Market Scenario 1: Long positions above 0.7671 with target @ 0.7740.

Market Scenario 2: Short positions below 0.7671 with target @ 0.7631.

Comment: The pair fell and found support on pivot point 0.7671.

Supports and Resistances:

R3 0.7849

R2 0.7780

R1 0.7740

PP 0.7671

S1 0.7631

S2 0.7562

S3 0.7522

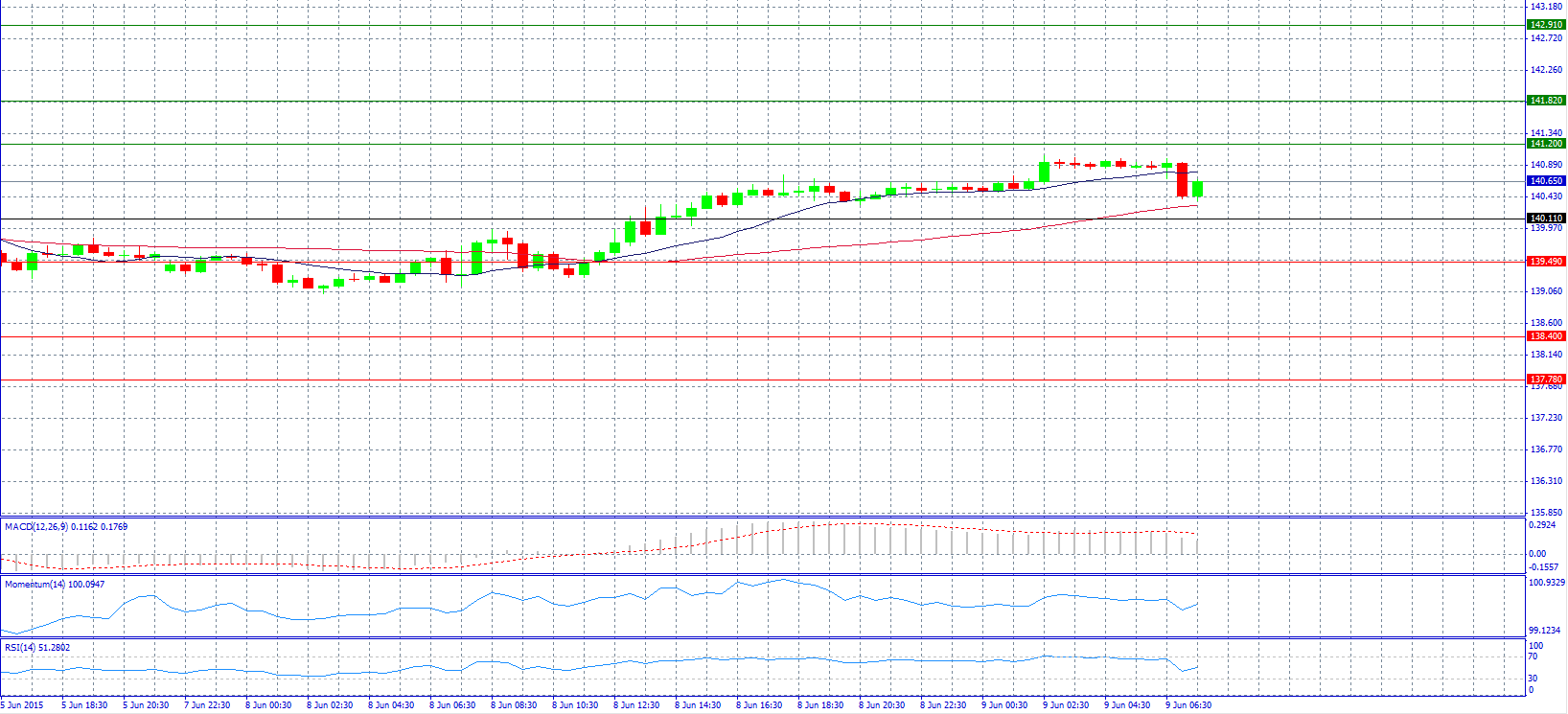

Market Scenario 1: Long positions above 141.20 with target @ 141.82.

Market Scenario 2: Short positions below 140.11 with target @ 139.49.

Comment: The pair made a sharp fall near 140.40 level.

