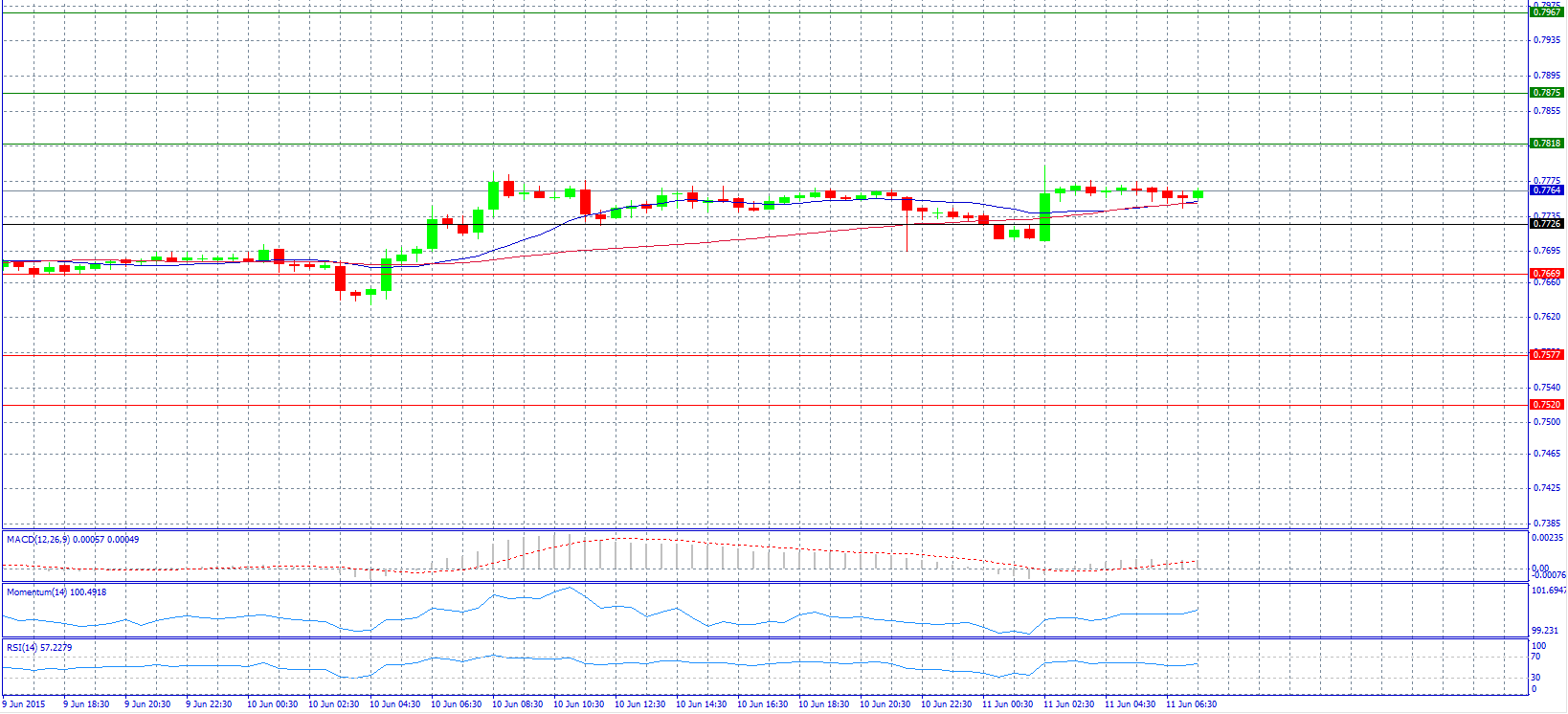

Market Scenario 1: Long positions above 0.7818 with target at 0.7875.

Market Scenario 2: Short positions below 0.7726 with target at 0.7669.

Comment: The pair has a small bearish tone and trades below 0.7770 level, though the Chinese industrial production and consumption ticked up in May.

