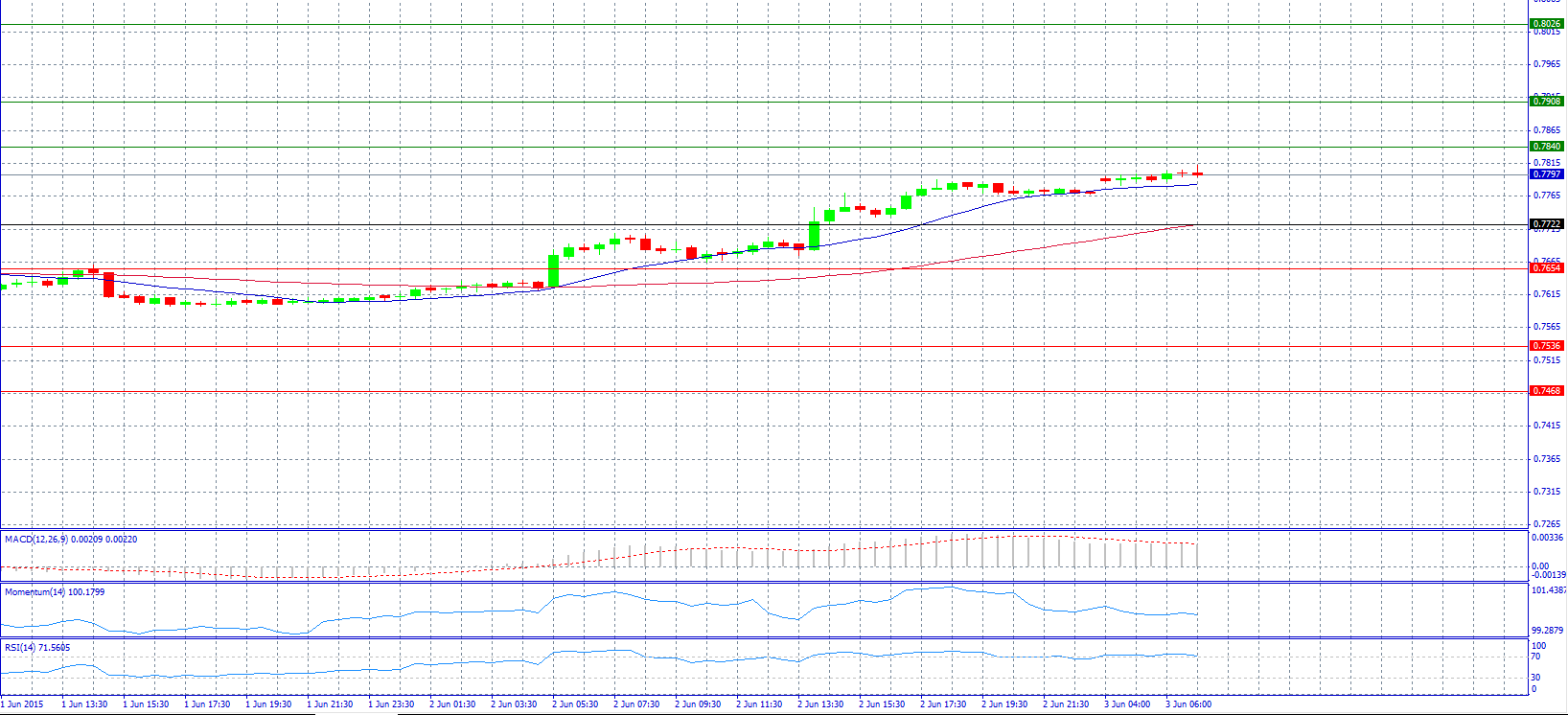

Market Scenario 1: Long positions above 0.7840 with target at 0.7908.

Market Scenario 2: Short positions below 0.7722 with target at 0.7654.

Comment: The pair climbed higher than expected due to Australia's Q1 GDP.