Supports and Resistances:

R3 142.91

R2 141.82

R1 141.20

PP 140.11

S1 139.49

S2 138.40

S3 137.78

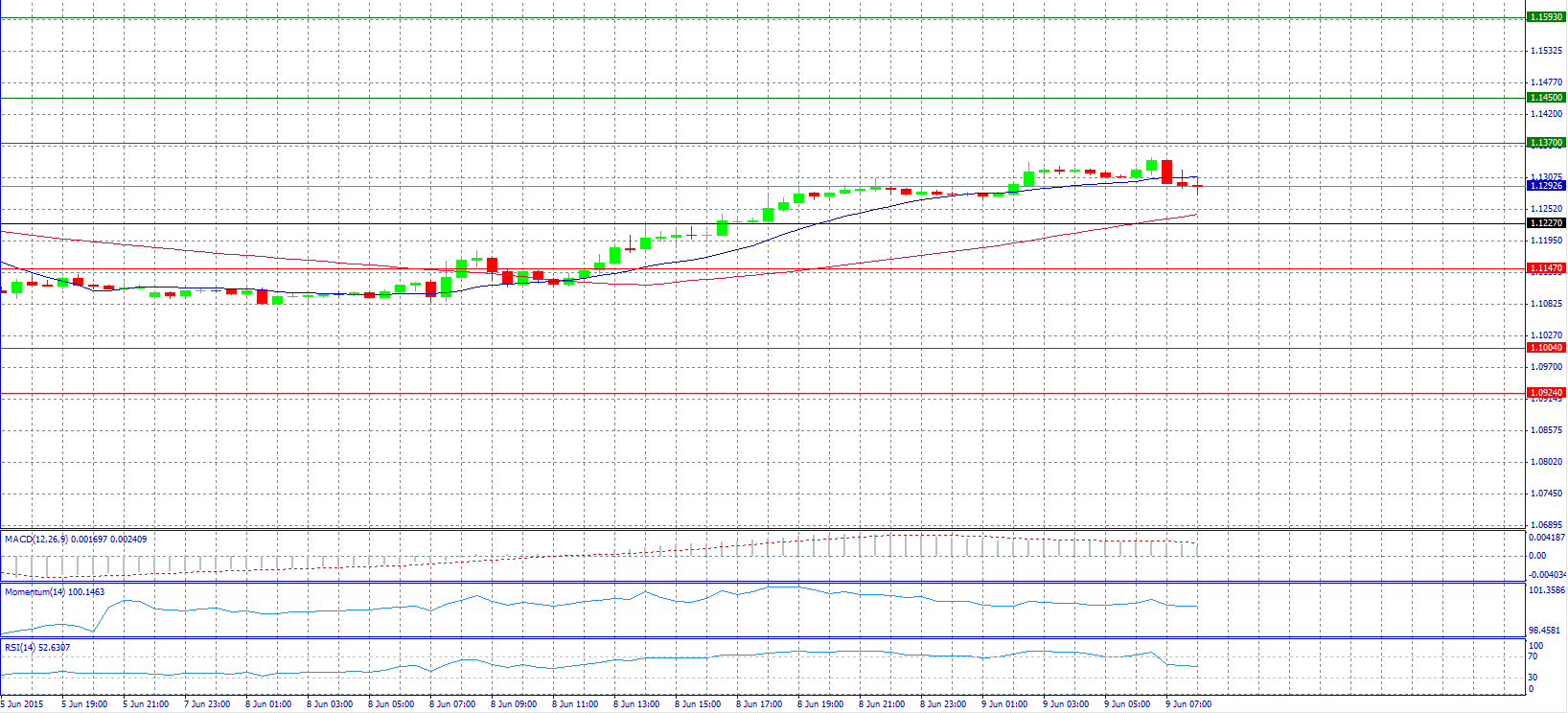

Market Scenario 1: Long positions above 1.1370 with target @ 1.1450.

Market Scenario 2: Short positions below 1.1227 with target @ 1.1147.

Comment: The pair weakened and trades below 1.1300 level.