Supports and Resistances:

R3 0.7967

R2 0.7875

R1 0.7818

PP 0.7726

S1 0.7669

S2 0.7577

S3 0.7520

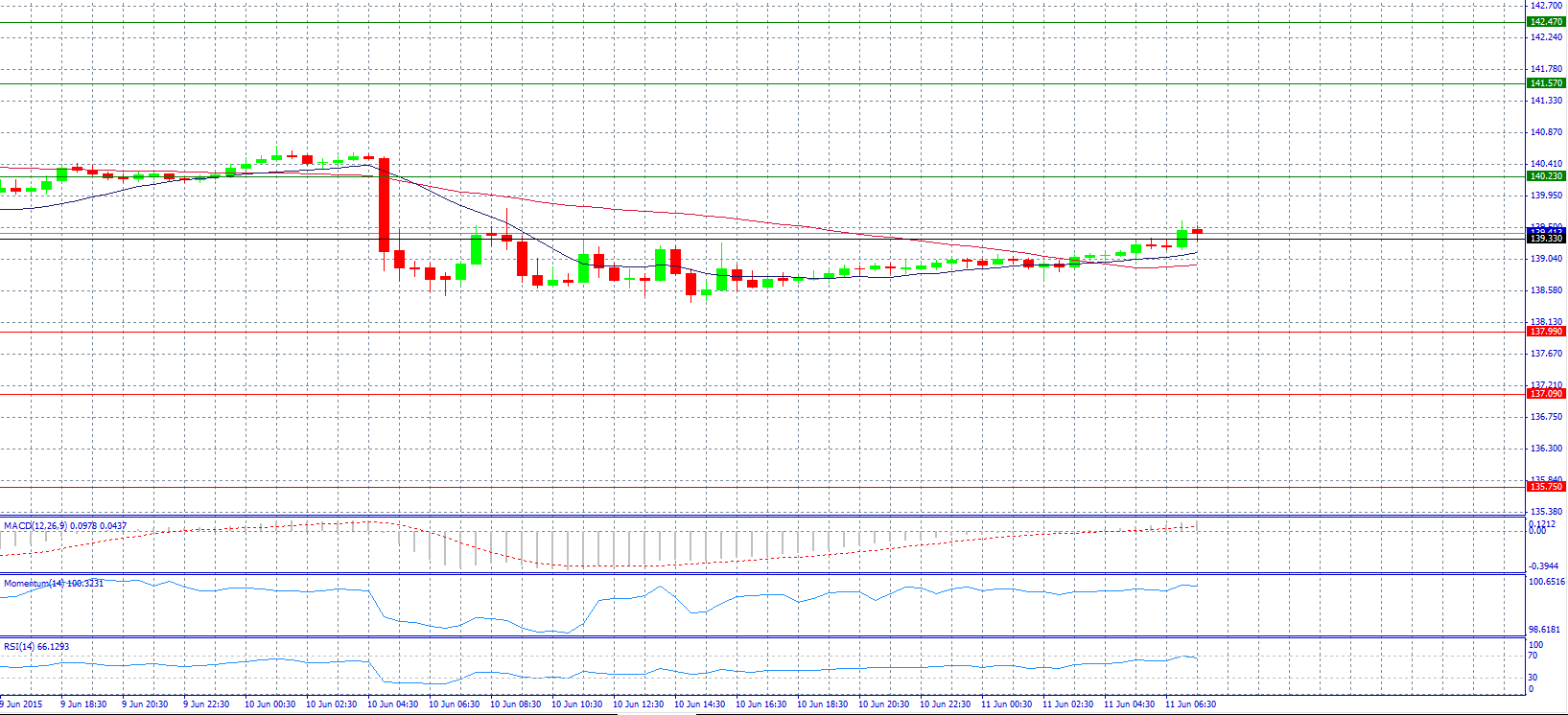

Market Scenario 1: Long positions above 139.33 with target at 140.23.

Market Scenario 2: Short positions below 139.33 with target at 137.99.

Comment: The pair trades neutral near pivot point 139.33.