Supports and Resistances:

R3 0.8026

R2 0.7908

R1 0.7840

PP 0.7722

S1 0.7654

S2 0.7536

S3 0.7468

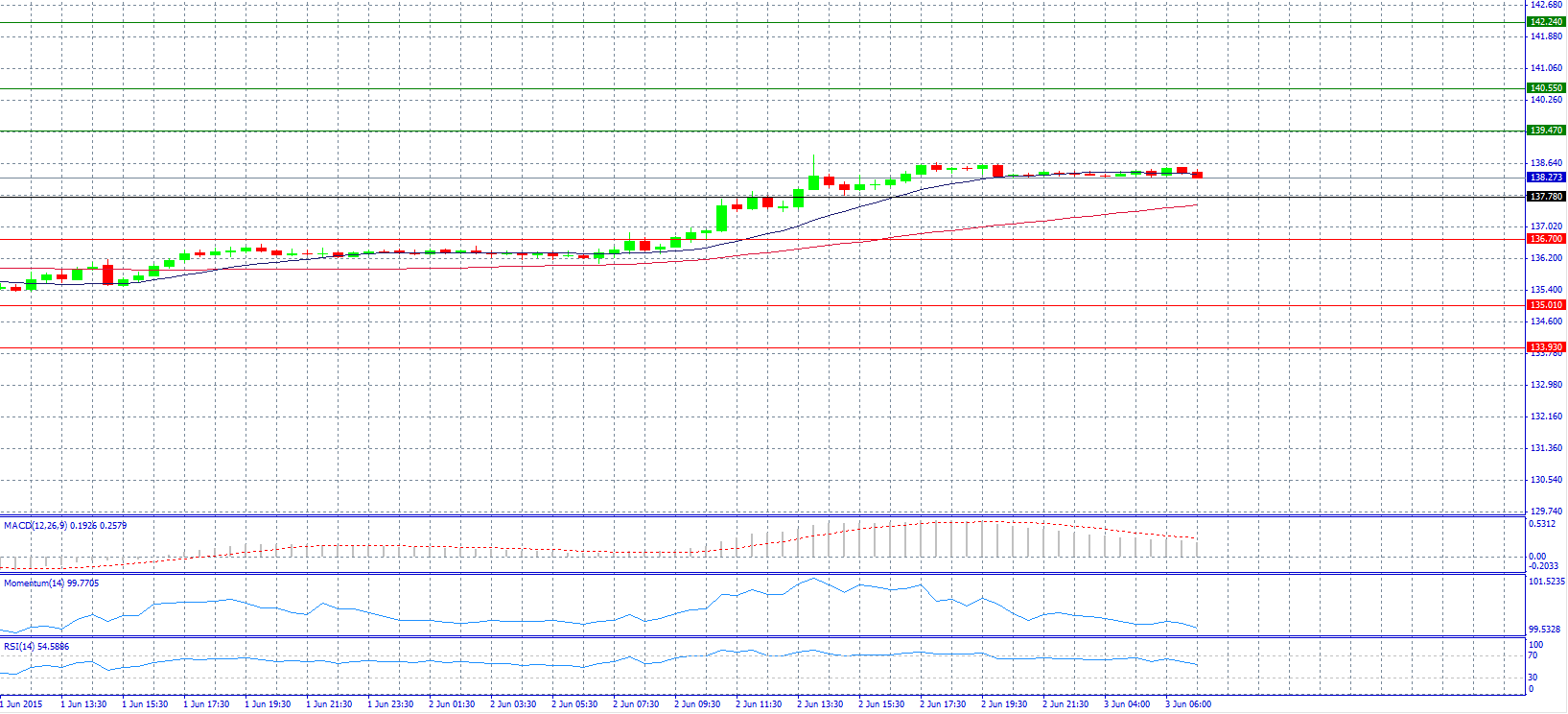

Market Scenario 1: Long positions above 139.47 with target at 140.55.

Market Scenario 2: Short positions below 137.78 with target at 136.70.

Comment: The pair trade neutral near 138.30 level.

Supports and Resistances:

R3 142.24

R2 140.55

R1 139.47

PP 137.78

S1 136.70

S2 135.01

S3 133.93

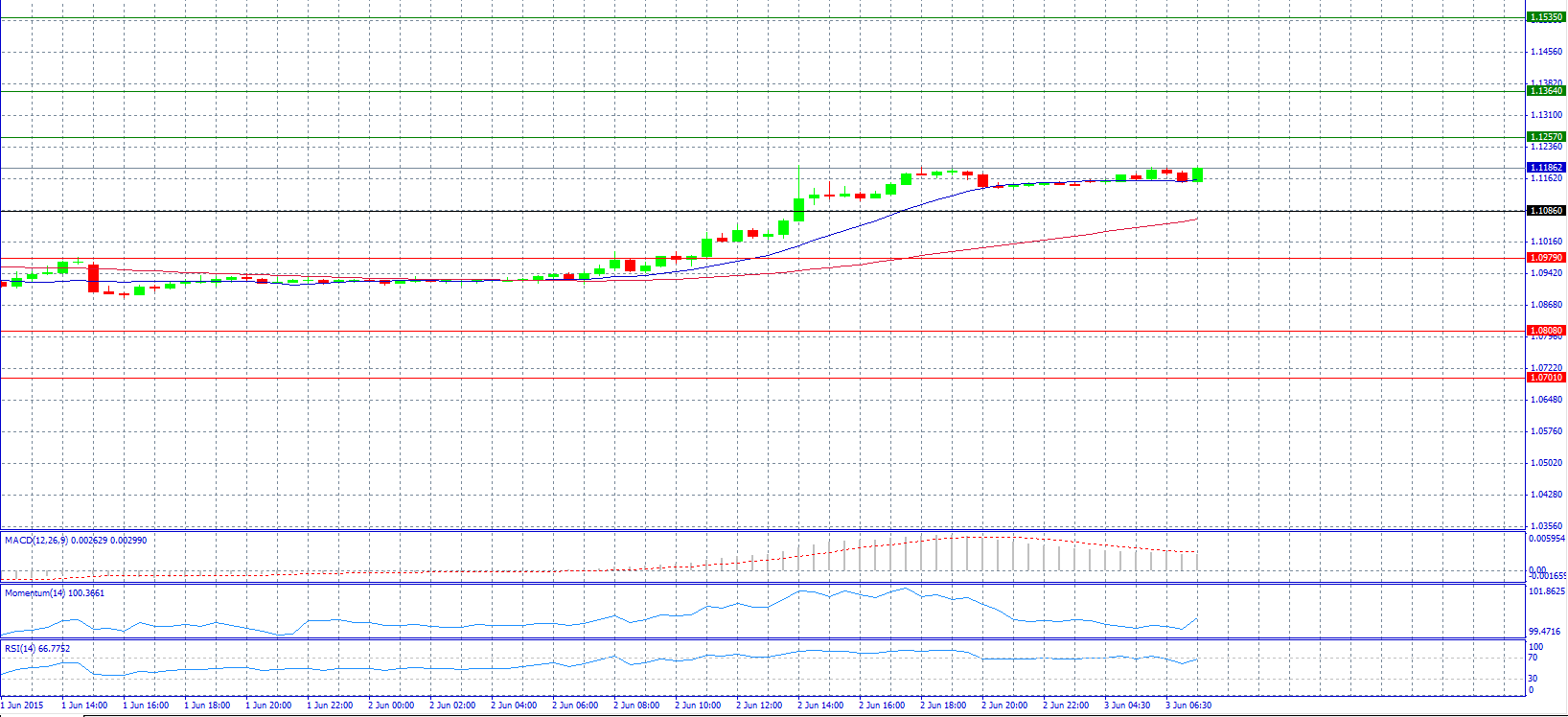

Market Scenario 1: Long positions above 1.1257 with target at 1.1364.

Market Scenario 2: Short positions below 1.1086 with target at 1.0979.

Comment: The pair may attempt to reach for 1.1200 again, with initial support expected towards the 100-day MA (1.1079) pending the ECB meeting, according to analysts.

Supports and Resistances:

R3 1.1535

R2 1.1364

R1 1.1257

PP 1.1086

S1 1.0979

S2 1.0808

S3 1.0701

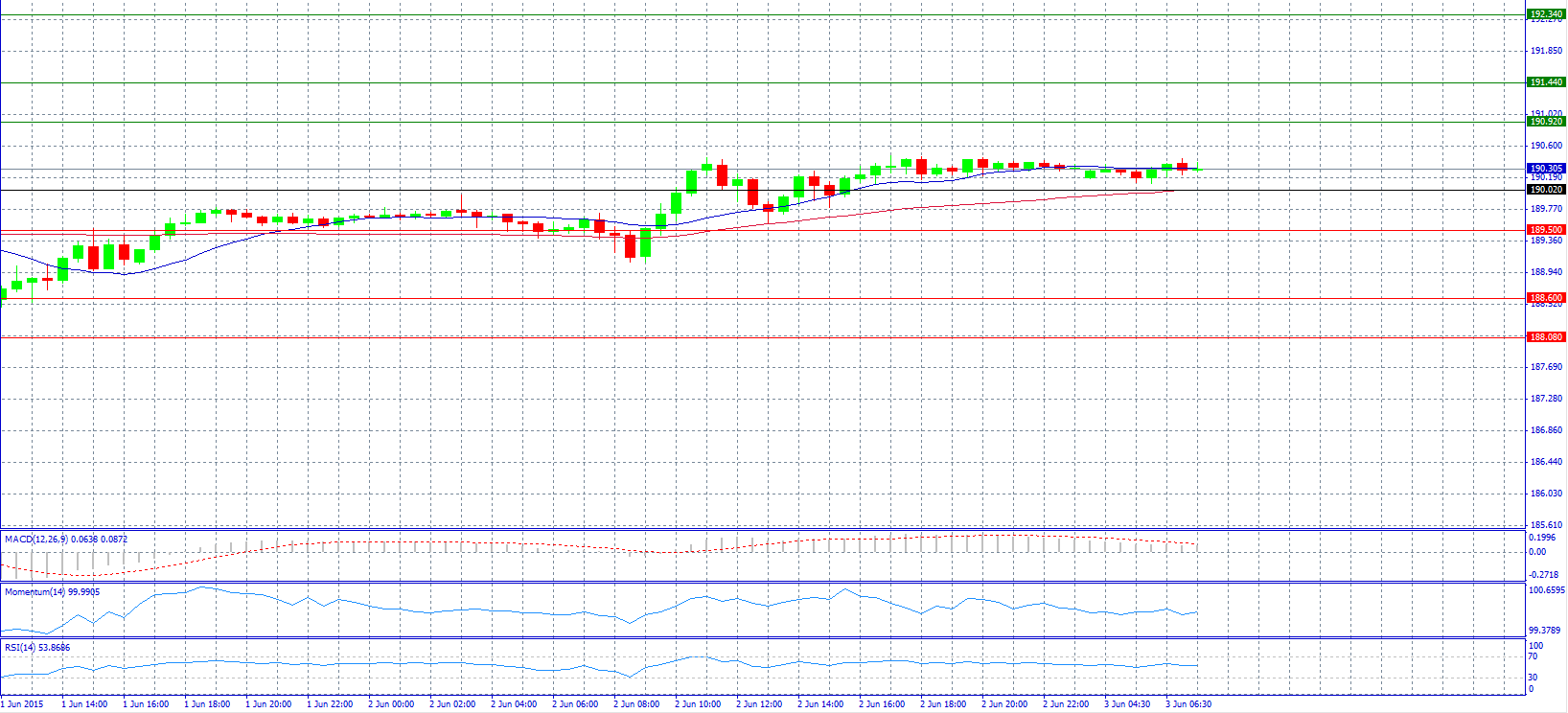

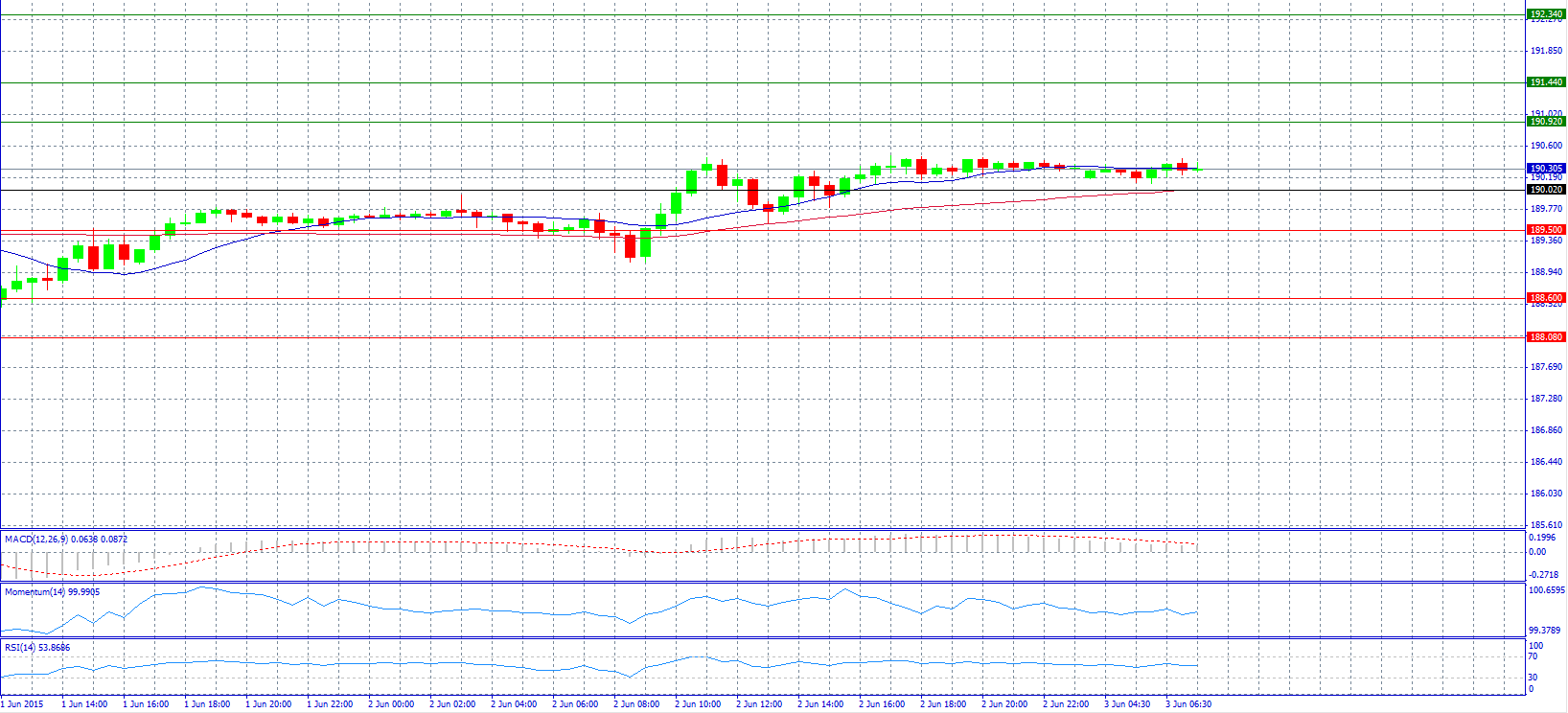

Market Scenario 1: Long positions above 190.92 with target at 191.44.

Market Scenario 2: Short positions below 190.02 with target at 189.50.

Comment: The pair trades unchanged for the moment near 190.30 level.

Supports and Resistances:

R3 192.34

R2 191.44

R1 190.92

PP 190.02

S1 189.50

S2 188.60

S3 188.08

Market Scenario 1: Long positions above 1.5413 with target at 1.5483.

Market Scenario 2: Short positions below 1.5296 with target at 1.5226.

Comment: The pair might extend gains towards 1.5417, according to analysts.

Supports and Resistances:

R3 1.5600

R2 1.5483

R1 1.5413

PP 1.5296

S1 1.5226

S2 1.5109

S3 1.5039

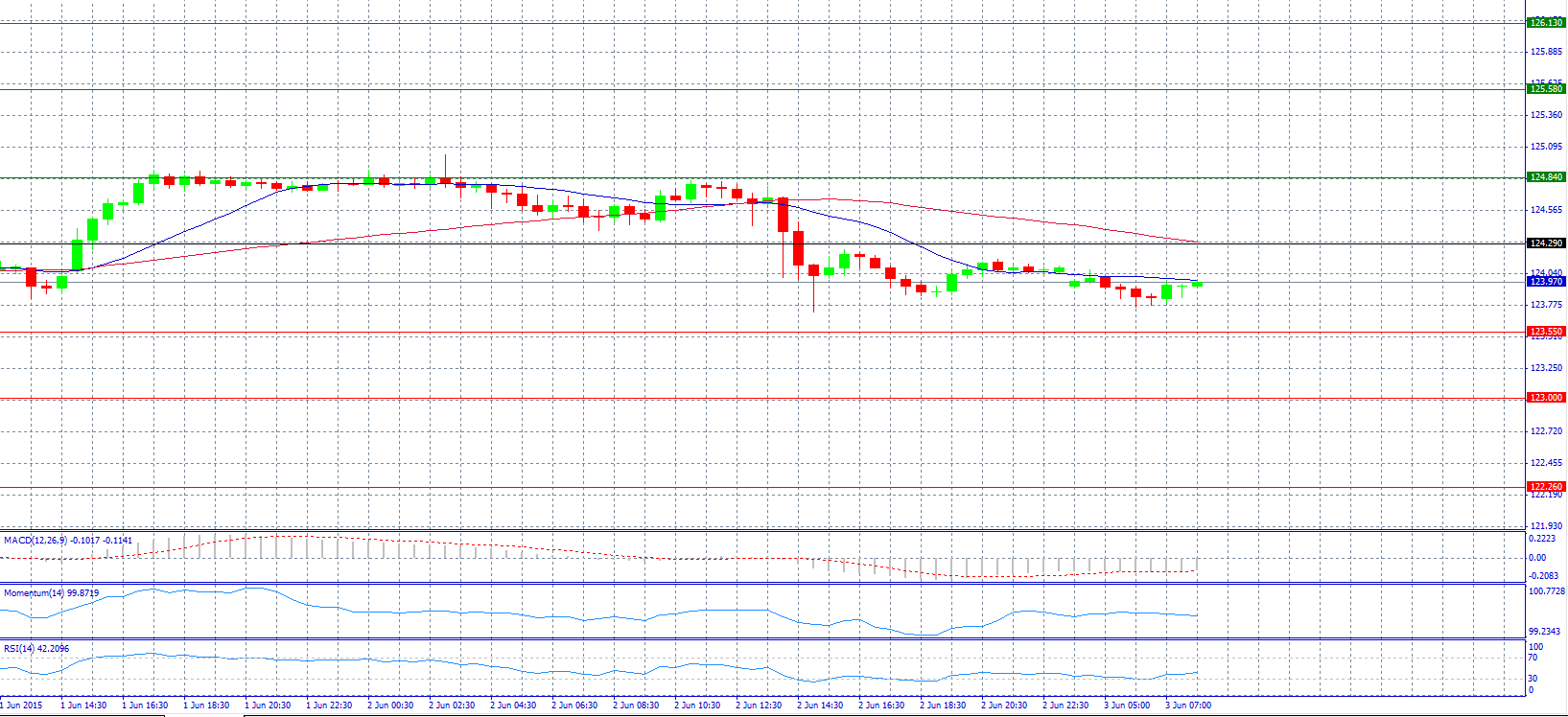

Market Scenario 1: Long positions above 124.29 with target at 124.84.

Market Scenario 2: Short positions below 123.55 with target at 123.00.

Comment: The pair might remain in the low to mid-120s for the next year, though it will be subject to inevitable spikes around US economic and/or Fed optimism, according to analysts’ forecast.

Supports and Resistances:

R3 126.13

R2 125.58

R1 124.84

PP 124.29

S1 123.55

S2 123.00

S3 122.26

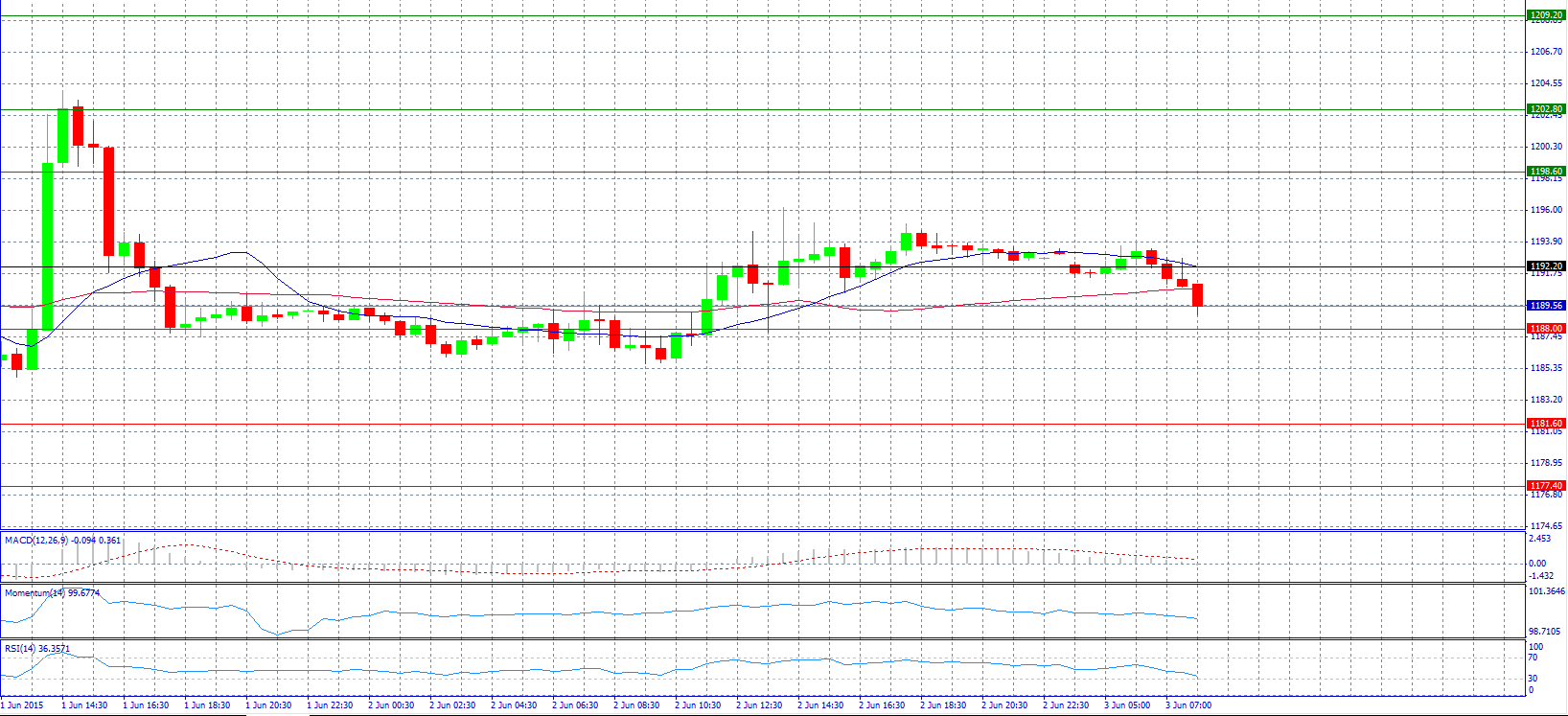

Market Scenario 1: Long positions above 1192.20 with target at 1198.60.

Market Scenario 2: Short positions below 1188.00 with target at 1181.60.

Comment: Gold prices weakened in Asia amid Greek debt talks.

Supports and Resistances:

R3 1209.20

R2 1202.80

R1 1198.60

PP 1192.20

S1 1188.00

S2 1181.60

S3 1177.40

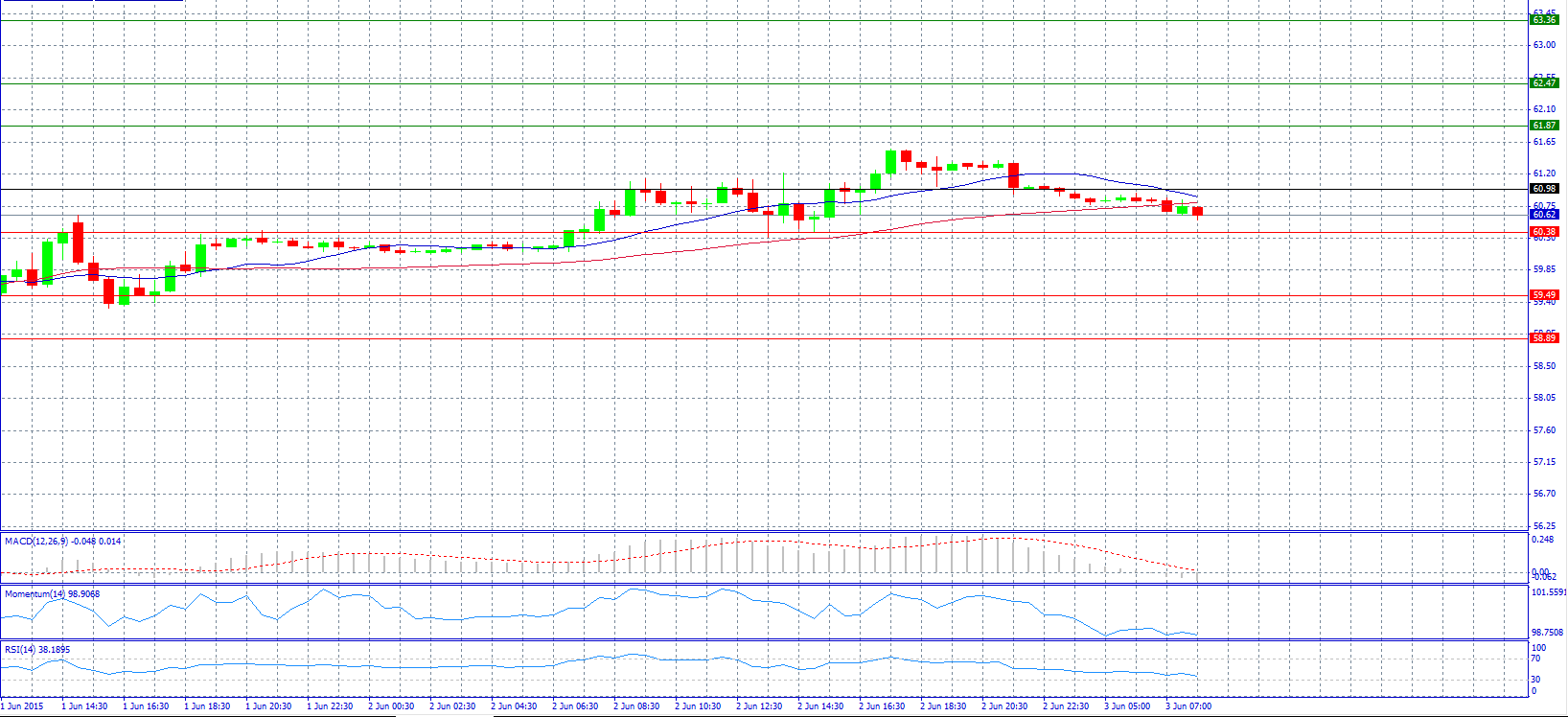

Market Scenario 1: Long positions above 60.98 with target at 61.87.