Supports and Resistances:

R3 1.1593

R2 1.1450

R1 1.1370

PP 1.1227

S1 1.1147

S2 1.1004

S3 1.0924

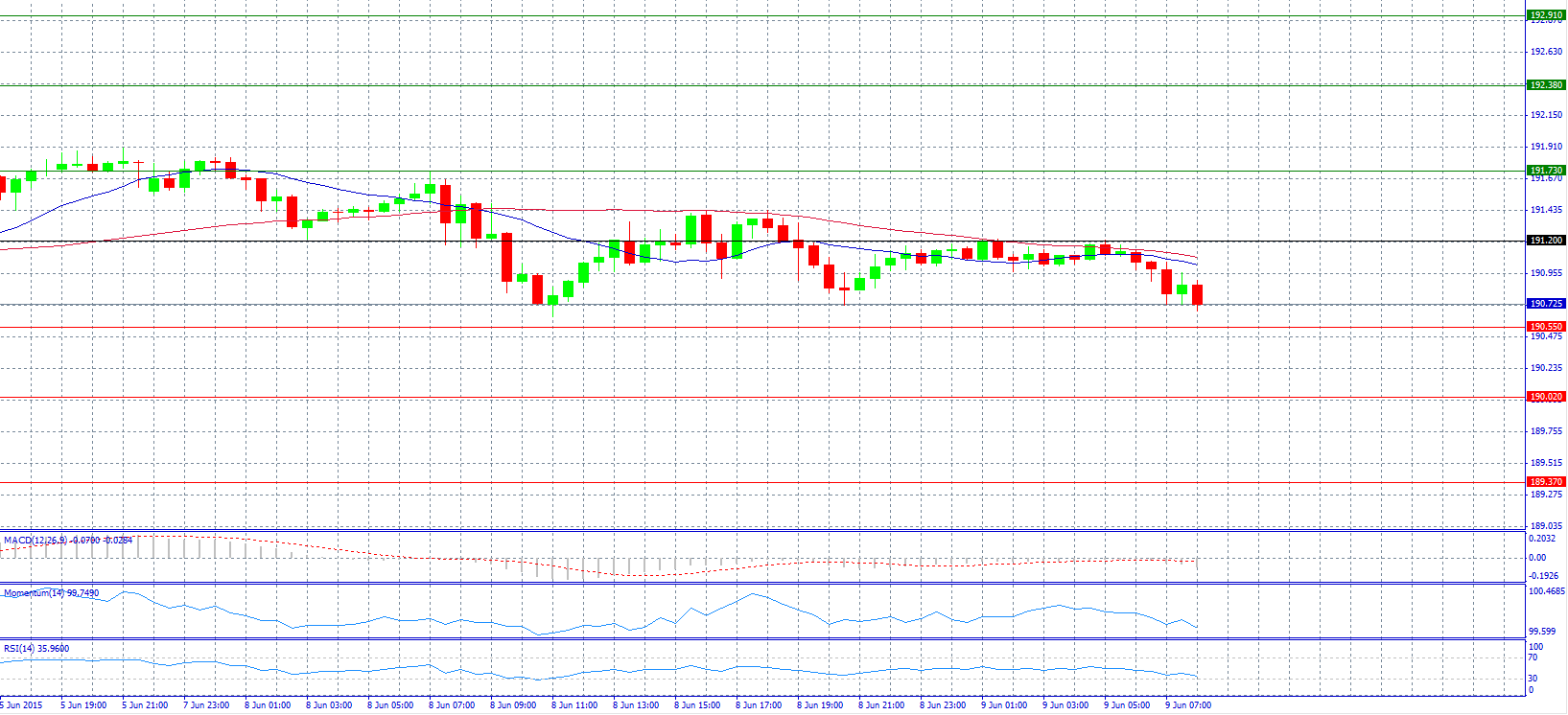

Market Scenario 1: Long positions above 191.20 with target @ 191.73.

Market Scenario 2: Short positions below 190.55 with target @ 190.02.

Comment: The pair after some attempts to break pivot point 191.20, continues to fall.