Supports and Resistances:

R3 142.47

R2 141.57

R1 140.23

PP 139.33

S1 137.99

S2 137.09

S3 135.75

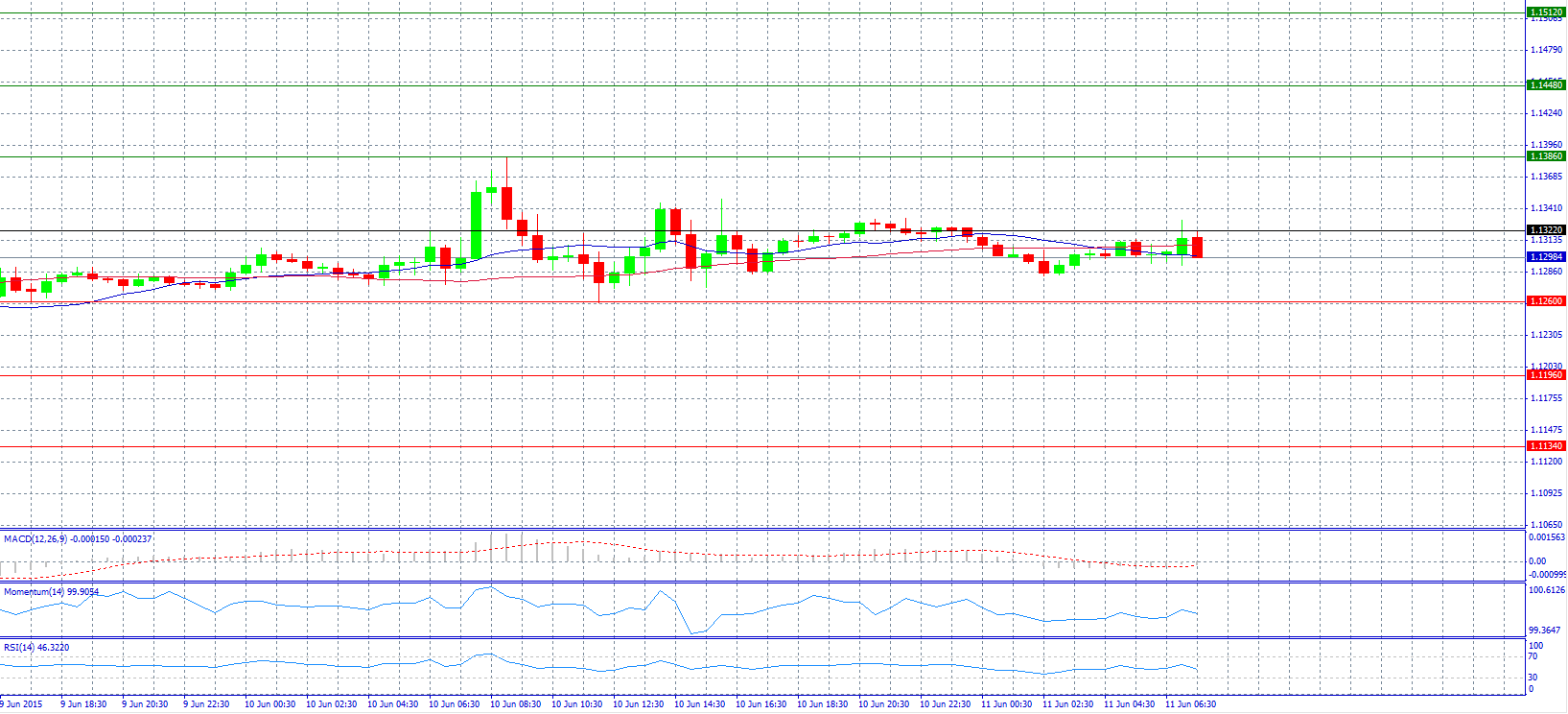

Market Scenario 1: Long positions above 1.1322 with target at 1.1386.

Market Scenario 2: Short positions below 1.1322 with target at 1.1266.

Comment: The pair couldn’t break the resistance level on pivot point 1.1322 and retraced.