Market Scenario 2: Short positions below 60.38 with target at 59.49.

Comment: Crude oil prices might increase because supply from shale drilling in the U.S. won’t be enough to meet increasing global demand, according to Royal Dutch Shell (LONDON:RDSa) Plc.

Supports and Resistances:

R3 63.36

R2 62.47

R1 61.87

PP 60.98

S1 60.38

S2 59.49

S3 58.89

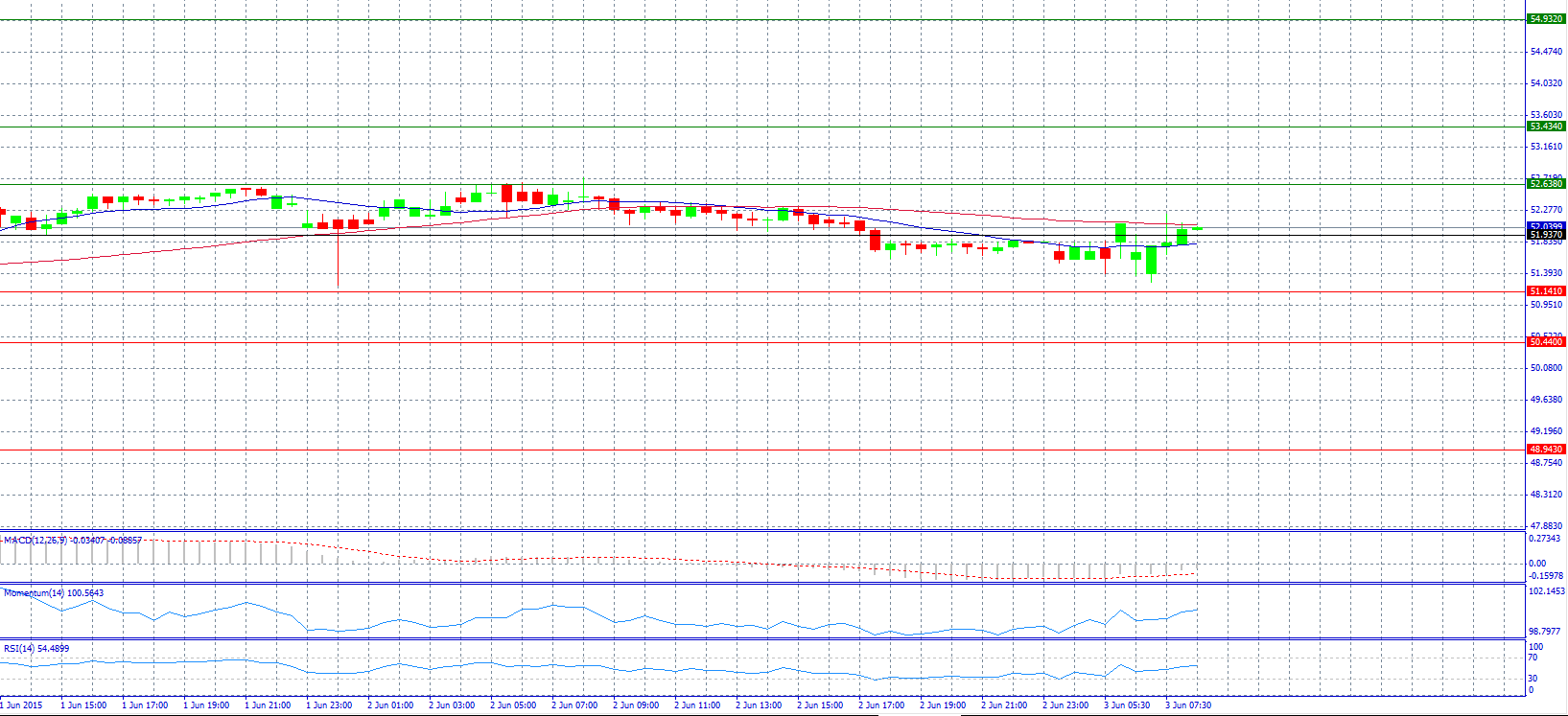

Market Scenario 1: Long positions above 51.937 with target at 52.638.

Market Scenario 2: Short positions below 51.937 with target at 51.141.

Comment: The pair struggles to stay above pivot point 51.937.

Supports and Resistances:

R3 54.932

R2 53.434

R1 52.638

PP 51.937

S1 51.141

S2 50.440

S3 48.943