Supports and Resistances:

R3 192.91

R2 192.38

R1 191.73

PP 191.20

S1 190.55

S2 190.02

S3 189.37

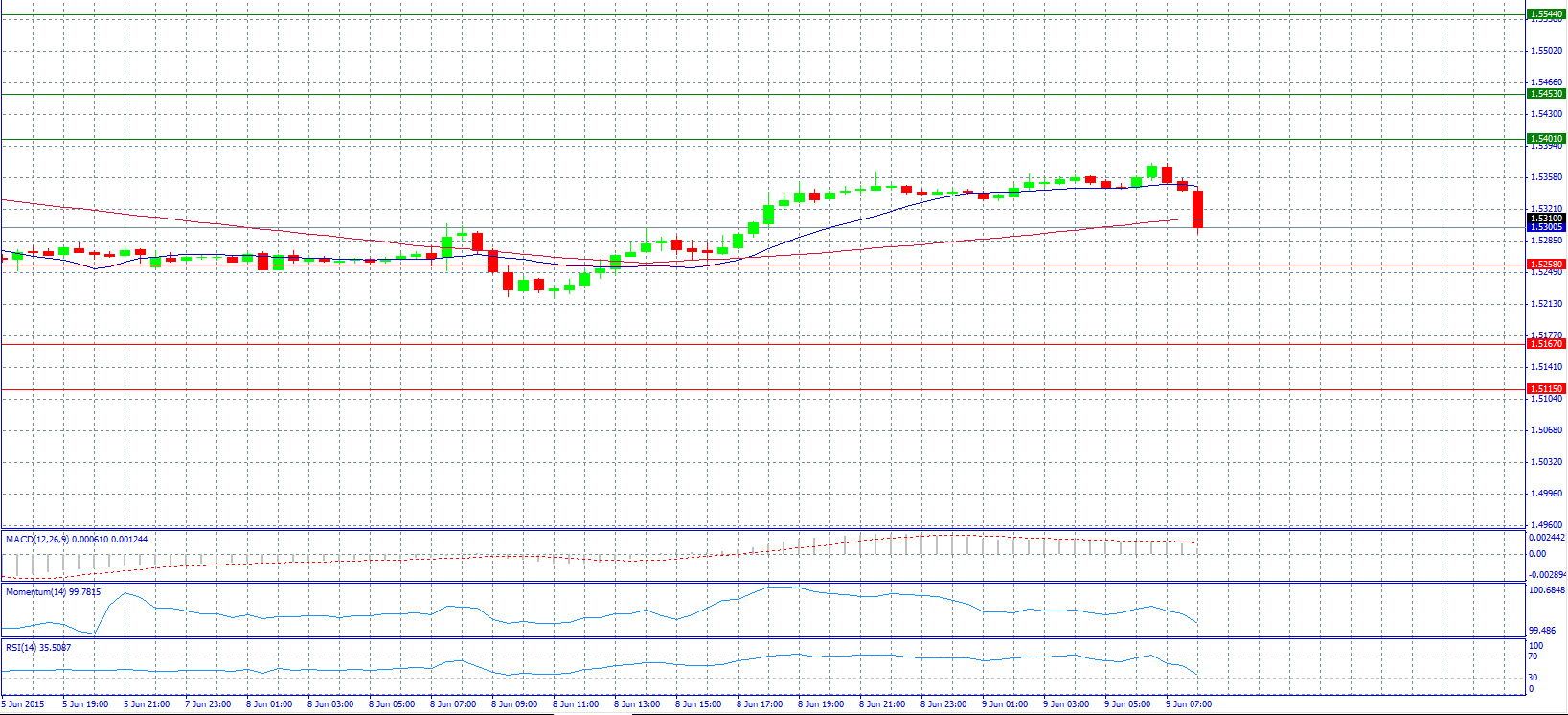

Market Scenario 1: Long positions above 1.5310 with target @ 1.5401.

Market Scenario 2: Short positions below 1.5310 with target @ 1.5258.

Comment: The pair has a bearish outlook and targets 1.5000 level according to analysts.

Supports and Resistances:

R3 1.5544

R2 1.5453

R1 1.5401

PP 1.5310

S1 1.5258

S2 1.5167

S3 1.5115

Market Scenario 1: Long positions above 124.82 with target @ 125.35.

Market Scenario 2: Short positions below 123.97 with target @ 123.44.

Comment: The pair remains within 124.0 on shaky dollar and as Asian equities moved lower.