Supports and Resistances:

R3 1.1512

R2 1.1448

R1 1.1386

PP 1.1322

S1 1.1260

S2 1.1196

S3 1.1134

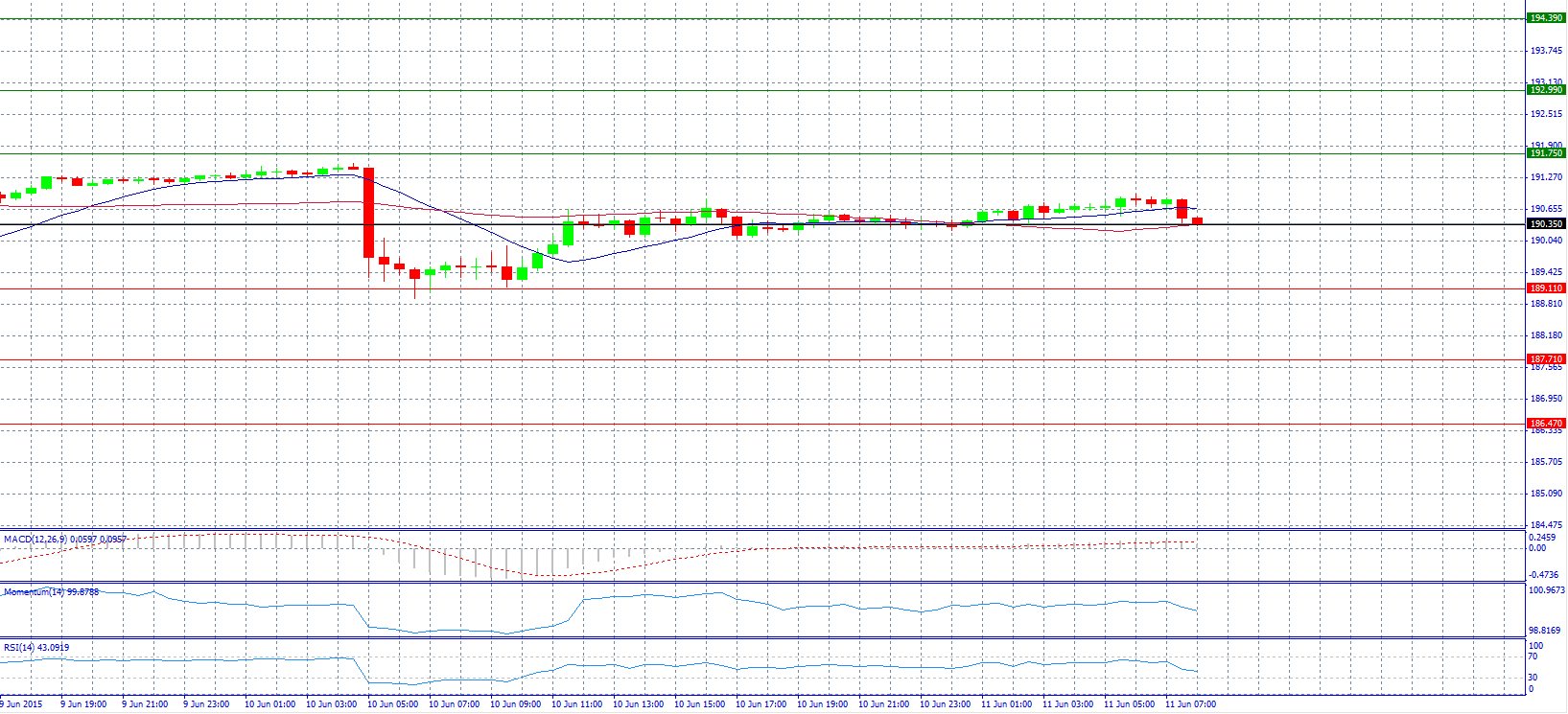

Market Scenario 1: Long positions above 190.35 with target at 191.75.

Market Scenario 2: Short positions below 190.35 with target at 189.11.

Comment: The pair weakened and went back to pivot point 190.35.