Supports and Resistances:

R3 126.73

R2 126.20

R1 125.35

PP 124.82

S1 123.97

S2 123.44

S3 122.59

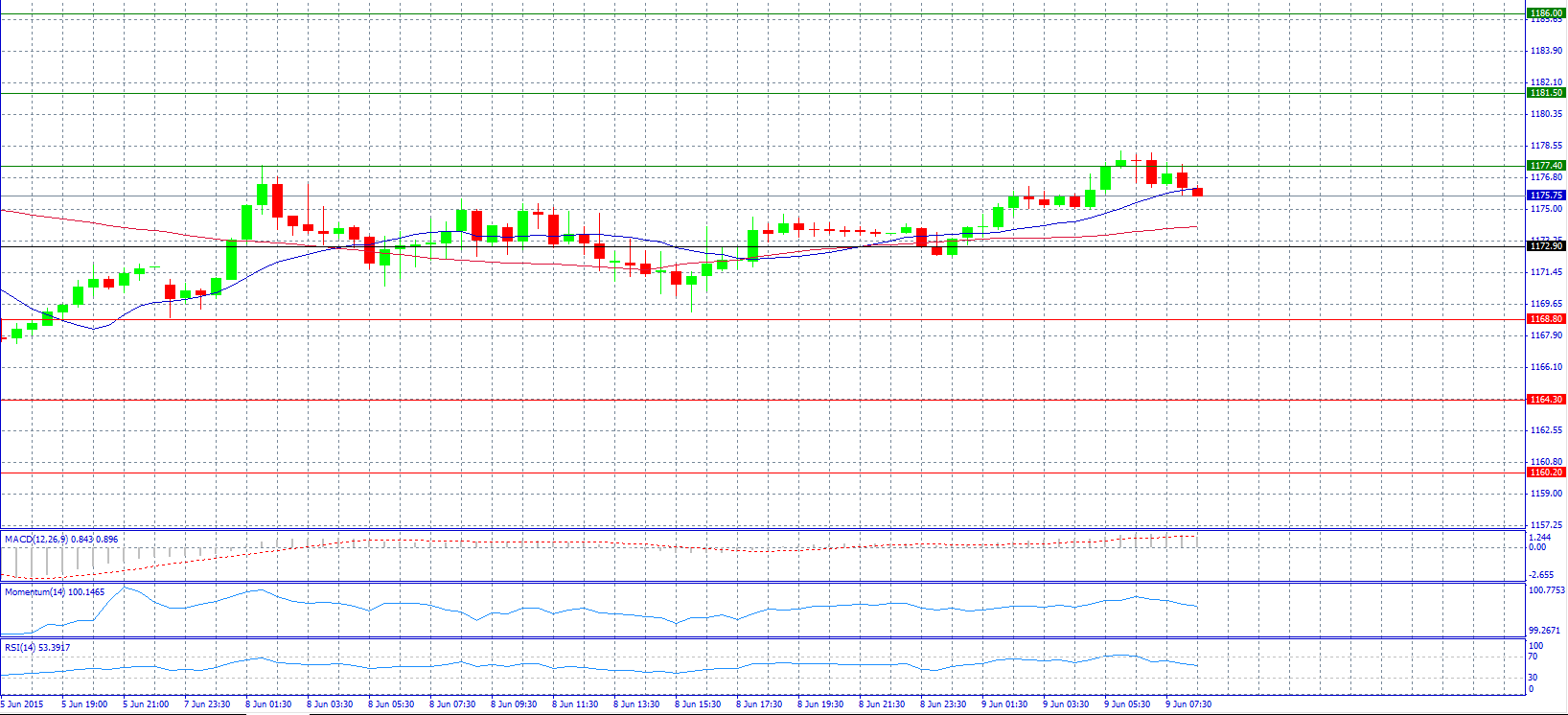

Market Scenario 1: Long positions above 1177.40 with target @ 1181.50.

Market Scenario 2: Short positions below 1172.90 with target @ 1168.80.

Comment: Gold prices witness moderate strength in the early European session on the back of a weak US dollar.

Supports and Resistances:

R3 1186.00

R2 1181.50

R1 1177.40

PP 1172.90

S1 1168.80

S2 1164.30

S3 1160.20

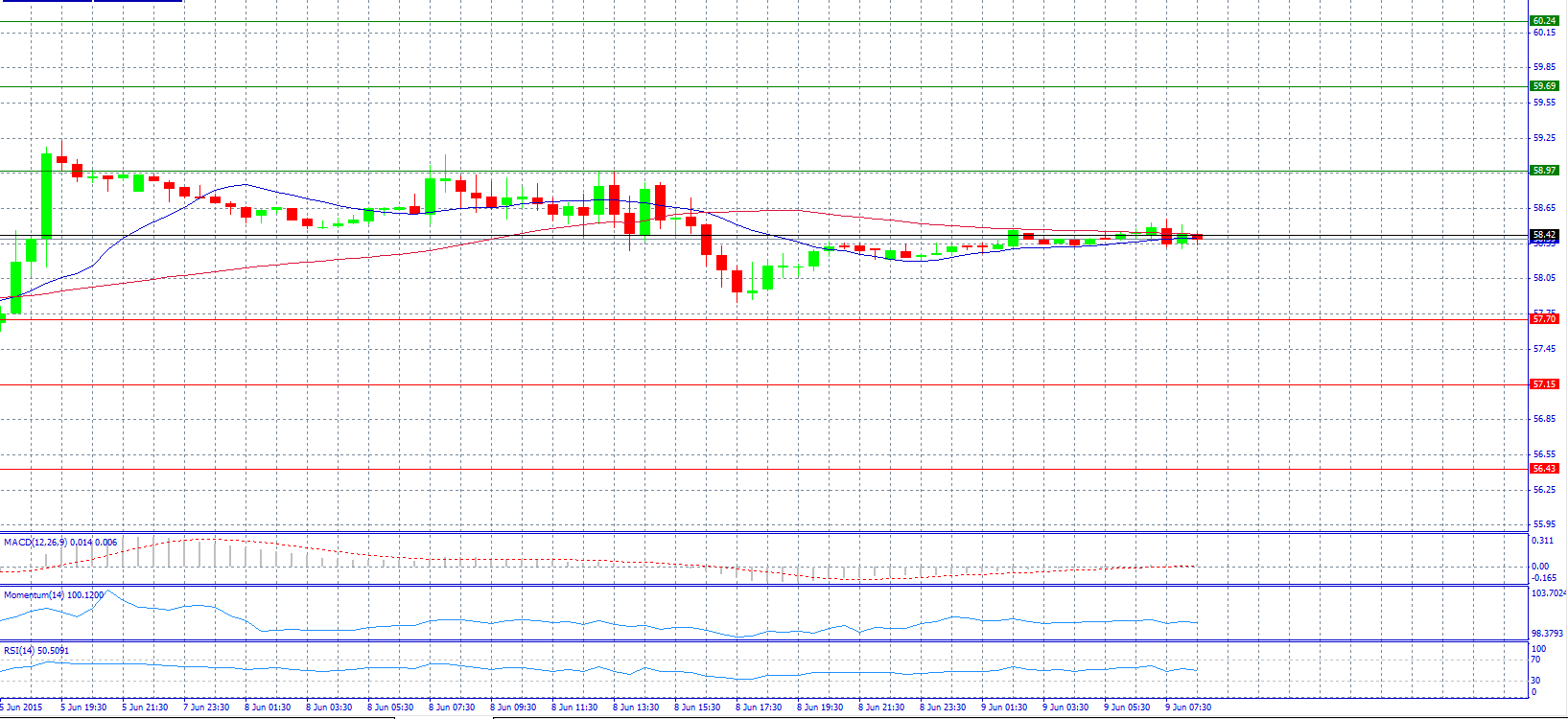

Market Scenario 1: Long positions above 58.42 with target @ 58.97.

Market Scenario 2: Short positions below 58.42 with target @ 57.70.

Comment: Crude oil prices trade neutral near pivot point 58.42.

Supports and Resistances:

R3 60.24

R2 59.69

R1 58.97

PP 58.42

S1 57.70

S2 57.15

S3 56.43

Market Scenario 1: Long positions above 55.031 with target @ 55.475.

Market Scenario 2: Short positions below 55.031 with target @ 54.548.

Comment: The pair struggles to break above pivot point 55.031.

Supports and Resistances:

R3 56.885

R2 55.958

R1 55.475

PP 55.031

S1 54.548

S2 54.103

S3 53.176