Supports and Resistances:

R3 194.39

R2 192.99

R1 191.75

PP 190.35

S1 189.11

S2 187.71

S3 186.47

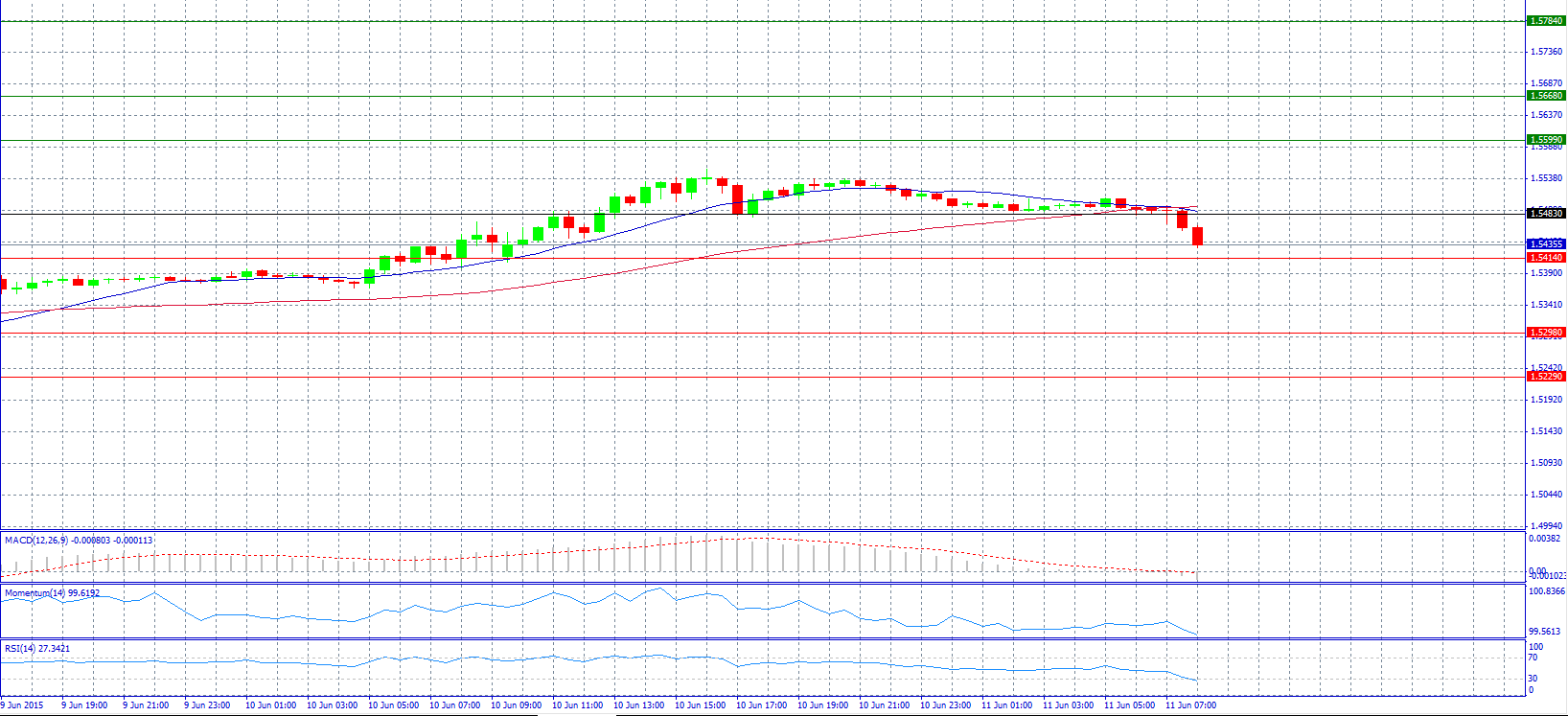

Market Scenario 1: Long positions above 1.5483 with target at 1.5599.

Market Scenario 2: Short positions below 1.5414 with target at 1.5298.

Comment: The pair has a downside pressure and currently trades below 1.5440 level.

Supports and Resistances:

R3 1.5784

R2 1.5668

R1 1.5599

PP 1.5483

S1 1.5414

S2 1.5298

S3 1.5229

Market Scenario 1: Long positions above 123.24 with target at 124.04.

Market Scenario 2: Short positions below 123.24 with target at 121.88.

Comment: The pair is expected to consolidate in the 122-125 range, according to analysts.

Supports and Resistances:

R3 126.20

R2 125.40

R1 124.04

PP 123.24

S1 121.88

S2 121.08

S3 119.72

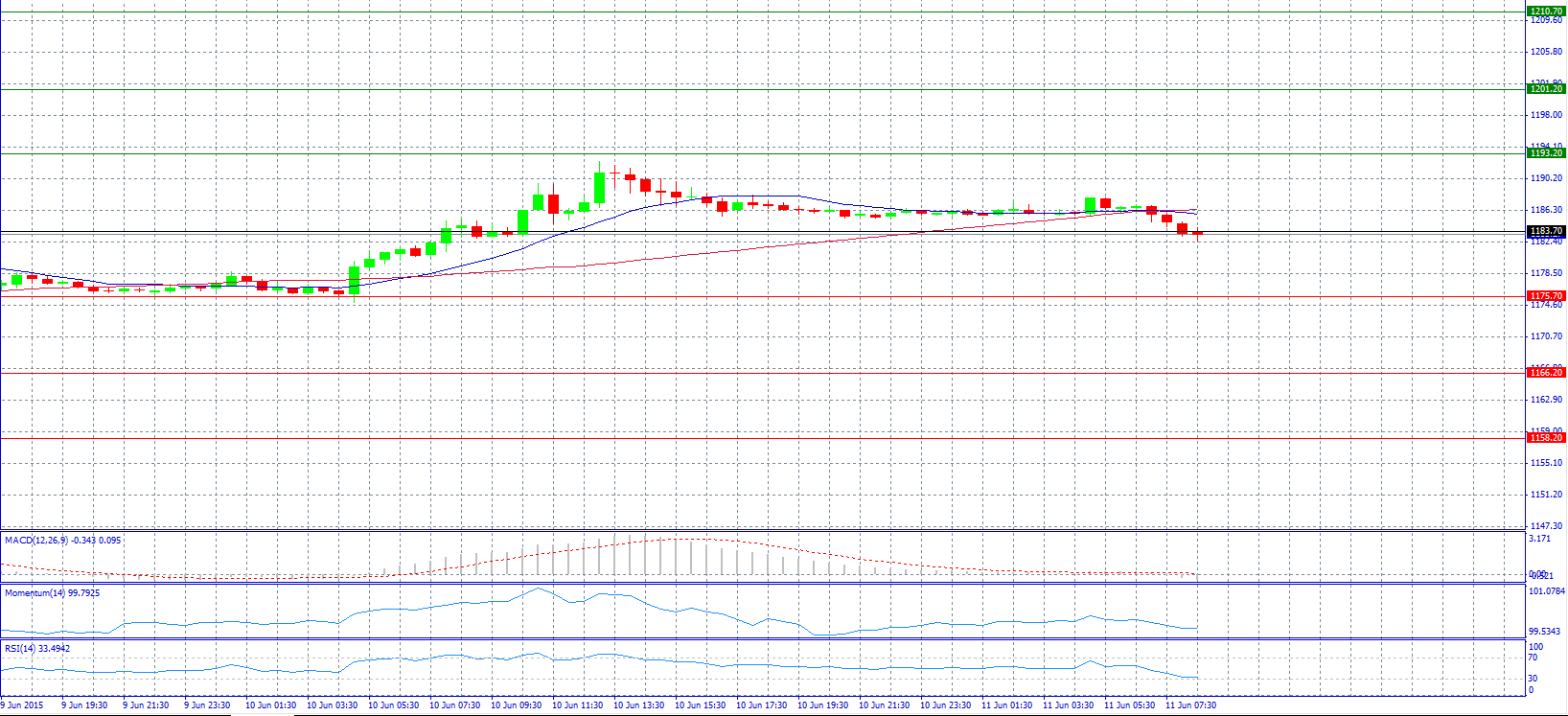

Market Scenario 1: Long positions above 1183.70 with target at 1193.20.

Market Scenario 2: Short positions below 1183.70 with target at 1175.70.

Comment: Gold prices fell and are testing support level at pivot point 1183.70.

Supports and Resistances:

R3 1210.70

R2 1201.20

R1 1193.20

PP 1183.70

S1 1175.70

S2 1166.20

S3 1158.20

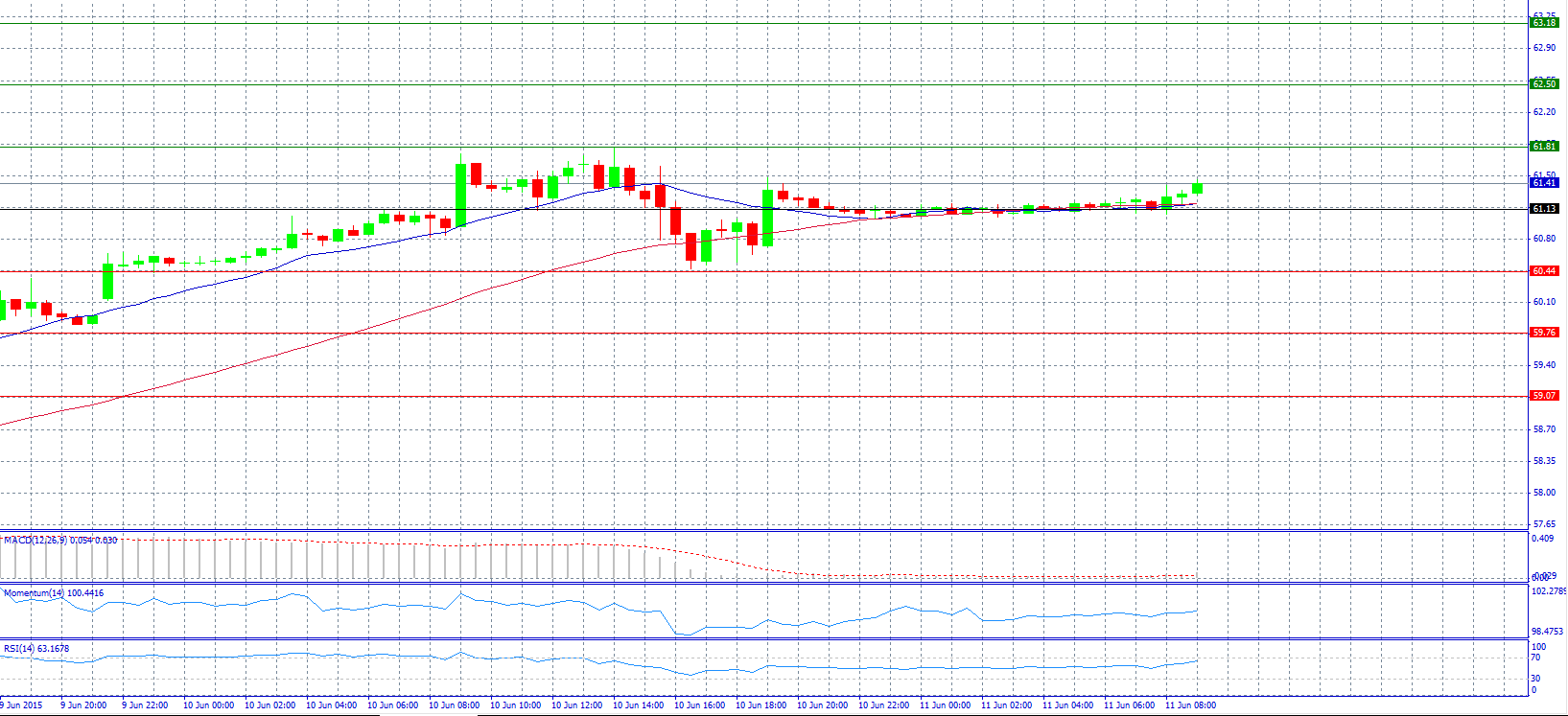

Market Scenario 1: Long positions above 61.81 with target at 62.50.

Market Scenario 2: Short positions below 61.13 with target at 60.44.

Comment: Crude oil prices advanced and trade near 61.40 level.

Supports and Resistances:

R3 63.18

R2 62.50

R1 61.81

PP 61.13

S1 60.44

S2 59.76

S3 59.07

Market Scenario 1: Long positions above 53.624 with target at 54.488.

Market Scenario 2: Short positions below 53.624 with target at 52.561.

Comment: The pair rose and tries to break resistance level at pivot point 53.624.

Supports and Resistances:

R3 57.477

R2 55.551

R1 54.488

PP 53.624

S1 52.561

S2 51.698

S3 49.771